Integrated Operating Room Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440744 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Integrated Operating Room Systems Market Size

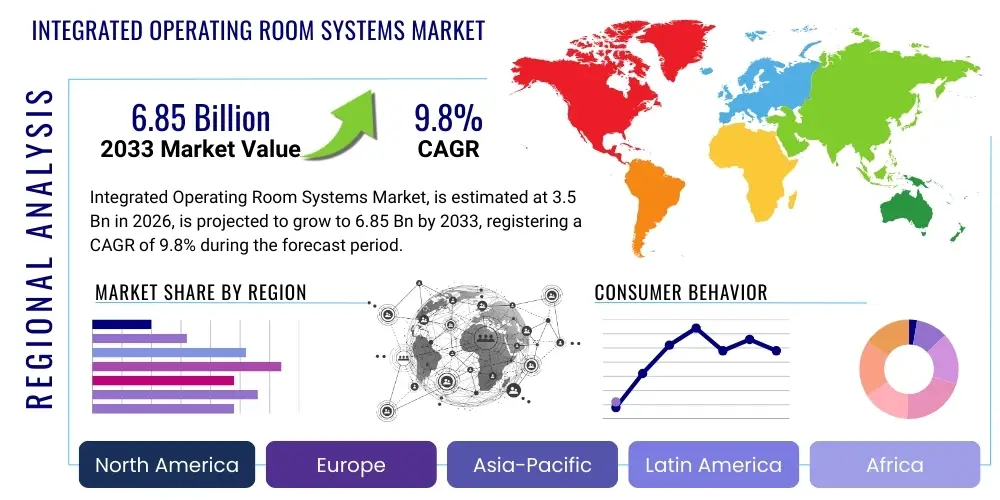

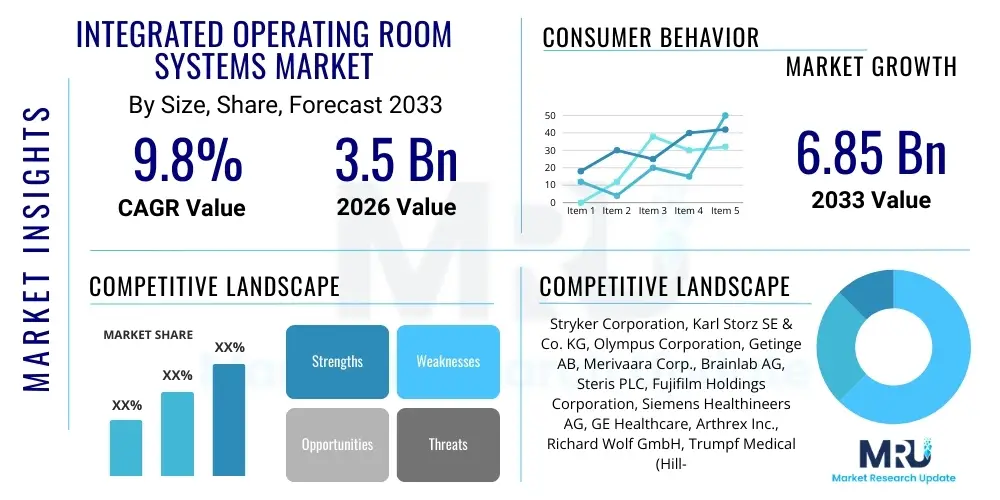

The Integrated Operating Room Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.85 Billion by the end of the forecast period in 2033.

Integrated Operating Room Systems Market introduction

The Integrated Operating Room (OR) Systems Market is characterized by the convergence of advanced medical technologies and digital solutions aimed at optimizing surgical workflows and enhancing patient care. These systems encompass a suite of interconnected components, including surgical displays, medical imaging devices, audio-video management, patient data management, robotic systems, and environmental controls, all centralized for seamless operation. The core product offering revolves around creating a cohesive, interoperable, and efficient surgical environment that minimizes manual intervention, reduces setup times, and improves communication within the surgical team. Key applications span a wide range of surgical disciplines, from general surgery and orthopedics to neurosurgery and cardiology, facilitating complex procedures with enhanced precision and safety.

The primary benefits of adopting integrated OR systems include significant improvements in operational efficiency, reduced risk of human error, better resource utilization, and superior patient outcomes. By centralizing control and data access, these systems enable surgeons to focus more intently on the procedure while having immediate access to critical information and control over various devices. Furthermore, the integration supports advanced functionalities like surgical navigation, real-time imaging, and tele-mentoring, which are crucial for complex and minimally invasive surgeries. The market’s growth is fundamentally driven by the escalating demand for minimally invasive surgical procedures, technological advancements in medical imaging and robotics, and a growing emphasis on optimizing hospital operational costs and patient safety standards globally.

Integrated Operating Room Systems Market Executive Summary

The Integrated Operating Room Systems Market is experiencing robust growth, propelled by several key business trends including the rapid digitization of healthcare, the increasing adoption of minimally invasive surgeries, and strategic investments in advanced medical infrastructure. Businesses are focusing on developing highly modular and scalable solutions that can be customized to various surgical specialties and hospital sizes, ensuring future-proofing and adaptability. There is a strong emphasis on interoperability and connectivity, as healthcare providers seek systems that can seamlessly integrate with existing hospital information systems and electronic health records. Furthermore, a rising trend towards value-based healthcare models is pushing manufacturers to innovate solutions that not only enhance surgical efficiency but also contribute to cost-effectiveness and improved patient satisfaction, thereby driving sustainable market expansion and competitive differentiation among key players.

Regionally, North America and Europe continue to dominate the market due to their advanced healthcare infrastructures, high adoption rates of cutting-edge technologies, and significant healthcare expenditures. However, the Asia Pacific region is emerging as the fastest-growing market, fueled by increasing healthcare awareness, improving economic conditions, government initiatives to modernize healthcare facilities, and a rising prevalence of chronic diseases necessitating surgical interventions. Latin America and the Middle East & Africa regions are also showing promising growth potential, driven by expanding access to healthcare services and increasing investments in upgrading medical facilities. Each region presents unique market dynamics, with varying regulatory landscapes and healthcare priorities influencing adoption patterns and market penetration strategies for integrated OR system providers.

From a segmentation perspective, the market sees significant traction across different component types, with high-definition display systems, advanced imaging modalities, and intelligent control units being pivotal. Software and data management platforms are gaining prominence as hospitals increasingly rely on data for decision-making, workflow optimization, and training. Applications in general surgery, orthopedics, and neurosurgery represent substantial market shares, reflecting the diverse utility of integrated ORs. End-user segments, primarily hospitals and ambulatory surgical centers (ASCs), are expanding their investment in these systems to enhance operational efficiency and cater to the growing volume of surgical procedures. The evolution of these segments underscores a broader industry shift towards comprehensive, technologically advanced, and patient-centric surgical environments, driving sustained innovation and market development.

AI Impact Analysis on Integrated Operating Room Systems Market

User questions frequently revolve around how Artificial Intelligence (AI) can revolutionize surgical precision, improve patient safety, and streamline complex OR workflows. There's significant interest in AI's role in predictive analytics for surgical outcomes, real-time intraoperative guidance, and automating repetitive tasks. Concerns often emerge regarding data privacy, the ethical implications of AI in clinical decision-making, and the challenges of integrating AI models into existing, disparate hospital IT infrastructures. Expectations are high for AI to reduce surgical errors, enhance surgeon training through virtual reality and simulation, and enable personalized surgical planning, ultimately leading to more efficient operations and faster patient recovery times.

- Enhanced Surgical Navigation: AI algorithms process real-time imaging data to provide surgeons with precise anatomical mapping and guidance during complex procedures, improving accuracy and reducing invasiveness.

- Predictive Analytics for Outcomes: AI models analyze vast datasets of patient history, surgical parameters, and post-operative recovery to predict potential complications and optimize treatment plans.

- Automated Workflow Optimization: AI-powered systems can manage scheduling, resource allocation, and instrument tracking, significantly reducing turnaround times and improving OR utilization.

- Real-time Decision Support: AI assists surgeons by providing immediate insights from patient data and medical literature, aiding in critical intraoperative decisions.

- Robotics and Automation: AI integration with surgical robots enables more autonomous functions, enhancing precision for tasks like suturing and dissection, and reducing surgeon fatigue.

- Personalized Surgical Planning: AI facilitates the creation of patient-specific surgical plans by analyzing individual anatomical and physiological data, leading to tailored and more effective interventions.

- Training and Simulation: AI-driven virtual reality and augmented reality platforms offer realistic surgical simulations, providing invaluable training opportunities for medical students and experienced surgeons alike.

- Intelligent Imaging Analysis: AI rapidly analyzes medical images (CT, MRI) to detect subtle anomalies, assist in diagnosis, and guide surgical approaches more effectively than traditional methods.

DRO & Impact Forces Of Integrated Operating Room Systems Market

The Integrated Operating Room Systems Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities. Key drivers include the escalating global demand for minimally invasive surgical procedures, which necessitate advanced imaging, navigation, and display technologies for enhanced precision and safety. Technological advancements in medical robotics, high-definition visualization, and data integration platforms further propel market growth by offering superior surgical capabilities. Additionally, the increasing focus on optimizing operational efficiency within hospitals, reducing surgical errors, and improving overall patient outcomes strongly encourages the adoption of these integrated systems. The rising prevalence of chronic diseases requiring surgical intervention and the growing geriatric population also contribute to a steady demand for modern OR solutions, making them indispensable for contemporary healthcare facilities.

Conversely, the market faces several notable restraints that could impede its growth trajectory. The substantial initial capital investment required for installing and upgrading integrated OR systems presents a significant barrier for many healthcare facilities, particularly in developing economies or those with budget constraints. The inherent complexity of integrating diverse technological components from multiple vendors often leads to implementation challenges, including compatibility issues and the need for specialized technical expertise. Furthermore, stringent regulatory approval processes for medical devices and integrated systems can delay market entry for new innovations. A shortage of skilled professionals capable of operating and maintaining these advanced systems, coupled with concerns regarding data security and patient privacy in interconnected environments, also poses considerable challenges that need to be addressed by market players and policymakers.

Despite these restraints, the Integrated Operating Room Systems Market is ripe with opportunities for expansion and innovation. The burgeoning healthcare infrastructure in emerging economies, coupled with increasing government and private sector investments in medical technology, offers significant avenues for market penetration. The continuous evolution of artificial intelligence and machine learning promises to further enhance surgical precision, automate routine tasks, and provide advanced predictive analytics, creating new product development possibilities. Moreover, the growing trend towards value-based healthcare, which prioritizes efficiency and patient satisfaction, encourages hospitals to invest in solutions that deliver measurable improvements. The integration of telemedicine and remote surgical assistance capabilities, along with the development of modular and scalable systems, represents fertile ground for future growth and innovation, allowing for broader adoption across various healthcare settings and specialties.

Segmentation Analysis

The Integrated Operating Room Systems Market is comprehensively segmented based on various factors including components, applications, and end-users, providing a granular view of its diverse landscape. This segmentation allows for a detailed understanding of market dynamics, growth drivers within specific niches, and the varying demands of different healthcare environments. Each segment represents distinct technological requirements, operational considerations, and customer needs, influencing product development strategies and market positioning for manufacturers. Analyzing these segments is critical for stakeholders to identify lucrative opportunities and tailor their offerings to address specific market demands effectively.

- By Component:

- Audio & Video Management Systems

- Display Systems

- Light Source

- Surgical Booms

- Integration Software

- Data Management Systems

- Communication Systems

- Robotic Systems

- Imaging Systems (e.g., MRI, CT, X-ray, Ultrasound)

- Anesthesia Delivery Systems

- Sterilization Systems

- Operating Tables

- Surgical Lights

- By Application:

- General Surgery

- Neurosurgery

- Cardiology

- Orthopedics

- Urology

- Gynecology

- Plastic & Reconstructive Surgery

- Pediatric Surgery

- ENT Surgery

- By End User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Academic & Research Institutes

- By Type of Integration:

- Hybrid OR

- Minimal Invasive OR

- Fixed OR

- Mobile OR

- By Technology:

- Surgical Navigation Systems

- Robotics

- Advanced Visualization

- Data Archiving & Communication

Value Chain Analysis For Integrated Operating Room Systems Market

The value chain for the Integrated Operating Room Systems Market begins with upstream activities involving raw material procurement and the manufacturing of specialized components. This includes suppliers of high-definition displays, advanced sensors, robotic parts, medical-grade plastics, and complex electronic circuits. These components are then assembled and integrated by system manufacturers who develop the core hardware and software platforms that form the complete integrated OR solution. Quality control, regulatory compliance, and R&D for continuous innovation are critical at this stage to ensure product efficacy and safety. The upstream segment is highly competitive and characterized by a focus on material science, precision engineering, and adherence to stringent medical device standards.

Further along the value chain, downstream activities involve the distribution, installation, and post-sales support of these complex systems. Distribution channels are typically a mix of direct sales forces, especially for large hospital groups, and a network of specialized third-party distributors for broader market reach, particularly in regional markets. These distributors often provide localized expertise in installation, training, and maintenance. Hospitals and ambulatory surgical centers are the primary end-users, requiring extensive technical support, software updates, and maintenance services throughout the product lifecycle. The downstream segment emphasizes strong customer relationships, effective logistics, and the ability to offer comprehensive service packages, which include training for medical staff and ongoing technical assistance to ensure optimal system performance and patient safety.

Both direct and indirect distribution channels play a pivotal role in market penetration. Direct channels allow manufacturers to maintain greater control over sales, pricing, and customer relationships, often utilized for high-value contracts with major healthcare institutions. Indirect channels, through distributors, help manufacturers tap into diverse geographical markets and smaller healthcare facilities, leveraging the distributors' established networks and local presence. This dual-channel approach ensures market coverage while balancing cost-efficiency and direct customer engagement. The complexity of these systems also necessitates robust technical support, training, and maintenance services, which are often provided through a combination of in-house teams and certified third-party service providers, forming a critical component of the value proposition in this specialized market.

Integrated Operating Room Systems Market Potential Customers

The primary potential customers and end-users for Integrated Operating Room Systems are healthcare providers across various scales and specialties, all seeking to modernize their surgical environments and enhance operational efficiency. This segment primarily comprises large public and private hospitals, which conduct a high volume and variety of surgical procedures, making them significant investors in advanced OR technologies. These institutions often require comprehensive, scalable solutions that can integrate seamlessly with their existing IT infrastructure and accommodate multiple surgical disciplines. Their demand is driven by the need to improve patient safety, reduce surgical turnaround times, optimize resource utilization, and adopt the latest minimally invasive techniques to stay competitive and provide high-quality care.

Ambulatory Surgical Centers (ASCs) represent another rapidly growing segment of potential customers. ASCs typically focus on outpatient surgical procedures that do not require an overnight hospital stay, emphasizing efficiency, cost-effectiveness, and a streamlined patient experience. For ASCs, integrated OR systems that offer rapid setup, easy sterilization, and efficient data management are particularly attractive as they directly contribute to higher patient throughput and lower operational costs. As the trend towards outpatient surgery continues to expand due to cost pressures and technological advancements allowing more procedures to be performed outside traditional hospital settings, the demand from ASCs for integrated solutions is expected to intensify, driving innovation in more compact and cost-effective system designs.

Beyond hospitals and ASCs, specialty clinics focusing on specific surgical areas such as orthopedics, ophthalmology, or plastic surgery also constitute a segment of potential customers. These clinics often seek tailored integrated solutions that cater to their highly specialized procedural requirements, emphasizing features like specific imaging modalities or robotic assistance relevant to their niche. Academic and research institutes also invest in integrated OR systems for training purposes, surgical simulation, and conducting advanced clinical research, preparing the next generation of surgeons and advancing surgical techniques. The diversification of end-users underscores the broad applicability and increasing necessity of integrated OR technology across the entire healthcare ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.85 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Karl Storz SE & Co. KG, Olympus Corporation, Getinge AB, Merivaara Corp., Brainlab AG, Steris PLC, Fujifilm Holdings Corporation, Siemens Healthineers AG, GE Healthcare, Arthrex Inc., Richard Wolf GmbH, Trumpf Medical (Hill-Rom), Skytron LLC, Alvo Medical, Barco NV, Drägerwerk AG & Co. KGaA, Nihon Kohden Corporation, Mizuho OSI, Eschmann Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Integrated Operating Room Systems Market Key Technology Landscape

The technological landscape of the Integrated Operating Room Systems Market is rapidly advancing, driven by innovations aimed at enhancing surgical precision, improving operational efficiency, and ensuring superior patient outcomes. High-definition (HD) and ultra-high-definition (UHD) imaging systems, including 4K and 3D visualization, are foundational, providing surgeons with unprecedented clarity and depth perception during complex procedures. These imaging modalities are often integrated with advanced surgical navigation systems that use real-time tracking and augmented reality overlays to guide instruments and implants with extreme accuracy. The seamless integration of these visualization tools with patient data and anatomical models creates an immersive and highly informative surgical environment, reducing the margin for error and improving surgical effectiveness across various specialties.

Robotics and automation play an increasingly significant role in the modern integrated OR, moving beyond simple assistance to more autonomous functions under surgeon supervision. Surgical robots, often equipped with AI-powered features, enhance dexterity, stability, and precision for minimally invasive surgeries, allowing for finer movements and reduced tremor. Coupled with advanced data management and communication systems, these technologies enable comprehensive real-time information sharing within the OR and with remote experts, facilitating tele-mentoring and collaborative surgical approaches. Internet of Medical Things (IoMT) devices further contribute by connecting various instruments and sensors, gathering vast amounts of operational data that can be analyzed to optimize workflows, predict maintenance needs, and enhance decision-making through predictive analytics and machine learning algorithms.

Cloud computing and artificial intelligence (AI) are emerging as transformative technologies within the integrated OR landscape. Cloud-based platforms facilitate secure storage and accessibility of patient data, images, and surgical videos, enabling remote consultation, surgical planning, and post-operative analysis. AI algorithms are being deployed for various applications, including image analysis for disease detection, predictive modeling for surgical risk assessment, and automating repetitive tasks during surgical preparation. Furthermore, advancements in interoperability standards are crucial for ensuring that diverse devices and software from different vendors can communicate seamlessly, fostering a truly integrated and efficient operating environment. The continuous evolution of these technologies underscores a trend towards increasingly intelligent, autonomous, and connected surgical suites, redefining the future of modern surgery.

Regional Highlights

- North America: This region holds a dominant share in the Integrated Operating Room Systems Market, driven by a highly developed healthcare infrastructure, early adoption of advanced medical technologies, and significant investments in R&D. The presence of major market players, high healthcare expenditure, and increasing demand for minimally invasive procedures further fuel market growth. Both the US and Canada are at the forefront of technological innovation and sophisticated surgical techniques.

- Europe: Europe is another key region characterized by strong healthcare systems, favorable government initiatives for digital health, and a high awareness of patient safety. Countries like Germany, the UK, France, and Italy are major contributors, demonstrating robust adoption of integrated OR solutions due to an aging population and rising prevalence of chronic diseases requiring surgical intervention. Stringent regulatory frameworks also ensure high-quality product development and deployment.

- Asia Pacific (APAC): Expected to be the fastest-growing market, APAC offers immense growth potential. Factors contributing to this include improving healthcare infrastructure, rising disposable incomes, increasing medical tourism, and a growing patient pool. Countries such as China, India, Japan, and South Korea are making significant investments in modernizing their hospitals and adopting advanced surgical technologies. Government support for healthcare development further boosts market expansion.

- Latin America: This region is experiencing steady growth, primarily driven by increasing healthcare expenditure, a rising demand for quality medical facilities, and the expansion of private healthcare sectors. Brazil and Mexico are leading the adoption of integrated OR systems, although challenges like economic instability and varying regulatory landscapes exist. Efforts to upgrade existing hospitals and build new medical centers are creating opportunities.

- Middle East and Africa (MEA): The MEA market is gradually gaining traction, supported by increasing government spending on healthcare infrastructure development, particularly in GCC countries. Growing awareness about advanced surgical treatments and a focus on reducing reliance on overseas medical tourism are propelling the adoption of integrated OR systems. However, limited access to advanced technologies and skilled professionals in some parts of Africa remain challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Integrated Operating Room Systems Market.- Stryker Corporation

- Karl Storz SE & Co. KG

- Olympus Corporation

- Getinge AB

- Merivaara Corp.

- Brainlab AG

- Steris PLC

- Fujifilm Holdings Corporation

- Siemens Healthineers AG

- GE Healthcare

- Arthrex Inc.

- Richard Wolf GmbH

- Trumpf Medical (Hill-Rom)

- Skytron LLC

- Alvo Medical

- Barco NV

- Drägerwerk AG & Co. KGaA

- Nihon Kohden Corporation

- Mizuho OSI

- Eschmann Equipment

Frequently Asked Questions

What are Integrated Operating Room Systems?

Integrated Operating Room Systems combine various medical devices, imaging modalities, data management, and environmental controls into a single, cohesive surgical environment. They streamline workflows, enhance communication, and provide centralized control for surgeons, aiming to improve efficiency, safety, and patient outcomes during surgical procedures.

What are the main benefits of using an Integrated OR System?

Key benefits include enhanced surgical precision, reduced setup and turnover times, improved patient safety due to centralized control and better information access, optimized resource utilization, and superior data management for post-operative analysis and training. These systems contribute to a more efficient and effective surgical workflow.

How does AI impact the Integrated Operating Room Systems market?

AI significantly impacts the market by enabling advanced surgical navigation, predictive analytics for patient outcomes, automated workflow optimization, and real-time decision support. It enhances robotic surgery precision, facilitates personalized surgical planning, and provides robust tools for training and simulation, driving a new era of intelligent surgical care.

What are the primary challenges in adopting Integrated OR Systems?

Major challenges include the high initial capital investment, the complexity of integrating diverse technologies from multiple vendors, regulatory hurdles for new devices, and a shortage of skilled professionals required to operate and maintain these advanced systems. Data security and interoperability also pose significant concerns for healthcare providers.

Which regions are leading the growth of the Integrated OR Systems Market?

North America and Europe currently dominate the market due to advanced healthcare infrastructure and high adoption rates. However, the Asia Pacific region is projected to be the fastest-growing market, driven by increasing healthcare investments and modernization efforts. Latin America and MEA also show promising growth as healthcare access expands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager