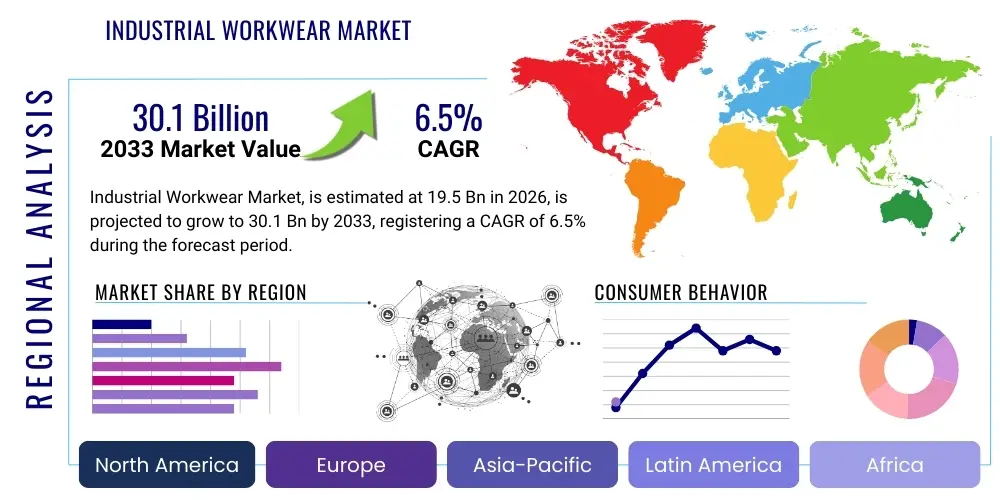

Industrial Workwear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441105 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Industrial Workwear Market Size

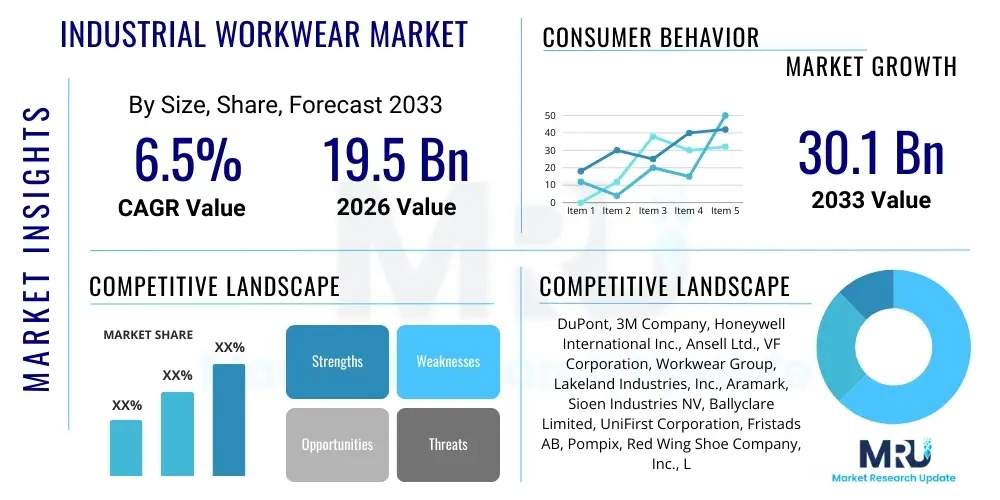

The Industrial Workwear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 30.1 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by increasingly stringent global occupational safety regulations, rising industrialization in emerging economies, and continuous technological advancements in protective material sciences aimed at enhancing worker comfort and compliance across hazardous and non-hazardous environments.

Industrial Workwear Market introduction

The Industrial Workwear Market encompasses specialized clothing designed to protect workers from physical, chemical, thermal, and biological hazards encountered in various industrial settings, while also promoting corporate identity and enhancing worker efficiency. These garments range from basic uniforms and high-visibility apparel to complex Personal Protective Equipment (PPE) such such as flame-resistant (FR) clothing, chemical splash suits, and anti-static wear. Major applications span high-risk sectors like oil and gas, manufacturing, construction, healthcare, and utilities, where protection against serious injury or fatality is paramount. The primary benefits derived from industrial workwear include adherence to mandatory regulatory standards (OSHA, EN, ISO), reduced incidence of workplace injuries, prolonged asset lifecycle management through specialized maintenance processes, and improved overall operational continuity. Key driving factors propelling market expansion involve stricter enforcement of governmental safety mandates, rapid infrastructural development globally, and a growing emphasis on smart workwear integrating technology for enhanced monitoring and proactive risk management.

Industrial Workwear Market Executive Summary

The Industrial Workwear Market is characterized by intense focus on innovation, particularly concerning material science and smart textile integration, reflecting major business trends toward customized protective solutions tailored for specific industrial risks. Companies are increasingly investing in sustainable manufacturing practices, driven by consumer demand and regulatory pressures, leading to the development of eco-friendly, yet highly durable, protective fabrics. Regional trends indicate that Asia Pacific (APAC) is set to exhibit the fastest growth, fueled by rapid industrialization, expansion of the manufacturing base, and increased awareness regarding worker safety standards, particularly in large economies such as China and India. Conversely, North America and Europe remain key mature markets, dictating regulatory and technological standards, emphasizing high-performance, comfortable, and specialized protective wear. Segment trends show a significant uptick in demand for flame-resistant (FR) and high-visibility clothing due to increased construction and oil and gas activities. The rental and laundry services segment is also witnessing substantial growth as companies seek cost-effective compliance management and maintenance solutions for large inventories of specialized protective clothing, further boosting overall market fluidity and service optimization across diverse end-user industries.

AI Impact Analysis on Industrial Workwear Market

User queries regarding AI in the Industrial Workwear Market predominantly focus on optimizing supply chain resilience, enhancing predictive maintenance for workwear integrity, and integrating smart features into garments for improved safety monitoring. Users are keen to understand how AI can personalize protective gear selection based on individual worker risk profiles and specific task requirements, moving beyond standardized PPE provisioning. Concerns center on data privacy regarding wearable sensors and the initial high cost of adopting AI-driven manufacturing or inventory management systems. Overall expectation is that AI will significantly boost efficiency, reduce waste in production, and provide real-time risk assessment, thereby improving the proactive management of worker safety programs and ensuring that protective gear is available, certified, and optimally utilized at all times, minimizing downtime and compliance failure risks.

- AI-driven Predictive Maintenance: Analyzing wear patterns through embedded sensors to signal replacement needs proactively, ensuring sustained protective performance and compliance.

- Optimized Supply Chain Management: Utilizing machine learning algorithms to forecast demand accurately, reduce inventory holding costs, and streamline global distribution of specialized fabrics and finished garments.

- Personalized Workwear Sizing and Design: Employing AI imaging and data analytics to create custom-fit protective gear, significantly enhancing worker comfort, mobility, and effectiveness in hazardous environments.

- Real-Time Risk Monitoring: Integrating AI with smart workwear sensors to analyze physiological data and environmental hazards (e.g., heat stress, fatigue detection), triggering alerts before critical incidents occur.

- Quality Control Automation: Implementing AI vision systems in manufacturing lines to detect minuscule flaws in technical textiles and garment construction, ensuring stringent quality assurance standards are met.

DRO & Impact Forces Of Industrial Workwear Market

The Industrial Workwear Market is primarily driven by stringent global occupational safety regulations and mandatory compliance requirements imposed by international and regional bodies, compelling organizations across industrial sectors to invest continuously in high-quality protective gear. Restraints often include the high initial cost associated with specialized, high-performance protective materials (such as FR aramid fibers), resistance to change among smaller enterprises regarding advanced workwear adoption, and the challenge of maintaining material standards through rigorous washing and maintenance cycles. Opportunities are substantial in the burgeoning markets for smart workwear—integrating IoT sensors for biometric monitoring and hazard detection—and in providing end-to-end managed service solutions, including cleaning, repair, and inventory tracking. The major impact forces governing the market include the regulatory landscape, which mandates minimum protection levels, rapid technological advancement in textile engineering leading to lighter yet safer materials, and the increasing globalization of industrial operations, demanding harmonized safety standards across multiple geographies and operational environments.

Segmentation Analysis

The segmentation of the Industrial Workwear Market provides a granular view of demand dynamics, enabling targeted strategic planning based on specific product characteristics, application environments, and material composition. The market is primarily bifurcated based on the protective function (e.g., flame resistance, chemical resistance), the material used (e.g., natural fibers, synthetics, blends), and the specific end-user industry, which dictates the level of hazard exposure and regulatory requirement. Analyzing these segments is crucial for manufacturers to align product development with evolving industrial needs, such as the growing demand for multi-functional workwear that addresses complex, mixed hazards simultaneously. Furthermore, the Service segment, encompassing rental, cleaning, and maintenance, is gaining prominence as industries prioritize operational efficiency and guaranteed compliance over outright purchasing and managing complex protective assets internally.

- By Product Type

- General Purpose Workwear

- Safety Workwear (High Visibility, Anti-Static, FR)

- Corporate Workwear/Uniforms

- Chemical Protective Clothing

- Cleanroom Apparel

- By End-User Industry

- Manufacturing (Automotive, Heavy Machinery)

- Construction

- Oil & Gas and Mining

- Chemical and Petrochemical

- Healthcare and Pharmaceuticals

- Utilities and Electrical

- By Material Type

- Cotton

- Polyester and Blends

- Aramid (Kevlar, Nomex)

- Polypropylene

- Others (PBI, PFR Rayon)

- By Service

- Rental

- Purchase

Value Chain Analysis For Industrial Workwear Market

The value chain for Industrial Workwear begins with the upstream segment involving raw material sourcing, primarily focusing on textile fiber production (natural, synthetic, and specialized high-performance materials like aramid and modacrylic). Innovation at this stage is critical, as specialized protective properties are inherently built into the fibers, demanding high technical expertise and proprietary formulations from chemical and textile producers. Key upstream challenges include volatile raw material pricing and ensuring sustainable sourcing practices for natural fibers or specialized chemical inputs necessary for flame retardancy or chemical barrier properties. Manufacturers, positioned in the midstream, focus on fabric weaving, treatment (e.g., lamination, coating), garment design, and final assembly, necessitating adherence to rigorous quality standards and certification protocols (e.g., CE, NFPA, ANSI).

The downstream analysis primarily concerns distribution and end-user engagement. The distribution channel is often complex, involving direct sales to large corporations (especially in Oil & Gas or utilities) or utilizing multi-tiered systems including distributors, wholesalers, and specialized safety equipment suppliers. Direct distribution allows for customization and specialized technical support, which is critical for highly regulated protective wear. Indirect channels, through safety distributors, provide broader market reach and localized inventory management, particularly valuable for smaller and medium-sized enterprises (SMEs). The proliferation of rental and maintenance services adds another crucial layer to the downstream value chain, shifting the focus from a transactional sale to a long-term service contract, thereby optimizing the lifecycle of the protective assets and guaranteeing compliance integrity for the end-user.

The overall structure of the value chain is increasingly influenced by vertical integration, where major players acquire or partner with raw material providers or expand their downstream service capabilities to gain competitive control over quality, speed, and cost throughout the entire product lifecycle. This integration ensures that the integrity of the protective garment, from fiber source to final laundry procedure, is maintained, which is a non-negotiable requirement for high-hazard industries. Furthermore, e-commerce platforms are emerging as a vital indirect distribution channel, particularly for standardized or corporate workwear, although specialized protective gear still heavily relies on technical sales representatives and direct negotiation due to the complexity of regulatory requirements and product specifications.

Industrial Workwear Market Potential Customers

Potential customers for the Industrial Workwear Market represent a vast array of sectors where operational safety is a mandatory requirement and potential hazards necessitate specialized protection for personnel. The primary end-users or buyers are organizational procurement departments within large industrial enterprises, facility management companies, and specialized contractors operating in high-risk environments. Key purchasing decisions are often driven by compliance officers, safety managers, and union representatives, who prioritize technical specifications (e.g., Arc Flash ratings, chemical penetration resistance) and compliance certification over simple cost considerations. Major consuming sectors include heavy manufacturing (automotive assembly, metal fabrication), infrastructure development (large-scale construction projects), energy production (onshore and offshore drilling, power generation), and the chemical processing industry, where protection against corrosive substances and extreme temperatures is essential. Healthcare workers and pharmaceutical researchers also form a significant customer base, requiring sterile, specialized garments to prevent contamination and ensure environmental control within sensitive research and production areas.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 30.1 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, 3M Company, Honeywell International Inc., Ansell Ltd., VF Corporation, Workwear Group, Lakeland Industries, Inc., Aramark, Sioen Industries NV, Ballyclare Limited, UniFirst Corporation, Fristads AB, Pompix, Red Wing Shoe Company, Inc., Lindström Group, Williamson-Dickie Manufacturing Company, Uvex Group, TenCate Protective Fabrics, Teijin Aramid, Milliken & Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Workwear Market Key Technology Landscape

The technological landscape of the Industrial Workwear Market is undergoing a rapid transformation, shifting the focus from mere protection to integrated performance, comfort, and data connectivity. The core technology remains rooted in advanced textile engineering, specifically the development of multi-hazard protective fabrics that offer resistance to flame, chemicals, and electrical arc flash, often simultaneously. Innovations include inherently flame-resistant (IFR) fibers, which maintain protective properties throughout the garment's lifecycle, contrasting with treated fabrics that can degrade over time and wash cycles. Furthermore, microencapsulation technology is utilized to integrate features like thermal regulation, mosquito repellency, or specialized chemical neutralization capabilities directly into the fabric structure, significantly broadening the functional scope of traditional workwear and extending its applicability into specialized environments such as tropical construction sites or chemical cleanup operations.

Beyond material science, the most disruptive technology is the integration of IoT (Internet of Things) and wearable technology, leading to the rise of 'Smart Workwear.' This involves embedding miniature sensors, RFID chips, and communication modules directly into the garments. These systems enable crucial functionalities such as automated inventory tracking (critical for managed workwear services), immediate location tracking of personnel in emergencies, and the monitoring of environmental conditions (e.g., toxic gas levels) or biological parameters (e.g., heart rate, core body temperature) of the wearer. This real-time data flow is essential for preventative safety measures and compliance auditing, moving industries toward a predictive safety model rather than a reactive one. The successful deployment of smart workwear relies heavily on durable, flexible electronics that can withstand harsh industrial conditions and repeated cleaning processes without compromising functionality or wearer comfort.

Moreover, manufacturing processes themselves are being revolutionized by technology. Advanced computer-aided design (CAD) and automated cutting systems ensure precision fitting and reduce material waste, optimizing cost efficiency for large-scale production runs. The adoption of 3D scanning and printing technologies is also beginning to emerge, particularly for prototyping complex protective components or customizing accessories that integrate seamlessly with the workwear. Regulatory technology (RegTech) is also influencing the market, providing digital tools that help manufacturers and end-users track product certification, compliance documents, and maintenance history via cloud-based platforms, ensuring that every garment meets the required safety standards at the point of use. This holistic approach, integrating advanced materials with intelligent digital management systems, defines the leading edge of the Industrial Workwear Market technology landscape and is key to future market growth.

Regional Highlights

- North America: Characterized by highly mature safety standards, driven primarily by OSHA and NFPA regulations. The market demands high-specification, specialized protective gear, particularly in the oil and gas, utilities, and high-tech manufacturing sectors. High adoption rates of rental programs and sophisticated managed service contracts are prevalent. The US market dictates technological trends, focusing heavily on arc flash protection and high visibility compliance.

- Europe: Governed by the strict EN (European Norms) standards, mandating comprehensive testing and certification (CE marking) for PPE. Sustainability and eco-friendly manufacturing are significant drivers here, favoring suppliers who offer responsibly sourced materials and circular economy solutions for workwear lifecycle management. Germany, the UK, and France are dominant consumers, heavily investing in standardized, high-quality protective uniforms for automotive and chemical industries.

- Asia Pacific (APAC): Represents the fastest-growing region, powered by rapid urbanization, massive infrastructure projects, and the shifting of global manufacturing bases to countries like China, India, and Southeast Asia. While cost sensitivity remains a factor, increasing enforcement of local safety laws, often benchmarked against international standards, is accelerating the demand for certified protective workwear, particularly in construction and electronics manufacturing.

- Latin America (LATAM): Growth is steady, driven by expanding mining and energy sectors (especially Brazil and Mexico). The market is highly price-sensitive but showing increased compliance, particularly by multinational corporations operating within the region, demanding international-standard protective clothing to mitigate operational risks and align with corporate safety policies.

- Middle East and Africa (MEA): Dominated by the oil, gas, and petrochemical industries, demanding highly specialized, thermally protective, and flame-resistant workwear tailored for extreme heat environments. Government initiatives focusing on large-scale construction (e.g., Saudi Arabia’s Vision 2030) are generating significant demand for high-quality protective gear for extensive expatriate and local workforces.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Workwear Market.- DuPont

- 3M Company

- Honeywell International Inc.

- Ansell Ltd.

- VF Corporation

- Workwear Group

- Lakeland Industries, Inc.

- Aramark

- Sioen Industries NV

- Ballyclare Limited

- UniFirst Corporation

- Fristads AB

- Pompix

- Red Wing Shoe Company, Inc.

- Lindström Group

- Williamson-Dickie Manufacturing Company

- Uvex Group

- TenCate Protective Fabrics

- Teijin Aramid

- Milliken & Company

Frequently Asked Questions

Analyze common user questions about the Industrial Workwear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Industrial Workwear Market?

The dominant factor is the increasing global stringency of occupational safety regulations (e.g., OSHA, EN standards), which mandates the use of certified protective clothing to minimize workplace injuries and ensure employer compliance across high-risk sectors.

How are 'Smart Textiles' revolutionizing the Industrial Workwear sector?

Smart textiles integrate sensors and IoT technology into garments, enabling real-time monitoring of worker physiology (e.g., fatigue, heart rate) and environmental hazards, facilitating predictive safety management and enhancing emergency response capabilities.

Which geographical region exhibits the highest growth potential for industrial workwear?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by accelerated industrialization, expansion of manufacturing activities, and growing awareness and regulatory adoption of advanced safety standards in major economies like China and India.

What is the difference between inherent and treated Flame-Resistant (FR) workwear?

Inherent FR workwear utilizes fibers (like Aramid or Modacrylic) that possess permanent flame resistance built into their molecular structure, lasting the lifetime of the garment. Treated FR workwear uses chemically applied treatments that may degrade over repeated industrial laundering cycles.

What role do rental and managed service models play in the industrial workwear market?

Rental and managed services allow companies to outsource the complex logistics of inventory management, cleaning, repair, and compliance tracking of specialized workwear, guaranteeing that garments meet safety standards without incurring significant capital expenditure or administrative burden.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager