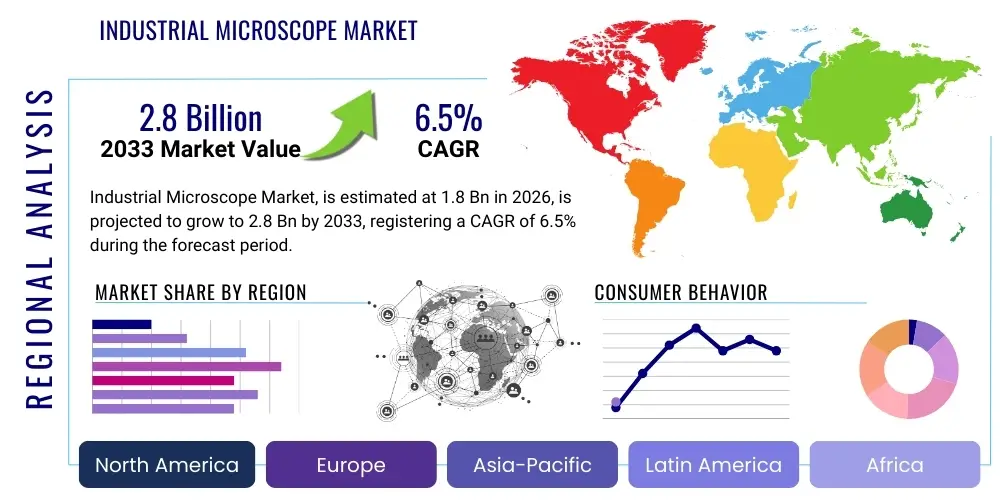

Industrial Microscope Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441549 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Microscope Market Size

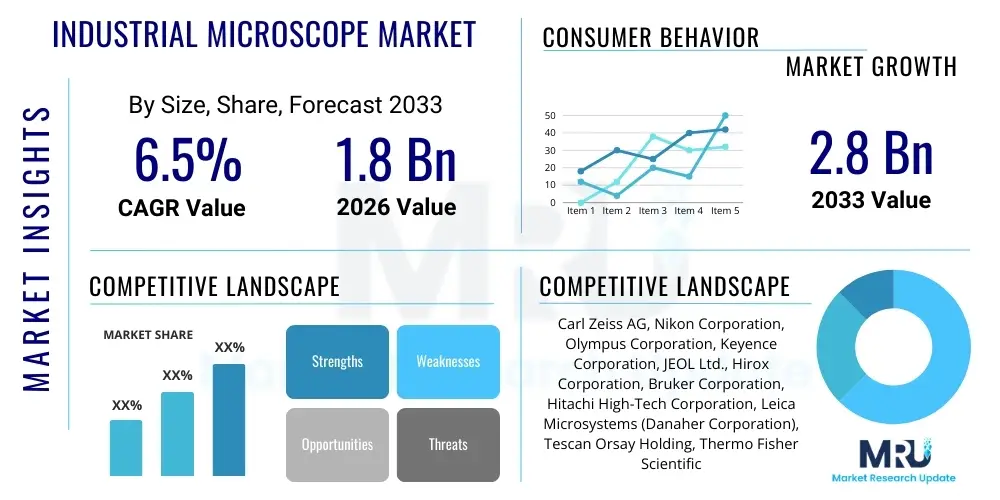

The Industrial Microscope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Industrial Microscope Market introduction

The Industrial Microscope Market encompasses advanced optical and digital imaging systems specifically designed for quality control, defect analysis, metrology, failure investigation, and research applications across various manufacturing and material science sectors. These instruments provide high-resolution magnification and measurement capabilities essential for examining microstructures, surface textures, component integrity, and critical dimensions of industrial parts and materials. The core products range from traditional optical microscopes (stereo, compound, metallurgical) to high-end systems like Scanning Electron Microscopes (SEMs) and Atomic Force Microscopes (AFMs), increasingly integrating digital capabilities, automation, and advanced image analysis software to enhance throughput and precision in demanding industrial environments.

Major applications driving market demand include semiconductor manufacturing, where microscopes are critical for inspecting wafer patterns and ensuring defect-free integrated circuits; automotive manufacturing, utilized for material testing, welding inspection, and coating analysis; and advanced materials research, necessary for characterizing new alloys, polymers, and composites. These systems ensure adherence to stringent quality standards, minimize production waste, and accelerate product development cycles. The integration of ergonomic designs and modular components also allows these microscopes to be adapted easily into automated production lines and specialized inspection laboratories.

Key driving factors propelling market growth include the global trend toward miniaturization in electronics and healthcare, which necessitates more precise inspection tools; the increasing complexity of manufacturing processes requiring sophisticated metrology and failure analysis; and stringent regulatory requirements across industries like aerospace and medical devices that mandate detailed quality documentation. Furthermore, the transition from conventional analog systems to fully digital and automated microscopy solutions, offering better data management and reduced operator fatigue, significantly contributes to market expansion and technological adoption globally.

Industrial Microscope Market Executive Summary

The Industrial Microscope Market is experiencing robust expansion, fundamentally driven by the escalating demand for ultra-precise quality control and detailed failure analysis in high-tech industries. Current business trends indicate a significant shift towards digitalization and automation, where manufacturers are integrating machine vision, advanced robotics, and specialized software to perform rapid, non-destructive inspection of complex samples. This focus on automated inspection workflows, particularly in the semiconductor and electronics sectors, is pushing vendors to develop faster, higher-throughput systems capable of managing large datasets derived from high-resolution images. Strategic mergers, acquisitions, and collaborative partnerships focused on integrating artificial intelligence (AI) for enhanced defect recognition and classification are defining the competitive landscape, prioritizing solutions that reduce human intervention and improve measurement accuracy across diverse production lines.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in semiconductor fabrication plants (fabs) in countries like China, South Korea, and Taiwan, coupled with rapid expansion in general electronics and automotive manufacturing across Southeast Asia. North America and Europe, while mature markets, maintain strong demand due to stringent quality regulations in aerospace, defense, and medical device manufacturing, leading to early adoption of high-end microscopy technologies such as confocal and super-resolution systems. These developed regions are focused on enhancing research and development capabilities, often utilizing specialized microscopy for materials science innovation and additive manufacturing quality assurance.

Segment trends reveal that the Digital Microscope segment is growing the fastest, largely replacing traditional optical benches due to its superior image sharing, measurement capabilities, and connectivity features. Technology-wise, Electron Microscopes (specifically SEMs) maintain dominance in failure analysis where ultra-high magnification is required, while the growing need for 3D topographical mapping is bolstering the demand for Atomic Force Microscopes (AFMs) and other non-contact measurement tools. End-user segmentation confirms the Semiconductor industry as the leading consumer, consistently demanding the most advanced and highly automated inspection equipment to manage shrinking feature sizes and complex 3D architectures, closely followed by the Metallurgy and Material Science sector utilizing advanced systems for detailed structural characterization.

AI Impact Analysis on Industrial Microscope Market

Common user questions regarding AI's impact on industrial microscopy often center on how these advanced algorithms can streamline quality control, specifically addressing queries about enhanced defect detection accuracy, the feasibility of full automation in complex inspection routines, and the ability of AI to interpret vast amounts of image data generated by high-throughput systems. Users frequently ask about minimizing false positives and false negatives, speeding up the decision-making process, and integrating AI models seamlessly into existing manufacturing execution systems (MES). Key concerns revolve around the cost of implementing AI-driven systems, the need for specialized training data, and the standardization of algorithms for reliable performance across different sample types and magnification levels. In essence, users expect AI to transition industrial microscopy from a manual, expertise-dependent task to a fully automated, scalable, and highly accurate component of Industry 4.0 quality assurance.

- AI algorithms enable faster and more accurate automated defect classification and identification, significantly reducing inspection time.

- Machine learning optimizes microscope settings (focus, illumination, contrast) in real-time, improving image acquisition efficiency and reliability.

- Predictive maintenance analytics are applied to microscope components, reducing downtime and optimizing instrument performance and longevity.

- AI facilitates the processing and analysis of large-scale datasets from high-throughput digital and electron microscopes, aiding complex metrology.

- Integration of deep learning allows for automated segmentation and feature extraction, crucial for analyzing complex material microstructures and biological samples.

- Remote operation and augmented reality interfaces, powered by AI, enable technicians to perform complex analysis from off-site locations efficiently.

DRO & Impact Forces Of Industrial Microscope Market

The Industrial Microscope Market dynamics are primarily influenced by the relentless push for technological precision and automation across manufacturing industries globally. Key drivers include the ongoing miniaturization of components in microelectronics and medical devices, necessitating inspection tools capable of nanometer-scale resolution, and the stringent regulatory frameworks in highly regulated sectors like aerospace and pharmaceuticals, which demand rigorous documentation and quality verification. Opportunities arise from the convergence of digital microscopy with advanced software tools, specifically AI and robotics, enabling the creation of fully automated, intelligent inspection cells that drastically improve throughput and accuracy. Furthermore, the increasing adoption of Additive Manufacturing (3D Printing) generates substantial demand for industrial microscopes to analyze material integrity, powder quality, and layer structure post-production, presenting a major avenue for market growth and diversification.

However, the market faces significant restraints that temper its growth trajectory. The high initial capital investment required for advanced microscopy systems, such as SEMs and high-resolution digital microscopes, poses a barrier to entry, particularly for Small and Medium-sized Enterprises (SMEs). Technical complexities associated with operating and maintaining high-end electron and scanning probe microscopes necessitate specialized training and dedicated technical staff, contributing to high operational costs. Additionally, the rapid pace of technological obsolescence, especially in digital imaging sensors and analytical software, requires manufacturers to frequently upgrade equipment, adding to the total cost of ownership (TCO) and slowing replacement cycles in cost-sensitive regions.

The core impact forces shaping this market include the pervasive influence of Industry 4.0 principles, which mandate interconnectedness, real-time data analysis, and automation in all manufacturing processes. This necessitates microscopes that are network-ready and capable of integrating seamlessly into factory ecosystems. Competitive rivalry among key players drives continuous innovation in features like 3D imaging capabilities, ease of use through automated workflows, and software integration to deliver holistic quality assurance solutions rather than standalone instruments. Finally, globalization of supply chains means that quality standards must be uniformly applied across international production facilities, increasing the need for standardized, highly repeatable microscopic inspection protocols and certified equipment capable of meeting international metrology standards.

Segmentation Analysis

The Industrial Microscope Market is comprehensively segmented across several dimensions, including product type, magnification level, application, and end-user industry, reflecting the diverse technical requirements of modern manufacturing and research environments. Product type segmentation distinguishes between high-resolution systems like electron microscopes necessary for sub-micron analysis and widely used optical microscopes known for versatility and ease of operation. Magnification segmentation categorizes tools based on the scale of inspection required, ranging from stereo microscopes used for macroscopic assembly checks to atomic force microscopes used for true nanoscale surface profiling. This detailed segmentation allows manufacturers to target specific industrial needs, tailoring their offerings, such as digital features or automation levels, to specific end-user environments where cost sensitivity and technical resolution requirements vary significantly across sectors like aerospace versus general electronics assembly.

- By Product Type:

- Optical Microscopes (Stereo Microscopes, Compound Microscopes, Metallurgical Microscopes, Confocal Microscopes)

- Electron Microscopes (Scanning Electron Microscopes (SEM), Transmission Electron Microscopes (TEM))

- Scanning Probe Microscopes (SPM, Atomic Force Microscopes (AFM), Scanning Tunneling Microscopes (STM))

- Digital Microscopes (Portable and Benchtop Systems)

- By Magnification:

- Low Magnification (Up to 100x)

- Medium Magnification (100x to 1,000x)

- High Magnification (Above 1,000x)

- By Application:

- Quality Control and Inspection

- Metrology and Measurement

- Failure Analysis

- Research and Development

- By End-User Industry:

- Semiconductor and Electronics

- Automotive

- Aerospace and Defense

- Metallurgy and Material Science

- Medical Devices

- Chemical and Pharmaceuticals

- Others (Academic and Forensics)

Value Chain Analysis For Industrial Microscope Market

The value chain for the Industrial Microscope Market begins with upstream component suppliers responsible for manufacturing high-precision optical elements, advanced sensors, electronic components, and specialized mechanical stages, all critical for achieving superior imaging resolution and reliable motion control. Key upstream elements include sophisticated glass and crystal manufacturers for lenses, high-speed camera sensor providers (CMOS/CCD), and specialized software developers providing image processing and proprietary automation algorithms. The quality and cost of these components directly impact the final product performance and pricing structure. Manufacturers in the middle tier, such as Olympus, Nikon, Zeiss, and Keyence, focus on system integration, software development, and assembly, optimizing the ergonomic and automated features of the final microscope unit to meet specific industrial requirements for speed, accuracy, and environmental robustness.

The downstream distribution channel involves a complex mix of direct sales forces, especially for high-end Electron Microscopes and customized automated systems sold directly to large semiconductor fabs and automotive OEMs, and indirect distribution networks comprising regional distributors and specialized value-added resellers (VARs). VARs play a crucial role by providing localized technical support, integration services, and training specific to the end-user's application, thereby bridging the technical gap between sophisticated instrumentation and diverse industrial users. The shift towards digital connectivity necessitates distributors capable of handling software licensing, network integration, and providing ongoing IT support, distinguishing them from traditional hardware distributors.

Direct sales ensure maximum profitability and allow manufacturers to maintain close relationships with key strategic accounts, enabling tailored product development based on direct feedback from leading industry innovators. Conversely, the indirect channel is essential for penetrating geographically dispersed markets, particularly in emerging economies, and reaching smaller research laboratories or educational institutions where localized service and lower overhead distribution models are preferred. Optimization of the value chain now heavily leans towards post-sale services, including calibration, long-term service contracts, and offering subscription-based access to advanced analytical software, ensuring recurring revenue streams and maximizing customer retention and satisfaction throughout the equipment's lifecycle.

Industrial Microscope Market Potential Customers

The primary customers for industrial microscopes span high-value manufacturing and research sectors where precision quality control and detailed material analysis are non-negotiable prerequisites for operational success and regulatory compliance. End-users in the Semiconductor and Electronics industries, including chip manufacturers, PCB assemblers, and component suppliers, represent the largest and most demanding customer segment, requiring advanced SEMs and high-magnification optical inspection systems for critical dimension measurement and defect detection on nanometer scales. These buyers prioritize automation, throughput, and the ability to integrate microscopy data directly into their yield management systems.

Another crucial customer segment involves organizations within the Automotive and Aerospace industries, including component manufacturers (e.g., engine parts, composite structures) and raw material suppliers. These customers rely heavily on metallurgical microscopes and failure analysis tools to assess weld integrity, inspect metal fatigue, analyze surface coatings, and ensure compliance with stringent safety and material standards like ISO and ASTM. Their purchasing decisions are often driven by robustness, repeatability of measurements, and compliance auditing capabilities. Furthermore, research laboratories and academic institutions also serve as significant customers, primarily driving demand for versatile, high-end instruments like TEMs and SPMs for pure material science innovation and foundational research.

The rising adoption of industrial microscopes by the Medical Device manufacturing sector, particularly for quality assurance of implants, surgical tools, and micro-fluidic devices, marks a high-growth customer segment characterized by an emphasis on ultra-cleanliness inspection and detailed surface morphology assessment. These buyers require microscopes that adhere to strict validation protocols (e.g., FDA requirements) and offer non-destructive testing capabilities. Across all segments, the modern potential customer is increasingly seeking integrated solutions that combine high-quality optics with advanced software, network connectivity, and AI-driven automation, moving away from simple imaging tools towards comprehensive analytical platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carl Zeiss AG, Nikon Corporation, Olympus Corporation, Keyence Corporation, JEOL Ltd., Hirox Corporation, Bruker Corporation, Hitachi High-Tech Corporation, Leica Microsystems (Danaher Corporation), Tescan Orsay Holding, Thermo Fisher Scientific Inc., Aven Inc., Motic, Mitutoyo Corporation, COXEM Co. Ltd., Vision Engineering Ltd., Meiji Techno Co. Ltd., Scienscope International, Shimadzu Corporation, Oxford Instruments plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Microscope Market Key Technology Landscape

The technological landscape of the Industrial Microscope Market is rapidly evolving, driven by the shift towards non-destructive, rapid, and fully automated inspection capabilities essential for high-volume manufacturing. A foundational technology is the transition to advanced Digital Microscopy, which utilizes high-resolution digital cameras and powerful computer interfaces to replace traditional eyepieces, enabling enhanced image processing, easy data storage, and network sharing capabilities crucial for remote collaboration and centralized quality management systems. Furthermore, advanced optics are continually being refined, with a focus on improving Numerical Aperture (NA) and working distance, particularly in metallurgical and stereo microscopes, to achieve higher clarity and better accessibility to complex or recessed sample areas without compromising resolution. This evolution ensures that even standard optical systems can compete with entry-level electron microscopy in specific industrial applications.

The high-end segment is dominated by the integration of advanced analytical techniques, notably Confocal Microscopy and Super-Resolution Microscopy (SRM) adapted for industrial use. Confocal systems provide precise optical sectioning to generate high-contrast 3D renderings of opaque or complex surfaces, indispensable for measuring thin films or internal structures in micro-electromechanical systems (MEMS) and semiconductor components. Simultaneously, the increasing sophistication of Electron Microscopes (SEMs and TEMs) involves integrating energy-dispersive X-ray spectroscopy (EDS) and electron backscatter diffraction (EBSD) detectors, transforming the instruments from mere imaging tools into powerful micro-analytical workstations capable of determining both the topography and the elemental/crystallographic composition of the sample simultaneously and automatically.

Automation and software are now paramount technological differentiators. The adoption of robotic stages, auto-focus, and motorized turrets is standard in high-throughput industrial settings, minimizing human error and maximizing repeatability. Crucially, the embedding of sophisticated metrology software and AI/Machine Learning algorithms is revolutionizing data interpretation, enabling automatic pass/fail decisions, trend analysis, and predictive quality control based on large historical image datasets. Technologies related to enhanced connectivity, such as secure cloud-based data storage and integration via standardized APIs (Application Programming Interfaces), are increasingly required to ensure these high-tech instruments fit seamlessly into the broader ecosystem of smart factories and Industry 4.0 infrastructure, facilitating real-time monitoring and global process consistency across manufacturing sites.

Regional Highlights

- Asia Pacific (APAC): APAC maintains its dominant position and is projected to exhibit the highest growth rate during the forecast period. This trajectory is primarily driven by massive government and private sector investments in the semiconductor industry, particularly in China, Taiwan, South Korea, and Singapore, which necessitates extremely high volumes of advanced microscopes (SEM, High-Resolution Digital) for wafer inspection and quality control. Furthermore, the region's burgeoning automotive manufacturing base and rapid expansion in general electronics assembly, coupled with a growing focus on indigenous R&D and materials science in countries like India, significantly boost the demand for both optical and electron microscopy solutions. The competitive pricing and focus on high-volume production requirements make APAC a critical market for manufacturers focusing on automated, high-throughput instruments.

- North America: North America represents a mature, high-value market characterized by early adoption of cutting-edge microscopy technologies and strong demand from high-regulated sectors. The aerospace and defense, medical device manufacturing, and advanced material research industries in the U.S. and Canada require specialized, high-precision tools for failure analysis and compliance testing. The region leads in the integration of AI-powered software solutions and digital connectivity, emphasizing systems that offer robust data security and detailed audit trails. Demand here is less volume-driven and more focused on advanced capabilities such as extreme resolution (AFM/SPM) and integrated analytical spectroscopy techniques, reflecting a focus on innovation and complex research applications.

- Europe: The European market is characterized by stringent quality standards, particularly within the automotive, precision engineering, and pharmaceutical industries (including biotech). Countries like Germany, France, and Switzerland are hubs for advanced materials science and high-precision manufacturing, driving steady demand for high-quality, reliable metallurgical and digital microscopes. The focus in Europe is on implementing sustainable manufacturing practices, leading to a need for microscopes optimized for non-destructive testing and high repeatability. Furthermore, strong academic and institutional research funding ensures a constant demand for high-end TEM and specialized confocal microscopes for materials characterization and industrial R&D projects across the continent.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily, primarily driven by expanding automotive manufacturing and increasing industrialization in Brazil and Mexico. The demand is currently centered on cost-effective, durable optical and digital microscopes for basic quality control and educational purposes. As foreign direct investment increases in electronics assembly and resource extraction industries, the requirement for more sophisticated failure analysis and quality inspection tools is expected to rise, shifting purchasing trends toward integrated digital systems with basic automation features.

- Middle East and Africa (MEA): MEA remains a nascent but promising market. Growth is predominantly concentrated in areas with significant oil and gas infrastructure (requiring metallurgical analysis of pipelines and components), along with emerging medical device and construction sectors in the Gulf Cooperation Council (GCC) countries. The market currently relies heavily on imported equipment, with increasing demand for robust, easy-to-maintain digital microscopes for routine inspection and quality verification, supported by government initiatives to diversify industrial bases beyond reliance on hydrocarbons.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Microscope Market.- Carl Zeiss AG

- Nikon Corporation

- Olympus Corporation

- Keyence Corporation

- JEOL Ltd.

- Hirox Corporation

- Bruker Corporation

- Hitachi High-Tech Corporation

- Leica Microsystems (Danaher Corporation)

- Tescan Orsay Holding

- Thermo Fisher Scientific Inc.

- Aven Inc.

- Motic

- Mitutoyo Corporation

- COXEM Co. Ltd.

- Vision Engineering Ltd.

- Meiji Techno Co. Ltd.

- Scienscope International

- Shimadzu Corporation

- Oxford Instruments plc.

Frequently Asked Questions

Analyze common user questions about the Industrial Microscope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Industrial Microscope Market?

The primary driver is the accelerating trend of component miniaturization in high-tech manufacturing, particularly within the semiconductor and electronics industries, which necessitates high-resolution, precise inspection, and measurement tools for ensuring nanoscale quality control and defect detection during production.

How is digital technology transforming industrial microscopy operations?

Digital technology is transforming operations by enabling high-throughput automated inspection, integrating advanced image analysis software, facilitating remote access, and providing seamless connectivity to manufacturing execution systems (MES) for real-time quality assurance data management and streamlined reporting.

Which industrial microscope segment is projected to grow the fastest?

The Digital Microscope segment is projected to exhibit the fastest growth, largely due to its superior efficiency, ease of use, network compatibility, and the ability to replace manual inspection processes with fully automated metrology and measurement workflows across diverse industrial applications globally.

What role does Artificial Intelligence play in modern industrial microscopy?

AI, primarily machine learning and deep learning, enhances modern industrial microscopy by enabling automated, high-accuracy defect classification, optimizing system parameters in real-time, and significantly accelerating the interpretation of complex image datasets, thereby increasing inspection speed and reliability.

Why is the Asia Pacific region dominating the market for industrial microscopes?

The Asia Pacific region dominates due to massive ongoing investments in semiconductor fabrication and electronics manufacturing hubs, particularly in East Asia, which creates the highest demand globally for high-end electron microscopes and high-throughput digital inspection systems critical for advanced manufacturing quality control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager