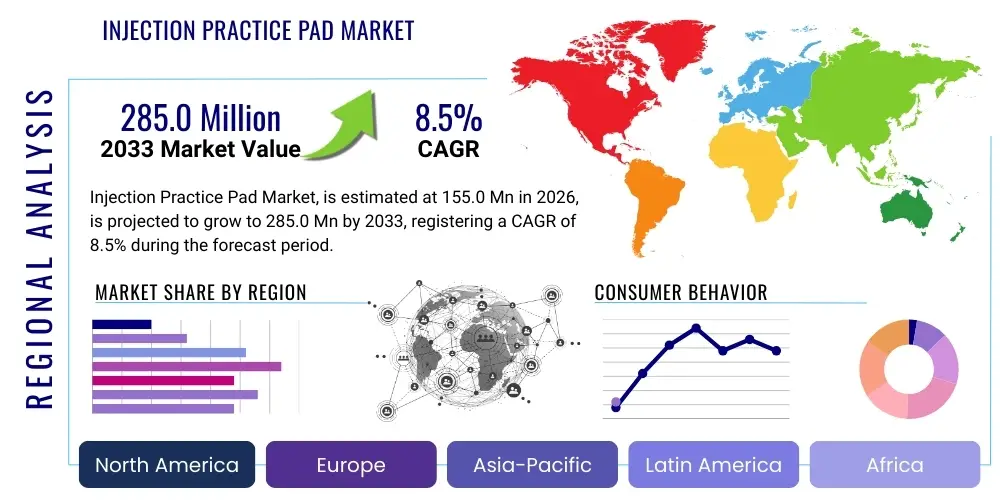

Injection Practice Pad Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443121 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Injection Practice Pad Market Size

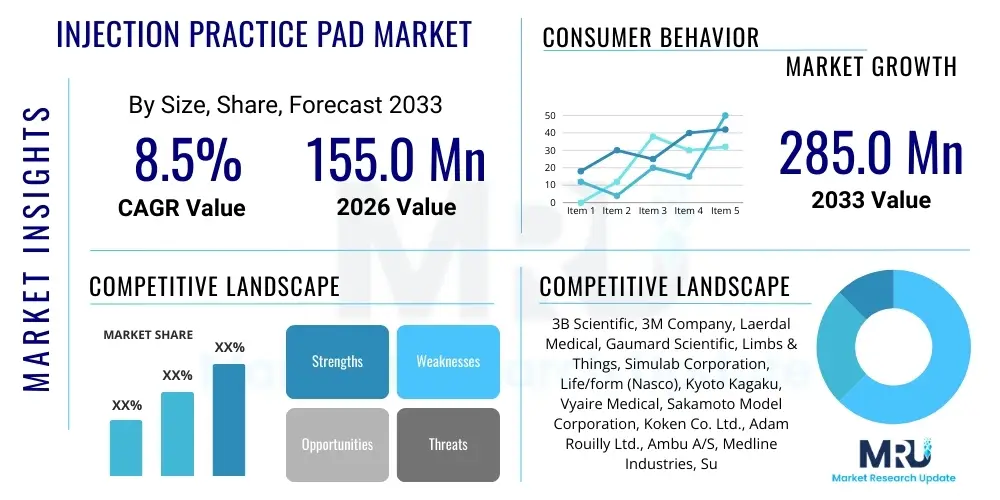

The Injection Practice Pad Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 155.0 Million in 2026 and is projected to reach USD 285.0 Million by the end of the forecast period in 2033.

Injection Practice Pad Market introduction

The Injection Practice Pad Market encompasses the manufacturing and distribution of specialized anatomical models or simulated skin pads designed for training healthcare professionals, students, and laypersons in various injection techniques, including intramuscular (IM), subcutaneous (SC), intradermal (ID), and intravenous (IV) procedures. These training tools are critical components of medical education and patient self-care training, providing a realistic, non-threatening environment for mastering manual dexterity and ensuring patient safety before live practice. Key products range from simple silicone pads mimicking skin texture and resistance to complex models featuring underlying musculature and fluid return systems, enhancing the fidelity of the training experience.

Major applications of injection practice pads span educational institutions, nursing schools, medical colleges, hospitals for staff competency assessment, pharmaceutical companies for device training (e.g., auto-injectors), and home care settings for chronic disease management training (e.g., insulin injections). The primary benefits of utilizing these pads include reducing the risk of accidental needle sticks, minimizing discomfort for patients during learning phases, providing repeatable practice sessions, and standardizing training quality globally. They offer tactile feedback essential for developing the fine motor skills required for accurate needle insertion depth and angle, which is paramount in clinical practice.

The market is predominantly driven by the escalating demand for highly skilled medical personnel globally, coupled with stringent regulatory requirements emphasizing simulation-based training (SBT) in medical curricula. Furthermore, the rise in chronic diseases, such as diabetes, necessitating self-administration of injectable medications, fuels the adoption of these pads for patient education. Technological advancements, particularly the incorporation of realistic materials and sensor integration for feedback, continue to propel market growth by making simulation experiences more effective and measurable.

Injection Practice Pad Market Executive Summary

The global Injection Practice Pad Market is experiencing robust growth driven by the shift towards high-fidelity simulation in healthcare education and mandatory competency requirements across clinical settings. Business trends indicate a strong move toward hybrid models integrating physical pads with digital learning platforms and augmented reality (AR) feedback mechanisms, enhancing the diagnostic and procedural training value. Leading manufacturers are focusing on material innovation to better mimic human tissue resilience, vascular structures, and healing response, thereby commanding premium pricing in professional training sectors. Furthermore, there is a distinct trend towards customization, where pads are tailored to specific drug delivery systems or niche medical procedures, expanding their utility beyond basic nursing skills.

Regional trends reveal North America and Europe maintaining dominance due to well-established simulation centers, advanced medical education infrastructure, and high expenditure on healthcare training technologies. However, the Asia Pacific (APAC) region is poised for the fastest expansion, fueled by increasing medical tourism, rapid establishment of new medical schools, and government initiatives aimed at improving healthcare quality and safety standards. Latin America and the Middle East & Africa (MEA) represent emerging opportunities, characterized by growing awareness regarding standardized clinical training and expanding adoption of foundational medical technologies.

Segment trends highlight the dominance of the Intramuscular (IM) and Subcutaneous (SC) pads by application type, largely due to their ubiquity in general medical practice and patient self-care. Based on material, high-grade silicone and polymer-based pads command the highest market share owing to their durability and realistic feel, although hydrogel-based alternatives are gaining traction for ultra-realistic tactile feedback. The end-user segment is led by academic institutions (nursing schools, universities) globally, yet hospitals and clinical skill centers are showing accelerated procurement rates for continuous professional development and procedural recertification.

AI Impact Analysis on Injection Practice Pad Market

Common user inquiries regarding AI’s impact on the Injection Practice Pad Market center around whether AI will replace physical simulation entirely, how AI can enhance the feedback provided by pads, and the potential for AI-driven personalized training curricula. Users frequently seek reassurance regarding the continued relevance of tactile training while exploring how technology can overcome traditional simulation limitations. Analysis shows that the key themes revolve around integration, not replacement. Users anticipate AI acting as a sophisticated co-pilot, interpreting biometric and procedural data captured during practice sessions, providing granular performance metrics, and adjusting subsequent training scenarios dynamically. The expectation is that AI will transform basic physical pads into intelligent feedback systems, optimizing learning paths and accelerating skill acquisition for complex or high-risk injection procedures.

The primary concern remains the cost and complexity associated with integrating advanced sensors and AI processing capabilities into what are traditionally low-cost, disposable training aids. However, developers are addressing this by focusing on centralized AI algorithms that analyze output from basic sensors (e.g., pressure, insertion angle) embedded in the pads, communicating feedback via connected applications. This synergy ensures the core tactile experience remains essential, while the educational efficacy is exponentially improved through objective, real-time assessment, reducing reliance on human instructors for initial skill grading. This shift ensures the market moves towards 'Smart Simulation Pads,' retaining the necessity of the physical product while leveraging cognitive technology.

- AI-driven performance evaluation: Analyzing needle insertion depth, angle, and steadiness in real-time.

- Personalized training modules: Generating custom practice routines based on trainee weakness identification.

- Augmented Reality (AR) integration: Overlaying anatomical data onto the physical pad via smart devices, guided by AI.

- Automated feedback systems: Providing objective, quantifiable scores immediately post-injection procedure.

- Predictive analytics: Identifying trainees at risk of procedural failure based on simulation data.

- Enhanced realism calibration: Using machine learning to refine material properties based on trainee interaction data.

DRO & Impact Forces Of Injection Practice Pad Market

The Injection Practice Pad Market dynamics are shaped by a strong interplay of drivers stemming from healthcare modernization and restraints related to material costs and durability, alongside substantial opportunities in emerging economies and technological convergence. Key drivers include the global mandate for standardized medical training, the increasing prevalence of diabetes and other chronic conditions requiring self-injection skills, and the demonstrable efficacy of simulation-based training in reducing medical errors. These factors combine to create a sustained demand foundation, particularly in professional education settings where procedural competency must be rigorously verified.

Restraints primarily involve the high upfront cost associated with high-fidelity, advanced practice pads compared to traditional static models, limiting adoption in resource-constrained environments. Furthermore, the limited lifespan and necessary frequent replacement of disposable and semi-disposable pads contribute to high long-term operating costs for training centers. Opportunities are abundant, focusing on the expansion into patient-centric training, such as customized pads for pediatric care or complex vascular access procedures, and geographical expansion into APAC and Latin American markets where medical infrastructure development is accelerating. Strategic alliances between manufacturers and medical device companies to create injection-specific training kits also represent a significant avenue for growth.

The impact forces driving this market include technological advances in synthetic skin materials that offer superior tactile realism (Impact Force 1: Material Innovation), mandatory clinical skill assessment protocols in developed nations (Impact Force 2: Regulatory Compliance), and the shift towards decentralized training models facilitated by portable practice pads (Impact Force 3: Decentralization of Medical Education). These forces collectively ensure sustained market expansion, pushing manufacturers toward innovative product development that balances realism, durability, and cost-effectiveness to meet the diverse needs of both academic and clinical end-users.

Segmentation Analysis

The Injection Practice Pad Market is comprehensively segmented based on product type, application, material, and end-user, allowing for a detailed understanding of consumer preferences and market demand dynamics across various healthcare sectors. Product types differentiate between simple single-site pads and complex multi-site trainers, often including venous or arterial structures. Application segmentation highlights the specific clinical skills being taught, such as basic needle insertion versus specialized vascular access. Material composition dictates the level of realism and durability, while the end-user analysis specifies the primary consumers, ranging from academic institutions to pharmaceutical companies.

Detailed analysis of these segments reveals that Intramuscular (IM) and Subcutaneous (SC) pads constitute the largest share due to their fundamental role in general practice and chronic disease management. The End-User segment is dominated by Academic & Research Institutions, reflecting the continuous influx of students requiring foundational training. However, the fastest-growing segment is expected to be Hospitals & Clinical Skill Centers, driven by the need for continuous professional development (CPD) and maintenance of high clinical standards among existing staff. Strategic market players are increasingly focusing on developing versatile, modular pad systems to cater to multiple application needs simultaneously, thereby maximizing value for institutional buyers.

- By Product Type:

- Single-Site Injection Pads

- Multi-Site Injection Trainers

- IV/Venipuncture Pads

- Advanced Injection Simulators (with fluid reservoirs)

- By Application:

- Intramuscular (IM) Injection Practice

- Subcutaneous (SC) Injection Practice

- Intradermal (ID) Injection Practice

- IV/Venipuncture and Blood Draw Training

- Central Line Insertion Practice

- By Material:

- Silicone/Elastomer-Based Pads

- Polymer-Based Pads (PVC, Thermoplastics)

- Hydrogel/Gelatin-Based Pads

- Natural Rubber/Latex-Free Materials

- By End-User:

- Academic & Research Institutions (Medical Colleges, Nursing Schools)

- Hospitals & Clinical Skill Centers

- Pharmaceutical & Medical Device Companies

- Home Healthcare & Patient Training

Value Chain Analysis For Injection Practice Pad Market

The Value Chain for the Injection Practice Pad Market begins with upstream activities centered on the procurement and refinement of specialized raw materials, primarily medical-grade silicone, advanced polymers, and hydrogel compounds, which dictate the realism and biocompatibility of the final product. Key suppliers in this phase include specialized chemical companies and elastomer manufacturers. Manufacturing involves precision molding, casting, and assembly, often incorporating embedded sensors, artificial vascular structures, and fluid recirculation systems for high-fidelity trainers. Quality assurance and compliance with healthcare simulation standards (e.g., ISO guidelines) are critical steps at this stage to ensure product safety and educational effectiveness.

The distribution channel is characterized by a mix of direct and indirect sales models. Direct sales are often utilized for large institutional contracts with major academic centers, where customization and long-term support are required. Indirect channels involve partnering with specialized medical and surgical equipment distributors, educational supply wholesalers, and increasingly, e-commerce platforms specializing in simulation technology. These distributors play a vital role in inventory management, localized marketing, and rapid deployment to smaller clinical practices and individual consumers. The final downstream phase involves the end-users—medical students, practicing clinicians, or patients—where the pad is integrated into structured training curricula or self-practice routines.

The efficiency of the value chain is significantly impacted by logistical capabilities, given that some high-fidelity pads have limited shelf lives or require specific storage conditions. Furthermore, intellectual property rights concerning proprietary materials and embedded technology create bottlenecks and competitive advantages for firms investing heavily in R&D. Optimization of the value chain focuses on reducing the cost of high-grade raw materials while simultaneously improving the durability and realism of the simulation pads, ensuring a balance between educational value and operational expenditure for the purchasing institution.

Injection Practice Pad Market Potential Customers

The primary end-users and buyers of Injection Practice Pads are broadly categorized into educational, clinical, and commercial entities, each having distinct requirements regarding realism, durability, and complexity. Academic institutions, including university medical programs, nursing schools, and technical training colleges, form the largest foundational customer base, utilizing these pads extensively for mandatory procedural skill training before student interaction with live patients. These institutions prioritize bulk purchasing, curriculum integration ease, and products that offer robust durability to withstand repeated use across multiple cohorts of students annually.

Hospitals, large clinical networks, and independent skill centers represent a high-value customer segment focused on continuous professional development (CPD), staff onboarding, and competency validation for specialized procedures, such as IV therapy and advanced medication administration. For clinical environments, the demand leans towards high-fidelity pads that mimic specific patient populations (e.g., geriatric skin models or pediatric venous access) and can be used in combination with proprietary medical devices. The procurement decisions in this segment are often driven by patient safety metrics and accreditation requirements.

A rapidly growing customer segment includes pharmaceutical and medical device manufacturers who use these pads extensively for demonstrating and training patients or practitioners on the correct usage of novel drug delivery systems, such as insulin pens, auto-injectors for biological therapies, or pre-filled syringes. This segment demands specialized, often disposable, pads that accurately simulate the resistance and tactile feedback specific to their proprietary devices. Furthermore, individual practitioners and patients managing chronic conditions (e.g., diabetes) who require self-injection training represent a substantial direct-to-consumer market, seeking simplicity and realistic self-training tools for home use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Million |

| Market Forecast in 2033 | USD 285.0 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3B Scientific, 3M Company, Laerdal Medical, Gaumard Scientific, Limbs & Things, Simulab Corporation, Life/form (Nasco), Kyoto Kagaku, Vyaire Medical, Sakamoto Model Corporation, Koken Co. Ltd., Adam Rouilly Ltd., Ambu A/S, Medline Industries, Sunlife Science, Wallcur, Inc., HealthScience International, Clinical Skills Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Injection Practice Pad Market Key Technology Landscape

The technological landscape of the Injection Practice Pad Market is rapidly evolving from basic inert models to sophisticated interactive training tools. The foundational technology remains the advancement in materials science, specifically the development of proprietary synthetic skins and tissues that accurately replicate human biomechanical properties, including elasticity, puncture resistance, and self-sealing capabilities. High-grade medical silicone and complex polymer matrices are engineered to closely mimic the dermis, epidermis, and subcutaneous fat layers, ensuring that the tactile feedback experienced by the trainee is highly authentic. Manufacturers continuously invest in optimizing the composition of these materials to extend the lifespan of the pads without compromising realism.

A significant technological shift involves the integration of smart components. Modern injection pads often feature embedded sensors—such as pressure transducers, micro-accelerometers, and positional sensors—to capture granular data related to needle insertion angle, depth penetration, force applied, and withdrawal speed. This raw data is often wirelessly transmitted (e.g., via Bluetooth) to dedicated software platforms. This sensor integration facilitates objective, quantitative performance assessment, moving beyond subjective instructor evaluation and fulfilling the requirements of modern simulation-based education methodologies.

Furthermore, technology is enhancing functional realism. Advanced IV practice pads incorporate closed-loop fluid systems that allow for simulated blood return (flashback) upon successful venous access, reinforcing correct technique. The future direction involves integrating these pads into broader virtual or augmented reality (VR/AR) training environments. AR overlays can display real-time anatomical structures or guide indicators directly onto the physical pad, merging the essential physical skill practice with contextual digital information, creating a hybrid learning experience that maximizes instructional efficacy and prepares trainees for dynamic clinical scenarios.

Regional Highlights

The global Injection Practice Pad Market exhibits significant regional variations in growth drivers, technological adoption rates, and end-user demands, yet all regions are unified by the common goal of improving clinical training standards.

- North America (U.S. and Canada): This region dominates the market due to high healthcare expenditure, the presence of stringent accreditation bodies requiring simulation competency (e.g., ACGME, CCNE), and a mature network of dedicated simulation centers. Demand is concentrated on high-fidelity, sensor-equipped simulators and pads for advanced procedural training and recertification. Early adoption of smart technology integration, including AI-driven feedback systems, positions North America as a technological leader.

- Europe (Germany, UK, France, etc.): Europe represents the second-largest market, driven by universal healthcare quality standards and a strong focus on nursing education reform. Countries like Germany and the UK show high procurement rates from academic institutions. The market is moderately mature, with a steady shift towards sustainable and durable simulation solutions to meet long-term training needs while adhering to strict material safety regulations.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is projected to be the fastest-growing region owing to rapid expansion of medical infrastructure, increasing governmental investment in healthcare education, and a vast, growing population requiring specialized medical care. While price sensitivity remains a factor, the demand for foundational IM/SC pads is surging in rapidly developing economies like India and China, compensating for the historical gap in simulation training.

- Latin America (Brazil, Mexico): Characterized by increasing investment in public health systems and expanding medical education access. The market is emerging, driven by the need to standardize basic nursing and clinical skills. Adoption focuses on mid-fidelity, cost-effective pads, though specialized clinical centers in urban hubs are beginning to procure advanced simulation trainers.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) due to high per capita income and investment in world-class medical cities and international partnerships for clinical training. The rest of Africa presents nascent opportunities, focusing on fundamental training tools essential for addressing high disease burdens and skills gaps.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Injection Practice Pad Market.- 3B Scientific

- 3M Company

- Laerdal Medical

- Gaumard Scientific

- Limbs & Things

- Simulab Corporation

- Life/form (Nasco)

- Kyoto Kagaku

- Vyaire Medical

- Sakamoto Model Corporation

- Koken Co. Ltd.

- Adam Rouilly Ltd.

- Ambu A/S

- Medline Industries

- Sunlife Science

- Wallcur, Inc.

- HealthScience International

- Clinical Skills Ltd.

Frequently Asked Questions

Analyze common user questions about the Injection Practice Pad market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials provide the highest realism in injection practice pads?

The highest level of realism is generally achieved using advanced medical-grade silicone elastomers and proprietary hydrogel compositions, which closely mimic the elasticity, density, and tactile resistance of human skin and subcutaneous tissue layers. Self-sealing properties are also key to realism and product longevity.

How is the adoption of Injection Practice Pads influenced by self-care trends?

The rise in chronic diseases, particularly diabetes requiring insulin administration, significantly drives demand for simple, durable practice pads used in home healthcare and patient education settings. These pads are essential tools for teaching patients safe and accurate self-injection techniques, mitigating the risk of complications.

What is the primary difference between high-fidelity and low-fidelity injection pads?

Low-fidelity pads offer basic puncture resistance and are cost-effective for foundational training. High-fidelity pads integrate complex features such as multi-layered tissue simulation, internal fluid reservoirs, simulated vascular structures with palpable pulses, and embedded sensors for objective performance measurement and feedback.

Which geographical region shows the fastest projected growth rate for this market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly developing healthcare infrastructure, significant governmental focus on standardizing medical education, and the expansion of the population requiring clinical services.

Are Injection Practice Pads being replaced by Virtual Reality (VR) simulators?

No, VR simulators complement rather than replace physical injection pads. Physical pads remain essential for developing critical haptic (touch-based) skills and muscle memory, which VR cannot fully replicate. The market trend is towards hybrid training, combining the tactile benefits of pads with the analytical and scenario-based capabilities of digital simulation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager