Intelligent Nitrogen Drying Oven Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442724 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Intelligent Nitrogen Drying Oven Market Size

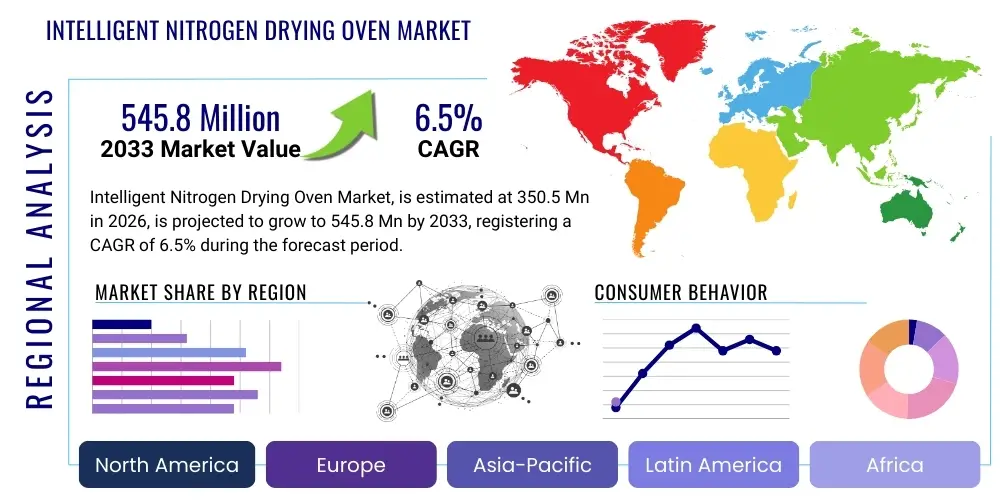

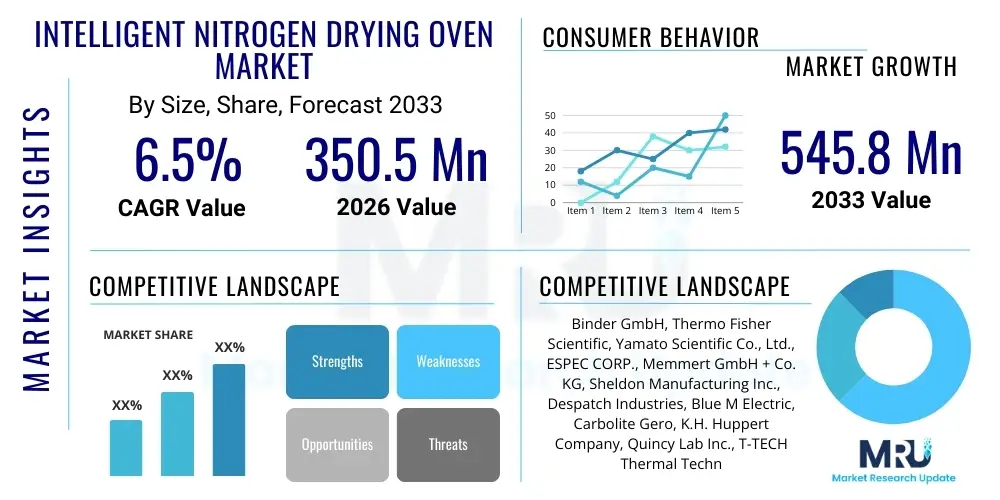

The Intelligent Nitrogen Drying Oven Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 545.8 Million by the end of the forecast period in 2033.

Intelligent Nitrogen Drying Oven Market introduction

The Intelligent Nitrogen Drying Oven Market fundamentally addresses the crucial industrial requirement for processing moisture-sensitive and oxidation-prone materials within a precisely controlled, inert atmosphere. These specialized thermal processing units transcend the capabilities of conventional drying equipment by integrating high-fidelity sensors, advanced proportional-integral-derivative (PID) control loops, and sophisticated gas flow management systems, ensuring that residual oxygen levels are meticulously maintained at parts per million (ppm) concentrations. This precision is paramount in sectors where material integrity directly correlates with final product performance and reliability, such as in the fabrication of advanced semiconductors, the assembly of microelectronic components, and the development of next-generation energy storage solutions. The core differentiation of 'intelligent' ovens lies in their automation features, including recipe storage, remote diagnostic capabilities, and robust data logging, essential for meeting stringent quality assurance and regulatory requirements globally.

Product description centers on the engineering necessity of achieving outstanding temperature uniformity (typically ±1°C or better) across the entire working volume, even during rapid ramp-up or recovery cycles, while simultaneously managing the dynamic purging and maintenance of the nitrogen atmosphere. These ovens typically feature double-walled stainless steel construction, specialized door seals to prevent atmospheric leakage, and often incorporate catalytic converters or specialized gas scrubbers to remove trace contaminants from the circulated nitrogen, thereby ensuring the highest level of material purity. Major applications span critical process steps such as pre-baking of semiconductor wafers before deposition, controlled curing of high-performance polymer adhesives used in display assembly, controlled drying of lithium battery electrodes to remove residual solvent traces without degradation, and stress-relieving specialized metal alloys and advanced ceramics in environments free from corrosive oxygen interaction. These diverse applications underscore the critical infrastructural role these ovens play in modern high-tech manufacturing supply chains.

The market benefits significantly from the superior process control and reduced risk of batch failure offered by intelligent systems. Driving factors include the escalating global demand for smaller, more powerful, and reliable electronic devices (e.g., 5G components, IoT sensors), necessitating pristine manufacturing conditions. Furthermore, the massive capital expenditure influx into the electric vehicle (EV) sector worldwide—specifically focused on improving battery energy density and lifespan—mandates strict control over the drying environment for battery components, which are highly susceptible to moisture and oxygen contamination. The ongoing digitalization of manufacturing floors, promoting Industry 4.0 standards, also fuels the adoption of intelligent ovens that offer seamless communication and integration into broader automated production management systems, ensuring full traceability and optimizing energy consumption through sophisticated process modeling and predictive controls that minimize nitrogen waste during standby or low-load operations.

The complexity involved in handling cutting-edge materials that are extremely sensitive to thermal oxidation or humidity dictates a non-negotiable requirement for these specialized ovens. For instance, in advanced microelectronics, the failure rate dramatically increases if processing steps occur even slightly outside specified inert conditions. This intrinsic material sensitivity, coupled with the rising cost of failed batches, significantly pushes manufacturers towards investing in high-precision, intelligent equipment capable of providing documented proof of atmospheric integrity throughout the entire thermal cycle. Consequently, the Intelligent Nitrogen Drying Oven is viewed less as laboratory equipment and more as a foundational element of advanced industrial quality control infrastructure, securing its steady demand profile across established and emerging manufacturing hubs.

Intelligent Nitrogen Drying Oven Market Executive Summary

The global Intelligent Nitrogen Drying Oven Market is experiencing vigorous expansion, fundamentally underpinned by strategic business trends focusing on integration, sustainability, and technological convergence. Key business stakeholders are shifting their emphasis toward offering full-stack solutions, combining robust hardware with subscription-based software services for remote monitoring, predictive diagnostics, and advanced recipe management, thereby creating sticky revenue streams and enhancing customer lifetime value. Furthermore, compliance with environmental regulations, particularly regarding energy consumption and efficient utilization of industrial gases, is compelling manufacturers to introduce high-efficiency models featuring enhanced thermal insulation and advanced nitrogen recirculation and purification systems. Competitive dynamics are increasingly centered on acquiring specialized software firms or developing in-house expertise in industrial IoT and machine learning to maintain a technological edge in process optimization.

Regional trends clearly delineate Asia Pacific (APAC) as the undisputed leader, accounting for the largest market share due to its entrenched dominance in semiconductor foundry operations, passive component manufacturing, and the exponential build-out of giga-factories for lithium-ion battery production, primarily centered in East Asia. North America and Europe, while growing at a slower pace due to market maturity, maintain high average selling prices (ASPs) driven by demand for custom-engineered, highly compliant systems for highly regulated sectors such as medical devices, specialized aerospace alloys, and advanced materials research requiring extremely high purity and validation. Growth in emerging regions is highly dependent on governmental initiatives promoting localized high-tech manufacturing and the subsequent establishment of reliable industrial gas supply infrastructure necessary to support these high-demand thermal processes.

Segmentation analysis reveals crucial shifts in product preference; the High Temperature Range segment (>300°C) is projected for accelerated growth, reflecting increasing research and production activities involving advanced composites and high-performance ceramics that require inert sintering or curing. Concurrently, the Industrial Scale Capacity segment is demonstrating robust unit volume growth, directly correlating with the need for mass production in the EV battery supply chain and large-scale electronics packaging operations. The evolution of control systems toward Advanced AI/IoT Integrated Control is becoming non-negotiable for large enterprises seeking to leverage real-time data for global operational consistency, error reduction, and maximizing overall equipment effectiveness (OEE) across multiple geographically dispersed manufacturing sites, signaling a strong investment trajectory in sophisticated connectivity features.

The convergence of material science requirements and digital manufacturing paradigms dictates the market trajectory. Manufacturers that can successfully integrate durable hardware with scalable, intelligent software platforms capable of providing full compliance reporting and remote operational oversight are best positioned for long-term dominance. This integration facilitates quicker troubleshooting and significantly reduces the reliance on manual calibration and process adjustments, which are prone to human error. The executive landscape is characterized by strategic partnerships between equipment vendors and industrial gas suppliers to offer optimized total process solutions, addressing both CAPEX and recurring OPEX concerns for the end-user.

AI Impact Analysis on Intelligent Nitrogen Drying Oven Market

Analysis of common user questions highlights a significant desire for AI to elevate the intelligent nitrogen drying oven from a merely automated device to a cognitive processing asset capable of continuous self-improvement and predictive operation. Key user concerns revolve around defining tangible ROI from AI implementation, understanding the cybersecurity risks associated with network-connected thermal equipment, and ensuring the accuracy and reliability of the sensor data feed required for effective AI training. Users frequently inquire about algorithms that can predict optimal maintenance schedules before performance degradation is noticeable, and those that can adapt process parameters based on subtle variations in ambient conditions or incoming material quality, essentially seeking a truly 'zero-defect' processing environment achievable only through advanced algorithmic control.

AI's fundamental impact is rooted in optimizing the delicate balance between temperature, time, and atmospheric composition (residual oxygen levels), all of which are highly interdependent. Traditional PID controllers rely on fixed settings, but AI-driven systems utilize machine learning models trained on historical batch data, material specifications, and real-time environmental factors to predict the precise energy input and nitrogen purge rate needed moment-by-moment to achieve the desired outcome with minimum waste. For instance, if an oven is loaded slightly differently than the previous batch, the AI can instantly calculate the thermal inertia change and adjust the ramp-up profile proactively, preventing overshoot and reducing the required inert gas usage by precisely timing the purge cycles based on validated atmospheric models rather than fixed timer settings, resulting in significant savings in nitrogen consumption, a major operational cost.

Furthermore, AI is instrumental in streamlining compliance and quality control documentation. In highly regulated environments like pharmaceuticals or aerospace, every processing step must be recorded and traceable. AI systems can automatically analyze the millions of data points generated during a drying cycle, identify any subtle deviations from the established quality parameters (e.g., slight fluctuation in temperature uniformity), flag them immediately, and generate comprehensive, auditor-ready reports detailing the corrective actions taken by the system itself. This self-documentation capability vastly reduces the manual effort required for batch release verification and enhances the overall reliability and defensibility of the manufacturing process. The adoption curve for AI integration is directly correlated with the stringency of regulatory oversight and the cost of material sensitivity, making its impact particularly profound in high-value, low-tolerance manufacturing sectors.

The predictive capabilities extend to quality assurance, where AI algorithms are trained to correlate internal processing data with final product testing results. By analyzing features such as the rate of solvent evaporation (via integrated residual gas analysis systems), the AI can predict the eventual mechanical or electrical properties of the cured material before the batch is even complete. This allows for early termination or modification of a potentially compromised batch, preventing downstream waste. Consequently, AI acts as a digital quality gate, ensuring that the intelligent drying oven operates not just efficiently, but also with cognitive awareness of the desired material outcome, positioning it as a pivotal technology for smart manufacturing initiatives globally.

- Enhanced predictive maintenance forecasting equipment failure based on sensor data analysis, reducing unplanned downtime.

- Real-time dynamic optimization of nitrogen consumption and flow rates based on load mass, specific material properties, and ambient humidity.

- Self-correcting thermal profiles ensuring exceptional temperature uniformity and eliminating overshoot/undershoot conditions using adaptive modeling.

- Automated anomaly detection, deviation flagging, and instantaneous generation of compliance and quality assurance documentation logs.

- Integration into wider factory execution systems (MES) for seamless, AI-driven workflow scheduling and global facility optimization.

- Machine learning models used for predicting final product quality parameters based on in-situ process data, enabling early batch intervention.

- Optimized energy management by coupling heating element modulation with load characteristics analyzed by the AI, reducing utility costs.

- Enhanced remote diagnostic capabilities allowing specialized technicians to troubleshoot issues globally based on AI-generated error reports.

DRO & Impact Forces Of Intelligent Nitrogen Drying Oven Market

The trajectory of the Intelligent Nitrogen Drying Oven Market is significantly defined by influential drivers, predominantly the relentless technological push towards material miniaturization and functional integration in electronics, demanding ultra-clean and inert processing. The rapid global expansion of high-capacity manufacturing for specialized components, such as multi-layer ceramic capacitors (MLCCs) and sophisticated packaging solutions (e.g., flip chips, system-in-package), necessitates the precise thermal control offered exclusively by nitrogen-purged, intelligent ovens. Additionally, the mandated shift toward sustainable and energy-efficient manufacturing practices acts as a driver, as intelligent systems, paradoxically, reduce energy and gas waste through optimized operational cycles, presenting a long-term cost advantage despite higher initial investment. This sustained demand from critical industries ensures market buoyancy.

Key restraints tempering market growth include the substantial initial capital expenditure (CAPEX) required for sophisticated intelligent ovens, which can often exceed that of conventional equipment by a significant margin, posing a barrier to entry for small to medium enterprises (SMEs). Furthermore, the operational constraint of relying heavily on a consistent, high-purity nitrogen supply chain presents logistical challenges, particularly in regions where industrial gas infrastructure is less developed or where localized storage costs are prohibitive. Another limiting factor is the requirement for highly specialized technical personnel capable of commissioning, maintaining, and developing complex thermal recipes on these advanced control systems, leading to increased operational expenditure (OPEX) related to skilled labor and training, slowing down adoption rates in less technologically mature regions.

Opportunities for exponential market growth are concentrated in emerging technological domains, notably the post-processing of components produced via additive manufacturing (3D printing), where inert atmosphere curing is vital for achieving desired material properties in metals and polymers. The growing focus on developing solid-state batteries (SSBs) also represents a high-potential avenue, as SSBs demand even more stringent atmospheric control during manufacturing than traditional lithium-ion batteries. The dominant impact force is the undeniable material science imperative: as the sensitivity of manufactured components to oxidation and contamination increases across all high-tech sectors, the adoption of intelligent, inert atmosphere processing becomes less of an option and more of an economic necessity to ensure competitive yields and product reliability, exerting continuous pressure on manufacturers to upgrade their thermal processing infrastructure.

The market faces structural challenges related to standardization. While the need for precision is universal, the specific requirements (temperature tolerance, oxygen limits, particle control) vary significantly across industries (e.g., semiconductor vs. pharma). This lack of universal standardization means manufacturers often need to heavily customize equipment, increasing lead times and complexity. Conversely, this complexity drives the opportunity for highly specialized niche players who can offer custom-engineered solutions for specific, highly technical applications, further segmenting the market based on required precision and compliance levels, such as those meeting extreme vacuum standards alongside inert processing.

Segmentation Analysis

The Intelligent Nitrogen Drying Oven Market is characterized by highly technical segmentation criteria that allow manufacturers to target specific industrial needs with precision-engineered equipment. Segmentation by temperature range is crucial, directly dictating the end-user application: low-temperature ovens are typically utilized for bio-pharmaceutical solvent removal, medium-temperature ranges serve general electronics curing and baking, while high-temperature ovens are indispensable for complex materials like advanced ceramics, specific metallurgy processes, or high-power electronics packaging where heat tolerance is maximized. The selection of materials used in oven construction, such as insulation and internal chamber finishes, varies significantly across these temperature tiers to ensure longevity and maintain atmospheric integrity under extreme conditions.

Capacity segmentation mirrors the economic scale of the end-user operation. Benchtop models, highly flexible and portable, are the mainstay of academic research labs and small-scale R&D pilot lines, focusing on versatility and low throughput. Standard floor-standing units cater to specialized low-to-medium volume production and quality control labs. Conversely, the Industrial Scale segment, encompassing walk-in or conveyor-style ovens, is defined by its integration into 24/7 automated production lines, demanding high reliability, robust data connectivity, and rapid processing cycles—a segment heavily driven by the automotive (battery) and large-format display industries. The convergence of capacity needs with intelligence levels means that industrial-scale units are almost exclusively adopting Advanced AI/IoT Integrated Control systems to handle complex production logistics.

Segmentation by End-User Industry reveals the market's primary reliance on the Semiconductor and Electronics sector, which demands ultra-clean, particle-free environments (often Class 100 or better) alongside inert atmosphere capability to prevent oxide layer formation on micro-components. The Pharmaceutical and Biotechnology segment necessitates validation packages (IQ/OQ/PQ) and strict adherence to FDA and EMEA guidelines for temperature mapping and data integrity, driving demand for advanced data logging and calibration features. The emerging Automotive segment, specifically linked to EV battery manufacturing, represents the highest growth potential for industrial-scale high-temperature ovens due to the immense throughput required for electrode processing. Each industry vertical imposes unique technical and regulatory requirements that significantly influence oven design, material selection, and software functionality, ensuring high product differentiation across segments.

- By Temperature Range:

- Low Temperature (Up to 150°C): Bio-pharma drying, low-stress curing.

- Medium Temperature (151°C to 300°C): General electronics curing, component baking.

- High Temperature (Above 300°C): Advanced ceramics, specialized metallurgy, high-power component processing.

- By Capacity:

- Benchtop (Small Volume/R&D): Flexible, highly accurate small batch processing.

- Standard Floor Standing (Medium Volume): QC labs, specialized component production.

- Industrial Scale (Large Volume/Production Line): High-throughput manufacturing, integrated automation systems.

- By End-User Industry:

- Semiconductor and Electronics: Wafer processing, component packaging, stringent cleanliness required.

- Pharmaceutical and Biotechnology: GMP compliant drying, solvent removal, critical validation needs.

- Automotive (EV Battery Manufacturing): High-volume electrode drying, high temperature capability.

- Aerospace and Defense: Material testing, specialized alloy curing, requiring high traceability.

- Materials Science and Research Laboratories: Academic and corporate R&D, pilot-scale applications.

- By Control Type (Intelligence Level):

- Basic Intelligent Control (PID with Data Logging): Entry-level automation, sequential control.

- Advanced AI/IoT Integrated Control (Self-Optimizing Systems): Networked, predictive maintenance, dynamic process control.

Value Chain Analysis For Intelligent Nitrogen Drying Oven Market

The upstream segment of the value chain is highly reliant on specialized component suppliers providing core technological elements that define the oven’s performance envelope. This includes high-purity stainless steel (often 304 or 316 grade) crucial for internal chamber construction to minimize particle generation and withstand corrosive environments; advanced thermal insulation materials such as vacuum insulated panels or high-density ceramic fiber to enhance energy efficiency; and complex electronic systems, including high-accuracy oxygen sensors, pressure transducers, flow meters, and industrial-grade PLCs and network communication modules. Ensuring the reliability and calibration traceability of these sensors is paramount, as they form the data foundation for the 'intelligent' features of the oven. Disruptions in the supply of high-end electronic components or specialized metals can significantly impact production timelines and pricing strategies for oven manufacturers.

The core midstream manufacturing process involves the precise assembly of these components into a functioning, inert-capable system. Differentiation in this stage is achieved through superior engineering practices focused on internal airflow patterns to maximize temperature uniformity (critical for large ovens), proprietary sealing mechanisms to guarantee gas tightness, and the development of sophisticated proprietary software and firmware. Successful manufacturers invest heavily in R&D to optimize the nitrogen purging logic, seeking intellectual property protection around systems that can achieve faster atmospheric transition times with minimal gas consumption. Quality control is rigorous, involving thermal mapping validation and leak rate testing under operational conditions to certify performance against published specifications before equipment release, particularly crucial for clients in regulated industries.

The downstream sector is characterized by a high degree of technical sales consultation and robust after-market services. Distribution channels are bifurcated: high-volume, standard models may go through large laboratory or industrial distributors (indirect channel), while complex, customized industrial-scale ovens are typically sold via the manufacturer’s direct sales and engineering support teams. Post-installation, the value chain extends through long-term service contracts covering preventative maintenance, calibration, software updates (especially critical for AI/IoT enabled systems), and necessary regulatory re-qualification. The revenue from these services often contributes significantly to the manufacturer’s overall profitability, mitigating the cyclical nature of capital equipment sales, making customer service and technical expertise a key competitive differentiator in the market.

Intelligent Nitrogen Drying Oven Market Potential Customers

The primary cohort of potential customers consists of multinational corporations dominating the electronics and semiconductor fabrication landscape. These end-users, including major chip foundries, outsourced semiconductor assembly and test (OSAT) companies, and manufacturers of advanced displays (OLED, microLED), are constant buyers of high-precision, industrial-scale intelligent nitrogen drying ovens. Their procurement decisions are driven by the need for ultra-low particle generation, exceptional atmospheric stability, and seamless integration with cleanroom automation and robotic handling systems, prioritizing superior process reliability and the capacity for full digital traceability to maintain stringent quality protocols and maximize yield rates across complex multi-step processes.

A rapidly expanding customer base is found within the emerging energy sector, particularly companies engaged in the mass production of next-generation batteries, including lithium-ion, solid-state, and fuel cells. The manufacturing processes for battery electrodes and electrolytes are acutely sensitive to moisture and oxygen; hence, these customers require large-format, high-temperature intelligent ovens capable of continuous, high-throughput operation with extremely tight control over residual contaminants. Their buying criteria emphasize scalability, durability, energy efficiency, and low operational expenditure related to gas usage, leading to significant demand for AI-optimized nitrogen management systems in floor-standing and conveyorized configurations essential for Giga-factory output.

Finally, the pharmaceutical, medical device, and specialized research sectors represent specialized, high-value customer segments. Pharmaceutical companies use these ovens for controlled solvent removal and drying of active pharmaceutical ingredients (APIs) and excipients under validated conditions. Medical device manufacturers rely on inert atmospheres for specialized curing or sterilization of polymer-based devices where surface chemistry integrity is critical. These customers require extensive documentation packages (IQ/OQ/PQ), adherence to GAMP 5 and CFR 21 Part 11 standards for electronic records, and specialized features such as bio-decontamination cycles, making system validation and regulatory compliance the foremost deciding factors in their purchasing process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 545.8 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Binder GmbH, Thermo Fisher Scientific, Yamato Scientific Co., Ltd., ESPEC CORP., Memmert GmbH + Co. KG, Sheldon Manufacturing Inc., Despatch Industries, Blue M Electric, Carbolite Gero, K.H. Huppert Company, Quincy Lab Inc., T-TECH Thermal Technology, Gruenberg, VWR International, S&A Scientific Instruments, Across International, Precision Equipment, Test Equity, MMM Group, Jeio Tech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intelligent Nitrogen Drying Oven Market Key Technology Landscape

The technological evolution within the Intelligent Nitrogen Drying Oven Market is highly focused on achieving extreme purity and enhanced operational efficiency, driven by material science imperatives. A fundamental technology involves the integration of high-resolution, fast-response oxygen analyzers, often based on zirconia or optical sensor technology, which provide real-time feedback to proportional solenoid valves regulating nitrogen flow. This enables closed-loop control of the residual oxygen concentration, allowing manufacturers to maintain atmospheric purity below critical thresholds (e.g., <10 ppm or <5 ppm) dynamically. Sophisticated internal gas circulation and filtration systems, including HEPA or ULPA filters, are concurrently employed to ensure particle cleanliness within the chamber, vital for semiconductor and medical device applications that operate in Class 100 or better environments, ensuring that the inert atmosphere is also ultra-clean.

The intelligence layer relies heavily on industrial automation and connectivity standards. Modern ovens are equipped with powerful industrial PCs or high-performance PLCs capable of executing complex thermal and atmospheric recipes and providing comprehensive data acquisition at sub-second intervals. Key technology features include compliance-focused software interfaces adhering to FDA 21 CFR Part 11 for electronic signatures and records, ensuring data integrity and auditability. Furthermore, the adoption of IIoT protocols (e.g., MQTT, OPC UA) facilitates seamless machine-to-machine communication, allowing the oven to report its status, consume data from upstream processes, and adjust its cycle parameters accordingly. This integration capability is critical for optimizing throughput and reducing bottlenecks in highly automated smart factories, moving the oven beyond standalone equipment into an integrated node within the manufacturing execution system (MES) infrastructure.

Thermal management innovations focus on minimizing energy consumption without compromising uniformity. This includes the use of high-efficiency, low-thermal mass heating elements that allow for extremely fast ramp rates and precise temperature modulation. Advanced computational fluid dynamics (CFD) modeling is utilized during the design phase to optimize fan placement and baffling within the chamber, ensuring highly laminar and uniform airflow across all shelves, thereby achieving validated temperature uniformity specifications even in large-volume industrial ovens. The implementation of variable frequency drives (VFDs) for circulation fans also allows for dynamic adjustment of airflow speed based on the process stage, optimizing both energy use and process safety, particularly during volatile solvent removal processes, solidifying the market's trajectory towards sustainable and intelligent processing solutions.

Regional Highlights

- Asia Pacific (APAC): Represents the epicenter of global demand, anchored by extensive manufacturing capacity in China, Taiwan, South Korea, and Japan. The region’s dominance is driven by high investment in leading-edge semiconductor fabrication, which necessitates thousands of ultra-high-precision inert ovens, and the unparalleled scale of EV battery production (giga-factories). APAC exhibits strong demand for large-capacity, high-throughput conveyorized systems, focused on minimizing OPEX through optimal gas efficiency and high uptime performance metrics.

- North America: Focuses primarily on high-value, low-volume specialized applications, particularly within the aerospace and defense sectors, requiring ovens engineered for extreme performance and material traceability. The pharmaceutical and biotechnology industry, centered largely in the US, demands systems with robust validation capabilities (IQ/OQ/PQ) and software compliance with strict federal regulations. Innovation in this region is geared towards AI-driven process control and developing hybrid vacuum/inert atmosphere systems for complex material research.

- Europe: Characterized by stringent regulatory environments related to energy consumption and environmental impact. European market growth is stable, driven by the mature pharmaceutical manufacturing sector and high-end automotive component suppliers (excluding high-volume battery production, which is relatively newer). Demand emphasizes reliability, precision, and adherence to European standards for machinery safety and environmental protection, prompting a focus on advanced thermal insulation and highly efficient nitrogen recovery systems.

- Latin America (LATAM): Offers significant long-term growth potential, particularly as foreign direct investment establishes localized electronics assembly and pharmaceutical formulation facilities in countries like Mexico and Brazil. The market entry strategy often involves lower-to-mid-range intelligent ovens, prioritizing ruggedness and local technical support availability. Infrastructure challenges, particularly securing consistent, high-purity industrial gas supplies, can sometimes act as a dampener on aggressive expansion.

- Middle East and Africa (MEA): A nascent market segment, primarily driven by nascent government initiatives aimed at diversifying economies away from oil through investment in advanced manufacturing, including localized medical device production and petrochemical research. Current demand is low volume and highly specific, reliant on specialized import logistics and technical training provided directly by international original equipment manufacturers (OEMs), focusing on basic, reliable intelligent control systems rather than advanced AI integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intelligent Nitrogen Drying Oven Market.- Binder GmbH

- Thermo Fisher Scientific

- Yamato Scientific Co., Ltd.

- ESPEC CORP.

- Memmert GmbH + Co. KG

- Sheldon Manufacturing Inc.

- Despatch Industries

- Blue M Electric

- Carbolite Gero

- K.H. Huppert Company

- Quincy Lab Inc.

- T-TECH Thermal Technology

- Gruenberg

- VWR International

- S&A Scientific Instruments

- Across International

- Precision Equipment

- Test Equity

- MMM Group

- Jeio Tech

Frequently Asked Questions

Analyze common user questions about the Intelligent Nitrogen Drying Oven market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an intelligent nitrogen drying oven compared to a standard vacuum oven?

The primary function is to achieve an extremely low residual oxygen atmosphere (often <5 ppm) using active nitrogen purging and intelligent flow control, preventing oxidation and thermal degradation of highly sensitive materials, which standard vacuum ovens may not achieve consistently or efficiently, especially under high heat conditions required for modern electronics and battery materials.

Which industries are the major drivers of demand for high-capacity intelligent nitrogen drying ovens?

The Semiconductor industry, particularly for advanced packaging and wafer processing, and the rapidly scaling Electric Vehicle (EV) battery manufacturing sector, requiring high-volume electrode drying, are the major drivers demanding industrial-scale, highly precise, and inert thermal processing capabilities globally.

How does AI integration improve the efficiency and cost-effectiveness of nitrogen drying operations?

AI optimizes efficiency by enabling predictive maintenance, minimizing unplanned downtime, and dynamically adjusting nitrogen flow rates and thermal profiles based on real-time load conditions and material modeling. This substantially reduces variable operating costs associated with nitrogen consumption and energy use while ensuring superior process repeatability.

What are the key technological advancements expected in this market, particularly regarding sustainability?

Future advancements focus on superior oxygen sensor resolution and speed, enhanced IIoT integration for factory-wide control, and significant improvements in sustainability through advanced thermal insulation and sophisticated nitrogen gas recirculation and purification systems aimed at minimizing environmental footprint and operational waste.

What are the primary restraints affecting the adoption of intelligent nitrogen drying ovens in developing regions?

The primary restraints include the high initial capital expenditure (CAPEX) required for sophisticated equipment, the complexity of integrating advanced control systems into existing infrastructure, and the logistical challenge of securing a reliable, consistent supply of high-purity industrial nitrogen gas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager