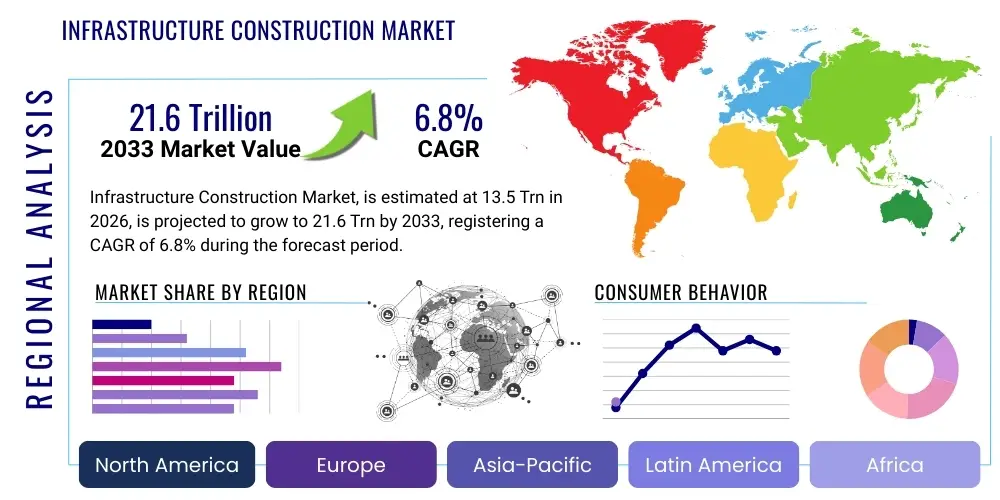

Infrastructure Construction Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442124 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Infrastructure Construction Market Size

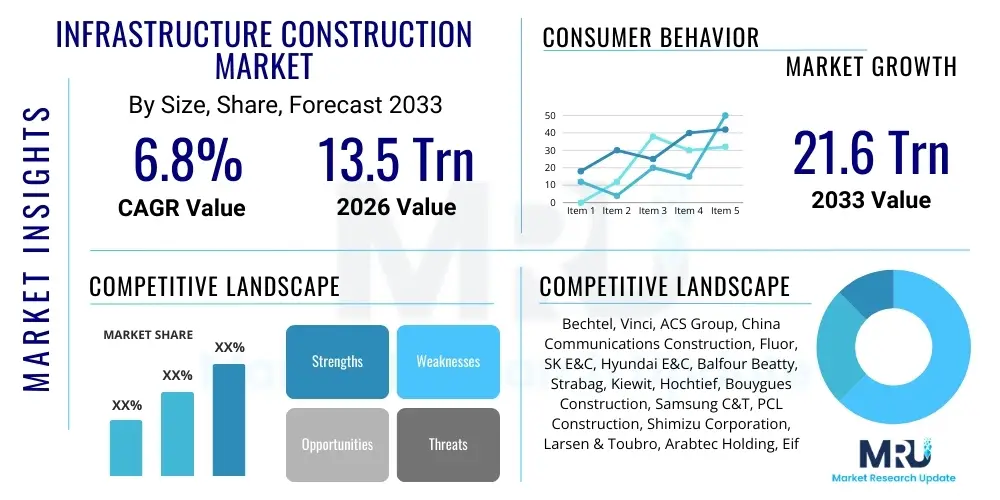

The Infrastructure Construction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 13.5 Trillion in 2026 and is projected to reach USD 21.6 Trillion by the end of the forecast period in 2033.

Infrastructure Construction Market introduction

The Infrastructure Construction Market encompasses all activities related to the planning, design, execution, and maintenance of fundamental systems and structures necessary for a functioning society and economy. This broad category includes critical components such as transportation networks (roads, railways, airports, ports), utility systems (power generation, transmission, and distribution, water supply, sewage, and telecommunications), and social infrastructure (hospitals, schools, public buildings). The market's intrinsic linkage to global economic growth, urbanization trends, and public policy makes it a cornerstone of modern development, providing the essential backbone that supports commercial activity and enhances the quality of life for citizens worldwide. Investment cycles in this sector are often long-term and heavily influenced by government spending, international development banks, and public-private partnerships (PPPs).

The core product offerings within this market range from large-scale civil engineering projects, like high-speed rail development and dam construction, to essential maintenance and upgrading of existing facilities, such as bridge repair and smart grid implementation. Major applications span industrial zones requiring robust logistics infrastructure, dense urban areas needing advanced transit and utility management, and rural areas demanding better connectivity and accessibility. The substantial benefits derived from robust infrastructure construction include improved economic productivity due to reduced transit times and reliable power supply, enhanced disaster resilience through modernized utility networks, and job creation across the construction and engineering supply chain. Furthermore, modern infrastructure projects increasingly integrate sustainability criteria, focusing on lower carbon footprints and circular economy principles.

Key driving factors accelerating the market’s expansion include relentless global urbanization, particularly in emerging economies of Asia Pacific and Africa, which necessitates massive investments in urban utilities and housing-related infrastructure. Concurrently, developed nations face the urgent requirement to replace or significantly modernize aging infrastructure that has exceeded its design life, particularly water pipes, bridges, and energy grids. Furthermore, technological advancements, such as Building Information Modeling (BIM), prefabricated construction methods, and the integration of IoT for smart infrastructure management, are enhancing project efficiency, reducing costs, and attracting further investment into complex engineering undertakings, ensuring sustained market momentum throughout the forecast period.

Infrastructure Construction Market Executive Summary

The global Infrastructure Construction Market is experiencing robust expansion, fundamentally driven by pervasive governmental commitments to economic stimulus packages focused on resilient infrastructure renewal and green development initiatives. Current business trends highlight a significant shift toward integrated project delivery (IPD) models and increased adoption of digital construction technologies, enhancing transparency and predictability in project timelines and costs. Financially, the market is characterized by a rise in complex financing mechanisms, including Build-Operate-Transfer (BOT) and hybrid annuity models (HAM), which leverage private sector efficiency and capital to manage large-scale public projects, thereby mitigating fiscal strain on government budgets. Furthermore, there is a distinct trend towards modular and industrialized construction techniques to address persistent labor shortages and improve construction quality and speed, especially in standardized infrastructure elements like road segments and utility casings.

Regional trends indicate that Asia Pacific (APAC) remains the dominant powerhouse in terms of volume and new project starts, fueled by the rapid expansion of megacities in China, India, and Southeast Asian nations requiring fundamental transportation and utility infrastructure. Conversely, North America and Europe are concentrating investments on modernization, decarbonization, and resilience, specifically upgrading electricity grids to handle intermittent renewable energy sources and improving water management systems to cope with climate volatility. Latin America and the Middle East & Africa (MEA) are seeing significant activity linked to resource extraction infrastructure (ports, railways) and large-scale social development projects, often backed by foreign direct investment and multilateral financial institutions. These divergent regional priorities necessitate specialized expertise and customized supply chain strategies for contractors operating globally.

In terms of segmentation, the Transportation infrastructure segment, encompassing road, rail, and airport construction, continues to hold the largest market share globally due to the necessity of connecting economic hubs and managing increasing freight volumes. However, the Utilities segment, particularly related to smart grids, renewable energy transmission, and sophisticated water treatment facilities, is projected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the global imperative to transition toward sustainable and efficient resource management. Within the utilities segment, specialized infrastructure for 5G network rollout and data centers is also rapidly gaining prominence, repositioning telecommunication infrastructure as a critical pillar of modern construction spending, attracting technology-focused investment and driving innovation in material science and construction automation.

AI Impact Analysis on Infrastructure Construction Market

User inquiries regarding Artificial Intelligence (AI) in Infrastructure Construction primarily center on optimizing project life cycles, mitigating chronic risks, and enhancing asset performance management post-construction. Key themes identified include the expectation that AI will revolutionize safety protocols through real-time risk prediction, streamline complex supply chain logistics by optimizing material flow, and dramatically improve design efficiency through generative design algorithms. Users frequently express concerns about the necessary digital skills gap within the traditionally conservative construction workforce and the standardization challenges associated with integrating disparate data sources from various sensors, BIM models, and site monitoring systems. There is also significant curiosity about AI's role in predictive maintenance (PdM) for assets like bridges and tunnels, shifting operations from reactive repair to proactive intervention, ultimately minimizing downtime and maximizing the operational lifespan of critical public infrastructure.

- Predictive Maintenance & Asset Management: AI algorithms analyze sensor data from existing infrastructure (bridges, roads, utility pipes) to predict equipment failure or structural deterioration, optimizing maintenance schedules and reducing catastrophic failures.

- Generative Design & Optimization: AI tools rapidly generate thousands of design options based on predefined constraints (cost, material, environmental impact), allowing engineers to quickly select the most efficient and sustainable project blueprints.

- Construction Robotics & Automation: AI powers autonomous construction equipment and robotic processes (e.g., bricklaying, welding), enhancing precision, consistency, and worker safety on hazardous sites.

- Project Risk and Schedule Management: Machine learning models process vast historical project data to identify potential schedule delays, cost overruns, and resource conflicts in real-time, enabling proactive managerial adjustments.

- Supply Chain Efficiency: AI optimizes logistics, material procurement, and inventory management, ensuring just-in-time delivery of components to complex, multi-site infrastructure projects, minimizing storage costs and waste.

DRO & Impact Forces Of Infrastructure Construction Market

The Infrastructure Construction Market is shaped by a powerful interplay of Driving forces (D), Restraints (R), and Opportunities (O), which together constitute the primary Impact Forces determining sector growth trajectory. Key drivers include massive governmental spending on green and resilient infrastructure, spurred by global climate goals and economic stimulus programs, particularly in response to economic downturns, positioning infrastructure as a crucial counter-cyclical investment tool. These drivers are bolstered by rapid global demographic shifts, such as intense urbanization in emerging markets, necessitating new utility systems, mass transit, and housing-supporting infrastructure. However, growth is substantially restrained by persistent challenges, including volatile raw material pricing (steel, cement, asphalt), chronic shortages of skilled labor and technical expertise, and cumbersome regulatory approval processes which often delay project execution and inflate overall costs, particularly in politically complex environments.

The most compelling opportunities for market participants lie in the rapid adoption of smart infrastructure solutions, leveraging IoT, 5G, and AI to create interconnected, optimized, and sustainable systems (Smart Cities). The shift toward Public-Private Partnership (PPP) models globally offers financial opportunities by tapping into private capital and operational expertise, allowing governments to undertake large-scale projects without immediate full debt burden. Additionally, the increasing focus on retrofitting existing infrastructure for seismic resilience, energy efficiency, and climate adaptation presents a significant, long-term revenue stream distinct from new build projects. These opportunities demand technological innovation and revised business models focused on life-cycle asset performance rather than mere construction delivery.

The cumulative impact forces indicate a market transitioning toward greater sophistication and digitalization. While traditional constraints related to finance and labor persist, the overriding global political and economic commitment to sustainable and resilient development acts as a powerful accelerator. Successful market players will be those who can strategically mitigate risks associated with material volatility and labor scarcity by adopting industrialized construction and technological solutions, while simultaneously capitalizing on the demand for green, climate-proof infrastructure assets. The pressure for faster, more transparent project delivery, fueled by public scrutiny, drives innovation in procurement and construction management practices, profoundly impacting profitability and competitive positioning within the global infrastructure landscape.

Segmentation Analysis

The Infrastructure Construction Market is comprehensively segmented based on the type of infrastructure being developed, the materials utilized in construction, the application sector it serves, and the specific delivery model employed. This segmentation framework is crucial for understanding the diverse investment patterns and technological requirements across various subsectors. The core categorization often revolves around the functional purpose of the asset, differentiating essential services like energy and water from connectivity-focused systems like transportation and telecommunications. Furthermore, analyzing the market by construction material helps track commodity demand and technological shifts, such as the increasing use of sustainable materials and high-performance composites in place of traditional concrete and steel, driven by sustainability mandates and durability requirements.

- By Type:

- Transportation Infrastructure (Roads, Highways, Railways, Bridges, Tunnels, Airports, Ports)

- Utility Infrastructure (Power Generation & Transmission, Water Supply & Treatment, Sewage Systems, Gas Pipelines)

- Social Infrastructure (Hospitals, Educational Institutions, Government Buildings, Public Housing)

- Communication Infrastructure (Fiber Optic Networks, Data Centers, Cell Towers, 5G Network Rollout)

- By Construction Material:

- Concrete and Cement

- Steel and Metals

- Asphalt

- Aggregates and Sand

- Advanced Materials (Composites, Geotextiles)

- By Application:

- Residential Infrastructure Support

- Commercial Infrastructure Support

- Industrial Infrastructure Support

- Public Works and Government

- By Procurement Model:

- Traditional Contracts (Design-Bid-Build)

- Design-Build (DB)

- Engineering, Procurement, and Construction (EPC)

- Public-Private Partnerships (PPP/P3)

Value Chain Analysis For Infrastructure Construction Market

The Infrastructure Construction market’s value chain is extensive and highly integrated, starting with Upstream activities centered on planning, financing, and raw material extraction. Upstream involves initial feasibility studies, land acquisition, detailed engineering design (often utilizing BIM software), and securing large-scale project finance from governmental bodies, private equity, or consortiums. This phase is characterized by intensive intellectual capital, involving architects, specialized engineers, and financial analysts who lay the contractual and technical groundwork for the project. Raw material suppliers—such as producers of cement, structural steel, heavy machinery, and specialized aggregates—form the immediate beginning of the physical supply chain, and their performance is critical to managing early project costs and timelines. Volatility and sustainability concerns in material sourcing significantly influence the upstream planning phase.

The Midstream component constitutes the core construction and execution phase, involving general contractors, specialized subcontractors (e.g., foundation specialists, electrical installers), and on-site project management. This stage is highly labor-intensive and increasingly reliant on integrated digital tools for project monitoring, quality control, and safety management. Distribution Channels play a critical role here; they include direct relationships between tier-one contractors and major material manufacturers (Direct), as well as utilizing regional distributors and logistics providers for specialized components and minor materials (Indirect). Efficiency in the midstream phase is paramount for profit margins, driving the trend toward off-site prefabrication and modularization to accelerate site assembly and improve labor productivity, effectively streamlining the channel flow.

Downstream activities focus on the operational lifecycle of the constructed asset, covering commissioning, long-term maintenance, rehabilitation, and eventual decommissioning. This phase involves asset management firms, facility operators, and specialized maintenance contractors utilizing data analytics and AI for predictive maintenance and asset optimization. The revenue stream in the downstream segment is characterized by long-term service contracts and potentially toll or usage fees, making the quality and durability of the initial construction critical. The increasing focus on smart infrastructure means the downstream phase is rapidly integrating technological service providers who manage IoT sensors, data platforms, and cybersecurity, extending the value chain far beyond the physical construction completion and creating a sustainable service market.

Infrastructure Construction Market Potential Customers

The primary customers and buyers in the Infrastructure Construction Market are predominantly large, institutional entities, driven by public necessity and long-term capital planning. The most significant customer base comprises National and Sub-national Governments (federal, state, and municipal authorities) that commission public works projects related to transportation, utilities, and social amenities. These governmental bodies act as owners and often financers, driving demand based on political mandates, economic development goals, and regulatory requirements (e.g., environmental standards). Their purchasing decisions are highly influenced by budgetary cycles, competitive bidding laws, and the selection of project delivery methods like Design-Build or PPP, prioritizing long-term value and operational efficiency over minimal upfront cost.

Another major segment includes Public Utility Providers and Quasi-Governmental Agencies, such as electricity transmission system operators, water treatment authorities, airport and port authorities, and telecommunications firms. These entities require specialized infrastructure to deliver essential services and often finance projects through user fees, bond issues, or regulatory tariffs. For instance, private energy companies expanding renewable energy portfolios are major buyers of new transmission and substation infrastructure, necessitating specialized construction expertise tailored to complex environmental and geological constraints. Their buying behavior emphasizes technical compliance, integration capabilities with existing networks, and guaranteed long-term asset performance and reliability.

Finally, Private Sector Developers and Industrial Corporations constitute a vital, albeit secondary, customer segment. This includes residential developers requiring supporting utility connections and access roads; logistics and industrial firms needing dedicated port facilities, warehouses, and rail spurs; and major corporations commissioning specialized infrastructure like data centers or large manufacturing complexes. These private buyers prioritize speed to market, cost certainty, and customized solutions that directly support their core business operations. Their projects often involve EPC contracts and focus heavily on minimizing construction disruption while maximizing operational uptime, demanding contractors with strong vertical integration and advanced project management capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Trillion |

| Market Forecast in 2033 | USD 21.6 Trillion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bechtel, Vinci, ACS Group, China Communications Construction, Fluor, SK E&C, Hyundai E&C, Balfour Beatty, Strabag, Kiewit, Hochtief, Bouygues Construction, Samsung C&T, PCL Construction, Shimizu Corporation, Larsen & Toubro, Arabtec Holding, Eiffage, Ferrovial, Sacyr |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Infrastructure Construction Market Key Technology Landscape

The technological landscape of the Infrastructure Construction Market is rapidly evolving, driven by the need for enhanced efficiency, precision, and sustainability across massive, complex projects. Central to this evolution is the pervasive adoption of Building Information Modeling (BIM), which serves as a collaborative digital framework managing all project information from design through asset operation. BIM facilitates clash detection, visualization, and simulation, drastically reducing rework and improving communication between geographically dispersed stakeholders. Beyond BIM, the incorporation of Geographic Information Systems (GIS) is vital for infrastructure, allowing for sophisticated analysis of site topography, geological conditions, and integration planning with existing urban layouts, ensuring projects are optimized for both environmental context and functional necessity. Furthermore, digital twins—virtual replicas of physical infrastructure—are increasingly being deployed, offering real-time performance monitoring and predictive scenario testing for long-term asset management.

On the construction site, the integration of advanced hardware and sensing technologies is revolutionizing execution. Drones and unmanned aerial vehicles (UAVs) equipped with LiDAR and photogrammetry are essential for rapid, high-resolution site mapping, progress tracking, and safety inspections, replacing time-consuming manual surveys. Coupled with this, construction robotics and automated heavy machinery, guided by GPS and AI, are undertaking repetitive and hazardous tasks, such as automated paving, rebar tying, and precise earthmoving, thereby increasing construction speed and maintaining exceptional quality consistency. These technologies collectively address critical market restraints, specifically labor shortages and the demand for shorter project timelines, fundamentally altering traditional workflows and demanding new digital proficiencies from the construction workforce.

Material innovation is also a significant element of the technology landscape, focusing predominantly on durability and environmental impact reduction. This includes the development and utilization of low-carbon concrete mixes, self-healing materials, and advanced high-performance composite materials (HPC) for structural elements, particularly in high-stress applications like bridge construction. Simultaneously, the implementation of Internet of Things (IoT) sensors embedded within materials and structures allows for continuous, non-invasive monitoring of strain, temperature, and moisture levels throughout the structure's lifetime. This data collection feeds into sophisticated predictive maintenance platforms, maximizing the asset’s longevity and informing strategic maintenance intervention, thus integrating technology not just into the build phase, but into the entire decades-long operational life cycle of the infrastructure asset.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market volume, fueled by aggressive government investments in urbanization, national infrastructure corridors (e.g., China’s Belt and Road Initiative, India’s National Infrastructure Pipeline), and the mass expansion of high-speed rail and smart city initiatives. The region is characterized by high growth rates, intense competition, and a critical need for sustainable project delivery due to rapidly escalating environmental concerns in dense population centers.

- North America: Market growth is driven primarily by modernization and resilience mandates, especially in the United States, following substantial federal infrastructure spending packages focused on upgrading aging utility grids, repairing deficient bridges and roads, and investing heavily in renewable energy transmission capacity. Emphasis is placed on technological integration (BIM, modular construction) and meeting strict safety and environmental standards.

- Europe: Focuses heavily on sustainable infrastructure, decarbonization targets, and cross-border connectivity (e.g., TEN-T network). The European market is mature, characterized by stringent regulations and a significant pipeline of projects related to offshore wind energy infrastructure, hydrogen pipelines, and urban mobility improvements designed to reduce carbon emissions and improve quality of life.

- Middle East and Africa (MEA): This region experiences high growth linked to large-scale, visionary mega-projects (e.g., smart cities in Saudi Arabia and UAE), driven by diversification efforts away from oil economies. Infrastructure development in the MEA region often involves international contractors and sophisticated funding models, focusing heavily on modern transportation hubs, advanced water desalination, and power infrastructure to support rapid population growth and industrialization.

- Latin America: Growth is steady but often hampered by political and economic volatility. Key drivers include necessity-driven investments in basic utilities, water management (especially in drought-prone areas), and essential transportation links to facilitate resource extraction and trade. The adoption of PPP models is gaining traction as a strategy to secure necessary foreign investment and private expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Infrastructure Construction Market.- ACS Group

- Vinci SA

- Bechtel Corporation

- China Communications Construction Group (CCCC)

- Fluor Corporation

- Balfour Beatty plc

- Strabag SE

- Kiewit Corporation

- Bouygues Construction

- Hochtief AG

- Samsung C&T Corporation

- Hyundai Engineering & Construction (Hyundai E&C)

- PCL Construction Enterprises

- Shimizu Corporation

- Larsen & Toubro Ltd. (L&T)

- Arabtec Holding PJSC

- Eiffage SA

- Ferrovial SA

- Sacyr SA

- SK Engineering & Construction

Frequently Asked Questions

Analyze common user questions about the Infrastructure Construction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary investment drivers influencing the Infrastructure Construction Market?

The primary drivers are substantial governmental stimulus packages aimed at economic recovery and resilience, the global imperative for climate change adaptation requiring investment in renewable energy transmission and flood defense systems, and relentless urbanization in emerging economies necessitating new core utilities and mass transit solutions. Additionally, the replacement or upgrade of aging infrastructure in developed nations provides a consistent foundation for market spending.

How is digital technology reshaping infrastructure construction project delivery?

Digital technology, notably Building Information Modeling (BIM), Geographic Information Systems (GIS), and Construction Management Software, is optimizing project delivery by enhancing collaboration, improving design accuracy, and enabling real-time progress tracking. Technologies like drones and autonomous heavy equipment accelerate physical construction, while AI is being increasingly used for predictive maintenance and risk assessment throughout the asset lifecycle.

Which segment within the Infrastructure Construction Market is expected to grow the fastest?

The Utility Infrastructure segment, particularly sub-segments related to smart grid modernization, high-voltage direct current (HVDC) transmission for renewable energy, and advanced water treatment facilities, is forecast to exhibit the highest CAGR. This growth is driven by the global transition to sustainable energy sources and the urgent need for climate-resilient water management systems.

What role do Public-Private Partnerships (PPPs) play in financing large infrastructure projects?

PPPs are critical financing mechanisms, allowing governments to transfer construction and operational risks to the private sector while leveraging private capital and expertise. These models facilitate the execution of mega-projects, especially in the transportation and social infrastructure sectors, easing the fiscal burden on public budgets and often leading to improved efficiency and faster project completion.

What are the key sustainability trends impacting material selection in infrastructure?

Sustainability is shifting material preference toward low-carbon and circular economy solutions. This includes the increased use of recycled aggregates, specialized low-carbon cement and concrete mixes, and modular or prefabricated components that minimize on-site waste. Durability and resilience against extreme weather are also key factors driving the adoption of high-performance composites and self-healing materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Transportation Infrastructure Construction Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Water Infrastructure Construction Market Statistics 2025 Analysis By Application (Public Facility, Industrial, Residential Building), By Type (Applied water, Waste water), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Infrastructure Construction Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Electricity and Power, Roads, Railways, Airports and Ports, Water and Sewerage), By Application (Public Sector, Private Sectors), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager