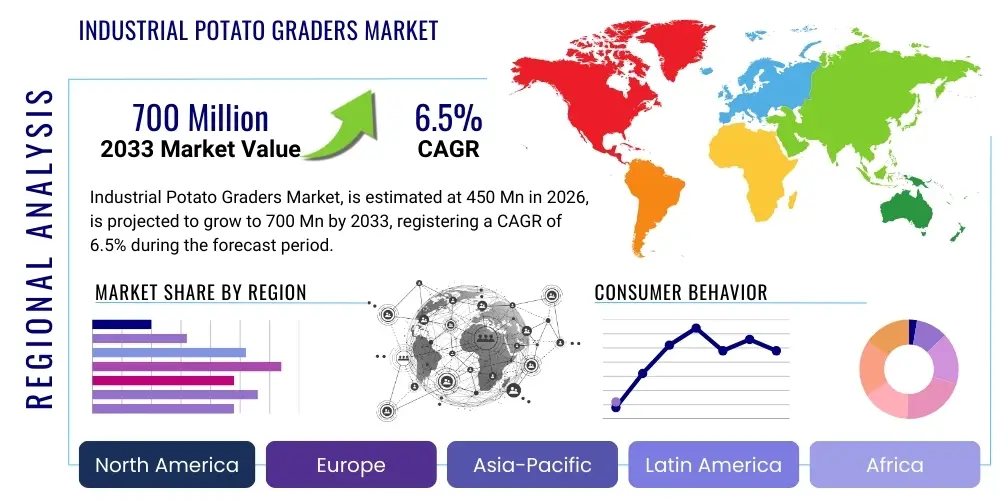

Industrial Potato Graders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441137 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Industrial Potato Graders Market Size

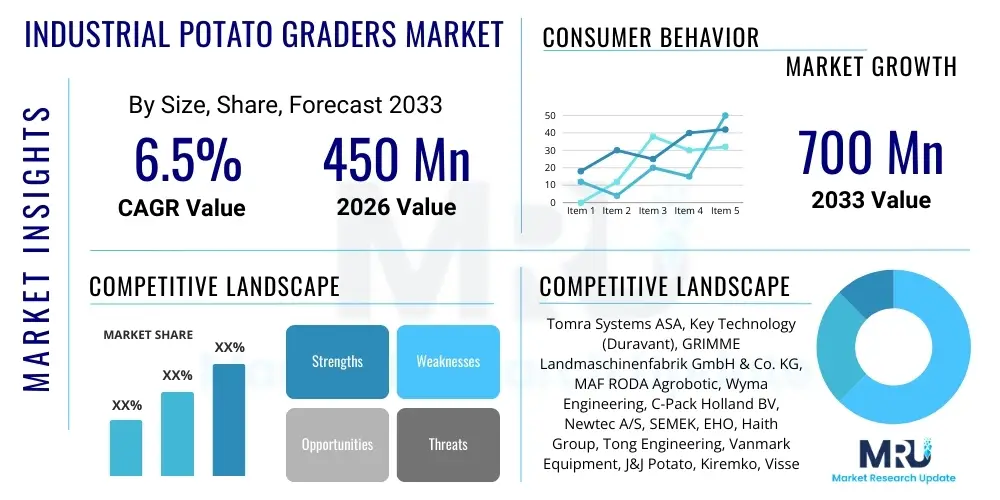

The Industrial Potato Graders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033.

Industrial Potato Graders Market introduction

The Industrial Potato Graders Market encompasses specialized machinery designed for the automated sorting, sizing, and defect detection of potatoes harvested on a large, industrial scale. These systems are crucial components within the post-harvest handling chain, ensuring that potatoes meet strict quality standards required by fresh market retailers, processors, and seed producers. The primary objective of industrial grading equipment is to maximize yield efficiency, minimize manual labor dependence, and ensure uniform product quality, thereby enhancing profitability across the agricultural supply chain. Modern industrial graders utilize advanced technologies, including optical sensors, high-speed cameras, and sophisticated software algorithms, which distinguish them significantly from traditional mechanical sorting methods.

Industrial potato graders facilitate high throughput processing by accurately classifying potatoes based on parameters such as weight, diameter, shape, color, and the presence of external or internal defects, including greening, scabs, cuts, and foreign material. The application spectrum is broad, ranging from large commercial farms that require initial field sorting to massive processing facilities that prepare potatoes for value-added products like frozen fries, chips, or dehydrated mashed potatoes. Benefits derived from adopting these advanced systems include substantial reductions in product waste, improved operational speed, enhanced hygiene standards, and the ability to comply with increasingly stringent food safety regulations globally. The move towards fully automated, non-destructive testing (NDT) grading methods is a key evolutionary trend driving market expansion.

Major applications of these grading systems are concentrated in large-scale potato farming operations, centralized packing houses, and primary processing plants for food manufacturing. Key driving factors accelerating market growth include the global impetus toward agricultural automation necessitated by rising labor costs and shortages, the escalating consumer demand for consistent, high-quality processed potato products, and technological advancements, particularly in high-definition imaging and Artificial Intelligence (AI) integration, which significantly boost sorting accuracy and speed. These factors collectively position the industrial potato graders market for robust expansion throughout the forecast period.

Industrial Potato Graders Market Executive Summary

The Industrial Potato Graders Market is poised for substantial growth, driven primarily by fundamental shifts in agricultural labor dynamics and the relentless consumer demand for processed potato derivatives. Business trends indicate a strong move toward advanced optical sorting technology, replacing older, less efficient mechanical systems. Manufacturers are focusing on modular designs that offer scalability and adaptability to diverse processing requirements, alongside emphasizing data integration capabilities to allow farmers and processors to track quality metrics in real-time. Strategic partnerships between machinery manufacturers and specialized software developers are becoming commonplace to enhance defect detection algorithms, especially concerning internal quality assessment.

Regional trends highlight that North America and Europe remain the dominant markets due to high levels of agricultural mechanization, strict quality control mandates, and established infrastructure for large-scale potato processing. However, the Asia Pacific (APAC) region, particularly countries like China and India, is emerging as the fastest-growing market segment. This rapid growth is fueled by increasing urbanization, rising disposable incomes leading to higher consumption of processed snacks, and governmental focus on modernizing traditional agricultural practices. Investment in automated post-harvest solutions is accelerating across APAC to address post-harvest losses and improve global export competitiveness.

Segment trends reveal that optical graders, specifically those utilizing high-resolution cameras and spectroscopy, are experiencing the highest adoption rates, overshadowing traditional mechanical graders due to superior speed and accuracy in detecting subtle blemishes and internal defects. Within the capacity segmentation, high-capacity systems (above 30 tons per hour) designed for massive processing plants are seeing robust demand, reflecting the consolidation of the processing industry into larger, centralized facilities. The processed food production application segment, including frozen fries and chips, continues to dominate market consumption, necessitating highly consistent grading to ensure optimal manufacturing output and minimal rework.

AI Impact Analysis on Industrial Potato Graders Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the industrial potato grading landscape, shifting it from deterministic rule-based sorting to highly adaptive, intelligent classification systems. Common user questions often revolve around how AI can improve sorting accuracy beyond human capabilities, the cost-benefit analysis of implementing complex neural networks for defect identification, and the potential for these systems to grade potatoes based on characteristics previously impossible to assess, such as predicting cooking quality or shelf life. Users are also concerned about the ease of updating ML models to handle new potato varieties or novel diseases without extensive system downtime. The consensus expectation is that AI will unlock unprecedented levels of precision and efficiency, significantly reducing false reject rates and enabling processors to target specific, high-value market segments based on highly granular quality data.

AI’s influence is primarily manifested through enhanced machine vision systems that leverage deep learning algorithms to distinguish between hundreds of potential defect types, going far beyond simple size and color sorting. These algorithms are trained on massive datasets of potato images, enabling them to identify subtle internal bruising, early-stage diseases, and complex shape deformities with exceptional reliability, even at very high conveyor speeds. This capability is critical for large processors who require zero tolerance for certain contaminants or quality flaws in their final product. Furthermore, AI allows for dynamic adjustments to grading parameters in real-time, optimizing the sorting process based on instantaneous quality fluctuations within a batch, a capability unattainable with static programming.

The economic value proposition of AI in grading is centered on waste reduction and yield optimization. By accurately separating marketable product from waste or lower-grade streams, processors maximize the value extracted from every harvest. AI also plays a pivotal role in predictive maintenance, analyzing sensor data from the grading equipment itself to forecast potential mechanical failures, thereby minimizing unexpected downtime and optimizing operational longevity. This holistic approach, combining sorting intelligence with operational intelligence, represents the next generation of industrial grading technology, directly addressing the key concerns of minimizing waste, maximizing throughput, and achieving unparalleled quality consistency sought by market stakeholders.

- Enhanced Defect Detection: AI algorithms identify complex, subtle defects (internal bruising, early blight) invisible to traditional sensors.

- Real-Time Parameter Adjustment: Machine learning enables dynamic calibration of sorting rules based on instantaneous batch quality variations.

- Minimized False Rejects: Increased accuracy leads to a significant reduction in mistakenly discarded high-quality produce.

- Predictive Quality Assessment: AI models predict end-product attributes (e.g., starch content, cooking characteristics) for optimized routing.

- Automated System Calibration: Reduced reliance on manual configuration and calibration, increasing operational uptime.

- Data-Driven Decision Making: Integration of grading data into larger farm management systems for optimized harvesting and storage strategies.

DRO & Impact Forces Of Industrial Potato Graders Market

The Industrial Potato Graders Market is shaped by a potent combination of driving forces related to modernization and quality standards, moderated by significant capital expenditure restraints, yet buoyed by vast opportunities stemming from technological innovation and geographical expansion. The central drivers are the intensifying global demand for consistency in food products, which mandates high-precision sorting, and the pervasive trend of agricultural automation driven by chronic labor shortages and escalating wage costs in developed economies. Conversely, the market faces constraints primarily due to the substantial initial investment required for sophisticated optical grading machinery, posing a barrier to entry for smaller or developing agricultural enterprises, alongside the technical complexity of maintaining and operating advanced vision systems, which necessitates specialized training and infrastructure.

Opportunities within this market are centered around the relentless pace of technological advancement. The development and commercialization of Hyperspectral Imaging (HSI) technology, coupled with the application of deep learning, offers the potential for non-invasive detection of internal defects and chemical composition, opening new avenues for quality classification. Furthermore, significant market opportunities exist in emerging economies, particularly across Asia and Africa, where government initiatives are actively promoting post-harvest technology to drastically reduce food waste, which currently stands at high percentages. The push towards sustainable agriculture also creates an opportunity for graders to optimize resource allocation by better analyzing input quality.

The impact forces are substantial, creating high entry barriers but promoting rapid technological turnover among leading manufacturers. Economic factors, such as volatile raw material costs (e.g., steel, electronic components) and currency fluctuations, influence manufacturing costs and final equipment prices. Regulatory forces, specifically evolving food safety standards (e.g., stricter EU or FDA requirements for foreign material detection), necessitate continuous innovation in grading accuracy, thereby favoring suppliers who integrate cutting-edge sensor and software technology. Competitive pressure among key players is high, leading to rapid product innovation cycles focused on maximizing throughput, minimizing footprint, and improving energy efficiency, ensuring that the market remains highly dynamic and focused on achieving optimal operational performance for end-users globally.

Segmentation Analysis

The Industrial Potato Graders Market is systematically segmented based on technology type, processing capacity, and application across the value chain, allowing for a precise analysis of specific user needs and technological preferences. The core segmentation by technology differentiates between older, reliable mechanical systems that sort primarily by weight and dimension, and modern, highly accurate optical systems that use sophisticated sensors for detailed quality assessment. Capacity segmentation addresses the varying needs of users, ranging from smaller packing houses requiring low throughput systems to large, integrated food processing giants demanding ultra-high-speed machinery. The primary application segmentation reflects the distinct quality requirements for fresh market produce versus highly standardized inputs required for processed goods, defining the necessary precision levels for the deployed grading technology.

- By Type:

- Mechanical Graders (Sizing via screens/rollers)

- Optical Graders (Vision Systems, Color Sorting, Defect Sorting, Hyperspectral Imaging)

- By Capacity:

- Low Capacity (Under 10 Tons Per Hour - TPH)

- Medium Capacity (10 TPH – 30 TPH)

- High Capacity (Above 30 TPH)

- By Application:

- Fresh Market Potatoes (Retail/Wholesale)

- Processed Food Production (Frozen Fries, Chips, Flakes)

- Seed Potato Sorting (Disease and size control)

- By Geography:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Netherlands)

- Asia Pacific (China, India, Japan, Australia)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Industrial Potato Graders Market

The value chain for the industrial potato graders market begins with upstream component manufacturing, primarily involving highly specialized suppliers of electronic sensors, high-speed cameras, computing hardware, and precision mechanical components such as belts, rollers, and stainless steel frames. These suppliers are critical as the performance and reliability of the final grading equipment are directly dependent on the quality and synchronization of these specialized components. Technological advancements in upstream sectors, particularly in sensor resolution and processing power, directly translate into superior grading capabilities for the downstream equipment manufacturers. Manufacturers focus heavily on research and development to integrate these components into modular, durable, and user-friendly systems, often requiring deep expertise in food handling hygiene and industrial automation standards. This stage involves significant capital investment in fabrication, assembly, and rigorous testing protocols to ensure system longevity under harsh agricultural conditions.

The mid-stream segment is dominated by Original Equipment Manufacturers (OEMs) who design, assemble, and customize the grading lines. These OEMs utilize a dual-channel distribution approach. Direct sales are often preferred for large, customized, high-capacity installations targeting major international food processors (e.g., companies producing high-volume frozen french fries), allowing for close consultation, installation support, and tailored service contracts. This direct channel ensures better communication regarding complex system specifications and maintenance agreements. Conversely, the indirect channel, involving regional dealers, distributors, and specialized agricultural machinery resellers, is typically used for selling standard or medium-capacity modular graders to individual large-scale farms or smaller regional packing facilities. Distributors provide essential local sales support, financing options, and immediate maintenance services, which are crucial in geographically dispersed agricultural markets.

The downstream analysis focuses on the end-users: large agricultural enterprises, cooperative packing houses, and multinational food processing companies. For fresh market applications, grading accuracy ensures product presentation and compliance with retail shelf standards, directly impacting market price realization. For the processed food segment, accurate sorting minimizes variations in raw material quality, leading to optimized frying or baking processes and reduced waste during manufacturing. After-sales service, including software updates, calibration support, and spare parts provision, forms a crucial part of the downstream value chain, as equipment downtime is highly costly during peak harvest seasons. The longevity of customer relationships is often determined by the responsiveness and technical proficiency of the OEM or distributor in providing continuous operational support and technological upgrades.

Industrial Potato Graders Market Potential Customers

The potential customers for industrial potato grading systems are highly diverse but generally fall into three distinct categories based on their operational scale and quality requirements. The largest segment comprises multinational and large regional food processing companies specializing in value-added potato products such as frozen french fries, potato chips, and dehydrated products. These entities demand the highest throughput, greatest sorting accuracy (often utilizing optical and AI systems), and stringent quality controls to ensure raw material consistency essential for their mass production lines. Their purchasing decisions are driven by ROI calculations based on waste reduction, speed, and regulatory compliance.

The second major customer group includes large-scale commercial potato farms, cooperative farming associations, and centralized packing facilities (pack houses). These customers utilize graders primarily for post-harvest handling, preparing potatoes for the fresh market or bulk storage. While throughput is important, they often prioritize robust, durable, and flexible grading solutions capable of handling varying field conditions and sorting based on general size, weight, and easily detectable visual defects. The shift towards automation in this segment is strongly motivated by high labor costs and the difficulty in securing reliable seasonal workers for manual sorting tasks.

Finally, seed potato producers and specialized agricultural research institutions constitute a smaller but critically important customer segment. For seed potato production, grading is less about market aesthetics and more about rigorous health, disease, and specific size standardization (calibre). These customers require highly sensitive, often bespoke grading systems capable of identifying subtle disease markers or genetic anomalies, ensuring the quality and viability of the subsequent crop. Their purchasing criteria prioritize extreme accuracy and data logging capabilities over sheer speed, often requiring advanced spectral or bio-sensing technologies integrated into the sorting process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tomra Systems ASA, Key Technology (Duravant), GRIMME Landmaschinenfabrik GmbH & Co. KG, MAF RODA Agrobotic, Wyma Engineering, C-Pack Holland BV, Newtec A/S, SEMEK, EHO, Haith Group, Tong Engineering, Vanmark Equipment, J&J Potato, Kiremko, Visser Separation Technology, GP Graders, Reemoon Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Potato Graders Market Key Technology Landscape

The core technology landscape of the industrial potato graders market is characterized by a rapid migration from mechanical sorting methods to sophisticated sensor-based and software-driven platforms. Traditional graders rely on physical mechanisms such as vibrating screens, roller sizers, and weight scales to achieve separation, offering robustness and simplicity but often lacking the precision required for modern quality demands, particularly for defect detection and internal quality assessment. The contemporary market standard is the Optical Grader, which incorporates high-definition color cameras, infrared (IR) sensors, and occasionally X-ray technology to perform non-destructive testing (NDT) at speeds exceeding several tons per hour. These optical systems are highly effective at sorting based on external color, size, shape, and visible defects, providing a significant leap in efficiency and reducing labor dependency dramatically.

The cutting edge of grading technology is defined by the integration of Artificial Intelligence (AI) and Hyperspectral Imaging (HSI). HSI utilizes a wider spectrum of light, including the near-infrared region, allowing the system to analyze the chemical composition of the potato, thereby detecting internal quality flaws such as hollow heart, internal bruising, or early stages of disease that are invisible to the naked eye or standard color cameras. AI/ML algorithms are essential to process the massive datasets generated by HSI and high-resolution cameras, enabling the system to learn and adapt to various potato varieties and changing defect profiles. This predictive capability and granular analysis are crucial for processors aiming for highly standardized input materials to optimize downstream manufacturing processes like frying or starch extraction, maximizing output consistency and minimizing costly errors.

Furthermore, technology development is heavily focused on modularity and connectivity, aligning with the industry 4.0 paradigm. Modern industrial graders are designed as modular units that can be scaled up or down and easily integrated into existing processing lines. They incorporate sophisticated Internet of Things (IoT) capabilities, allowing for real-time data transmission regarding throughput, quality distribution, and maintenance alerts. This data integration supports farm-to-fork traceability initiatives and enables processors to make immediate operational adjustments based on the quality feedback loop. The emphasis is increasingly placed not just on sorting accuracy, but also on energy efficiency, reduced water usage in washing/sorting cycles, and improved sanitary design for easier cleaning and maintenance.

Regional Highlights

- North America: Represents a mature and technologically advanced market segment, characterized by high adoption rates of automated sorting and grading equipment. The U.S. and Canada lead in implementing high-capacity optical graders, driven by chronic agricultural labor shortages, stringent food safety standards, and the presence of large multinational food processing corporations (e.g., frozen food manufacturers). The region focuses on integrating AI for internal defect detection and predictive quality analysis.

- Europe: A dominant market, particularly Western European nations like Germany, the Netherlands, and France, which are major potato producers and exporters. The market is propelled by strict European Union regulations regarding quality specifications, size uniformity, and disease control, particularly concerning seed potatoes. There is a strong emphasis on sustainability, leading to demand for energy-efficient and water-saving grading solutions.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally. Rapid urbanization, increasing disposable income, and the subsequent surge in demand for packaged and processed foods (chips, snacks) are accelerating the need for high-throughput graders in countries like China, India, and Australia. Governments are actively subsidizing agricultural modernization, making advanced systems more accessible to large farms and new processing ventures.

- Latin America (LAMEA): Showing steady growth, primarily focused in Brazil and Argentina, major agricultural exporters. Market expansion is driven by the need to professionalize post-harvest operations to meet international export quality standards. Adoption rates are currently higher for medium-capacity mechanical and basic optical systems, with increasing investment in advanced technology expected.

- Middle East and Africa (MEA): Currently a nascent market but holds significant potential, especially in South Africa and agricultural hubs in the Middle East. Growth is contingent on governmental investment in water-efficient farming technologies and initiatives aimed at drastically reducing post-harvest losses and enhancing food security. Adoption is predominantly focused on essential mechanical and entry-level optical sorting solutions to manage scale and variability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Potato Graders Market.- Tomra Systems ASA

- Key Technology (Duravant)

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- MAF RODA Agrobotic

- Wyma Engineering

- C-Pack Holland BV

- Newtec A/S

- SEMEK

- EHO

- Haith Group

- Tong Engineering

- Vanmark Equipment

- J&J Potato

- Kiremko

- Visser Separation Technology

- GP Graders

- Reemoon Technology

- Greefa B.V.

- S&B Processing Equipment Co., Ltd.

- Tolsma-Grisnich BV

Frequently Asked Questions

Analyze common user questions about the Industrial Potato Graders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of optical potato graders over traditional mechanical graders?

Optical potato graders offer significantly higher sorting accuracy and speed, utilizing advanced cameras and sensors to detect subtle external and internal defects, color variations, and shape irregularities, which are impossible for mechanical systems to classify. This non-destructive testing (NDT) capability maximizes yield and ensures compliance with high-tier quality specifications.

How does AI technology enhance the efficiency and precision of industrial potato grading?

AI, specifically Machine Learning (ML) and Deep Learning, improves efficiency by processing complex visual data from hyperspectral and high-speed cameras, allowing for real-time classification of complex defects and predicting internal quality metrics (e.g., starch levels). This dramatically reduces false reject rates and automates system calibration.

Which geographical region is expected to exhibit the fastest growth in the potato graders market?

The Asia Pacific (APAC) region is projected to register the fastest growth due to rapid modernization of agricultural infrastructure, increasing investment in reducing post-harvest losses, and soaring consumer demand for high-quality processed potato products driven by urbanization and rising disposable incomes in countries like China and India.

What are the main financial constraints hindering the widespread adoption of industrial potato graders?

The primary constraint is the high initial capital investment required for purchasing and installing advanced optical and AI-integrated grading systems. This cost barrier disproportionately affects small-to-medium-sized agricultural operations, necessitating favorable financing schemes or government subsidies for broader market penetration.

What applications require the highest level of sorting precision in potato grading?

Seed potato production and the preparation of raw material for high-end processed food applications (like premium frozen fries or specific chip lines) demand the highest precision. Seed potato sorting requires rigorous checks for subtle disease markers and precise size uniformity, often relying on specialized spectral analysis to ensure optimal crop health and viability.

Market Outlook and Strategic Recommendations

The Industrial Potato Graders Market is transitioning through a critical phase of technological innovation, moving decidedly away from purely mechanical processes toward holistic, intelligent sorting systems powered by AI and advanced optical sensor fusion. The market’s future growth is highly dependent on manufacturers’ ability to address the key challenges of reducing the total cost of ownership (TCO) for these sophisticated machines and simplifying their maintenance requirements. Companies that successfully develop modular, user-friendly interfaces with strong remote diagnostic capabilities will capture significant market share, particularly among operators in regions with nascent technical support infrastructures.

Strategic recommendations for stakeholders include aggressive investment in R&D focused on proprietary deep learning models for defect recognition, especially for internal defects which currently represent the largest area of potential optimization and yield increase. Furthermore, manufacturers should prioritize the development of flexible financing and leasing models to mitigate the high initial capital outlay, making high-end optical systems accessible to a wider pool of medium-sized processors and large commercial farms in rapidly expanding markets like Southeast Asia and Eastern Europe. Establishing robust local technical training centers and spare parts supply networks in these emerging markets is also crucial for long-term customer satisfaction and market entrenchment.

The convergence of increasing global population, escalating food quality expectations, and the persistent pressure to reduce agricultural waste guarantees a sustained, high-growth trajectory for the industrial potato graders market. As labor cost pressures continue to mount across developed nations, automation transitions from a competitive advantage to an operational necessity, solidifying the demand foundation for high-throughput, precision grading solutions. Successful market participation requires a nuanced understanding of regulatory demands, regional labor dynamics, and continuous technological alignment with the evolving capabilities of sensor and artificial intelligence platforms.

Manufacturers are advised to engage in strategic partnerships with technology providers specializing in data analytics and cloud computing. Integrating quality data generated by graders with upstream agricultural management systems (e.g., planting, harvesting, and storage systems) offers a comprehensive value proposition that extends beyond mere sorting. This data-driven approach enables potato producers to optimize field practices based on the observed quality output, leading to systemic efficiency improvements across the entire supply chain. Future competitive differentiation will heavily rely on providing solutions that offer not only superior mechanical sorting but also invaluable agronomic and operational intelligence.

In summary, the market outlook remains strongly positive, characterized by technological disruption and geographical diversification. While Europe and North America will continue to be primary revenue centers for high-value optical systems, the dynamic growth opportunities presented by APAC and other emerging economies, driven by evolving dietary habits and government push towards modernization, necessitate tailored product strategies focusing on rugged reliability, scalability, and cost-effectiveness. The industrial potato graders sector is poised to be a pivotal facilitator of global food quality and security initiatives.

The ongoing refinement of sorting criteria, driven by specific industrial needs—such as sorting potatoes based on sugar content for crisping or frying suitability—further underlines the market's trajectory towards hyper-specialization. Manufacturers are increasingly developing modular components that can be quickly swapped or reconfigured to transition a line from fresh market grading to processed food grading, enhancing the utility and investment return for processing facilities that handle multiple end-products. This flexibility is a key differentiator in a market where operational agility is increasingly valued. Furthermore, compliance with international standards for machine safety and food contact materials remains non-negotiable, influencing design choices and material specifications across all major segments.

The necessity for minimal product damage during the grading process has spurred innovation in gentle handling mechanisms, including specialized cushioned transfer points and soft roller systems, particularly crucial for high-speed lines handling delicate varieties. Stakeholders must therefore balance the need for high throughput and extreme accuracy with the requirement for gentle product treatment. This delicate balance reinforces the technical complexity involved in developing market-leading industrial graders. The future of this industry is intertwined with the successful adoption of fully integrated, end-to-end post-harvest solutions that incorporate washing, cleaning, grading, and automated packaging seamlessly, delivering total line efficiency rather than optimizing individual components in isolation.

Finally, sustainability considerations are becoming a powerful market force. Customers are beginning to demand graders that minimize energy consumption and reduce reliance on water, especially in regions facing water scarcity. Innovations in dry sorting technologies, combined with highly efficient air handling systems, are gaining traction as they align with global environmental mandates and reduce operational utility costs. Equipment manufacturers that can demonstrate superior sustainability metrics, validated through life cycle assessments (LCA), will gain a significant competitive edge, appealing not only to corporate responsibility objectives but also to processors looking to optimize long-term operational costs in the face of rising environmental fees and resource prices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager