Inorganic Conductive Adhesive Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443208 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Inorganic Conductive Adhesive Market Size

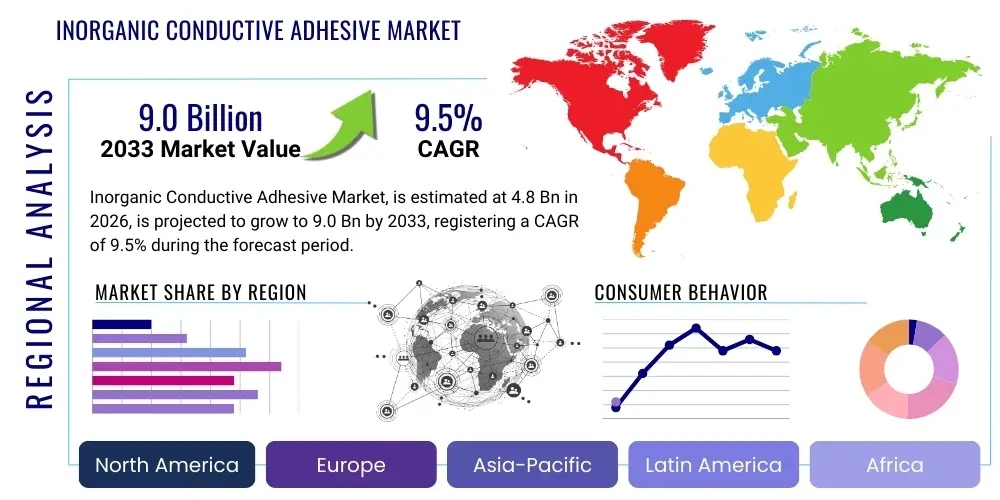

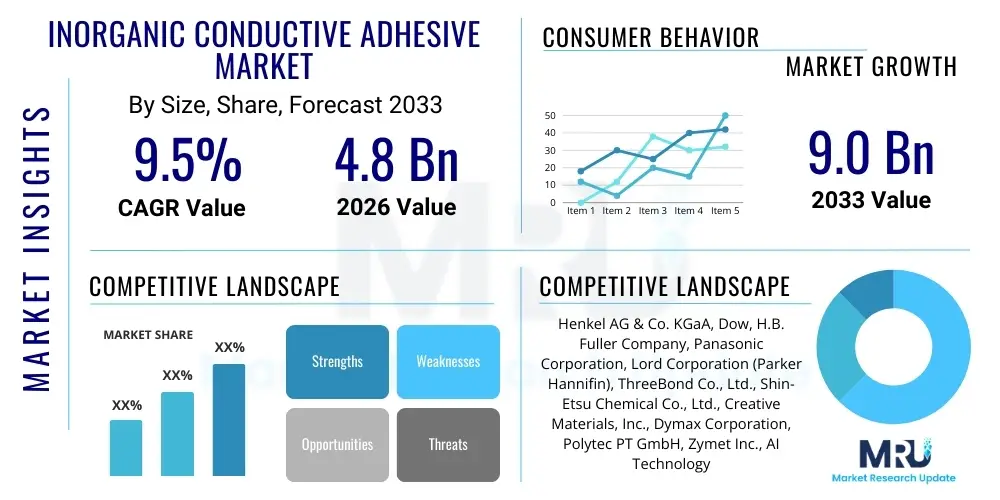

The Inorganic Conductive Adhesive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Inorganic Conductive Adhesive Market introduction

Inorganic Conductive Adhesives (ICAs) represent a critical class of bonding materials designed to replace traditional lead-based solders in sensitive electronic applications where high thermal stability, reliable electrical conductivity, and minimal volatile organic compound (VOC) emissions are mandatory. These materials typically consist of highly conductive metallic fillers, such as silver, gold, or copper, dispersed within an inorganic matrix, often based on high-performance polymers or ceramic formulations, ensuring superior performance under extreme operational conditions. Their primary function is to provide robust electrical interconnection and thermal dissipation pathways, particularly in miniaturized and high-density electronic assemblies where space constraints and operational temperatures prohibit the use of conventional organic adhesives.

The product is essential across several high-growth industries, notably in advanced packaging (die attach), light-emitting diodes (LEDs), automotive electronics, and specialized aerospace and defense systems. Major applications include attaching integrated circuits (ICs) to substrates, securing surface-mounted devices (SMDs), and ensuring efficient heat transfer in power modules. The shift toward higher operating temperatures and increased power densities in modern electronics, especially in electric vehicle (EV) inverters and 5G infrastructure components, significantly benefits from the inherent thermal robustness and mechanical strength provided by ICAs, often exceeding the performance limits of epoxy-based conductive adhesives.

The market growth is fundamentally driven by the relentless pursuit of electronic miniaturization and the mandated transition to lead-free manufacturing environments across global jurisdictions, particularly the European Union's Restriction of Hazardous Substances (RoHS) Directive. Furthermore, the rapid expansion of the Internet of Things (IoT), sophisticated sensor technologies, and high-reliability industrial control systems necessitates adhesive solutions that maintain integrity and conductivity under harsh environmental stresses. The exceptional long-term stability and high-frequency performance of inorganic systems solidify their role as indispensable materials in next-generation microelectronics manufacturing processes.

Inorganic Conductive Adhesive Market Executive Summary

The Inorganic Conductive Adhesive market is characterized by intense technological innovation, focused on enhancing conductivity at lower curing temperatures and improving materials suitability for extreme thermal cycling associated with automotive and power electronics. Business trends indicate a robust strategic emphasis on R&D collaborations between adhesive manufacturers and semiconductor fabrication houses to develop specialized formulations for emerging wide-bandgap (WBG) semiconductors like silicon carbide (SiC) and gallium nitride (GaN), which operate at significantly higher temperatures than traditional silicon chips. Consolidation activity remains moderate, though strategic partnerships focused on supply chain integration of high-purity metal fillers are increasingly common, driven by the need for reliable, scalable production in Asia Pacific, the global epicenter of electronics manufacturing.

Regionally, the market is spearheaded by the Asia Pacific (APAC) region, primarily due to the concentration of major consumer electronics, automotive manufacturing, and high-volume semiconductor assembly operations in countries such as China, South Korea, Japan, and Taiwan. North America and Europe demonstrate steady, quality-driven growth, fueled by strong demand from the aerospace, defense, and high-reliability industrial sectors, where stringent performance specifications necessitate premium, high-cost ICA solutions. Latin America and the Middle East & Africa (MEA) currently represent nascent but rapidly emerging markets, supported by increasing investment in renewable energy infrastructure and localized electronics assembly operations, particularly in power generation and telecommunications applications.

Segment trends reveal that silver-filled adhesives dominate the market due to their unparalleled electrical conductivity and established commercial viability, although copper-based alternatives are gaining traction owing to their lower cost and promising performance in applications less sensitive to oxidation. By application, die attach processes remain the largest consumer segment, benefiting directly from the trend toward densely packed, multi-chip modules (MCMs) and System-in-Package (SiP) technologies. The growing prevalence of electric vehicles is profoundly influencing the end-use segment landscape, positioning automotive electronics, particularly power inverters and battery management systems (BMS), as the fastest-growing application area throughout the forecast period.

AI Impact Analysis on Inorganic Conductive Adhesive Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Inorganic Conductive Adhesive Market frequently center on themes such as optimization of formulation complexity, enhancement of quality control during manufacturing, and the role of ICAs in enabling AI-driven hardware, specifically high-performance computing (HPC) and advanced sensor arrays. Users are keen to understand how AI and machine learning (ML) algorithms can be applied to predict adhesive performance characteristics based on raw material inputs and processing parameters, thereby accelerating the R&D cycle for novel, high-specification ICAs needed for AI accelerators and neuromorphic computing chips. Furthermore, there is significant interest in how AI-powered visual inspection systems can improve defect detection, particularly voids and inconsistencies in the thin bond lines required for advanced die attachment, ensuring the thermal and electrical reliability crucial for AI hardware operating under extreme loads.

AI's influence extends to enhancing the material discovery process, where ML models are employed to simulate the behavior of various inorganic filler material combinations and matrix chemistries, drastically reducing the need for extensive physical prototyping. This computational approach allows manufacturers to rapidly zero in on formulations that meet stringent criteria for low-temperature curing, high glass transition temperatures (Tg), and optimal thermal dissipation required by emerging power modules and specialized AI chips. By leveraging predictive analytics, manufacturers can optimize production yields and minimize waste, contributing to cost-efficiency in a high-value material segment.

Crucially, the proliferation of AI and High-Performance Computing (HPC) necessitates sophisticated thermal management solutions. Inorganic Conductive Adhesives play an integral role in this ecosystem by serving as Thermal Interface Materials (TIMs) or die attach pastes that efficiently transfer heat away from increasingly power-dense AI processing units (GPUs and specialized ASICs). The structural reliability and conductivity achieved through advanced ICA technology are fundamental prerequisites for the sustained, reliable operation of servers and edge devices powering the global AI infrastructure. Therefore, AI drives demand for more complex, higher-performing ICAs while simultaneously offering tools to optimize their production.

- AI accelerates R&D for novel ICA formulations by predicting performance characteristics based on material inputs and processing conditions.

- Machine Learning (ML) enhances quality control systems, improving defect detection and optimizing automated dispensing accuracy in high-volume assembly lines.

- AI computing hardware, such as GPUs and specialized AI accelerators, increases the demand for ultra-high thermal conductivity ICAs for efficient heat dissipation.

- Predictive maintenance analytics, powered by AI, can be applied to monitor the long-term reliability and aging of ICA bonds in critical applications like automotive power electronics.

- AI-driven supply chain optimization reduces material variability and ensures timely sourcing of high-purity metallic fillers (e.g., silver flakes, copper powder).

DRO & Impact Forces Of Inorganic Conductive Adhesive Market

The market is primarily propelled by stringent regulatory frameworks globally mandating the phase-out of lead-based solders, particularly the RoHS and REACH directives, compelling electronics manufacturers to transition immediately to reliable, lead-free alternatives like ICAs. This regulatory push coincides with fundamental technological advancements in electronics, specifically the increasing operational frequency and power density in devices, which necessitate superior thermal management capabilities that ICAs inherently provide through high thermal conductivity fillers. The exponential growth in the production of Electric Vehicles (EVs) and hybrid vehicles, where power modules (inverters and converters) require adhesives capable of withstanding extreme thermal cycling (-50°C to 200°C), acts as a powerful demand accelerator for high-reliability inorganic systems.

However, the market faces significant restraints, primarily stemming from the substantially higher material cost of ICAs compared to traditional organic conductive adhesives or standard solders, driven by the inclusion of high-purity noble metal fillers such as silver. Furthermore, technical challenges related to the handling and processing of ICAs, including precise dispensing requirements and managing potential filler settling or oxidation during storage and use, pose adoption barriers, particularly for smaller manufacturers lacking advanced dispensing and curing infrastructure. The mechanical rigidity and inherent brittleness of some fully inorganic or heavily filled systems, which can lead to cracking under severe thermal or mechanical stress, also require careful material selection and design consideration, slowing their adoption in certain flexible or high-vibration applications.

Significant market opportunities reside in the development and commercialization of next-generation, non-noble metal conductive adhesives, such as sophisticated copper or nickel systems, that offer a favorable balance of cost and performance through advanced surface treatments and protective coatings to mitigate oxidation challenges. The rapid deployment of 5G infrastructure, requiring high-frequency components and advanced antennae arrays, opens new avenues for conductive shielding and bonding applications utilizing ICAs. Moreover, the integration of advanced sintering technologies, enabling dense interconnections and robust bonds at relatively lower processing temperatures, is poised to unlock new markets in heat-sensitive substrates and flexible hybrid electronics, further diversifying the application landscape for Inorganic Conductive Adhesives globally.

Segmentation Analysis

The Inorganic Conductive Adhesive market is comprehensively segmented based on its material composition (type), the specific electronic function it performs (application), and the overarching industry that utilizes the product (end-user). Understanding these segments is crucial for strategic market positioning, as performance requirements vary drastically between, for instance, a high-power automotive inverter application requiring extreme thermal stability and a low-cost RFID tag application focused on cost-effectiveness. The segmentation reflects the sophisticated interplay between material science innovations and the increasingly demanding specifications of modern microelectronics and power systems globally.

The segmentation by Type, specifically the filler material, is the most crucial determinant of cost and performance, with silver dominating due to its superior conductivity, followed by copper and carbon-based systems, which are cost-sensitive alternatives. Segmentation by application highlights the core uses, where die attach technology remains the most complex and valuable segment, driven by the requirement for extremely thin, void-free, and high-reliability bonds in advanced semiconductor packaging. End-use segmentation clearly illustrates the macroeconomic drivers, with automotive electronics now surpassing consumer electronics in terms of growth trajectory, reflecting the global investment shift toward electric mobility and robust industrial automation.

Market growth within these segments is not uniform; while silver-filled adhesives continue to command the highest market share, the fastest growth is observed in non-noble metal conductive systems due to cost pressures and in emerging applications like advanced sensor packaging for autonomous systems. Manufacturers are increasingly focused on developing hybrid ICAs that blend organic and inorganic matrices to achieve a balance between mechanical flexibility, processing ease, and electrical robustness, addressing niche demands within the burgeoning areas of flexible electronics and wearables, thus diversifying the traditional segments of the ICA market.

- By Type (Filler Material)

- Silver-Filled Adhesives (Dominant market share due to superior conductivity)

- Copper-Filled Adhesives (Cost-effective alternatives, focusing on oxidation mitigation)

- Carbon-Based Conductive Adhesives (Used for applications requiring lower conductivity but high mechanical stability)

- Other Metallic Fillers (Gold, Nickel, Aluminum, etc.)

- By Application

- Die Attach/Die Bonding (Critical for semiconductor packaging)

- Surface Mount Device (SMD) Bonding

- EMI/RFI Shielding (For sensitive components in communication devices)

- Circuit Assembly and Interconnects

- Thermal Interface Materials (TIMs)

- By End-User Industry

- Automotive Electronics (Power modules, battery management systems)

- Consumer Electronics (Smartphones, tablets, IoT devices)

- Aerospace and Defense (High-reliability and extreme environment applications)

- Industrial Electronics (Power supplies, control systems)

- LED Lighting (Heat dissipation and electrical connection in LED modules)

- Telecommunications and Infrastructure (5G components, high-frequency modules)

Value Chain Analysis For Inorganic Conductive Adhesive Market

The value chain for the Inorganic Conductive Adhesive market commences with upstream activities centered on the highly specialized sourcing and processing of ultra-high-purity conductive filler materials, primarily micron-sized and nano-sized silver flakes, copper powder, and advanced carbon nanotubes. This segment requires significant capital investment in refining, purification, and particle morphology control to ensure the consistency and performance critical for final adhesive conductivity. Key suppliers in this upstream segment include specialized chemical and metal processing companies who dictate the raw material cost structure, which constitutes a major component of the final product price, particularly for silver-filled systems.

Midstream activities involve the core manufacturing process, where adhesive formulators blend the conductive fillers with specialized inorganic or hybrid polymer matrices, curing agents, and rheology modifiers. This step is proprietary and technology-intensive, focusing on achieving optimal viscosity for automated dispensing, maximizing filler loading for conductivity, and ensuring desired thermal properties. Distribution channels for ICAs are typically complex, involving a combination of direct sales and specialized distributors. Direct distribution is favored for large original equipment manufacturers (OEMs) in the semiconductor and automotive sectors that require customized formulations and dedicated technical support, ensuring tight integration into their assembly processes.

The downstream segment focuses on the integration and use of ICAs by end-user industries, including outsourced semiconductor assembly and test (OSAT) companies, automotive tier-one suppliers, and aerospace component manufacturers. Indirect distribution, leveraging specialized chemical and electronics distributors, plays a vital role in reaching smaller manufacturers and localized repair and maintenance markets across diverse geographic areas. Effective logistics, including temperature-controlled storage and rapid fulfillment, are paramount in the distribution process, given the limited shelf life and sensitivity of many high-performance conductive adhesive formulations.

Inorganic Conductive Adhesive Market Potential Customers

The primary customers for Inorganic Conductive Adhesives are entities engaged in the manufacture of high-reliability and high-power density electronic components and systems, where thermal management and long-term connection stability are non-negotiable requirements. This core customer base includes major global semiconductor manufacturers and outsourced semiconductor assembly and test (OSAT) providers, who utilize ICAs for die attach operations in multi-chip modules, power discretes, and high-performance packages intended for challenging environments. These customers prioritize technical specifications such as volume resistivity, shear strength, and the ability to withstand extreme thermal cycling profiles, often demanding custom formulations that integrate seamlessly with their proprietary substrate materials and packaging designs.

A rapidly expanding segment of potential customers includes Tier 1 and Tier 2 suppliers within the automotive industry, particularly those specializing in electric vehicle (EV) powertrain electronics, including traction inverters, on-board chargers, and DC-DC converters. The electrification trend mandates adhesives that can reliably operate at junction temperatures exceeding 175°C, a threshold often met only by advanced inorganic systems, making these manufacturers crucial and high-growth end-users. Additionally, defense contractors and aerospace electronics integrators represent a consistent, high-value customer group, requiring ICAs for avionic control systems, radar equipment, and satellite communication modules where regulatory compliance and zero-failure tolerance are strictly enforced.

Beyond these critical sectors, significant customer acquisition potential exists within the rapidly scaling LED lighting industry, particularly in high-brightness and outdoor fixtures where adhesives must manage significant heat output while maintaining electrical connection integrity over extended periods. Furthermore, manufacturers of 5G infrastructure equipment, including high-frequency filter modules and active antenna systems (AAS), are increasing their adoption of ICAs for EMI shielding and robust component bonding, highlighting the expanding diversity of end-user/buyer requirements across the telecommunications infrastructure segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, Dow, H.B. Fuller Company, Panasonic Corporation, Lord Corporation (Parker Hannifin), ThreeBond Co., Ltd., Shin-Etsu Chemical Co., Ltd., Creative Materials, Inc., Dymax Corporation, Polytec PT GmbH, Zymet Inc., AI Technology, Inc., Masterbond, Inc., Epoxy Technology, Inc., Hitachi Chemical Co., Ltd., Tanaka Kikinzoku Kogyo K.K., Kyocera Corporation, Dupont de Nemours, Inc., Momentive Performance Materials Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inorganic Conductive Adhesive Market Key Technology Landscape

The technological evolution within the Inorganic Conductive Adhesive market is primarily focused on overcoming the trade-offs between conductivity, cost, and mechanical flexibility, leading to several advanced material science developments. A cornerstone technology is the refinement of filler morphology, moving beyond simple micro-flakes to sophisticated silver nanowires and dendrites, which enable lower percolation thresholds and thus high conductivity at reduced filler concentrations, lowering material costs and improving flow characteristics. Concurrently, the industry is heavily investing in the surface functionalization of non-noble metal fillers (like copper and nickel) using protective polymeric shells or self-assembled monolayers to prevent oxidation during processing and service life, addressing the major reliability concern associated with cost-effective alternatives.

Another crucial technological area is the advancement of low-temperature sintering conductive adhesives (SCAs). Traditional ICAs often require high-temperature curing, which can damage heat-sensitive substrates or components. SCAs utilize nano-scale metallic particles that fuse or sinter together at temperatures significantly lower than the melting point of the bulk metal (e.g., silver sintering below 300°C), resulting in bonds with bulk-metal-like electrical and thermal properties. This technology is vital for high-power semiconductor packaging, particularly for SiC and GaN devices, allowing for ultra-reliable connections necessary for severe thermal cycling in automotive applications.

Furthermore, innovative binder and matrix chemistry, including the use of high-performance polyimides, silicones, and hybrid organic-inorganic resins, is essential for improving the structural integrity and mechanical properties of the final adhesive joint. These advanced matrices are designed to manage the Coefficient of Thermal Expansion (CTE) mismatch between the semiconductor chip and the substrate, thereby reducing thermo-mechanical stress on the bondline during operation. The development of specialized thixotropic formulations also addresses processing challenges, ensuring precise vertical and horizontal alignment capabilities crucial for automated, high-throughput manufacturing processes in advanced microelectronics assembly lines.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed global leader in the Inorganic Conductive Adhesive market, commanding the largest market share primarily due to its overwhelming concentration of semiconductor manufacturing, consumer electronics production, and major automotive assembly hubs. Countries like China, South Korea, Taiwan, and Japan are at the forefront of adopting advanced packaging technologies (e.g., Fan-Out Wafer Level Packaging, 3D stacking) and high-volume LED production, all of which rely heavily on high-performance ICAs for reliability and thermal management. The region's ongoing massive investment in domestic 5G infrastructure deployment further accelerates the demand for conductive adhesives suitable for high-frequency components and sophisticated antennae modules, establishing APAC as the fastest-growing market during the forecast period.

North America and Europe represent mature, high-value markets characterized by demand for premium, mission-critical ICA solutions driven by the aerospace, defense, and specialized high-reliability industrial control sectors. In North America, technological innovation centers around power electronics for data centers and the burgeoning electric vehicle sector, requiring adherence to stringent military and industrial specifications. European market growth is particularly robust in automotive electrification, propelled by ambitious regulatory targets for carbon neutrality, where German and French automotive suppliers are leaders in developing advanced power modules utilizing silver-sintering adhesives for superior thermal robustness in harsh engine compartment environments. These regions prioritize quality, technical support, and established supply chain stability over immediate cost advantages.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions exhibiting considerable potential, primarily driven by increasing foreign investment in localized electronics manufacturing assembly plants, especially for telecommunications infrastructure and renewable energy systems. While currently possessing a smaller market share, the rapid urbanization and digitalization efforts in key countries such as Brazil, Mexico, and the UAE are leading to a steady increase in demand for standardized ICA formulations. The growth trajectory in these regions is heavily reliant on the expansion of local industrial bases and the adoption of modern electronics standards that necessitate reliable, lead-free conductive solutions, moving away from legacy soldering technologies.

- Asia Pacific (APAC): Dominant market size; driven by high-volume semiconductor fabrication, consumer electronics manufacturing, and leading adoption of advanced die attach technologies, especially in China and Taiwan.

- North America: Focus on high-reliability applications (aerospace, military), HPC power management, and premium solutions for EV power electronics, emphasizing technical specification and performance.

- Europe: Strong demand from the automotive sector for electric vehicle power modules (inverters/converters), stringent environmental regulations promoting lead-free materials, and robust industrial automation application requirements.

- Latin America (LATAM): Emerging growth tied to expanding local manufacturing and telecommunications infrastructure development, focusing on cost-effective, reliable ICAs.

- Middle East & Africa (MEA): Growth driven by investment in smart city projects, renewable energy infrastructure, and regional data center construction, requiring steady supply of standard and mid-to-high performance adhesives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inorganic Conductive Adhesive Market.- Henkel AG & Co. KGaA

- Dow

- H.B. Fuller Company

- Panasonic Corporation

- Lord Corporation (Parker Hannifin)

- ThreeBond Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Creative Materials, Inc.

- Dymax Corporation

- Polytec PT GmbH

- Zymet Inc.

- AI Technology, Inc.

- Masterbond, Inc.

- Epoxy Technology, Inc.

- Hitachi Chemical Co., Ltd.

- Tanaka Kikinzoku Kogyo K.K.

- Kyocera Corporation

- Dupont de Nemours, Inc.

- Momentive Performance Materials Inc.

- Aremco Products, Inc.

Frequently Asked Questions

Analyze common user questions about the Inorganic Conductive Adhesive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Inorganic Conductive Adhesives (ICAs) over traditional solders?

The primary advantage of ICAs is their superior thermal stability and reliability, especially under high operating temperatures (often exceeding 200°C) and severe thermal cycling, which is crucial for modern power electronics and high-reliability semiconductor packaging. They also offer a compliant, lead-free alternative.

Which end-user industry is driving the highest growth rate for the ICA market?

The Automotive Electronics sector, specifically the rapidly expanding production of Electric Vehicle (EV) power modules and battery management systems (BMS), is driving the highest growth due to the critical need for ICAs capable of managing high heat flux and ensuring robust reliability in mission-critical applications.

What are the main types of filler materials used in Inorganic Conductive Adhesives?

The main filler materials are Silver (known for highest conductivity), Copper (cost-effective alternative), and Carbon-based materials (used in specific applications requiring low density or specific mechanical properties). Silver remains the dominant choice despite its higher cost.

What technical challenge must be overcome for wider adoption of non-noble metal ICAs, such as copper-filled adhesives?

The key technical challenge for non-noble metal ICAs is managing oxidation, which severely degrades conductivity. Manufacturers must employ advanced surface treatments, protective coatings, and process modifications (e.g., inert atmosphere curing) to ensure long-term electrical reliability comparable to silver systems.

How do advanced sintering conductive adhesives (SCAs) differ from standard conductive adhesives?

SCAs utilize nano-scale metallic particles that fuse together (sinter) at relatively low temperatures (e.g., <300°C) to form a dense, metallic bond with bulk-metal properties. Standard conductive adhesives use micro-flakes suspended in a polymer matrix, relying on particle-to-particle contact within the cured binder for conductivity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager