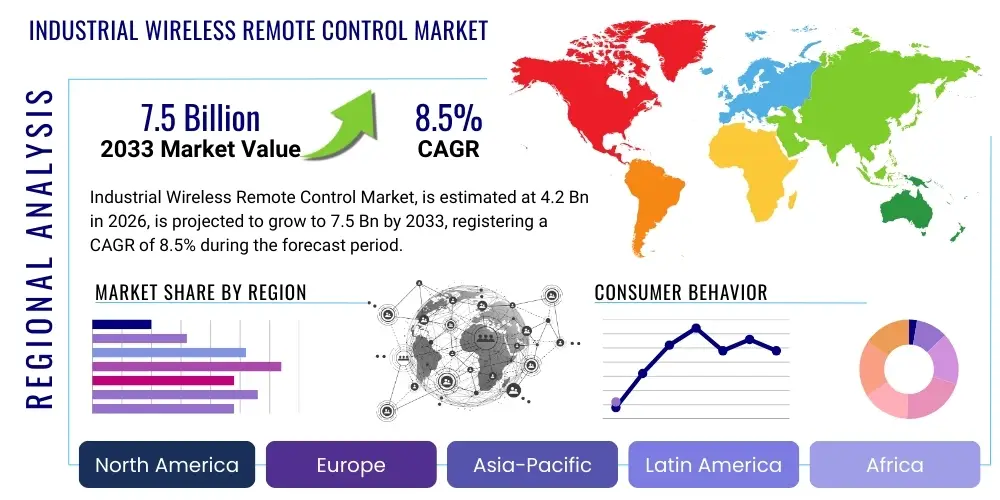

Industrial Wireless Remote Control Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442098 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Industrial Wireless Remote Control Market Size

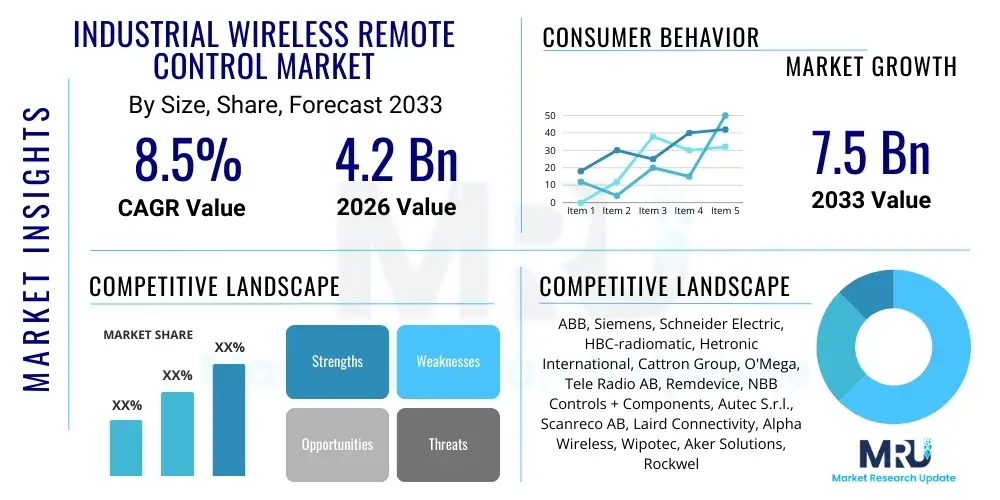

The Industrial Wireless Remote Control Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $4.2 Billion in 2026 and is projected to reach $7.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for enhanced operational safety, augmented worker productivity, and the widespread adoption of automation solutions across heavy industries globally, necessitating robust and reliable remote operational capabilities. The shift towards digitization and the integration of IoT concepts within manufacturing and logistics environments further solidify this growth trajectory, establishing wireless control as a critical component of modern industrial infrastructure investment.

Industrial Wireless Remote Control Market introduction

The Industrial Wireless Remote Control Market encompasses the specialized equipment designed to operate heavy machinery, cranes, hoists, production lines, and other complex industrial systems from a safe distance using radio frequencies (RF) or other wireless protocols. These systems consist primarily of handheld transmitters (consoles or push-button units) and fixed receivers connected to the controlled equipment. The core product offering provides operators with freedom of movement, improved visibility, and crucial safety separation from high-risk operational zones, which is paramount in sectors like construction, mining, and heavy manufacturing. The transition from cumbersome wired controls to versatile, durable wireless systems represents a fundamental paradigm shift in industrial workflow management, leading to significant efficiency gains and reduction in workplace accidents.

Major applications of industrial wireless remote controls span across vertical markets, including sophisticated material handling in logistics and warehousing, precision movements in construction equipment such as tower cranes and concrete pumps, complex sequence control in mining environments, and critical safety operations in oil & gas facilities. These applications demand high reliability, low latency, and robust resistance to electromagnetic interference (EMI) and harsh environmental conditions (dust, moisture, extreme temperatures). The systems are engineered to meet rigorous international safety standards (e.g., PLd, SIL 3), ensuring fail-safe operation and immediate system shutdown capabilities when necessary, thereby protecting both personnel and valuable assets.

Key benefits driving the market include drastically improved worker safety by removing personnel from immediate hazard zones, enhanced operational flexibility and efficiency due to improved mobility, and optimized process flow resulting from the operator's ability to monitor the load and machinery from the most advantageous vantage point. Driving factors fueling this market growth involve stringent regulatory requirements mandating higher safety standards in industrial operations, continuous technological advancements in battery life and wireless range, and the overarching global trend towards industrial automation (Industry 4.0), which requires seamless, interconnected operational control mechanisms to maximize throughput and minimize human error. The expanding infrastructure development across emerging economies further necessitates sophisticated material handling equipment paired with advanced wireless controls.

Industrial Wireless Remote Control Market Executive Summary

The Industrial Wireless Remote Control Market is characterized by robust technological innovation, driven by the convergence of Industrial IoT (IIoT) and enhanced connectivity standards, resulting in significant business model shifts favoring integrated control solutions. Current business trends indicate a strong focus on developing ergonomic, highly customizable transmitter units with advanced Human-Machine Interface (HMI) capabilities, enabling intuitive control of multi-axis machinery. Furthermore, the market is seeing increased adoption of subscription-based models for integrated services, including predictive maintenance, remote diagnostics, and software updates for control systems. Competitive strategies revolve around vertical integration, geographical expansion into high-growth Asian markets, and strategic partnerships to embed control systems early in the original equipment manufacturer (OEM) process, ensuring compatibility and seamless integration from the point of deployment.

Regionally, the market dynamics are heavily influenced by the pace of infrastructure development and industrial modernization efforts. North America and Europe currently represent the largest revenue generators, primarily due to established high safety standards, widespread industrial automation penetration, and the early adoption of advanced wireless communication technologies like 5G in manufacturing sectors. The Asia Pacific (APAC) region, however, is projected to exhibit the highest CAGR during the forecast period, fueled by massive investment in logistics infrastructure, manufacturing expansion, and governmental initiatives promoting automation in countries like China, India, and Southeast Asian nations. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily driven by expanding mining operations and oil & gas infrastructure projects, which inherently require robust, explosion-proof remote control solutions.

Segment trends reveal that the Radio Frequency (RF) technology segment continues to dominate due to its proven reliability, long range, and capability to penetrate physical barriers in industrial settings. However, there is accelerating growth in Bluetooth and Wi-Fi based industrial controls for short-range, data-intensive applications within localized factory environments. From an application perspective, the Crane & Hoist segment remains the largest volume consumer, crucial for material handling across nearly all industrial verticals. Nonetheless, the most rapid growth is anticipated within the specialized segments such as Mining and Construction, where the criticality of safety and the necessity for operating powerful machinery remotely are non-negotiable operational requirements, demanding controls with exceptional ruggedness and redundancy features.

AI Impact Analysis on Industrial Wireless Remote Control Market

Users frequently inquire about how Artificial Intelligence (AI) will transition industrial wireless remote controls from mere command relays into intelligent operational systems, particularly concerning autonomy, predictive maintenance, and cybersecurity. Key user themes center on the feasibility of integrating AI algorithms for real-time load balancing, collision avoidance in complex multi-crane environments, and the shift from operator control to supervised autonomous operation. There is substantial concern regarding the reliability and safety implications of granting AI decision-making authority in high-stakes industrial operations, requiring robust verification and validation protocols for AI-driven control software. Furthermore, questions persist about how AI analytics applied to operational data gathered wirelessly will reshape maintenance schedules, moving from scheduled repairs to condition-based and predictive interventions, thereby maximizing asset uptime and reducing unforeseen operational failures.

The integration of AI significantly enhances the capabilities of industrial wireless remote control systems by introducing intelligence directly into the control loop. AI algorithms can analyze continuous streams of telemetry data—such as motor temperature, vibration levels, control input patterns, and load fluctuations—received wirelessly from the controlled machinery. This real-time analysis enables the system to provide proactive warnings, optimize energy consumption based on current operational demands, and suggest optimal control parameters to the human operator, effectively creating an augmented control experience. This transition elevates the remote control system from a simple device to a central hub for operational intelligence, providing quantifiable improvements in safety margins and overall equipment efficiency (OEE).

Moreover, AI is instrumental in developing next-generation autonomous and semi-autonomous industrial vehicles and equipment, where wireless control remains essential for oversight, intervention, and emergency override by human operators. In highly structured environments, AI manages routine tasks like material retrieval or assembly sequencing, while the wireless remote control acts as the ultimate safety layer and commissioning tool. This blend allows industries to leverage the high precision and tireless nature of AI for repetitive tasks while retaining immediate human control for safety-critical or non-standard scenarios. The future of wireless industrial control is intrinsically linked to sophisticated AI algorithms that enhance system redundancy and decision-making capabilities in increasingly complex operational landscapes.

- Enhanced Predictive Maintenance: AI analyzes wireless sensor data to forecast component failure, optimizing service intervals.

- Autonomous Operation Oversight: AI enables supervised autonomy, with wireless controls providing human override and safety intervention.

- Real-Time Load Optimization: Algorithms adjust control commands dynamically based on load dynamics and environmental factors.

- Improved Safety Protocols: AI detects dangerous operational patterns and immediately restricts or modifies remote control inputs.

- Advanced Collision Avoidance: Utilizing data fusion from wireless sensors and machine vision for intelligent path planning in multi-machine environments.

- Cybersecurity Enhancements: AI-driven anomaly detection monitors wireless communication channels for unauthorized access or interference attempts.

DRO & Impact Forces Of Industrial Wireless Remote Control Market

The Industrial Wireless Remote Control Market is propelled by substantial Drivers, notably the paramount need for improved safety and operational efficiency across heavy industries, which directly translates into reduced risk and insurance costs. Restraints primarily involve challenges related to spectrum management, wireless signal reliability in harsh electromagnetic environments, and the high initial capital investment required for implementing advanced systems compliant with stringent industrial standards. Opportunities are emerging through the convergence of 5G technology, Ultra-Wideband (UWB) precision, and IIoT integration, allowing for higher data throughput, lower latency, and highly precise localization capabilities for controlled assets. These dynamics collectively create significant Impact Forces that dictate investment priorities, regulatory compliance focus, and technological innovation pathways within the industrial control ecosystem.

Major Drivers include the global intensification of safety regulations, such as those governed by OSHA and European directives, which heavily favor remote operation to minimize direct human exposure to moving machinery, hazardous materials, and unstable environments. Furthermore, economic pressures demand optimization of operational cycles; wireless controls demonstrably reduce setup times, increase the speed of material handling, and allow single operators to manage complex, multi-functional equipment more effectively than traditional wired systems. The modernization drive within aging infrastructure and manufacturing plants, particularly in developed markets, necessitates replacing obsolete control technologies with modern, feature-rich wireless alternatives that support digital integration and data logging capabilities, contributing significantly to market momentum.

Conversely, significant market Restraints pertain to the technical difficulties of ensuring uninterrupted, secure wireless communication in massive industrial complexes where steel structures, high-power electrical systems, and existing legacy communication protocols create formidable interference challenges. Cybersecurity is another constraint; as these systems become networked, they become potential entry points for malicious attacks aimed at disrupting critical infrastructure, requiring continuous investment in complex encryption and authentication protocols. Moreover, the integration complexity of installing new wireless controls into heterogeneous fleets of legacy machinery requires specialized expertise and custom engineering, presenting a barrier to entry for smaller enterprises and adding to overall implementation costs.

The core Opportunities revolve around leveraging next-generation connectivity standards. The deployment of private industrial 5G networks offers ultra-low latency and massive machine-type communication (mMTC), fundamentally changing the viability of fully autonomous remote control systems that require instantaneous feedback and high bandwidth for video telemetry. Integrating wireless remote controls with broader IIoT platforms allows for comprehensive fleet management, condition monitoring, and integration into enterprise resource planning (ERP) systems. Finally, the development of robust, battery-efficient components and standardized industrial wireless protocols (like WirelessHART or ISA100.11a) opens up new applications in explosion-proof environments and geographically isolated operational sites, further broadening the market scope and accelerating adoption.

Segmentation Analysis

The Industrial Wireless Remote Control market is segmented based on critical technical and application parameters that define product functionality, deployment environment, and end-user requirements. A thorough segmentation analysis reveals that product differentiation hinges significantly on the technological backbone—specifically, the wireless protocol utilized, which determines factors like range, data rate, and resilience to interference. Furthermore, the market is structurally segmented by the physical components (Transmitter vs. Receiver), reflecting the distinct technological investments required for both user interface and machine integration aspects. Understanding these segments is crucial for market stakeholders to tailor product development, pricing strategies, and distribution channels to target specific industrial needs, ranging from simple hoist operation to complex, multi-machine control sequences in harsh environments.

The primary segmentation breakdown allows for clear identification of market saturation points and areas poised for rapid expansion. For instance, while the core market remains reliant on robust, proven RF technology for its reliability, the future growth potential lies within enhanced connectivity solutions like specialized industrial Wi-Fi and Bluetooth implementations optimized for low power consumption and high data integrity within controlled factory settings. The Application segmentation dictates the durability and feature set required; control units designed for mining or oil & gas must meet significantly higher protection ratings (e.g., ATEX/IECEx certified) compared to standard warehouse applications. This granular understanding ensures that manufacturers can align their offerings with precise vertical market demands, maximizing utility and adherence to strict industry-specific standards.

Consequently, market participants focus their strategic investments on developing high-reliability components, ensuring compliance with global safety standards (SIL, PL), and customizing interfaces for specific end-use industries. The dominance of segments like Crane & Hoist reflects the ubiquity of material handling needs, while the accelerating growth in construction and transportation indicates a broader industrial acceptance and integration of wireless control systems beyond traditional lifting apparatus. Analyzing these segments provides a roadmap for innovation, highlighting the need for specialized software features, such as frequency hopping, redundant safety circuitry, and seamless integration with legacy PLC (Programmable Logic Controller) systems to address the diverse requirements across the industrial landscape.

- By Component:

- Transmitter Units (Handheld, Belly-box, Joystick)

- Receiver Units

- Control Software & Accessories

- By Technology:

- Radio Frequency (RF)

- Infrared (IR)

- Bluetooth

- Wi-Fi

- Other Advanced Wireless Protocols (e.g., UWB, 5G Industrial)

- By Application:

- Crane & Hoist Control

- Conveyors and Material Handling

- Mining Machinery Control

- Construction Equipment (Concrete Pumps, Earthmovers)

- Oil & Gas Equipment (Drilling Rigs, Valves)

- Transportation and Logistics

- Agriculture and Forestry Machinery

- By End-Use Industry:

- Manufacturing (Automotive, Heavy Machinery)

- Logistics and Warehousing

- Energy & Power Generation

- Construction & Infrastructure

- Oil & Gas and Chemical

- Mining

Value Chain Analysis For Industrial Wireless Remote Control Market

The value chain for the Industrial Wireless Remote Control Market is complex, involving multiple specialized stages starting from high-tech component manufacturing and culminating in customized system integration and aftermarket support. The upstream segment is dominated by specialized suppliers of critical components, including high-frequency radio modules (transceivers), durable battery technology (lithium-ion cells), robust housing materials (impact-resistant polymers or metal enclosures), and complex microcontrollers (MCUs) necessary for safety processing and signal encryption. This phase is characterized by stringent quality control and high barriers to entry due to the specialized nature of industrial-grade electronics that must perform reliably under severe operational stresses, ensuring the foundation of system integrity.

The midstream phase, involving assembly and integration, is where the core value is added. System manufacturers design and assemble the finished transmitter and receiver units, focusing heavily on ergonomic design for handheld units and ruggedization for fixed receivers. This stage requires significant investment in firmware development to ensure interoperability with various industrial control systems (PLCs, VFDs) and compliance with international functional safety standards (ISO 13849, IEC 62061). Customization and configuration for specific applications—such as developing marine-grade or explosion-proof enclosures—are key differentiators in this segment, transforming standard electronic components into certified industrial safety devices.

The downstream distribution channel involves a mix of direct sales to large OEMs (Original Equipment Manufacturers) for integration into new machinery and indirect sales through specialized industrial distributors, system integrators, and value-added resellers (VARs). Direct sales channels are crucial for high-volume contracts and customization, particularly in the crane and automotive manufacturing sectors. Indirect channels play a vital role in reaching smaller end-users, providing localized technical support, installation services, and necessary regulatory certification assistance. Aftermarket services, including system upgrades, calibration, repair, and replacement of consumables like batteries, also represent a significant and high-margin component of the overall value chain, ensuring long-term customer retention and operational reliability.

Industrial Wireless Remote Control Market Potential Customers

The potential customers for industrial wireless remote control systems are diverse, spanning virtually every sector that involves heavy lifting, complex machinery operation, or operations in hazardous environments. The primary end-users, or buyers, are organizations that prioritize worker safety, operational efficiency, and adherence to strict regulatory guidelines, necessitating robust remote operation capabilities for their machinery fleets. This includes large multinational manufacturing conglomerates, global logistics and warehousing giants, major infrastructure and construction firms, and governmental bodies responsible for utility and transportation infrastructure maintenance, all seeking solutions to enhance productivity while mitigating operational risks inherent in their demanding fields of operation.

Within the Manufacturing sector, potential customers include automotive assembly plants and heavy equipment manufacturers, which rely heavily on overhead cranes, robotic arms, and complex material transfer systems that must be controlled precisely and safely from a distance. In Logistics and Warehousing, major customers are fulfillment centers and port operators utilizing remote controls for stackers, automated guided vehicles (AGVs) requiring human supervision, and ship-to-shore gantry cranes. These buyers often demand high-performance, low-latency systems that can operate reliably 24/7 and integrate smoothly with complex warehouse management systems (WMS) to ensure continuous operational flow and inventory accuracy across vast operational footprints.

Furthermore, specialized heavy industries represent critical customer segments due to the extreme environments and high safety stakes. Companies in the Mining sector purchase systems for operating underground loaders, roof bolters, and continuous miners, where wireless control is the only viable method of keeping personnel safe from rockfalls and explosive atmospheres. Similarly, Oil & Gas companies are key buyers, using explosion-proof (Ex-rated) remote control systems for operating valves, pumps, and drilling equipment in highly volatile processing and extraction sites. These customers place a premium on system robustness, intrinsic safety certification, and long-range reliability, making them prime targets for high-end, customized wireless control solutions that meet specific hazardous area requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.2 Billion |

| Market Forecast in 2033 | $7.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, Schneider Electric, HBC-radiomatic, Hetronic International, Cattron Group, O'Mega, Tele Radio AB, Remdevice, NBB Controls + Components, Autec S.r.l., Scanreco AB, Laird Connectivity, Alpha Wireless, Wipotec, Aker Solutions, Rockwell Automation, Emerson Electric, Danfoss, Omron |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Wireless Remote Control Market Key Technology Landscape

The Industrial Wireless Remote Control market is undergoing rapid technological evolution, driven primarily by the need for enhanced reliability, longer range, and seamless digital integration. The core technology remains proprietary or licensed Radio Frequency (RF) systems operating in ISM bands (Industrial, Scientific, and Medical), typically leveraging robust techniques like Frequency Hopping Spread Spectrum (FHSS) or Direct Sequence Spread Spectrum (DSSS) to minimize interference and ensure secure, continuous communication. Modern systems are increasingly incorporating advanced error correction coding and sophisticated redundancy mechanisms, including dual-processor architectures in safety-critical receivers, to achieve compliance with stringent functional safety ratings (e.g., up to SIL 3 or PLe Category 4) required for controlling potentially dangerous heavy machinery.

A significant trend involves the adoption of modern wireless standards, particularly the optimization of Wi-Fi (802.11ah HaLow) and dedicated industrial mesh networks for local, high-bandwidth communication needs within manufacturing plants. Furthermore, the burgeoning deployment of 5G private networks is set to revolutionize the landscape by offering guaranteed quality of service (QoS), extremely low latency (sub-10ms), and massive connectivity capabilities. This transformation allows for not only command transmission but also high-definition video feedback and vast telemetry data collection in real time, moving industrial control beyond simple commands to fully monitored and data-rich operational management. Ultra-Wideband (UWB) technology is also gaining traction, particularly for applications requiring high-accuracy indoor localization (asset tracking and collision avoidance systems) alongside control functions.

Beyond connectivity, advancements in hardware technology are crucial. Battery technology is evolving toward smaller, lighter, and longer-lasting lithium chemistries with smart charging capabilities, reducing operational downtime. The development of ergonomic, modular Human-Machine Interfaces (HMIs) featuring high-resolution displays, customizable tactile feedback, and intuitive joystick designs is enhancing operator effectiveness and reducing fatigue. Finally, the integration of advanced security features, including military-grade encryption standards (e.g., AES 256-bit) and secure boot processes, is now standard practice, addressing the escalating cybersecurity threats inherent in networked industrial control systems and ensuring data integrity and command authenticity throughout the entire control sequence.

Regional Highlights

- North America: This region is a major contributor to the market, driven by high labor costs and stringent occupational safety standards established by agencies like OSHA. The U.S. and Canada show high adoption rates, particularly in the manufacturing, construction, and oil & gas sectors. Demand is characterized by a preference for high-end, technologically advanced systems featuring sophisticated diagnostics and compliance with advanced safety protocols. Investment in smart factory initiatives and digitalization across major manufacturing hubs reinforces the continuous demand for integrated wireless control solutions.

- Europe: Europe is a mature market distinguished by rigorous regulatory environments (e.g., Machinery Directive, ATEX/IECEx standards) and a strong focus on industrial automation (Industry 4.0). Countries like Germany, Italy, and Scandinavia are technological leaders, demanding highly reliable, custom-engineered control systems, especially for cranes, automated warehouses, and specialized machinery. The presence of numerous key component manufacturers and system providers further solidifies Europe’s position as a hub for innovation in functional safety and certified wireless communication systems.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by massive infrastructure projects, burgeoning manufacturing capabilities (especially in China, India, and South Korea), and rapid urbanization. While price sensitivity exists, the increasing investment in logistics modernization, particularly port automation and mega-warehousing facilities, is driving the demand for high-volume control systems. Regional growth is accelerating as safety standards are gradually elevated, mirroring global best practices, thereby increasing the requirement for sophisticated, reliable remote controls over basic wired alternatives.

- Latin America: This region exhibits steady growth driven mainly by expanding mining activities (Chile, Peru, Brazil) and oil & gas exploration projects. Demand is concentrated on ruggedized, reliable systems capable of operating across vast distances and often requiring intrinsically safe certification for use in combustible atmospheres. Economic volatility can temper investment, yet the long-term necessity for improved operational safety in resource extraction continues to underpin stable market expansion.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated within the GCC nations, largely due to extensive investment in oil, gas, and petrochemical infrastructure, alongside massive construction projects (e.g., smart city developments). The demand here is specific, requiring controls that can withstand extreme high temperatures, dust, and corrosive environments. The focus is on specialized, explosion-proof, heavy-duty systems compliant with international standards, particularly for refinery operations and port handling facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Wireless Remote Control Market.- ABB

- Siemens

- Schneider Electric

- HBC-radiomatic

- Hetronic International

- Cattron Group

- O'Mega

- Tele Radio AB

- Remdevice

- NBB Controls + Components

- Autec S.r.l.

- Scanreco AB

- Laird Connectivity

- Alpha Wireless

- Wipotec

- Aker Solutions

- Rockwell Automation

- Emerson Electric

- Danfoss

- Omron

Frequently Asked Questions

Analyze common user questions about the Industrial Wireless Remote Control market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Industrial Wireless Remote Control Market?

The primary driving factor is the escalating need to enhance worker safety and boost operational efficiency across heavy industrial sectors. Wireless controls significantly mitigate risks by allowing operators to manage machinery from a safe distance while simultaneously increasing productivity through improved mobility and visibility, aligning with global regulatory demands for safer work environments.

How does 5G technology specifically impact the future of industrial remote control systems?

5G technology is highly impactful as it enables ultra-low latency, high data throughput, and massive machine connectivity. This performance leap supports the development of sophisticated remote control applications, including real-time video streaming, advanced telemetry diagnostics, and critical supervised autonomous operation, which were previously constrained by traditional wireless limits.

Which industrial segments exhibit the highest growth potential for wireless remote controls?

While the Crane & Hoist segment remains the largest by volume, the highest growth potential is concentrated in specialized sectors such as Mining, Construction, and Oil & Gas. These segments require robust, highly customized, and often explosion-proof systems to manage dangerous processes remotely, ensuring compliance and maximizing operational safety in severe environmental conditions.

What are the main technical challenges facing the adoption of industrial wireless remote controls?

The main technical challenges include mitigating radio frequency interference (RFI) caused by other industrial equipment, ensuring robust cybersecurity against unauthorized control access, and guaranteeing consistent signal reliability and range across vast, complex industrial infrastructures that often contain significant signal obstruction.

What is the role of AI in next-generation industrial wireless remote control systems?

AI is transforming remote controls into intelligent systems by enabling predictive maintenance, optimizing real-time control inputs based on machine conditions, and overseeing semi-autonomous equipment operations. AI integrates with wireless data to enhance functional safety and maximize asset uptime by moving control decisions from manual responses to condition-based intelligence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager