Industrial Robot Speed Reducer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441581 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Robot Speed Reducer Market Size

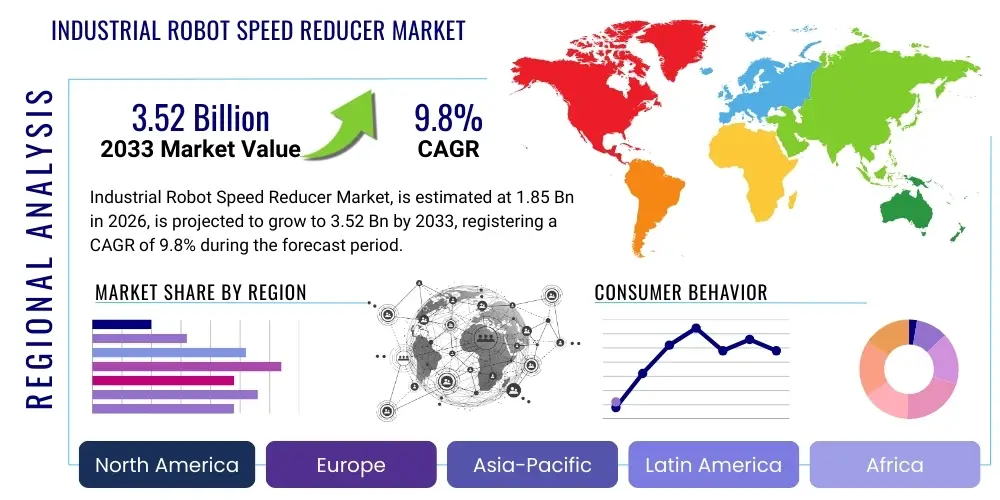

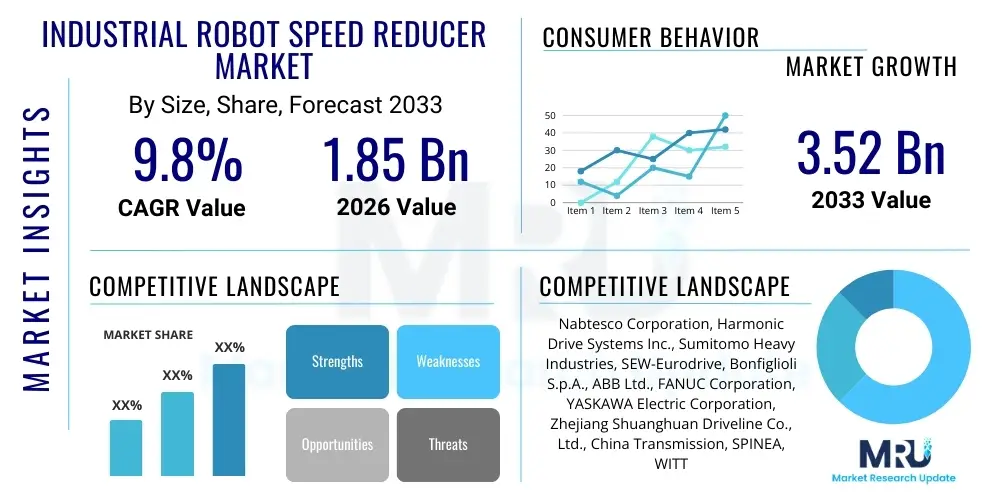

The Industrial Robot Speed Reducer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.52 Billion by the end of the forecast period in 2033.

Industrial Robot Speed Reducer Market introduction

The Industrial Robot Speed Reducer Market is critical to the automation industry, providing the essential mechanical interface required for high-precision motion control in robotic systems. Speed reducers, specifically Harmonic Drive (Strain Wave Gearing) and RV (Cycloidal) reducers, function to significantly decrease the rotational speed of the motor while simultaneously amplifying the output torque, ensuring the robot can execute complex, repetitive tasks with extreme accuracy, high rigidity, and zero backlash. These components are non-negotiable for articulated robots, SCARA robots, and delta robots, especially those deployed in high-stress, high-throughput environments like automotive welding and semiconductor handling. The primary applications span across automotive manufacturing (body-in-white processes, painting), electronics assembly (cleanroom environments, pick-and-place operations), logistics automation (palletizing, sorting), and precision machinery, driven by the global imperative to enhance manufacturing efficiency, reduce labor costs, and improve product quality consistency. The enduring benefits of utilizing high-quality speed reducers include extended robot lifespan, reduction in power consumption due to optimized motion, and enhanced payload capacity relative to motor size. Key driving factors accelerating market expansion include rapid global expansion of smart factories, increasing capital investment in automation across emerging economies, the rising adoption of collaborative robots (cobots) which require lightweight, high-precision harmonic drives, and ongoing technological advancements focused on developing maintenance-free, higher torque-density reducer units.

Industrial Robot Speed Reducer Market Executive Summary

The global Industrial Robot Speed Reducer Market is characterized by intense technological competition and a definitive shift towards specialized, high-precision components essential for next-generation automation systems. Current business trends indicate a strong prioritization among robot manufacturers (OEMs) for compact, lightweight reducers that offer superior power-to-weight ratios, catering directly to the burgeoning cobot and small-to-medium payload robot segments. Strategic alliances and mergers between specialized gear manufacturers and large automation corporations are increasing, aiming to vertically integrate the supply chain and secure patented reduction technologies, particularly in harmonic and cycloidal mechanisms. Regional trends underscore Asia Pacific (APAC), particularly China and South Korea, as the leading consumption and manufacturing hubs, driven by massive domestic industrial digitization initiatives and high capital expenditures in automotive and electronics production facilities. North America and Europe demonstrate mature market conditions, focusing on upgrading existing robotic fleets with advanced, IoT-enabled reducers capable of predictive maintenance diagnostics. Segment trends show RV reducers maintaining dominance in heavy-duty applications requiring high rigidity and load-bearing capacity (large industrial robots), while Harmonic Drive reducers are capturing significant growth in low-payload, high-accuracy applications such as semiconductor manufacturing, medical robotics, and the aforementioned collaborative robot segment, reflecting the broader market move towards flexibility and precision in automated tasks.

AI Impact Analysis on Industrial Robot Speed Reducer Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Industrial Robot Speed Reducer Market predominantly revolve around how AI can enhance the performance, predictive maintenance capabilities, and design optimization of these critical components. Common themes include the potential for AI algorithms to process vibrational data and temperature readings generated by embedded sensors within the reducer to anticipate failure modes (predictive maintenance), thereby dramatically reducing unplanned downtime in automated lines. Users also inquire about AI's role in optimizing the gear tooth geometry and lubrication schedules to maximize efficiency and operational lifespan, pushing the boundaries of traditional mechanical engineering design. There is a strong user expectation that AI-driven quality control during the manufacturing of reducers will drastically improve precision, ensuring near-perfect backlash characteristics across mass-produced batches. Furthermore, AI is expected to influence the integration of reducers into robot motion planning systems, enabling robots to dynamically adjust torque limits and speed profiles based on real-time task demands, indirectly reducing mechanical stress on the speed reducer components and extending their service intervals, thereby shifting the market focus from pure mechanical durability towards smart mechanical durability.

- AI-enabled Predictive Maintenance: Utilizing machine learning models to analyze vibration, acoustic, and thermal signatures from speed reducers to predict imminent mechanical failure before critical damage occurs, significantly boosting overall equipment effectiveness (OEE).

- Optimized Design and Simulation: Employing generative AI tools to simulate millions of design iterations for gear profiles (especially cycloidal discs and flexsplines) to achieve maximum torque density and minimum size while maintaining desired rigidity and reducing backlash.

- Enhanced Manufacturing Quality Control: Integrating AI vision systems and sensor fusion in the production process to perform ultra-precise, real-time inspection of gear components, ensuring tighter tolerances and higher consistency than conventional methods.

- Dynamic Motion Control Integration: Using AI to allow the robot controller to dynamically adjust the loading and unloading cycles on the speed reducer based on current operational variables, minimizing excessive wear and tear and optimizing energy efficiency.

- Supply Chain Optimization: Leveraging AI for demand forecasting and inventory management of specialized materials and components (e.g., specialized bearing steel, high-performance greases) required for speed reducer manufacturing, ensuring timely production despite volatile global supply chain conditions.

DRO & Impact Forces Of Industrial Robot Speed Reducer Market

The Industrial Robot Speed Reducer Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces shaping its trajectory. The primary Driver is the accelerating global adoption of Industry 4.0 paradigms, necessitating higher levels of automation, particularly in sectors facing severe labor shortages and requiring uncompromising product quality standards, such as precision electronics and pharmaceuticals. This demand translates directly into a requirement for millions of high-precision joints, each reliant on a speed reducer. Concurrently, the increasing market penetration of collaborative robots (cobots), which demand compact, lightweight, and inherently safe reduction gears, fuels innovation and volume growth. However, market expansion faces substantial Restraints, most notably the extremely high manufacturing complexity and capital investment required for precision machining of components like cycloidal discs and harmonic flexsplines. The requirement for zero-backlash operation mandates expensive, specialized production facilities, limiting the entry of new competitors and maintaining the pricing power of established leaders. Furthermore, dependency on high-quality, specialized raw materials (e.g., proprietary steel alloys) introduces supply chain vulnerabilities. The core Opportunity lies in the potential for miniaturization and integration; developing speed reducers that are smaller, lighter, yet capable of handling equivalent or higher torque loads, aligning perfectly with the shift towards smaller, more flexible robotic systems. Another major opportunity is the integration of advanced smart sensing technology within the reducer housing for real-time condition monitoring, providing data valuable for predictive maintenance services and opening new revenue streams for manufacturers. The combined Impact Forces underscore a market characterized by high technical barriers to entry and sustained growth fueled by mandatory industrial modernization.

Segmentation Analysis

The Industrial Robot Speed Reducer Market is primarily segmented based on the type of reduction mechanism, the payload capacity of the robot utilizing the component, and the specific application sector where the robot is deployed. These segmentations are crucial as they reflect differing technical requirements in terms of rigidity, precision, size, and cost. Type segmentation distinguishes between highly rigid, torque-dense solutions like RV reducers often used in high-load axes of large articulated robots, and lightweight, high-precision harmonic drives favored for wrists, end effectors, and smaller robots. Application segmentation highlights the dominance of the automotive sector, driven by extensive welding and assembly lines, followed closely by the rapidly automating electronics sector requiring highly clean and precise operations. Understanding these distinct segment requirements allows manufacturers to tailor their product offerings, focusing R&D efforts on specific performance metrics, whether it is maximizing shock load resistance for automotive applications or minimizing component size for electronic pick-and-place robots.

- By Type: Harmonic Drive Reducers (Strain Wave Gearing), RV Reducers (Cycloidal Reducers), Planetary Gearboxes (Used in less precise, heavy-duty applications).

- By Payload Capacity: Low Payload Robots (Under 20kg), Medium Payload Robots (20kg to 100kg), High Payload Robots (Above 100kg).

- By Application: Automotive Industry, Electronics and Semiconductor Manufacturing, Machinery and Metal Fabrication, Logistics and Warehousing, Food and Beverage Processing, Pharmaceuticals and Medical Devices.

- By Sales Channel: OEM (Original Equipment Manufacturer), Aftermarket (MRO - Maintenance, Repair, and Overhaul).

Value Chain Analysis For Industrial Robot Speed Reducer Market

The Value Chain for the Industrial Robot Speed Reducer Market begins with upstream activities focused on raw material sourcing and highly specialized component manufacturing. The performance of a speed reducer is fundamentally dependent on the quality of its inputs, primarily high-grade, alloyed steels (such as proprietary bearing steels) necessary for manufacturing cycloidal discs, inner rings, and flexsplines that endure extreme stress and fatigue cycles while maintaining tight tolerances. Key upstream players include specialized metal producers and bearing manufacturers. The subsequent stage involves core manufacturing, which is the most capital-intensive and technologically demanding phase. This includes complex processes like precision CNC machining, heat treatment, superfinishing of gear teeth profiles, and the implementation of proprietary assembly techniques required to achieve the necessary zero or near-zero backlash characteristics. Manufacturers in this segment invest heavily in metrology and cleanroom environments to ensure dimensional accuracy down to micron levels, which is a prerequisite for robotic accuracy.

Midstream activities involve the assembly, testing, and system integration of the final speed reducer unit. After assembly, every unit undergoes rigorous quality assurance testing, including torque capacity testing, backlash measurement, and durability cycles, often simulating years of operational use. Distribution channels play a critical role, bifurcating into direct and indirect routes. Direct distribution involves sales teams engaging directly with major robot OEMs (e.g., FANUC, ABB, KUKA) who integrate the reducers into their proprietary robot designs. These relationships are often long-term contracts based on customized specifications and high volume. Indirect distribution involves sales through highly specialized industrial distributors and technical representatives, who handle smaller volume orders, aftermarket sales, and MRO (Maintenance, Repair, and Overhaul) services. The technical knowledge required at the distributor level is substantial, as they must often assist customers with selection, installation, and troubleshooting of highly precise mechanical components.

The downstream analysis focuses on the end-user adoption and post-sales support mechanisms. End-users are predominantly large-scale manufacturers (Tier 1 automotive suppliers, global electronics giants) who purchase integrated robotic arms. The speed reducer market’s profitability is increasingly linked to post-sales services, including specialized maintenance, lubrication guidance, and replacement component supply. Given that a speed reducer failure can halt an entire production line, reliability and rapid service response are paramount. Furthermore, the market is seeing a push towards ‘Reducer-as-a-Service,’ where manufacturers integrate advanced sensors into the reducer to offer condition monitoring and predictive maintenance contracts, turning the reducer from a pure capital expenditure component into a managed, performance-assured asset. This shift requires sophisticated data analytics and strong collaboration between the reducer manufacturer and the end-user’s operational technology (OT) teams.

Industrial Robot Speed Reducer Market Potential Customers

The primary potential customers and end-users of industrial robot speed reducers are the major global Original Equipment Manufacturers (OEMs) of industrial robots, who purchase these components in large volumes for immediate integration into their robotic arms. Companies such as FANUC, Yaskawa, ABB, KUKA, and Kawasaki are critical volume buyers. Their purchasing decisions are driven not solely by cost but predominantly by technical specifications, including guaranteed lifespan, maximum torque rating, certified repeatability, and minimal backlash, as these factors directly dictate the performance claims of the robot arm itself. These OEMs often require long-term supply agreements and demand components that meet specific form factors and interface standards to ensure seamless integration into their proprietary mechanical designs and control systems. The quality and performance consistency of the speed reducer are paramount, as it represents one of the most mechanically stressed components within the robotic kinematic chain, making the relationship between reducer suppliers and robot OEMs highly strategic and tightly coupled.

A second major category of customers includes large industrial conglomerates and system integrators who specialize in designing and deploying custom automation solutions for diverse manufacturing clients. These integrators purchase speed reducers directly for building specialized machines, custom gantry systems, and complex non-standard robotic applications where off-the-shelf robot arms may not be suitable. This customer segment places a strong emphasis on versatility, availability of different sizes and reduction ratios, and engineering support for component selection. For example, an integrator building a massive payload handling system for aerospace assembly might require custom-built RV reducers with extremely high torque resilience, while an integrator specializing in pharmaceutical cleanroom automation will prioritize stainless steel harmonic drives with low particulate generation and extreme positional accuracy for precise dosing or inspection tasks.

Finally, the Maintenance, Repair, and Overhaul (MRO) sector, alongside independent repair shops and internal maintenance departments of large factory owners, constitute the aftermarket customer segment. These buyers focus on replacement units and parts necessary to maintain existing robotic fleets, typically driven by urgency and component compatibility. As the global installed base of industrial robots expands rapidly, the demand for replacement speed reducers—which are wear components subject to high operational stress—is growing proportionally. For this segment, price, lead time, and documented reliability of replacement parts are key purchasing criteria. Moreover, the increasing adoption of collaborative robots is creating a new segment of smaller, often high-tech manufacturing companies that require smaller, more consumer-friendly harmonic drives for flexible production setups, expanding the customer base beyond traditional heavy industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.52 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nabtesco Corporation, Harmonic Drive Systems Inc., Sumitomo Heavy Industries, SEW-Eurodrive, Bonfiglioli S.p.A., ABB Ltd., FANUC Corporation, YASKAWA Electric Corporation, Zhejiang Shuanghuan Driveline Co., Ltd., China Transmission, SPINEA, WITTENSTEIN SE, ZF Friedrichshafen AG, Schaeffler Group, Lenze SE, Apex Dynamics, Inc., SGR Precision, Nidec Corporation, Donghua Chain Group, Cone Drive. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Robot Speed Reducer Market Key Technology Landscape

The technological landscape of the Industrial Robot Speed Reducer Market is primarily defined by continuous advancements in two core gear technologies: Cycloidal (RV) gearing and Strain Wave Gearing (Harmonic Drive). For RV reducers, innovation focuses heavily on enhancing mechanical rigidity and maximizing shock load resistance, crucial for the base and major axes of heavy-duty industrial robots. Manufacturers are utilizing proprietary computational fluid dynamics (CFD) models to optimize the profile of the cycloidal discs and pin gears, minimizing friction and optimizing load distribution across the rolling elements. Furthermore, there is a consistent effort in material science to introduce new highly fatigue-resistant steel alloys and specialized surface treatments, such as carburizing and nitriding, which allow the reducers to handle higher input speeds and torque peaks without compromising operational lifespan or increasing maintenance requirements. These technical enhancements are directly responsible for the increasing payload capacities seen in modern industrial robots without corresponding increases in the reducer's physical size or weight.

In the Harmonic Drive segment, the technological emphasis is on achieving higher precision, greater compactness, and integrating smart features suitable for collaborative robotics and high-precision tasks. Key technological breakthroughs include developing thinner, yet more robust, flexspline designs using advanced metal injection molding or specialized forging processes to enhance fatigue life, which is historically the primary limitation of this technology. Manufacturers are also introducing integrated solutions, such as "actuator units" which combine the motor, encoder, and speed reducer into a single, pre-calibrated, sealed module. This integration simplifies robot assembly for OEMs and guarantees optimal alignment between components. The focus on zero or ultra-low backlash mechanisms continues, with proprietary assembly methods and post-manufacturing calibration techniques being critical competitive advantages. Furthermore, lubrication technology plays a crucial role; the development of proprietary high-performance greases that maintain viscosity and stability over wide temperature ranges and extended operational periods is essential for guaranteeing maintenance-free operation over the robot's warranty period, driving down total cost of ownership (TCO).

The most significant emerging technological trend is the incorporation of smart monitoring capabilities directly within the reducer housing, enabling the shift from scheduled maintenance to predictive maintenance. This involves embedding micro-sensors, including accelerometers, temperature probes, and occasionally acoustic emission sensors, designed to collect highly granular data regarding the reducer’s internal operation. This sensor data is processed by dedicated on-board microcontrollers or passed to external AI analytics platforms to detect subtle changes in vibrational patterns or temperature anomalies indicative of impending bearing or gear wear. This integration not only improves reliability but also positions the speed reducer as a crucial data point within the industrial IoT ecosystem. Future technology development is expected to focus on magnetically levitated or contactless gearing mechanisms, though currently theoretical for industrial scale, and the continuous search for non-metallic, composite materials for high-speed, low-load components to further reduce weight, particularly for advanced drone and mobile manipulation applications requiring ultra-lightweight components.

Regional Highlights

Asia Pacific (APAC) currently dominates the Industrial Robot Speed Reducer Market, both in terms of production volume and consumption value, and is projected to maintain the highest growth rate throughout the forecast period. This dominance is intrinsically linked to the immense manufacturing base of countries like China, Japan, and South Korea, which are global leaders in automotive production, consumer electronics, and semiconductor fabrication—sectors that rely heavily on sophisticated automation. China, in particular, is undergoing a massive, state-backed industrial modernization program (e.g., Made in China 2025), leading to unprecedented capital expenditure on advanced industrial robots and automated production lines. Japanese and South Korean manufacturers are technological leaders, possessing deep expertise in precision engineering crucial for reducer manufacturing, ensuring high domestic supply and global export capabilities. The regional growth is characterized by high volume demand for both large RV reducers (for heavy industry) and smaller, high-accuracy harmonic drives (for electronics assembly and cobots).

Europe represents a mature yet highly quality-conscious market, driven primarily by Germany, Italy, and the Central European manufacturing belt. The European market emphasizes high-durability, energy efficiency, and adherence to stringent quality standards. Demand is stable, centered on upgrading existing automation infrastructure and adopting specialized robotics for high-mix, low-volume production characteristic of advanced machinery manufacturing and aerospace sectors. Key players in Europe focus heavily on innovation in gear geometry, material science, and the development of integrated actuator systems with advanced diagnostics. While growth rates are generally lower than APAC, the average selling price (ASP) for high-end, custom-engineered reducers tends to be higher, reflecting the demand for superior technical performance and extended warranty periods necessary to meet the demanding operational schedules prevalent in European industrial settings.

North America, led by the United States, exhibits strong demand driven by the revitalization of domestic manufacturing, particularly in automotive (Electric Vehicle production), aerospace, and expanding logistics automation (warehousing and fulfillment centers). The US market is characterized by rapid adoption of new automation technologies, including large-scale implementation of automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), which require specialized reduction gears optimized for mobility and high duty cycles. Investment in collaborative robots is also accelerating, fueled by efforts to address skilled labor shortages. The Middle East and Africa (MEA) and Latin America (LATAM) currently hold smaller market shares but represent significant long-term opportunities. Growth in these regions is primarily spurred by government initiatives to diversify economies away from reliance on natural resources, leading to initial investments in basic manufacturing, food processing, and logistics automation, creating a nascent, yet rapidly expanding, demand for industrial robot speed reducers as foundational automation components.

- Asia Pacific (APAC): Dominant market in consumption and production; growth driven by China’s industrial policy, semiconductor, and electronics manufacturing expansion.

- Europe: Mature market focused on high-precision, customized solutions; strong demand from automotive, machinery, and specialized robotics sectors.

- North America: Rapid growth in logistics automation, EV manufacturing, and aerospace sectors; high adoption rate of cobots and smart factory technologies.

- Latin America (LATAM): Emerging market potential linked to increasing investment in industrialization, particularly in Brazil and Mexico.

- Middle East & Africa (MEA): Growth driven by economic diversification efforts and initial automation projects in logistics and basic manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Robot Speed Reducer Market. These companies are distinguished by their patented technologies, established OEM relationships, stringent quality control measures, and continuous investment in R&D aimed at miniaturization, precision, and torque density improvements across their cycloidal and harmonic drive portfolios, making them the primary architects of the industrial robotics motion control ecosystem.- Nabtesco Corporation

- Harmonic Drive Systems Inc.

- Sumitomo Heavy Industries

- SEW-Eurodrive

- Bonfiglioli S.p.A.

- ABB Ltd.

- FANUC Corporation

- YASKAWA Electric Corporation

- Zhejiang Shuanghuan Driveline Co., Ltd.

- China Transmission

- SPINEA

- WITTENSTEIN SE

- ZF Friedrichshafen AG

- Schaeffler Group

- Lenze SE

- Apex Dynamics, Inc.

- SGR Precision

- Nidec Corporation

- Donghua Chain Group

- Cone Drive

Frequently Asked Questions

Analyze common user questions about the Industrial Robot Speed Reducer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between RV and Harmonic Drive reducers?

The primary distinction lies in their operating principle and application suitability. RV (Cycloidal) reducers use cycloidal discs and pin gears to achieve reduction, offering extremely high torsional rigidity, high load capacity, and exceptional resistance to shock loads, making them ideal for the base and major articulated joints of large, heavy-duty industrial robots. Harmonic Drive (Strain Wave Gearing) reducers utilize a flexible spline (Flexspline) that deforms against a circular spline via a wave generator. This mechanism provides very high precision, low backlash, compact size, and lighter weight, making them superior for the wrist, end effector joints, and collaborative robots where space and weight constraints are critical factors, often utilized in intricate assembly tasks like those found in the electronics industry.

How significant is backlash in speed reducers, and how do manufacturers mitigate it?

Backlash, defined as the angular clearance or lost motion in a gear train when direction reverses, is highly detrimental in robotic applications as it directly compromises positional accuracy, repeatability, and system stiffness. In industrial robots, minimizing backlash is essential for precision tasks like welding or pick-and-place, often requiring backlash to be near zero (arc minutes or less). Manufacturers mitigate this through extremely precise machining (superfinishing and grinding of gear teeth/discs), specialized assembly techniques (pre-loading mechanisms), and continuous development of gear geometry. Harmonic drives inherently offer lower backlash due to their design, while RV reducers achieve low backlash through highly rigid structures and precise component tolerances, contributing significantly to the high cost of these components compared to standard gearboxes.

Which industrial application drives the highest demand for speed reducers, and why?

The Automotive Industry consistently drives the highest volume demand for industrial robot speed reducers globally. This is due to the extensive reliance on highly automated production lines for vehicle manufacturing, particularly in demanding segments such as body-in-white (welding), painting, and final assembly. These applications utilize large, multi-axis articulated robots that require powerful, extremely rigid RV reducers in their major joints to handle heavy components, operate at high speeds, and withstand the shock loads inherent in welding and heavy material handling. Furthermore, the massive production scale and the need for consistent, repeatable quality across millions of units solidify the automotive sector's position as the foundational consumer of high-performance speed reduction components.

What impact does the increasing adoption of collaborative robots (cobots) have on speed reducer design?

The rise of collaborative robots fundamentally shifts design priorities towards miniaturization, safety, and weight reduction. Cobots typically operate at lower payloads and must share workspace with human operators, necessitating lightweight components. This trend favors Harmonic Drive technology over bulkier RV reducers. Manufacturers must focus on designing smaller, lighter harmonic drives with exceptional torque density and highly integrated features (e.g., integrated bearings and encoders). Safety requirements also dictate smoother operation and improved efficiency, requiring advanced internal gearing optimization to reduce heat generation and vibration, ensuring the component complies with stringent collaborative safety standards (ISO/TS 15066) while providing the necessary precision for human-robot interaction tasks.

How is the market incorporating smart technology into speed reducers for maintenance?

The market is rapidly integrating smart technology via the implementation of embedded sensor packages within the reducer housing. These packages typically include micro-electromechanical systems (MEMS) sensors like accelerometers for vibration monitoring, thermistors for temperature tracking, and sometimes acoustic sensors. This data is collected and analyzed using local edge computing or transmitted to cloud platforms. The primary objective is predictive maintenance—using machine learning algorithms to identify subtle anomalies (e.g., changes in vibration frequency or spikes in operating temperature) that signal incipient wear of bearings or gear teeth. This capability allows operators to schedule maintenance proactively before catastrophic failure occurs, dramatically reducing unplanned downtime and optimizing the total operational lifespan of the robot, which is a key selling point for high-value automation assets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager