Injection Port Septa Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443054 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Injection Port Septa Market Size

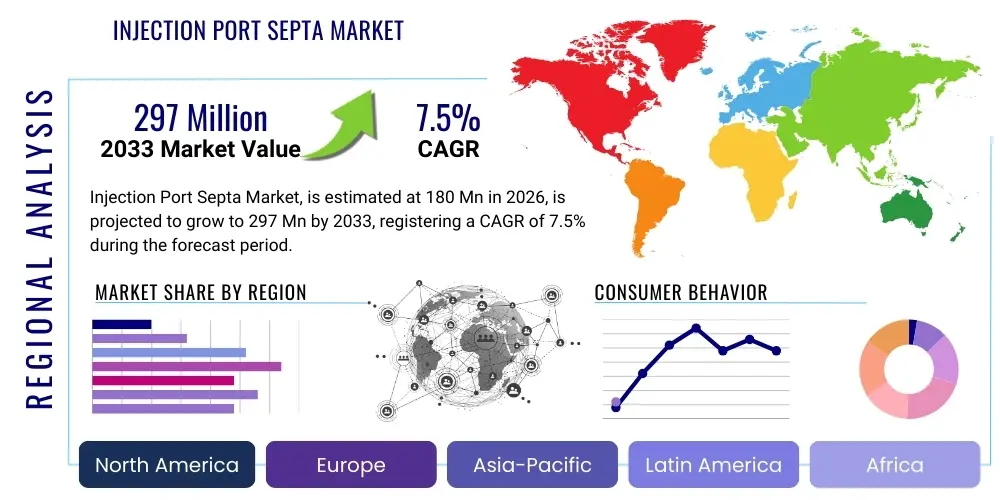

The Injection Port Septa Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 180 million in 2026 and is projected to reach USD 297 million by the end of the forecast period in 2033.

Injection Port Septa Market introduction

The Injection Port Septa Market encompasses specialized consumable components crucial for gas chromatography (GC) and high-performance liquid chromatography (HPLC) systems. Injection port septa function as a high-integrity barrier, ensuring the airtight seal of the injection port while enabling the precise introduction of samples via a syringe into the chromatographic column. These components are typically made from elastomers like silicone, PTFE (Polytetrafluoroethylene), or combinations thereof, designed to withstand high temperatures, repeated puncturing, and chemical exposure from various solvents and analytes. The quality and chemical inertness of the septa directly influence the accuracy, reproducibility, and sensitivity of analytical results, making them indispensable in quality control and research environments.

The principal applications of injection port septa span a wide array of high-stakes analytical fields, including pharmaceuticals, biotechnology, environmental testing, food and beverage safety, and petrochemical analysis. In pharmaceutical quality control, septa facilitate the testing of active pharmaceutical ingredients (APIs) and final drug products for purity and stability. Environmental laboratories rely on septa for volatile organic compound (VOC) analysis in air and water samples. Furthermore, the increasing complexity of regulatory standards globally, necessitating more rigorous and frequent testing, acts as a primary catalyst for market expansion. The core benefit provided by advanced septa materials is the minimization of "bleeding" (the release of volatile components from the septum material), which can otherwise contaminate the sample path and introduce ghost peaks, thereby maintaining chromatographic system integrity.

Driving factors for the sustained growth of this specialized market include the escalating demand for highly sensitive and accurate analytical instruments worldwide, particularly in emerging economies where industrialization and food safety regulations are becoming stringent. Technological advancements in septa material science, such as the development of long-life, low-bleed septa optimized for high-throughput automated systems, significantly contribute to market dynamics. Moreover, the sustained investment in life science research and development, coupled with the routine replacement cycle of these consumables due to wear and tear, ensures a continuous and stable revenue stream for manufacturers.

Injection Port Septa Market Executive Summary

The Injection Port Septa Market is characterized by robust growth, driven primarily by the global expansion of the pharmaceutical and biotechnology sectors and increasingly stringent regulatory requirements mandating precise analytical testing. Business trends highlight a strong focus on material innovation, specifically the shift toward proprietary composite septa that offer superior thermal stability, reduced fragmentation upon injection, and minimal chromatographic interference (low bleed). Manufacturers are actively pursuing strategic partnerships and long-term supply agreements with major analytical instrument providers to secure recurring revenue streams. Key market strategies revolve around product differentiation based on longevity, chemical resistance, and ease of use, catering specifically to high-throughput laboratories that require minimal instrument downtime and maximum sample integrity.

Regionally, North America and Europe maintain dominance, attributed to high levels of R&D expenditure, the presence of major pharmaceutical companies, and established regulatory frameworks governing analytical testing. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid industrialization, burgeoning domestic pharmaceutical manufacturing, and significant government investment in healthcare infrastructure and environmental monitoring capabilities in countries like China and India. This regional diversification is prompting key players to localize manufacturing and distribution networks to optimize supply chain efficiency and reduce logistical costs associated with specialized consumables.

Segment trends indicate a pronounced preference for high-performance septa materials, particularly those integrating PTFE layers with high-purity silicone, offering the optimal balance between resealability and chemical inertness. The market for general-purpose septa remains stable but is seeing slow erosion as complex applications requiring ultra-low detection limits become standard. Furthermore, the specialized septa segment tailored for automated systems, which must handle tens or hundreds of thousands of injections without failure, is experiencing accelerated adoption. The increasing penetration of advanced analytical techniques, such as hyphenated chromatography systems (e.g., GC-MS and LC-MS), further solidifies the demand for premium, precision-engineered injection port septa designed to maintain vacuum integrity and prevent cross-contamination.

AI Impact Analysis on Injection Port Septa Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Injection Port Septa Market primarily revolve around predictive maintenance, automation efficiency, quality control, and the potential for AI-driven material discovery. Users seek to understand how AI can reduce instrument downtime caused by septum failure, optimize injection parameters based on septum degradation, and improve overall laboratory workflow efficiency. Key concerns include whether AI systems can accurately predict the lifespan of specialized septa, ensuring timely replacement before sample contamination occurs, thereby enhancing data quality and compliance. The integration of machine learning algorithms with chromatographic data analysis is expected to streamline method development, indirectly increasing the demand for consistent, high-quality consumables like septa.

- AI optimizes septum usage through predictive maintenance algorithms, reducing unexpected instrument downtime.

- Machine vision systems, powered by AI, enhance quality control during septa manufacturing, ensuring defect-free production.

- AI-driven laboratory information management systems (LIMS) track septum lifespan based on injection count, temperature exposure, and solvent usage, prompting automated reordering.

- Computational chemistry and machine learning accelerate the discovery of new, advanced polymer formulations for ultra-low-bleed septa materials.

- AI optimizes GC and HPLC injection protocols by adjusting parameters (e.g., injector temperature ramps) to compensate for minor septa degradation, maintaining sample integrity over long runs.

DRO & Impact Forces Of Injection Port Septa Market

The Injection Port Septa Market is primarily driven by the expanding global demand for analytical testing services, particularly in the pharmaceutical, life sciences, and food safety sectors. However, the market faces significant restraints related to the sensitivity of pricing pressure for high-volume consumables and the challenge of managing material compatibility across diverse chemical applications. Opportunities for growth are abundant in developing next-generation, self-sealing septa materials and expanding market penetration in emerging economies with rapidly improving regulatory infrastructure. These factors collectively exert complex impact forces on pricing, innovation cycles, and supply chain management within the highly specialized analytical consumables industry, pushing manufacturers toward superior material science and cost-effective production methods.

Drivers: A major driver is the stringent global regulatory environment, particularly the Good Manufacturing Practice (GMP) standards, which mandate comprehensive and reproducible analytical testing, necessitating continuous use and replacement of septa. Furthermore, the continuous increase in pharmaceutical R&D activities, including drug discovery and clinical trials, fuels the demand for chromatographic consumables. The growing concern over environmental pollution and the subsequent rise in environmental monitoring activities, requiring high-throughput analysis of trace contaminants, provides a robust underpinning for market growth. Technological advancements in chromatography, such as miniaturization and higher sensitivity instruments, demand equally high-quality consumables to realize their full performance potential.

Restraints: Key restraints include the finite lifespan of septa, necessitating frequent replacement, which contributes significantly to the operating costs of analytical laboratories, leading to increased pressure on manufacturers to lower unit prices for high-volume orders. Another significant challenge is material "bleed," where volatile components from the septum contaminate the sample, especially at high operating temperatures, which can severely compromise ultra-sensitive analyses. This forces labs to choose expensive, ultra-low-bleed options. Additionally, the lack of standardization across different chromatographic instrument manufacturers requires septa producers to maintain a diverse and complex product portfolio, increasing manufacturing complexity and inventory costs.

Opportunities: Significant opportunities exist in the development of novel septa technologies, such as advanced proprietary polymers offering exceptional chemical resistance and thermal stability up to 450°C, extending the range of applications. The implementation of automation and robotics in analytical laboratories creates a demand for specialized septa designed for enhanced durability and precision in automated injection systems. Furthermore, market expansion into previously underserved regions, particularly in Latin America and certain parts of APAC, represents a greenfield opportunity as these regions rapidly modernize their industrial and regulatory landscapes. Developing recyclable or biodegradable septa also offers a crucial opportunity to align with growing laboratory sustainability goals.

Segmentation Analysis

The Injection Port Septa Market is meticulously segmented based on material type, product characteristics, end-user industry, and application, reflecting the highly specialized nature of chromatographic requirements. Material type is the primary differentiator, influencing chemical inertness, temperature tolerance, and resealability, with silicone and PTFE combinations dominating the high-performance sector. Product characteristics segment the market based on design features such as pre-slitted versus non-slitted, diameter, and thickness, catering to specific instrument requirements and injection volumes. Understanding these granular segments is crucial for manufacturers to tailor their offerings precisely to the diverse needs of analytical laboratories globally, from routine quality control to complex research and development environments.

The application segmentation highlights the dominant role of gas chromatography (GC), where septa must endure extreme thermal conditions and repeated puncture, contrasting with high-performance liquid chromatography (HPLC) which often utilizes different sealing mechanisms but still relies on precision injection components. End-user industries, particularly pharmaceuticals, represent the largest consumption base due to rigorous regulatory testing cycles. The growth rate differential between these segments underscores the market's trajectory, moving toward specialized, high-durability consumables that minimize contamination and enhance the efficiency of increasingly sensitive analytical techniques. This detailed segmentation allows stakeholders to focus on areas offering the highest return on investment, such as the rapidly expanding bioanalytical segment.

- By Material Type:

- Silicone Septa

- PTFE-Lined Silicone Septa

- High-Purity Composite Septa (Proprietary Elastomers)

- Butyl Rubber Septa

- By Product Characteristic:

- Pre-Slitted Septa (Single or Multi-slitted)

- Non-Slitted Septa (Standard)

- Low-Bleed Septa (Certified Ultra-low bleed)

- High-Temperature Septa

- By Application:

- Gas Chromatography (GC)

- High-Performance Liquid Chromatography (HPLC) Systems (Less prevalent use compared to GC)

- Headspace Analyzers

- Sample Vials and Storage

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Food and Beverage Testing Laboratories

- Environmental Testing Agencies

- Petrochemical and Chemical Industries

Value Chain Analysis For Injection Port Septa Market

The value chain for the Injection Port Septa Market begins with the upstream procurement of highly specialized raw materials, primarily high-purity silicone elastomers, PTFE films, and specific chemical additives designed to enhance thermal stability and minimize volatile components. This upstream phase requires stringent quality control to ensure raw material consistency, as any impurity can lead to chromatographic errors (bleed). Key activities include polymerization, compounding, and molding of precision parts, followed by rigorous cleaning and packaging in controlled environments to maintain the ultra-clean standards required by analytical instrumentation. The efficiency of the upstream supply chain is critical, as proprietary material formulations often define the competitive edge of the final product.

The downstream analysis focuses on the distribution and end-user adoption of the septa. Distribution channels are highly structured, relying heavily on specialized analytical instrument distributors and authorized laboratory supply dealers who provide technical support and rapid inventory turnover. Direct distribution often occurs through major instrument manufacturers who private-label or bundle septa with their GC and HPLC systems. Indirect channels, involving third-party suppliers and e-commerce platforms specializing in laboratory consumables, facilitate global reach. The final stage involves the end-user (laboratories) purchasing based on instrument compatibility, application requirements (e.g., high temperature vs. low temperature), and brand reputation for quality and low bleed characteristics.

The interplay between direct and indirect distribution channels significantly influences market penetration. Direct sales by septa manufacturers or their affiliated instrument partners ensure technical consistency and often target large, high-volume contract research organizations (CROs) and pharmaceutical manufacturers. Indirect distribution via third-party catalog suppliers provides crucial flexibility and accessibility, especially to smaller academic or environmental laboratories. Overall, the value chain emphasizes precision manufacturing, certified clean packaging, and a robust, technically supported distribution network to ensure that high-integrity consumables reach sensitive analytical environments efficiently.

Injection Port Septa Market Potential Customers

The primary customers for injection port septa are highly regulated entities that rely on accurate and repeatable chromatographic analysis for quality assurance, regulatory compliance, and scientific research. The pharmaceutical and biotechnology sectors constitute the largest segment of potential customers, consuming septa for routine testing of raw materials, intermediates, stability samples, and finished dosage forms, where high precision and zero contamination are non-negotiable. Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) also represent a high-growth customer segment due to outsourcing trends in drug development and testing.

Beyond the life sciences, environmental testing laboratories are crucial customers. They utilize septa extensively for gas chromatography methods, particularly when analyzing volatile organic compounds (VOCs) and semi-volatile organic compounds (SVOCs) in air, soil, and water samples, requiring robust, temperature-stable septa. Furthermore, the burgeoning food and beverage industry, driven by global food safety regulations, represents a growing customer base, using chromatography to detect contaminants, additives, and authenticity markers. These diverse end-users share a common requirement for high-quality, reliable, and application-specific septa to ensure the integrity of their analytical data and maintain operational efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 180 Million |

| Market Forecast in 2033 | USD 297 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agilent Technologies, Merck KGaA (Sigma-Aldrich), Thermo Fisher Scientific, Restek Corporation, Waters Corporation, PerkinElmer Inc., VWR International (Avantor), SGE Analytical Science (Trajan Scientific), Shimadzu Corporation, Glas-Col, La-Pha-Pack GmbH, National Scientific, Chromacol, J.G. Finneran Associates, Zeo-Pure. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Injection Port Septa Market Key Technology Landscape

The technology landscape in the Injection Port Septa Market is predominantly focused on advanced material science and manufacturing precision, aiming to overcome the twin challenges of thermal degradation and chemical reactivity. A key innovation involves the utilization of proprietary composite materials, often fusing ultra-pure silicone rubbers with high-density PTFE layers. This combination provides the essential barrier properties against reactive solvents while maintaining the self-sealing characteristic required for repeated syringe injections. Manufacturers employ specialized curing processes, such as platinum-cured silicone, to minimize residual volatile organic components (VOCs), thereby achieving the coveted ultra-low bleed designation essential for highly sensitive mass spectrometry (MS) applications coupled with GC systems. Continuous technological refinement in material composition and cross-linking density is critical for achieving higher thermal stability (up to 400°C and above) without compromising resilience.

Precision manufacturing techniques, including highly controlled molding and die-cutting, are central to the technological profile. Consistency in physical dimensions, such as diameter and thickness, is paramount for maintaining system pressure integrity in automated injection systems. Any deviation can lead to leaks, system faults, or poor analytical results. A significant technological advancement is the widespread adoption of pre-slitted septa technology. Slitting involves making fine cuts in the septum surface before use, which dramatically reduces the force required for syringe needle penetration, minimizing needle bending, and decreasing core fragmentation (small pieces of septum breaking off). This fragmentation is a major cause of contamination and blockage in the GC inlet liner, and pre-slitting technology directly addresses this operational bottleneck.

Furthermore, technology is evolving towards intelligent consumables integration. While nascent, efforts are underway to incorporate passive RFID tags or similar identification technologies into the septa packaging or holder assembly. This allows modern analytical instruments to automatically track the installation date, total injection count, and estimated lifespan of the septum. This intelligent tracking capability, combined with laboratory information management systems (LIMS), enables precise utilization monitoring, optimizing replacement schedules, and further enhancing compliance and data integrity. This technological trajectory indicates a move from simple consumables toward integrated, high-tech components within the overall chromatographic system ecosystem.

Regional Highlights

- North America: North America remains the leading market, driven by substantial R&D expenditure in the pharmaceutical and biotechnology sectors, particularly in the US. The presence of major analytical instrument manufacturers and early adoption of high-throughput automated chromatography systems ensure high, continuous demand for premium, ultra-low bleed septa. Stringent regulatory oversight from organizations like the FDA requires constant, certified analytical testing, solidifying the market base for high-quality consumables.

- Europe: Europe holds the second-largest market share, fueled by strong pharmaceutical manufacturing in countries like Germany, Switzerland, and the UK. The European Union's robust environmental monitoring directives (e.g., REACH) necessitate extensive testing of chemicals and pollutants, thereby supporting the consistent demand for GC septa. Innovation centers and universities across the region are consistently pushing the boundaries of analytical chemistry, requiring the latest material technologies.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, characterized by rapid expansion of generic drug manufacturing and increased foreign direct investment into clinical research centers in China, India, and South Korea. Improving environmental standards, increasing food safety concerns, and government initiatives to modernize laboratory infrastructure are significantly driving the consumption of laboratory consumables, presenting lucrative growth opportunities for septa manufacturers.

- Latin America (LATAM): The LATAM market is experiencing steady growth, mainly centered in Brazil and Mexico. Expansion is propelled by rising healthcare expenditure and increasing local pharmaceutical production capabilities. While price sensitivity is higher compared to North America, the demand for reliable, standard-grade septa for routine quality control applications is increasing steadily.

- Middle East and Africa (MEA): Growth in MEA is driven by investments in the petrochemical and oil and gas industries, which utilize GC extensively for quality analysis and refining processes. Development of healthcare infrastructure in GCC countries and South Africa is also contributing to the moderate but continuous expansion of the septa market, focusing primarily on established global brands for assured quality.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Injection Port Septa Market.- Agilent Technologies

- Merck KGaA (Sigma-Aldrich)

- Thermo Fisher Scientific

- Restek Corporation

- Waters Corporation

- PerkinElmer Inc.

- VWR International (Avantor)

- SGE Analytical Science (Trajan Scientific and Medical)

- Shimadzu Corporation

- Glas-Col

- La-Pha-Pack GmbH

- National Scientific

- Chromacol (Part of Thermo Fisher Scientific)

- J.G. Finneran Associates

- Zeo-Pure

- Aijiren Technology Co., Ltd.

- Scientific Glassware & Instruments (S.G.I.)

- Grace Davison Discovery Sciences

- Sun-SRi (S.R.I. Instruments)

- MicroSolv Technology Corporation

Frequently Asked Questions

Analyze common user questions about the Injection Port Septa market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an injection port septum in chromatography?

The injection port septum serves as a critical, reusable seal that maintains system pressure and atmosphere integrity in chromatography instruments, particularly Gas Chromatography (GC), while allowing a syringe needle to pass through cleanly for sample introduction without leakage or air ingress.

Why is material bleed a major concern when selecting septa?

Material bleed refers to the vaporization of volatile compounds from the septum material at high temperatures. This contamination introduces unwanted peaks (ghost peaks) into the chromatogram, severely compromising the accuracy and sensitivity of analytical results, especially in trace analysis applications.

How do pre-slitted septa differ from standard septa, and what is their main advantage?

Pre-slitted septa have fine cuts on the surface, reducing the force required for needle penetration. Their main advantage is minimizing septum coring (fragmentation) and needle damage, significantly extending the life of the septum and the instrument liner, and enhancing automation efficiency.

Which end-user segment drives the highest demand for injection port septa?

The Pharmaceutical and Biotechnology segment drives the highest demand, attributed to the mandatory and frequent analytical testing required for quality control, stability studies, and regulatory compliance of drug products using high-throughput chromatography systems.

What are the most crucial factors to consider when choosing septa for high-temperature GC applications?

For high-temperature GC applications (above 350°C), the crucial factors are maximum operating temperature tolerance, minimal bleed characteristics (often requiring high-purity composite materials), and excellent resealability to prevent air leakage during temperature cycling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager