Insufflator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441885 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Insufflator Market Size

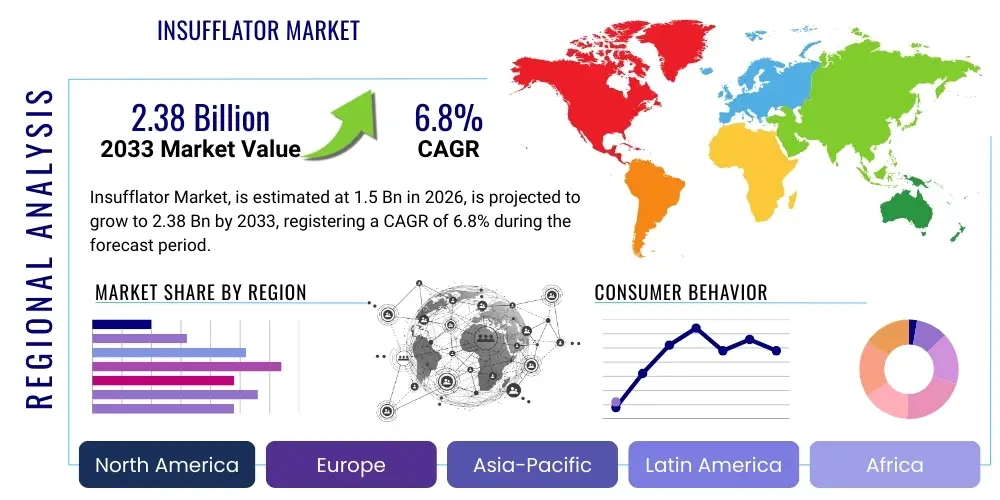

The Insufflator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.38 Billion by the end of the forecast period in 2033.

Insufflator Market introduction

The Insufflator Market encompasses the entire ecosystem associated with the manufacturing, distribution, and utilization of sophisticated medical devices specifically engineered to introduce and precisely maintain controlled pressure of an inert gas, predominantly medical-grade carbon dioxide (CO2), into a confined anatomical space, typically the peritoneal cavity. This crucial process, fundamentally known as insufflation, serves as the cornerstone for executing successful Minimally Invasive Surgery (MIS), including general laparoscopy, advanced robotic surgery, and various thoracoscopic procedures. The technical function of the insufflator is to create and sustain a stable pneumoperitoneum or pneumothorax, thereby lifting the abdominal wall or lung tissue, offering surgeons an unimpeded, magnified working field and essential space to safely manipulate intricate instruments, thus transforming surgical practice by substituting large incisions with small keyhole accesses. The technological evolution of these devices is characterized by advancements in pressure sensing fidelity, gas flow capacity, and the integration of sophisticated electronic control systems necessary for maintaining physiological stability and enhancing patient safety throughout the duration of the surgical procedure.

The product segmentation within this critical medical device market reflects a differentiation based primarily on flow rate capabilities, which directly corresponds to the complexity and gas consumption rate of the surgical procedure. Conventional systems, often utilized in simpler diagnostic laparoscopies, provide comparatively lower flow rates (typically up to 20 L/min), whereas modern surgical techniques, particularly those involving advanced robotic platforms like the Da Vinci system, necessitate the use of Ultra-High Flow Insufflators capable of delivering 45 L/min or more. This escalating requirement for high flow arises from the substantial volumes of gas lost due to frequent instrument exchanges, necessary smoke evacuation mechanisms during electrocautery, and the inherent demands of prolonged surgical periods. Furthermore, contemporary insufflators are increasingly designed to actively manage gas temperature and humidity, a critical feature aimed at mitigating the adverse systemic effects of cold, dry CO2 on patient core body temperature and preserving the delicate peritoneal surfaces, which is a major factor driving technological competitive advantage and market adoption in highly regulated developed economies.

The compelling benefits driving the robust growth of the insufflator market are inextricably linked to the patient-centric advantages of MIS, establishing a clear value proposition for healthcare providers globally. These benefits include dramatically reduced surgical trauma, leading to smaller, cosmetically superior scars, significantly less postoperative pain requiring lower doses of opioid analgesics, and critically, a marked reduction in overall hospital stay duration, which translates directly into substantial cost efficiencies for healthcare systems struggling with capacity constraints. The market is also heavily influenced by pervasive demographic trends, specifically the global aging population and the increasing prevalence of lifestyle-related chronic diseases (e.g., morbid obesity requiring bariatric surgery, gall bladder issues, and specific localized cancers), all of which exhibit a higher propensity for MIS intervention. These powerful demand drivers, coupled with increasing governmental and private sector investment in specialized surgical training programs and the procurement of advanced robotic equipment across rapidly industrializing developing nations, ensure a sustained and robust upward trajectory for insufflator demand over the defined forecast period.

Insufflator Market Executive Summary

The Insufflator Market is currently navigating a dynamic phase of accelerated technological integration, fundamentally characterized by a palpable shift toward smarter, networked surgical ecosystems that prioritize data capture and connectivity. Key business trends underscore an intensive focus among multinational industry leaders on enhancing the connectivity and data management capabilities of their insufflator systems, transitioning them from passive pressure regulators into active devices that seamlessly communicate critical operational parameters with Electronic Health Records (EHR) systems and centralized Operating Room (OR) management platforms. This push towards 'smart ORs' necessitates substantial research and development investment in proprietary control software and sophisticated communication hardware, driving strategic alliances between traditional medical device manufacturers and specialized healthcare IT solution providers. Furthermore, corporate responsibility and sustainability in the supply chain are emerging as critical competitive factors, with manufacturers exploring options for recyclable components and streamlined logistics, addressing growing environmental, social, and governance (ESG) pressures emanating from institutional investors and governmental procurement organizations. Consolidation efforts through strategic mergers, acquisitions, and comprehensive partnerships continue to actively reshape the competitive landscape, primarily aimed at strengthening market share in high-growth product categories, such as integrated gas warming systems and specialized pediatric units, enabling companies to offer fully comprehensive minimally invasive surgery portfolios.

Regionally, the market exhibits a clear dichotomy between mature, high-value markets and emerging, high-volume growth territories, requiring tailored market penetration strategies. North America maintains its position as the largest revenue contributor, attributed to extremely high standardized procedure volumes and an established, favorable reimbursement framework that strongly encourages the rapid adoption of advanced, expensive surgical technologies, including high-end robotic systems that are critically dependent on ultra-high-flow insufflation for their operational efficacy. Conversely, the Asia Pacific (APAC) region is poised to demonstrate the most aggressive growth metrics, driven by rapid economic development, substantial government-led public health infrastructural expansion in populous nations such as China and India, and a swift, accelerating increase in the number of trained laparoscopic surgeons. This APAC growth trajectory is particularly concentrated on the demand for affordable, highly robust mid-to-high flow systems, often either locally manufactured or strategically adapted to meet diverse regional price sensitivities and high operational usage demands. Europe remains a stable yet innovation-focused region, with rigorous regulatory compliance under the Medical Device Regulation (MDR) driving mandatory product redesigns and prioritizing devices that demonstrate superior long-term clinical effectiveness and verifiable safety data.

Detailed analysis of market segmentation trends reveals a prevailing, undeniable preference for Ultra-High Flow Insufflators (delivering 45 L/min and above) across all major geographical regions, reflecting their necessity in facilitating complex, multi-hour procedures and enabling the efficient operation of sophisticated surgical robotics; these advanced systems accordingly command premium pricing and deliver superior profit margins. Among end-users, large hospital organizations continue to dominate procurement volumes due to their comprehensive service offerings, substantial capital budgets, and inherently high patient throughput capacity. However, the rise of Ambulatory Surgical Centers (ASCs) is fundamentally transforming the distribution landscape; ASCs, prioritizing unparalleled operational efficiency and quick patient turnaround time, are rapidly becoming crucial buyers for compact, reliable, and standardized insufflation equipment. Additionally, the Application segment focusing on Bariatric Surgery is showing disproportionate, accelerated growth, given the severe global obesity epidemic, which necessitates specialized insufflation parameters (including higher pressure limits and flow rates) specifically tailored to accommodate the increased abdominal wall tension encountered in bariatric patients, actively driving demand for purpose-built, high-pressure devices.

AI Impact Analysis on Insufflator Market

In-depth analysis of user engagement and common search queries surrounding the integration of Artificial Intelligence (AI) in the medical technology space highlights a focused and intense interest in transforming the insufflator from a primarily mechanical regulatory tool into an intelligent, actively responsive component of the integrated surgical team. Key themes frequently explored by potential users—including leading surgeons, specialized biomedical engineers, and hospital procurement managers—center on the utilization of AI for dynamic pressure stabilization, predictive monitoring to minimize acute physiological stress on the patient, and facilitating autonomous operational control within sophisticated integrated robotic surgical suites. Users hold significant expectations that AI algorithms can effectively process complex, multivariate data streams—such as patient demographic variables (BMI, age), real-time physiological status (end-tidal CO2, heart rate, blood pressure), and immediate procedural demands (instrumentation movement frequency, rate of cauterization smoke generation)—to predict and proactively adjust insufflation parameters (flow rate, pressure ceiling) with unmatched micro-second precision. This anticipated paradigm shift towards predictive, rather than merely reactive, gas management systems represents the highest level of user expectation for AI influence in this critical domain, promising to enhance surgical consistency and safety significantly.

The current tangible impact of AI is manifesting primarily in two critical, strategically important areas: the optimization of surgical safety protocols through enhanced data analysis and the driving of substantial operational efficiencies in high-value equipment management. Regarding safety, advanced insufflator models, particularly those designed for integration into next-generation robotic platforms, are beginning to leverage machine learning capabilities to accurately interpret continuous data derived from high-fidelity pressure sensors and synchronous patient physiological monitors. This AI-driven capability allows the surgical system to establish highly accurate, patient-specific tolerance limits for pneumoperitoneum pressure and gas absorption rates, which is a significant clinical advantage. If the AI detects a subtle, adverse trending pattern—such as a consistently increasing CO2 absorption rate correlating with slightly elevated and sustained intra-abdominal pressure—it can instantly issue highly specific, actionable alerts to the surgical team or autonomously make minute, preventative corrective adjustments to the flow rate, potentially preventing complications like hypercapnia or subcutaneous emphysema far earlier and more reliably than traditional human monitoring could achieve. This crucial AI layer thus adds a layer of sophisticated, systematic safety redundancy to the surgical environment.

From an operational and financial standpoint, AI-powered systems are currently revolutionizing the entire servicing and maintenance lifecycle of high-value capital equipment such as specialized insufflators. By methodically analyzing vast amounts of aggregated machine operational data, detailed internal error logs, subtle power consumption fluctuations, and comprehensive historical usage patterns across multiple units, predictive maintenance algorithms can accurately forecast the impending failure of critical internal components, such as high-wear seals, electronic control boards, or sensitive pressure regulators, often weeks or even months in advance of total failure. This highly precise predictive capability allows hospital biomedical departments to strategically schedule proactive, non-emergency maintenance during planned or low-volume operational downtime, effectively eliminating the costlier and highly disruptive emergency breakdown scenarios that severely impact complex surgical schedules. Furthermore, AI contributes significantly to optimized inventory management by accurately tracking the real-time consumption and necessary sterilization cycles of proprietary accessories, such as heated tubing sets and specialized gas filters, thereby optimizing purchasing strategies and substantially reducing economic waste associated with device underutilization or accidental expiration of critical consumables, consequently enhancing the overall economic viability and utilization rate of the expensive surgical suite assets.

- AI-Enhanced Pressure Stability: Utilizing machine learning algorithms to achieve ultra-precise and lightning-fast dynamic pressure adjustment based on real-time physiological and procedural feedback, ensuring optimal, sustained working conditions for the surgeon.

- Predictive Maintenance: Applying sophisticated AI analytics to operational data for accurate forecasting of hardware failure, minimizing critical equipment downtime, and optimizing strategic asset management strategies in high-volume, capital-intensive surgical centers.

- Integration with Robotics: Enabling seamless, real-time, automated, and highly reliable communication between complex robotic surgical platforms and ultra-high-flow insufflators for highly synchronized and efficient gas management during complex multi-quadrant surgical maneuvers.

- Optimized Patient Protocols: Leveraging large surgical outcome datasets (Big Data) and complex machine learning models to develop customized, highly accurate, patient-specific insufflation protocols based on crucial demographic factors such as BMI, age, and existing cardiovascular health status, significantly enhancing standardized perioperative safety and clinical outcomes.

- Intelligent Workflow Automation: AI-driven recognition and precise analysis of specific surgical phases (e.g., initial access creation, tissue dissection, final specimen retrieval) to automatically adjust flow rates and maintain optimal working space without continuous, repetitive manual intervention, thereby significantly reducing cognitive load on surgical staff attention.

DRO & Impact Forces Of Insufflator Market

The trajectory of the Insufflator Market is fundamentally determined by the overwhelming clinical evidence persistently supporting the superior patient outcomes and reduced recovery times associated with Minimally Invasive Surgery (MIS) when compared to traditional, highly invasive open surgery. This pervasive clinical endorsement serves as the most powerful inherent driver, compelling global healthcare systems—both public and private—to consistently invest heavily in the requisite high-quality equipment. Specifically, the rising global volume of complex laparoscopic procedures, necessitated by the increasing prevalence of chronic and lifestyle-related diseases, such as morbid obesity demanding specialized bariatric procedures and the early detection of localized cancers, directly translates to exponentially increased demand for reliable, high-caliber insufflation systems. Furthermore, technological innovation acts as a substantial market accelerator, especially the continuous development and refinement of features such as integrated heated and humidified CO2 insufflation systems that effectively address the critical clinical concern of patient hypothermia, and advanced filtration systems that ensure superior sterility and minimize the risk of surgical site infections, thereby significantly increasing the clinical appeal, utilization, and marketability of newer-generation devices.

Conversely, several substantial and persistent constraints actively hinder the market’s potential pace of expansion. The foremost restraint remains the inherently high initial capital expenditure (CapEx) associated with purchasing modern, ultra-high-flow insufflators, which often demand investments ranging from US$30,000 to over US$50,000 per unit, not including the significant, recurring costs associated with specialized, often proprietary, disposable tubing sets and filters. This considerable cost barrier poses a severe impediment to widespread adoption, disproportionately affecting smaller hospitals, community health centers, and healthcare facilities operating within low and middle-income regions, frequently resulting in a continued reliance on outdated, less efficient equipment or substantial delays in adopting MIS methodologies altogether. Moreover, the increasing complexity of navigating highly diverse and often conflicting international regulatory environments, particularly the rigorous quality assurance mandates imposed by the EU MDR and the US FDA, significantly escalates the necessary time, effort, and cost required for new product market entry and continuous innovation cycles, placing a substantial financial and operational burden on mid-tier medical device manufacturers.

Significant market opportunities exist, primarily centered on strategic geographical expansion and the development of symbiotic integration technologies. The massive, historically underserved healthcare markets in the rapidly expanding Asia Pacific and Latin America present highly lucrative opportunities for exponential volume growth, provided manufacturers are able to successfully offer strategically priced, robust, and reliable mid-range systems specifically tailored for high-use, cost-sensitive operational environments. Technologically, the rapid, accelerating proliferation of robotic surgery platforms globally is creating a vital, symbiotic market opportunity, as these platforms mandate the use of specialized, highly responsive, and digitally integrated insufflators capable of handling extreme, rapid pressure demands without fluctuation, positioning specialized ultra-high-flow technology providers for substantial and sustainable revenue growth. Finally, the growing industry trend toward disposable accessories and single-use components, driven by heightened global awareness of cross-contamination risks and the need for streamlined infection control protocols, represents a crucial, high-margin opportunity for manufacturers to secure reliable and recurring revenue streams throughout the entirety of the forecast period, shifting revenue generation toward consumables.

Segmentation Analysis

The granular analysis of the Insufflator Market segmentation is critical for accurately understanding current market dynamics and for allowing institutional stakeholders to precisely pinpoint specific areas of high profitability and sustained, long-term demand. Segmentation by Product Type, notably the technical distinction between flow capabilities, clearly reveals the industry's directional preference for high-performance systems. Ultra-High Flow Insufflators (delivering 45 L/min and above) are rapidly gaining market dominance and consistently command premium pricing, particularly in large teaching hospitals and specialty centers focusing on complex bariatric, transplant, and oncological surgeries. This segment’s accelerating growth trajectory accurately reflects the increasing technical complexity and prolonged duration of modern MIS procedures, which necessitates robust, instantaneous gas delivery systems that ensure maximum patient safety and consistently optimal surgical visualization, even under continuous high-stress conditions. Conversely, Standard Flow systems are experiencing a diminishing market share but still maintain a viable niche in highly cost-sensitive markets or for simpler, routine diagnostic procedures, mandating the use of highly differentiated sales and marketing strategies based explicitly on regional technological maturity and budget constraints.

Analysis segmented by Application highlights General Surgery as the leading category globally, encompassing the widest array of common, frequently performed procedures (e.g., cholecystectomy, appendectomy, routine hernia repair) and consistently generating the highest overall volume demand for insufflators. However, specialized surgical segments such as Bariatric Surgery and Urology are definitively projected to register above-average, accelerated growth rates. Bariatric procedures, due to the unique physiological constraints imposed by patient body habitus, inherently require both higher stable intra-abdominal pressure and much higher sustained flow rates, actively driving demand for specialized, heavy-duty insufflators capable of reliably handling these unique anatomical challenges. Urology procedures, particularly complex robotic-assisted radical prostatectomies and cystectomies, benefit greatly from precise, highly controlled insufflation to facilitate intricate robotic maneuvers, consequently linking this application segment directly to the demand for high-end, digitally integrated insufflator market platforms. Understanding this granular, application-specific demand profile is absolutely vital for product development teams aiming to strategically capture high-value niches.

The End-User segmentation remains structurally heavily weighted towards Hospitals, specifically large university-affiliated and tertiary care facilities, which benefit from extensive capital budgets and the imperative requirement to accommodate consistently high patient turnover across multiple surgical disciplines simultaneously. Hospitals typically purchase capital equipment in large batches and prioritize features directly related to system longevity, comprehensive serviceability, and seamless Operating Room (OR) integration compatibility. However, the rapidly expanding and increasingly influential role of Ambulatory Surgical Centers (ASCs) is fundamentally changing the procurement and demand profile. ASCs focus intently on efficiency, quick patient turnaround, and minimized operational costs, consequently seeking equipment that is robust, highly reliable, easy to use, compact in physical design, and offers a highly competitive total cost-of-ownership over its operational lifecycle. Manufacturers are actively responding to this shift by offering modular, standardized insufflation systems specifically designed to meet the high-efficiency and lower cost structures inherent to the outpatient surgical environment, thereby successfully fragmenting the end-user landscape and necessitating the implementation of dual strategic approaches: high-end integration and complex features for hospitals, and high-efficiency standardization and durability for ASCs.

- By Product Type:

- Standard Flow Insufflators (< 20 L/min)

- High Flow Insufflators (20 L/min – 45 L/min)

- Ultra-High Flow Insufflators (> 45 L/min)

- Specialized Insufflators (e.g., Pediatric, Single-Port Access, High-Pressure Bariatric Units, Endoscopic Insufflators)

- By Application:

- General Surgery (Cholecystectomy, Appendectomy, Hernia Repair, Splenectomy)

- Gynecology and Obstetrics (Hysterectomy, Ovarian Cystectomy, Tubal Ligation)

- Urology (Nephrectomy, Prostatectomy, Cystectomy, Adrenalectomy)

- Cardiothoracic Surgery (Thoracoscopy, Lung Biopsy)

- Vascular Surgery (Aortic Repair)

- Bariatric Surgery (Gastric Bypass, Sleeve Gastrectomy, Gastric Banding)

- Orthopedic Surgery (Arthroscopy for shoulders and knees)

- By End User:

- Hospitals (Large Tertiary and Secondary Care Centers, Academic Hospitals)

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics and Diagnostic Centers (e.g., Gastrointestinal Endoscopy Centers, Outpatient Surgery Centers)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (APAC) (China, Japan, India, South Korea, Rest of APAC)

- Latin America (LATAM) (Brazil, Mexico, Argentina, Rest of LATAM)

- Middle East and Africa (MEA) (GCC Countries, South Africa, Turkey, Rest of MEA)

Value Chain Analysis For Insufflator Market

The Insufflator market value chain rigorously initiates with complex upstream procurement and manufacturing activities, focusing intensely on securing high-reliability, medical-grade components essential for the safe and precise clinical operation of the final device. Key upstream suppliers specialize in manufacturing micro-electro-mechanical systems (MEMS) sensors, highly advanced proportional solenoid valves, accurate pressure transducers, specialized gas regulators, and robust electronic control boards, all of which are intrinsically linked to the device’s core functionality, fidelity, and safety profile. Given the extremely specialized nature of the finished product, major manufacturers typically establish deeply integrated, long-term, and highly collaborative relationships with key component providers to ensure mandatory adherence to stringent global medical device quality standards, such such as ISO 13485 and necessary biocompatibility standards, often requiring proprietary tooling and specialized component certification. Strategic management of volatile raw material costs, particularly for medical-grade plastics, high-grade stainless steel used in the device housing, and sophisticated electronics, directly influences the ultimate profitability and final device margin. Inventory management optimization at this critical upstream stage is perpetually crucial to mitigate significant risks associated with sudden supply chain disruptions or pronounced volatility in essential commodity prices, a factor emphasized greatly by recent global supply chain rationalization efforts.

The midstream phase focuses on core device manufacturing, encompassing complex assembly processes, integration of proprietary pressure control and safety software, and rigorous, multi-stage calibration routines to ensure precisely regulated pressure delivery across a vast range of variable flow rates. Leading manufacturers significantly differentiate themselves in this phase through proprietary intellectual property related to predictive flow algorithms for instantaneous pressure stability and patented designs for specialized heating and humidification modules, which enhance clinical efficacy. Distribution—the crucial downstream activity—is managed through a highly effective hybrid model tailored to diverse global markets. Direct sales channels are preferentially employed for high-value capital transactions involving major international hospital networks and large governmental tenders, allowing manufacturers greater, immediate control over product installation, comprehensive staff training, and essential post-sales customer feedback loops, thereby strongly fostering deep brand loyalty and securing future upgrade cycles. Conversely, extensive indirect distribution through established regional medical equipment dealers is absolutely essential for penetrating geographically fragmented and diverse markets, especially throughout APAC and LATAM, where specialized local market knowledge, cultural understanding, and established clinical relationships are paramount for achieving broad market reach and successfully navigating complex regional import and regulatory hurdles.

Post-market service activities constitute a significant and increasingly strategic portion of the total value proposition, focusing heavily on continuous customer support and the lucrative, recurring sale of consumables. Technical service and preventative maintenance contracts generate highly predictable, high-margin revenue streams, as sophisticated insufflators are complex medical devices requiring specialized periodic calibration, software updates, and rigorous preventative maintenance by vendor-certified technicians to ensure ongoing regulatory compliance and guaranteed functional integrity throughout their operational life. Moreover, the demand for disposable, single-use accessories—including specialized sterile high-flow tubing sets, hydrophobic particulate filters, and specific gas line adaptors—is accelerating rapidly, driven by increasingly stringent global infection control guidelines and streamlined operational requirements. These crucial consumables, purchased repeatedly throughout the device's lifespan, substantially increase the total lifetime value of the customer relationship and solidify the vendor lock-in, making the continuous development and aggressive market promotion of proprietary, high-quality disposable accessories a key strategic imperative across the entire operational value chain for sustained profitability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Karl Storz SE & Co. KG, Richard Wolf GmbH, Olympus Corporation, Fujifilm Holdings Corporation, B. Braun Melsungen AG, Medtronic plc, Johnson & Johnson (Ethicon), ConMed Corporation, Becton, Dickinson and Company (BD), Steris plc, AneticAid, LiNA Medical, Ackermann Instrumente GmbH, XION GmbH, Soring GmbH, Rudolf Medical GmbH + Co. KG, Optomic, Tonglu Hospital Equipment Co. Ltd., Shandong Kang'erjian Medical Technology Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insufflator Market Key Technology Landscape

The contemporary Insufflator Market is characterized by highly sophisticated technological innovations aimed at maximizing patient safety, optimizing surgical visibility, and facilitating seamless digital integration within the modern, complex operating room (OR) environment. The foremost technological imperative driving current development is the absolute mastery of gas flow dynamics, which has led to the market dominance of Ultra-High Flow Insufflators, capable of reliably delivering CO2 at continuous rates frequently exceeding 60 liters per minute. This extreme flow capability is critically paramount for maintaining stable intra-abdominal pressure (IAP) during complex procedures that routinely involve frequent venting, aggressive suctioning, or substantial gas loss due to the repeated insertion and removal of multiple instruments through various trocars. These advanced systems rely on highly sophisticated proportional valve technology and ultra-fast, real-time pressure feedback loops to instantaneously compensate for sudden pressure changes in milliseconds, thereby ensuring that the surgeon’s endoscopic view remains consistently clear and minimizing the critical risk of hemodynamic compromise to the patient associated with prolonged exposure to inconsistent IAP levels.

A second, crucial area of transformative technological advancement centers squarely on mitigating pervasive clinical complications directly associated with the creation and maintenance of pneumoperitoneum. This is comprehensively achieved through the integration of highly effective Gas Conditioning Units (GCUs), which actively heat and precisely humidify the CO2 gas prior to its safe delivery into the patient cavity. Utilizing advanced micro-heater elements and sensitive humidity sensors, these systems accurately regulate the gas output parameters to match the patient's core body temperature and saturation levels. This technological feature dramatically reduces the debilitating incidence of patient hypothermia, preserves the delicate peritoneal mesothelium from desiccation damage, and significantly minimizes postoperative pain, thereby consistently improving recovery parameters. The mandatory incorporation of these specialized GCUs is rapidly becoming a non-negotiable standard feature in all high-end insufflator models and serves as a major purchasing criterion in highly competitive developed markets, actively driving the technological obsolescence of older, non-heated systems and creating a strong, sustained replacement demand cycle.

Furthermore, the accelerating convergence of medical technology and pervasive digital connectivity fundamentally defines the latest generation of insufflators as sophisticated networked devices. Advanced units now routinely feature integrated networking capabilities, fully supporting standardized hospital communication protocols such as DICOM and HL7, which enables the automatic and secure logging of critical flow rate profiles, detailed pressure data, and precise total gas usage directly into the patient's electronic surgical records and centralized hospital data management systems. This critical digitalization feature not only substantially streamlines clinical documentation for stringent regulatory compliance but also profoundly supports quality assurance audits and comprehensive performance analysis across surgical departments. Peripheral safety technologies, such as integrated high-efficiency smoke evacuation systems, often built directly into the insufflator unit or controlled synchronously by it, also significantly enhance the overall technological landscape. These systems actively filter harmful surgical smoke and particulates, improving both visualization and reducing surgical plume exposure risks for the OR staff, solidifying the insufflator's modern role as a central, multi-functional gas and environmental management hub in the high-tech surgical theater.

Regional Highlights

North America maintains its unquestionable leadership position in the global Insufflator Market, largely dictated by the high volume of complex minimally invasive procedures performed annually across the United States and Canada, which benefit from highly robust healthcare expenditure and a highly favorable, entrenched reimbursement landscape that actively encourages the sustained use of expensive, technologically superior medical equipment. The regional market is structurally characterized by an extremely high penetration rate of state-of-the-art robotic surgical systems, which are functionally dependent on ultra-high flow, seamlessly integrated insufflators for optimal operational efficacy and stability. Key market drivers include the rapid, competitive pace of technological innovation adopted by major industry players headquartered in the region (e.g., Stryker, Medtronic, ConMed) and sophisticated infrastructure fully capable of supporting continuous advanced equipment maintenance and the rapid, widespread adoption of disposable accessories. The demand in this mature market focuses heavily on recurring replacement cycles aimed at upgrading older systems to fully connected, AI-ready platforms equipped with superior gas conditioning and advanced safety features, ensuring stable and predictable revenue generation throughout the entire forecast period.

The European market, led by major economies such as Germany, the United Kingdom, and France, is a substantial and critical revenue contributor, distinguished by a strong, institutional emphasis on rigorous clinical safety and mandated quality adherence, particularly enforced under the demanding and complex framework of the EU Medical Device Regulation (MDR). This restrictive regulatory environment mandates that manufacturers invest substantially in comprehensive clinical validation studies and the development of robust, fail-safe safety features, resulting in high market acceptance for integrated heated insufflation systems and advanced intraoperative monitoring technology. While the overall growth rates are structurally lower than those projected for the APAC region due to high market maturity and existing saturation levels, the underlying demand remains highly steady, driven by the necessary need to replace aging capital equipment and integrate newer digital connectivity standards across both public and private hospital sectors. Central and Eastern European countries collectively offer moderate, incremental expansion potential, currently focused on acquiring basic and high-quality mid-range insufflators as their national healthcare systems incrementally modernize and strive to increase patient accessibility to routine MIS procedures.

Asia Pacific (APAC) stands out unequivocally as the global hotspot for future market expansion, projected to achieve the highest Compound Annual Growth Rate over the forecast horizon due to converging positive macroeconomic factors. This dynamic, aggressive growth is fueled by surging urbanization, rapidly improving economic stability leading to substantially higher private healthcare spending, and proactive government efforts in populous nations like China and India to elevate surgical standards and reduce the systemic reliance on traditional, open surgery methodologies. While fundamental price sensitivity remains an important constraining factor, the rapidly burgeoning medical tourism industry across Southeast Asia and the substantial increase in the incidence of lifestyle diseases requiring laparoscopic intervention (e.g., bariatric and complex gastrointestinal surgeries) are collectively generating colossal underlying demand. Manufacturers are strategically responding by partnering closely with local distributors and investing strategically in regional manufacturing facilities to offer localized product configurations that precisely balance technological efficacy with extremely competitive pricing, successfully targeting both the mass volume market of public hospitals and the high-end specialized surgical centers catering to the affluent international patient segment.

- North America: Dominant market share due to widespread use of robotic surgery, high institutional CapEx spending capacity, and the leading presence of global MedTech giants. Focus remains intensely on premium, fully integrated systems with advanced data connectivity.

- Europe: Stable second-largest market, strongly guided by stringent regulatory standards (MDR) and high clinical adoption of advanced safety features like heated gas delivery and automated filtering. Germany and the Benelux countries serve as the primary clinical procurement hubs.

- Asia Pacific (APAC): Highest projected CAGR globally, propelled by rapid large-scale infrastructure expansion, rising middle-class healthcare access, and significant procedural volume growth, particularly in developing economies (China, India). Focus remains on highly scalable and cost-effective high-flow solutions.

- Latin America (LATAM): Moderate growth market, with Brazil and Mexico driving regional demand through rapidly increasing private insurance coverage and the successful standardization of laparoscopic training protocols across key metropolitan surgical centers.

- Middle East and Africa (MEA): Emerging revenue source, with growth heavily concentrated in the affluent Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) driven by ambitious medical city projects, high per capita healthcare spending, and a continuous reliance on imported, high-specification Western technology for specialty care.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insufflator Market.- Stryker Corporation

- Karl Storz SE & Co. KG

- Richard Wolf GmbH

- Olympus Corporation

- Fujifilm Holdings Corporation

- B. Braun Melsungen AG

- Medtronic plc

- Johnson & Johnson (Ethicon)

- ConMed Corporation

- Becton, Dickinson and Company (BD)

- Steris plc

- AneticAid

- LiNA Medical

- Ackermann Instrumente GmbH

- XION GmbH

- Soring GmbH

- Rudolf Medical GmbH + Co. KG

- Optomic

- Tonglu Hospital Equipment Co. Ltd.

- Shandong Kang'erjian Medical Technology Co.

Frequently Asked Questions

Analyze common user questions about the Insufflator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Insufflator Market?

The Insufflator Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period spanning 2026 to 2033. This growth is principally driven by the increasing global adoption of minimally invasive surgical procedures and continuous technological advancements in ultra-high-flow insufflation systems necessary for complex surgery and robotics.

How do high-flow insufflators differ from standard units, and why are they critical?

High-flow insufflators are critical as they offer significantly elevated gas flow rates (typically 20 L/min and above) compared to standard units, enabling surgeons to rapidly establish and, more importantly, stably maintain consistent intra-abdominal pressure during complex laparoscopic or robotic surgeries, countering the high rates of CO2 leakage associated with frequent instrumentation exchanges.

Which geographical region is expected to demonstrate the fastest market growth?

The Asia Pacific (APAC) region is strongly anticipated to be the fastest-growing market segment due to substantial investments in developing healthcare infrastructure, escalating patient volumes resulting from increased access to care, and the proactive governmental push to adopt advanced, less invasive surgical technologies in key economies like China and India.

What is the primary factor restraining market growth globally?

The primary factor significantly restraining market expansion is the substantial upfront capital expenditure (CapEx) required for acquiring sophisticated, digitally integrated insufflator units and their necessary proprietary accessories, which limits the rapid adoption rate in smaller clinics and hospitals in emerging economies with constrained operating budgets.

What role does heated insufflation play in modern surgical practice?

Heated and humidified insufflation systems play an increasingly vital role by actively conditioning the CO2 gas to near body temperature before entry. This critical process minimizes patient risks associated with intraoperative hypothermia, significantly reduces postoperative pain and discomfort, and helps maintain the integrity of the peritoneal membrane, thereby enhancing patient recovery profiles and overall clinical outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager