Intelligent RFID Platform Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442217 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Intelligent RFID Platform Market Size

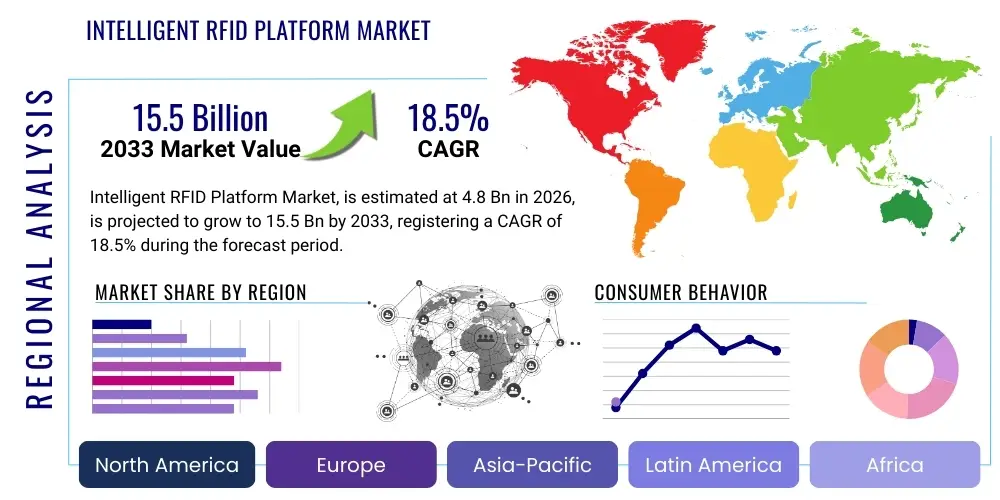

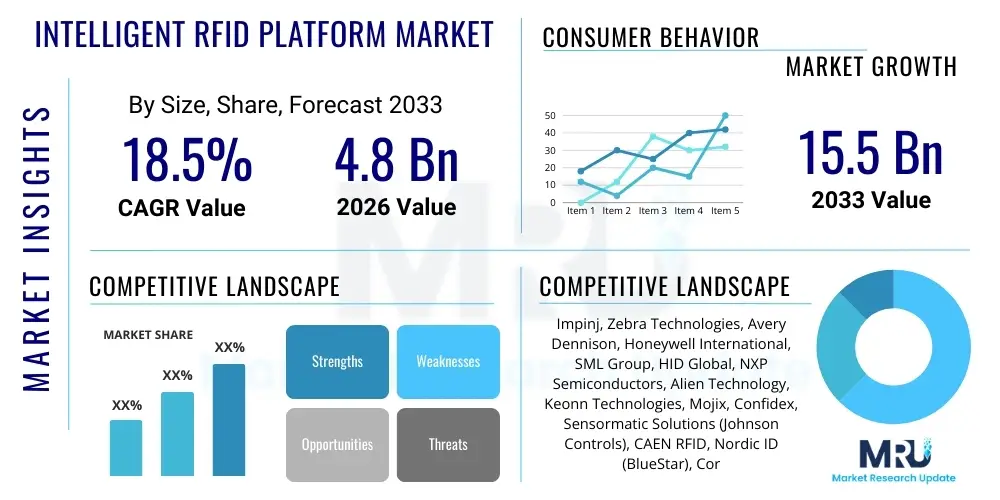

The Intelligent RFID Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 15.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for highly accurate, real-time inventory and asset management solutions across core industrial sectors, including retail, logistics, and manufacturing. The integration of advanced analytics, machine learning capabilities, and cloud computing within traditional RFID infrastructure is transforming basic data capture into actionable, predictive intelligence, thereby justifying high levels of capital investment.

The transition from fragmented, proprietary RFID systems to integrated, scalable platforms represents a critical inflection point in market dynamics. These Intelligent RFID Platforms are designed not only to read and track tags but also to process vast streams of data, contextualize information, and automate responses, significantly reducing human intervention and operational latency. Furthermore, the standardization of ultra-high frequency (UHF) protocols and the decreasing cost of high-performance RFID tags are accelerating adoption, making sophisticated tracking accessible to small and medium-sized enterprises (SMEs) that previously found the technology prohibitively expensive. The projected growth reflects a global consensus among enterprises that digital visibility is paramount for optimizing supply chain resilience and enhancing customer experience.

Geographically, market growth is heavily influenced by rapid industrial digitalization initiatives in regions such as Asia Pacific (APAC), particularly in China, Japan, and India, where large-scale manufacturing and e-commerce expansion necessitate sophisticated tracking systems. Concurrently, mature markets in North America and Europe are focusing on platform refinement, integrating RFID data with existing Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS) to maximize return on investment (ROI). The CAGR of 18.5% underscores a strong, sustained momentum fueled by technological convergence and the imperative for operational excellence in a globally competitive landscape.

Intelligent RFID Platform Market introduction

The Intelligent RFID Platform Market encompasses comprehensive software and hardware ecosystems designed to leverage Radio Frequency Identification (RFID) technology alongside advanced data processing capabilities, including AI, machine learning, and cloud infrastructure. Unlike traditional RFID systems, which primarily function for simple identification and tracking, Intelligent RFID Platforms provide real-time location services, predictive analytics for inventory optimization, automated compliance verification, and enhanced security features. These platforms serve as the nerve center for asset visibility, transforming raw tag data into structured, actionable business insights. The core product offering typically includes specialized RFID readers and antennas, ruggedized tags or sensors, sophisticated middleware for data aggregation and filtering, and a cloud-based analytics layer that integrates with enterprise applications.

Major applications of these intelligent systems span across several high-growth industries. In retail, they are crucial for loss prevention, detailed inventory accuracy (essential for omnichannel fulfillment), and improving the in-store customer experience through smart shelves and automated checkout. Within logistics and supply chain management, Intelligent RFID Platforms enable granular tracking of goods from point of manufacture to consumption, optimizing route planning, reducing transit shrinkage, and ensuring cold chain integrity for perishable goods. Furthermore, manufacturing facilities utilize these platforms for tracking work-in-progress (WIP) assets, tooling management, and optimizing automated production lines, directly contributing to lean manufacturing initiatives. The robustness and scalability of these platforms are fundamental requirements for managing complex, global operations.

The principal benefits driving market expansion include a dramatic improvement in inventory accuracy, often exceeding 98%, which minimizes costly stockouts and overstocking. This enhanced accuracy translates directly into significant operational efficiencies and reduced labor costs associated with manual counting and tracking processes. Key driving factors accelerating market adoption involve the rapid proliferation of the Internet of Things (IoT), the increasing complexity of global supply chains necessitating superior visibility, and the growing regulatory demands for product traceability, particularly in pharmaceuticals and food sectors. The convergence of 5G networks further enhances the capability of these platforms to transmit large volumes of data instantly, supporting highly dynamic and distributed deployments.

Intelligent RFID Platform Market Executive Summary

The Intelligent RFID Platform Market is characterized by robust growth, propelled by major business trends centered on digitalization and automation across global industries. Key business trends include the shift towards subscription-based Platform-as-a-Service (PaaS) models, making advanced analytics accessible without heavy upfront capital expenditure on infrastructure. Strategic collaborations between hardware manufacturers (tags/readers) and software providers (AI/Cloud analytics) are creating highly optimized, end-to-end solutions tailored for specific vertical applications, such as specialized platforms for healthcare asset tracking or robust systems for harsh industrial environments. Furthermore, sustainability and circular economy initiatives are increasingly utilizing intelligent RFID platforms to track product components and materials throughout their lifecycle, aiding in recycling and repair operations, thereby adding a layer of compliance and corporate social responsibility to operational efficiency.

From a regional perspective, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in smart factory implementation, the rapid expansion of e-commerce logistics infrastructure, and governmental support for national digital transformation agendas. North America maintains market leadership in terms of technology penetration and high average solution prices, driven by early adoption in the retail apparel sector and extensive use within defense and aerospace applications for high-value asset tracking. Europe demonstrates steady growth, highly influenced by stringent regulatory requirements for traceability, especially within the food and pharmaceutical supply chains (e.g., EU Falsified Medicines Directive). Regional competition is intensifying, with local system integrators developing customized solutions that effectively navigate specific jurisdictional and operational complexities.

Segment trends highlight a strong preference for cloud-based deployment models due to their scalability, flexibility, and reduced total cost of ownership (TCO). Within components, the software and services segment, particularly middleware and analytics suites, is experiencing the fastest revenue growth, reflecting the market’s focus on intelligence rather than just hardware installation. Application-wise, logistics and supply chain management remains the dominant segment, though retail is rapidly increasing its sophisticated use of platform capabilities for inventory accuracy and security. Technologically, the Ultra-High Frequency (UHF) RFID platform segment dominates due to its superior read range and suitability for large-scale logistics operations, yet specialized high-frequency (HF) and low-frequency (LF) platforms continue to hold strong niches in secure access control and specialized medical device tracking, necessitating vendors to maintain diverse platform compatibilities.

AI Impact Analysis on Intelligent RFID Platform Market

Analysis of common user questions regarding AI's impact on the Intelligent RFID Platform Market reveals a convergence of themes surrounding ROI justification, deployment complexity, and the creation of truly autonomous supply chain systems. Users frequently ask: "How exactly does AI improve inventory accuracy beyond 99%?" "What infrastructure is required to implement AI-driven predictive maintenance based on RFID data?" and "What are the ethical implications of using AI to monitor employee productivity via RFID-enabled assets?" These queries indicate that key themes center on the practical, quantifiable benefits of AI, specifically its ability to move RFID from descriptive tracking (what happened) to prescriptive and predictive capabilities (what will happen and what should be done). Concerns also revolve around the high initial investment in data integration tools and machine learning expertise necessary to operationalize these advanced platforms, and the regulatory environment governing automated decision-making in logistics.

The integration of Artificial Intelligence and Machine Learning (ML) transforms the Intelligent RFID Platform from a passive data collector into a dynamic, decision-making engine. AI algorithms analyze vast datasets generated by RFID reads, sensor inputs (temperature, humidity), and external factors (weather, traffic) to identify complex patterns that are imperceptible to human analysts or rule-based systems. This capability is paramount for enabling predictive inventory forecasting, optimizing restocking cycles by anticipating demand fluctuations with greater precision, and identifying potential bottlenecks or fraudulent activities in real-time. This high level of analytical sophistication elevates the platform's value proposition from merely cost reduction to strategic business transformation, positioning it as an essential tool for achieving competitive differentiation in high-volume, dynamic environments like e-commerce logistics and pharmaceutical distribution.

Consequently, market expectations are shifting; users are demanding platforms capable of immediate self-calibration and learning. AI is being deployed within the middleware layer to autonomously filter out erroneous or duplicate reads (data cleansing), improving the quality and reliability of the operational data feed. Furthermore, computer vision, often coupled with RFID data in AI platforms, provides visual verification of tagged items, reducing errors in packing and shipping. This synergy between AI-driven software and robust RFID hardware establishes a foundation for fully automated warehouses and smart retail environments where inventory management tasks are handled without manual input, minimizing labor dependency and achieving levels of accuracy previously unattainable.

- AI enables Predictive Inventory Optimization, anticipating stockouts based on historical RFID movement data and external variables.

- Machine Learning algorithms enhance Data Reliability by autonomously filtering and correcting duplicate or spurious RFID reads.

- AI facilitates Automated Decision Making for tasks like dynamic shelving relocation and robotic picking sequence optimization.

- Enhanced Security and Fraud Detection by identifying anomalous or unauthorized item movements across monitored zones.

- Implementation of Prescriptive Maintenance for readers and infrastructure based on usage patterns analyzed by ML models.

- AI-driven simulation and modeling allow users to test supply chain changes virtually before physical deployment, optimizing platform configuration.

DRO & Impact Forces Of Intelligent RFID Platform Market

The Intelligent RFID Platform Market is powerfully influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its future trajectory and market impact. Key drivers include the global imperative for enhanced supply chain visibility, necessitated by increased complexity, globalization, and the demands of omnichannel commerce, which requires flawless inventory synchronization across physical and digital storefronts. Technological advancements, particularly the widespread adoption of IoT sensors and 5G connectivity, provide the foundational infrastructure required for massive, real-time data transmission inherent to intelligent platforms. Restraints primarily involve the high initial cost of deploying large-scale infrastructure, including specialized readers, antennas, and the extensive middleware required for integration with legacy enterprise systems. Furthermore, data security concerns regarding the sensitive tracking information captured by these platforms pose a significant hurdle. Opportunities are concentrated in niche, high-growth applications such as smart infrastructure development, patient tracking in complex hospital settings, and the potential for regulatory mandates that require sophisticated product serialization and tracking capabilities, particularly in regulated industries like food safety and pharmaceuticals. These factors combine to create a highly dynamic environment where innovation must continually address cost and integration challenges.

Impact forces acting on this market can be categorized into technological, competitive, and regulatory pressures. Technologically, the continuous evolution of chip performance (smaller, cheaper, greater memory) and the standardization of protocols (e.g., EPC Gen2 V2) lower the entry barrier for new adopters and enhance system interoperability. Competitively, the market is fragmenting, with specialized solution providers emerging that focus on vertical-specific platforms (e.g., automotive parts tracking or clinical trial management), forcing established players to innovate and offer customizable, modular services. Regulatory forces, particularly those relating to radio spectrum allocation and data privacy (like GDPR), necessitate that platform providers invest heavily in compliance tools and robust data governance frameworks. These forces mandate that successful vendors must not only deliver high performance but also guarantee seamless integration and adherence to complex international standards, positioning sophisticated software integration services as a major differentiator.

The strong impact of drivers, particularly digital transformation agendas globally, far outweighs the constraining effects of high initial investment costs over the long term, as demonstrated by the accelerating CAGR. The critical factor sustaining market growth is the compelling return on investment (ROI) derived from minimized shrinkage, optimized labor utilization, and superior customer satisfaction achieved through accurate inventory management. As the technology matures and becomes more commoditized, the focus shifts entirely to the "intelligence" layer—the analytics, AI, and integration capabilities—further cementing the market's evolution toward platform-centric solutions rather than mere component provision. Addressing standardization challenges and ensuring cross-platform compatibility remain crucial tasks for vendors aiming to capitalize on emerging opportunities in smart city logistics and interconnected industrial ecosystems.

Segmentation Analysis

The Intelligent RFID Platform Market is meticulously segmented based on components, technology type, deployment model, and application, reflecting the diverse requirements across various end-user industries. This structured segmentation provides vendors with clear avenues for specialization and allows end-users to select platforms optimized for their specific operational demands. The market’s segmentation highlights the strategic importance of the software layer, which integrates raw data from the physical hardware (tags, readers) and transforms it into actionable intelligence via specialized middleware, analytics engines, and reporting tools. The increasing sophistication of these platforms means that revenue generation is shifting predominantly towards service contracts, cloud deployments, and advanced analytics subscriptions, underscoring a maturation from hardware-centric sales to comprehensive solution delivery.

Key segmentation trends indicate that Ultra-High Frequency (UHF) technology continues to dominate due to its exceptional read range, making it ideal for massive logistics and retail applications where bulk reading is necessary. However, High Frequency (HF) technology maintains critical relevance in specific security-sensitive applications like contactless payment, access control, and library management, where proximity and higher data integrity are prioritized. Furthermore, the deployment model segmentation reveals a rapid transition toward cloud-based platforms, favored for their flexibility, reduced maintenance burden, and seamless updates, appealing particularly to global enterprises seeking centralized management capabilities. Conversely, on-premise solutions remain vital for highly regulated sectors (e.g., defense, banking) where strict data sovereignty and security protocols prohibit the use of public cloud infrastructure. This duality in deployment models emphasizes the need for vendors to offer versatile hybrid solutions capable of meeting heterogeneous customer requirements.

In terms of application, the market is highly dynamic. While the retail apparel sector was an early and heavy adopter, leading growth in inventory visibility, the fastest current growth is projected in the logistics and supply chain sector due to the explosion of e-commerce and the associated complexity of reverse logistics and last-mile delivery. The healthcare sector, driven by mandates for tracking surgical tools, patient records, and pharmaceuticals, is also poised for rapid adoption. Segmentation by component confirms that services, including system integration, consulting, and maintenance, constitute a significant and growing revenue stream, reflecting the inherent complexity of integrating intelligent RFID platforms with sprawling, often disparate, enterprise IT environments. Successful market penetration is increasingly reliant on providing robust, post-implementation support and expertise.

- By Component:

- Hardware (Readers, Antennas, Tags/Labels, Printers)

- Software (Middleware, Data Analytics, Cloud Platforms)

- Services (Consulting, System Integration, Maintenance & Support)

- By Technology:

- Ultra-High Frequency (UHF) RFID

- High Frequency (HF) RFID

- Low Frequency (LF) RFID

- By Application:

- Retail & E-commerce

- Logistics & Supply Chain Management

- Manufacturing & Automotive

- Healthcare & Pharmaceuticals

- Government & Defense

- Others (Agriculture, Library Management, Energy)

- By Deployment Model:

- On-Premise

- Cloud-Based

- Hybrid

Value Chain Analysis For Intelligent RFID Platform Market

The value chain for the Intelligent RFID Platform Market is highly specialized and spans from fundamental component manufacturing to complex system integration and service delivery. Upstream activities are dominated by semiconductor manufacturers and specialized material providers who focus on producing high-quality integrated circuits (ICs) for RFID tags, coupled with advanced antenna design and flexible substrate materials. The efficiency and cost-effectiveness in this segment are crucial, as the cost of tags directly impacts the viability of large-scale deployments. Key strategic activities at the upstream level involve research and development to reduce tag size, increase memory capacity, and improve read sensitivity, especially for challenging environments (e.g., metal and liquid interference). Tag and inlay manufacturers subsequently convert these ICs into finished tags, often customized for specific applications like harsh environment tagging or embeddable security labels, necessitating strong ties between semiconductor firms and converter specialists to ensure scalable production.

Midstream activities primarily focus on the development and production of the physical infrastructure, including specialized RFID readers (fixed and handheld), portals, and printers, alongside the development of the essential middleware. The middleware layer is arguably the most critical component, serving as the bridge between raw data captured by the readers and the enterprise applications. It performs data filtering, aggregation, and rule application before feeding clean data into ERP, WMS, or bespoke analytics platforms. Competition at this stage is fierce, centered on optimizing read reliability, system throughput, and providing robust APIs for seamless integration. Furthermore, platform providers are increasingly embedding AI capabilities directly into the middleware to enable edge computing and real-time local decision-making, reducing reliance on constant cloud connectivity and improving latency for high-speed operations.

Downstream analysis encompasses system integration, distribution, and end-user services. Distribution channels are typically multifaceted: direct sales are common for large, strategic accounts requiring highly customized platform deployments (e.g., a major global logistics provider). However, the majority of sales often flow through Value-Added Resellers (VARs) and specialized system integrators who possess the technical expertise to install, configure, and maintain the complex hardware and software ecosystem within the client's environment. These integrators are essential for tailoring generic platform solutions to vertical-specific challenges, such as integrating RFID data streams into existing patient management systems in healthcare or linking them to automated guided vehicles (AGVs) in manufacturing. The long-term service contracts, maintenance agreements, and periodic software updates generated in the downstream phase represent a significant and recurring revenue stream, solidifying the importance of strong channel partnerships and robust technical support networks.

Intelligent RFID Platform Market Potential Customers

Potential customers for Intelligent RFID Platforms are predominantly large-scale enterprises and organizations operating complex, asset-intensive environments where precise real-time visibility is critical to operational integrity and profitability. The primary buyers of these sophisticated platforms span major sectors including consumer goods retail, where platform deployment is essential for minimizing shelf gaps, executing accurate inventory counts vital for omnichannel fulfillment strategies, and combating organized retail crime through enhanced asset tracking. Logistics and third-party logistics (3PL) providers constitute another massive customer base, leveraging these platforms to optimize warehouse operations, sortation processes, cross-docking efficiency, and global container tracking. For these users, the ROI is derived from significant reductions in misdirected shipments and faster cycle times, directly enhancing service level agreements (SLAs) with their clients.

Beyond retail and logistics, the manufacturing sector, particularly high-value discrete manufacturing (aerospace, automotive) and process manufacturing (chemicals, pharmaceuticals), represents a rapidly growing customer segment. Manufacturers deploy Intelligent RFID Platforms for sophisticated Work-in-Progress (WIP) tracking, managing expensive tooling lifecycles, and ensuring regulatory compliance by providing an immutable record of component serialization and quality control checkpoints. In healthcare, hospitals and clinics are adopting these platforms to track high-value medical devices (e.g., pumps, monitors), manage pharmaceutical supplies (especially controlled substances), and improve patient safety by ensuring timely access to critical assets. These customers are driven by regulatory requirements, the need to optimize capital expenditure on assets, and the imperative to reduce medical errors caused by misplaced equipment.

Furthermore, government and defense agencies are key buyers, utilizing these systems for highly secure asset management, maintenance tracking of military equipment, and managing large-scale archives or documentation centers. The inherent need for high security and controlled access in these environments makes the Intelligent RFID Platform, often deployed in conjunction with on-premise cloud infrastructure, an ideal solution. Emerging customer segments include operators of smart cities and large public infrastructure (e.g., transit systems, utilities) that require platforms to monitor assets, track maintenance schedules, and manage public safety equipment efficiently. The increasing sophistication and integration capabilities of these platforms, especially with existing ERP systems, make them attractive to any organization struggling with disparate data sources and manual inventory reconciliation processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 15.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Impinj, Zebra Technologies, Avery Dennison, Honeywell International, SML Group, HID Global, NXP Semiconductors, Alien Technology, Keonn Technologies, Mojix, Confidex, Sensormatic Solutions (Johnson Controls), CAEN RFID, Nordic ID (BlueStar), CoreRFID, RF Technologies, Smartrac Technology Group (Avery Dennison), Vizinex RFID, GAO RFID, Invengo Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intelligent RFID Platform Market Key Technology Landscape

The Intelligent RFID Platform market’s technological landscape is multifaceted, underpinned by advancements in radio frequency hardware, sophisticated data processing middleware, and cloud-native integration tools. The foundational technology relies on specialized RFID tags (passive, semi-passive, and active) that are increasingly being designed for niche applications, such as tags optimized for metal environments, high-temperature resistance, or minimal visual footprint. A critical technological trend is the evolution of advanced RFID readers, which now incorporate edge computing capabilities, allowing them to perform data filtering, aggregation, and preliminary anomaly detection directly at the read point, thereby reducing the bandwidth burden on central servers and improving real-time responsiveness. Antenna design is also rapidly advancing, focusing on multi-directional read capabilities and extended range to ensure comprehensive coverage in challenging physical spaces like densely packed warehouses or complex industrial yards. Standardization efforts, particularly around EPC Global standards (Gen2 V2), ensure interoperability across different vendor hardware, which is crucial for global supply chain applications.

In the software domain, the technology landscape is dominated by sophisticated middleware and API integration frameworks. Modern Intelligent RFID Platforms employ modular software architectures that facilitate seamless connection with existing enterprise resource planning (ERP) systems (e.g., SAP, Oracle), warehouse management systems (WMS), and bespoke IoT platforms. Middleware functions are evolving beyond simple data routing to include complex business logic and sophisticated event processing capabilities, enabling the platform to trigger automated actions based on predefined criteria (e.g., triggering a replenishment order when inventory levels drop below a dynamic threshold). The shift towards cloud-based platforms, predominantly utilizing hyperscalers like AWS, Azure, and Google Cloud, leverages their inherent scalability and security features, providing the necessary infrastructure to process the enormous volumes of raw data generated by widespread RFID deployments and integrate them with high-level AI/ML services for predictive analytics.

Furthermore, convergence with complementary technologies is defining the next generation of Intelligent RFID Platforms. This includes integrating RFID data streams with location technologies such as Global Positioning Systems (GPS) and ultra-wideband (UWB) for enhanced location precision, especially in outdoor or complex indoor environments. Sensor fusion is also paramount, where RFID tags are combined with environmental sensors (temperature, vibration, moisture) to create "smart tags" capable of providing comprehensive condition monitoring, critical for applications like cold chain logistics or industrial equipment monitoring. The adoption of blockchain technology is an emerging technological pillar, used to create tamper-proof, decentralized records of item traceability. This ensures data integrity and trust throughout the entire supply chain, offering significant value to highly regulated industries that require immutable proof of authenticity and provenance, such as pharmaceuticals and high-end luxury goods.

Regional Highlights

- North America (NA): North America maintains market leadership, characterized by high investment in technology infrastructure and early adoption across sectors like retail, defense, and aviation. The market here is mature, focusing heavily on integrating intelligent RFID platforms with complex, existing enterprise IT ecosystems to drive deep operational efficiency and maximize ROI. High labor costs necessitate automation, further propelling the use of these platforms for autonomous inventory management and asset tracking. Key drivers include the large presence of global retailers and major logistics hubs, alongside stringent regulatory requirements for tracking in highly sensitive sectors like defense and government services. Innovation is concentrated on AI-driven analytics and cloud-native solutions, leveraging the substantial domestic capacity of hyper-scale cloud providers.

- Europe: The European market demonstrates steady, robust growth, largely driven by strict regulations regarding product traceability, particularly the EU’s Falsified Medicines Directive (FMD) and evolving food safety standards, which mandate granular tracking capabilities. Western European countries, particularly Germany and the UK, are focusing on Industry 4.0 initiatives, integrating RFID platforms with industrial IoT (IIoT) frameworks for smart factory optimization and automotive supply chain precision. Central and Eastern Europe are emerging as high-growth areas as manufacturing and logistics hubs expand. The emphasis is on developing standardized, interoperable solutions that comply with diverse national and EU-level data privacy (GDPR) and spectrum regulations.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth over the forecast period, fueled by rapid urbanization, massive investments in manufacturing automation (e.g., China’s "Made in China 2025"), and the unparalleled expansion of e-commerce markets (India, China, Southeast Asia). The need for scalable and cost-effective tracking solutions across vast supply chains is paramount. Governments in this region are actively promoting digitalization, creating favorable environments for large-scale RFID platform deployment in smart ports, public infrastructure, and large-scale asset management. Market growth is heavily dependent on reducing the TCO of hardware and developing localized software solutions that address the linguistic and logistical complexities unique to the region.

- Latin America (LATAM): The LATAM market is nascent but rapidly accelerating, driven by the modernization of retail sectors and increasing efforts to combat supply chain shrinkage and counterfeit goods, particularly in Brazil and Mexico. Economic volatility and infrastructure challenges necessitate scalable, often hybrid, deployment models. Adoption is strongest in areas like mining, oil and gas, and agriculture, where asset tracking in remote or harsh environments is essential. Growth is highly dependent on foreign investment and partnerships that bring proven technology platforms into the region, often coupled with local system integration expertise.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by mega-projects related to smart cities (e.g., NEOM in Saudi Arabia) and the diversification of economies away from oil dependency. Large-scale infrastructure projects, modernizing logistics hubs (ports and airports), and significant investments in healthcare and defense are the key demand drivers. The African market is showing pockets of growth focused on asset security and supply chain integrity, often leapfrogging older technologies directly to intelligent, cloud-based solutions to overcome infrastructural gaps. Security and high-value asset tracking dominate procurement priorities across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intelligent RFID Platform Market.- Impinj

- Zebra Technologies

- Avery Dennison

- Honeywell International

- SML Group

- HID Global

- NXP Semiconductors

- Alien Technology

- Keonn Technologies

- Mojix

- Confidex

- Sensormatic Solutions (Johnson Controls)

- CAEN RFID

- Nordic ID (BlueStar)

- CoreRFID

- RF Technologies

- Smartrac Technology Group (Avery Dennison)

- Vizinex RFID

- GAO RFID

- Invengo Technology

Frequently Asked Questions

Analyze common user questions about the Intelligent RFID Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between traditional RFID and an Intelligent RFID Platform?

Traditional RFID provides basic item identification and location data (descriptive tracking). An Intelligent RFID Platform integrates this data with AI/ML, cloud computing, and advanced middleware to deliver predictive analytics, automated decision-making, and deep operational insights (prescriptive tracking), transforming data into actionable business value.

Which technology segment (UHF, HF, LF) dominates the market and why?

Ultra-High Frequency (UHF) RFID technology dominates the market due to its superior read range (up to 30 feet) and its capability for rapid, simultaneous reading of hundreds of tags (bulk reading). This makes it the preferred technology for large-scale logistics, retail inventory management, and general supply chain visibility applications.

What is the typical Return on Investment (ROI) period for adopting an Intelligent RFID Platform?

The ROI period varies significantly by industry and scale, but large enterprises typically report achieving full ROI within 12 to 24 months. Key drivers for rapid ROI include minimized inventory shrinkage, significant reductions in labor costs associated with manual counting, and improved customer satisfaction through guaranteed product availability.

How does the Intelligent RFID Platform address concerns related to data security and privacy?

Intelligent platforms address security through advanced encryption protocols (e.g., EPC Gen2 V2), robust access controls, and often deploy on private cloud or on-premise infrastructure in regulated sectors. Furthermore, compliance with data privacy regulations like GDPR is managed through anonymization tools and strict governance protocols within the platform's software layer.

In which industry is the highest growth potential for Intelligent RFID Platforms projected?

The highest growth potential is projected in the Logistics & Supply Chain Management sector, driven by the massive expansion of global e-commerce, the increasing complexity of omnichannel fulfillment, and the critical need for real-time visibility to optimize complex reverse logistics and last-mile delivery operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager