Integrated Automation System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442342 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Integrated Automation System Market Size

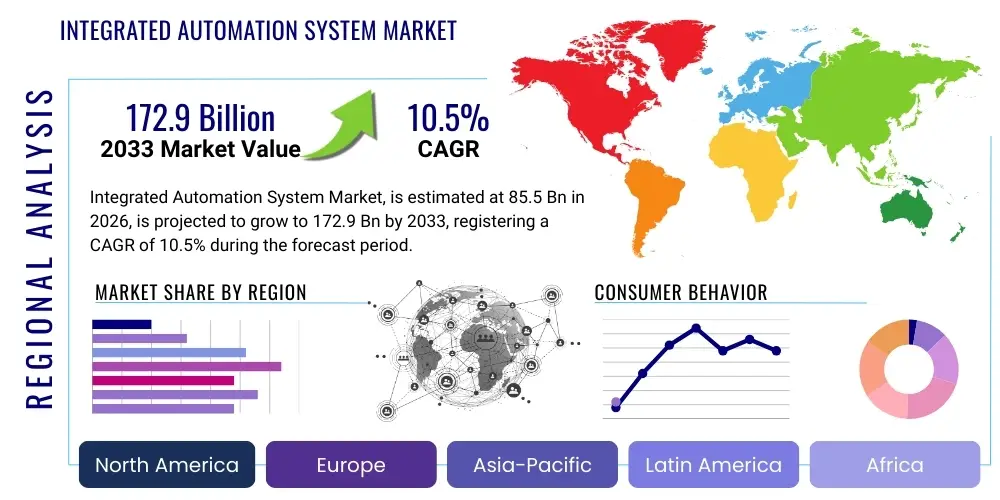

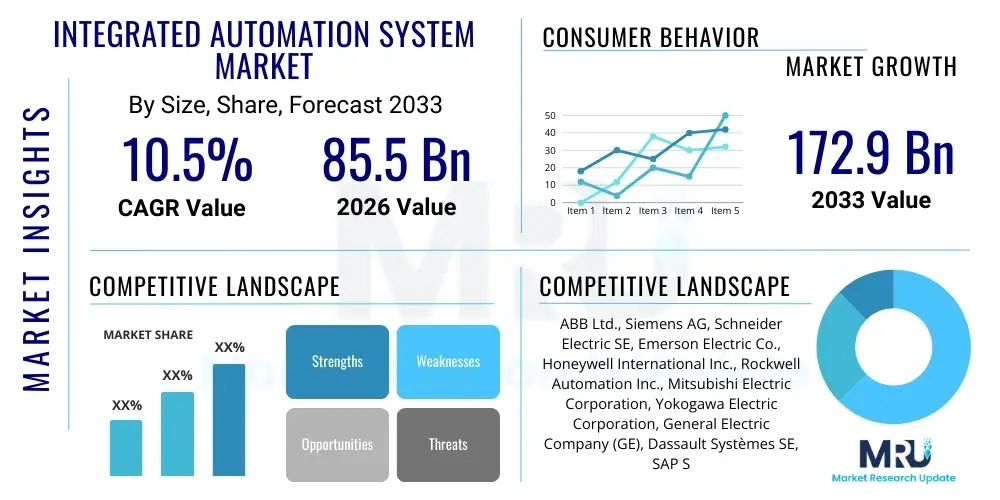

The Integrated Automation System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 172.9 Billion by the end of the forecast period in 2033.

Integrated Automation System Market introduction

The Integrated Automation System (IAS) market encompasses a sophisticated ecosystem of interconnected hardware, software, and services designed to optimize industrial processes across various sectors. IAS integrates previously disparate control systems, such as Distributed Control Systems (DCS), Supervisory Control and Data Acquisition (SCADA), Manufacturing Execution Systems (MES), and enterprise resource planning (ERP) solutions, into a unified operational framework. This holistic approach facilitates seamless data exchange, real-time monitoring, centralized control, and enhanced decision-making capabilities, moving industrial operations towards the paradigm of Industry 4.0. The primary goal of adopting IAS is to achieve higher levels of operational efficiency, reduce downtime, minimize energy consumption, and ensure consistent product quality, which are crucial competitive differentiators in today's global manufacturing landscape.

The evolution of IAS is intrinsically linked to the increasing complexity of industrial environments and the demand for higher flexibility in production lines. Key product offerings within this market range from high-performance programmable logic controllers (PLCs) and advanced sensors capable of collecting granular operational data, to complex software platforms that employ predictive analytics and machine learning algorithms. Major applications span critical infrastructure, including power generation, water and wastewater management, oil and gas, pharmaceuticals, and discrete manufacturing sectors like automotive and electronics. The robust nature of these systems ensures reliability and security, addressing growing concerns related to cyber threats in connected industrial environments.

The primary benefits driving the widespread adoption of IAS include significant improvements in throughput and yield, attributed to optimized scheduling and resource allocation. Furthermore, IAS fundamentally enhances safety protocols by providing precise monitoring and automated shutdown mechanisms, critical in high-risk environments like chemical processing and nuclear energy. The market is propelled by factors such as the global push for smart factories, massive investments in industrial IoT (IIoT) infrastructure, the need for stringent regulatory compliance, and the competitive pressure to reduce operational expenditure (OpEx) while maximizing asset utilization. This technological convergence is establishing integrated automation as the cornerstone of future industrial productivity.

Integrated Automation System Market Executive Summary

The Integrated Automation System (IAS) market is experiencing robust expansion, driven primarily by the transition towards digital manufacturing ecosystems and the crucial need for end-to-end operational visibility. Business trends indicate a shift from standalone systems to highly integrated, software-centric platforms that leverage cloud computing and edge intelligence for distributed processing. Key industry players are focusing on developing scalable, modular solutions that allow for flexible customization based on specific industrial requirements, moving away from monolithic legacy architectures. Mergers and acquisitions, alongside strategic partnerships between IT providers and traditional operational technology (OT) vendors, are defining the competitive landscape, aiming to offer comprehensive, integrated solutions from the factory floor up to the enterprise level.

Regionally, the market dynamics are highly differentiated. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapid industrialization, massive government initiatives supporting smart city and smart factory development in countries like China, India, and South Korea, and substantial foreign direct investment in manufacturing capacity expansion. North America and Europe, characterized by high adoption rates of advanced technologies and established industrial bases, represent the largest market shares, focusing predominantly on optimization, cybersecurity, and the retrofitting of existing infrastructure (brownfield projects) with advanced IAS capabilities. The Middle East and Africa (MEA) and Latin America are showing strong growth potential, largely centered around modernizing critical infrastructure, particularly in the oil and gas, utilities, and mining sectors.

Segment trends highlight the increasing importance of the software component within IAS, especially solutions related to Manufacturing Execution Systems (MES) and advanced analytics platforms, which provide the intelligence layer necessary for optimization. While traditional components like PLCs and sensors remain essential hardware building blocks, their functionality is being enhanced through embedded connectivity and edge computing capabilities. The process industry segment, including Oil & Gas and Chemical, currently holds the largest market share due to the necessity of continuous, precise control over complex processes. However, the discrete manufacturing segment, particularly automotive and electronics, is witnessing the highest adoption growth rate as these industries strive for mass customization and production flexibility, necessitating highly integrated and agile automation systems.

AI Impact Analysis on Integrated Automation System Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Integrated Automation System Market center around several critical areas: specifically, how AI enhances predictive maintenance capabilities, the role of machine learning in optimizing complex process control loops, and the feasibility of autonomous decision-making in industrial operations. Users are keen to understand the shift from traditional rule-based automation to adaptive, AI-driven systems. Key themes analyzed include the necessary data infrastructure (Edge AI vs. Cloud AI), concerns regarding system reliability and safety during autonomous operation, and the overall Return on Investment (ROI) derived from implementing AI within existing IAS frameworks. There is a clear expectation that AI will unlock deeper operational efficiencies, particularly in managing variability and complexity across global supply chains and production schedules.

AI profoundly transforms Integrated Automation Systems by moving them beyond simple data collection and pre-programmed responses toward genuine intelligence. Machine learning algorithms analyze vast datasets generated by sensors and controllers, identifying subtle patterns indicative of impending equipment failure, thereby shifting maintenance strategies from preventative or reactive approaches to highly precise predictive scheduling. This optimization not only minimizes unexpected downtime but also extends asset lifespan, fundamentally changing the economics of industrial operations. Furthermore, AI-driven process optimization uses reinforcement learning techniques to fine-tune control parameters in real time, adapting dynamically to changes in raw material quality, ambient conditions, or shifting energy costs, something conventional PID controllers cannot achieve with the same level of granularity.

The integration of AI also addresses complex integration challenges inherent in linking multiple automation domains. AI platforms act as intelligent mediators, translating data and commands across different proprietary systems (e.g., integrating a legacy DCS with a modern MES), reducing implementation complexity and system silos. Furthermore, cognitive automation, a form of advanced AI, is beginning to automate supervisory tasks, such as production scheduling, quality control inspections using computer vision, and intricate resource management, allowing human operators to focus on higher-level strategic oversight and troubleshooting. This convergence of AI and IAS is creating highly resilient, self-optimizing industrial environments, which is crucial for maximizing efficiency in the competitive global market.

- AI enables highly accurate predictive maintenance, reducing unplanned downtime by identifying equipment failure indicators proactively.

- Machine Learning optimizes complex control loops and process parameters in real-time, adapting dynamically to operational variability.

- Computer Vision and AI-based quality control streamline inspection processes, ensuring consistent product quality with higher throughput.

- Cognitive automation assists in complex decision-making tasks, such as production scheduling and resource allocation, enhancing overall supply chain agility.

- AI facilitates seamless data harmonization and communication between previously siloed Operational Technology (OT) and Information Technology (IT) systems.

- Edge AI deployment allows for faster, localized decision-making, minimizing latency critical for high-speed manufacturing processes.

DRO & Impact Forces Of Integrated Automation System Market

The dynamics of the Integrated Automation System (IAS) market are shaped by a powerful confluence of drivers necessitating technological adoption, restraints hindering swift implementation, and opportunities that promise substantial future growth, all consolidated into a set of impactful forces. The primary drivers include the escalating global demand for improved operational efficiencies, the relentless competitive pressure to reduce manufacturing costs, and the widespread necessity for enhanced regulatory compliance, particularly in regulated industries like pharmaceuticals and food & beverage. Simultaneously, the accelerating adoption of Industry 4.0 paradigms, which mandates interconnected and smart manufacturing environments, serves as a foundational driver, pushing companies to invest heavily in integrated platforms that unify data and control functions. The immediate impact forces center on capital expenditure decisions and the speed of digital transformation across various industrial sectors.

Key restraints tempering market growth primarily revolve around the substantial initial investment required for migrating from legacy systems (brownfield challenges), the inherent complexity associated with integrating heterogeneous technologies from multiple vendors, and the critical shortage of skilled personnel capable of managing, maintaining, and programming advanced IAS solutions. Cybersecurity risks also pose a significant restraint; as systems become more connected, the vulnerability to cyberattacks increases, requiring robust and costly security measures. Furthermore, the perceived lack of standardization across communication protocols and hardware interfaces can prolong implementation timelines and increase integration costs, creating resistance among smaller or more cautious enterprises.

Nevertheless, the market is poised for significant future expansion due to several compelling opportunities. The rapidly expanding deployment of Industrial IoT (IIoT) infrastructure presents vast opportunities for data aggregation and advanced analytics, creating value through optimization insights. The increasing adoption of cloud-based and hybrid automation architectures offers scalability and reduced hardware footprint, lowering the total cost of ownership over time. Furthermore, the emerging potential for highly customized and specialized automation solutions catering to niche market requirements, alongside the continuous development of AI and machine learning tools, opens new avenues for predictive maintenance and autonomous operations. These opportunities, underpinned by the ongoing need for efficiency and quality control, ensure sustained market momentum.

Segmentation Analysis

The Integrated Automation System Market is segmented across several critical dimensions, enabling tailored analysis of adoption trends, technological preferences, and expenditure patterns across diverse industrial ecosystems. These segmentations typically categorize the market based on the type of automation solution implemented (e.g., DCS, SCADA), the underlying components (hardware, software, services), and the industry vertical utilizing the systems (process vs. discrete manufacturing). Understanding these segments is crucial as different end-user industries possess distinct operational needs; for instance, the process industry prioritizes continuous control and safety integrity, while the discrete industry focuses on flexibility and speed of changeover. The resulting segmentation matrix highlights areas of high growth, technological maturity, and regional specialization, informing strategic investment decisions.

Segmentation by component reveals the evolving importance of software and services. While hardware—comprising controllers, sensors, and actuators—remains essential for physical execution, the rapid growth is often centered within the software layer, which includes advanced analytics, MES platforms, and cybersecurity tools. This trend reflects the market's evolution from purely physical automation to data-driven operational intelligence. The services segment, encompassing consulting, integration, maintenance, and training, is also expanding significantly as system complexity necessitates specialized external expertise for deployment and continuous optimization, especially for large-scale, multi-site integrated projects.

The segmentation across end-user industries demonstrates the core demand drivers. The Process Industry segment (including oil & gas, chemicals, power generation, and metals & mining) represents a significant revenue share due to the requirement for highly precise, uninterrupted processes and the critical need for safety compliance, making Integrated Automation Systems indispensable. Conversely, the Discrete Industry segment (including automotive, electronics, aerospace, and packaging) is projected to exhibit a higher growth rate, driven by the intense pressure for production flexibility, customization capabilities, and the integration of robotics and advanced manufacturing techniques, all of which rely heavily on fully integrated automation architectures.

- By Type:

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition (SCADA)

- Manufacturing Execution System (MES)

- Product Lifecycle Management (PLM)

- Enterprise Resource Planning (ERP) Integration

- By Component:

- Hardware (Sensors, PLCs, Controllers, HMIs, Networking Equipment)

- Software (SCADA Software, MES Software, Analytics Platforms, Cybersecurity Solutions)

- Services (Consulting, Integration, Maintenance, Training, Managed Services)

- By End-User Industry:

- Process Industry (Oil & Gas, Chemicals, Pharmaceuticals, Food & Beverage, Utilities, Metals & Mining)

- Discrete Industry (Automotive, Electronics & Semiconductor, Aerospace & Defense, Packaging, Machinery Manufacturing)

Value Chain Analysis For Integrated Automation System Market

The value chain for the Integrated Automation System (IAS) market is complex and highly specialized, beginning with the upstream analysis involving fundamental component manufacturing and extending through to downstream services and end-user deployment. Upstream activities involve key technology providers focusing on research and development of core hardware components such as microprocessors, high-precision sensors, industrial networking equipment, and advanced actuators. These specialized technology suppliers are crucial as their innovations in speed, miniaturization, and ruggedness directly influence the capabilities of the final automation system. Furthermore, software development firms specializing in industrial operating systems, real-time databases, and connectivity protocols form a vital part of this upstream segment, ensuring the foundational elements are robust and interconnected.

Midstream activities primarily encompass system integration and configuration. This phase is dominated by major IAS providers and specialized third-party system integrators who architect, customize, and assemble the disparate hardware and software modules into a cohesive operational solution tailored to the client's specific industrial requirements. This integration effort includes developing custom application logic, configuring Human-Machine Interfaces (HMIs), ensuring cyber-physical security across the network, and rigorous testing before deployment. The distribution channel is multifaceted, relying heavily on direct sales for large, customized projects, and indirect channels—such as authorized distributors and value-added resellers (VARs)—for standardized components and smaller deployments. Direct sales ensure tight control over the complex installation process and facilitate long-term service contracts.

Downstream analysis focuses on deployment, ongoing operation, and support. This stage involves installation, commissioning, staff training, and continuous maintenance and optimization services. Post-sales support is a critical value differentiator, particularly maintenance and modernization services aimed at maximizing the lifespan of the installed base. Direct interaction often occurs through field service engineers and consulting teams employed by the primary IAS vendors or certified partners. The value chain is characterized by a high degree of collaboration, where specialized domain knowledge is transferred from integrators and vendors to the end-users, ensuring the automation system delivers its intended operational benefits throughout its entire lifecycle. The quality of integration and ongoing service ultimately determines the long-term customer value derived from the IAS investment.

Integrated Automation System Market Potential Customers

The potential customers for Integrated Automation Systems are any industrial entity requiring precise, reliable, and scalable control over complex operational processes, aiming to maximize efficiency and maintain stringent quality standards. Primarily, these customers are large enterprises within regulated and capital-intensive industries where downtime is exceedingly costly and safety is paramount. The primary buyers fall into two broad categories: process industries and discrete manufacturing industries. In the process domain, large-scale corporations operating oil refineries, chemical plants, pharmaceutical manufacturing facilities, and municipal utility providers (water, power) are high-priority clients, as they utilize IAS for continuous process control, advanced regulatory compliance, and hazard mitigation, typically relying on robust DCS and SCADA platforms.

In the discrete manufacturing sector, potential customers include global automotive manufacturers seeking flexible production lines to handle customized orders, high-tech electronics and semiconductor firms needing ultra-precise control over assembly and testing, and aerospace and defense contractors demanding high reliability and traceability. These segments are increasingly adopting advanced automation integrating MES with robotics and vision systems to achieve Industry 4.0 goals. Furthermore, mid-market companies are becoming increasingly viable customers due to the emergence of modular, scalable, and cloud-enabled IAS solutions that reduce the upfront capital expenditure barrier, allowing smaller players to benefit from integrated digital transformation efforts previously exclusive to industry giants.

The purchasing decision within these organizations is often complex, involving engineering, operations, IT, and procurement departments, with the final decision maker typically being a C-level executive (e.g., COO or CIO) focused on strategic operational efficiency and digital transformation initiatives. The adoption rate is also highly dependent on the lifecycle stage of the customer's existing infrastructure; companies undergoing expansions (greenfield projects) or major system overhauls (brownfield modernization) represent immediate and significant customer opportunities. The long-term relationship between vendors and customers is sustained through ongoing service contracts and technology upgrades necessary to adapt to evolving operational demands and technological advancements, positioning customers as long-term partners in the automation ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 172.9 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Emerson Electric Co., Honeywell International Inc., Rockwell Automation Inc., Mitsubishi Electric Corporation, Yokogawa Electric Corporation, General Electric Company (GE), Dassault Systèmes SE, SAP SE, Cisco Systems Inc., Fanuc Corporation, Kuka AG, Omron Corporation, Keyence Corporation, Advantech Co. Ltd., Bosch Rexroth AG, Eaton Corporation plc, Hitachi, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Integrated Automation System Market Key Technology Landscape

The Integrated Automation System (IAS) market is defined by a rapidly evolving technological landscape where traditional operational technology (OT) converges fundamentally with advanced information technology (IT) elements. Key technologies underpinning modern IAS include high-performance Programmable Logic Controllers (PLCs) and Distributed Control Systems (DCS) which form the foundational control layer, now featuring enhanced connectivity protocols like OPC UA for vendor-neutral communication and robust cybersecurity integration. The shift is evident in the adoption of standardized Ethernet-based communication (e.g., Time-Sensitive Networking or TSN) to ensure deterministic and low-latency data transfer across the industrial network, crucial for real-time control and synchronization of complex processes across vast manufacturing facilities.

Crucially, the rise of Industrial Internet of Things (IIoT) platforms and edge computing is reshaping how data is collected and processed within IAS. IIoT sensors are enabling massive data collection at granular levels, feeding powerful analytics engines. Edge computing devices, deployed close to the physical processes, allow for instantaneous data processing and localized decision-making, significantly reducing reliance on centralized cloud resources for critical control actions. This hybrid architecture (Edge-to-Cloud) ensures both real-time operational efficiency and long-term, enterprise-wide strategic data analysis. This technological advancement directly supports the transition to genuinely integrated systems where data is seamlessly shared between the plant floor and enterprise resource planning (ERP) systems.

Furthermore, specialized technologies such as digital twin creation and simulation software are becoming integral components of IAS. Digital twins allow organizations to model, simulate, and test changes to their automation systems or physical processes virtually before implementing them in the live environment, drastically minimizing risk and optimizing performance outcomes. The integration of advanced human-machine interfaces (HMIs) featuring augmented reality (AR) capabilities is also transforming how operators interact with the systems, providing contextual, real-time diagnostic and operational data overlays onto physical machinery. These technologies, combined with integrated cybersecurity frameworks tailored for OT environments, establish the backbone of sophisticated, resilient, and adaptive integrated automation solutions.

Regional Highlights

The global Integrated Automation System Market exhibits distinct growth trajectories and adoption patterns across major geographical regions, influenced by industrial maturity, regulatory frameworks, and investment in digital transformation.

- North America: Recognized for its early adoption of cutting-edge technologies and high expenditure on modernizing aging critical infrastructure, particularly in oil & gas, aerospace, and advanced manufacturing. The focus here is on leveraging AI and predictive analytics within existing IAS to maximize asset uptime and operational efficiency. The stringent regulatory environment also drives demand for sophisticated, traceable automation systems.

- Europe: Driven significantly by initiatives like Industry 4.0 in Germany and similar digitalization mandates across the EU. Europe boasts a strong industrial base, especially in automotive, machinery, and pharmaceuticals. The region is highly focused on sustainable and energy-efficient automation solutions, prioritizing cyber resilience and the implementation of deterministic networking technologies like TSN for real-time control.

- Asia Pacific (APAC): The fastest-growing regional market, propelled by rapid industrial expansion, massive investments in manufacturing capacity (China, India, Southeast Asia), and government support for smart city and smart factory projects. APAC represents a diverse landscape with significant greenfield investment opportunities, leading to large-scale adoption of modern, fully integrated automation solutions often incorporating advanced robotics and complex MES systems.

- Latin America: Characterized by increasing investment in primary sectors, including mining and natural resources, driving the need for robust automation systems for remote monitoring and operational safety. Adoption is steadily increasing, focusing primarily on optimizing core processes and securing critical infrastructure through integrated SCADA and control systems.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, heavily driven by large-scale oil and gas projects and infrastructure development (utilities, desalination plants). The demand centers around high-reliability control systems (DCS) and integrated cybersecurity measures necessary to protect vital national assets from physical and digital threats.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Integrated Automation System Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Yokogawa Electric Corporation

- General Electric Company (GE)

- Dassault Systèmes SE

- SAP SE

- Cisco Systems Inc.

- Fanuc Corporation

- Kuka AG

- Omron Corporation

- Keyence Corporation

- Advantech Co. Ltd.

- Bosch Rexroth AG

- Eaton Corporation plc

- Hitachi, Ltd.

Frequently Asked Questions

Analyze common user questions about the Integrated Automation System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the core difference between traditional automation and Integrated Automation Systems (IAS)?

Traditional automation typically involves isolated control loops (PLCs, standalone SCADA) lacking seamless communication across the enterprise layers. IAS, conversely, integrates these operational technologies (OT) with business intelligence systems (IT/ERP) via standardized protocols and unified platforms, enabling real-time data flow, centralized management, and holistic operational optimization from the factory floor to the boardroom.

How does the convergence of IT and OT drive the growth of the Integrated Automation Market?

IT/OT convergence breaks down data silos, allowing operational data collected by sensors and controllers (OT) to be analyzed by enterprise software (IT) using advanced analytics and AI. This integration facilitates smarter decision-making, predictive maintenance, optimized supply chains, and greater system agility, fundamentally accelerating digital transformation and market expansion.

What are the primary cybersecurity challenges facing Integrated Automation Systems?

The increasing connectivity of IAS, particularly the integration of IIoT devices and external networks, introduces a larger attack surface. Key challenges include protecting legacy equipment not designed with modern security in mind, managing patches across heterogeneous systems, ensuring network segmentation, and mitigating threats like ransomware targeting operational continuity.

Which industrial sector is currently leading the investment in integrated automation solutions?

The Process Industry, particularly the Oil & Gas, Chemicals, and Utilities sectors, currently accounts for the largest share of IAS investment due to the critical need for continuous operation, high safety integrity, and precise, real-time control over complex chemical and physical processes. However, the Discrete Manufacturing sector (Automotive and Electronics) is exhibiting the fastest growth rate.

What role does cloud computing play in modern Integrated Automation Systems?

Cloud computing provides scalable infrastructure for storing and analyzing massive volumes of industrial data, enabling advanced analytics, historical trending, and large-scale asset management across multiple facilities. It supports services like remote monitoring and predictive maintenance, moving the computational burden for non-critical strategic analysis away from on-site industrial hardware.

The Integrated Automation System Market is expected to witness substantial technological advancements and geographical expansion throughout the forecast period, transitioning towards self-optimizing, highly resilient, and AI-enabled industrial ecosystems. This market evolution is critical for global industries striving for competitive superiority and sustainable operational efficiency in the age of Industry 4.0.

The detailed analysis confirms that system flexibility, cybersecurity measures, and the deployment of hybrid cloud/edge architectures are pivotal factors influencing vendor strategies and enterprise purchasing decisions. Continued investment in skilled labor training and the standardization of communication protocols will be necessary to fully realize the vast potential offered by highly integrated automation solutions worldwide.

In conclusion, the market trajectory is definitively upward, reinforced by the continuous pressure on manufacturing entities to enhance productivity while simultaneously managing complexity and regulatory demands. Major players are strategically positioning themselves through enhanced software offerings and comprehensive service portfolios, ensuring long-term engagement with high-value industrial customers.

The adoption cycle in emerging economies, particularly within APAC, suggests a significant opportunity for greenfield projects to deploy the latest integrated platforms directly, potentially leapfrogging older automation generations prevalent in more established markets. This regional divergence in adoption patterns will be a key differentiator in overall market share distribution by 2033.

Furthermore, sustainability goals globally are increasingly tied to automation strategies. Integrated systems optimize energy usage, reduce waste, and improve resource efficiency, positioning IAS vendors as crucial partners in corporate environmental, social, and governance (ESG) reporting and compliance efforts. This alignment with sustainability mandates provides a powerful, non-traditional driver for market expansion in the coming decade.

To fully capitalize on this growth, technology providers must prioritize user-friendly interfaces, modular design, and open architectures that simplify integration and reduce the overall complexity faced by end-users transitioning from legacy control methodologies. The future success of IAS lies in its ability to deliver complexity reduction through intelligent system management.

The competitive landscape remains intense, characterized by continuous innovation in software-defined automation and strategic alliances aimed at providing end-to-end solutions. Differentiation will increasingly rely on the speed of AI integration, the robustness of cybersecurity layers, and the depth of industry-specific domain expertise offered by vendors to solve unique operational challenges.

Market analysts project that the most significant disruption will come from platforms that successfully integrate operational data seamlessly with advanced analytical tools, transforming raw production statistics into actionable business intelligence across the enterprise. This holistic approach is the defining characteristic of the next generation of Integrated Automation Systems.

The high capital intensity of process industries ensures continued investment in advanced DCS and SCADA platforms, while the high pace of innovation in discrete manufacturing drives demand for flexible, modular solutions capable of accommodating rapid product changeovers and customization, further segmenting the technological focus of major market participants.

Ultimately, the Integrated Automation System Market is transitioning from a focus on control to a focus on intelligence. Systems are becoming self-aware, self-diagnosing, and self-optimizing, marking a crucial evolution in industrial operational capability and setting the stage for truly autonomous manufacturing environments.

This comprehensive report provides a foundation for strategic planning, revealing key growth areas and technological imperatives necessary for navigating the competitive landscape and capitalizing on the significant expansion forecasted for the Integrated Automation System Market through 2033.

Regional economic stability and government policies favoring industrial digitalization will be crucial factors influencing investment cycles. Countries offering tax incentives or subsidies for technology adoption will likely see accelerated growth rates in IAS implementation compared to regions with stricter regulatory hurdles or economic uncertainty.

Finally, the growing trend of remote operations, necessitated by globalization and recent public health crises, has solidified the importance of highly integrated, secure, and remote-accessible automation systems, ensuring business continuity regardless of physical accessibility to the plant floor. This resilience factor is now a primary requirement for new system deployments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager