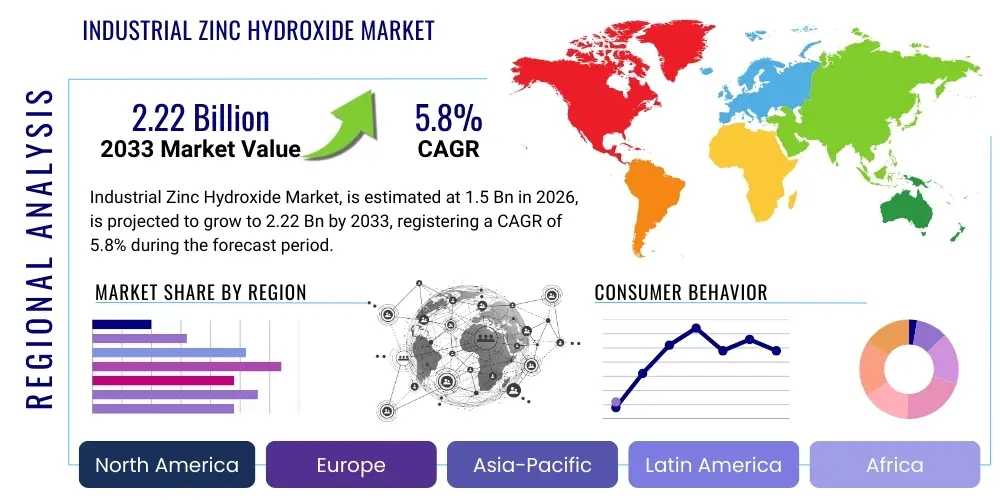

Industrial Zinc Hydroxide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442545 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Industrial Zinc Hydroxide Market Size

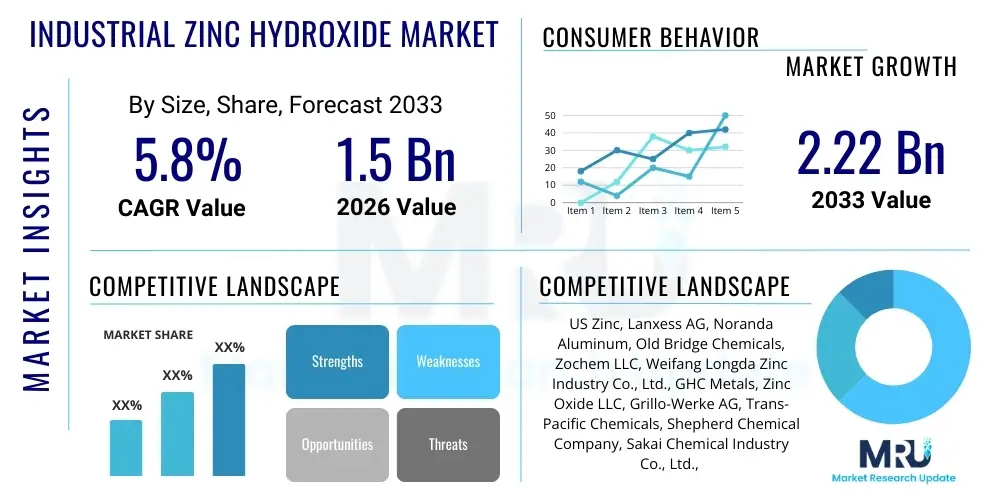

The Industrial Zinc Hydroxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.22 Billion by the end of the forecast period in 2033.

Industrial Zinc Hydroxide Market introduction

Industrial Zinc Hydroxide (Zn(OH)2) is an amphoteric white solid primarily utilized as a precursor for the production of high-purity zinc oxide (ZnO), a key ingredient across numerous industrial sectors. It is produced through the controlled reaction of zinc salts with a base, ensuring specific crystal structures and purity levels suitable for sensitive applications. The product's inherent properties, including its ability to act as a mild base or acid depending on the solution, make it highly versatile. It is critical in processes requiring controlled alkalinity or the introduction of zinc ions without excessive free acidity, distinguishing it from standard zinc salts.

Major applications of industrial zinc hydroxide span across rubber manufacturing, where it acts as a vulcanization accelerator and activator; chemical synthesis, especially in the production of specialized zinc compounds; and the coatings industry, where it is used in pigments and anticorrosive treatments. Furthermore, its high purity grades find crucial roles in the pharmaceutical and cosmetic sectors. The demand is intrinsically linked to the growth of the automotive and construction industries, which are significant consumers of rubber products and protective coatings, respectively. The shifting focus toward high-performance materials in these end-use sectors drives the need for purer and more reactive zinc compounds.

The primary benefits driving market expansion include its non-toxic nature compared to certain other metal hydroxides, its high reactivity for chemical processes, and its suitability for synthesizing nanostructured zinc oxide, which exhibits superior catalytic and UV-blocking properties. Driving factors encompass the burgeoning demand for eco-friendly paint formulations, increased regulation promoting non-toxic vulcanization agents in tire manufacturing, and sustained growth in emerging economies necessitating rapid expansion of infrastructure and manufacturing capabilities. Innovations in controlled precipitation methods are further enhancing product consistency and yield, making zinc hydroxide production more economically viable.

Industrial Zinc Hydroxide Market Executive Summary

The global Industrial Zinc Hydroxide market trajectory is characterized by steady expansion, underpinned by robust consumption in the Asia Pacific region and accelerating adoption in advanced material applications worldwide. Key business trends indicate a vertical integration strategy among major players, aiming to secure raw material supplies (primarily zinc) and control production quality to meet stringent regulatory requirements, particularly in Europe and North America regarding chemical safety and environmental standards. Furthermore, market competition is intensifying based on product purity, with high-grade zinc hydroxide commanding significant premiums due to its necessity in specialized catalysts and medical applications. Technological advancements are focused on developing continuous precipitation techniques over traditional batch processes to improve efficiency and reduce energy consumption, addressing cost pressures and sustainability goals.

Regional trends highlight Asia Pacific, led by China and India, as the central growth engine, driven by massive domestic automotive production and ongoing infrastructure projects boosting the demand for rubber products, coatings, and specialized chemicals. North America and Europe demonstrate mature markets focused on innovation, particularly in the development of sophisticated catalysts for petrochemical processes and high-performance, non-leaching pigments for coatings. Regulatory harmonization regarding chemical handling and disposal in these regions also influences demand dynamics, favoring suppliers who demonstrate strict compliance and traceability. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, spurred by industrialization and localized manufacturing growth, although market penetration remains fragmented and dependent on global commodity pricing.

Segment trends reveal that the Technical Grade segment maintains the largest market share, predominantly serving bulk industries like rubber and general chemical manufacturing, owing to its cost-effectiveness. However, the Pharmaceutical Grade and High-Purity segments are experiencing the highest growth rates, driven by escalating R&D spending in drug formulation and the increased use of high-purity precursors in electronic components and advanced ceramics. Application-wise, the Rubber Manufacturing segment remains dominant, but the Catalysts and Chemical Synthesis segments are exhibiting superior compound annual growth, reflecting the increasing complexity of global chemical processing and the crucial role zinc hydroxide plays in facilitating specialized reactions. Investment is increasingly directed towards enhancing production capabilities for fine particle sizes and uniform crystal morphology, which are prerequisites for next-generation catalyst systems.

AI Impact Analysis on Industrial Zinc Hydroxide Market

User queries regarding the impact of Artificial Intelligence on the Industrial Zinc Hydroxide market frequently revolve around themes of manufacturing optimization, predictive quality control, supply chain resilience, and the potential for AI-driven material discovery. Common concerns include how AI can manage the complexity of batch precipitation processes to ensure uniform crystal size and purity—a critical factor for end-use performance—and how predictive maintenance (PdM) can minimize downtime in zinc processing plants. Users are keen on understanding AI's role in mitigating volatility in raw material (zinc) prices and optimizing logistical flows for heavy chemical transport. Furthermore, there is significant interest in AI's capacity to model complex chemical reactions involving zinc hydroxide, potentially accelerating the development of novel zinc-based catalysts or flame retardants, thereby opening new application pathways for the industrial chemical.

The primary impact of AI adoption is expected to revolutionize production efficiency and product quality within zinc hydroxide manufacturing facilities. By integrating machine learning algorithms with real-time sensor data from reactors, manufacturers can precisely monitor parameters such as pH, temperature profiles, and stirring rates during the precipitation process. This level of control minimizes batch-to-batch variation, significantly reducing waste and the need for costly reprocessing. AI-driven spectroscopic analysis can perform instantaneous quality checks, moving beyond traditional lab-based testing cycles. This capability is paramount for high-purity applications, where even minor impurities can compromise the functionality of the final product, such as specialized pigments or pharmaceutical intermediates.

Beyond the manufacturing floor, AI is instrumental in streamlining the complex global supply chain for industrial chemicals. Predictive analytics algorithms forecast demand fluctuations based on global manufacturing indices, helping suppliers optimize inventory levels of both raw materials and finished products, reducing warehousing costs and mitigating risks associated with sudden market shifts. Moreover, AI tools enhance R&D efforts by simulating molecular interactions and predicting the performance characteristics of new zinc hydroxide derivatives in various matrixes (e.g., polymer composites or coating formulations). This acceleration of material innovation is vital for maintaining competitive advantage, particularly as industries seek highly specific material properties tailored to sustainable and high-efficiency applications.

- AI-enhanced process optimization drives higher yields and uniformity in crystal structure during precipitation.

- Machine learning facilitates predictive quality control, reducing impurity levels necessary for pharmaceutical and catalyst grades.

- Predictive maintenance minimizes operational downtime of complex chemical reactors and processing equipment.

- AI supply chain optimization mitigates volatility risks associated with zinc commodity pricing and logistics.

- Generative AI models accelerate the discovery and testing of novel zinc hydroxide-based flame retardants and catalysts.

- Data analytics improve adherence to global regulatory standards by automating compliance tracking and reporting.

DRO & Impact Forces Of Industrial Zinc Hydroxide Market

The Industrial Zinc Hydroxide market is propelled by key drivers, constrained by specific challenges, and benefits from significant future opportunities, all acting in concert as powerful impact forces shaping its trajectory. The foremost driver is the surging demand from the rubber industry, especially the tire sector, where zinc hydroxide and its derived oxide are indispensable vulcanization activators. Simultaneously, stringent environmental regulations in developed economies favoring less hazardous chemical precursors over older, more toxic alternatives are creating mandatory opportunities for high-purity zinc hydroxide. However, the market faces significant restraint due to the inherent volatility and cost fluctuation of zinc metal, the primary raw material, which directly impacts production economics and profitability margins. Opportunities lie significantly in developing advanced applications, such as high-efficiency solar cells and specialized electronic components, where the unique properties of nanostructured zinc hydroxide derivatives are highly valued.

Drivers contributing to market expansion include rapid industrialization in emerging markets, necessitating robust infrastructure development and associated manufacturing output, which relies heavily on protective coatings and durable elastomeric products. Furthermore, advancements in catalysis technology, particularly for polymerization and hydrogenation processes, increasingly require high-surface-area zinc compounds, positioning zinc hydroxide as a premium precursor. On the restraint side, the complex and energy-intensive manufacturing process required to achieve high purity levels—essential for pharmaceutical or catalyst applications—acts as a barrier to entry for smaller manufacturers and limits overall scalability. Moreover, potential substitution threats from alternative compounds, such as certain aluminum or magnesium hydroxides in specific flame retardant or pigment applications, occasionally limit market growth in niche areas.

The impact forces generated by this dynamic interaction lead to sustained innovation in production methods, focusing heavily on sustainability and energy efficiency to counteract high operational costs. Key opportunities include leveraging the material’s potential in agricultural fungicides and feed additives, responding to the global drive for enhanced food security and livestock health. The growing Electric Vehicle (EV) industry, requiring high-performance tires and specialized battery components, represents a substantial future growth vector for zinc hydroxide consumption. Successfully navigating the raw material price volatility through long-term hedging strategies and efficient supply chain management will be critical for players aiming to capitalize on these expanding application opportunities and secure dominant market positions over the forecast period.

Segmentation Analysis

The Industrial Zinc Hydroxide market is comprehensively segmented based on product purity (Grade), the specific functionality or method of production (Type), and the diverse sectors where it is utilized (Application). Segmentation by Grade—Technical, High Purity, and Pharmaceutical—is crucial as purity dictates the end-use industry and pricing structure; for instance, Pharmaceutical Grade demands minimal heavy metal content and commands the highest premium. Segmentation by Application reveals the breadth of market dependency, ranging from high-volume usage in rubber and ceramics to highly specialized, low-volume consumption in advanced electronics and specialized chemical synthesis. This granular segmentation allows stakeholders to accurately gauge market penetration, identify high-growth niches, and tailor investment strategies toward segments exhibiting superior profitability potential and regulatory ease of entry.

The dominance of the Technical Grade segment is primarily attributed to its indispensable role in the massive rubber and tire industry globally, which consumes zinc compounds in large quantities as essential activators. Conversely, the high-purity and pharmaceutical segments are growing rapidly due to the accelerating demand for high-quality intermediates in life sciences, nutraceuticals, and high-tech electronic components requiring precise chemical compositions and crystal structures. Geographically, segmentation highlights disparities in consumption patterns; developed regions prioritize high-purity applications and environmental compliance, while developing economies focus on bulk consumption driven by construction and automotive manufacturing outputs. Understanding these segment dynamics is vital for market forecasting and competitive analysis.

- By Grade:

- Technical Grade

- High Purity Grade

- Pharmaceutical Grade

- By Type/Form:

- Powder Form

- Suspension/Slurry Form

- Granular Form

- By Application:

- Rubber Manufacturing and Vulcanization

- Chemical Synthesis (Precursor to Zinc Oxide and other Zinc Salts)

- Pigments and Coatings

- Pharmaceuticals and Cosmetics

- Catalysts and Catalytic Converters

- Ceramics and Glass Production

- Flame Retardants

- By End-User Industry:

- Automotive

- Construction

- Chemicals and Petrochemicals

- Healthcare

- Electronics

Value Chain Analysis For Industrial Zinc Hydroxide Market

The value chain for Industrial Zinc Hydroxide begins with the upstream sourcing and processing of raw zinc materials, predominantly zinc metal or zinc salts derived from mining and smelting activities. Upstream complexity is high, given the sensitivity of global commodity markets and the need for suppliers to ensure consistent quality of input materials to meet the stringent purity requirements of downstream applications. Zinc smelting is energy-intensive, and environmental compliance at this stage heavily influences the final cost structure of zinc hydroxide. Key activities in the initial phase include extraction, beneficiation, refining, and the production of intermediary zinc compounds necessary for the chemical synthesis of zinc hydroxide, emphasizing secure, traceable sourcing from established mining operations to minimize supply chain risks.

The midstream stage involves the chemical manufacturing of zinc hydroxide, primarily through precipitation methods. This phase is capital-intensive, requiring specialized reaction vessels, precise control systems (often leveraging automation and advanced sensors), and stringent quality assurance protocols to control particle size, morphology, and purity. Distribution channels for industrial zinc hydroxide are bifurcated: direct sales channels dominate for large-volume customers like major tire manufacturers or captive chemical producers requiring specific formulations, ensuring tight control over logistics and quality. Indirect channels, involving specialized chemical distributors and regional agents, handle smaller orders, manage local inventory, and provide tailored technical support to a dispersed customer base, particularly in emerging markets where localized expertise is essential.

The downstream segment encompasses the utilization of zinc hydroxide by end-user industries. This product serves as a crucial intermediate, often quickly converted into zinc oxide, or used directly in processes like vulcanization or complex chemical synthesis. End-users range from large multinational corporations (MNCs) in automotive and healthcare to smaller, specialized producers of pigments and catalysts. Efficiency and product performance at this downstream stage are heavily dependent on the purity and consistency provided by the upstream manufacturer. The continuous feedback loop from downstream users concerning material performance requirements drives innovation and customization in the manufacturing process, ensuring the final product meets the high performance standards required for specialized applications such as high-thermal stability ceramics or pharmaceutical excipients.

Industrial Zinc Hydroxide Market Potential Customers

Potential customers for industrial zinc hydroxide span a wide array of manufacturing and processing sectors, primarily revolving around industries that require high-performance fillers, activators, precursors, or specialized chemical agents. The largest segment of buyers comprises global tire manufacturers and general rubber product producers who rely on zinc hydroxide (or its derived zinc oxide) as a non-negotiable component in the vulcanization process, essential for imparting strength, durability, and resilience to rubber compounds. These customers require Technical Grade material in high volumes and are extremely sensitive to pricing and supply reliability, often entering into long-term procurement contracts with primary chemical producers to ensure consistent supply and quality specifications for mass production cycles.

A secondary, high-value customer base exists within the specialty chemicals and pharmaceutical industries. Chemical synthesis companies purchase zinc hydroxide as a high-purity precursor for manufacturing advanced zinc salts, organic zinc compounds, and specialized catalysts used in petrochemical refining and fine chemical production. Pharmaceutical companies and nutraceutical manufacturers utilize Pharmaceutical Grade zinc hydroxide as an active ingredient, an excipient, or a raw material for synthesizing zinc supplements and topical treatments. These buyers prioritize quality certifications (e.g., GMP standards), traceability, and consistency over cost, driving demand for premium products tailored to regulatory compliance and biomedical compatibility.

Other significant potential customers include manufacturers in the coatings, ceramics, and electronics sectors. Coatings companies use zinc hydroxide derivatives as anti-corrosion pigments and UV stabilizers for protective paints and marine coatings, requiring materials with specific particle sizes for optimal dispersion and film formation. Ceramic and glass producers use it as a fluxing agent or opacifier, demanding high-purity grades to prevent discoloration or defects in finished products. Finally, the electronics industry, particularly manufacturers of varistors, transducers, and transparent conductive films, relies on specialized zinc oxide materials synthesized from high-purity zinc hydroxide precursors, representing a fast-growing, highly technical customer segment focused entirely on material performance and functional precision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.22 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | US Zinc, Lanxess AG, Noranda Aluminum, Old Bridge Chemicals, Zochem LLC, Weifang Longda Zinc Industry Co., Ltd., GHC Metals, Zinc Oxide LLC, Grillo-Werke AG, Trans-Pacific Chemicals, Shepherd Chemical Company, Sakai Chemical Industry Co., Ltd., Hindustan Zinc Ltd., Hebei Yuanda Chemical, American Zinc Recycling Corp., Cimbar Performance Minerals, EverZinc, Votorantim Metais, Rubamin Pvt. Ltd., Hakusui Chemical Industries, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Zinc Hydroxide Market Key Technology Landscape

The technological landscape for Industrial Zinc Hydroxide production is defined by advancements in controlled precipitation, hydrothermal synthesis, and novel drying/milling techniques aimed at achieving superior control over particle morphology, size distribution, and chemical purity. Traditional production methods often rely on batch processing, leading to inherent variations in product quality. Modern technological shifts focus on continuous flow reactors and microreaction technology, which promise enhanced uniformity and scalability, especially critical for producing fine or nano-sized zinc hydroxide particles essential for catalyst and electronics applications. High-efficiency crystallization techniques, coupled with precise pH and temperature monitoring, represent the core of process innovation, enabling manufacturers to meet the escalating demand for high-grade materials with specific, tailored surface area characteristics.

Another crucial technological area is the integration of advanced filtration and washing systems, particularly relevant for achieving Pharmaceutical Grade purity. These systems employ ultrafiltration membranes and ion-exchange columns to meticulously remove heavy metal traces and soluble impurities that are unacceptable in regulated end-use sectors like healthcare. Furthermore, the development of specialized drying technologies, such as spray drying or vacuum drying, minimizes agglomeration and preserves the desired particle morphology established during the synthesis phase. Continuous technological investment in these separation and finishing steps is paramount, as quality is frequently determined by the ability to consistently produce free-flowing, low-moisture-content powder with uniform physicochemical properties.

The future technology outlook centers on sustainable production methods, including the exploration of routes utilizing recycled zinc materials, which aligns with circular economy principles and mitigates reliance on volatile primary zinc commodities. Research into microwave-assisted synthesis or mechanochemical processing offers potential pathways for reducing the significant energy footprint associated with conventional hydrothermal methods. Moreover, leveraging sensor technology and AI integration for real-time multivariate process control is becoming standard practice among market leaders. This allows for instant adjustments to reaction parameters, maximizing yield while minimizing deviation from strict product specifications, thereby institutionalizing the production of premium zinc hydroxide materials necessary for cutting-edge industrial and advanced material applications globally.

Regional Highlights

The global consumption and production landscape for Industrial Zinc Hydroxide is highly diverse, reflecting varying levels of industrial maturity, regulatory stringency, and end-use market growth rates across key geographical regions. Asia Pacific (APAC) stands out as the dominant region in terms of volume consumption, driven primarily by its colossal manufacturing sector, extensive automotive industry, and continuous heavy investment in infrastructure and construction. Countries like China, India, and Southeast Asian nations are massive consumers of rubber products, coatings, and basic chemicals, making them central to the global demand trajectory for Technical Grade zinc hydroxide. The region benefits from lower operating costs and burgeoning domestic demand, although it faces challenges related to enforcing strict environmental standards compared to Western counterparts.

North America and Europe represent mature markets characterized by steady, moderate growth, but they are leaders in high-value consumption, specifically Pharmaceutical Grade and high-purity materials for advanced chemical synthesis and specialized catalysts. Stringent environmental, health, and safety (EHS) regulations in these regions drive demand for highly compliant, traceable raw materials, favoring manufacturers who adhere to superior quality standards. Europe, in particular, maintains strong demand for zinc hydroxide in niche applications like specialty plastics and protective coatings, responding to EU directives promoting sustainability and the phase-out of hazardous substances.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions exhibiting significant future potential. LATAM's growth is tied to recovering industrial activity in Brazil and Mexico, particularly in automotive and construction sectors. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in downstream petrochemical and manufacturing diversification, which is expected to fuel demand for chemical precursors like zinc hydroxide in the medium to long term. However, market growth in these regions is susceptible to economic instability and dependency on imported materials, necessitating localized strategic distribution partnerships to effectively serve the burgeoning industrial base.

- Asia Pacific (APAC): Dominant in volume, powered by manufacturing giants China and India; key consumption concentrated in rubber, coatings, and general chemicals due to massive automotive and construction output.

- North America: Mature market focused on high-purity grades for advanced catalysts, pharmaceuticals, and environmental applications; characterized by high regulatory oversight and technological innovation.

- Europe: High-value market with strict EHS regulations driving demand for sustainable and high-specification materials; strong presence in specialty chemical production and high-performance coatings.

- Latin America (LATAM): Emerging market growth linked to industrial recovery and regional automotive manufacturing; prone to commodity price fluctuations affecting material costs.

- Middle East & Africa (MEA): Future growth potential driven by industrial diversification plans (e.g., in Saudi Arabia and UAE) and rising demand for protective coatings and construction chemicals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Zinc Hydroxide Market.- US Zinc

- Lanxess AG

- Noranda Aluminum

- Old Bridge Chemicals

- Zochem LLC

- Weifang Longda Zinc Industry Co., Ltd.

- GHC Metals

- Zinc Oxide LLC

- Grillo-Werke AG

- Trans-Pacific Chemicals

- Shepherd Chemical Company

- Sakai Chemical Industry Co., Ltd.

- Hindustan Zinc Ltd.

- Hebei Yuanda Chemical

- American Zinc Recycling Corp.

- Cimbar Performance Minerals

- EverZinc

- Votorantim Metais

- Rubamin Pvt. Ltd.

- Hakusui Chemical Industries, Ltd.

Frequently Asked Questions

Analyze common user questions about the Industrial Zinc Hydroxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary industrial function of Zinc Hydroxide?

The primary industrial function of zinc hydroxide is serving as a crucial intermediate or precursor, mainly for the production of high-purity zinc oxide (ZnO). Zinc oxide is indispensable as a vulcanization accelerator and activator in the rubber industry, and as a pigment and additive in coatings, catalysts, and specialized ceramic applications.

Which application segment drives the largest demand for Industrial Zinc Hydroxide?

The rubber manufacturing and vulcanization segment consistently drives the largest demand for Industrial Zinc Hydroxide globally. Its derived product, zinc oxide, is essential for imparting mechanical strength and durability to tires and other elastomeric products, linking the market closely to the growth of the global automotive sector.

How does the purity grade of Zinc Hydroxide affect its market price and utilization?

Purity grade directly correlates with market price and application. Technical Grade is the most economical and used for high-volume applications like general rubber. Conversely, Pharmaceutical Grade and High-Purity Grade materials command significantly higher prices due to the rigorous purification processes required to eliminate heavy metals, making them suitable only for sensitive uses like catalysts, electronics, and medical formulations.

What are the main constraints affecting the profitability of the Zinc Hydroxide market?

The main constraint affecting market profitability is the significant volatility and cost fluctuation of zinc metal, the primary raw material. Since zinc is a globally traded commodity, its price swings directly impact the production costs of zinc hydroxide, necessitating effective hedging strategies and efficient process optimization by manufacturers to maintain stable margins.

Which geographical region is forecasted to exhibit the highest growth rate for Zinc Hydroxide consumption?

Asia Pacific (APAC), particularly China and India, is forecasted to exhibit the highest volume growth rate for Industrial Zinc Hydroxide consumption. This growth is sustained by rapid urbanization, massive infrastructure development, and continuous expansion in the regional automotive and chemical manufacturing sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager