Intelligent Electronic Game Console Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443479 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Intelligent Electronic Game Console Market Size

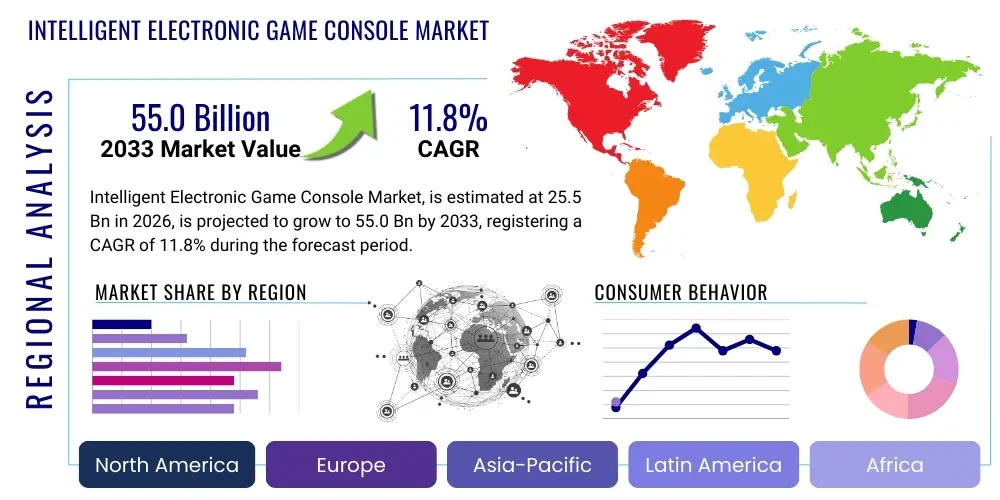

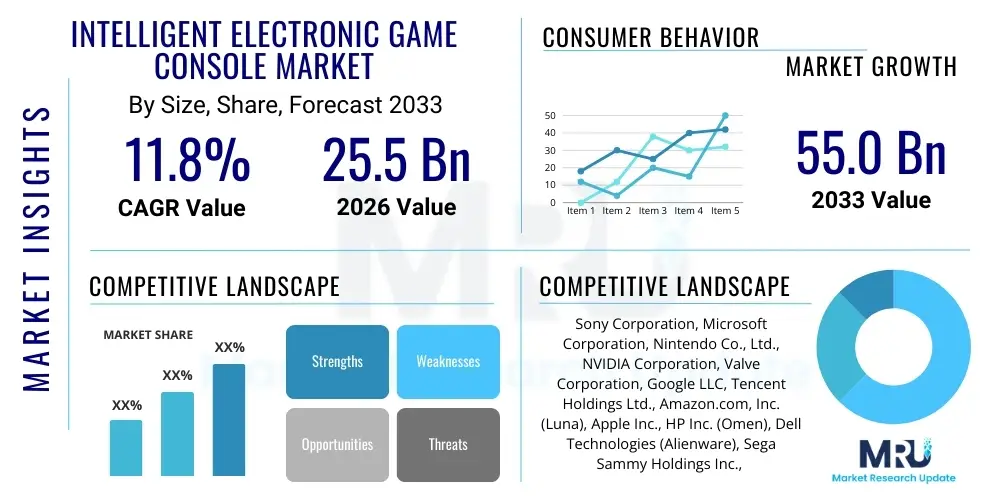

The Intelligent Electronic Game Console Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at $25.5 Billion in 2026 and is projected to reach $55.0 Billion by the end of the forecast period in 2033.

Intelligent Electronic Game Console Market introduction

The Intelligent Electronic Game Console Market encompasses sophisticated computing platforms specifically designed for interactive entertainment, characterized by their integration of advanced hardware specifications, proprietary operating systems, and connectivity features crucial for digital distribution and online multiplayer experiences. These consoles transcend traditional gaming devices by incorporating artificial intelligence capabilities for dynamic difficulty adjustment, personalized content recommendations, and enhanced graphical processing techniques such as ray tracing. The fundamental objective of these devices is to provide an optimized, seamless, and high-fidelity gaming environment, often serving as central media hubs within modern households.

Major applications of intelligent electronic game consoles extend beyond mere entertainment to include interactive educational content, advanced simulation training, and media consumption through integrated streaming services. The core product benefits revolve around superior processing power, optimized latency management crucial for competitive gaming (eSports), and the establishment of dedicated, proprietary ecosystems that maintain high quality control over software distribution and performance standards. Furthermore, the modern intelligent console serves as the primary gateway to cloud gaming platforms, offloading intensive rendering tasks to remote servers while ensuring low-latency interactive play for a rapidly expanding user base.

Driving factors stimulating the rapid expansion of this market include the global proliferation of high-speed internet infrastructure, particularly 5G networks, which mitigate bandwidth restraints for high-definition streaming and online play. The increasing professionalization of eSports, coupled with rising disposable incomes in emerging economies, has catalyzed demand for dedicated high-performance gaming hardware. Moreover, continuous innovation in semiconductor technology, leading to smaller, more powerful processors and faster storage solutions (e.g., custom SSDs), continually renews the upgrade cycle among both hardcore enthusiasts and casual consumers seeking the latest immersive experiences like virtual reality (VR) and augmented reality (AR) integration.

Intelligent Electronic Game Console Market Executive Summary

The Intelligent Electronic Game Console Market is currently witnessing transformative business trends centered on evolving monetization strategies and ecosystem expansion. Major console manufacturers are strategically shifting revenue streams from exclusive hardware sales toward high-margin digital content, subscription services (such as Xbox Game Pass and PlayStation Plus), and accessory integration. This trend emphasizes the long-term value of platform lock-in and recurring revenue, making the installed base of consoles the primary asset. Technological innovation continues unabated, particularly concerning bespoke semiconductor development aimed at optimizing thermal performance and graphical fidelity to support 4K and 8K resolution gaming, further cementing the premium positioning of these intelligent systems against lower-cost alternatives like mobile gaming.

Regionally, the market dynamics are highly heterogeneous, with the Asia Pacific (APAC) region maintaining its status as the dominant market, driven by high population density, enthusiastic adoption of eSports culture, and strong sales in countries like China, Japan, and South Korea. North America and Europe remain mature, high-value markets characterized by a high average selling price (ASP) and a strong demand for exclusive AAA titles and advanced digital services. Emerging markets in Latin America and the Middle East & Africa (MEA) are demonstrating the highest growth rates, spurred by increasing urbanization and improved infrastructure facilitating digital content consumption, though pricing sensitivity remains a critical factor influencing adoption across these territories.

Segment trends highlight the growing importance of cloud-integrated capabilities and the resurgence of dedicated handheld/portable consoles that offer enhanced graphic performance while maintaining mobility. While dedicated home consoles dominate the revenue share due to their superior computational power, the integration of advanced AI chips is segmenting the market further, enabling developers to create more complex, procedural content. Furthermore, the accessories segment, including specialized controllers, VR headsets, and high-fidelity audio equipment, is seeing significant growth, reflecting consumer willingness to invest in peripheral enhancements that maximize the immersive experience provided by the base console hardware.

AI Impact Analysis on Intelligent Electronic Game Console Market

Users frequently inquire about how Artificial Intelligence is fundamentally altering the core gaming experience, often focusing on the sophistication of Non-Player Characters (NPCs), the ethics of using AI for content generation (procedural generation), and the role of machine learning in optimizing console performance. Common concerns revolve around whether AI-driven analytics infringe upon user privacy, if adaptive difficulty settings detract from the intrinsic challenge of games, and how proprietary AI hardware accelerators (like Tensor Cores or custom ASICs) will influence the exclusivity of high-end graphics features. Users are generally highly expectant of AI delivering hyper-realistic graphics, truly dynamic narratives, and system-level optimization that reduces load times and thermal throttling, ensuring peak performance under sustained load. The primary thematic thread is the balance between AI enhancing immersion and maintaining developer control over creative vision.

The integration of AI extends deeply into the operational framework of intelligent game consoles, moving beyond simple gameplay elements. Machine learning algorithms are now critical for predictive maintenance, anticipating potential hardware failures or performance bottlenecks before they impact the user. Furthermore, AI is utilized heavily in system resource allocation, dynamically balancing CPU, GPU, and memory loads based on real-time game demands, ensuring superior frame rate stability compared to previous generations. This level of system optimization, often invisible to the user, is crucial for delivering the promised high-resolution, high-frame-rate experiences that define the current generation of consoles and differentiates them significantly from general-purpose computing platforms.

AI also plays a pivotal role in content curation and community management. Modern consoles employ deep learning models to analyze user play patterns, social interactions, and genre preferences to generate highly personalized store recommendations, news feeds, and matchmaking groupings. For developers, AI tools facilitate faster asset creation and testing, particularly in open-world environments where procedural generation of environments and side quests drastically reduces manual development time. This technological convergence ensures that the intelligent game console remains at the forefront of personalized, dynamic, and ever-evolving entertainment experiences, fueling market growth through continuous software refinement.

- Enhanced Personalized Content: AI algorithms curate game recommendations and adapt UI/UX based on individual player behavior.

- Dynamic Difficulty Adjustment (DDA): Machine learning models modify game challenge in real-time to maintain player engagement and flow state.

- Real-Time Rendering Optimization: AI upscaling technologies (e.g., DLSS equivalents) render lower resolutions internally and upscale to 4K/8K, boosting performance with minimal quality loss.

- Smarter Non-Player Characters (NPCs): AI enables NPCs with complex, emergent behaviors and decision-making capabilities, enhancing realism.

- System Resource Allocation: Predictive AI manages CPU/GPU core usage and cooling systems for optimal power efficiency and thermal performance.

DRO & Impact Forces Of Intelligent Electronic Game Console Market

The market is predominantly driven by the surging popularity of high-fidelity gaming experiences and the mainstream acceptance of eSports as a global phenomenon. Drivers include the launch of new console generations featuring significant leaps in graphical and processing power, coupled with strong exclusive title releases that incentivize hardware upgrades. The move toward digital distribution and subscription services provides predictable revenue streams for platform holders and lowers the barrier to entry for consumers through monthly payment models. Opportunities are abundant in the burgeoning field of virtual reality (VR) and augmented reality (AR) integration, where intelligent consoles serve as the necessary high-powered host for immersive peripheral devices. Furthermore, expansion into emerging markets, coupled with strategic partnerships with major telecommunication providers for cloud streaming initiatives, presents substantial untapped growth potential as internet penetration improves globally.

However, significant restraints temper the market’s explosive potential. The primary challenge remains the high initial cost of flagship intelligent consoles, which can deter casual or budget-conscious consumers, particularly in economically sensitive regions. This is exacerbated by persistent supply chain volatility, particularly concerning critical semiconductor components, which causes stock shortages and inflated resale prices. Another substantial restraint is the increasing competition from alternative gaming platforms, specifically the ubiquity of high-performance mobile devices and the flexible, upgradeable nature of PC gaming, which offer consumers different value propositions depending on their preferences for portability or customization.

Impact forces currently shaping the market are intense competitive pressure between the major platform owners, who continually invest heavily in securing exclusive software titles and optimizing their digital ecosystems. Regulatory scrutiny over digital content pricing, microtransactions, and consumer data privacy also exerts a powerful external impact, necessitating constant compliance and strategic adjustment. Finally, the rapid evolution of technology, particularly the shift toward fully cloud-rendered gaming, poses a long-term transformative impact. While currently supportive of dedicated hardware, successful cloud transition could fundamentally alter the necessity of high-end home consoles by the end of the forecast period, shifting market focus from hardware ownership to service subscription.

Segmentation Analysis

The Intelligent Electronic Game Console Market is systematically segmented based on Type, Application, and Geography, providing granular insights into varying consumer preferences and technological adoption patterns. Segmentation by Type differentiates between dedicated home consoles, which prioritize peak performance and graphical fidelity for stationary play, and portable/handheld consoles, which focus on mobility and extended battery life. Analyzing the market through the lens of Application reveals usage patterns spanning hardcore gaming, where high-end processing is paramount, and casual or family entertainment, where content accessibility and ease of use are prioritized. Geographical segmentation remains crucial for identifying regional hotspots, assessing infrastructure readiness, and tailoring marketing strategies to local cultural preferences regarding content and pricing.

Further analysis within these segments reveals specific trends; for example, within the Application segment, the growth of eSports significantly fuels demand for home consoles capable of sustaining ultra-high refresh rates and ultra-low input lag. Conversely, the Type segment shows that while home consoles generate the highest revenue, the portable segment is experiencing a resurgence driven by hybrid models that seamlessly bridge home and mobile play. Understanding these segment interactions is vital for manufacturers to optimize their product portfolios, ensuring that hardware specifications, software exclusivity, and pricing strategies align directly with the specific needs of targeted consumer cohorts, thereby maximizing market penetration and revenue capture across diverse user groups.

- By Type:

- Dedicated Home Console

- Portable/Handheld Console

- Micro Console (Cloud-focused)

- By Component:

- Hardware (Console Unit, Processors, Memory, Storage)

- Software (Operating System, Exclusive Titles, Digital Games)

- Services (Subscription Models, Cloud Gaming Platforms)

- By Application/End-User:

- Hardcore Gamers

- Casual & Family Users

- eSports Organizations

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Intelligent Electronic Game Console Market

The value chain for the Intelligent Electronic Game Console Market is highly complex and integrated, starting with intensive upstream analysis dominated by specialized semiconductor manufacturing. Key activities here involve the design and production of custom System-on-Chips (SoCs), high-speed solid-state drives (SSDs), and specialized cooling solutions. This stage requires enormous capital investment and relies heavily on strategic partnerships between console manufacturers (e.g., Sony, Microsoft, Nintendo) and leading semiconductor foundries (e.g., TSMC, Samsung). Control over the upstream supply chain, especially chip allocation and proprietary architecture design, is a major source of competitive advantage, influencing final product cost and feature sets.

Midstream activities encompass the manufacturing, assembly, and integration of components, often outsourced to major contract manufacturers in Asia. Simultaneously, the software development phase is crucial, involving internal development studios and third-party partnerships to secure exclusive titles that drive hardware sales. Downstream analysis focuses critically on distribution channels. While traditional retail channels (physical stores, large electronics retailers) remain important for visibility and physical copies, the market is rapidly pivoting toward digital distribution. Direct distribution through proprietary online stores allows manufacturers to bypass intermediaries, capture higher margins on software sales, and maintain direct customer relationships essential for promoting subscription services and downloadable content (DLC).

The efficiency of the distribution channel dictates market penetration. Direct channels (online console stores) provide rapid, low-cost delivery of digital goods and services, maximizing profitability per unit of software. Indirect channels (major retailers, e-commerce platforms like Amazon) are essential for hardware sales and reaching consumers who prefer physical media or bundled purchases. Optimization of logistics, ensuring sufficient inventory during peak demand periods (holiday seasons, launch events), is critical. The intelligent console ecosystem leverages both channels strategically: physical sales establish the installed base, while the proprietary digital storefront maximizes the lifetime value (LTV) of each console owner through continuous service offerings.

Intelligent Electronic Game Console Market Potential Customers

The primary customer segment for the Intelligent Electronic Game Console Market consists of hardcore gamers, defined as individuals who dedicate significant time and financial resources to gaming, prioritize high performance (4K resolution, 120 FPS), and actively seek exclusive, demanding AAA titles. This segment drives the initial sales cycles of new console generations and serves as the core consumer for high-margin accessories and premium digital content. Their demand for superior graphical processing and minimized input latency dictates the fundamental design specifications of intelligent consoles, forcing manufacturers to integrate cutting-edge technologies like custom SSDs and ray tracing capabilities.

A second major customer segment is casual and family users. These consumers value accessibility, ease of use, and content suitability for diverse age groups, often using the console as a multi-media entertainment hub rather than strictly for performance-driven gaming. They are more likely to engage with subscription services that offer a broad library of accessible games rather than purchasing expensive individual titles. This segment's purchasing decision is often influenced by parental controls, social integration features, and exclusive family-friendly intellectual property (IP), representing a significant recurring revenue stream through ecosystem services.

Furthermore, new segments such as eSports organizations and educational institutions are emerging as significant potential customers. eSports organizations require the reliability and standardized performance offered by dedicated consoles for competitive play, ensuring fair, non-variable performance environments. Educational settings utilize intelligent consoles for advanced gamification, simulation training, and interactive learning modules, leveraging the high computational power and interactive peripherals for engaging pedagogy. Addressing these diverse segments requires manufacturers to employ differentiated marketing strategies and ensure hardware flexibility to support a wide array of non-traditional gaming applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion |

| Market Forecast in 2033 | $55.0 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Microsoft Corporation, Nintendo Co., Ltd., NVIDIA Corporation, Valve Corporation, Google LLC, Tencent Holdings Ltd., Amazon.com, Inc. (Luna), Apple Inc., HP Inc. (Omen), Dell Technologies (Alienware), Sega Sammy Holdings Inc., Atari SA, Razer Inc., Logitech International S.A., Electronic Arts Inc. (Software Focus), Activision Blizzard (Software Focus), Samsung Electronics Co., Ltd. (Component Supplier), Advanced Micro Devices (AMD), Intel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intelligent Electronic Game Console Market Key Technology Landscape

The Intelligent Electronic Game Console Market is fundamentally defined by its adoption of proprietary and cutting-edge hardware architectures designed to maximize graphical output and minimize I/O latency. Central to the current technological landscape is the widespread adoption of custom-built Solid State Drives (SSDs) integrated with proprietary I/O pathways, effectively eliminating the storage bottleneck that plagued previous generations. This allows consoles to load enormous game assets instantaneously, fundamentally changing game design possibilities and enabling seamless transitions in massive open-world environments. Furthermore, advanced graphical fidelity is achieved through the integration of dedicated hardware accelerators for real-time ray tracing, simulating realistic lighting, shadows, and reflections, which was previously exclusive to high-end PC environments.

Beyond core processing, the peripheral and interaction technology landscape is rapidly evolving. Haptic feedback systems in controllers have moved beyond simple vibration to deliver nuanced, directional, and textured sensory input, increasing immersion exponentially. Audio technology has also been revolutionized, with dedicated spatial audio processing units creating highly accurate 3D soundscapes, critical for competitive gaming and enhancing narrative impact. These technologies are managed by highly optimized, often Linux-based, proprietary operating systems designed specifically for low overhead and rapid multitasking between intense gaming applications and streaming services, ensuring system stability and responsiveness.

Looking forward, the technology landscape is being shaped by cloud integration and the development of dedicated AI processing units (NPUs/AI Accelerators) within the console's SoC. Cloud technology enables hybrid rendering approaches, where some processing is handled remotely, alleviating the need for constant, massive local storage updates. AI accelerators are poised to unlock the full potential of machine learning for graphics upscaling (e.g., boosting 1080p rendered content to 4K display quality with minimal visual degradation) and dynamic gameplay modification, ensuring the current generation of consoles remains technologically relevant throughout the forecast period and capable of supporting complex applications like untethered, high-fidelity VR experiences.

Regional Highlights

The global intelligent electronic game console market exhibits distinct regional characteristics, driven by varying economic conditions, consumer tastes, and infrastructural maturity. North America (NA) and Europe represent highly mature markets characterized by substantial per-capita spending on hardware and digital content, strong broadband penetration, and established competitive ecosystems among platform holders. These regions are primary drivers for premium accessories, early adopters of new services like cloud streaming subscriptions, and hold significant influence over global content trends, driven by a preference for Western AAA titles and high-end graphical specifications.

The Asia Pacific (APAC) region stands as the largest and fastest-growing market globally, primarily fueled by massive consumer bases in China, Japan, and South Korea. APAC's growth is inherently linked to its deeply rooted eSports culture, high rates of urbanization, and a strong preference for both dedicated home consoles (especially in Japan) and innovative portable gaming solutions. The region is a key manufacturing hub, contributing to favorable supply chain dynamics, but is also highly sensitive to localization efforts, demanding regional content exclusivity and culturally relevant software to drive market penetration and sustain user engagement.

Latin America (LATAM) and the Middle East & Africa (MEA) are designated as emerging markets with immense untapped potential. Growth in these regions is accelerating due to rising disposable incomes, improving internet infrastructure, and increasing youth populations adopting gaming as a mainstream leisure activity. However, these regions face challenges related to pricing sensitivity and regulatory hurdles concerning digital imports and taxation. Success in LATAM and MEA depends heavily on offering flexible payment models, competitive pricing strategies, and localizing distribution to overcome logistics barriers, thus maximizing access to the global console ecosystem.

- Asia Pacific (APAC): Dominates the market in terms of volume and exhibits the highest growth rate, driven by China's massive market size and Japan's historical strength in console innovation and proprietary IP. Emphasis on eSports and portable devices.

- North America: High-value market focused on digital distribution, subscription services, and early adoption of 4K/8K technologies. Strong competition between platform ecosystems, characterized by high average selling prices.

- Europe: Mature and fragmented market requiring targeted strategies due to linguistic and regulatory diversity. Strong demand for physical media alongside digital services; key drivers are exclusive content and cross-platform play capabilities.

- Latin America (LATAM): Rapidly emerging market with high growth potential, constrained by currency volatility and duties, necessitating careful pricing and local manufacturing or assembly strategies.

- Middle East & Africa (MEA): Small but accelerating market, largely concentrated in Gulf Cooperation Council (GCC) countries. Growth is contingent on infrastructure development and overcoming logistics challenges for hardware distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intelligent Electronic Game Console Market.- Sony Corporation (PlayStation)

- Microsoft Corporation (Xbox)

- Nintendo Co., Ltd. (Switch)

- NVIDIA Corporation (Component & Cloud Gaming)

- Valve Corporation (Steam Deck, Software Ecosystem)

- Google LLC (Stadia - Historical Context/Technology Influence)

- Tencent Holdings Ltd. (Investment & Distribution Focus)

- Amazon.com, Inc. (Luna Cloud Gaming)

- Apple Inc. (Gaming Ecosystem Influence)

- HP Inc. (Omen Gaming PCs/Peripherals)

- Dell Technologies (Alienware/Peripherals)

- Sega Sammy Holdings Inc. (Software/Historical Influence)

- Atari SA (Niche Console/Retro Focus)

- Razer Inc. (Peripherals & Connectivity)

- Logitech International S.A. (Peripherals)

- Electronic Arts Inc. (Major Software Partner)

- Activision Blizzard (Major Software Partner)

- Advanced Micro Devices (AMD) (Primary Chip Supplier)

- Samsung Electronics Co., Ltd. (Memory & Component Supplier)

- Intel Corporation (Alternative Processing Solutions/Cloud Infrastructure)

Frequently Asked Questions

Analyze common user questions about the Intelligent Electronic Game Console market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift toward proprietary console hardware despite strong PC and mobile competition?

The primary driver is proprietary optimization. Intelligent consoles use custom-designed silicon (SoCs) and ultra-fast integrated SSDs that allow developers unprecedented access to the system's architecture, yielding highly optimized performance and graphical capabilities often unattainable on general-purpose PCs at a comparable price point. This optimization ensures a standardized, high-quality gaming experience exclusive to the console ecosystem.

How significant are subscription services like Xbox Game Pass or PlayStation Plus to future console market revenue?

Subscription services are increasingly vital, transitioning the market focus from single hardware sales to recurring revenue and long-term customer lifetime value (LTV). These services boost platform loyalty, lower the effective cost of entry for consumers, and constitute a rapidly growing, high-margin revenue stream that often surpasses earnings from initial hardware sales over the console's lifespan.

What role does cloud gaming play in the demand for intelligent console hardware?

Cloud gaming, while potentially disruptive long-term, currently acts as an enhancer for console hardware. Major platform holders utilize cloud infrastructure to augment their consoles, enabling remote play, rapid game streaming, and handling non-essential rendering tasks, thereby extending the utility and longevity of the console unit rather than immediately replacing it. The console remains essential for the lowest latency, highest fidelity local performance.

Which geographical region holds the highest growth potential for console manufacturers through 2033?

The Asia Pacific (APAC) region currently holds the highest growth potential, largely driven by the expansion of the Chinese and Indian markets, increasing consumer access to digital payment methods, and the pervasive culture of competitive eSports. While North America and Europe generate high revenue, APAC offers the largest scope for new customer acquisition and market penetration.

How is the current semiconductor shortage impacting the strategic positioning of key console manufacturers?

The semiconductor shortage severely restricts the ability of manufacturers to meet high consumer demand, creating intense stock shortages and limiting market expansion. Strategically, this forces companies to prioritize higher-margin models, strengthen long-term supply agreements with foundries (like AMD and TSMC), and accelerate the transition toward digital-only sales models to mitigate reliance on physical distribution logistics affected by supply chain instability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager