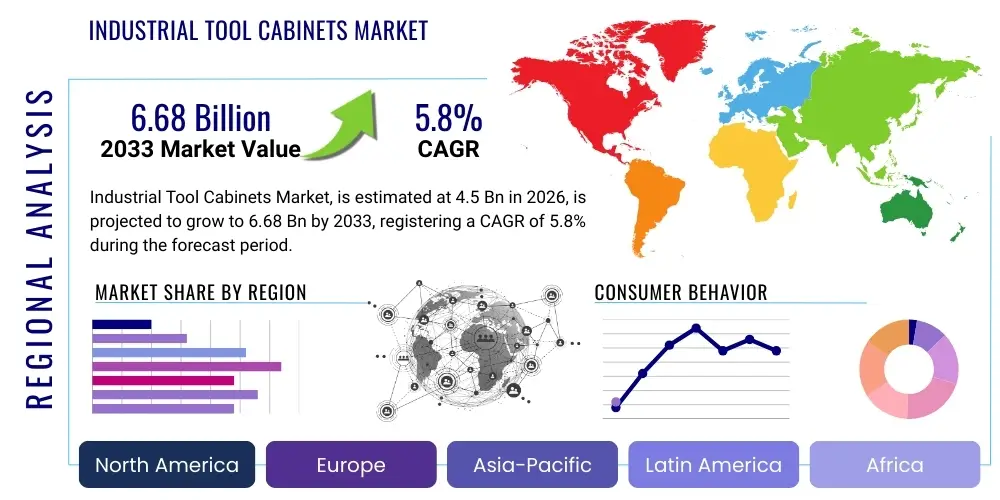

Industrial Tool Cabinets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441317 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Industrial Tool Cabinets Market Size

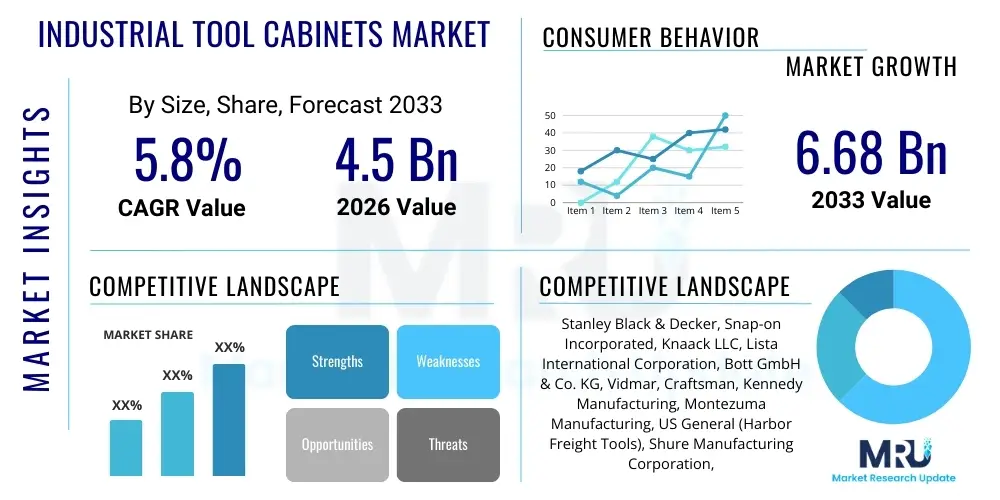

The Industrial Tool Cabinets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.68 Billion by the end of the forecast period in 2033.

Industrial Tool Cabinets Market introduction

The Industrial Tool Cabinets Market encompasses the production and distribution of specialized storage solutions designed for organizing, securing, and protecting tools, components, and equipment within rigorous industrial environments. These cabinets are engineered to withstand heavy use, resist chemical exposure, and often incorporate features for enhanced security and ergonomic access, crucial for maintaining efficiency and safety in manufacturing, maintenance, repair, and operations (MRO) facilities. The core product definition ranges from heavy-duty steel workstations and modular drawer systems to specialized mobile units utilized across diverse sectors globally.

Major applications of industrial tool cabinets span the automotive sector, aerospace manufacturing, heavy machinery maintenance, energy production facilities, and general fabrication workshops. These cabinets serve as indispensable assets for inventory control, ensuring that critical tools are readily available, accounted for, and properly maintained, thereby minimizing downtime and improving operational throughput. The robust construction, typically featuring welded steel frames and high load-bearing capacity drawers, distinguishes them from standard commercial storage units, making them vital for high-demand industrial settings where durability is paramount.

Key driving factors accelerating the market growth include the global expansion of the manufacturing sector, particularly in emerging economies, coupled with increasing regulatory emphasis on workplace organization and safety standards (EHS compliance). Furthermore, the trend toward industrial automation and the necessity for precise, controlled inventory management systems are compelling industries to adopt advanced, high-specification tool cabinets that can integrate with modern inventory tracking technologies, ensuring market buoyancy and sustained demand throughout the forecast period.

Industrial Tool Cabinets Market Executive Summary

The Industrial Tool Cabinets Market exhibits strong business trends driven by the adoption of modular storage systems and the integration of IoT-enabled tracking features, responding to the industry need for optimized space utilization and real-time inventory visibility. Companies are increasingly focusing on customized solutions tailored to specific industrial workflows, particularly those requiring specialized handling of sensitive or high-value instruments. The shift toward lean manufacturing methodologies globally necessitates highly efficient organizational tools, positioning premium, customized tool cabinets as critical capital expenditure for operational excellence, thereby elevating the overall average selling price (ASP) across key product categories.

Regional trends indicate significant growth momentum in the Asia Pacific (APAC) region, primarily fueled by massive expansion in automotive production, electronics assembly, and heavy industrial infrastructure development in countries like China, India, and Southeast Asia. North America and Europe, characterized by mature industrial bases, demonstrate stable demand, driven primarily by replacement cycles, facility modernization, and the adoption of advanced, high-security smart cabinets to safeguard sophisticated tooling. Regulatory demands for workplace safety and ergonomic design are particularly stringent in European markets, influencing product innovation towards features minimizing manual handling risks.

Segment trends highlight the dominance of steel-based cabinets due to their inherent durability, although high-density polyethylene (HDPE) cabinets are gaining traction in chemical and corrosive environments. The mobile segment is experiencing faster growth than the stationary segment, reflecting the increasing requirement for flexible, on-the-spot maintenance and repair services within large-scale industrial complexes. Furthermore, the market for integrated tool management systems, combining the physical cabinet structure with embedded software for dispensing control and usage tracking, represents a high-potential sub-segment attracting significant R&D investment.

AI Impact Analysis on Industrial Tool Cabinets Market

Common user questions regarding AI's impact on the Industrial Tool Cabinets Market center around how artificial intelligence can move beyond simple RFID tracking to truly optimize industrial workflows. Users frequently inquire about the integration of predictive maintenance schedules linked directly to tool usage data stored within smart cabinets, automated tool dispensing based on work order prioritization, and the potential for AI algorithms to manage dynamic inventory levels based on real-time consumption rates across different production lines. There is significant interest in systems that can autonomously detect misplaced tools or flag potential machine failures based on tool wear patterns analyzed by AI, transforming cabinets from passive storage units into active, data-generating nodes essential for Industry 4.0 environments.

The integration of AI into industrial tool cabinets revolutionizes inventory management by enabling advanced forecasting and automated replenishment cycles. By analyzing historical usage data, seasonal maintenance schedules, and production forecasts, AI algorithms can predict optimal stock levels for tools and consumables stored in the cabinets, drastically reducing both overstocking costs and costly stock-outs. This predictive capability ensures that maintenance teams have the right tools available precisely when needed, enhancing overall operational continuity and reducing the human effort associated with traditional manual inventory counts and management decisions.

Furthermore, AI facilitates enhanced security and compliance by monitoring access patterns and identifying anomalous behavior. If a high-value tool is withdrawn outside of typical operating hours or by an unauthorized individual, the AI system can instantly flag the event and trigger security protocols. This level of granular, intelligent oversight not only protects valuable assets but also generates comprehensive audit trails required for quality control and regulatory compliance, particularly in sensitive sectors like aerospace and pharmaceuticals where tool traceability is a non-negotiable requirement for ensuring product integrity and safety standards.

- AI-driven predictive maintenance scheduling based on tool usage cycle analysis.

- Automated, intelligent dispensing and retrieval optimization, minimizing search time.

- Real-time inventory level management and dynamic reordering algorithms.

- Anomaly detection for improved tool security and theft prevention.

- Integration of cabinet data feeds with Enterprise Resource Planning (ERP) systems via AI processors.

- Optimization of cabinet layout and content based on workflow frequency analysis.

- Voice-activated or gesture-controlled inventory queries using integrated AI interfaces.

DRO & Impact Forces Of Industrial Tool Cabinets Market

The Industrial Tool Cabinets Market is primarily propelled by stringent workplace safety and organization regulations, requiring formalized storage solutions to mitigate hazards and improve operational visibility. However, high initial investment costs associated with automated and smart cabinet systems pose a significant restraint, particularly for small and medium-sized enterprises (SMEs). Opportunities abound in the development of highly customized, IoT-enabled modular systems that integrate seamlessly with broader industrial automation frameworks, offering vendors a pathway to premium market penetration. The major impact forces governing the market include the accelerating pace of manufacturing infrastructure investment globally, the persistent need for efficiency gains in MRO activities, and the growing complexity of specialized tools requiring secure, climate-controlled storage.

Key drivers include the global expansion of manufacturing capacity, particularly in the heavy machinery and automotive industries, which necessitates high volumes of durable, reliable tool storage. The focus on lean manufacturing and 5S methodology across industrial facilities further compels companies to invest in structured storage solutions to minimize waste, reduce search time, and improve overall productivity. Additionally, advancements in material science, leading to lighter yet stronger cabinet designs, are broadening the product appeal and application scope across demanding mobile environments. The demand for robust security features, especially in sectors handling precision instruments, also acts as a powerful market driver.

Restraints primarily involve the saturation of basic, low-cost standard cabinets in developed markets, leading to intense price competition in the commodity segment. Furthermore, the resistance to adopting expensive smart cabinet technology, stemming from uncertainty regarding the return on investment (ROI) for smaller firms, hinders widespread adoption of high-tech solutions. Opportunities lie in penetrating the developing market infrastructure and leveraging the transition toward Industry 4.0 through the introduction of rental or leasing models for high-end tool management systems. These systems offer integrated solutions, encompassing both physical storage and proprietary inventory software, shifting the focus from product sales to value-added service delivery and recurring revenue generation.

Segmentation Analysis

The Industrial Tool Cabinets Market is analyzed across various critical dimensions including the type of product (stationary vs. mobile), the primary material used in construction (metal vs. non-metal), and the critical end-use applications (automotive, aerospace, heavy industry, etc.). Stationary cabinets dominate the market share due to their widespread use in fixed production lines and large workshop environments, valued for their stability and high load capacity. Conversely, the mobile segment, encompassing roller cabinets and tool carts, is projected to exhibit the highest growth rate, driven by the increasing demand for flexible maintenance operations that require immediate tool access at various points across expansive industrial sites.

The material segmentation highlights the continued reliance on robust metallic constructions, primarily high-grade steel, which provides unparalleled strength, longevity, and resistance to impact, fire, and theft. However, there is a niche, yet growing, demand for non-metallic alternatives, such as advanced plastic composites, particularly in environments susceptible to corrosion or those with strict cleanliness requirements, such as laboratories and specialized electronics manufacturing cleanrooms. This segmentation reflects the balance between traditional industrial requirements for durability and emerging needs for specific environmental compatibility.

End-use segmentation confirms the automotive and general manufacturing sectors as the largest consumers, given their large-scale production volumes and high MRO expenditure. However, specialized sectors like aerospace and defense, characterized by stringent quality control and high-value tooling, offer lucrative opportunities for vendors supplying highly specialized, secure, and technologically integrated tool management systems, often requiring custom configurations and specialized tool storage inserts to protect sensitive measuring instruments and components.

- By Product Type:

- Stationary Tool Cabinets

- Mobile Tool Cabinets (Roller Cabinets, Tool Carts)

- By Material:

- Metal (Steel, Aluminum)

- Non-Metal (Plastic/Composite)

- By Capacity/Drawer Configuration:

- Light Duty

- Medium Duty

- Heavy Duty

- By End-Use Industry:

- Automotive

- Aerospace and Defense

- Heavy Industry and Machinery

- Oil and Gas

- Electronics and Precision Manufacturing

- Maintenance, Repair, and Operations (MRO) Facilities

Value Chain Analysis For Industrial Tool Cabinets Market

The value chain for industrial tool cabinets begins with the upstream sourcing of raw materials, primarily high-quality sheet steel, specialized locking mechanisms, casters, and drawer slides, which are procured from primary metals producers and specialized component manufacturers. Manufacturing involves precision cutting, bending, welding, and advanced powder coating processes to ensure product integrity and resistance to industrial wear. The technological complexity is introduced at this stage through the integration of electronic components for smart cabinets, including RFID readers, touchscreens, and proprietary software interfaces, requiring strong partnerships with technology providers.

The midstream stage focuses on manufacturing, assembly, and quality control, ensuring compliance with industry standards such as ISO and relevant ergonomic guidelines. Key strategic decisions at this stage revolve around mass customization capabilities—balancing standardized production efficiency with the need to fulfill specialized orders regarding drawer configurations, dimensions, and locking mechanisms. Efficiency in the manufacturing process directly impacts profitability, making robust supply chain management of raw steel crucial, as input material price fluctuations can significantly affect final product pricing.

Downstream activities involve distribution channels, which are predominantly direct sales for large, complex projects and a mix of indirect channels through industrial distributors, wholesalers, and specialized Maintenance, Repair, and Operations (MRO) supply houses for standard products and replenishment orders. The rise of e-commerce platforms and digital marketplaces is transforming distribution, allowing manufacturers to reach a wider base of SMEs directly. Installation, after-sales service, and continuous software support (for smart cabinets) form the final, critical links in the value chain, crucial for maintaining customer loyalty and ensuring long-term operational satisfaction with the durable goods purchase.

Industrial Tool Cabinets Market Potential Customers

Potential customers for industrial tool cabinets are highly diverse, encompassing virtually any sector that utilizes tools for manufacturing, assembly, maintenance, or fabrication. The largest consumer base resides within the Maintenance, Repair, and Operations (MRO) departments of large corporations, who require organized storage for costly diagnostic equipment and specialized hand tools used to keep production lines running smoothly. Automotive original equipment manufacturers (OEMs) and their extensive network of suppliers represent a core segment, needing high-capacity, heavy-duty storage solutions integrated into their lean production environments.

Further key customers include aerospace and defense contractors, where regulatory requirements mandate meticulous accountability for every tool (Foreign Object Debris/Damage prevention). These sectors demand cabinets with advanced security features, often biometric access control, to protect highly calibrated and expensive instruments. Similarly, oil and gas, mining, and heavy construction industries utilize rugged, mobile cabinets designed to withstand harsh operating conditions and frequent relocation to remote worksites, prioritizing durability and resistance to environmental factors over aesthetic appeal.

In addition to large industrial players, small-to-medium enterprises (SMEs), particularly job shops, local fabrication businesses, and independent service providers, represent a voluminous customer base for standard and medium-duty roller cabinets. Educational institutions offering vocational training and technical colleges also constitute a stable market segment, requiring durable, lockable cabinets for student workshops. The common thread across all these end-users/buyers is the critical need for asset protection, efficiency gains through organization, and compliance with workplace safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.68 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker, Snap-on Incorporated, Knaack LLC, Lista International Corporation, Bott GmbH & Co. KG, Vidmar, Craftsman, Kennedy Manufacturing, Montezuma Manufacturing, US General (Harbor Freight Tools), Shure Manufacturing Corporation, Strong Hand Tools (Industrial Tool & Supply), Proto Industrial Tools, Fami S.R.L., C. & G. Tool, Hazet, Beta Utensili S.p.A., Teng Tools, C&H Industrial Services, Huot Manufacturing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Tool Cabinets Market Key Technology Landscape

The technology landscape of the Industrial Tool Cabinets Market is rapidly evolving from basic physical storage to sophisticated, intelligent tool management systems. The primary technological advancement involves the integration of smart cabinet features utilizing the Internet of Things (IoT). These systems employ embedded sensors, microprocessors, and network connectivity (Wi-Fi or Ethernet) to provide real-time monitoring of tool location, inventory levels, and user access. RFID (Radio Frequency Identification) technology is crucial here, enabling quick, automated tool audits and precise tracking of critical assets, fundamentally reducing the administrative burden associated with tool accountability in large facilities.

Furthermore, security technology is a key focus area, moving beyond standard key locks to incorporate advanced access control systems. This includes biometric scanners (fingerprint or retina recognition), centralized software-managed electronic locking systems, and personalized PIN access, ensuring that only authorized personnel can access specific sets of tools, thereby preventing unauthorized use and maintaining chain of custody. These advanced security features are essential for industries like defense and aerospace, where strict security protocols and tool traceability are mandatory to prevent highly sensitive items from being compromised or lost, ensuring compliance with strict industry standards.

Material and coating technologies also play a crucial role in enhancing product longevity and performance. Manufacturers are employing advanced, durable powder coatings that offer superior resistance to chemicals, abrasions, and corrosion, extending the cabinet's lifespan in harsh industrial environments. Ergonomic design innovations, supported by technology, focus on smoother drawer slides (high-capacity bearing systems), automated drawer soft-closing mechanisms, and modular internal configuration systems that allow users to rapidly reconfigure storage spaces based on changing tool requirements, maximizing both user comfort and spatial efficiency within the industrial workspace.

Regional Highlights

The global Industrial Tool Cabinets Market exhibits diverse dynamics across key geographical regions, dictated by manufacturing activity, labor costs, and regulatory compliance requirements. North America remains a significant market, characterized by high adoption rates of premium, technologically integrated cabinets, particularly in the aerospace, automotive R&D, and precision machinery sectors. The regional demand is driven by the necessity for advanced inventory control and asset management systems to support highly digitized and automated manufacturing processes, justifying the investment in expensive smart storage solutions.

Europe demonstrates stable demand, underpinned by stringent occupational health and safety (OHS) standards, which mandate organized and ergonomically designed workspaces, favoring high-quality German and Italian modular systems. European manufacturers often lead in sustainability and material quality, appealing to customers prioritizing long-term durability and environmental compliance. The key growth driver here is the replacement of aging infrastructure and the modernization of MRO facilities across Western and Central European countries.

Asia Pacific (APAC) represents the fastest-growing region globally, fueled by exponential growth in manufacturing output, infrastructure development, and industrialization across China, India, and Southeast Asia. While the APAC market still consumes a significant volume of standard, cost-effective cabinets, the increasing presence of multinational corporations and the adoption of Industry 4.0 principles are rapidly increasing the demand for automated, high-density storage solutions. This region is critical for future market expansion due to its sheer scale of industrial expansion and evolving supply chain complexity.

- North America: High penetration of smart cabinet technology; strong demand from aerospace and high-tech automotive sectors; emphasis on integration with centralized inventory systems.

- Europe: Driven by strict OHS regulations and ergonomic standards; focus on modularity and high-quality, long-lasting construction; high replacement rate in mature industries.

- Asia Pacific (APAC): Highest growth rate due to rapid industrialization; significant manufacturing capacity expansion in China and India; growing adoption of international quality standards driving demand for better storage.

- Latin America (LATAM): Emerging market driven by expansion in oil & gas and mining sectors; focus on basic, durable heavy-duty cabinets suitable for demanding operational environments.

- Middle East and Africa (MEA): Demand concentrated in infrastructure projects, large industrial zones, and energy sectors; slow but steady growth, favoring robust and secure storage solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Tool Cabinets Market.- Stanley Black & Decker

- Snap-on Incorporated

- Knaack LLC

- Lista International Corporation

- Bott GmbH & Co. KG

- Vidmar

- Craftsman

- Kennedy Manufacturing

- Montezuma Manufacturing

- US General (Harbor Freight Tools)

- Shure Manufacturing Corporation

- Strong Hand Tools (Industrial Tool & Supply)

- Proto Industrial Tools

- Fami S.R.L.

- C. & G. Tool

- Hazet

- Beta Utensili S.p.A.

- Teng Tools

- C&H Industrial Services

- Huot Manufacturing

Frequently Asked Questions

Analyze common user questions about the Industrial Tool Cabinets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards smart industrial tool cabinets?

The primary driver is the necessity for enhanced inventory control, real-time asset tracking, and reduction of tool loss in high-value manufacturing environments. Smart cabinets, utilizing RFID and IoT technology, minimize human error, automate inventory audits, and integrate data directly with enterprise resource planning (ERP) systems, supporting Industry 4.0 objectives.

Which material segment holds the largest share in the tool cabinets market?

The Metal segment, specifically high-grade steel, holds the dominant market share due to its superior strength, durability, fire resistance, and ability to handle heavy load capacities required in traditional industrial settings like automotive and heavy machinery manufacturing.

What is the projected CAGR for the Industrial Tool Cabinets Market between 2026 and 2033?

The Industrial Tool Cabinets Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period, driven by global industrial modernization and increasing regulatory emphasis on workplace organization and safety standards across major manufacturing hubs, particularly in the Asia Pacific region.

How do industrial tool cabinets contribute to lean manufacturing?

Industrial tool cabinets are foundational to lean manufacturing by enabling the 5S methodology (Sort, Set in Order, Shine, Standardize, Sustain). They eliminate wasted time spent searching for tools, reduce clutter, improve visibility of inventory levels, and standardize workflow, directly boosting operational efficiency and reducing non-value-added activities.

What are the key differences between stationary and mobile tool cabinet types?

Stationary cabinets are designed for high stability, maximum storage capacity, and placement in fixed workshop locations. Mobile cabinets (roller carts) offer flexibility and portability, allowing maintenance personnel to transport necessary tools directly to the work site for immediate repairs, minimizing travel time across large industrial campuses, and typically feature robust casters and braking systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager