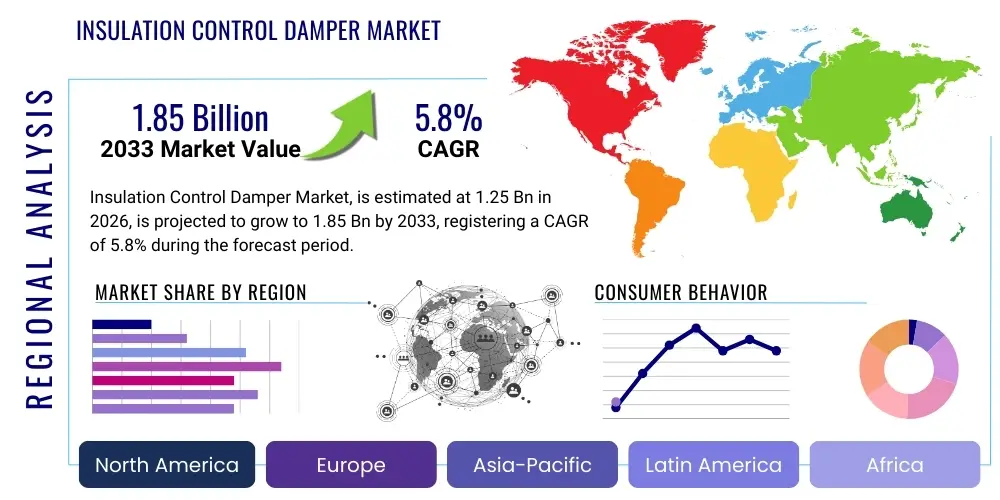

Insulation Control Damper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442024 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Insulation Control Damper Market Size

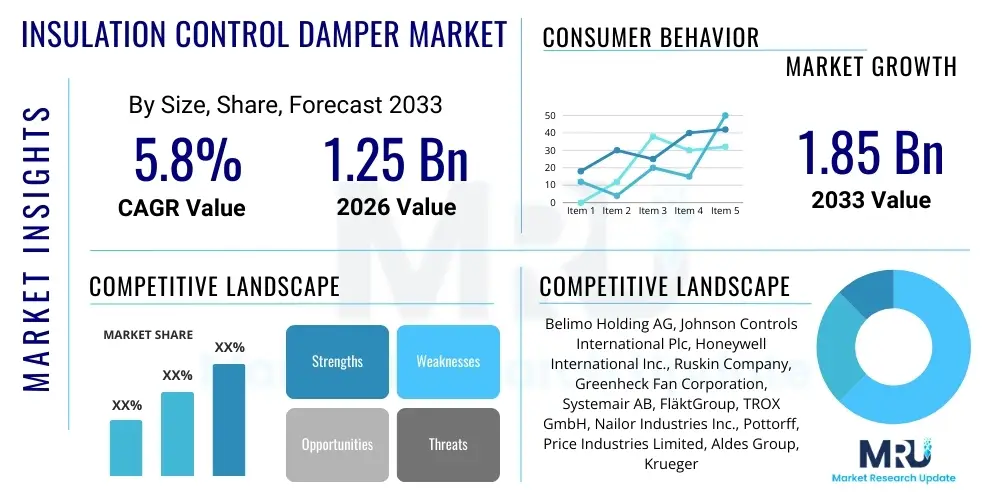

The Insulation Control Damper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for energy-efficient HVAC systems across commercial and industrial infrastructure, particularly in regions adopting stringent green building codes. Market expansion is further supported by innovations in material science, leading to the development of dampers offering superior thermal breaks and minimal leakage rates, ensuring optimal performance in critical temperature control applications.

Insulation Control Damper Market introduction

The Insulation Control Damper Market encompasses specialized components designed to regulate airflow within heating, ventilation, and air conditioning (HVAC) systems while simultaneously preventing heat transfer through the damper structure itself. These devices are crucial for maintaining thermal integrity in ductwork, particularly where ducts pass through areas of differing temperatures or are exposed to external environments, thereby mitigating energy losses associated with conventional damper designs. Key product features often include advanced thermal breaks, insulating foam cores, and high-performance sealing mechanisms to ensure airtight closure and minimized thermal bridging.

Major applications for insulation control dampers span across commercial buildings, institutional facilities (hospitals, schools), industrial complexes, and data centers, where precise temperature and humidity control are paramount. In commercial office spaces and hospitality sectors, these dampers play a vital role in zone control, preventing conditioned air from escaping unused sections and ensuring compliance with stringent building energy performance standards. For industrial ventilation systems, particularly those handling varied processes, insulation control is necessary to manage condensation risk and maintain process efficiency.

The primary benefits derived from the adoption of these specialized dampers include substantial energy savings due to reduced thermal loss, enhanced indoor air quality (IAQ) through superior sealing capabilities, and improved system reliability and longevity. Driving factors for market growth include the global impetus toward sustainable construction practices, mandatory energy efficiency regulations (such as ASHRAE 90.1 and various regional codes), and the rising investment in smart building technologies that require precise, automated airflow components to achieve optimal operational efficiency. Furthermore, the increasing complexity of HVAC infrastructure in modern architecture necessitates components capable of high-performance thermal segregation.

Insulation Control Damper Market Executive Summary

The Insulation Control Damper Market is currently defined by robust business trends emphasizing digitalization and system integration. Manufacturers are increasingly focusing on developing dampers that integrate seamlessly with Building Management Systems (BMS) and utilize smart actuation capabilities, moving beyond traditional mechanical control toward fully automated, predictive airflow management. Key business strategies revolve around lifecycle cost reduction for end-users, achieved through superior material choices that offer longevity and require minimal maintenance. The competitive landscape is characterized by a strong emphasis on product certification (e.g., AMCA testing) to validate leakage rates and thermal performance, which acts as a major differentiator in high-specification projects.

Regionally, the market exhibits dynamic growth, with Asia Pacific (APAC) emerging as the fastest-growing region, fueled by rapid urbanization, massive infrastructure development, and increasing adoption of international energy conservation standards in developing economies like China and India. North America and Europe, while mature markets, maintain high demand due to mandatory energy retrofitting programs, stringent governmental policies aimed at decarbonization, and continuous innovation in low-leakage damper technology. These regions focus heavily on replacing outdated, non-insulated components to meet updated efficiency benchmarks, driving the aftermarket segment.

Segment trends reveal a strong preference for aluminum and composite material dampers over galvanized steel, primarily due to better thermal properties and lighter weight, simplifying installation. The market is seeing increased adoption of motorized dampers over manual variants, reflecting the widespread implementation of automated building control systems that require remote adjustment and precise positioning. Furthermore, the commercial sector, particularly healthcare and data centers, remains the dominant end-user segment due to the critical nature of their environmental control requirements and the high penalties associated with thermal instability or energy wastage. Growth is particularly notable in custom-engineered solutions tailored for large-scale industrial applications requiring specialized insulation tolerances.

AI Impact Analysis on Insulation Control Damper Market

User inquiries regarding AI's influence predominantly center on questions of predictive maintenance, optimized energy consumption, and the feasibility of autonomous HVAC operation using smart control devices integrated with insulation dampers. Key user concerns include the cybersecurity risks associated with networked dampers and the Return on Investment (ROI) derived from implementing complex AI algorithms to control relatively passive components. Expectations highlight the potential for AI to move beyond simple scheduling and sequencing to achieve true dynamic airflow optimization based on real-time environmental data, occupancy patterns, and external weather forecasts, thereby maximizing the thermal benefits provided by insulated dampers and dramatically reducing overall energy expenditure.

- Predictive Failure Analysis: AI algorithms analyze actuator performance data, temperature differentials, and cycle counts to predict potential mechanical failures in dampers, enabling proactive maintenance scheduling and preventing system downtime.

- Dynamic Airflow Optimization: AI integrated into BMS utilizes machine learning to continuously adjust damper positioning, ensuring optimal airflow and minimizing leakage based on instantaneous thermal loads and zone requirements.

- Energy Consumption Forecasting: Advanced analytics predict future thermal demands, allowing the system to pre-position insulation control dampers to maintain desired temperatures efficiently, thus optimizing start-up sequences and standby modes.

- Enhanced Commissioning and Calibration: AI assists in the initial calibration and fine-tuning of damper systems, speeding up installation processes and ensuring precise sealing performance across all operating conditions.

- Fault Detection and Diagnostics (FDD): AI monitors thermal sensor data surrounding insulated ducts to instantly detect compromised insulation or excessive heat loss, providing immediate alerts regarding potential thermal bridging failures.

- Integration with Digital Twins: AI uses digital models of the building to simulate the impact of damper positioning changes on overall energy performance, refining control strategies before deployment in the physical system.

DRO & Impact Forces Of Insulation Control Damper Market

The insulation control damper market growth is governed by a complex interplay of regulatory mandates, economic considerations, and technological evolution. Key drivers include stringent national and international energy codes, such as the International Energy Conservation Code (IECC) and European Energy Performance of Buildings Directive (EPBD), which necessitate the use of high-performance, low-leakage, and thermally broken components in modern construction and extensive retrofit projects. The rising global awareness regarding climate change and the corporate push towards achieving Net-Zero carbon emissions further accelerates the adoption of these efficient components. Opportunities arise predominantly from the vast, aging inventory of commercial HVAC infrastructure worldwide, which presents significant potential for replacement and upgrade with thermally superior damper systems, alongside growing investment in energy-intensive environments like hyperscale data centers and controlled environment agriculture.

However, the market faces significant restraints. The initial capital investment required for high-grade, fully insulated and motorized dampers is substantially higher compared to standard volume control dampers, which can deter cost-sensitive construction projects. Furthermore, a lack of standardized testing and clear specification guidelines in certain regional markets leads to confusion among specifiers and potential underperformance of installed systems if lower-quality products are chosen. The complexity involved in retrofitting existing ductwork with larger, more robust insulated dampers also poses an installation challenge, requiring specialized contractor expertise and often resulting in higher labor costs.

The market impact forces are strong and predominantly positive. The increasing emphasis on lifecycle cost analysis over initial purchase price—driven by energy savings—compels businesses to invest in premium insulation control solutions. Technological advancements in actuator integration and connectivity, supported by IoT infrastructure, are making these dampers essential elements of smart, resilient buildings. Overall, the powerful regulatory push for sustainable building performance and the undeniable economic benefits derived from energy reduction are the primary forces ensuring sustained market expansion, mitigating the impact of high initial costs over the long term, and solidifying the market's trajectory towards high-specification, automated products.

Segmentation Analysis

The Insulation Control Damper Market is extensively segmented based on criteria such as product type, material composition, operation mechanism, application, and end-user vertical. This detailed segmentation allows manufacturers to target specific performance requirements in varying environments, ranging from highly sensitive laboratory HVAC systems to large-scale industrial exhaust systems. The classification by mechanism, specifically the shift from manual to motorized operation, reflects the broader industry trend towards centralized automation and remote control necessitated by modern Building Management Systems (BMS). Furthermore, segmentation by material highlights the increasing adoption of specialized composites and thermally broken aluminum to maximize energy efficiency.

- By Product Type

- Parallel Blade Dampers

- Opposed Blade Dampers

- Backdraft Dampers (Check Dampers)

- Bubble Tight Dampers (Isolating Dampers)

- By Material

- Galvanized Steel

- Aluminum (Thermally Broken Frame)

- Stainless Steel

- Composite Materials (Fiberglass Reinforced Plastic, PVC)

- By Mechanism/Operation

- Manual Control Dampers

- Motorized/Automated Dampers

- Pneumatic Control Dampers

- By Application

- Volume Control (Airflow Modulation)

- Smoke/Fire Isolation

- Pressure Relief

- Thermal Segregation/Isolation

- By End-User

- Commercial Buildings (Offices, Retail, Hospitality)

- Industrial Facilities (Manufacturing, Power Generation)

- Institutional (Healthcare, Education, Government)

- Data Centers and Server Farms

- Residential (High-End Custom HVAC Systems)

Value Chain Analysis For Insulation Control Damper Market

The value chain for the Insulation Control Damper Market begins with the upstream suppliers providing critical raw materials, primarily specialized steel, aluminum alloys, high-density insulating foam (e.g., polyurethane or mineral wool), and high-performance sealing materials (gaskets and thermal breaks). Quality and consistency in material inputs are paramount, as they directly determine the thermal efficiency and leakage rating of the final product. Key upstream activities involve precision metal fabrication and the sourcing of highly reliable actuators and control electronics from specialized component suppliers, emphasizing robust integration capabilities and durability under varied environmental conditions.

The manufacturing stage involves highly specialized processes, including CNC machining, welding, and assembly, focusing on achieving the tight tolerances required for low-leakage performance, often validated through AMCA (Air Movement and Control Association) testing protocols. Unlike standard damper manufacturing, the production of insulated dampers requires additional steps for incorporating the thermal breaks and injecting high-density insulation materials without compromising structural integrity or blade alignment. Direct distribution often involves sales to large mechanical contractors and wholesalers specializing in HVAC system installations, while indirect channels utilize a network of regional distributors and representatives who provide localized inventory and technical support.

Downstream activities are dominated by mechanical contractors, HVAC engineers (specifiers), and facility management services. The installation phase is crucial, as improper fitting can negate the thermal benefits of the damper; hence, manufacturers increasingly offer technical training and commissioning services. End-users, who are the final recipients, value integration support and post-sales maintenance services. The increasing complexity of BMS integration means that software configuration and system tuning services are becoming integral parts of the value chain, shifting the focus from product sales alone to comprehensive system solutions and long-term performance contracts.

Insulation Control Damper Market Potential Customers

The primary consumers of insulation control dampers are complex organizations requiring stringent environmental control and high energy efficiency standards for their operations. Mechanical Contractors (MCs) and Engineering Procurement and Construction (EPC) firms serve as the immediate buyers, procuring these components based on the detailed specifications provided by Consulting Engineers (CEs). These buyers prioritize product certification, adherence to project specifications regarding thermal performance, and ease of installation, seeking robust components that minimize warranty claims and lifecycle maintenance burdens associated with integrated HVAC systems.

A major segment of direct end-users includes Facility Managers and Building Owners in the commercial and institutional sectors. High-performance insulation control dampers are particularly critical in hospitals, pharmaceutical manufacturing facilities, and laboratories, where contamination control, precise air pressure relationships, and energy security are non-negotiable operational requirements. These customers focus on maximizing operational savings through reduced energy consumption, improving indoor air quality, and ensuring regulatory compliance related to building thermal performance metrics.

Furthermore, specialized industrial sectors such as Data Center Operators represent a rapidly growing customer base. Hyperscale data centers require massive volumes of air handling while maintaining tight temperature and humidity bands. Insulation control dampers are essential for preventing thermal infiltration and managing outside air economizer cycles efficiently, ensuring operational uptime and PUE (Power Usage Effectiveness) optimization. The trend towards modular and high-density computing further accentuates the need for the reliable thermal isolation provided by these specialized dampers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Belimo Holding AG, Johnson Controls International Plc, Honeywell International Inc., Ruskin Company, Greenheck Fan Corporation, Systemair AB, FläktGroup, TROX GmbH, Nailor Industries Inc., Pottorff, Price Industries Limited, Aldes Group, Krueger, Continental Control & Engineering, Louvers & Dampers, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insulation Control Damper Market Key Technology Landscape

The technology landscape for insulation control dampers is rapidly evolving, moving beyond simple mechanical components towards sophisticated, integrated thermal management devices. A cornerstone of this evolution is the development of advanced thermal break technologies, specifically focusing on composite materials and engineered structural separation to minimize conduction across the damper frame and blades. Manufacturers are utilizing materials with extremely low thermal conductivity, often replacing conventional metal connections with reinforced polymer or fiberglass components, ensuring that the damper structure itself does not act as a thermal bridge between environments, which is critical for maximizing energy conservation in ductwork.

Another crucial technological advancement involves the integration of high-precision actuation systems and smart connectivity. Modern insulation control dampers are increasingly fitted with sophisticated digital or analog actuators capable of modulation, allowing for minute adjustments in airflow volume rather than simple open/close states. These actuators often incorporate internal feedback mechanisms and network communication capabilities (e.g., BACnet, Modbus), enabling remote diagnostics, precise positioning, and seamless integration with complex Building Management Systems (BMS). This shift towards smart, networked dampers is fundamental to achieving high-level building automation and demand-controlled ventilation (DCV) strategies.

Furthermore, innovations are focused on improving the sealing performance and reducing leakage rates (measured in cfm/sq ft). This involves utilizing advanced perimeter seals and blade seals made from materials like EPDM rubber or proprietary closed-cell foam that maintain integrity over wide temperature ranges and high cycling frequencies. Research is also directed toward lightweight yet durable materials that simplify installation while enhancing corrosion resistance and longevity. The combination of superior thermal breaks, low-leakage performance, and integrated digital controls defines the current state-of-the-art in the insulation control damper market, supporting the shift toward Passive House and Net-Zero building standards.

Regional Highlights

- North America: This region holds a significant market share, primarily driven by strict enforcement of energy conservation codes, notably ASHRAE 90.1, which mandates minimum thermal performance requirements for HVAC components in commercial settings. The U.S. and Canada see high adoption rates, especially in institutional buildings, healthcare, and data centers. The market is mature but highly innovative, focusing on premium, AMCA-certified, low-leakage dampers that integrate fully with sophisticated digital control networks.

- Europe: Europe is characterized by aggressive decarbonization targets set by the European Union (EU) and high energy costs, leading to strong governmental support for energy retrofitting projects. The Energy Performance of Buildings Directive (EPBD) is a major driver, ensuring continuous demand for thermally efficient components. Countries like Germany and the UK lead in adopting high-specification insulation dampers, with a strong preference for sustainable materials and systems that minimize lifecycle carbon footprint.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by unprecedented growth in commercial real estate, industrial expansion, and rapid urbanization. While regulatory standards are catching up to Western norms, the sheer volume of new construction—particularly in data centers and high-rise commercial towers in China, India, and Southeast Asia—creates massive demand. The market here is sensitive to price, but the trend toward international green building certifications (e.g., LEED, Green Star) is pushing demand toward higher quality, insulated products.

- Latin America (LATAM): This region exhibits moderate growth, focused primarily on major metropolitan areas in Brazil and Mexico. Market growth is generally tied to multinational corporate investment in commercial infrastructure and specialized industrial facilities, particularly in the food and beverage and pharmaceutical sectors, which require robust environmental control systems.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in the Gulf Cooperation Council (GCC) countries, driven by mega-projects, luxurious commercial developments, and the intense need for energy efficiency due to extreme climatic conditions. Insulation control dampers are critical here for mitigating thermal ingress and maximizing the effectiveness of high-capacity cooling systems, essential for combating high ambient temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insulation Control Damper Market.- Belimo Holding AG

- Johnson Controls International Plc

- Honeywell International Inc.

- Ruskin Company

- Greenheck Fan Corporation

- Systemair AB

- FläktGroup

- TROX GmbH

- Nailor Industries Inc.

- Pottorff

- Price Industries Limited

- Aldes Group

- Krueger

- Continental Control & Engineering

- Louvers & Dampers, Inc.

- United Enertech

- Titus HVAC

- Ventilation Control Products (VCP)

- Hahn & Co. (Formerly part of SKM)

- Hürner-Funken GmbH

Frequently Asked Questions

Analyze common user questions about the Insulation Control Damper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and benefit of an insulation control damper?

An insulation control damper regulates airflow in HVAC systems while providing a thermal break to prevent unwanted heat transfer (conduction, convection) through the damper blades and frame. The primary benefit is significant energy savings by maintaining thermal integrity in ductwork, reducing thermal losses, and mitigating condensation risk.

How do insulation control dampers comply with current energy efficiency standards?

Insulation control dampers comply by meeting stringent leakage rate requirements (often certified by AMCA) and providing superior thermal isolation compared to standard dampers. Compliance is typically measured against standards like ASHRAE 90.1, which mandates specific U-factors and air leakage limitations for components separating conditioned and unconditioned spaces.

What are the key material differences between insulated and standard dampers?

Insulated dampers utilize materials with low thermal conductivity, such as composite or thermally broken aluminum frames, and incorporate insulating cores (e.g., injected foam) within the blades. Standard dampers are typically single-wall galvanized steel without thermal separation, making them susceptible to significant thermal bridging.

In which applications are motorized insulation control dampers most crucial?

Motorized insulation control dampers are crucial in applications requiring precise, dynamic modulation and integration with Building Management Systems (BMS), such as data centers, critical healthcare facilities, and modern commercial offices utilizing Demand-Controlled Ventilation (DCV) to optimize energy usage based on real-time occupancy and thermal load.

Which geographical region exhibits the highest growth potential for this market?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, shows the highest growth potential. This is driven by rapid investment in new commercial and institutional infrastructure, coupled with the increasing adoption of international green building standards that mandate high-performance HVAC components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager