Industrial Real Estate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443320 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Industrial Real Estate Market Size

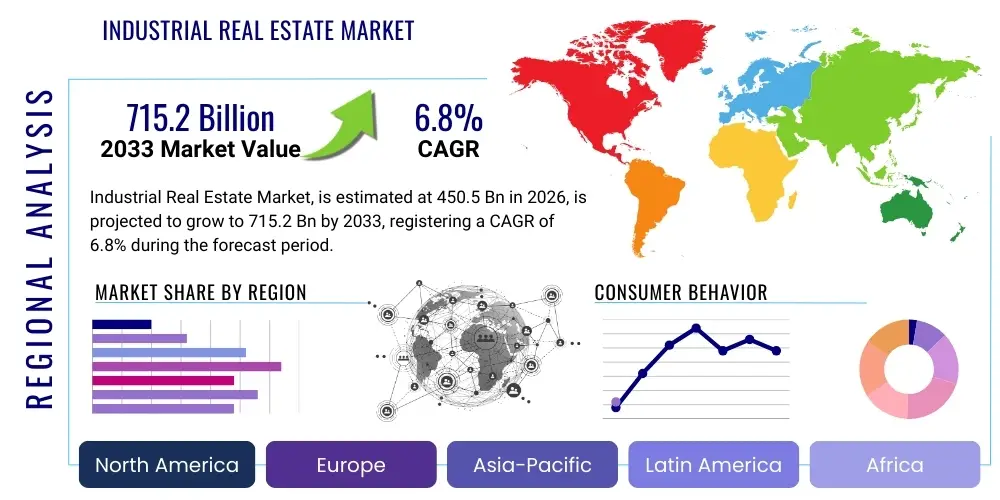

The Industrial Real Estate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 715.2 Billion by the end of the forecast period in 2033.

Industrial Real Estate Market introduction

The Industrial Real Estate Market encompasses properties utilized for manufacturing, logistics, distribution, storage, and specialized production facilities. This sector is characterized by a diverse range of assets, including large-scale fulfillment centers, urban last-mile distribution hubs, temperature-controlled cold storage facilities, and technologically advanced manufacturing plants. The primary purpose of industrial properties is to facilitate the supply chain efficiency necessary for modern commerce, driven significantly by the explosive growth of e-commerce, global trade complexity, and the strategic necessity for inventory resilience following recent geopolitical and health crises. Key types of industrial assets include sophisticated logistics warehouses capable of supporting automated systems, flexible space (flex) properties combining high-quality office space with functional industrial areas, and dedicated research and development centers, each meticulously tailored to the specific operational requirements of tenants spanning major sectors such as retail, pharmaceutical, automotive, and high technology.

Product demand within the industrial real estate sector is intrinsically linked to macroeconomic health, shifting consumer spending patterns, and rapid technological advancements in automation and supply chain management. The essential benefits derived from leasing high-quality, modern industrial assets include demonstrably streamlined operational efficiency, significantly reduced transportation costs achieved through optimized and geographically strategic location strategies, and enhanced inventory visibility and management capabilities facilitated by integrated smart building technology. Furthermore, contemporary industrial facilities are now designed specifically to incorporate high clear heights (often 36 to 40+ feet), expansive column spacing, ample heavy-duty docking bays, specialized flooring capable of handling high point loads from heavy machinery, and robust infrastructure necessary to support advanced automated guided vehicles (AGVs) and complex robotic picking systems. This evolution elevates the industrial property from a simple storage box to a critical, high-performance node within the tenant’s sophisticated competitive supply chain infrastructure.

The market’s substantial and sustained expansion is driven by several pervasive, long-term secular factors. Foremost among these are the unrelenting digitalization of retail and business-to-business (B2B) commerce, leading to immense and continuous demand for highly efficient warehousing and accelerated fulfillment capabilities, particularly in dense metropolitan areas. This is compounded by the global imperative for companies to maintain resilient supply chains through diversified, strategic inventory buffers—a clear shift toward the "just-in-case" inventory model following widespread pandemic-related disruptions. Additionally, substantial governmental incentives supporting domestic and regional manufacturing (known as reshoring or nearshoring), particularly targeting advanced sectors such as semiconductor fabrication, electric vehicle component production, and biotechnology research, necessitates the rapid development of specialized, high-specification industrial parks and bespoke build-to-suit facilities, fueling massive capital investment and corresponding market growth across all major geographical regions, including established logistical corridors and emerging secondary markets.

Industrial Real Estate Market Executive Summary

The industrial real estate market currently operates in a state of high demand equilibrium, globally characterized by historically low vacancy rates, often below 4% in prime metropolitan and major logistics corridor areas. Key business trends indicate a definitive structural shift toward multi-story warehousing solutions in densely populated urban cores, a necessary adaptation to support highly demanding rapid last-mile delivery requirements where land scarcity is acute. This operational trend is coupled with a major surge in institutional investment dedicated to the cold storage infrastructure sub-segment, driven both by highly specialized pharmaceutical logistics (cold chain transport for biologics) and the continued expansion of fresh food e-commerce platforms. Institutional investors are increasingly classifying industrial assets as essential core holdings due to their robust defensive characteristics, strong rent growth potential that often outpaces inflation, and long-term capital preservation qualities, particularly for assets linked to resilient supply chains and located within high-barrier-to-entry logistics markets, ultimately leading to sustained compressed capitalization rates globally across all asset classes.

Regionally, the market dynamics are intensely varied yet universally strong. North America, especially the U.S. coastal logistics hubs and the Inland Empire in California, maintains its position as a global powerhouse, benefiting from the world’s largest consumer base and highly sophisticated, integrated transportation networks. However, severe development constraints, regulatory complexities, and land scarcity in these core markets are simultaneously pushing developers and tenants toward increasingly viable secondary and tertiary markets. Asia Pacific (APAC), led by dynamic economies such as China, India, and Australia, is experiencing the most dramatic infrastructural catch-up growth globally, primarily catalyzed by rapid, ongoing urbanization and the massive proliferation of sophisticated local e-commerce and retail giants. Concurrently, Europe is focused primarily on modernizing its legacy logistics infrastructure, intensively integrating automated sorting and distribution facilities and optimizing complex cross-border distribution networks to ensure seamless trade flow and comply with the European Union’s increasingly stringent environmental and energy efficiency regulations.

Segmentation analysis highlights the continued market dominance of the general logistics and warehousing segment, which absorbs the majority of new supply. However, specialized, high-specification segments, such as technically demanding data centers (which often share significant industrial property characteristics) and advanced biotech manufacturing facilities, are consistently exhibiting superior growth trajectories and rental premiums. A critical structural trend influencing the entire market is the intense focus on Environmental, Social, and Governance (ESG) standards; this is fundamentally transforming the design specifications, with "green" buildings featuring on-site renewable energy sources, optimized insulation, rainwater harvesting systems, and sustainably sourced construction materials becoming the unambiguous preferred choice. These highly sustainable assets consistently command measurable rental premiums and are significantly influencing investment valuation metrics. Furthermore, the increasing viability of flexible industrial space models is effectively catering to the scalability and short-term operational needs of Small and Medium-sized Enterprises (SMEs) requiring agile operations without necessitating massive, long-term capital commitments typical of traditional industrial leases.

AI Impact Analysis on Industrial Real Estate Market

User queries regarding AI in industrial real estate predominantly center on how technology will transform operational efficiency, the necessity for building modifications to support autonomous systems, and the implications for long-term labor requirements within highly automated warehouses. Concerns often revolve around the initial substantial capital expenditure required for sophisticated AI system integration, the potential data security risks associated with interconnected smart building platforms, and the expected technical lifespan and risk of early obsolescence for current automation infrastructure investments. Users are keenly interested in understanding how predictive maintenance capabilities powered by advanced AI systems can drastically reduce unplanned facility downtime, how machine learning algorithms optimize complex routing logistics and highly efficient inventory placement strategies within massive fulfillment centers, and, critically, the measurable valuation premium commanded by buildings actively designated as "AI-ready" or "smart logistics hubs" in the investment community.

The consensus expectation across the sector is that AI will rapidly transform industrial real estate from a passive, purely structural storage asset into an active, dynamically optimized platform critical for efficient goods movement. AI algorithms are fundamentally changing the entire process of strategic site selection by analyzing thousands of complex, interconnected variables—including localized labor availability dynamics, real-time traffic congestion patterns, utility capacity access, and precise proximity analysis to the target consumer base—with exponentially greater precision and predictive capability than traditional static modeling approaches. Furthermore, the widespread integration of sophisticated AI-driven Building Management Systems (BMS) allows for the dynamic adjustment of energy consumption in response to real-time demands, proactive prediction of equipment failure (e.g., HVAC or conveyor systems), and automated, high-resolution security monitoring, leading to demonstrably lower operating expenses (OpEx) and consequently achieving a higher sustainable Net Operating Income (NOI) for property owners and institutional landlords.

Investment decisions and capital allocation strategies are now increasingly swayed by a property’s inherent capacity and infrastructure robustness for intelligent, large-scale automation. Landlords and industrial developers recognize explicitly that failure to incorporate adequate AI-supporting infrastructure, such as enhanced power redundancy, seamless high-speed data connectivity (5G and fiber), and highly optimized spatial layouts designed specifically for automated guided vehicles (AGVs) and robotic picking systems, will inevitably render assets functionally obsolete and non-competitive in the hyper-efficient modern logistics landscape. The specific ability of AI to model complex, multi-echelon supply chain scenarios is directly influencing strategic demand for specific geographical locations—strongly favoring sites near major multimodal transport hubs that can rapidly absorb, process, and efficiently dispatch high volumes of varied inventory, simultaneously reducing reliance on scarce human labor and strategically mitigating persistent labor shortage risks that plague major economic corridors globally.

- AI-driven Predictive Maintenance: Reduces facility downtime and lowers overall operational expenditure (OpEx) through anticipating and preempting mechanical and system failures.

- Optimized Site Selection: Machine learning models analyze thousands of critical variables (labor, traffic, consumer proximity) to pinpoint optimal development locations for distribution efficiency, dramatically impacting land and asset valuation.

- Automated Warehouse Management: AI dynamically guides robotics, optimizes inventory slotting logic, and manages real-time picking routes, necessitating specialized, high-power building layouts and robust connectivity.

- Smart Building Systems (BMS): Utilizes advanced AI algorithms to dynamically adjust HVAC, lighting, and security systems, achieving significant measurable energy savings and dramatically enhancing overall sustainability and ESG profiles.

- Supply Chain Resilience Modeling: AI simulates large-scale operational disruptions (weather, geopolitical events) and identifies optimal inventory positioning across a real estate portfolio, aggressively driving demand for highly diversified, geographically dispersed location strategies.

DRO & Impact Forces Of Industrial Real Estate Market

The long-term trajectory of the Industrial Real Estate Market is fundamentally shaped by a powerful interplay of entrenched secular growth drivers, persistent structural restraints, and substantial technological opportunities that impact long-term asset viability. The sustained, secular acceleration of e-commerce penetration and the accompanying shift in retail supply chain architecture act as the most significant primary driver, continually increasing the necessary warehouse space required per capita across developed and developing economies. This exponential demand necessitates that retailers and logistics providers rapidly expand and optimize their physical footprints. This driving force is further amplified by pervasive global urbanization trends, which paradoxically require the development of smaller, highly efficient, and geographically constrained fulfillment centers closer to high-density consumer hubs, thereby creating intense and sustained rental escalation pressure across all prime urban industrial markets.

Notwithstanding the overwhelming demand, the market faces several significant structural restraints that limit growth velocity. Chief among these are acute land scarcity, particularly within established logistics clusters and densely populated urban areas where industrial land is often rezoned for residential use; highly restrictive and time-consuming zoning regulations which delay project approvals and increase associated costs; and consistently soaring construction costs driven by persistent material inflation, global supply chain bottlenecks for key building components (like steel, roofing, and mechanical systems), and severe labor shortages in skilled construction trades. These cumulative factors significantly limit the speed and volume at which new, technologically advanced inventory can be delivered to effectively meet the explosive market demand, resulting in continued supply deficits and upward pressure on effective rental rates, challenging developers' profitability models for speculative projects.

High-value opportunities arise predominantly from the strategic adoption of automation technology and specialization within high-growth niche sectors. The burgeoning global demand for temperature-controlled cold storage, specifically fueled by advances in pharmaceutical cold chain logistics (especially complex biological drugs and vaccines) and the systemic growth of online fresh grocery delivery services, presents a highly lucrative, high-barrier-to-entry niche characterized by robust returns and superior lease stability, requiring highly specialized infrastructure investment. Furthermore, increasing geopolitical volatility and the observed trend toward supply chain fragmentation offer a distinct opportunity for developers to capitalize directly on reshoring and nearshoring initiatives—building technologically advanced, resilient manufacturing facilities in established economies like North America and Europe to actively reduce reliance on highly distant, potentially vulnerable global supply chains. External impact forces, such as global interest rate hikes and broader credit tightening, critically influence capital availability and borrowing costs, potentially slowing large-scale speculative development, while escalating climate change risks necessitate significant preemptive investment in robust flood mitigation, durable infrastructure, and sustainable energy solutions to safeguard asset longevity and satisfy institutional investor mandates.

Segmentation Analysis

The Industrial Real Estate Market is fundamentally segmented based on Property Type, End-User Industry, and Facility Size, providing a detailed framework for critical investment and development decisions across the global landscape. Segmentation by property type is crucial as it accurately reflects the specific operational requirements, associated technological complexity, and necessary capital expenditure required for specialized assets, such as highly controlled temperature-controlled facilities versus standard dry bulk storage warehouses. Analyzing the market through property types helps identify assets with defensive cash flow characteristics.

The segmentation by end-user industry reveals which specific macroeconomic forces and consumer trends are driving underlying demand in particular industrial subsectors, allowing investors to strategically target resilient areas such as pharmaceuticals/healthcare logistics, or the non-cyclical fast-moving consumer goods (FMCG) segment. This approach provides granular visibility into demand stability. Furthermore, facility size segmentation is vital as it dictates the asset’s functional suitability, differentiating between large-scale bulk storage, regional distribution centers, and the high-value requirements of urban last-mile delivery hubs, which directly influences achievable rental rates, leasing terms, and locational strategy.

- By Property Type:

- Warehouse and Distribution (General Purpose Logistics, Big-Box)

- Light Manufacturing and Assembly (Standard industrial parks)

- Flex Industrial (Office-Warehouse Hybrids, often used by R&D firms)

- Heavy Industrial (Specialized Production, smelters, refineries)

- Cold Storage and Temperature Controlled Logistics (Refrigerated/Freezer space)

- Data Centers (Edge Computing Facilities, Hyperscale Centers)

- By End-User Industry:

- E-commerce and Retail (Fulfillment Centers)

- Third-Party Logistics (3PLs) and Fourth-Party Logistics (4PLs)

- Manufacturing (Automotive, Aerospace, EV Batteries)

- Pharmaceuticals and Healthcare (Medical Device Storage, Biologics Cold Chain)

- Food and Beverage Processing and Distribution

- Technology and Electronics (Semiconductor Fabrication)

- By Facility Size:

- Small-Bay (Under 50,000 sq ft, Urban Infill, Last Mile)

- Mid-Box (50,000 to 200,000 sq ft, Regional Hubs)

- Big-Box (200,000 sq ft and above, Primary Fulfillment Centers, Mega Centers)

Value Chain Analysis For Industrial Real Estate Market

The value chain in the Industrial Real Estate Market is highly complex and multi-staged, beginning with essential upstream activities focused on strategic land acquisition, securing robust project financing, navigating complex regulatory and environmental approvals, and initial architectural feasibility studies. Upstream analysis critically involves assessing the availability, environmental remediation requirements, and cost variability of suitable undeveloped land, which represents a major and growing constraint in high-demand, densely populated urban areas. Financing and sourcing equity capital also sits firmly upstream, being heavily influenced by macroeconomic factors, global interest rate environments, institutional investor appetite for long-term, inflation-hedging assets, and perceived market risk profiles. The meticulous selection of specialized construction materials and supply chain partners, now heavily influenced by stringent sustainability targets and the critical need for supply chain reliability, forms a critical upstream bottleneck impacting development timelines and overall project costs.

The crucial middle segment of the value chain is dedicated to the actual development and construction process. This includes sophisticated architectural planning that meticulously integrates contemporary logistics requirements, such as ultra-high clear heights, optimized column spacing for robotics, advanced security systems, and high-capacity electrical infrastructure necessary for automation. The subsequent construction phase utilizes a carefully managed network of general contractors, specialized engineering firms, and subcontractors. Distribution channels connecting the completed asset to the tenant base are primarily direct, involving development firms leasing directly to major occupiers (often through complex build-to-suit arrangements tailored to specific operational needs). Alternatively, the assets move through indirect channels involving institutional investment funds, Real Estate Investment Trusts (REITs), and private equity firms that acquire and strategically manage large portfolios, utilizing professional third-party property management firms to maintain the assets. The indirect channel relies heavily on sophisticated brokerage and advisory firms that facilitate complex leasing transactions and asset sales, acting as crucial intermediaries connecting property supply with intricate end-user demand.

Downstream activities center entirely on effective asset operation, proactive maintenance, and strategic tenant retention to maximize asset longevity and value. This encompasses highly responsive property management, diligent infrastructure maintenance (especially for complex, specialized systems like low-temperature cold storage or proprietary automation grids), and providing high-value-added services to tenants such as advanced energy consumption monitoring, data analytics for space utilization, and specialized security protocols. The end-users, or tenants (comprising 3PLs, e-commerce giants, and specialized manufacturers), constitute the ultimate downstream link, and their operational satisfaction, lease renewal probabilities, and financial longevity are paramount to sustaining and growing asset valuations. Effective downstream asset management increasingly utilizes predictive technology for tenant relations, proactive maintenance scheduling, and facility optimization, ensuring the operational continuity essential for modern, high-speed supply chain execution.

Industrial Real Estate Market Potential Customers

Potential customers for industrial real estate assets are broadly and strategically categorized into three core groups based on their operational models and capital structures: high-volume logistics providers, captive corporate users, and highly specialized infrastructure-dependent manufacturers. High-volume logistics providers, predominantly comprising Third-Party Logistics (3PL) companies and emerging 4PL entities, represent the single largest and most frequent segment of lessees. These firms require vast, complex, and geographically dispersed networks of big-box distribution centers and cross-docking facilities to efficiently handle fulfillment and transport contracts for multiple client portfolios. These customers prioritize immediate operational scalability, strategic location accessibility to major intermodal hubs (ports, rail, highways), and speed of facility build-out, driving substantial demand for standardized, ready-to-use, and highly customizable space solutions across all major logistics corridors.

Captive corporate users include major global retailers (especially e-commerce native powerhouses and integrated omnichannel firms like Amazon or major big-box chains) and large industrial manufacturers who opt to manage their entire warehousing, distribution, and logistics networks internally. These customers almost always seek long-term, typically 10-15 year leases on strategically located, often bespoke facilities that are customized specifically to seamlessly integrate with their unique proprietary technology stack, established operational flow, and branding requirements, such as high-volume cross-docking centers or dedicated dark stores optimized for hyper-local fulfillment. Their underlying demand for space is notably inelastic and driven primarily by aggressive market share expansion goals, consumer service level agreements, and internal efficiency mandates, rather than short-term fluctuations in real estate costs.

The specialized customer segment encompasses tenants that require highly regulated, technically complex, or purpose-built environments. This includes pharmaceutical companies needing validated cold chain storage (requiring specific temperature ranges, often -20°C or ultra-low temperature cryogenic environments), or advanced technology manufacturers needing contamination-controlled cleanrooms, extreme power capacity, or specialized floor specifications to accommodate complex machinery (e.g., semiconductor production). These highly demanding users require superior infrastructure quality, robust utility redundancy measures, and absolute adherence to stringent local, national, and international regulatory compliance standards, often resulting in materially higher rental rates, longer lease commitments due to the difficulty and massive cost of relocating specialized operations, and strong landlord-tenant partnerships focused on maintenance and compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 715.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prologis Inc., Goodman Group, Rexford Industrial Realty, Inc., Segro plc, GLP Pte Ltd, EastGroup Properties, Terreno Realty Corporation, Indospace, Brookfield Asset Management, W. P. Carey Inc., Panattoni Development Company, Hillwood Properties, Cushman & Wakefield, CBRE Group, JLL, Tishman Speyer, BentallGreenOak, Blackstone, Starwood Capital Group, M&G Real Estate |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Real Estate Market Key Technology Landscape

The technological landscape within industrial real estate is undergoing a radical transformation, evolving rapidly from basic storage infrastructure to highly interconnected, data-rich operational platforms capable of autonomous goods management. The most critical technological shift involves the seamless integration of the physical facility with the broader digital supply chain ecosystem through the widespread deployment of the Internet of Things (IoT) sensors and advanced, centralized building management systems (BMS). IoT devices are essential for monitoring environmental conditions (temperature, humidity), asset location within the facility, energy usage efficiency, and security parameters in real time, feeding vast, continuous data streams into centralized AI and machine learning systems. This critical integration allows for highly accurate predictive facility maintenance, enhanced security protocols, and dynamic optimization of internal operational workflows, drastically increasing the measurable throughput capacity and reliability of the physical building itself.

Crucial enabling technologies driving modern industrial facility design include advanced Automated Storage and Retrieval Systems (AS/RS), specialized robotics (Autonomous Mobile Robots or AMRs, and robotic picking arms), and highly efficient high-speed conveyor technology. The incorporation of these systems necessitates specific, non-negotiable building specifications such as super-flat precision flooring to ensure robotic stability, significantly increased electrical power capacity and redundancy (often requiring high-voltage substation capacity), and ultra-high clear heights (frequently exceeding 40 feet) to maximize vertical storage density. Furthermore, the global corporate push for stringent environmental compliance and operational transparency drives the adoption of sophisticated energy management software and leading-edge green building technologies, including expansive solar panel installations, high-performance insulation, and optimized thermal envelopes, fundamentally transforming capital expenditure priorities toward resilient, high-tech, and sustainable infrastructure that demonstrably commands premium rents.

The importance of robust, high-speed, and reliable connectivity infrastructure cannot be overstated; modern, automated industrial assets rely entirely on strong 5G and dedicated fiber optic networks to support the simultaneous, low-latency transmission of thousands of data transactions between autonomous operating systems and cloud-based warehouse management platforms (WMS). This deep reliance on high-speed, continuous data transmission fundamentally positions technology not merely as an optional add-on but as a core, non-negotiable utility—equally vital as electricity or water supply—significantly influencing the long-term desirability, operational viability, and valuation of the asset. Developers and investors who fail to prioritize significant investment in future-proofed, scalable technology infrastructure risk creating functionally obsolete properties within an aggressively short timeframe, highlighting the absolute critical nature of continuous technological analysis and proactive incorporation into all new industrial design and retrofit planning.

Regional Highlights

Regional dynamics are critical drivers of investment and development strategy in the industrial real estate sector, reflecting significant variances in e-commerce market maturity, quality of logistics infrastructure, labor cost structures, and the regulatory environment. North America, specifically the United States, represents the most mature and institutionally robust market, characterized by immense transaction volumes, complex and sprawling supply chain networks spanning vast geographies, and a constant requirement for new, high-specification logistics facilities strategically located near major dense population centers. The market is aggressively fueled by consistently strong consumer demand and continued near-shoring trends, which particularly impact major coastal ports (Los Angeles/Long Beach, New York/New Jersey) and large inland distribution hubs such as Chicago, Dallas-Fort Worth, and Atlanta. High structural barriers to entry, restrictive permitting processes, and intense competition for prime development sites consistently result in rapid rental growth and sustained high asset values across the core markets.

Asia Pacific (APAC) is strategically positioned and projected to exhibit the fastest proportional growth globally over the forecast period, propelled by a rapidly expanding middle class, high mobile internet penetration rates, and strong, proactive government support for essential logistics infrastructure development in key emerging economies like India, Vietnam, Indonesia, and Southeast Asia generally. While China remains the largest single market in terms of volume, the region as a whole is systematically decentralizing and diversifying its supply chains away from single-country reliance, leading to diversified industrial growth across numerous secondary and tertiary hubs. The primary focus in APAC remains on developing massive, integrated logistics parks and the accelerated modernization of existing, older, and often less efficient facilities, crucially leveraging automation technology to strategically leapfrog traditional logistical constraints and efficiently manage complex, multi-island or challenging cross-border distribution requirements.

Europe presents a fragmented but highly sophisticated industrial market, heavily influenced by complex cross-border trade agreements (EU and customs union dynamics) and world-leading, stringent environmental and sustainability standards. The investment focus across the continent is primarily on optimization, efficiency, and pan-European network integration, heavily utilizing central European corridors (particularly the Benelux region, Germany, and Poland) for high-speed cross-continental distribution. Political stability, strong rule of law, and high mandatory regulatory compliance drive exceptional investor confidence in core markets. Simultaneously, the Middle East and Africa (MEA) are developing as significant emerging markets, with industrial investments highly concentrated around strategic maritime and air cargo hubs (like the UAE, Saudi Arabia, and regional African ports) driven by ambitious government-led economic diversification plans and massive infrastructure mega-projects specifically designed to establish these regions as critical global trade choke points and manufacturing centers, particularly for light assembly, specialized petrochemicals, and high-tech component distribution.

- North America: Market dominance in high-volume e-commerce fulfillment; characterized by intense competition for last-mile urban facilities; major institutional investment concentrated in cold storage and high-tech biotech manufacturing clusters; faces critical constrained land supply issues in coastal gateway markets.

- Asia Pacific (APAC): Highest projected proportional growth rates; growth is overwhelmingly driven by urbanization, rapid e-commerce maturity, and B2B growth in emerging economies; major ongoing focus on developing large-scale logistics parks and rapid infrastructure modernization across India, China, and Southeast Asia.

- Europe: Strong regulatory emphasis on sustainability, Net Zero compliance, and resource-efficient development; critical requirement for complex cross-border logistics focusing intensely on multimodal transport integration (rail, road, sea); sophisticated tenant base demands high-specification, technologically automated facilities.

- Latin America (LATAM): Growth is primarily driven by regional trade agreements and robust domestic consumption patterns; market maturity varies widely by individual country (Mexico benefits heavily from US nearshoring, Brazil dominates the Southern Cone trade); high and sustained demand for modern distribution centers proximate to major capital cities and industrial centers.

- Middle East and Africa (MEA): Growth fundamentally tied to ambitious government-led infrastructure initiatives and extensive economic diversification strategies (e.g., Saudi Vision 2030); industrial development is strategically concentrated around major ports, logistics hubs, and designated free zones; increasing demand for modern warehousing to support growing non-oil commercial sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Real Estate Market.- Prologis Inc.

- Goodman Group

- Rexford Industrial Realty, Inc.

- Segro plc

- GLP Pte Ltd

- EastGroup Properties

- Terreno Realty Corporation

- Indospace

- Brookfield Asset Management

- W. P. Carey Inc.

- Panattoni Development Company

- Hillwood Properties

- Cushman & Wakefield

- CBRE Group

- JLL

- Tishman Speyer

- BentallGreenOak

- Blackstone

- Starwood Capital Group

- M&G Real Estate

Frequently Asked Questions

What is driving the current high demand and low vacancy rates in industrial real estate?

The primary driver is the ongoing structural shift to e-commerce, which requires approximately three times the amount of physical logistics space compared to traditional brick-and-mortar retail operations. This is intensified by strategic inventory normalization, shifting global supply chain models from Just-in-Time to more resilient Just-in-Case buffering strategies, necessitating substantial storage capacity.

How is industrial real estate adapting to last-mile delivery requirements?

Last-mile delivery necessitates aggressive urban infill development strategies, specifically focusing on the construction of multi-story warehouses and smaller, highly efficient small-bay facilities situated as close as possible to dense population centers. These specialized urban assets command premium rental rates due to high land costs and provide the expedited fulfillment capabilities essential for modern consumer expectations of speed.

What role does Cold Storage play in the overall industrial market segmentation?

Cold storage represents a high-growth, technically specialized niche within industrial real estate. Its expansion is fueled aggressively by complex pharmaceutical logistics (especially sensitive biologics requiring validated cold chains) and the systemic growth of online fresh grocery and meal kit delivery services. This segment is characterized by extremely high capital expenditure, specialized infrastructure needs, resulting in high barriers to entry and superior, stable rental income.

Are sustainability features influencing industrial property valuation?

Yes, significantly. Highly sustainable industrial properties (e.g., assets featuring rooftop solar arrays, achieving LEED or BREEAM certifications, and boasting high energy efficiency ratings) are overwhelmingly preferred by major institutional tenants, leading to superior long-term occupancy rates, longer lease terms, lower operating costs for tenants, and consequently, demonstrably premium valuations and stronger long-term asset performance for investors.

How do rising interest rates impact industrial development and investment?

Rising interest rates directly increase the cost of capital and borrowing, potentially slowing the viability of speculative development projects and increasing investment hurdle rates for acquisitions. While exceptionally strong underlying tenant demand mitigates this effect for high-quality core assets, the tightening credit environment generally leads to compressed asset capitalization rates and requires developers to rely more heavily on secure pre-leasing commitments to successfully secure development financing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager