Insulin Drug and Delivery Technologies Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442058 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Insulin Drug and Delivery Technologies Market Size

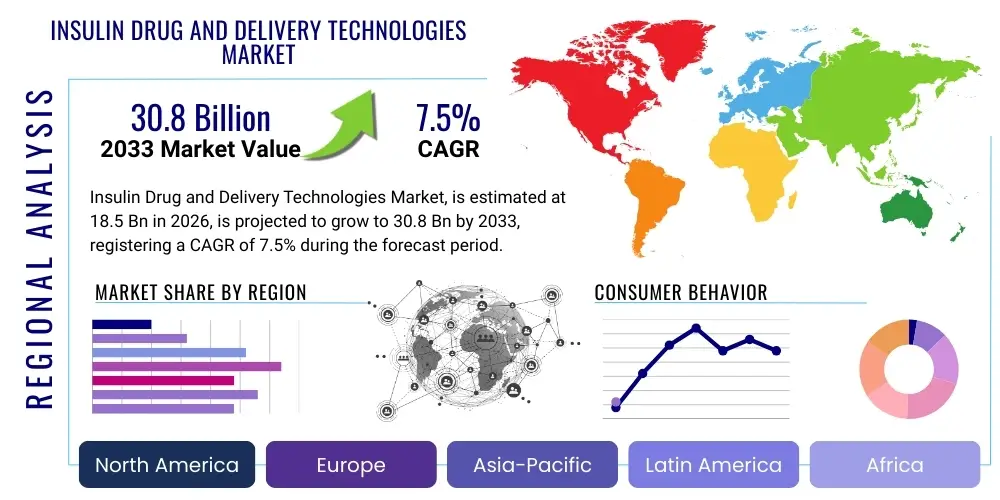

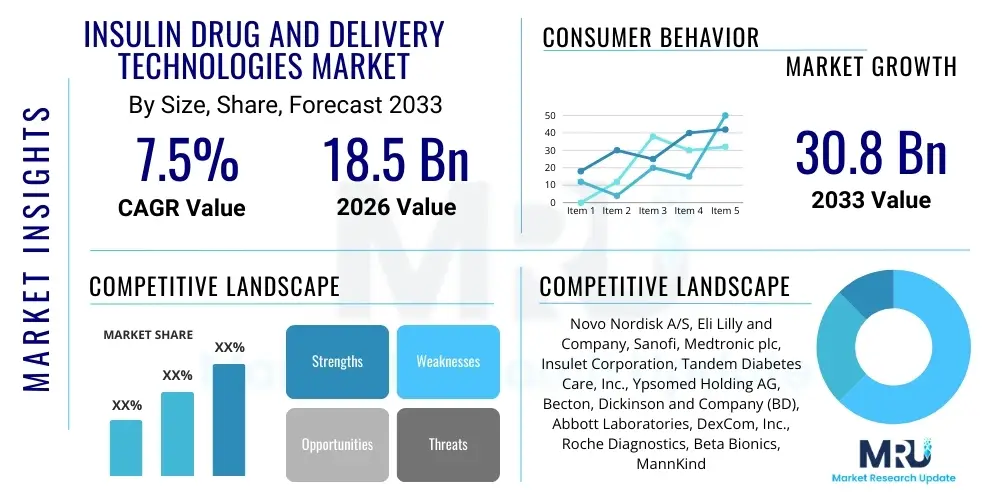

The Insulin Drug and Delivery Technologies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 30.8 Billion by the end of the forecast period in 2033.

Insulin Drug and Delivery Technologies Market introduction

The Insulin Drug and Delivery Technologies Market encompasses a sophisticated range of pharmaceutical products and medical devices designed to manage diabetes by regulating blood glucose levels. This market is fundamentally driven by the escalating global incidence of Type 1 and Type 2 diabetes, requiring lifelong exogenous insulin administration. Key products include various recombinant human insulin analogs classified by their onset and duration of action, such as rapid-acting, short-acting, intermediate-acting, and long-acting formulations. The increasing shift towards technologically advanced delivery methods represents a major evolutionary trend within this sector, moving away from traditional vials and syringes.

The product description spans two primary categories: the drugs themselves, which include biosimilar and novel insulin formulations designed for enhanced stability and predictable absorption profiles, and the corresponding delivery technologies. These technologies are crucial for patient adherence and quality of life, ranging from standardized insulin pens (reusable and disposable) and syringe systems to sophisticated electronic insulin pumps (both tethered and patch-based), and smart connected devices that integrate glucose monitoring data. Major applications center around glycemic control in both Type 1 Diabetes Mellitus (T1DM) and insulin-dependent Type 2 Diabetes Mellitus (T2DM) patients, aiming to prevent acute complications like ketoacidosis and long-term sequelae such as neuropathy, retinopathy, and cardiovascular disease.

The primary benefits offered by modern delivery technologies include enhanced dosing accuracy, increased patient convenience, reduced injection pain, and improved adherence to complex treatment regimens. Furthermore, the integration of connectivity and decision-support features in smart insulin pens and pumps facilitates personalized therapy adjustments and data sharing with healthcare providers, thereby optimizing overall clinical outcomes. Driving factors include continuous technological innovation, favorable regulatory pathways for biosimilars, increasing healthcare expenditure in emerging economies, and persistent efforts by major pharmaceutical companies to develop ultra-long-acting and non-invasive delivery systems, positioning the market for sustained, robust growth over the forecast period.

Insulin Drug and Delivery Technologies Market Executive Summary

The Insulin Drug and Delivery Technologies Market is characterized by intense competition driven by the need for simplified, highly accurate, and patient-centric diabetes management solutions. Current business trends indicate a significant focus on developing closed-loop insulin delivery systems, commonly referred to as the artificial pancreas, which combine continuous glucose monitoring (CGM) and automated insulin pumps utilizing advanced algorithms. This integration is attracting substantial investment from both established medical device manufacturers and biotechnology startups. Additionally, the proliferation of biosimilar insulin products is exerting downward pressure on drug pricing, forcing originator companies to differentiate their portfolios through superior delivery devices and integrated digital health services, thereby creating complex pricing and market access strategies across global regions.

Regional trends highlight the dominance of North America and Europe, attributed to high diabetes prevalence, established healthcare infrastructure, and favorable reimbursement policies for advanced medical devices like insulin pumps and connected pens. However, the Asia Pacific (APAC) region is poised to exhibit the highest growth rate, fueled by rapidly increasing diabetes diagnosis rates, improving economic conditions leading to greater accessibility of proprietary treatments, and governmental initiatives aimed at improving diabetes care standards, particularly in densely populated countries such as China and India. Latin America and the Middle East and Africa (MEA) are also showing promising potential, driven by urbanization and changes in lifestyle patterns that contribute to metabolic disorders, although market penetration faces challenges related to infrastructure and affordability.

Segment trends reveal that the insulin pump segment, particularly the patch pump category, is experiencing accelerated adoption due to its discretion and ease of use, signifying a strong consumer preference for wearable technologies. Within the drug segment, long-acting and ultra-long-acting insulin analogs maintain significant market share due to their convenience and efficacy in basal insulin requirements, though biosimilars are expected to erode the revenue base of older branded products. The shift toward integrated digital solutions and smart connectivity across all delivery segments underscores a macro trend toward proactive and personalized chronic disease management, where data-driven insights enhance therapeutic efficacy and drive segment innovation.

AI Impact Analysis on Insulin Drug and Delivery Technologies Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Insulin Drug and Delivery Technologies Market frequently revolve around personalized dosing accuracy, the safety and efficacy of autonomous closed-loop systems, and the potential for AI algorithms to predict glycemic excursions before they occur. Users are keen to understand how machine learning can interpret complex patient data—including glucose readings, dietary intake, physical activity, and stress levels—to fine-tune insulin delivery dynamically, moving beyond rule-based programming to true personalization. Major concerns center on data privacy and security, regulatory hurdles associated with autonomous decision-making algorithms, and equitable access to these high-cost, advanced systems across diverse socioeconomic groups.

The integration of AI algorithms into Continuous Glucose Monitoring (CGM) systems and automated insulin pumps is pivotal to the evolution of diabetes care, facilitating the transition from reactive treatment to proactive intervention. AI models are being utilized to develop predictive algorithms that anticipate fluctuations in blood sugar, enabling systems to modulate insulin delivery preemptively. This capability drastically reduces the incidence of both hyperglycemia and dangerous hypoglycemia, which are major obstacles in achieving tight glycemic control. Furthermore, AI contributes significantly to the optimization of clinical trials for new insulin formulations and delivery devices by identifying suitable patient populations and analyzing vast datasets to assess long-term safety and effectiveness endpoints more efficiently.

Beyond closed-loop systems, AI is transforming patient support and adherence. AI-powered applications analyze adherence patterns based on data collected from smart pens and connected pumps, providing personalized coaching and reminders. For healthcare providers, AI tools offer comprehensive dashboards that prioritize patients requiring immediate intervention based on risk scores generated from longitudinal data analysis. This shift enhances the overall patient experience, decreases the burden on clinical staff, and significantly improves the efficiency of chronic disease management, making AI an indispensable element in the future development of insulin drug and delivery technologies, focusing heavily on safety validation and regulatory alignment.

- AI enables real-time, predictive analytics for closed-loop insulin delivery systems, minimizing hypoglycemia risk.

- Machine learning algorithms optimize personalized basal and bolus dosing based on physiological and behavioral inputs (e.g., activity, meals).

- AI accelerates clinical research by analyzing genetic markers and treatment responses to improve the development pipeline for new insulin analogs.

- Predictive modeling assists healthcare providers in identifying high-risk patients needing timely intervention and optimized care pathways.

- AI-driven interpretation of CGM and smart pen data enhances patient engagement and adherence through personalized feedback loops.

DRO & Impact Forces Of Insulin Drug and Delivery Technologies Market

The Insulin Drug and Delivery Technologies Market is powerfully shaped by a confluence of escalating global health concerns, rapid technological advancements, and persistent economic pressures. Key drivers include the overwhelming global surge in diabetes prevalence, particularly Type 2 Diabetes, attributed to aging populations and widespread lifestyle changes like sedentary behavior and poor diet, creating a massive, sustained demand for insulin therapy. The increasing patient preference for non-invasive, discrete, and convenient delivery methods, such as patch pumps and smart pens, mandates continuous innovation in device design. Conversely, the market faces significant restraints, primarily the high initial cost associated with advanced delivery systems, especially insulin pumps and associated consumables, which creates barriers to entry in low and middle-income countries and complicates reimbursement negotiations even in developed markets. Furthermore, stringent regulatory requirements, particularly for software-driven medical devices (SaMD) utilizing AI, pose protracted challenges for product commercialization and market scale-up.

Opportunities for growth are abundant, particularly in the development and commercialization of biosimilar insulin products, which promise to increase access and affordability, thereby expanding the treatment pool in underserved populations. The ongoing push for interoperability between different diabetic management components—CGM, pumps, and mobile health apps—opens avenues for comprehensive, integrated digital diabetes management platforms. Specific technological opportunities involve the refinement of non-invasive insulin delivery, such as oral or inhaled formulations, although these technologies still face significant hurdles related to bioavailability and dose control. Investment in decentralized clinical trials and digital health solutions to monitor real-world evidence will further refine product offerings and accelerate market adoption.

The market is subjected to powerful impact forces originating from competitive dynamics and regulatory environments. The entry of major technology firms into the digital health space is disrupting traditional medical device structures, fostering convergence between consumer electronics and medical devices. Additionally, governmental policies aimed at cost containment and promoting generic/biosimilar adoption significantly influence drug pricing and market structure. The inherent risk associated with chronic disease management requires manufacturers to maintain exceptionally high standards of reliability and safety, making product recalls or device failures substantial negative impact forces. Ultimately, the successful navigation of this market depends on balancing innovation with affordability, ensuring that advanced therapies are accessible while maintaining robust profitability to fuel future research and development efforts.

Segmentation Analysis

The segmentation of the Insulin Drug and Delivery Technologies Market provides a granular understanding of the dynamics across product type, therapeutic profile, technology adoption, and end-user behavior. Market segmentation is primarily categorized by Insulin Type, Delivery Device, and End-User. Analyzing these segments is critical for manufacturers to allocate resources effectively, target specific patient populations, and anticipate shifts in clinical practice. The trend towards long-acting and ultra-long-acting insulin analogues continues to dominate the drug segment due to improved adherence and reduced injection frequency required for basal coverage, while rapid-acting insulins remain essential for mealtime management, often integrated within pump systems. The growth rate differential across these segments is highly influenced by patent expiration schedules and the resulting market entry of biosimilar competitors.

Within the Delivery Device segment, the market is rapidly bifurcating between traditional pen systems and advanced continuous infusion devices (pumps). Insulin pens, particularly smart pens equipped with Bluetooth connectivity and dose logging features, are capturing a substantial share in cost-sensitive and adherence-focused markets. Conversely, insulin pumps, including both traditional tethered pumps and discreet patch pumps, represent the premium segment, driven by demand for superior glycemic control and automated dosing capabilities, especially in Type 1 Diabetes management. Patch pumps are particularly accelerating due to their portability and reduction in injection frequency, appealing to a younger, more active patient demographic.

End-user segmentation clearly indicates hospitals and specialized diabetes clinics as major purchasers and points of prescription, largely due to their role in initiating complex therapies like insulin pumps and advanced training requirements. However, home care settings, supported by retail pharmacies and mail-order services, represent the fastest-growing segment, reflecting the chronic nature of diabetes and the necessity for continuous patient self-management. The evolution of digital health platforms and direct-to-consumer models for consumables and related services further supports the expansion of the home care segment, requiring integrated supply chain solutions capable of handling sensitive biological products and complex medical devices.

- By Insulin Type:

- Rapid-Acting Insulin Analogs

- Long-Acting Insulin Analogs (Basal Insulin)

- Intermediate-Acting Insulin Analogs

- Premixed Insulin Analogs

- Biosimilar Insulin

- By Delivery Device:

- Insulin Pens (Reusable and Disposable)

- Smart Insulin Pens

- Insulin Syringes

- Insulin Pumps

- Traditional Tethered Pumps

- Patch Pumps

- Insulin Infusion Sets

- Insulin Pens (Reusable and Disposable)

- By End-User:

- Hospitals and Clinics

- Home Care Settings

- Ambulatory Surgical Centers

- Retail Pharmacies

Value Chain Analysis For Insulin Drug and Delivery Technologies Market

The value chain for the Insulin Drug and Delivery Technologies Market is inherently complex, spanning intensive biotechnology research, precision engineering for device manufacturing, highly regulated distribution, and continuous post-market surveillance. The upstream segment is dominated by pharmaceutical R&D, focusing on developing genetically engineered insulin analogs that offer improved pharmacokinetic and pharmacodynamic profiles (e.g., smoother action profiles, reduced peak effects). This phase requires immense capital investment and spans years of clinical trials. Simultaneously, device manufacturers engage in specialized engineering and material science to create reliable, ergonomic, and disposable components for pens and pumps, ensuring biocompatibility and sterility under strict Good Manufacturing Practice (GMP) guidelines, often necessitating global sourcing for specialized electronic components and plastics.

The manufacturing and midstream logistics phase involves mass production under rigorous quality control standards, critical due to the sensitive nature of biological drugs and medical devices. Manufacturing centers are typically centralized for efficiency, but packaging and final assembly must comply with diverse regional regulatory labeling requirements. Distribution channels are highly specialized: Direct channels involve pharmaceutical companies supplying high-volume customers like large hospital groups or government programs (especially crucial for advanced pump systems requiring training). Indirect channels utilize specialized medical distributors, wholesalers, and retail pharmacy networks to reach individual patients, often governed by complex, region-specific contractual agreements and temperature-controlled logistics requirements (cold chain management).

Downstream analysis focuses heavily on the point of care and patient interaction. Once products reach the end-user, the role of specialized diabetes educators, clinicians, and pharmacists becomes crucial for training on device usage, ensuring compliance, and integrating the delivery device with continuous monitoring technologies. The market is increasingly influenced by third-party payers (insurance companies and government health schemes) who dictate access through formulary placement and coverage policies, significantly impacting the sales volume of high-cost advanced devices. Effective post-market surveillance is also mandatory, involving continuous feedback loops to detect device malfunctions or adverse drug events, ensuring patient safety and informing future product iterations and regulatory compliance efforts.

Insulin Drug and Delivery Technologies Market Potential Customers

The primary customers for Insulin Drug and Delivery Technologies are patients diagnosed with Type 1 Diabetes Mellitus (T1DM) and insulin-dependent Type 2 Diabetes Mellitus (T2DM). T1DM patients, representing the critical demand base, require lifelong insulin therapy, often preferring advanced delivery systems like insulin pumps and smart pens due to the necessity of intensive glycemic control and frequent dosing adjustments. The increasing prevalence of T2DM requiring insulin, especially due to prolonged disease duration or failure on oral medications, constitutes the largest volume segment of potential customers, though these patients often start with traditional syringe or basic pen systems before progressing to more sophisticated devices, depending on disease severity and socioeconomic factors.

Institutional customers form a vital procurement segment, encompassing hospitals, specialized endocrinology clinics, and regional diabetes centers. These entities act as key decision-makers, influencing initial prescribing patterns and purchasing advanced equipment necessary for inpatient care, patient education, and initiation of pump therapy. Governmental health organizations and national health services (such as the NHS in the UK or VA in the US) represent major bulk purchasers, often through competitive tendering processes focused on cost-effectiveness and proven clinical outcomes, particularly impacting the biosimilar segment and standard pen supply.

Beyond the direct patients and institutional purchasers, secondary potential customers include payers (private insurance companies and government agencies), who are highly influential due to their role in determining reimbursement levels and formulary access. Their decisions shape market dynamics by favoring cost-effective solutions or covering advanced, high-technology options based on demonstrated economic and clinical value. Research institutions and academic medical centers also constitute a niche customer segment, procuring devices and drugs for clinical research focused on optimizing diabetes management protocols and trialing next-generation delivery systems, thus driving early adoption of cutting-edge technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 30.8 Billion |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novo Nordisk A/S, Eli Lilly and Company, Sanofi, Medtronic plc, Insulet Corporation, Tandem Diabetes Care, Inc., Ypsomed Holding AG, Becton, Dickinson and Company (BD), Abbott Laboratories, DexCom, Inc., Roche Diagnostics, Beta Bionics, MannKind Corporation, Viacyte (acquired by Vertex Pharmaceuticals), Zealand Pharma A/S, Emperra GmbH, Biocon Ltd., Gerresheimer AG, Sensile Medical AG (part of Gerresheimer), Valeritas Holdings (acquired by Zealand Pharma). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insulin Drug and Delivery Technologies Market Key Technology Landscape

The current technology landscape in the Insulin Drug and Delivery Technologies Market is defined by a significant push towards automation, miniaturization, and seamless digital integration. The most transformative technology is the development of the closed-loop system, or Artificial Pancreas (AP), which combines Continuous Glucose Monitors (CGM), sophisticated control algorithms (often leveraging AI and machine learning), and advanced insulin pumps to autonomously manage basal insulin delivery. These systems represent the pinnacle of current technological innovation, offering near-physiologic insulin regulation and significantly reducing the cognitive burden of diabetes management for patients. Further refinement in this area includes improved sensor accuracy, faster-acting insulin formulations (ultra-rapid analogs), and robust algorithms capable of handling high variability in patient inputs, such as unpredictable meal sizes and exercise routines.

Miniaturization and form factor innovation are driving the rapid adoption of patch pumps, which are discrete, disposable, and tubeless insulin delivery systems, offering greater freedom and improved site rotation options compared to traditional tethered pumps. This innovation addresses a key patient complaint regarding bulkiness and visibility of older devices. Concurrently, smart insulin pens are revolutionizing the traditional pen market by incorporating Bluetooth connectivity to log time, date, and dosage information, automatically calculating doses, and providing reminders. These smart devices bridge the gap between simple manual injection and full automation, appealing to the vast population of patients who do not require or desire full pump therapy but benefit from digital adherence tracking and dose assurance.

Future-focused technologies include the pursuit of non-invasive delivery methods, most notably advanced oral insulin formulations and next-generation microneedle patches. Oral insulin seeks to mimic the natural physiological route of insulin via the hepatic portal system, bypassing the need for injections entirely, though challenges related to gastric degradation and inconsistent absorption remain paramount. Microneedle technology, currently in advanced preclinical and early clinical stages, promises minimally invasive, painless delivery through transdermal patches containing dissolvable insulin-loaded microstructure needles. While significant regulatory and scaling challenges persist for both non-invasive methods, they represent disruptive potential aimed at completely eliminating the reliance on hypodermic needles, drastically improving patient comfort and treatment acceptance across all demographic groups worldwide.

Regional Highlights

- North America: This region consistently holds the largest market share, characterized by a high prevalence of both Type 1 and Type 2 diabetes, combined with robust healthcare spending and highly developed technology adoption infrastructure. The U.S. drives the majority of revenue, benefiting from favorable reimbursement policies that cover advanced, high-cost technologies such as continuous glucose monitoring and integrated insulin pump systems. Competition is fierce, leading to rapid integration of digital health solutions and AI-driven features. The regional dynamics are heavily influenced by the presence of key industry leaders in pharmaceuticals (e.g., Eli Lilly) and medical devices (e.g., Medtronic, Tandem Diabetes Care), who maintain extensive clinical partnerships and aggressive product development cycles. Furthermore, the strong regulatory framework managed by the FDA provides clarity but also requires substantial investment in clinical evidence for market clearance, favoring large established players.

- Europe: The European market is mature and highly diverse, driven by strong governmental emphasis on chronic disease management and the adoption of biosimilar insulin products, particularly in Western European nations like Germany, the UK, and France. While technologically advanced, market penetration of devices like insulin pumps varies significantly based on national reimbursement policies; countries with universal healthcare systems often prioritize cost-effectiveness. The region shows high receptivity to smart pen technology, leveraging its strong digital health infrastructure. The regulatory environment (Medical Device Regulation - MDR) is rigorous, influencing how quickly new devices can be launched, prioritizing safety and long-term performance data, leading to steady but careful growth fueled by demographic pressure and improving access to diabetes specialty care across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period due to its enormous population base and the rapidly escalating incidence of diabetes linked to changing dietary habits and increasing urbanization. Key markets like China and India represent immense untapped potential. While syringe and standard pen use dominate due to lower cost and limited reimbursement for advanced devices, economic development is rapidly improving accessibility. Local manufacturing and distribution partnerships are critical to success in this fragmented market. Government initiatives focusing on public health awareness and infrastructure modernization are pivotal drivers, creating a significant opportunity for affordable biosimilars and high-volume, reliable delivery systems, signaling a shift toward higher technology adoption in metropolitan centers.

- Latin America (LATAM): The LATAM market is characterized by medium growth potential, influenced by significant socioeconomic disparities and complex healthcare funding mechanisms. Brazil and Mexico are the primary revenue contributors, exhibiting increasing adoption of insulin pens and some uptake of insulin pumps, particularly within the private healthcare sector. Challenges include navigating high import duties, currency volatility, and varying levels of regulatory standardization across countries. The demand is largely driven by increasing physician awareness and patient advocacy for modern therapies, coupled with incremental improvements in public health insurance coverage for essential diabetic supplies.

- Middle East and Africa (MEA): MEA presents a market of contrasts; the Gulf Cooperation Council (GCC) countries demonstrate high per capita spending on advanced insulin therapies due to high prevalence rates and robust, centralized healthcare systems. Conversely, many African nations struggle with basic access, relying heavily on donated or inexpensive generic insulins. Market growth is strongest in the UAE and Saudi Arabia, driven by government investments in specialized diabetes treatment centers and a willingness to adopt cutting-edge technology, positioning the region as a significant, though selective, market for premium drug and delivery technology offerings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insulin Drug and Delivery Technologies Market.- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi

- Medtronic plc

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- Ypsomed Holding AG

- Becton, Dickinson and Company (BD)

- Abbott Laboratories

- DexCom, Inc.

- Roche Diagnostics

- Beta Bionics

- MannKind Corporation

- Viacyte (acquired by Vertex Pharmaceuticals)

- Zealand Pharma A/S

- Emperra GmbH

- Biocon Ltd.

- Gerresheimer AG

- Sensile Medical AG (part of Gerresheimer)

- Valeritas Holdings (acquired by Zealand Pharma)

- B Braun Melsungen AG

- CellNovo Group SA

Frequently Asked Questions

Analyze common user questions about the Insulin Drug and Delivery Technologies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating the Insulin Drug and Delivery Technologies Market growth?

The market is primarily driven by the escalating global prevalence of both Type 1 and Type 2 diabetes, the continuous demand for non-invasive and user-friendly insulin delivery systems, and significant technological advancements in automated, integrated devices like closed-loop insulin pumps (Artificial Pancreas systems). Furthermore, improved diagnostic capabilities and expanded insurance coverage in key markets contribute substantially to market expansion.

How is the rise of biosimilar insulin impacting the market dynamics?

The introduction and increasing acceptance of biosimilar insulin products are intensifying competitive pressures, particularly on originator branded products, leading to price erosion in the basal and rapid-acting insulin segments. This trend fundamentally improves market accessibility and affordability, especially in emerging economies, forcing leading pharmaceutical companies to focus on differentiating their portfolios through superior delivery technology integration and advanced digital health services.

What defines a 'Smart Insulin Pen' and why are they becoming popular?

A Smart Insulin Pen is a connected injection device that automatically records dosing time, date, and insulin volume, transmitting this data via Bluetooth to a companion mobile application. They are popular because they bridge the gap between traditional manual injection and full pump therapy, enhancing patient adherence, improving the accuracy of dose logging, and providing valuable data insights to healthcare providers without the cost or complexity of a full insulin pump system.

Which geographic region is expected to show the highest growth rate, and why?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This accelerated growth is attributed to the monumental increase in diagnosed diabetic patients, rising disposable incomes that enable access to modern treatments, and supportive governmental efforts aimed at improving healthcare infrastructure and chronic disease management standards across major nations like China and India.

What is the significance of Artificial Intelligence (AI) in the future of insulin delivery?

AI is significant as it powers the predictive algorithms within closed-loop systems, enabling highly accurate, personalized, and proactive insulin dosing adjustments in real-time. AI minimizes the risks of hypoglycemia and hyperglycemia, optimizes therapeutic efficacy based on individualized physiological data, and is essential for achieving the regulatory approval and widespread adoption of fully autonomous diabetes management solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager