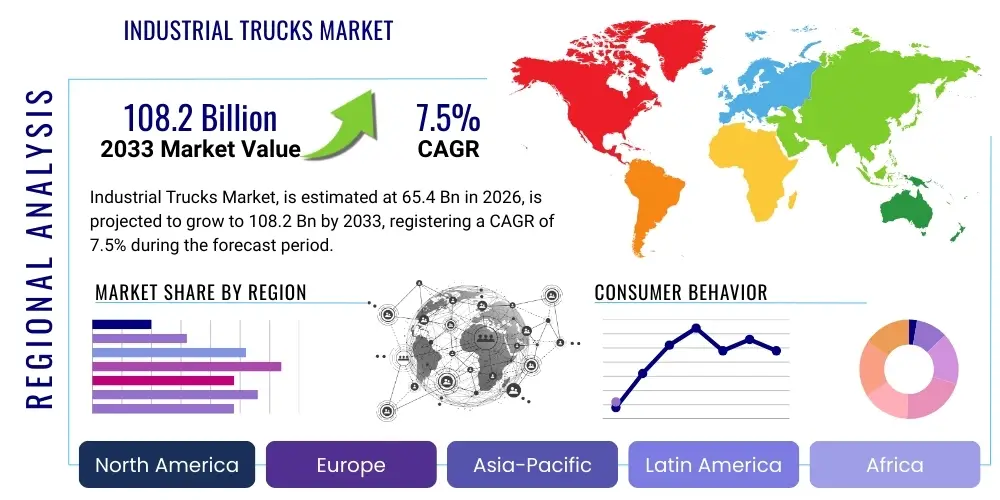

Industrial Trucks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441896 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Industrial Trucks Market Size

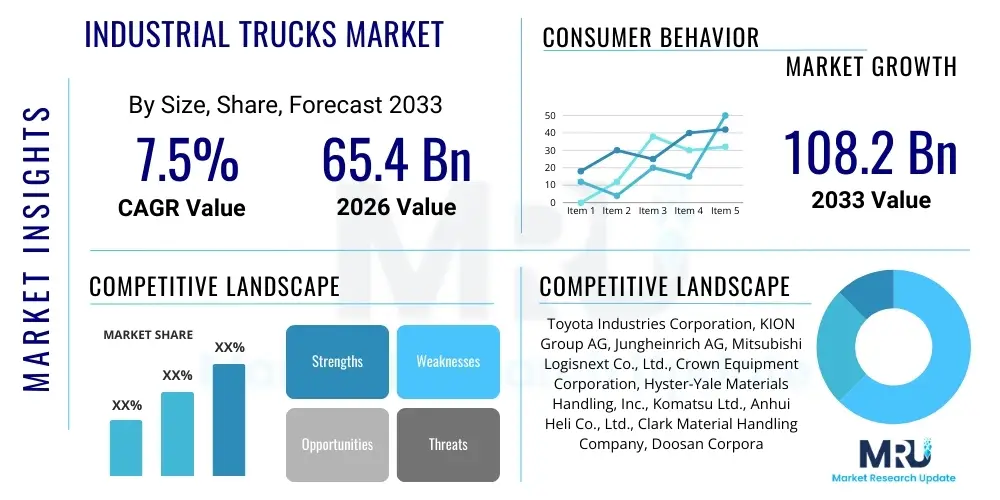

The Industrial Trucks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $65.4 Billion USD in 2026 and is projected to reach $108.2 Billion USD by the end of the forecast period in 2033.

Industrial Trucks Market introduction

The Industrial Trucks Market encompasses a wide array of specialized powered vehicles designed specifically for the handling, movement, stacking, and internal transport of materials over short to medium distances within controlled environments such as manufacturing facilities, warehouses, distribution centers, and port operations. This market is fundamental to the global supply chain, providing the necessary machinery, including counterbalanced forklifts, reach trucks, pallet jacks, stackers, and Automated Guided Vehicles (AGVs), that underpin efficient logistics. The core objective of these products is to optimize material flow, substantially reduce dependence on manual labor for heavy lifting, and enhance overall inventory throughput. The market's growth trajectory is intrinsically linked to macroeconomic factors, notably the surging global demand generated by e-commerce expansion and the subsequent necessity for highly automated and optimized warehousing infrastructure capable of rapid, accurate order fulfillment, driving constant technological refresh cycles across end-user industries.

The product portfolio within this sector is highly diverse, ranging from heavy-duty internal combustion (IC) engine trucks, often favored for robust, outdoor operations and high lifting capacity, to precision-engineered electric warehouse trucks optimized for complex, narrow-aisle environments. Major applications of industrial trucks span the entire logistics spectrum, from inbound material handling and assembly line feeding in the automotive sector to outbound cross-docking and container stacking in maritime terminals. Key benefits derived from the adoption of modern industrial trucks include demonstrable improvements in worker safety, reduced operational costs achieved through advancements in energy efficiency (especially electric power sources), minimization of product damage during handling, and the ability to rapidly scale operational capacity to meet fluctuating consumer demand. The functional reliability and technological sophistication of industrial trucks are directly contributing to the resilience and efficiency required by modern, just-in-time supply chains globally.

Driving factors propelling market expansion are numerous and multi-faceted. Paramount among these is the sustained, robust growth of the global e-commerce industry, which necessitates constant expansion and technological upgrading of fulfillment and distribution networks, invariably increasing the demand for automated and high-performance material handling equipment. Furthermore, legislative and societal pressure regarding workplace safety in developed economies incentivizes the replacement of outdated or potentially hazardous equipment with safer, ergonomically advanced, and semi-autonomous models. A pivotal driver is the global decarbonization imperative; corporate sustainability mandates and government incentives are accelerating the migration from traditional fossil fuel-powered trucks (Diesel, LPG) to zero-emission electric and hydrogen fuel cell alternatives. Continuous advancements in battery technology, which provide longer run times and rapid charging cycles, have significantly enhanced the economic viability of electric industrial trucks, positioning them favorably in terms of both operational performance and long-term TCO benefits compared to their IC counterparts, solidifying their role as the preferred choice for future fleet investments across major logistical operations.

Industrial Trucks Market Executive Summary

The Industrial Trucks Market is currently navigating a pivotal phase defined by rigorous competition, technological convergence, and a fundamental transition toward smart, interconnected, and sustainable material handling solutions. Key business trends indicate a distinct shift among customers towards demanding comprehensive, integrated logistics ecosystems rather than singular equipment purchases; this includes the provision of full-scale automation, sophisticated fleet management software, and data-driven predictive maintenance packages. Leading Original Equipment Manufacturers (OEMs) are responding by evolving into holistic solution providers, often necessitating extensive investment in software development, robotics capabilities, and strategic partnerships with technology firms to bridge the gap between traditional machinery manufacturing and cutting-edge automation integration. This pervasive trend toward digitalization is critically impacting aftermarket strategies, with remote diagnostics, over-the-air updates, and subscription-based service models becoming standard, effectively creating reliable recurring revenue streams and bolstering long-term customer relationships, shifting market emphasis from upfront capital investment to optimized operational lifetime cost.

Geographically, market dynamics exhibit significant disparity based on the level of economic maturity and technological readiness. The Asia Pacific (APAC) region continues to dominate in terms of sheer market size and growth rate, primarily fueled by the rapid expansion of infrastructure, manufacturing output, and e-commerce penetration across Southeast Asia, India, and particularly China. APAC demand presents a dual opportunity, encompassing high volume for foundational, entry-level warehouse equipment alongside accelerated uptake of advanced automation technology to address escalating localized labor costs and capacity demands. Conversely, the mature markets of North America and Europe demonstrate a steady pace of equipment replacement, with growth predominantly concentrated in the high-value segments of electric (especially Li-ion) and autonomous material handling systems (AGVs/AMRs). Regulatory landscapes in Europe, emphasizing stringent sustainability and emissions controls, further stimulate this high-value innovation, cementing the region's lead in adopting cutting-edge, low-carbon industrial truck technologies and defining global best practices in logistical efficiency.

Analysis of market segmentation reveals several key structural trends. The Power Source segment confirms the overwhelming momentum towards electrification; Lithium-ion batteries, owing to their operational superiority in terms of energy density, zero maintenance, and opportunity charging capability, are rapidly establishing dominance over legacy Lead-Acid and traditional IC Engine options in most warehouse applications. Regarding Product Type, the Warehouse Trucks sub-segment—including specialized vehicles like reach trucks and turret trucks—is experiencing the highest volume growth, driven directly by the global trend toward high-density, vertical storage systems within modern fulfillment centers where spatial efficiency is paramount. Crucially, the End-User analysis identifies the Retail and E-commerce sector as the leading consumer of industrial trucks; this segment's relentless pursuit of operational speed, precision, and scalability necessitates continuous investment in the most sophisticated, high-throughput material handling solutions available, far outpacing the replacement cycles traditionally seen in sectors like heavy manufacturing or automotive assembly.

AI Impact Analysis on Industrial Trucks Market

The integration of Artificial Intelligence (AI) is transforming the Industrial Trucks Market, prompting users to raise critical questions regarding the feasibility and long-term implications of intelligent automation. Common user inquiries revolve around clarifying how AI-powered fleets handle complex, non-repetitive tasks compared to human operators, the quantifiable safety improvements enabled by AI vision systems in environments shared with human workers, and the specific ROI derived from implementing expensive AI-driven navigation and optimization software over traditional, pre-programmed automation solutions. A significant concern for end-users, particularly logistics providers, is understanding how AI contributes to predictive maintenance, ensuring high asset availability and minimizing unanticipated operational stoppages. The underlying theme across these questions is the desire to move beyond incremental efficiency gains and leverage AI for genuinely transformative, adaptive logistics capabilities that manage complexity autonomously and reliably.

AI algorithms are foundational to the next generation of industrial truck functionality, moving them beyond simple mechanization into intelligent assets capable of operational self-optimization. In autonomous applications (AGVs and AMRs), AI provides the cognitive layer essential for dynamic path planning, allowing the vehicles to continuously assess real-time environmental data—such as obstacle locations, congestion points, and changing floor layouts—to calculate and execute the most efficient routes instantaneously. This adaptability is vastly superior to older, rule-based systems, offering unmatched flexibility crucial for navigating the highly variable and fast-paced environments of modern distribution centers. Furthermore, AI is utilized in fleet management systems to optimize energy consumption and task allocation across an entire fleet, dynamically adjusting speeds and assigning tasks based on remaining battery life and the urgency of the workload, thereby maximizing energy utilization and overall fleet throughput with high precision.

Beyond navigation and efficiency, AI is critical for enhancing safety and ensuring operational continuity through advanced diagnostics. AI-driven computer vision systems integrated into industrial trucks monitor both the surrounding environment and the behavior of human operators. These systems can accurately detect the proximity of pedestrians, identify potential collision risks earlier than human sight, and apply autonomous braking or intervention protocols seamlessly. In the maintenance domain, AI models analyze vast streams of telemetry data from motors, hydraulics, and batteries to identify subtle anomalies indicative of impending component failure. This predictive capacity allows maintenance to be scheduled precisely when required, minimizing unexpected downtime, optimizing spare parts inventory, and extending the service life of high-value components. Consequently, AI is not merely an optional feature but a core enabling technology that delivers superior performance, enhanced safety compliance, and significantly lower unplanned operational expenditure, justifying the higher upfront investment in advanced fleet infrastructure.

- AI-driven Predictive Maintenance: Minimizing downtime through real-time component health monitoring and failure prediction, ensuring high availability.

- Optimized Fleet Management: Dynamic task assignment, balancing workload distribution, and maximizing asset utilization across extensive facilities based on real-time needs.

- Enhanced Safety via Vision Systems: Real-time pedestrian detection, proactive collision avoidance, and operator behavior monitoring to enforce safety protocols.

- Autonomous Navigation and Path Planning: Adaptive routing for AGVs and AMRs in complex, frequently changing warehouse layouts, improving throughput efficiency.

- Energy Optimization: AI algorithms managing battery charging schedules and operational performance to maximize energy efficiency and prolong battery life.

- Improved Inventory Accuracy: Utilizing AI-powered vision systems integrated with industrial trucks for automated inventory counting, scanning, and stock verification during transport.

- Human-Robot Collaboration: Enabling semi-autonomous modes where trucks assist human workers, automating repetitive tasks while maintaining human supervision and control.

- Data-Driven Layout Optimization: Analyzing historical AI fleet data to recommend permanent improvements to warehouse physical layout and flow design.

- Simulation and Training: Using AI models to simulate complex operational scenarios for safety training and testing new automation deployment strategies before physical implementation.

DRO & Impact Forces Of Industrial Trucks Market

The core momentum propelling the Industrial Trucks Market is primarily derived from strong secular Drivers, most significantly the foundational transformation of the retail and supply chain sectors due to rapid e-commerce proliferation globally. The consequential demand for vastly expanded and optimized warehousing space makes the adoption of high-efficiency, often autonomous, material handling equipment indispensable. A secondary but equally powerful driver is the global scarcity of manual labor and the resultant pressure to manage escalating wage costs; automation through AGVs and sophisticated electric forklifts provides a robust, scalable economic solution to these persistent labor challenges. Furthermore, the international movement toward sustainable business practices and stringent regulatory environments in developed economies is forcing a mandatory, rapid shift from fossil fuel dependency to cleaner, electric and hydrogen fuel cell technologies, ensuring continuous product innovation and replacement cycles favoring sustainable solutions.

Despite significant tailwinds, the market expansion is tempered by several critical Restraints. The most prominent barrier to entry and fleet upgrading is the exceptionally high initial capital expenditure (CAPEX) required for sophisticated automated systems, including the purchase price of AGVs and the cost of necessary supporting infrastructure (e.g., Li-ion charging stations, warehouse modifications, integrated IT systems). This financial hurdle often limits rapid adoption among Small and Medium Enterprises (SMEs). Additionally, the successful integration of newly acquired, often complex, automated fleets with existing legacy Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) software presents substantial technical complexity and potential operational disruption. Finally, the need for a highly skilled technical workforce capable of programming, managing, and maintaining these advanced, software-intensive fleets poses a significant Constraint, particularly in emerging geographic markets where specialized expertise and training infrastructure are insufficient to support widespread technological adoption.

Opportunities for differentiated growth and market penetration are abundant, centered around innovative commercial and technological models. The shift away from pure hardware sales towards subscription and service models, such as Equipment-as-a-Service (EaaS) and Battery-as-a-Service (BaaS), provides financial flexibility that mitigates the high CAPEX Restraint, thus broadening the customer base. Technological Opportunities include the acceleration of hydrogen fuel cell adoption, which is ideal for heavy-duty, multi-shift operations seeking immediate refueling and zero emissions, aligning perfectly with major corporate ESG mandates. Furthermore, the development of highly customized industrial trucks designed for niche applications—such as extreme cold storage, cleanroom environments, or explosion-proof areas—allows manufacturers to capture premium market segments. The continuous enhancement of 5G network coverage also presents an opportunity by enabling seamless, high-bandwidth remote monitoring and control, vital for managing geographically dispersed, sophisticated autonomous fleets and unlocking new levels of centralized operational efficiency.

Segmentation Analysis

The Industrial Trucks Market segmentation provides a strategic framework for understanding diverse product offerings, consumption patterns, and technological priorities across the global industry landscape, structured primarily across Type, Power Source, and End-User Industry. Segmentation by Type critically differentiates between the foundational heavy-duty Counterbalanced Forklifts, the high-volume, precision-focused Warehouse Trucks (including reach trucks and pallet stackers essential for high-density storage), and the rapidly growing Automation segment comprising Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs). Analyzing this segment is crucial for tracking market maturity, as investment shifts rapidly toward autonomous and semi-autonomous types, reflecting the industry's focus on maximizing labor efficiency and operational consistency, especially in large fulfillment centers where vertical space utilization is optimized.

The Power Source segmentation is currently the most dynamic area, reflecting the aggressive market shift away from legacy Internal Combustion (IC) engines (Diesel and LPG) towards sustainable Electric power. Within the electric category, the dominance of Lithium-Ion (Li-ion) batteries is undeniable, as they offer superior operational metrics such as higher energy density, zero maintenance, and critical "opportunity charging" capabilities that facilitate 24/7 operations, outperforming conventional Lead-Acid solutions. Hydrogen Fuel Cell technology, though currently a smaller segment, is strategically important, carving out a vital niche in heavy-duty, high-throughput applications where traditional battery swap logistics are impractical. This segmentation analysis informs manufacturers’ long-term research and development strategies and highlights the imperative for OEMs to secure stable, high-quality Li-ion and Fuel Cell component supply chains to meet future regulatory and consumer demands for low-carbon material handling.

End-User segmentation reveals the primary drivers of market demand. The Logistics & Third-Party Logistics (3PL) sector, coupled with the Retail and E-commerce segment, collectively represent the largest and fastest-expanding consumer base. These users demand highly reliable, scalable, and interconnected fleets to manage high inventory turnover and demanding service level agreements (SLAs). Contrastingly, the Manufacturing sector, including Automotive and heavy machinery production, maintains steady demand, focusing on customized, often high-capacity trucks optimized for precise assembly line feeding and rigorous indoor/outdoor operational environments. The diversification of product offerings, catering to specific constraints like hygiene standards in the Food & Beverage industry or rugged durability in Construction, demonstrates the need for comprehensive market coverage, ensuring that product development is highly aligned with the specific operational constraints and regulatory compliance requirements of each vertical market.

- By Type:

- Counterbalanced Forklifts (Class 4 & 5)

- Warehouse Trucks (Class 2 & 3)

- Pallet Jacks and Walkies

- Reach Trucks

- Order Pickers

- Stackers

- Telehandlers (Rough Terrain Forklifts)

- Automated Guided Vehicles (AGVs) / Autonomous Mobile Robots (AMRs)

- Tow Tractors and Personnel Carriers (Class 6)

- By Power Source:

- Internal Combustion (IC) Engine

- Diesel

- LPG/Gasoline

- Electric (Battery Powered)

- Lead-Acid Batteries

- Lithium-Ion Batteries (Li-ion)

- Fuel Cells (Hydrogen)

- By End-User:

- Logistics and Third-Party Logistics (3PL)

- Retail and E-commerce Fulfillment

- Manufacturing and Automotive

- Food & Beverages (Including Cold Storage)

- Construction and Mining

- Pulp and Paper Industry

- Pharmaceuticals and Chemicals

- By Load Capacity:

- Below 3 Tons (Light Duty)

- 3–7 Tons (Medium Duty)

- Above 7 Tons (Heavy Duty)

- By Automation Level:

- Manual/Operator Controlled

- Semi-Autonomous (Assisted Operation)

- Fully Autonomous (AGVs/AMRs)

Value Chain Analysis For Industrial Trucks Market

The upstream segment of the Industrial Trucks Value Chain is centered on the procurement and supply of specialized, high-specification raw materials and critical technological components. This includes sourcing high-tensile steel and specialized alloys for the robust chassis and masts, crucial for ensuring structural integrity and lifting capacity. Critically, the upstream focus has dramatically shifted toward securing the supply of advanced electrical components: high-performance lithium-ion battery cells, sophisticated power electronics, high-efficiency AC motors, and increasingly, complex sensors (Lidar, vision systems) and high-density semiconductor chips necessary for control and automation. Strategic stability in the upstream segment requires OEMs to forge long-term, collaborative partnerships with key component suppliers—especially those providing Li-ion batteries and advanced sensor technology—to manage supply risks, control costs, and maintain a competitive edge in technological advancement, particularly in the face of volatile global raw material markets.

Midstream activities encompass the design, manufacturing, and complex assembly processes, representing the core value addition stage. Modern manufacturing relies heavily on advanced robotics and lean production methodologies to ensure high quality, precision, and adherence to global safety and regulatory standards. OEMs prioritize modular design to facilitate customization and rapid scaling of production across various truck classes. The integration process is highly complex for modern trucks, requiring the seamless fusion of mechanical hardware, sophisticated hydraulic systems, battery management systems (BMS), and extensive proprietary software for fleet control and telematics. This integration often occurs on dedicated, highly specialized assembly lines. Efficient midstream operations are paramount for reducing time-to-market for new electric and autonomous models, controlling fixed costs, and maintaining the high reliability standards demanded by commercial and industrial end-users globally.

The downstream phase involves distribution, sales, and comprehensive aftermarket support, which often dictates the profitability and long-term customer loyalty for industrial truck OEMs. Distribution channels typically operate through a dual structure: direct sales for large corporate accounts, major logistics firms, and complex automation projects requiring bespoke consultation; and a vast, localized indirect network of authorized dealers and distributors managing local sales, providing short-term rentals, and offering essential repair and maintenance services. The aftermarket is increasingly pivotal, encompassing the sales of spare parts, scheduled servicing, maintenance contracts, and, significantly, recurring revenue derived from software subscriptions for fleet management and telematics services. Effective aftermarket support, including rapid spare parts delivery and highly trained service technicians, is crucial for minimizing customer downtime and optimizing the total asset lifecycle cost, thereby solidifying the manufacturer's value proposition well beyond the initial equipment purchase.

Industrial Trucks Market Potential Customers

The market for industrial trucks targets a vast and diverse spectrum of commercial and industrial enterprises globally, with the largest and most dynamic customer segment being Logistics & Third-Party Logistics (3PL) providers and large-scale Retail & E-commerce operations. These customers operate extensive distribution networks and fulfillment centers, characterized by intense utilization rates and the critical need for scalable, high-speed material handling. Their purchasing decisions are heavily influenced by the ability of the equipment (particularly high-density warehouse trucks and AGVs) to integrate seamlessly with automated storage systems and provide continuous, high-availability operation, often necessitating the shift to electric fleets powered by fast-charging Lithium-Ion batteries to support 24/7 service level agreements and seasonal volume spikes.

A second major pillar of demand originates from the Manufacturing sector, encompassing automotive assembly, heavy machinery production, and industrial components fabrication. These customers prioritize industrial trucks with high lifting capacities, exceptional durability, and precision handling capabilities for managing raw material inputs and delivering components to assembly lines just-in-time. Their purchasing cycles are typically stable, focused on fleet replacement and incremental upgrades to comply with specialized in-house safety and lean manufacturing protocols. Furthermore, the Food & Beverages industry, especially those segments operating in cold chain logistics or requiring stringent hygiene (e.g., pharmaceuticals), demands highly specialized equipment; this includes trucks designed to operate efficiently in freezing temperatures or units constructed with corrosion-resistant materials, driving customized solution sales for niche operational requirements.

Beyond these core industrial segments, significant potential customers exist in specialized areas such as Port Operations, which demand the largest, highest-capacity container handlers and telehandlers for intermodal transport logistics. The Construction and Mining sectors rely on rugged, high-performance rough terrain forklifts and telescopic handlers capable of navigating challenging outdoor environments. A rapidly growing customer segment is the Equipment Rental and Leasing market. These firms function as key intermediaries, purchasing large volumes of industrial trucks from OEMs and offering flexible operational leasing options to smaller businesses or companies requiring temporary fleet augmentation, effectively lowering the financial barrier for industrial truck adoption and ensuring a stable, consistent volume of demand for OEMs across the economic cycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $65.4 Billion USD |

| Market Forecast in 2033 | $108.2 Billion USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toyota Industries Corporation, KION Group AG, Jungheinrich AG, Mitsubishi Logisnext Co., Ltd., Crown Equipment Corporation, Hyster-Yale Materials Handling, Inc., Komatsu Ltd., Anhui Heli Co., Ltd., Clark Material Handling Company, Doosan Corporation, Godrej & Boyce Mfg. Co. Ltd., Hangcha Group Co., Ltd., Konecranes, Manitou Group, Lonking Holdings Limited, EP Equipment, UniCarriers Corporation, Combilift Ltd., JLG Industries, Sany Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Trucks Market Key Technology Landscape

The technological evolution defining the modern Industrial Trucks Market is primarily dictated by radical advancements in motive power and pervasive digitalization. The rapid transition to Electric power sources, spearheaded by Lithium-Ion (Li-ion) battery technology, represents the most significant shift. Li-ion batteries offer superior performance metrics—including significantly longer run times, high energy efficiency, and the crucial ability for intermittent 'opportunity charging'—which allows trucks to operate continuously without dedicated downtime for swapping or long recharge cycles, meeting the rigorous demands of 24/7 fulfillment operations. Furthermore, Hydrogen Fuel Cell technology is emerging as a critical, complementary solution, particularly for large-scale operations requiring zero emissions and extremely fast refueling, thereby overcoming the potential logistical constraints of battery charging infrastructure in high-volume, heavy-duty applications. Manufacturers are strategically investing heavily in modular electric powertrains and proprietary Battery Management Systems (BMS) to standardize components and maximize the efficiency and safety of these advanced energy sources.

The second pillar of technological transformation is the deep integration of the Internet of Things (IoT) and sophisticated telematics, which has fundamentally transformed industrial trucks into intelligent, interconnected endpoints within the supply chain network. Modern fleets are equipped with an array of sensors capturing granular operational data: location, speed, lift cycles, component temperatures, and usage patterns. This data is transmitted in real-time to cloud-based Fleet Management Systems (FMS), often accessible via secure web portals, providing actionable intelligence on asset utilization, operator performance, and equipment health. This connectivity facilitates crucial remote diagnostics, predictive maintenance scheduling based on actual component wear (not just time), and enforcement of safety parameters. The growing stability of high-speed wireless networks, including 5G in major logistics corridors, is enabling even higher data throughput, supporting critical real-time decision-making and remote control capabilities essential for highly efficient, centralized management of geographically dispersed fleets.

The third and potentially most transformative technological domain is the rapid commercialization and deployment of Autonomy, embodied by Automated Guided Vehicles (AGVs) and highly flexible Autonomous Mobile Robots (AMRs). These autonomous industrial trucks leverage advanced sensor fusion—combining data from Lidar, 3D vision systems, and ultrasonic sensors—with sophisticated Artificial Intelligence (AI) algorithms for real-time localization, dynamic path planning, and robust obstacle avoidance. This technology frees up human operators from repetitive, low-value tasks like long-distance transport, allowing them to focus on complex, high-value operations such as specialized order picking. The industry is moving toward mixed-use environments where autonomous trucks safely and efficiently co-exist with human workers, requiring robust certification and safety protocols driven by continuous technological improvement in AI perception and reaction capabilities. This autonomy is crucial for addressing long-term labor shortages and achieving the consistency and throughput demanded by the hyper-efficient logistics models of the future.

Regional Highlights

- Asia Pacific (APAC): APAC retains its position as the global powerhouse for the Industrial Trucks Market, characterized by high volume demand and the fastest regional growth rate, propelled by rapid industrialization, massive government investment in infrastructure, and the unparalleled expansion of the regional e-commerce sector. China leads in both production and consumption, though increasing labor costs and environmental regulations are driving a notable shift toward high-end electric and domestic automation solutions. Countries like India, Vietnam, and Indonesia are experiencing a boom in logistics facility construction, driving significant demand for basic to medium-level warehouse trucks, signifying strong long-term expansion potential as these markets transition from manual to mechanized material handling practices.

- Europe: The European market is defined by its maturity, stringent environmental regulations (EU Emissions Standards), and strong emphasis on worker safety and ergonomics. Growth is largely driven by replacement cycles and the mandatory upgrading of fleets to comply with sustainability mandates, resulting in market leadership in electric and alternative power sources. Germany and the Nordic countries are at the forefront of adopting sophisticated Li-ion and hydrogen fuel cell technologies. The demand here is centered on high-quality, high-tech trucks integrated with advanced telematics and safety features, positioning Europe as a premium market for manufacturers focused on sustainable logistics solutions and operational excellence.

- North America: North America remains a highly lucrative market, characterized by large-scale logistics operations and substantial investment in automation to offset severe labor constraints and meet high consumer expectations for rapid delivery. The region is a massive adopter of advanced solutions, seeing rapid commercial deployment of both AGVs/AMRs and large-scale hydrogen fuel cell fleets, particularly among retail giants and major 3PL providers seeking maximum uptime and zero-emission operations across their expansive facilities. Market drivers include continuous expansion of warehousing capacity and aggressive investment in intelligent fleet management systems designed to optimize highly complex, high-throughput supply chains.

- Latin America (LATAM): The LATAM region presents a developing market structure, with growth linked to recovering industrial output and increasing foreign investment in localized supply chain infrastructure. Market demand is uneven but trending toward modernization, focusing initially on mechanizing material handling in sectors like mining, automotive, and large agricultural processing. While price sensitivity remains a factor, there is growing interest in electric warehouse trucks to address rising energy costs and operational efficiency needs, signaling a gradual shift away from reliance on older, less efficient IC engine models as economic stability improves.

- Middle East & Africa (MEA): Growth in MEA is highly localized, driven primarily by major infrastructure developments in the Gulf Cooperation Council (GCC) countries, focusing on establishing world-class logistics and transshipment hubs (e.g., UAE, Saudi Arabia). Government diversification plans and large construction projects necessitate investment in both heavy-duty industrial trucks and advanced terminal handling equipment. The market often favors proven technologies, but the adoption of electric and smart fleet management systems is accelerating, particularly in high-profile, newly developed economic zones aimed at attracting international trade and maintaining competitive logistical efficiency against global standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Trucks Market.- Toyota Industries Corporation

- KION Group AG

- Jungheinrich AG

- Mitsubishi Logisnext Co., Ltd.

- Crown Equipment Corporation

- Hyster-Yale Materials Handling, Inc.

- Komatsu Ltd.

- Anhui Heli Co., Ltd.

- Clark Material Handling Company

- Doosan Corporation

- Godrej & Boyce Mfg. Co. Ltd.

- Hangcha Group Co., Ltd.

- Konecranes

- Manitou Group

- Lonking Holdings Limited

- EP Equipment

- UniCarriers Corporation

- Combilift Ltd.

- JLG Industries

- Sany Group

Frequently Asked Questions

Analyze common user questions about the Industrial Trucks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Industrial Trucks Market?

The central driver is the relentless global expansion of the E-commerce sector, which necessitates extensive investment in automated, high-throughput fulfillment and distribution centers, subsequently increasing demand for electric forklifts and Autonomous Mobile Robots (AMRs) to manage complex material flow efficiently and offset rising labor costs.

How is the shift towards electrification impacting industrial truck operations?

The transition to electric power, particularly Lithium-Ion (Li-ion) batteries, is fundamentally improving operational uptime and efficiency. Li-ion technology allows for opportunity charging, eliminates maintenance associated with lead-acid batteries, and supports high-intensity, multi-shift operations without requiring battery swapping, significantly reducing the Total Cost of Ownership (TCO).

What role does Artificial Intelligence (AI) play in modern industrial trucks?

AI is crucial for enhancing automation and safety. It enables advanced capabilities such as dynamic path planning for AGVs/AMRs, optimizes fleet utilization by predicting maintenance needs (predictive maintenance), and utilizes sophisticated vision systems for real-time collision avoidance and operator safety monitoring in mixed-use environments.

Which geographical region exhibits the highest market growth rate?

Asia Pacific (APAC), particularly driven by substantial infrastructure and logistics investments in China and India, exhibits the highest market growth rate. This growth is fueled by rapid industrialization, massive e-commerce adoption, and the increasing modernization of material handling fleets across the region.

What is the difference between AGVs and AMRs in the context of industrial trucks?

Automated Guided Vehicles (AGVs) follow fixed, predefined routes (often guided by wires or magnetic tape). In contrast, Autonomous Mobile Robots (AMRs) use advanced sensors (Lidar, cameras) and AI for navigation, allowing them to dynamically plan routes, avoid obstacles, and adapt to changing environments without fixed infrastructure, offering much greater flexibility in modern warehouses.

What challenges restrain the widespread adoption of autonomous industrial trucks?

Key restraints include the high initial capital expenditure (CAPEX) for fully autonomous systems, the technical complexity of integrating these systems with existing legacy Warehouse Management Systems (WMS), and the persistent shortage of specialized technical personnel required for their maintenance and programming.

How does telematics technology improve fleet operational efficiency?

Telematics uses embedded IoT sensors and connectivity to transmit real-time data on asset utilization, location, performance, and operational health to a centralized management system. This allows managers to optimize task assignment, schedule predictive maintenance based on actual usage, and monitor driver behavior for safety and efficiency compliance.

Which industrial truck type is seeing the highest volume growth globally?

Warehouse Trucks (including reach trucks, pallet stackers, and order pickers) are experiencing the highest volume growth. This is directly attributable to the global trend of high-density storage and vertical space utilization in modern e-commerce fulfillment and distribution centers, requiring specialized equipment for narrow aisles.

Why is the Automotive industry a significant end-user for industrial trucks?

The Automotive industry demands robust, reliable industrial trucks for critical tasks such as handling heavy parts, transporting raw materials, and precision feeding of components directly onto assembly lines following stringent just-in-time (JIT) manufacturing protocols, often requiring specialized, high-capacity equipment.

What is the 'last mile' relevance of industrial trucks in E-commerce?

Industrial trucks are crucial for optimizing the 'final step' within the warehouse or distribution center—the preparation and loading of goods onto outbound delivery vehicles. Efficient handling at this stage, often performed by highly integrated AGVs or high-speed pallet trucks, is essential for meeting rapid shipping deadlines and maintaining logistical speed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager