Industrial Wireless Devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441346 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Industrial Wireless Devices Market Size

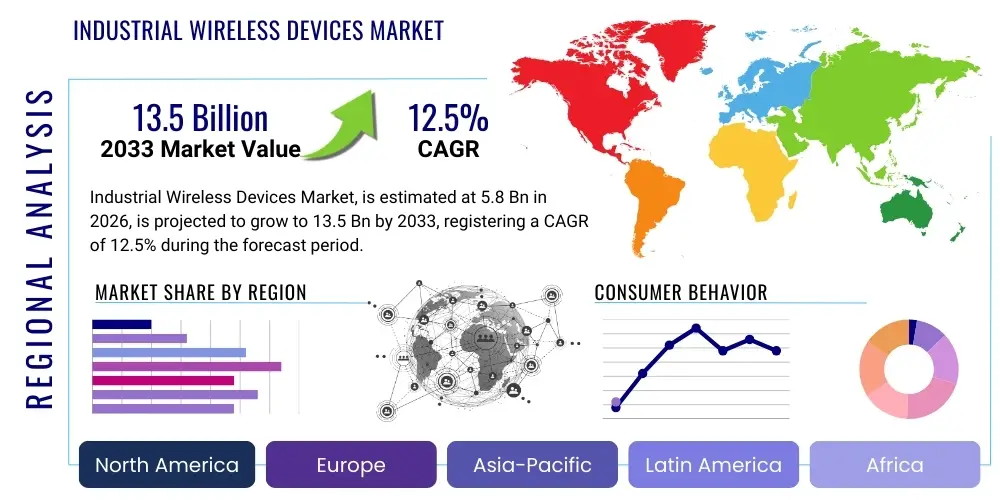

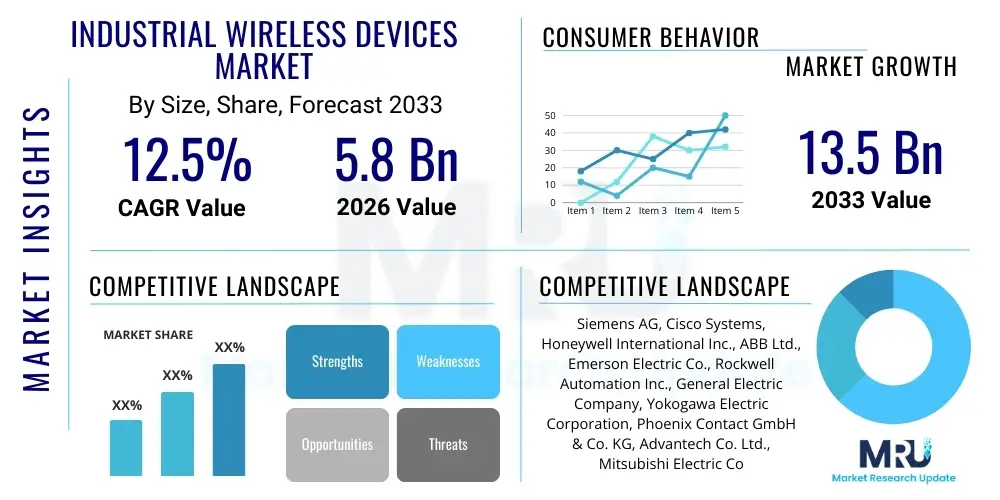

The Industrial Wireless Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $13.5 Billion by the end of the forecast period in 2033.

Industrial Wireless Devices Market introduction

The Industrial Wireless Devices Market encompasses a wide array of communication and sensing hardware designed for deployment within harsh, complex industrial environments, facilitating the convergence of Operational Technology (OT) and Information Technology (IT). These devices, which include wireless sensors, controllers, routers, access points, and gateways, are fundamental components of the Industrial Internet of Things (IIoT) ecosystem. They enable real-time data acquisition, remote monitoring, and control of critical assets and processes without the need for extensive, costly wired infrastructure. Key applications span across process industries such as Oil & Gas and Power Generation, and discrete manufacturing sectors like Automotive and Electronics, where mobility and flexibility are increasingly prioritized.

The primary benefit of adopting industrial wireless solutions is the enhanced operational efficiency derived from predictive maintenance capabilities, minimized downtime, and improved worker safety due to continuous monitoring in hazardous locations. These devices often utilize robust, low-power mesh networking protocols such as WirelessHART, ISA100.11a, and specialized Wi-Fi and Bluetooth variants engineered to withstand temperature extremes, vibration, and electromagnetic interference typical of factory floors and remote sites. The increasing complexity of modern supply chains and the global drive towards Industry 4.0 adoption are compelling manufacturers to integrate wireless networks for greater transparency and decentralized decision-making.

Driving factors for this market surge include the widespread adoption of cloud computing and edge analytics, which require massive amounts of sensor data to feed advanced algorithms. Furthermore, the prohibitive cost and physical limitations associated with installing or modifying wired infrastructure in existing brownfield sites make wireless devices an economically attractive alternative for modernization projects. Governments and regulatory bodies globally are also promoting digitalization initiatives, standardizing communication protocols, thereby reducing interoperability concerns and accelerating the deployment cycles of integrated industrial wireless networks. The transition towards 5G technology, offering ultra-low latency and high reliability, is anticipated to further catalyze the market growth, opening avenues for mission-critical wireless control applications.

Industrial Wireless Devices Market Executive Summary

The Industrial Wireless Devices Market Executive Summary highlights robust growth driven by the imperative for operational resilience and efficiency across global manufacturing and process industries. Business trends indicate a significant shift from proprietary protocols to standardized, open architectures, accelerating integration with existing enterprise resource planning (ERP) systems and modern cloud platforms. Key vendors are focusing intensely on enhancing cybersecurity features within wireless mesh networks, addressing the primary concern of industrial operators regarding data integrity and system security in decentralized OT environments. Furthermore, strategic partnerships between hardware manufacturers and software analytics providers are becoming commonplace, enabling comprehensive end-to-end solutions that transition customers from basic monitoring to advanced predictive diagnostics.

Regionally, Asia Pacific (APAC) is projected to exhibit the fastest growth, primarily due to massive investments in smart factory initiatives in countries like China, India, and South Korea, coupled with rapidly expanding infrastructure in energy and utilities sectors. North America and Europe, while representing mature markets, maintain dominance in terms of technology adoption, particularly in deploying high-value, sophisticated applications utilizing 5G and industrial Wi-Fi 6 for ultra-reliable low-latency communication (URLLC). Regional segmentation demonstrates that while developed markets focus on asset performance management (APM) optimization, emerging economies prioritize initial digitization and remote asset monitoring capabilities in hard-to-reach locations.

Segment trends reveal that wireless sensor networks (WSN) continue to hold the largest market share by device type, driven by pervasive monitoring needs across temperature, pressure, and vibration applications. However, the fastest-growing segment is expected to be wireless controllers and gateways, reflecting the increasing maturity of wireless technology moving beyond pure sensing into actual process control functions. In terms of technology, WirelessHART remains dominant in process automation due to its reliability and established ecosystem, but Wi-Fi 6 and 5G are rapidly gaining traction, poised to revolutionize discrete automation by offering the bandwidth and reliability necessary for real-time robotic control and automated guided vehicle (AGV) operations. The convergence of OT and IT networks, facilitated by secure wireless gateways, is the central technological pillar supporting market expansion.

AI Impact Analysis on Industrial Wireless Devices Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Industrial Wireless Devices Market frequently center on how AI can utilize the vast amounts of generated sensor data, whether AI integration will improve network resilience and optimization, and how it will influence predictive maintenance accuracy. Key themes emerging from these common questions revolve around the scalability of data processing, the capability of edge AI to reduce network latency, and the necessary cybersecurity enhancements required when integrating intelligent, autonomous systems. Users are concerned about the complexity of deploying AI models directly onto resource-constrained industrial wireless devices (Edge AI) versus relying solely on centralized cloud processing, seeking clarity on the trade-offs between speed, cost, and data privacy.

The direct influence of AI and Machine Learning (ML) algorithms is profoundly visible in transforming data generated by industrial wireless sensors from simple measurements into actionable insights, driving the demand for higher bandwidth and reliable connectivity. AI algorithms are crucial for optimizing the performance of the wireless network itself, dynamically adjusting transmission power, frequency channels, and routing paths to ensure high quality of service (QoS) and reliability in noisy industrial environments. Furthermore, AI-driven predictive maintenance applications depend entirely on the continuous, accurate data feed provided by these wireless devices, drastically enhancing the value proposition of IIoT deployment by predicting equipment failures significantly earlier than traditional methods.

This increasing reliance on AI processing at the network edge mandates that next-generation industrial wireless devices be equipped with enhanced processing capabilities and specialized neural network accelerators, moving beyond basic communication functionalities. AI also plays a critical role in bolstering the security of industrial wireless networks by detecting anomalous patterns indicative of cyber threats or network intrusions in real-time. This synergistic relationship—where industrial wireless devices provide the sensory data infrastructure, and AI provides the intelligence for optimization and security—is a primary growth catalyst for the entire market ecosystem, pushing vendors toward developing more secure, high-throughput, and compute-capable wireless hardware.

- AI drives demand for higher data throughput and ultra-low latency in wireless communication standards like 5G and Wi-Fi 6.

- Edge AI implementation optimizes sensor data processing locally, reducing backbone network traffic and improving real-time response capabilities.

- Machine Learning algorithms enhance network reliability by optimizing dynamic frequency selection and power control protocols in mesh networks.

- AI significantly improves the accuracy of predictive maintenance by analyzing complex vibration, temperature, and current data collected wirelessly.

- AI algorithms enable advanced cybersecurity monitoring, detecting and mitigating network anomalies and potential security breaches in decentralized wireless architectures.

- Autonomous industrial applications, such as AGVs and wireless robotic control, rely on AI-processed data transmitted through reliable wireless infrastructure.

DRO & Impact Forces Of Industrial Wireless Devices Market

The Industrial Wireless Devices Market is significantly shaped by a compelling combination of market drivers (D), existing restraints (R), and future opportunities (O), creating a dynamic competitive landscape where technological advancement is paramount. Key drivers include the massive global push towards Industry 4.0 adoption, which necessitates flexible, scalable connectivity for digitalization initiatives, coupled with the proven financial benefits of reduced cabling costs and accelerated deployment timelines, particularly in brownfield sites. However, the persistent challenge of industrial cybersecurity remains a critical restraint, as connecting more devices introduces broader attack surfaces and heightened concerns over proprietary data theft or sabotage of critical infrastructure. Latency and reliability issues in traditional wireless standards also serve as a barrier for mission-critical control loops, forcing manufacturers to remain cautious.

Opportunities for exponential market growth are predominantly linked to the rollout and integration of high-performance wireless technologies like 5G and Wi-Fi 6, which promise to address the reliability and latency shortcomings of previous generations, enabling wireless integration into real-time control applications. The growing trend of edge computing and the resulting requirement for decentralized data aggregation and processing directly boosts the demand for smarter, more capable wireless gateways and controllers deployed closer to the assets. Furthermore, regulatory support for spectrum allocation for industrial use and standardization of protocols continue to foster a more predictable and competitive market environment, encouraging widespread adoption across diverse industrial sectors, including utilities and remote mining operations.

The collective impact forces of these drivers, restraints, and opportunities are pushing the market towards sophisticated, hybrid network architectures that blend licensed and unlicensed spectrums, ensuring high reliability while maintaining flexibility. The primary impact force is the necessity for operational visibility and efficiency: industries that successfully overcome the security and latency restraints by strategically leveraging 5G and advanced mesh networking protocols will achieve significant competitive advantages through true real-time operational optimization. Conversely, industries failing to invest in secure, high-reliability wireless infrastructure risk being sidelined due to operational inefficiencies and heightened exposure to cyber risks, underscoring the critical nature of these technological investments for sustained industrial competitiveness.

Segmentation Analysis

The Industrial Wireless Devices Market is comprehensively segmented based on Device Type, Technology, End-Use Industry, and Application, providing a multifaceted view of market dynamics and adoption patterns across the global industrial landscape. The segmentation by Device Type, encompassing sensors, controllers, and gateways, reflects the different levels of functionality, ranging from basic data acquisition to complex process control and network bridging. The Technology segmentation (e.g., WirelessHART, Wi-Fi, 5G) highlights the competitive landscape between established, industry-specific protocols favored in process automation and emerging, high-speed standards that are critical for modern discrete manufacturing and robotics applications.

The End-Use Industry breakdown is vital for understanding specific market needs, recognizing that the demands of the Oil & Gas sector for rugged, explosion-proof devices differ significantly from the high-density, low-latency requirements of the Automotive or Electronics manufacturing industries. Furthermore, segmentation by Application, such as asset monitoring, process control, and tracking and navigation, reveals where the highest return on investment is currently being realized, guiding vendor product development and strategic market entry. These segmentations are critical for stakeholders aiming to tailor solutions to specific industrial pain points and capitalize on high-growth sub-sectors.

- By Device Type: Wireless Sensors, Wireless Controllers, Wireless I/O Devices, Wireless Access Points/Routers, Gateways, Adapters/Modems.

- By Technology: WirelessHART, ISA100.11a, Wi-Fi (802.11), Bluetooth Low Energy (BLE), ZigBee, Cellular (4G/LTE, 5G), Proprietary Mesh Networks.

- By End-Use Industry: Oil & Gas, Automotive & Transportation, Power & Energy, Food & Beverage, Mining & Metals, Chemicals & Petrochemicals, Discrete Manufacturing, Pharmaceuticals, Others.

- By Application: Asset Monitoring, Process Control & Automation, Predictive Maintenance, Energy Management, Tracking & Navigation (AGVs/Drones), Remote Diagnostics.

Value Chain Analysis For Industrial Wireless Devices Market

The Value Chain Analysis for the Industrial Wireless Devices Market begins with upstream activities involving core component suppliers, primarily semiconductor manufacturers who develop specialized chips for wireless communication (e.g., microcontrollers, transceivers, and specialized memory optimized for low-power, rugged industrial use). These suppliers are fundamental to setting the performance and cost parameters of the final device. Following the component stage, Original Equipment Manufacturers (OEMs) and device assemblers integrate these components, designing and manufacturing the final industrial-grade sensors, controllers, and gateways, focusing heavily on robust casing, security firmware development, and compliance with stringent industrial standards (e.g., ATEX, IECEx for hazardous areas). Quality control and certification processes are crucial in this manufacturing phase to ensure reliability in challenging environments.

The midstream of the value chain is dominated by system integrators and solution providers, who play a critical role in bridging the gap between raw hardware and operational readiness. These integrators are responsible for network planning, configuration, commissioning, and ensuring seamless interoperability between various industrial wireless devices, legacy wired systems, and enterprise IT networks. Their expertise in customizing network topologies (e.g., mesh, star) and deploying specific industrial protocols (like WirelessHART or PROFINET over Wi-Fi) adds significant value. This phase often includes the development and integration of proprietary software platforms for data visualization, network management, and initial edge processing capabilities.

Downstream activities involve the distribution channel and the end-user deployment and service phase. Distribution is typically handled through a mix of direct sales channels for large, custom industrial projects (especially for tier-one manufacturers like Siemens and Honeywell) and indirect channels utilizing authorized regional distributors and specialized industrial automation resellers who possess localized technical support capabilities. Post-sales service, including long-term maintenance, calibration, firmware updates, and the provision of data analytics services (often subscription-based), represents a critical recurring revenue stream. The trend is moving towards a service-oriented model where vendors offer Device-as-a-Service (DaaS) or connectivity packages, emphasizing long-term customer relationships and integrated solution provision rather than just hardware sales.

Industrial Wireless Devices Market Potential Customers

Potential customers and end-users of Industrial Wireless Devices span the entire spectrum of global manufacturing and heavy process industries, driven by the universal need for increased efficiency, safety, and asset longevity. The primary buyers include Maintenance Managers, Operational Technology (OT) engineers, and Chief Information Officers (CIOs) within large industrial organizations who are tasked with implementing Industry 4.0 strategies and modernizing existing infrastructure. In the Oil & Gas sector, customers prioritize devices capable of continuous monitoring in remote, explosive environments for leak detection and pipeline integrity management, demanding extreme reliability and certification compliance.

In discrete manufacturing, particularly Automotive and Electronics, the key customers are production line managers focusing on high-speed data acquisition for quality control, real-time robotics synchronization, and optimizing Automated Guided Vehicle (AGV) routing within highly dynamic factory floors. Power and Energy utilities represent another significant customer segment, utilizing wireless devices for monitoring substation health, remote smart grid management, and distributed renewable energy generation assets. The key commonality across all these potential customers is the requirement for ruggedized, secure, and easily scalable wireless solutions that can integrate seamlessly with their existing control systems (e.g., DCS, PLC) and deliver demonstrable return on investment through reduced operational costs and preventive maintenance capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $13.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Cisco Systems, Honeywell International Inc., ABB Ltd., Emerson Electric Co., Rockwell Automation Inc., General Electric Company, Yokogawa Electric Corporation, Phoenix Contact GmbH & Co. KG, Advantech Co. Ltd., Mitsubishi Electric Corporation, Schneider Electric SE, Belden Inc., Huawei Technologies Co., Ltd., Moxa Inc., Texas Instruments, Dell Technologies, Eurotech S.p.A., HPE (Hewlett Packard Enterprise), Aruba Networks (HPE). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Wireless Devices Market Key Technology Landscape

The Industrial Wireless Devices Market is defined by a diverse and rapidly evolving technology landscape, marked by a convergence of traditional, reliable industrial protocols and high-speed commercial standards adapted for rugged use. WirelessHART and ISA100.11a represent the backbone of the process automation segment, specifically designed for low-power, mesh networking in harsh environments, offering high reliability for temperature and pressure monitoring applications where low data rates suffice. The strength of these standards lies in their mature ecosystem and deterministic behavior, crucial for ensuring operational uptime. However, the increasing requirement for bandwidth to support high-resolution video streams, augmented reality overlays for maintenance, and massive data sets for AI processing is driving the shift towards newer standards.

The adoption of industrial Wi-Fi, particularly Wi-Fi 6 (802.11ax), is rapidly gaining traction in discrete manufacturing, offering high capacity and improved performance in high-density device environments typical of factory floors. This standard addresses congestion and latency issues that plagued earlier Wi-Fi generations. Most critically, the emergence of 5G New Radio (NR) tailored for industrial use (Industrial 5G) is poised to be a major disruptive technology. 5G’s core characteristics—ultra-low latency (down to 1ms), massive machine-type communications (mMTC), and ultra-reliable low-latency communications (URLLC)—are essential for mission-critical applications such as closed-loop control systems, robotic motion control, and remote surgical operations within the industrial sphere, areas previously restricted to wired Ethernet solutions.

Furthermore, technology development is heavily focused on enhancing security and network management. This involves implementing advanced encryption techniques (e.g., end-to-end encryption, hardware-based security modules) and leveraging Software-Defined Networking (SDN) principles to manage complex, highly decentralized industrial wireless networks efficiently. Edge computing capabilities are increasingly being embedded directly into wireless gateways and sensors, allowing for local data filtering, analysis, and rapid decision-making, significantly reducing reliance on centralized cloud infrastructure for time-sensitive operations. The combination of high-reliability protocols (like 5G and Wi-Fi 6) with integrated processing power defines the competitive technological edge in this market.

Regional Highlights

- North America: North America holds a substantial share of the Industrial Wireless Devices Market, characterized by early adoption of advanced IIoT technologies and significant investment in cybersecurity solutions for critical infrastructure. The United States, in particular, drives demand through extensive modernization efforts in the Oil & Gas, aerospace, and defense sectors, coupled with a robust ecosystem of technology innovation centers focused on 5G deployment in manufacturing. High labor costs incentivize manufacturers to adopt automation rapidly, thus fueling the demand for reliable wireless control systems and predictive maintenance applications. The market here is highly competitive, dominated by major multinational automation and IT firms, emphasizing security and integration with legacy systems.

- Europe: Europe is a key growth region, largely supported by Germany's "Industrie 4.0" initiatives and widespread regulatory push for energy efficiency and sustainable manufacturing. Countries like Germany, the UK, and Scandinavian nations show high adoption rates, particularly in the automotive and machinery manufacturing sectors, focusing on flexible production lines supported by industrial Wi-Fi 6 and private LTE/5G networks. The market is characterized by a strong emphasis on standardization (e.g., utilizing standards like PROFINET and OPC UA) and stringent regulatory requirements regarding data privacy and network resilience, necessitating high-grade, certified industrial wireless hardware.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period, driven by massive state-backed investments in industrial digitization, particularly in China (Made in China 2025), South Korea, and Japan. The rapid expansion of manufacturing capabilities, coupled with new greenfield factory construction, provides ample opportunity for implementing wireless infrastructure from the ground up. The sheer volume of manufacturing output in this region, coupled with the rising demand for low-cost, scalable monitoring solutions in emerging markets like India and Southeast Asia, makes APAC the central driver of volume growth for industrial wireless sensors and basic connectivity devices.

- Latin America (LATAM): The LATAM market is gradually maturing, with adoption concentrated primarily in the resource-intensive sectors, namely Mining, Oil & Gas, and large-scale Agriculture in Brazil, Mexico, and Chile. Growth is steady but often constrained by high initial capital investment costs and fluctuating economic stability. Key applications focus on remote asset monitoring and safety compliance in dispersed operational sites, making long-range wireless technologies essential. Market penetration is highly reliant on system integrators capable of managing complex deployments in areas with limited existing communications infrastructure.

- Middle East and Africa (MEA): The MEA region’s demand is largely dictated by substantial investments in the Oil & Gas, refining, and infrastructure development sectors, particularly within the Gulf Cooperation Council (GCC) countries. Wireless devices are critical here for optimizing production, monitoring hazardous environments, and supporting large-scale desalination and power generation facilities. Africa presents emerging opportunities, especially in mobile network infrastructure integration for utilities and mining, with adoption strongly influenced by government-led smart city and industrial diversification programs requiring robust, field-hardened wireless communication.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Wireless Devices Market.- Siemens AG

- Cisco Systems, Inc.

- Honeywell International Inc.

- ABB Ltd.

- Emerson Electric Co.

- Rockwell Automation Inc.

- General Electric Company

- Yokogawa Electric Corporation

- Phoenix Contact GmbH & Co. KG

- Advantech Co. Ltd.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Belden Inc.

- Huawei Technologies Co., Ltd.

- Moxa Inc.

- Texas Instruments Incorporated

- Dell Technologies Inc.

- Eurotech S.p.A.

- HPE (Hewlett Packard Enterprise)

- Aruba Networks (HPE)

Frequently Asked Questions

Analyze common user questions about the Industrial Wireless Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical challenge hindering widespread adoption of industrial wireless devices in real-time control applications?

The primary technical challenge is ensuring deterministic, ultra-low latency, and high reliability (URLLC) communication, which is crucial for safety-critical, closed-loop control systems. While technologies like 5G and Wi-Fi 6 are addressing this, many legacy wireless standards lack the necessary performance guarantees for time-sensitive industrial processes.

How does the integration of 5G technology specifically impact the Industrial Wireless Devices Market?

5G integration allows industrial wireless devices to move beyond monitoring into advanced control applications by offering massive device connectivity, significantly higher bandwidth, and latency figures below 10 milliseconds, enabling applications like wireless robot control and autonomous vehicle operation previously impossible with existing wireless standards.

What are the most common industrial wireless protocols utilized in the process automation sector?

In process automation, the most common and widely trusted industrial wireless protocols are WirelessHART and ISA100.11a. These mesh networking standards are specifically designed for robust performance, battery longevity, and reliable data acquisition in harsh operating environments typical of Oil & Gas and chemical plants.

Which end-use industry is expected to demonstrate the fastest growth rate for industrial wireless device deployment?

The discrete manufacturing sector, particularly the Automotive and Electronics industries, is expected to show the fastest growth rate. This is driven by the urgent need for flexible, easily reconfigurable production lines and the accelerating deployment of robotics, AGVs, and advanced quality inspection systems requiring high-throughput wireless connectivity.

How is cybersecurity addressed in modern industrial wireless network architectures?

Modern industrial wireless networks address cybersecurity through multiple layers: hardware-based security modules, robust encryption protocols (e.g., WPA3, TLS), network segmentation (zoning of critical assets), constant real-time anomaly detection leveraging AI/ML, and strict identity and access management (IAM) controls for every connected device and gateway.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager