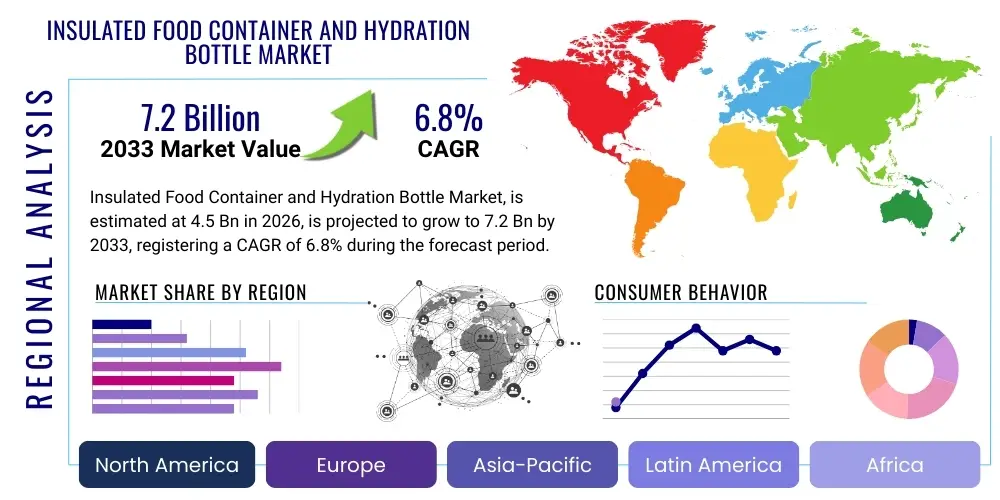

Insulated Food Container and Hydration Bottle Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442627 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Insulated Food Container and Hydration Bottle Market Size

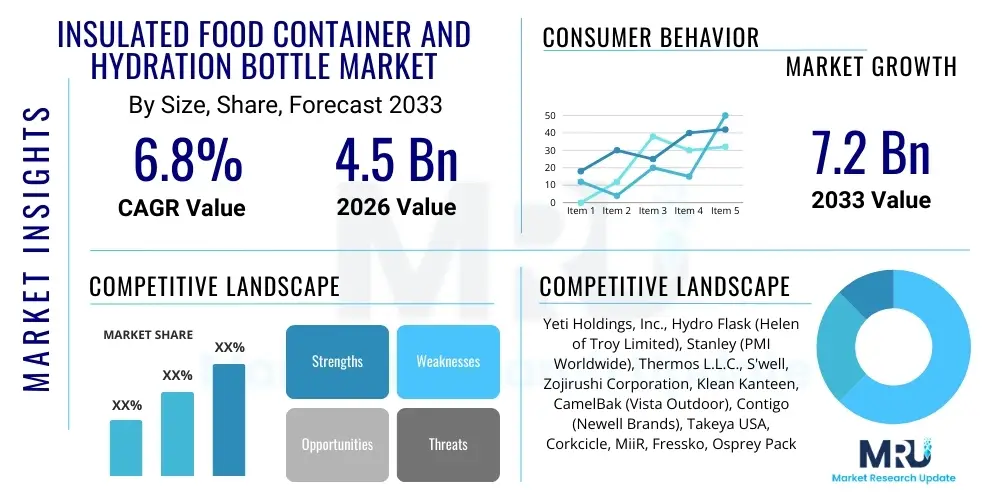

The Insulated Food Container and Hydration Bottle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.2 billion by the end of the forecast period in 2033.

Insulated Food Container and Hydration Bottle Market introduction

The Insulated Food Container and Hydration Bottle Market encompasses a diverse range of products designed primarily to maintain the temperature of food and beverages, whether hot or cold, over extended periods. This market segment has experienced robust expansion driven by increasing consumer awareness regarding health, wellness, and sustainability. Key products include double-walled stainless steel vacuum bottles, insulated lunch boxes, food jars, and specialized containers for infant formula or outdoor activities. The core technology relies on vacuum insulation, often coupled with advanced materials like food-grade stainless steel and BPA-free plastics, ensuring maximum thermal retention and minimizing condensation. These products are no longer perceived as mere utility items but rather as essential lifestyle accessories promoting convenience and reduced reliance on single-use plastics.

Major applications of these insulated products span various consumer segments, including daily commuters who require hot coffee or tea, students carrying packed lunches, outdoor enthusiasts needing temperature-stable hydration, and professionals seeking healthy, homemade meals. The utility extends beyond simple temperature maintenance; modern designs prioritize portability, leak-proof functionality, durability, and aesthetic appeal. The market dynamism is further fueled by continuous innovation in design, incorporating features like integrated purification systems, smart temperature indicators, and modular stacking systems for food containers. This adaptability to modern life’s demands—from fitness regimes to remote work setups—solidifies their indispensable role in consumer goods.

The primary benefits driving market adoption include enhanced food safety, cost savings associated with reducing restaurant purchases, and significant environmental contributions through the substitution of disposable packaging. Driving factors are multifaceted, encompassing the global push toward eco-friendly consumption habits, stringent regulatory measures against single-use plastics in several key regions, and a growing emphasis on health consciousness, encouraging consumers to prepare and transport their own nutritious meals. Furthermore, aggressive branding and marketing strategies by key players, focusing on personalization, material quality, and high-performance claims, significantly influence purchasing decisions, positioning these items as premium accessories rather than basic commodities.

Insulated Food Container and Hydration Bottle Market Executive Summary

The Insulated Food Container and Hydration Bottle Market is defined by intense competition and rapid innovation, primarily centering on durability, thermal performance, and design aesthetics. Current business trends indicate a strong shift towards premiumization, where consumers are willing to invest in higher-priced products offering enhanced features, superior materials (such as 18/8 food-grade stainless steel), and established brand loyalty, exemplified by companies known for lifetime guarantees and environmental responsibility. Strategic corporate initiatives focus on expanding direct-to-consumer (D2C) channels and forging partnerships with fitness and outdoor lifestyle brands to maximize visibility and consumer engagement. Furthermore, supply chain resilience, particularly post-2020 disruptions, has become a competitive differentiator, with manufacturers increasingly exploring localized or regionally diversified production hubs to mitigate risks and improve lead times, while simultaneously integrating sustainable manufacturing practices.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market due to rapid urbanization, increasing disposable incomes, and the widespread adoption of on-the-go lifestyles, particularly in densely populated economies like China and India, where temperature-controlled food transport is essential for daily routines. North America and Europe, while representing mature markets, maintain dominance in terms of revenue, driven by established consumer health trends, high penetration rates of outdoor leisure activities, and strong governmental and consumer pressure regarding plastic waste reduction, propelling the demand for reusable, high-quality hydration solutions. Latin America and the Middle East & Africa (MEA) are emerging regions exhibiting significant untapped potential, marked by growing consumer awareness of brand value and sustainability, promising substantial growth in the latter half of the forecast period as retail infrastructure improves and product accessibility increases.

Segment trends highlight the significant dominance of the Hydration Bottle segment, primarily stainless steel vacuum insulated bottles, driven by global wellness trends and the ubiquitous necessity of water consumption throughout the day. However, the Insulated Food Container segment is demonstrating accelerated growth, propelled by the rise of flexible work arrangements and the sustained trend of meal prepping and healthy eating at home or work. Segmentation by material clearly favors stainless steel due to its durability, safety profile, and superior thermal properties, displacing traditional plastic and glass alternatives. Distribution analysis indicates that E-commerce platforms are increasingly critical, offering wider product varieties and direct consumer interaction, though specialized retail stores (e.g., sporting goods, kitchenware) remain vital for physical product evaluation and premium purchases.

AI Impact Analysis on Insulated Food Container and Hydration Bottle Market

User queries regarding AI's influence in this market often revolve around smart product integration—specifically, "How can AI make my water bottle smarter?", "Will AI automate quality control in manufacturing?", and "Can AI predict sustainable material trends?" The collective user concern centers on achieving personalized utility, demanding functionalities such as real-time tracking of hydration goals, automatic alerts for water temperature changes, and integration with health monitoring apps. There is also significant interest from the business side regarding how AI-driven analytics can optimize complex supply chains, forecast demand for highly seasonal or trend-driven colors and designs, and enhance manufacturing efficiency, particularly in defect detection during the high-volume production of insulated containers.

The impact of Artificial Intelligence (AI) on the Insulated Food Container and Hydration Bottle Market is transforming several key operational and consumer touchpoints. In manufacturing, AI-powered computer vision systems are revolutionizing quality control by inspecting welded seams, surface finishes, and vacuum integrity far faster and more accurately than traditional manual or statistical sampling methods, significantly reducing defect rates and enhancing product lifespan. Furthermore, predictive maintenance algorithms, utilizing sensor data from machinery, minimize unplanned downtime, crucial for maintaining high production volumes and meeting fluctuating global demand, particularly for highly successful product lines.

From a consumer product standpoint, AI facilitates the development of 'smart' hydration solutions. These often involve embedded sensors paired with mobile applications that use machine learning to analyze user-specific factors like climate, activity level, and biological data, providing personalized hydration recommendations. For food containers, AI could potentially optimize thermal performance by analyzing usage patterns and environmental factors, suggesting ideal material combinations or warning users if internal temperatures are approaching unsafe levels. On the business intelligence front, AI algorithms analyze vast datasets of consumer reviews, social media sentiment, and sales trends to identify emerging aesthetic preferences and functional needs (e.g., the rising demand for matte finishes or specific cap types), thereby guiding rapid product development cycles and targeted marketing campaigns.

- AI-driven Quality Control: Enhanced defect detection in welding, painting, and vacuum sealing, leading to superior product quality and reduced waste.

- Predictive Demand Forecasting: Machine learning models optimize inventory levels and production schedules based on regional trends, seasonal effects, and promotional impact.

- Smart Hydration Systems: AI algorithms personalize daily fluid intake goals based on user biometrics and activity tracking.

- Optimized Supply Chain Logistics: AI enhances routing, warehousing efficiency, and risk mitigation across complex global distribution networks.

- Material Innovation Guidance: AI analyzes performance data of novel sustainable materials, accelerating the adoption of environmentally friendly composites and coatings.

DRO & Impact Forces Of Insulated Food Container and Hydration Bottle Market

The Insulated Food Container and Hydration Bottle Market is primarily driven by escalating consumer commitment to environmental sustainability and the widespread replacement of single-use plastics, coupled with growing awareness of the health benefits associated with carrying home-prepared, temperature-controlled meals and beverages. However, this growth is partially restrained by high initial costs associated with premium insulated products compared to inexpensive disposable alternatives, and the challenge of maintaining product differentiation in an increasingly saturated market. Significant opportunities arise from the integration of smart technology features, customization options, and expansion into niche markets such as medical transport and specialized extreme environment usage. These dynamics are shaped by intense competitive rivalry, technological advancements in vacuum sealing, and the substantial bargaining power of consumers demanding high-quality, long-lasting, and ethically produced goods.

Key drivers include regulatory tailwinds across major economies enforcing bans or taxes on disposable packaging, fundamentally shifting consumer behavior towards reusable items. Furthermore, the global trend of wellness and preventive healthcare emphasizes adequate hydration and nutritional continuity, directly increasing the demand for portable, safe, and efficient storage solutions. The impact forces are also heavily influenced by material science improvements; ongoing research into lighter, more durable, and cost-effective insulation materials, such as specific ceramic linings or advanced vacuum retention processes, continues to push product performance boundaries, making insulated containers viable for broader applications and longer retention periods.

Restraints largely involve the market’s reliance on raw materials like stainless steel, the prices of which can fluctuate significantly based on global trade dynamics and resource availability, impacting manufacturing costs and profitability. Additionally, the proliferation of counterfeit or low-quality insulated products, particularly from unverified online channels, poses a risk to established brand reputations and can dilute consumer trust in the overall category’s performance claims. Opportunities, however, stem from product innovation focused on modularity (e.g., interchangeable lids, stackable food modules), enhanced cleaning mechanisms, and the development of specialized antimicrobial coatings, catering to the hygiene-conscious consumer. Strategic geographic expansion into untapped retail sectors in emerging markets also presents substantial revenue potential for established market leaders.

Segmentation Analysis

The Insulated Food Container and Hydration Bottle Market is highly diversified, segmented comprehensively across Product Type, Material, Capacity, Distribution Channel, and End-User. This granular segmentation allows manufacturers and marketers to precisely target distinct consumer needs, ranging from professional athletes demanding high-capacity, durable hydration solutions to parents seeking small, easily cleanable, and safe insulated containers for baby food. The analysis of these segments reveals varying growth rates, with the hydration bottle category dominating revenue due to mass market penetration, while niche segments like smart containers and specialized high-performance food jars are demonstrating premiumization and rapid value growth, reflecting consumer willingness to pay for specialized utility.

Segmentation by Material illustrates the strong preference for stainless steel, owing to its recyclability, robustness, and effective insulation properties, although high-grade, vacuum-sealed plastics and specialized glass alternatives retain market share in categories where weight or transparency is prioritized. Capacity segmentation is crucial, differentiating products for daily personal use (e.g., 500ml-1L bottles) from larger family or outdoor/expedition volumes (e.g., 2L+). Understanding the interplay between these segments is vital for effective market positioning; for instance, a large-capacity stainless steel hydration bottle targeting the outdoor enthusiast segment utilizes a premium distribution channel (specialty sports stores) and justifies a higher price point based on material strength and extended thermal performance claims.

The segmentation by End-User further defines market demand, separating general consumer use from institutional or commercial applications, such as catering services, healthcare facilities requiring temperature stability for medical supplies, or corporate gifting programs. The fastest growing segment within End-Users includes younger generations (Millennials and Gen Z) who prioritize sustainable, aesthetically pleasing, and highly portable products that align with active, often social media-driven lifestyles. Strategic analysis of distribution channels confirms the increasing role of e-commerce, driven by convenience and expansive product catalogs, though traditional brick-and-mortar retains importance for immediate purchase and tactile quality assurance.

- Product Type:

- Insulated Hydration Bottles (Water Bottles, Thermoses)

- Insulated Food Containers (Lunch Boxes, Food Jars, Canisters)

- Specialty Containers (Growlers, Tumblers, Mugs)

- Material:

- Stainless Steel (Dominant Segment)

- Plastics (BPA-free, Tritan)

- Glass (Borosilicate, often used for baby food)

- Capacity:

- Below 500 ml

- 500 ml to 1 Litre (High Volume Segment)

- Above 1 Litre

- Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Supermarkets/Hypermarkets, Specialty Stores, Department Stores)

- End-User:

- Individual Consumers

- Commercial/Institutional (Catering, Offices)

Value Chain Analysis For Insulated Food Container and Hydration Bottle Market

The value chain for the Insulated Food Container and Hydration Bottle Market is complex, starting with raw material procurement and culminating in post-sale consumer service. Upstream analysis focuses heavily on the sourcing of primary materials, notably high-grade stainless steel (304 or 18/8), specialized plastics, silicon seals, and vacuum insulation components. The efficiency and ethical sourcing of these materials are critical, as they directly influence the product's thermal performance, durability, and brand reputation regarding sustainability claims. Key strategic focus areas upstream involve negotiating stable pricing contracts, ensuring material compliance with international food safety standards (e.g., FDA, LFGB), and managing inventory to respond swiftly to design changes or demand spikes, particularly those associated with seasonal shifts or viral marketing campaigns.

The midstream process involves manufacturing, which is typically highly specialized, requiring precision machinery for welding double walls, achieving high-vacuum sealing, and applying protective and aesthetic coatings (e.g., powder coating). Efficiency in manufacturing, driven by automation and stringent quality control (as noted in the AI analysis), determines cost competitiveness. Following manufacturing, products move into distribution channels. This stage is split between direct (brand-to-consumer via owned e-commerce) and indirect channels (retailers, distributors). Direct distribution offers higher margins and direct consumer data, enabling better relationship management and faster feedback loops on new products. Indirect channels, primarily through major retailers and sporting goods stores, ensure broad market reach and visibility.

Downstream analysis centers on marketing, sales, and post-purchase activities. Successful brands invest heavily in lifestyle marketing, associating their products with health, adventure, and environmental responsibility, thereby transforming a commodity into a premium lifestyle accessory. The final consumer touchpoint involves retail fulfillment and customer service, where the perceived quality of the warranty and ease of replacement significantly influence customer loyalty. The increasing importance of e-commerce means logistics and last-mile delivery have become critical competitive differentiators, demanding sophisticated warehousing and tracking systems to ensure products arrive quickly and in pristine condition, thereby completing the value loop successfully.

Insulated Food Container and Hydration Bottle Market Potential Customers

Potential customers for the Insulated Food Container and Hydration Bottle Market are highly segmented and span nearly every demographic, reflecting the universal need for portable temperature management solutions. The primary target groups include environmentally conscious individuals, health and fitness enthusiasts, and students/office professionals. Environmentally conscious consumers are focused on reducing their ecological footprint and actively seek out reusable, durable products, often prioritizing brands that utilize sustainable packaging and provide transparency regarding their supply chain ethics. This segment drives the demand for premium stainless steel and highly durable products with lifetime guarantees, viewing the initial cost as a long-term investment in sustainability.

Health and fitness enthusiasts constitute a major consumer base, requiring high-performance hydration bottles (often with volume markers and purification features) to maintain optimal fluid intake during workouts or demanding outdoor activities. This segment also includes individuals committed to meal prepping, who require modular, leak-proof, and easy-to-clean food containers that can safely store pre-portioned, nutritious meals for the week. Their purchasing decisions are often influenced by endorsements from athletes, fitness influencers, and alignment with high-performance sporting goods brands, emphasizing functionality and robustness under strenuous conditions.

Students and office professionals represent the largest volume segment, driven by practicality and cost-efficiency. Students rely on insulated containers to keep drinks cool throughout the school day or carry warm, budget-friendly meals. Office workers, particularly those adopting hybrid or remote work models, use these containers to maintain coffee temperature during meetings or transport healthy, homemade lunches, thereby reducing reliance on vending machines or cafeteria services. This group often prioritizes moderate pricing, attractive designs, and ease of cleaning, with aesthetic appeal and personalization features acting as strong motivators for purchase.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 7.2 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yeti Holdings, Inc., Hydro Flask (Helen of Troy Limited), Stanley (PMI Worldwide), Thermos L.L.C., S'well, Zojirushi Corporation, Klean Kanteen, CamelBak (Vista Outdoor), Contigo (Newell Brands), Takeya USA, Corkcicle, MiiR, Fressko, Osprey Packs, Pura Kiki |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insulated Food Container and Hydration Bottle Market Key Technology Landscape

The technological landscape of the Insulated Food Container and Hydration Bottle Market is primarily defined by advancements in vacuum insulation techniques, material science, and increasing integration of 'smart' features. The standard technology involves double-walled containers with a vacuum sealed space between the layers, which significantly minimizes heat transfer via conduction and convection. Recent innovations focus on improving the efficiency of the vacuum retention process and utilizing proprietary getter materials to maintain vacuum integrity over longer product lifecycles, thereby enhancing the thermal performance capabilities from 12 hours cold/6 hours hot to 24-48 hours cold/12-24 hours hot, meeting the demands of high-performance users.

Material science breakthroughs are driving significant technological evolution. While stainless steel remains dominant, manufacturers are investing in research for lightweight and high-strength alloys that reduce the overall product weight without compromising durability or insulation effectiveness. Additionally, the development of specialized interior coatings, such as ceramic linings or copper plating within the vacuum layer, aids in improving temperature retention and prevents the transfer of metallic tastes, enhancing the purity of the stored beverage or food. These coatings also often incorporate antimicrobial properties, addressing growing consumer concerns regarding hygiene and ease of cleaning, which is a critical technological differentiator in saturated markets.

The emergence of smart technology represents the frontier of innovation in this market. This includes the integration of micro-electronic sensors, Bluetooth capabilities, and IoT connectivity, transforming passive containers into active hydration monitoring devices. Features such as temperature monitoring displays, consumption tracking linked to mobile applications, and UV-C light sterilization systems embedded in the lid are becoming increasingly popular, particularly in premium segments. Furthermore, manufacturing technologies such as advanced powder coating application techniques offer superior chip resistance, improved grip, and a wider range of customizable, textured aesthetic finishes, which, while not core insulation technology, significantly contribute to the product's market acceptance and premium positioning.

Regional Highlights

Regional dynamics play a crucial role in shaping the Insulated Food Container and Hydration Bottle Market, driven by varying cultural preferences, disposable income levels, environmental regulations, and prevalence of specific lifestyle activities. North America and Europe currently hold the largest market shares, primarily due to high consumer spending power, established health and wellness trends, and strong governmental backing for environmental initiatives, such as plastic reduction mandates. In North America, the market is characterized by robust demand for large-capacity, rugged products favored by the outdoor and fitness communities, exemplified by the market saturation of premium brands focused on durability and aesthetic customization. Europe shows strong penetration driven by office culture, strict food safety regulations, and a widespread preference for stylish, compact designs suited for urban commuting and eco-friendly shopping.

Asia Pacific (APAC) is recognized as the engine of future market growth, anticipated to exhibit the highest CAGR during the forecast period. This rapid expansion is fueled by increasing middle-class populations, accelerated urbanization, and the region's cultural emphasis on carrying home-cooked meals for health and economic reasons. Specific countries like Japan and South Korea are leaders in integrating high-precision vacuum insulation technology and advanced features like lightweight design and precise temperature control, driven by demanding consumer expectations for technological sophistication. Meanwhile, rapidly developing economies such as India and China are witnessing mass adoption as consumers transition away from cheap disposable options towards mid-range and premium reusable solutions, strongly influenced by Western lifestyle trends and increasing environmental awareness.

The markets in Latin America (LATAM) and the Middle East & Africa (MEA) are emerging, offering significant untapped potential. In LATAM, growing concerns over the quality of tap water and rising health consciousness are driving the demand for reliable hydration bottles, often featuring filtration capabilities. In the MEA region, the need for robust temperature retention is particularly critical due to extreme climate conditions, fueling demand for high-performance insulated products suitable for maintaining cold temperatures for extended periods outdoors. Market penetration in these regions is currently lower, meaning strategic entry and localized distribution partnerships are key opportunities for international manufacturers seeking long-term growth and geographical diversification.

- North America: Market leader in premium, high-capacity, durable hydration solutions; driven by strong outdoor recreation culture and wellness trends.

- Europe: High penetration in urban centers; focus on sleek design, sustainability compliance, and efficient use for commuting and office environments.

- Asia Pacific (APAC): Fastest growing region; high demand driven by urbanization, meal-prepping culture, and technological sophistication (e.g., Japan, South Korea).

- Latin America (LATAM): Emerging market driven by improving economic conditions and increased focus on water safety and hydration.

- Middle East & Africa (MEA): Critical demand for extreme temperature retention capability due to harsh climates; substantial opportunity for high-performance products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insulated Food Container and Hydration Bottle Market.- Yeti Holdings, Inc.

- Hydro Flask (Helen of Troy Limited)

- Stanley (PMI Worldwide)

- Thermos L.L.C.

- S'well

- Zojirushi Corporation

- Klean Kanteen

- CamelBak (Vista Outdoor)

- Contigo (Newell Brands)

- Takeya USA

- Corkcicle

- MiiR

- Fressko

- Osprey Packs

- Pura Kiki

- Laken

- Tiger Corporation

- Lock&Lock Co., Ltd.

- W&P Design (Porter)

- BRITA GmbH

Frequently Asked Questions

Analyze common user questions about the Insulated Food Container and Hydration Bottle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Insulated Food Container and Hydration Bottle Market?

The primary driver is the global shift toward environmental sustainability and the widespread consumer adoption of reusable products to reduce reliance on single-use plastics. Legislative actions and increasing health consciousness regarding portable, safe, temperature-controlled food and beverages also significantly contribute to market expansion.

Which material dominates the insulated container market and why is it preferred?

Stainless steel, specifically 18/8 food-grade stainless steel, dominates the market due to its superior durability, resistance to corrosion and flavor retention, inherent food safety (BPA-free), and excellent thermal insulation capabilities when used in vacuum-sealed, double-walled construction. It also offers high recyclability, aligning with consumer sustainability demands.

How is AI technology impacting the manufacturing of insulated bottles?

AI is primarily impacting manufacturing through enhanced quality control and predictive maintenance. AI-powered computer vision systems ensure the integrity of welds and vacuum seals with high precision, minimizing defects, while predictive analytics optimize machinery operations to maintain continuous, efficient production schedules.

Which region is expected to show the fastest growth rate for insulated containers?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid urbanization, substantial growth in the middle-class population with increased disposable income, and a strong cultural tradition of carrying homemade meals and drinks.

What are the key differences between Vacuum Insulation and Foam Insulation in these products?

Vacuum insulation, used in premium products, provides superior thermal performance by removing air between two walls, effectively preventing heat transfer via conduction and convection, maintaining temperatures for 24+ hours. Foam insulation is less effective, relying on trapped air cells, offering shorter retention periods, and is typically used in lower-cost or less performance-critical containers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager