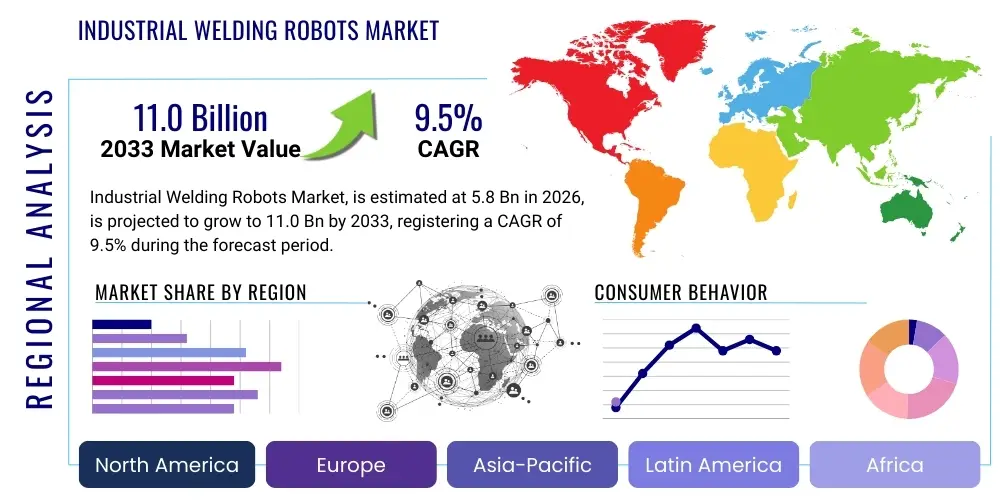

Industrial Welding Robots Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443202 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Welding Robots Market Size

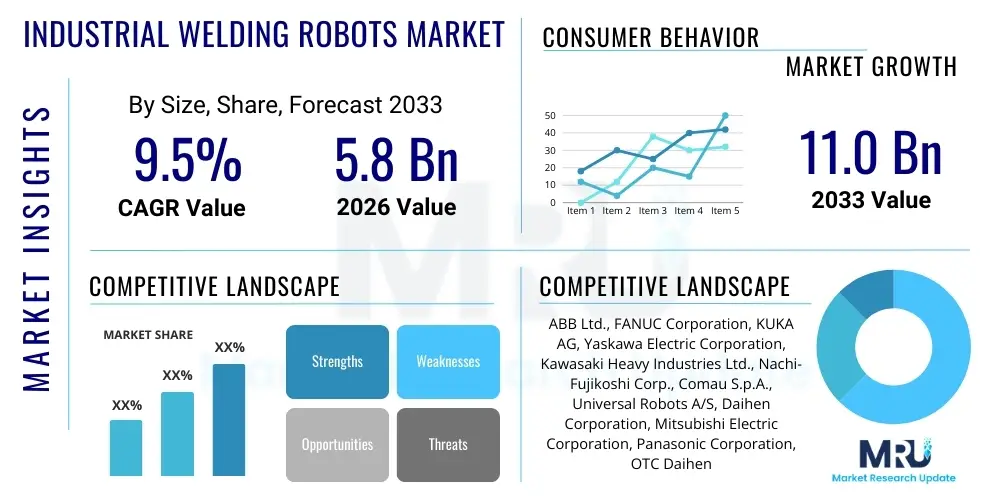

The Industrial Welding Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $11.0 Billion by the end of the forecast period in 2033.

Industrial Welding Robots Market introduction

The Industrial Welding Robots Market encompasses the manufacturing, deployment, and servicing of automated systems designed to perform various welding processes, including arc welding, spot welding, laser welding, and plasma welding, within industrial environments. These specialized robotic arms and integrated systems are crucial components of modern manufacturing facilities, providing high precision, repeatability, and increased throughput compared to manual welding methods. The core product offering includes multi-axis articulated robots, collaborative robots (cobots), control systems, end-effectors (weld guns/torches), and advanced vision systems necessary for complex welding tasks, catering primarily to high-volume industries requiring stringent quality control and operational consistency.

Major applications for industrial welding robots span across core manufacturing sectors, most notably automotive, heavy machinery, aerospace, construction, and electronics manufacturing. In the automotive industry, these robots are indispensable for spot welding vehicle chassis and assembling critical components, ensuring structural integrity and meeting rigorous safety standards. For heavy machinery, industrial robots handle large-scale, complex arc welding jobs that would be ergonomically challenging or time-consuming for human operators. The primary benefit derived from the adoption of welding robots includes substantial improvements in operational efficiency, reduction in labor costs, enhancement of weld quality and consistency, and marked safety improvements by removing human workers from hazardous welding environments. The deployment of these automated solutions aligns perfectly with the global trend toward smart factories and Industry 4.0 paradigms, driving continuous investment in advanced automation technologies across all major economic regions.

Key driving factors accelerating market expansion include the critical need for manufacturing companies globally to enhance productivity amid rising global competition and skilled labor shortages, particularly in specialized fields like certified welding. Furthermore, technological advancements, such as the integration of artificial intelligence (AI) for real-time quality inspection and adaptive control, and the development of easier-to-program collaborative welding robots (welding cobots), are lowering the barrier to entry for Small and Medium-sized Enterprises (SMEs). Regulatory pressures emphasizing workplace safety and the need for standardized, traceable welding processes, especially in infrastructure and energy sectors, also underpin the sustained growth trajectory of the Industrial Welding Robots Market. This robust demand across diverse industrial verticals ensures the market remains dynamic and highly competitive.

Industrial Welding Robots Market Executive Summary

The Industrial Welding Robots Market is characterized by robust growth driven by accelerating automation adoption across global manufacturing sectors, with significant technological shifts favoring collaborative systems and AI integration. Business trends indicate a strong move toward tailored, flexible automation solutions capable of handling multi-material and complex geometries, pushing manufacturers to invest heavily in advanced sensors and software capabilities to differentiate their offerings. Leading vendors are focusing on expanding their service models, including Robotics-as-a-Service (RaaS), to attract smaller players who require lower upfront capital investment. Supply chain resilience, particularly concerning electronics and sophisticated componentry, remains a critical operational focus, while mergers and acquisitions among software providers and hardware manufacturers continue to shape the competitive landscape.

Regionally, Asia Pacific (APAC), led by China, Japan, and South Korea, maintains dominance due to massive automotive production volumes and strong governmental support for factory modernization, making it the fastest-growing geographical segment. North America and Europe, characterized by high labor costs and stringent quality regulations, show mature growth driven by replacement cycles and the increasing implementation of high-end, precision welding applications, such as those found in aerospace and medical device manufacturing. Segment trends highlight that Arc Welding Robots command the largest revenue share due to their widespread application, while the Collaborative Robots segment is projected to exhibit the highest CAGR, reflecting the industry’s shift toward more flexible, safer, and easier-to-integrate automation solutions suitable for lighter manufacturing and assembly tasks. Furthermore, the adoption of laser welding robots is accelerating in industries requiring extremely high speed and minimal heat distortion, such as electronics and battery manufacturing.

In essence, the market outlook is overwhelmingly positive, underpinned by macro trends favoring operational digitalization and productivity enhancement. The ongoing evolution of robot capabilities—from fixed, high-payload systems to flexible, intelligent cobots—is broadening the market reach beyond traditional heavy industry. Successful market navigation hinges on addressing the dual challenges of initial investment cost and the necessity for specialized programming skills. Key stakeholders are responding by prioritizing user-friendly interfaces, modular designs, and integrated digital twin capabilities for simulation and deployment optimization, positioning the sector for sustainable long-term expansion throughout the forecast period.

AI Impact Analysis on Industrial Welding Robots Market

User queries regarding AI’s impact on the Industrial Welding Robots Market frequently revolve around three core themes: How AI enhances weld quality and defect detection, whether AI simplifies robot programming and setup for non-experts, and the long-term potential for fully autonomous welding environments. Users are particularly interested in AI's role in adaptive process control—adjusting parameters in real-time based on material variations or environmental changes—which traditional programmable robots struggle with. There is a clear expectation that AI will transition welding automation from fixed-path repeatability to intelligent, dynamic performance, addressing complex, low-volume, high-mix production challenges while significantly reducing the need for costly post-weld inspection and rework. Concerns often focus on data security, the required computation infrastructure, and the validation standards for AI-driven welding systems, highlighting a desire for robust, trustworthy intelligence.

- AI-Driven Adaptive Control: Real-time adjustment of welding parameters (current, voltage, speed) based on joint fit-up variations and thermal conditions, ensuring consistent bead geometry and penetration depth.

- Enhanced Quality Inspection: Integration of deep learning algorithms with vision systems (machine vision) to perform immediate, non-destructive evaluation (NDE) of weld integrity, identifying micro-defects faster and more accurately than human inspectors.

- Simplified Programming: Utilization of AI to enable teachless programming and trajectory generation through imitation learning or cloud-based knowledge libraries, drastically reducing setup time and the reliance on highly skilled robotics engineers.

- Predictive Maintenance: AI analyzes operational data (motor load, temperature, vibration) to predict potential robot failures or component wear, minimizing unplanned downtime and maximizing the utilization rate of expensive assets.

- Cognitive Welding Systems: Development of robots that can autonomously recognize different components, locate the weld seam in unstructured environments (bin picking), and choose the optimal welding strategy without explicit human intervention.

- Data Optimization and Process Analytics: Leveraging machine learning to analyze vast amounts of welding data (WPS records, defect rates, material usage) to continuously optimize the Welding Procedure Specification (WPS) and improve overall factory efficiency.

DRO & Impact Forces Of Industrial Welding Robots Market

The dynamics of the Industrial Welding Robots Market are significantly shaped by a powerful interplay of drivers, restraints, and opportunities, all influenced by critical impact forces such as technology cycles and geopolitical shifts. The primary driver is the pervasive global shift towards high-volume, precision manufacturing coupled with severe shortages of skilled manual welders, making automation an economic imperative rather than a luxury. Opportunities are emerging predominantly from the rapid maturation of collaborative robot technology (cobots), which offers lower capital costs and simplified integration, opening lucrative avenues within the vast Small and Medium-sized Enterprise (SME) sector previously constrained by the complexity and expense of traditional industrial automation. The core restraint, however, remains the substantial initial capital investment required for high-payload robotic cells, which can deter companies with limited cash flow, alongside the specialized technical expertise needed for complex integration and long-term maintenance.

Technological advancement acts as the most significant impact force, continually driving down the size and increasing the speed and payload capacity of welding robots. The integration of advanced sensors, machine vision, and AI is transforming the application scope, allowing robots to perform tasks with much higher variability and complexity than before. Geopolitical impact forces, particularly trade regulations and regional manufacturing incentive programs (e.g., reshoring initiatives in North America and Europe), are altering supply chain strategies and driving localized demand for highly automated production lines. These forces necessitate that market players offer not just hardware, but comprehensive, data-driven solutions capable of adapting to fluctuating operational demands and rigorous international standards.

The sustained impact of these forces ensures a polarized market environment: robust growth driven by necessity and innovation, tempered by adoption friction related to cost and complexity. Manufacturers are actively mitigating these restraints by developing modular, platform-based robotic solutions and enhancing their service portfolios, including financing options and advanced technical training packages. Furthermore, the increasing global focus on high-quality standards in critical infrastructure (such as energy pipelines and aerospace structures) means the unparalleled repeatability and traceability offered by robotic welding systems are becoming critical competitive advantages, cementing automation’s essential role in future industrial strategy.

Segmentation Analysis

The Industrial Welding Robots Market is segmented based on product type, welding technology, payload capacity, and end-use industry, reflecting the diverse application requirements across the global manufacturing landscape. This segmentation provides a granular view of market dynamics, revealing specific high-growth niches, such as collaborative welding robots and laser welding technology, which are outpacing traditional segments. The analysis demonstrates that while established segments like high-payload spot welding robots (dominated by the automotive industry) constitute the largest revenue base, future growth is structurally oriented towards solutions offering flexibility and intelligence. Understanding these divisions is crucial for strategic planning, allowing vendors to tailor R&D investments toward developing highly specialized systems that address sector-specific challenges, such as lightweight material joining in aerospace or rapid prototyping in contract manufacturing.

- By Type:

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Collaborative Robots (Cobots)

- By Welding Technology:

- Arc Welding (MIG, TIG, Plasma)

- Spot Welding

- Laser Welding

- Other Welding Technologies (e.g., Friction Stir Welding, Brazing)

- By Payload Capacity:

- Low Payload (Up to 15 kg)

- Medium Payload (15 kg to 60 kg)

- High Payload (Above 60 kg)

- By End-Use Industry:

- Automotive & Transportation

- Electrical & Electronics

- Heavy Machinery & Construction

- Aerospace & Defense

- Metal Fabrication

- Others (Medical, Energy, etc.)

Value Chain Analysis For Industrial Welding Robots Market

The value chain for industrial welding robots is complex, starting with core component suppliers and extending through integration, distribution, and critical post-sale service phases. Upstream activities involve the highly specialized manufacturing of key components, including precision servo motors, high-speed controllers, specialized welding power sources, and advanced sensor technologies (e.g., vision systems, tactile sensors). These components often originate from highly specialized technology firms in countries like Japan, Germany, and Switzerland, providing the technological foundation for the robot systems. Efficiency in the upstream segment relies heavily on maintaining rigorous quality control and managing the global supply chain for microelectronics, which are susceptible to lead time volatility. This segment is characterized by high capital expenditure and intensive R&D to ensure components meet the speed and precision demands of modern welding applications.

Midstream and downstream processes are centered around robot manufacturers and system integrators. Robot manufacturers (e.g., ABB, FANUC, KUKA) focus on the design, assembly, and testing of the articulated arms and control cabinets. Crucially, the system integrators form the vital link between the manufacturer and the end-user. These integrators specialize in designing custom welding cells, installing the robot, integrating peripheral equipment (fixtures, positioners), writing application-specific programming, and conducting runoff testing. Distribution channels are typically a mix of direct sales (especially for large, multinational clients) and indirect distribution through certified partners and value-added resellers (VARs) who provide local expertise and customized integration services. The indirect channel is particularly critical for penetrating the SME segment, offering localized support and customized financing.

The distribution channel efficiency significantly impacts market responsiveness and customer adoption rates. Direct channels offer tighter control over service quality and customer data, which is essential for developing bespoke high-end solutions. Indirect channels, primarily VARs and regional distributors, leverage localized engineering expertise and strong client relationships, accelerating deployment timelines and providing rapid technical support. Post-sale activities, including preventative maintenance, software updates, and training, are increasingly important profit centers, driving customer lifetime value and long-term hardware sales. The integration of digital services and remote diagnostics through the Internet of Things (IoT) infrastructure is modernizing the maintenance phase, ensuring maximum uptime and optimized robot performance throughout the entire operational lifecycle.

Industrial Welding Robots Market Potential Customers

The primary end-users and buyers of industrial welding robots span a broad spectrum of heavy and light manufacturing industries where precision, volume, and consistency in joining metals or plastics are critical operational requirements. The automotive and transportation industry remains the largest consumer, utilizing these robots extensively for high-speed spot welding of body-in-white structures, assembly of engine and powertrain components, and precise arc welding for complex chassis parts. These buyers prioritize high throughput, extremely high repeatability, and robust reliability to meet demanding production schedules and stringent safety standards dictated by global vehicle regulations, often requiring high-payload, high-speed articulated robots.

Beyond automotive, the heavy machinery and construction sector represents a major segment, purchasing welding robots for large-scale, complex fabrications, such as excavators, agricultural equipment, and structural steel components. In this segment, the robots are valued for handling extremely heavy and large workpieces and performing extensive, consistent arc welding tasks in environments that pose ergonomic challenges to human welders. Furthermore, the aerospace and defense sector represents a high-value, albeit smaller, segment. These buyers require ultra-high precision, traceability, and the ability to weld advanced materials (e.g., titanium, specialized alloys) using sophisticated technologies like laser and electron beam welding, driven by critical safety and performance criteria.

A rapidly expanding customer base includes general metal fabrication shops and electronics manufacturers. General fabricators, often SMEs, are increasingly adopting collaborative welding robots (cobots) due to their ease of programming, lower footprint, and ability to handle high-mix, low-volume job runs effectively. Electronics manufacturers rely on micro-welding and laser welding robots for highly precise joining of small components and battery assembly, driven by the explosive growth in consumer electronics and electric vehicle battery production. These diverse customer needs underscore the necessity for market vendors to offer a spectrum of solutions, ranging from fixed, high-power systems to flexible, user-friendly cobots, catering to varying levels of technical complexity and investment capacity across different industrial domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $11.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd., Nachi-Fujikoshi Corp., Comau S.p.A., Universal Robots A/S, Daihen Corporation, Mitsubishi Electric Corporation, Panasonic Corporation, OTC Daihen, Lincoln Electric, Genesis Systems Group, Robotiq, Co-Tasks Corporation, Welding Technology Corporation, Cloos Electronic Welding Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Welding Robots Market Key Technology Landscape

The technological landscape of the industrial welding robot market is rapidly evolving, moving beyond simple programmed path execution toward sophisticated, interconnected, and highly intelligent systems. A foundational technology remains the advancement in multi-axis articulated robot mechanics, focusing on improving rigidity, speed, and precision repeatability (down to sub-millimeter levels) while simultaneously making the robots lighter and more energy efficient. Crucially, the integration of advanced vision systems, leveraging both 2D and 3D imaging, is becoming standard. These systems allow robots to accurately locate irregular or misplaced parts, dynamically track the weld seam in real-time (seam tracking), and adjust the path accordingly, overcoming a major limitation of older, non-sensory dependent systems. This fusion of mechanics and sensing capability is essential for handling the increasing product mix variability demanded by modern manufacturing.

Further pushing the boundary are technologies centered around collaborative automation and digital integration. Collaborative robots (cobots) are fundamentally changing the market by incorporating advanced force and torque sensing technology, enabling them to safely operate alongside human workers without extensive safety caging. This safety feature, combined with simplified, tablet-based programming interfaces (often utilizing 'teach-by-demonstration' methods), drastically lowers the complexity barrier for SME adoption. Simultaneously, the proliferation of Industry 4.0 standards means that virtually all new welding robots are equipped with integrated IoT capabilities. This allows for seamless data exchange regarding operational metrics, welding procedure compliance, and performance diagnostics with central manufacturing execution systems (MES) and cloud platforms, facilitating remote monitoring and predictive maintenance strategies.

Specialized welding technologies also represent a vital technological area. Laser welding, particularly fiber and disc lasers, is seeing increased adoption, offering high power density, extremely fast welding speeds, and minimal heat-affected zones (HAZ). This technology is critical in the manufacturing of electric vehicle (EV) batteries, where precision and minimal thermal stress are paramount for cell integrity. Furthermore, advancements in power source technology, such as waveform control in advanced Metal Inert Gas (MIG) welding, allow for highly optimized welding processes for specific materials like aluminum and high-strength low-alloy steels, expanding the range of materials that can be reliably welded by automated systems. The continuous drive for better software intelligence, encompassing AI for quality assurance and machine learning for optimal parameter selection, ensures that technology remains the principal catalyst for market differentiation and growth.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the undisputed market leader in terms of volume and is the fastest-growing region, driven primarily by China, Japan, and South Korea. China’s extensive industrial output, particularly in automotive and electronics, combined with substantial state subsidies and initiatives like "Made in China 2025" promoting advanced manufacturing, fuels explosive demand. Japan remains a technological hub, home to major robot manufacturers, pushing the envelope in high-precision, heavy-payload robotics. South Korea is dominated by major conglomerates heavily investing in autonomous smart factories, ensuring consistent strong adoption rates. The region’s low labor costs historically acted as a restraint but are rapidly increasing, accelerating the ROI calculation for automation investment across Southeast Asia.

- North America: North America exhibits mature market characteristics, with growth driven largely by the automotive replacement cycle, reshoring initiatives, and intense focus on safety and high quality. The United States is a significant market for advanced arc welding systems used in heavy manufacturing, energy, and aerospace. The regional emphasis is shifting toward flexible automation, including collaborative robots, to address the severe shortage of skilled tradespeople. High labor costs provide a powerful economic incentive for quick automation adoption, particularly among fabricators looking to boost competitive advantage against offshore production.

- Europe: Europe maintains a strong position, characterized by high adoption of sophisticated technology and robust demand from the German automotive industry (including Tier 1 suppliers) and specialized machinery manufacturers in Italy and Scandinavia. Regulatory factors, particularly workplace safety directives, encourage the deployment of collaborative welding solutions. Investment is concentrated on optimizing energy efficiency and integrating complex welding tasks, such as those involving highly specialized materials for aerospace and renewable energy components. The market here demands high-end, customized robotic cells with integrated digital services.

- Latin America: This region presents nascent growth opportunities, primarily concentrated in the manufacturing centers of Mexico and Brazil, which serve as major production hubs for multinational automotive and construction equipment manufacturers. Growth is volatile, highly dependent on global commodity prices and internal political stability, but the long-term outlook is positive as manufacturing processes modernize to meet export quality standards. Cost-sensitivity necessitates a greater focus on proven, efficient, and standardized robotic systems.

- Middle East and Africa (MEA): MEA represents the smallest but emerging segment. Demand is primarily centered around large government-backed infrastructure projects, particularly in oil, gas, and construction sectors in the GCC countries (Saudi Arabia, UAE). The focus is on automating large-scale pipeline welding and structural fabrication, requiring heavy-duty, robust robot systems capable of operating in harsh environments. Technology adoption is often driven by direct imports and integration services provided by major international vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Welding Robots Market.- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries Ltd.

- Nachi-Fujikoshi Corp.

- Comau S.p.A.

- Universal Robots A/S

- Daihen Corporation

- Mitsubishi Electric Corporation

- Panasonic Corporation

- OTC Daihen

- Lincoln Electric

- Genesis Systems Group

- Robotiq

- Co-Tasks Corporation

- Welding Technology Corporation

- Cloos Electronic Welding Systems

- IGM Robotic Systems AG

- Estic Corporation

Frequently Asked Questions

Analyze common user questions about the Industrial Welding Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Industrial Welding Robots Market?

The Industrial Welding Robots Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033, driven by pervasive manufacturing automation trends and rising demand for high-quality, repeatable welding processes globally.

Which welding technology segment dominates the market revenue?

Arc Welding Robots currently hold the largest revenue share in the market, owing to their broad application across major industries, including automotive, heavy machinery, and general metal fabrication, utilizing techniques like MIG and TIG welding.

How are Collaborative Robots (Cobots) influencing the welding market?

Welding Cobots are expanding market accessibility, especially for Small and Medium-sized Enterprises (SMEs). Their influence stems from ease of integration, simplified programming requirements, lower initial investment compared to traditional systems, and safe operation alongside human workers.

Which region is the largest consumer and fastest-growing market for welding robots?

Asia Pacific (APAC), particularly driven by manufacturing powerhouses like China, is both the largest consumer market in terms of volume and the fastest-growing region globally, supported by mass automotive production and governmental automation mandates.

What is the primary role of Artificial Intelligence (AI) in industrial welding robots?

AI is primarily used to enhance quality control through real-time defect detection using vision systems and to enable adaptive process control, allowing the robot to automatically adjust welding parameters to compensate for joint variations and material inconsistencies, ensuring high-quality output.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager