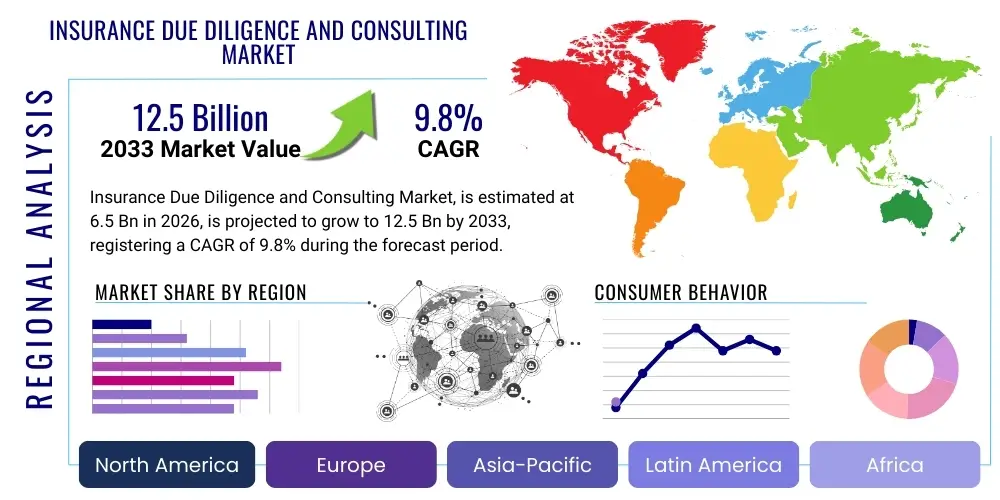

Insurance Due Diligence and Consulting Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441266 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Insurance Due Diligence and Consulting Market Size

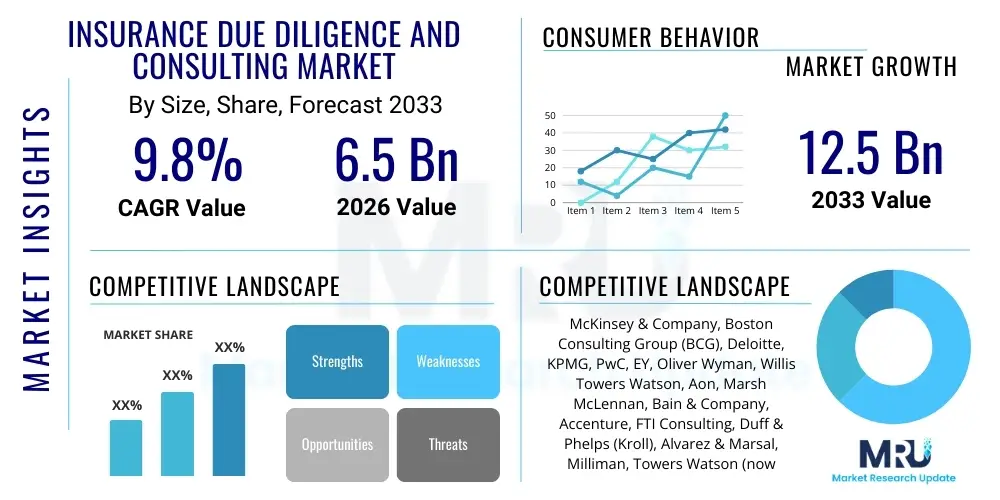

The Insurance Due Diligence and Consulting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $6.5 Billion in 2026 and is projected to reach $12.5 Billion by the end of the forecast period in 2033.

This robust growth trajectory is primarily driven by the escalating complexity of global insurance regulations, the continuous surge in merger and acquisition (M&A) activity within the financial services sector, and the necessity for incumbent insurers to modernize their technology infrastructure. Due diligence services are critical for mitigating financial, operational, and regulatory risks associated with these complex transactions. Furthermore, the increasing adoption of digital transformation initiatives necessitates specialized consulting services to ensure seamless integration and compliance checks for new digital platforms, underwriting models, and customer interaction systems.

The market expansion is also fundamentally supported by the dynamic risk landscape, encompassing cyber threats, climate change liabilities, and geopolitical instability. Insurers are increasingly relying on external, specialized consulting firms to gain unbiased, deep-dive analyses into target companies’ exposures and to develop resilient, future-proof business strategies. This demand spans across various segments, including life, non-life (P&C), and reinsurance, emphasizing the comprehensive nature of risk assessment required in today's highly scrutinized financial environment. The shift towards embedded insurance and parametric products further increases the need for consulting expertise in product development and regulatory adherence.

Insurance Due Diligence and Consulting Market introduction

The Insurance Due Diligence and Consulting Market encompasses specialized professional services designed to provide comprehensive, independent assessment and strategic guidance to entities involved in the insurance industry. This includes pre-transaction analysis, operational efficiency reviews, regulatory compliance audits, actuarial valuations, and strategic post-merger integration consulting. The services are crucial during pivotal business events such as mergers, acquisitions, divestitures, capital raises, and major operational transformations. Key applications involve financial due diligence (evaluating balance sheets and reserving methodologies), commercial due diligence (assessing market position and growth potential), and operational due diligence (reviewing IT systems, claims processing, and underwriting functions).

The core product offered in this market is expert advisory, delivering actionable insights derived from rigorous analysis of complex proprietary and public data. The major benefits derived by clients include reduced transaction risk, maximized deal value, improved operational performance post-acquisition, and guaranteed compliance with stringent local and international regulatory frameworks like Solvency II, IFRS 17, and various data privacy mandates. By leveraging deep industry expertise, consulting firms enable insurance carriers, brokers, and private equity investors to make informed decisions, optimize their portfolios, and achieve strategic objectives amid rapid technological and regulatory shifts.

Key driving factors accelerating the market’s growth include the persistent low-interest-rate environment pressuring margins, which forces consolidation and efficiency mandates; the rapid acceleration of digital adoption necessitating IT due diligence; and the escalating regulatory scrutiny, particularly around solvency and reserving. Furthermore, the rise of InsurTech startups and their integration or acquisition by legacy carriers generates substantial demand for specialized technical and commercial assessment services, ensuring that new technologies are scalable and compliant before large-scale investment.

Insurance Due Diligence and Consulting Market Executive Summary

The Insurance Due Diligence and Consulting Market is characterized by intense competition driven by high-stakes M&A activity, particularly involving private equity interest in closed life books and technological assets. Business trends indicate a pivot towards specialist consulting focused on digital maturity assessments, cyber risk due diligence, and Environmental, Social, and Governance (ESG) compliance evaluations, which are increasingly critical for valuation. Major industry players, including global management consultancies and specialized actuarial firms, are heavily investing in proprietary data analytics tools and AI capabilities to streamline the due diligence process, offering faster, more granular insights, thereby enhancing overall service efficiency and client value proposition.

Segment trends reflect a significant acceleration in demand for Operational Due Diligence (ODD) and IT Due Diligence, driven by the massive shifts in how insurers process claims and interact with customers using cloud-based platforms and API integrations. While financial and actuarial due diligence remain foundational, the growth rate of technology-focused consulting services is notably higher. By Application, M&A and restructuring activities dominate market revenue, but strategic consulting related to risk management and regulatory roadmap development is experiencing strong, steady demand, reflecting a proactive approach by large insurers to anticipate future challenges rather than merely reacting to immediate compliance requirements.

Regionally, North America maintains the largest market share due to its mature and highly consolidated insurance sector, sophisticated regulatory environment, and high volume of large-scale M&A transactions. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by expanding middle-class populations, increasing insurance penetration in emerging economies like China and India, and corresponding regulatory reforms that necessitate external expertise for market entry and operational setup. Europe remains a robust market, driven specifically by cross-border M&A and the ongoing compliance requirements of pan-European regulations such as Solvency II and GDPR, ensuring continuous demand for regulatory and compliance consulting services.

AI Impact Analysis on Insurance Due Diligence and Consulting Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are transforming the speed and depth of risk assessment, specifically asking if AI will replace human consultants in foundational data review tasks. Key concerns revolve around data security when migrating highly sensitive proprietary data to AI platforms and the reliability of algorithmic output in complex, subjective regulatory contexts. Users are particularly interested in AI's role in accelerating the initial screening phase of M&A targets, performing rapid analysis of thousands of policy documents, claims histories, and contractual agreements, traditionally a time-intensive process. The overarching expectation is that AI will function as an indispensable augmentation tool, dramatically improving efficiency and allowing human consultants to focus exclusively on strategic interpretation and high-value advisory, rather than basic data aggregation and anomaly detection.

AI’s influence is shifting the consulting model from labor-intensive data review to insight-driven strategy. AI algorithms, particularly Natural Language Processing (NLP) models, can rapidly process unstructured data, such as contract wordings and claims notes, identifying inconsistencies, potential liabilities, or hidden risks that manual review might miss. This capability significantly reduces the time required for operational due diligence, making transactions quicker and more cost-effective. Furthermore, predictive modeling powered by ML is being deployed to assess the longevity and accuracy of actuarial reserves, offering a layer of data-validated certainty to financial due diligence that was previously unattainable through traditional methods.

The integration of AI also necessitates a new type of consulting service focused on assessing the AI readiness and robustness of target companies. Due diligence now includes evaluating a target's proprietary algorithms, data quality, and governance frameworks to ensure their technological assets truly deliver the promised value and comply with ethical AI usage guidelines. This strategic layer of AI-focused due diligence, often termed 'Algorithmic Diligence,' ensures that acquiring firms are not inheriting technical debt or regulatory non-compliance issues related to automated decision-making systems, thereby creating new specialized revenue streams for consulting firms.

- Accelerated Document Review: NLP drastically reduces time spent analyzing policy documents, legal contracts, and historical claims data.

- Enhanced Predictive Modeling: ML models improve the accuracy of loss ratio forecasting and actuarial reserve adequacy assessments.

- Automated Anomaly Detection: AI identifies outliers in claims data and underwriting profiles indicative of potential fraud or systemic risk.

- Improved Data Visualization: AI tools synthesize complex data into intuitive dashboards, speeding up high-level strategic decision-making.

- Creation of Algorithmic Due Diligence: New service line focusing on auditing target company’s existing AI and ML models for bias, compliance, and performance.

DRO & Impact Forces Of Insurance Due Diligence and Consulting Market

The market is dynamically shaped by a critical interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces. A primary Driver is the increasing frequency and complexity of cross-border M&A activities within the financial ecosystem, coupled with intensified competition forcing insurers to seek operational efficiencies through external consulting. Concurrently, major Restraints include the high cost of premium consulting services, which can be prohibitive for smaller or regional carriers, and the persistent challenge of accessing, standardizing, and securing highly sensitive proprietary data during the due diligence process. Opportunities are largely concentrated in emerging technologies, such as providing consulting services related to ESG strategy implementation and evaluating InsurTech platforms, alongside expanding penetration into under-insured regions, particularly in Asia and Latin America.

Impact forces are centered around regulatory shifts and technological disruption. Stringent global regulatory environments, such as IFRS 17 and evolving privacy laws (e.g., CCPA, GDPR), continuously drive demand for specialized compliance due diligence, acting as a major positive force. Conversely, economic volatility and geopolitical instability can lead to a sudden decrease in planned M&A activities, thereby negatively impacting transaction-based due diligence revenue. The overall competitive intensity is further heightened by the entry of technology vendors offering self-service due diligence tools, challenging the traditional consulting revenue model but simultaneously creating new avenues for specialized advice on technology integration.

To mitigate restraints, consulting firms are developing tiered service offerings utilizing advanced technologies like Robotic Process Automation (RPA) and AI to standardize and automate basic data gathering, thereby lowering costs and making services accessible to a broader client base. The strongest positive impact force remains the industry's irreversible move towards digital transformation, which requires consulting expertise at every stage—from selecting appropriate cloud infrastructure to restructuring legacy systems—ensuring a foundational and sustained demand for advisory services throughout the forecast period.

Segmentation Analysis

The Insurance Due Diligence and Consulting Market is comprehensively segmented based on the Type of Service provided, the Specific Application of the service, the Deployment Model utilized by consulting firms, and the End-User purchasing these services. This segmentation offers a granular view of market dynamics, revealing that while traditional financial assessments remain essential, high-growth opportunities are increasingly emerging within the specialized technology and operational advisory segments. Understanding these sub-segments is vital for stakeholders looking to identify high-value niches and tailor service offerings to specific client needs, particularly in complex areas like regulatory compliance and cyber risk management which demand bespoke solutions.

The Type segment typically distinguishes between transactional services (due diligence for M&A) and strategic services (long-term operational improvement and risk management consulting). Deployment models relate to how the intellectual property or service is delivered, whether through integrated global teams or specific project-based outsourced advisory. Analysis confirms that the End-User base is diversifying, moving beyond traditional insurance carriers to include a growing population of private equity firms, asset managers, and non-traditional players acquiring insurance assets, driving demand for specialized valuation and operational exit planning due diligence.

- By Service Type:

- Financial Due Diligence (FDD)

- Operational Due Diligence (ODD)

- Actuarial Due Diligence

- Commercial Due Diligence (CDD)

- IT and Cybersecurity Due Diligence

- Regulatory and Compliance Consulting

- By Application:

- Mergers and Acquisitions (M&A)

- Divestitures and Carve-outs

- Restructuring and Turnaround

- Strategic Risk Management

- System Implementation and Integration

- By End-User:

- Insurance Carriers (Life, Non-Life/P&C, Reinsurance)

- Insurance Brokers and Agents

- Private Equity Firms and Asset Managers

- Government and Regulatory Bodies

- By Deployment Model:

- On-Premise (In-house teams working with consultants)

- Cloud-Based/SaaS (Utilizing consultant’s proprietary platforms)

- Hybrid Model

Value Chain Analysis For Insurance Due Diligence and Consulting Market

The Value Chain for Insurance Due Diligence and Consulting is primarily knowledge-based, beginning with upstream activities focused on talent acquisition, methodology development, and proprietary technology investment. Upstream involves acquiring highly specialized professionals—actuaries, former regulators, and technology experts—and developing advanced proprietary analytical tools (AI/ML platforms) crucial for efficient data ingestion and initial risk scoring. The ability of a firm to maintain a cutting-edge knowledge base and intellectual property portfolio directly determines the quality and uniqueness of its market offerings, differentiating high-tier global consultants from smaller, regionally focused advisory firms.

Midstream activities involve the core consulting engagement process, starting with client need assessment, structuring the due diligence project scope, data collection, and rigorous analysis. This phase involves intensive client interaction and iterative feedback loops. The distribution channel is predominantly direct, relying on personal relationships, strong brand reputation, and highly effective proposal generation. However, indirect channels are emerging through partnerships with investment banks, law firms, and technology vendors (System Integrators) who refer clients requiring specialized insurance expertise during large transactions or system overhauls. The global nature of large M&A requires consulting firms to leverage global networks to ensure regulatory coverage across multiple jurisdictions.

Downstream activities center on delivering the final, actionable report, presenting strategic recommendations, and supporting post-engagement implementation, especially in M&A integration consulting. The quality of post-deal support, particularly in resolving operational challenges identified during due diligence, is a key determinant of client satisfaction and repeat business. Effective downstream execution ensures that the initial due diligence insights are successfully translated into realized operational and financial benefits for the client, strengthening the firm's reputation as a reliable, end-to-end strategic partner rather than just a transaction facilitator.

Insurance Due Diligence and Consulting Market Potential Customers

The primary customer base for Insurance Due Diligence and Consulting services consists of large, multinational insurance carriers across the life, property and casualty (P&C), and reinsurance sectors. These organizations frequently engage consultants for strategic transformation, regulatory readiness assessments, and, most crucially, for complex cross-border merger and acquisition due diligence where internal expertise may lack the necessary independence or specialized regional knowledge. The focus for these incumbent carriers is optimizing capital allocation, enhancing distribution efficiency, and navigating the transformation from legacy systems to modern, cloud-based architectures, necessitating long-term strategic advisory relationships.

A rapidly expanding segment of potential customers includes Private Equity (PE) firms and Institutional Asset Managers. PE firms are increasingly targeting insurance assets, especially closed life insurance blocks or specialized InsurTech companies, requiring intensive financial and operational due diligence to validate valuation and identify potential cost synergies before investment. Unlike traditional carriers who seek operational improvement, PE customers require rapid, comprehensive assessments focused on maximizing returns within a defined exit timeframe, driving demand for efficient, high-impact due diligence reports tailored for transaction execution and post-acquisition restructuring.

Further potential customers encompass large corporate entities with captive insurance operations, insurance brokers seeking platform consolidation, and governmental or quasi-governmental regulatory bodies. Regulatory bodies occasionally contract specialized consultants for market research, stress testing models, and benchmarking industry practices, ensuring the stability and fair conduct of the market. Furthermore, emerging InsurTech startups often seek consulting expertise for validating their business models, obtaining regulatory approvals, and preparing for strategic partnerships or acquisition by larger carriers, thereby expanding the customer base beyond traditional financial services giants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $6.5 Billion |

| Market Forecast in 2033 | $12.5 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McKinsey & Company, Boston Consulting Group (BCG), Deloitte, KPMG, PwC, EY, Oliver Wyman, Willis Towers Watson, Aon, Marsh McLennan, Bain & Company, Accenture, FTI Consulting, Duff & Phelps (Kroll), Alvarez & Marsal, Milliman, Towers Watson (now part of WTW), SCOR Consulting. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insurance Due Diligence and Consulting Market Key Technology Landscape

The technological landscape driving the Insurance Due Diligence and Consulting market is fundamentally shifting towards sophisticated data processing and automation tools designed to handle the massive volumes of heterogeneous data inherent in insurance transactions. Key technologies include advanced Data Analytics platforms that enable consultants to ingest, cleanse, and structure data from legacy systems much faster than manual methods. Furthermore, the deployment of Machine Learning (ML) algorithms is paramount for predictive risk modeling, allowing for highly accurate forecasting of future liabilities (e.g., loss ratios and reserve adequacy), thereby moving due diligence from a backward-looking assessment to a forward-looking strategic projection.

Robotic Process Automation (RPA) and specialized Natural Language Processing (NLP) are essential for transforming operational due diligence. RPA bots are used to automate repetitive data extraction tasks from policy administration systems and claims platforms, improving efficiency and reducing the margin of human error during the initial data gathering phase. NLP is specifically critical for analyzing complex, unstructured legal documentation, such as reinsurance treaties and proprietary policy wordings, quickly identifying non-standard clauses or hidden exposures. The adoption of these tools allows consulting firms to deliver "digital due diligence," offering faster turnaround times and deeper scrutiny than previously possible.

Additionally, the adoption of secure, cloud-based data rooms and collaboration platforms is essential for ensuring confidentiality and facilitating global team cooperation during cross-border M&A. Consultants are increasingly leveraging proprietary InsurTech platforms, developed either internally or through strategic partnerships, which offer enhanced capabilities in areas like geospatial risk modeling or regulatory sandbox simulations. This reliance on proprietary technology transforms the competitive advantage, making firms that successfully integrate tech-enabled services leaders in efficiency and specialized insight delivery within the highly competitive due diligence space.

Regional Highlights

Regional dynamics play a crucial role in shaping demand, complexity, and growth opportunities within the Insurance Due Diligence and Consulting Market. North America, anchored by the highly consolidated and capital-intensive US market, represents the largest revenue base. Demand here is driven by continuous large-scale M&A among major P&C and life carriers, intense competition from InsurTechs, and the requirement for complex actuarial and financial due diligence related to capital adequacy and regulatory compliance under state-level scrutiny. The maturity of the US private equity market further ensures sustained demand for high-caliber transactional advisory services.

Europe is a mature, but highly fragmented market driven by the complex regulatory environment established by Solvency II and GDPR. Cross-border acquisitions within the Eurozone necessitate robust regulatory and compliance due diligence expertise. Key activity includes the divestiture of non-core assets by large European banks and insurers, and the increasing trend of transferring closed-book life portfolios to specialized third-party managers, creating substantial demand for actuarial and operational assessment services. The UK remains a critical hub, particularly for reinsurance and specialized financial services due diligence, despite changes due to Brexit.

Asia Pacific (APAC) is projected as the fastest-growing region, characterized by rapid insurance penetration in emerging markets (China, India, Southeast Asia) and modernization efforts in established markets (Japan, Australia). Growth in APAC is fueled by foreign insurers entering previously restricted markets, local insurers consolidating to achieve scale, and regulatory efforts to harmonize local standards. This creates significant opportunities for market entry strategy consulting and operational due diligence to bridge the gap between legacy systems and global best practices, particularly regarding digital distribution channels and cyber resilience.

- North America (US and Canada): Largest market share, driven by high transaction volume, sophisticated financial modeling needs, and robust regulatory compliance requirements.

- Europe (UK, Germany, France): Strong demand for regulatory (Solvency II, GDPR) and actuarial consulting, sustained by divestiture of closed-book portfolios and cross-border consolidation.

- Asia Pacific (APAC - China, India, Australia, Japan): Fastest-growing region, fueled by rising insurance penetration, digital transformation initiatives, and increasing foreign direct investment in the financial sector.

- Latin America (Brazil, Mexico): Emerging market driven by liberalization of financial services, local consolidation efforts, and the need for international compliance expertise.

- Middle East and Africa (MEA): Growth concentrated in the GCC states due to increased regulation (e.g., IFRS 17 adoption), privatization initiatives, and increasing interest in Takaful (Islamic insurance) due diligence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insurance Due Diligence and Consulting Market.- McKinsey & Company

- Boston Consulting Group (BCG)

- Deloitte

- KPMG

- PwC

- EY (Ernst & Young)

- Oliver Wyman

- Willis Towers Watson (WTW)

- Aon

- Marsh McLennan

- Bain & Company

- Accenture

- FTI Consulting

- Duff & Phelps (Kroll)

- Alvarez & Marsal

- Milliman

- SCOR Consulting

- Clyde & Co

- L.E.K Consulting

- BearingPoint

Frequently Asked Questions

Analyze common user questions about the Insurance Due Diligence and Consulting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of Insurance Due Diligence in an M&A transaction?

The primary role is risk mitigation and validation of deal economics. Due diligence assesses a target’s financial health, operational viability (systems and claims processing), actuarial reserves, and compliance posture to ensure the buyer pays a fair value and avoids inheriting undisclosed liabilities.

How is the adoption of IFRS 17 driving demand for consulting services?

IFRS 17 adoption necessitates extensive consulting for financial due diligence, particularly regarding the restatement of financial records and the development of new accounting and reporting systems. Consultants are crucial for ensuring acquired entities achieve full compliance and accurate valuation under the new standard.

Which segment of due diligence is expected to grow the fastest through 2033?

IT and Cybersecurity Due Diligence is projected to experience the highest growth. This acceleration is driven by the increasing digital transformation of insurers, requiring complex scrutiny of cloud infrastructure, data governance, cyber resilience, and the scalability of InsurTech platforms during acquisitions.

What distinguishes Commercial Due Diligence (CDD) from Financial Due Diligence (FDD)?

FDD focuses on historical financial performance, balance sheets, and reserve adequacy, providing a snapshot of financial health. CDD assesses the target's market position, competitive landscape, growth drivers, quality of distribution channels, and future commercial viability within the industry context.

How do Private Equity (PE) firms utilize insurance consulting services?

PE firms utilize insurance consulting primarily for rapid, high-intensity transactional due diligence on target carriers or closed books of business, focusing heavily on operational efficiency improvements, capital optimization, and developing clear, actionable exit strategies to maximize investment returns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager