Ink Proofers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441705 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Ink Proofers Market Size

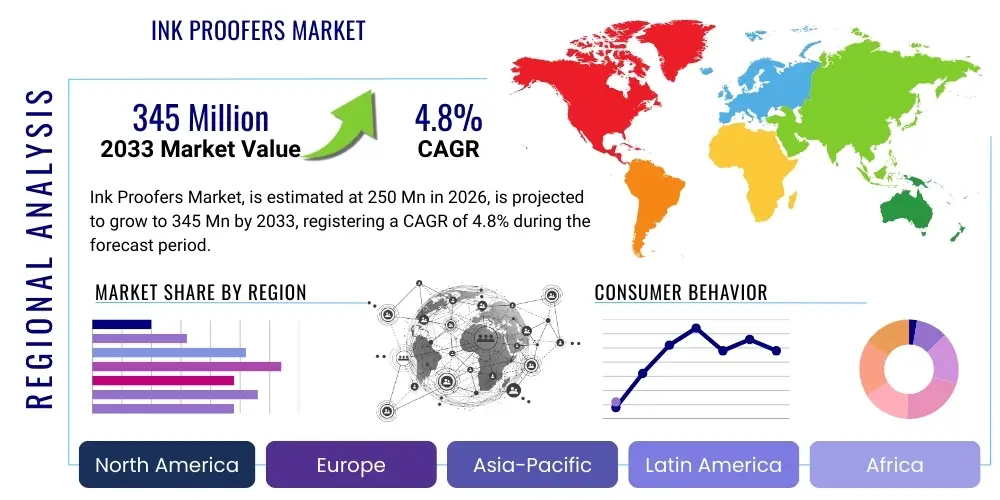

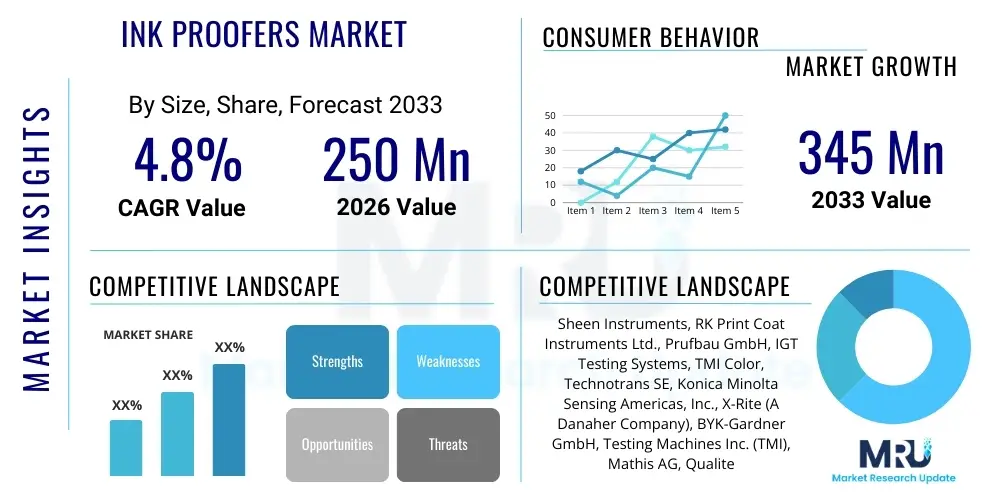

The Ink Proofers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $345 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the increasing demand for high-quality, standardized color reproduction across the packaging, publication, and specialty printing sectors, where precision in color matching is paramount for brand consistency and regulatory compliance.

Ink Proofers Market introduction

The Ink Proofers Market encompasses specialized equipment designed to simulate the final print characteristics of ink before large-scale production begins. These devices, which include bench-top units, automatic proofers, and specialized instruments for flexographic and gravure inks, are critical tools in process control and quality assurance within the graphic arts industry. Their primary function is to determine critical ink properties such as color density, laydown uniformity, light fastness, and rub resistance under controlled, reproducible conditions. This ability to accurately predict print results minimizes costly press downtime, reduces material waste associated with iterative adjustments, and accelerates the time-to-market for printed goods.

Ink proofers serve various major applications, including validating new ink formulations, ensuring batch-to-batch consistency of purchased inks, and calibrating printing plates and presses according to industry standards like ISO 12647 and G7 specifications. Key benefits derived from the adoption of advanced ink proofing technology include enhanced supply chain reliability, significant operational cost reductions, and superior client satisfaction due to precise color fidelity. The equipment plays a non-negotiable role in sectors demanding stringent quality, such as pharmaceutical packaging, luxury goods labeling, and high-end commercial printing, where visual defects or color deviations are unacceptable.

The market is predominantly driven by global trends toward shorter print runs requiring rapid setup and verification, alongside the escalating regulatory requirements for product traceability and consistent branding in competitive markets. Furthermore, the shift towards sustainable, low-VOC (Volatile Organic Compound) and UV-cured inks necessitates reliable proofing equipment capable of accurately testing the performance characteristics of these complex, modern formulations. Technological advancements, particularly in automated film applications and digital densitometry integrated into proofing systems, further propel market expansion by offering higher reproducibility and less reliance on operator subjectivity.

Ink Proofers Market Executive Summary

The Ink Proofers Market is characterized by steady technological evolution, favoring automation and integration into digital color management workflows. Current business trends indicate a strong move toward high-precision instruments that support multi-substrate testing, reflecting the diversification of materials used in packaging, including flexible films, corrugated board, and specialty paper stocks. Key market participants are investing heavily in R&D to develop software interfaces that allow seamless data sharing between the proofing station and the printing press, thereby closing the loop in the quality control process. The demand surge for robust proofing solutions is also driven by the ongoing consolidation of the printing industry, where large print conglomerates require standardized, globally harmonized proofing protocols to manage production across multiple facilities and geographies efficiently.

Regionally, the Asia Pacific (APAC) market is exhibiting the fastest growth due to the exponential expansion of the packaging industry, driven by rising consumer demand in populous economies like China and India, and the increasing adoption of modern printing standards. North America and Europe, while mature, remain dominant in terms of value, characterized by the early adoption of highly sophisticated, fully automated proofing systems and stringent regulatory environments that enforce colorimetric standards. The transition toward digital printing technologies is also influencing regional trends, pushing traditional ink proofer manufacturers to develop hybrid solutions that bridge the gap between conventional analog proofing and digital output simulation for color validation.

Segment trends reveal that gravure and flexographic proofing segments are experiencing robust growth, particularly in flexible packaging and converting industries, necessitating specialized proofers that accurately replicate the cell structure and ink transfer characteristics of those processes. In terms of product type, automated motorized proofers are gaining prominence over manual hand-held devices due to their superior repeatability and reduced risk of human error, critical factors in high-stakes printing environments. Furthermore, the specialized coatings and varnishes segment requires proofing solutions tailored to measure unique tactile and protective properties, ensuring functional as well as aesthetic quality is maintained across the final printed product.

AI Impact Analysis on Ink Proofers Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Ink Proofers Market typically revolve around three key areas: the potential for AI to automate color correction and formulation, the capability of AI-driven systems to predict printing defects before they occur, and whether AI integration will eventually render traditional physical proofing obsolete. Users are primarily concerned with how AI can enhance the speed and accuracy of color matching, reduce the reliance on skilled human operators for subjective evaluations, and improve overall operational efficiency within highly regulated production environments. The core expectation is that AI will transform proofing from a static quality check into a dynamic, predictive component of the printing workflow.

The immediate and tangible impact of AI is seen in data aggregation and predictive analytics. AI algorithms are increasingly being used to analyze vast datasets generated by proofing instruments, linking proofing results (color, density, consistency) with final press outcomes. This correlation allows the system to establish precise tolerance thresholds and automatically suggest real-time adjustments to ink viscosity or formulation before production begins, significantly minimizing waste. This shift from reactive quality control to proactive process management represents a profound change, enhancing the value proposition of modern, connected ink proofing instruments and driving demand for smart, network-enabled devices.

While AI will not replace the fundamental need for a physical ink proof to validate substrate interaction and real-world ink laydown, it drastically optimizes the interpretation and application of the resulting data. AI integration, especially through machine learning models trained on decades of printing data, enables highly refined color management systems that can predict metamerism, account for complex substrate interactions, and even model the impact of varying environmental conditions on the final print appearance. This technological layer provides a crucial competitive advantage for manufacturers and printing houses that leverage these insights to maintain perfect color consistency across multiple materials and print runs globally.

- AI optimizes color formulation algorithms, reducing the time required for accurate ink matching.

- Predictive analytics driven by AI minimizes defects by forecasting press performance based on proofing data.

- Machine learning enhances calibration processes by automating adjustments for substrate variability.

- AI-integrated proofers provide objective pass/fail criteria, reducing human subjectivity in quality control.

- Automation of data logging and reporting streamlines compliance with ISO and brand standards.

- AI facilitates closed-loop feedback systems between the proofer, formulation software, and the printing press.

- Remote diagnostics and maintenance are improved through AI analyzing instrument performance patterns.

DRO & Impact Forces Of Ink Proofers Market

The Ink Proofers Market is shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define its Impact Forces. Primary drivers include the intensifying demand for color standardization across global brands, the zero-tolerance policy for color inconsistencies in high-value packaging sectors (like pharmaceuticals and cosmetics), and stringent regulatory enforcement that mandates documented proof of quality. Restraints often center on the high initial capital investment required for automated, high-end proofing systems, particularly challenging for small and medium-sized print shops, and the persistent need for highly trained technicians to operate and maintain sophisticated colorimetric instruments. Key opportunities emerge from the transition to sustainable and functional inks (e.g., conductive inks, security inks), which require specialized proofing techniques, and the massive growth potential in emerging markets eager to adopt global quality standards.

One of the most powerful impact forces is the continuous pressure on the printing industry to reduce waste and improve sustainability. Ink proofers directly address this by minimizing the number of press setups needed to achieve the target color, translating into substantial savings in ink, paper, and labor hours. This economic benefit significantly outweighs the initial investment cost over the long term, pushing large enterprises toward adopting the most accurate and repeatable proofing solutions available. Conversely, the restraint posed by technological complexity acts as a filter, favoring manufacturers who can offer intuitive software and comprehensive support services to ensure effective utilization of the equipment by a global workforce with varying skill levels.

Another critical impact force is the accelerating speed of production cycles, particularly in digital and short-run printing. Proofing must be fast, reliable, and integrable into automated workflows to keep pace. The opportunity here lies in developing hybrid proofers that can handle both conventional and digital output verification, providing a unified quality metric across different production technologies. Companies that leverage these opportunities by developing compact, rapid-testing systems that integrate seamlessly with cloud-based color databases are positioned for significant market penetration, especially as global brands increasingly rely on decentralized printing networks that demand absolute color fidelity regardless of the production location.

Segmentation Analysis

The Ink Proofers Market is broadly segmented based on the type of printing technology supported, the level of automation offered by the equipment, and the specific end-use application of the printed material. Understanding these segments is crucial for manufacturers to tailor their product offerings and for end-users to select equipment that matches their specific production needs, whether it involves high-speed flexible packaging printing (requiring flexographic proofers) or highly accurate commercial offset printing. The market is increasingly specializing, moving away from universal testing devices toward process-specific instrumentation designed to replicate the exact shearing forces, ink viscosity, and pressure dynamics relevant to a specific print methodology.

Segmentation by technology is vital because the transfer mechanism differs vastly between offset, gravure, and flexography, meaning a proofer must replicate these mechanisms faithfully to yield accurate results. Automation segmentation reflects the shift towards industrial scale, where motorized and fully automated systems offer the highest throughput and repeatability, favored by major converters, contrasting with simpler, manual draw-down units used primarily in R&D or smaller labs for initial formulation checks. End-user application segmentation highlights the varying standards and substrate requirements of key industries, such as security printing demanding proofing of specialized security inks, versus general commercial printing focusing purely on color fidelity and density measurements.

- By Printing Technology:

- Offset Proofers

- Flexographic Proofers

- Gravure Proofers

- Digital Proofing Simulation Systems

- By Automation Level:

- Manual Proofers (Hand-held Draw-down)

- Semi-Automatic/Motorized Proofers

- Fully Automatic Proofing Systems

- By End-Use Application:

- Packaging (Flexible, Corrugated, Folding Carton)

- Commercial Printing and Publications

- Specialty Printing (Security, Functional/Conductive Inks)

- Textiles and Decor Printing

- By Product Type:

- Standard Ink Proofer Units

- Anilox Roll Transfer Systems

- Specialized Coating Applicators

Value Chain Analysis For Ink Proofers Market

The Value Chain for the Ink Proofers Market begins with upstream activities involving the sourcing of high-precision components, including specialized measuring sensors, motorized systems for application uniformity, and advanced materials for roller construction, often sourced from highly specialized electronics and engineering firms. Critical upstream elements also include the development of proprietary colorimetric software and calibration standards compliant with international bodies like CIE and ISO. Key challenges in this stage include maintaining supply chain resilience for highly specialized optics and ensuring that software updates keep pace with evolving ink chemistries and printing press technologies.

The core of the value chain is the manufacturing and assembly phase, where proofing instruments are precision-engineered to meet demanding repeatability specifications. This phase includes meticulous calibration and certification of the instruments before distribution. Following manufacturing, the distribution channel is crucial; this typically involves a mix of direct sales to major printing conglomerates and indirect channels via specialized distributors or agents who also provide localized technical support and training. Given the technical nature of the equipment, after-sales service, including calibration verification, repair, and software maintenance contracts, constitutes a significant portion of the value delivered to the customer.

Downstream activities involve the final end-users—printing houses, converters, and ink manufacturers—who integrate these proofers into their quality control loops. The efficiency and accuracy of the proofer directly impact the end-user’s operational profitability and quality adherence. Direct distribution is often preferred for large, strategic accounts as it allows manufacturers to maintain tight control over installation, training, and data collection, feeding valuable usage data back into R&D for product improvement. Indirect distribution, leveraging local market expertise, is vital for penetrating geographically fragmented markets where immediate technical support is a competitive necessity. The downstream success of the proofer relies heavily on its integration into existing digital color management workflows (like spectrophotometers and color servers).

Ink Proofers Market Potential Customers

The primary buyers and end-users of ink proofing equipment are entities deeply embedded in the printing and packaging ecosystem, where color fidelity and material consistency are fundamental to their business model and client contracts. These include large-scale commercial printing houses specializing in catalogs, magazines, and marketing materials, where brand colors must be perfectly maintained across millions of impressions. Ink manufacturers are also critical potential customers, utilizing proofers extensively in their R&D laboratories and quality control departments to ensure every batch of ink meets density, viscosity, and color matching specifications before shipping to clients, often using the proofing results as part of their Certificate of Analysis (CoA).

A second major segment comprises flexible packaging and converting companies. Given the rapid shift towards digitally enhanced and sustainable packaging materials, these companies rely on flexographic and gravure proofers to validate ink performance on non-absorbent substrates like films and foils. Their buying decisions are often influenced by the proofer's ability to replicate high line screen printing and accurately test specialized coatings or lamination properties. The stringent regulatory requirements of the food and pharmaceutical sectors drive their purchasing criteria, emphasizing systems that offer documented, auditable proofing processes to ensure compliance and material safety.

Furthermore, educational institutions, technical trade schools, and independent graphic arts consultants represent a niche but important customer base. These entities use ink proofers for training future printing professionals and for conducting third-party verification and quality auditing services for brands. For all potential customers, the purchasing decision is a capital expenditure based on return on investment (ROI), calculated through expected reductions in press setup time, minimization of waste, and the enhanced reputation gained from guaranteed color consistency and superior print quality, leading them to prioritize high-end, automated solutions with minimal variability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $345 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sheen Instruments, RK Print Coat Instruments Ltd., Prufbau GmbH, IGT Testing Systems, TMI Color, Technotrans SE, Konica Minolta Sensing Americas, Inc., X-Rite (A Danaher Company), BYK-Gardner GmbH, Testing Machines Inc. (TMI), Mathis AG, Qualitest International Inc., K-Printing Proofer, Erichsen Wuppertal, Ametek MOCON, Hanatek Instruments, Thwing-Albert Instrument Company, HunterLab, TQC Sheen, Teledyne FLIR. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ink Proofers Market Key Technology Landscape

The technological landscape of the Ink Proofers Market is rapidly evolving, moving away from purely mechanical drawdown techniques toward highly controlled, digital-integrated systems. The current focus is on replicating the exact dynamics of a modern printing press, including precise control over roller pressure, speed, and temperature, which are critical variables in ink transfer, especially in flexography and gravure printing. Key innovations include the incorporation of micro-electromechanical systems (MEMS) for highly accurate measurement of film thickness and the development of specialized anilox roll transfer mechanisms designed to accurately simulate the high-line screens used in high-definition flexible packaging. This dedication to precision mechanical engineering is coupled with advanced sensor technology, ensuring the physical proof is as representative as possible of the final printed product.

The integration of advanced colorimetric and spectroscopic technology is another defining feature of the modern proofer. Many high-end systems now include integrated spectrophotometers or densitometers, allowing for instantaneous measurement and digital archiving of the proof results according to standards like CIE L*a*b* values. This connectivity transforms the proofer from a standalone testing device into a core component of the wider digital color management workflow. Furthermore, there is a growing trend toward automated cleaning and dispensing systems within proofers, minimizing manual intervention and significantly improving the repeatability of the proofing process, which is essential for certification and regulatory compliance.

Looking ahead, the development of software solutions is paramount. Modern proofers leverage cloud connectivity for data logging, global standard sharing, and remote diagnostics. This allows multi-national corporations to enforce uniform proofing protocols across all their sites globally. The push towards sustainable inks, including water-based and specialty UV/EB curable inks, drives the need for proofers capable of accurately simulating their unique drying and adhesion characteristics, often requiring specialized heating or curing elements integrated directly into the proofing unit. The future landscape is centered on smart, self-calibrating systems that require minimal operator input and maximize data integrity.

Regional Highlights

-

North America: North America represents a mature yet highly valuable market segment characterized by the stringent quality demands of major brand owners and the widespread adoption of standardized printing protocols, notably G7 certification. The market here demands high-end, fully automated proofing systems capable of seamless integration into complex Enterprise Resource Planning (ERP) and color management infrastructures. Growth is steady, driven by the replacement cycle of older manual equipment with advanced motorized proofers that offer superior data traceability and repeatability, particularly within the pharmaceutical, consumer packaged goods (CPG), and high-security printing sectors. The robust regulatory environment concerning packaging safety and environmental standards (e.g., California’s environmental regulations) necessitates continuous investment in proofing technology capable of testing new, environmentally friendly ink formulations and substrates, ensuring their performance metrics are met before mass production. The regional emphasis is on efficiency, automation, and minimizing labor costs through smart technology.

The United States, as the primary consumer of high-quality printing services, leads the regional demand. Major printing conglomerates operate large, centralized facilities requiring network-enabled proofing solutions for standardized quality control across diverse product lines. Canada also contributes significantly, focusing heavily on sustainable printing practices, which necessitate accurate proofing of specialized, compliant inks. Key technology buyers are not just the printers themselves, but increasingly the brand owners and converters who require documented proof of color conformity as a prerequisite for engaging printing partners. Competitive dynamics in this region focus on service contracts, software integration capabilities, and the overall system repeatability (dE values). The market is saturated with established players, making technological differentiation and superior customer support the primary competitive levers. The adoption rate of AI-enhanced proofing software, which predicts ink behavior based on historical run data, is highest in this technologically advanced region. -

Europe: Europe is a highly diverse market segment, with Western Europe (Germany, UK, France) exhibiting high technological maturity and Eastern Europe demonstrating accelerating growth due to industrial modernization. The European market is strongly influenced by ISO standards (particularly ISO 12647 series), which are widely adopted and legally enforced across various printing sectors. This regulatory framework drives consistent demand for certified, calibrated proofing equipment. Germany, with its strong engineering and printing machinery sector, remains a critical hub for innovation and demand, emphasizing precision gravure and offset proofers for high-end publication and label printing. The overall market is characterized by fragmentation among SMEs, leading to substantial demand for modular and cost-effective semi-automatic proofing solutions that can still meet rigorous quality standards.

The European Union’s focus on circular economy initiatives and sustainable packaging mandates a quick shift toward eco-friendly inks and coatings. This creates a significant market opportunity for specialized proofers capable of accurately testing the functional and color properties of water-based and biodegradable inks across various temperature and humidity conditions, simulating real-world supply chain stresses. The printing houses in Italy and Spain, specializing in flexible packaging and specialty textiles, show high interest in advanced flexographic proofing technology. Competitive factors include energy efficiency, low maintenance requirements, and the ability of the proofer to handle a wide range of unique European substrates. The push for digitalization and Industry 4.0 principles is driving the requirement for proofing data to be automatically logged and shared via secure cloud platforms, linking production sites across borders and providing immediate quality audit capabilities for multinational customers. -

Asia Pacific (APAC): The APAC region is the fastest-growing market for Ink Proofers, driven by explosive growth in manufacturing, packaging, and rapidly expanding middle-class consumption across China, India, and Southeast Asia. This region is characterized by immense volumes of printing production, often prioritizing throughput and cost-efficiency, though quality standards are rapidly converging with Western norms due to increasing exports and global brand expansion into the region. China is the single largest driver of volume demand, fueled by massive investment in modern flexographic and gravure printing infrastructure, particularly for flexible food and beverage packaging. India’s burgeoning economy and rising domestic consumption are generating strong demand for moderately priced, reliable semi-automatic proofers.

The dynamic shift in the APAC market involves a dual demand structure: top-tier multinational printing facilities require the most sophisticated, fully automated systems comparable to those in North America, while numerous local manufacturers seek affordable, easy-to-use proofers for basic quality control and ink formulation checks. Market penetration is often achieved through local partnerships and establishing strong technical support infrastructure to serve decentralized manufacturing hubs. The region presents a significant opportunity for manufacturers to introduce mid-range, modular proofing solutions that offer excellent repeatability without the prohibitively high cost of Western-designed systems. The proliferation of diverse substrates and ink types—including rapid growth in high-speed web offset for publications and label printing—ensures sustained high demand for versatile and robust proofing equipment capable of handling diverse production needs under variable environmental conditions (e.g., high humidity). - Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets showing promising growth, primarily concentrated in economic hubs like Brazil, Mexico, Saudi Arabia, and South Africa. Growth is spurred by increased foreign direct investment in manufacturing and packaging, modernization of local printing presses, and the local implementation of global brand standards. Demand tends to be focused on improving consistency and reducing imported waste, making reliable ink proofing an essential tool for achieving competitive operational efficiency. These markets often prioritize manual or semi-automatic proofers due to budget constraints, but there is a clear upward trajectory toward adopting fully integrated systems as printing capabilities expand. Key drivers include food security packaging requirements in MEA and the growth of consumer product labeling in LATAM.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ink Proofers Market.- Sheen Instruments

- RK Print Coat Instruments Ltd.

- Prufbau GmbH

- IGT Testing Systems

- TMI Color

- Technotrans SE

- Konica Minolta Sensing Americas, Inc.

- X-Rite (A Danaher Company)

- BYK-Gardner GmbH

- Testing Machines Inc. (TMI)

- Mathis AG

- Qualitest International Inc.

- K-Printing Proofer

- Erichsen Wuppertal

- Ametek MOCON

- Hanatek Instruments

- Thwing-Albert Instrument Company

- HunterLab

- TQC Sheen

- Teledyne FLIR

Frequently Asked Questions

Analyze common user questions about the Ink Proofers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Ink Proofer in the printing process?

The primary function of an Ink Proofer is to accurately simulate the final ink transfer characteristics of a printing press on a small scale. This allows technicians to measure properties like color density, gloss, viscosity, and adhesion before committing to a costly, full-scale production run, ensuring color matching and quality consistency.

How do automated proofers improve efficiency compared to manual drawdown methods?

Automated proofers offer vastly superior efficiency and repeatability because they precisely control variables such as roller speed, pressure, and ink application quantity. This eliminates human variability inherent in manual drawdown methods, leading to fewer errors, faster press setup times, and highly reliable data for color validation according to ISO standards.

Which printing technologies require specialized proofing equipment?

Flexographic and gravure printing require highly specialized proofing equipment. Unlike offset, these processes rely on engraved or patterned rollers (anilox or engraved cylinders) to transfer ink. Proofers must accurately replicate these specific cell structures and ink metering systems to validate color and density effectively on flexible substrates.

What role does software integration play in modern Ink Proofers?

Software integration is crucial for modern proofers, enabling digital color management. It allows the proofer to automatically capture color data (via integrated spectrophotometers), compare it against established targets (L*a*b* values), generate audit reports for compliance, and share real-time quality control data across global production networks via cloud-based platforms.

Which market segment is currently driving the highest growth in Ink Proofer adoption?

The packaging segment, particularly flexible packaging and converting, is driving the highest growth. The increasing demand for high-definition graphics, coupled with the mandatory standardization of food and pharmaceutical packaging globally, necessitates high-precision flexographic and gravure proofers to ensure brand integrity and regulatory compliance.

The Ink Proofers Market faces significant demands for innovation due to the complexity of modern printing substrates and the proliferation of specialty functional inks. Functional inks, which include conductive inks used in printed electronics or security inks for anti-counterfeiting measures, require proofing equipment that can assess electrical conductivity, adhesion stability, and specific spectral responses, in addition to standard color properties. Traditional proofers are often insufficient for these specialized tasks, driving a niche segment of the market toward highly customized, multi-functional testing platforms. This customization extends to the physical design of the proofer rollers and plates, which must be engineered to withstand and accurately apply high-viscosity or highly abrasive functional compounds without degradation or inaccurate transfer. The validation of these specialized proofers necessitates collaboration between the instrument manufacturers, ink chemists, and end-product developers to establish mutually acceptable performance metrics, particularly concerning the longevity and durability of the printed feature under environmental stress. This specialized technical requirement acts as both a barrier to entry for new market participants and a strong revenue generator for established technological leaders who possess proprietary knowledge in materials science and precise mechanical control systems. The development process is iterative, often requiring fast turnaround times for customized prototypes to meet rapid product development cycles in the consumer electronics and security documentation industries. Compliance with material safety data sheets (MSDS) and specific industrial performance standards (e.g., relating to flexibility and abrasion resistance) adds another layer of complexity to the required testing capabilities of advanced proofing instruments.

Furthermore, the maintenance and calibration services sector surrounding the Ink Proofers Market is vital. Given the instrument's role in quality certification, periodic, traceable calibration to international standards (such as those maintained by NIST or equivalent bodies) is not optional, but a mandatory requirement for many regulated print jobs. Service contracts often represent a stable, recurring revenue stream for manufacturers. These contracts typically encompass preventative maintenance, emergency repair, and crucial software updates, ensuring the proofer remains integrated with the latest press technology and color management software revisions. The geographical dispersion of printing facilities globally necessitates a robust, responsive service network, often leading manufacturers to rely on certified third-party service providers in less centralized regions, while maintaining direct control over critical strategic accounts. Training services are equally important, as operating sophisticated proofing equipment requires specialized knowledge in colorimetry, rheology, and press mechanics. Manufacturers often provide comprehensive training programs, sometimes leveraging augmented reality (AR) tools for remote guidance and troubleshooting, thereby minimizing costly technician travel and reducing machine downtime for the end-user. This emphasis on support transforms the sale of the physical unit into a long-term partnership focused on maintaining operational excellence and audit readiness throughout the equipment's lifespan.

The competitive landscape is further segmented by pricing tiers, where manufacturers compete fiercely on the basis of unit accuracy (measured by Delta E values) and long-term operating cost. High-end providers focus on maximal automation, minimal operator interaction, and guaranteed long-term reliability for major conglomerates. Mid-range manufacturers target smaller-to-medium enterprises (SMEs) by offering semi-automatic solutions that balance cost with high accuracy, often capitalizing on the strong regional demand in APAC and Eastern Europe for modernizing existing facilities. Low-cost manual proofers, though diminishing in importance for production control, retain market share in laboratory R&D settings where rapid, indicative testing is sufficient. The ongoing trend of mergers and acquisitions in the printing industry, where large groups standardize on a single proofing brand across all newly acquired sites, creates substantial winner-take-all opportunities for key market leaders. Therefore, strategic alliances with leading color software developers and printing press manufacturers are critical for proofing instrument suppliers to ensure interoperability and secure preferred vendor status in major procurement contracts, positioning their technology as the default choice for integrated process control solutions across the entire production workflow.

Technological advancement is not solely confined to physical mechanics and optics; material science is playing an increasingly important role in improving proofing accuracy. Specialized ceramic or composite materials are being used for ink transfer rollers and application plates to minimize wear and maintain consistent surface energy, which is crucial for uniform ink laydown, particularly with increasingly aggressive ink chemistries. The longevity and resistance of these components directly translate to the proofer’s long-term repeatability and reduction in maintenance frequency. Furthermore, the development of specialized coatings for these components helps in reducing static charge buildup, which can interfere with the transfer of certain types of powdered or metallic inks, ensuring the proof remains an accurate representation of the final print result, regardless of the complexity of the ink formulation. The research into optimal roller geometries that minimize edge-effect inconsistencies during the transfer process is also a continuous area of investment, aiming to produce a proof patch that is perfectly uniform and measurable across its entire area, eliminating potential sources of measurement error that could lead to costly press adjustments. These incremental material and design improvements, while subtle, are fundamental to sustaining the relevance of physical proofing in an industry increasingly dominated by digital measurement and prediction tools, reinforcing the instrument's indispensable role as the primary ground truth reference for color and functional validation. The need for precise temperature control during the proofing process is also gaining traction, particularly for heat-sensitive inks or specialized high-viscosity coatings, requiring integrated thermal regulation systems to accurately simulate the press environment, thereby validating the ink’s performance under operational stresses.

The regulatory environment in sectors like food packaging (e.g., migration testing) and pharmaceutical labeling significantly influences the design requirements of ink proofers. Proofers used in these environments must be certified to prevent cross-contamination and must allow for the accurate proofing of low-migration inks. This often entails specialized, easy-to-clean components and strict procedural protocols, which are sometimes mandated by regulatory bodies to ensure that ink proofs themselves do not introduce potential contaminants into the supply chain during the validation process. The documented traceability of every proof created, including full environmental and operational metadata, is also becoming a non-negotiable feature for compliance-driven buyers. This emphasis on auditability necessitates sophisticated data management capabilities integrated into the proofer’s control software, allowing for long-term archiving and retrieval of specific proofing sessions linked to individual ink batches and production jobs. The intersection of quality assurance and regulatory compliance is transforming the ink proofer from a simple quality tool into a critical piece of audited infrastructure within the modern printing factory, pushing manufacturers to secure various international quality certifications and provide comprehensive documentation packages with every unit sold. This regulatory burden, while increasing development cost, strengthens the market moat around established, compliant suppliers. The evolution towards testing functional properties such as water resistance, chemical stability, and UV degradation resistance directly on the proofing unit, rather than relying solely on post-printing external tests, is emerging as a critical competitive differentiator, offering end-users a faster, integrated validation workflow that accelerates product release timelines.

The development of advanced spectroscopy for analyzing ink proofs is further revolutionizing the industry. While traditional proofers use densitometry (measuring optical density) and basic colorimetry (measuring CIE L*a*b*), next-generation systems incorporate multi-angle spectrophotometers or even hyperspectral imaging technology. This allows for a deeper analysis of the spectral characteristics of the ink laydown, providing insights into complex phenomena such as fluorescence, metallic effects, and metamerism (where colors match under one light source but not another). For high-value applications like automotive graphics, security printing, and luxury packaging, where metallic and iridescent inks are common, this enhanced spectral measurement capability is indispensable. These advanced systems generate exponentially more data than previous generations, which necessitates powerful onboard processing and AI-driven analytical tools to interpret the findings and translate them into actionable color correction advice for the ink kitchen or press operator. This higher data granularity provides a definitive competitive edge by enabling manufacturers to offer verifiable proofing of complex visual effects that were previously difficult to quantify objectively. The ongoing miniaturization and cost reduction of high-performance spectral sensors are facilitating the integration of these sophisticated technologies into standard production proofers, gradually democratizing access to previously exclusive analytical capabilities. Furthermore, the research into standardized methods for quantifying haptic and tactile properties (texture, feel) of printed coatings using the proofer system is a nascent but high-potential area of innovation, particularly relevant for the premium labeling and packaging sector that relies heavily on sensory marketing elements.

Investment in virtual and augmented reality (VR/AR) training simulations for operating and maintaining complex ink proofing systems is a growing trend, especially in regions facing skilled labor shortages. These technologies allow new operators to practice intricate calibration and troubleshooting procedures in a safe, controlled environment, reducing the risk of damaging expensive machinery or compromising proofing accuracy during the learning phase. For multinational companies, VR/AR facilitates standardized global training protocols, ensuring consistency in operation regardless of the physical location of the facility. This technological investment addresses the restraint of high technical skill requirements associated with advanced proofing instruments, making them more accessible to a broader workforce. Concurrently, the rise of industrial Internet of Things (IIoT) platforms is driving the connectivity of ink proofers, allowing them to communicate directly with ink inventory management systems and press control consoles. This seamless data flow facilitates automated restocking requests based on consumption data derived from proofing analyses and enables real-time fine-tuning of press parameters based on the validated proofing results, achieving true closed-loop process control. This level of automation and interconnectedness is a significant driver for capital expenditure in new proofing infrastructure across globally optimized manufacturing chains. The future market success will heavily depend on manufacturers’ ability to provide not just accurate hardware, but comprehensive, integrated software ecosystems that maximize data utility and minimize human intervention in the quality assurance cycle, catering directly to the efficiency goals of Industry 4.0 adoption strategies.

The market for specialty proofing consumables—such as standardized draw-down papers, films, and certified cleaning solutions—also constitutes an important ancillary segment of the Ink Proofers Market. The accuracy of the proofing result is highly dependent on the quality and consistency of these consumables. Manufacturers often establish proprietary or recommended supply chains for these items to ensure optimal performance of their instruments. This reliance creates a captive market opportunity, characterized by recurring revenue streams generated through the continuous supply of specialized materials essential for traceable proofing. Certification programs for third-party consumables, or conversely, strict warnings against using uncertified materials, are common tactics employed by key players to maintain high standards and protect the integrity of their proofing methodologies. The development of environmentally sustainable and low-waste proofing consumables, such as reusable or recyclable proofing films, aligns with broader sustainability drivers in the printing industry and presents a niche but growing market opportunity for suppliers innovating in green materials science. The overall market dynamics are thus influenced not only by the sale of capital equipment but also by the long-term, high-margin business of supporting maintenance, calibration, and consumable supply, which reinforces customer loyalty and provides essential operational continuity in high-stakes printing environments globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager