Interactive LED Floor Tile Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443429 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Interactive LED Floor Tile Market Size

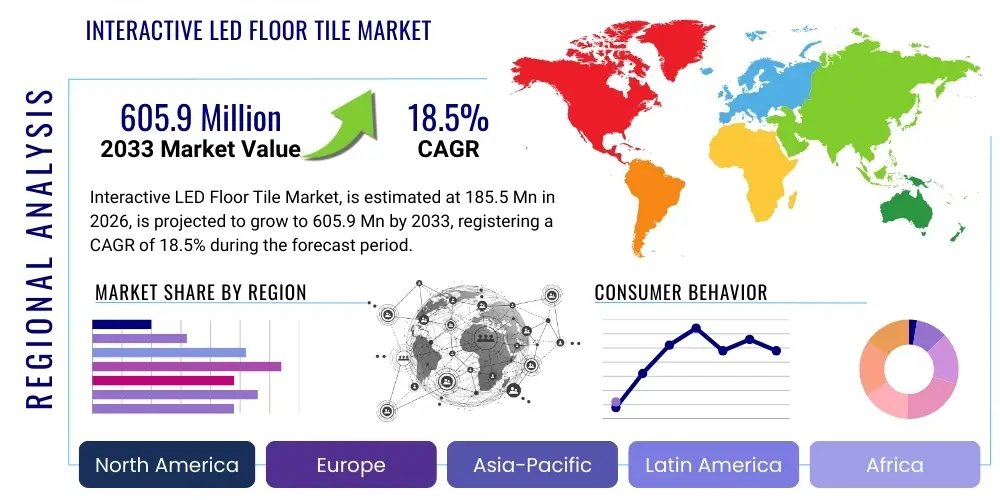

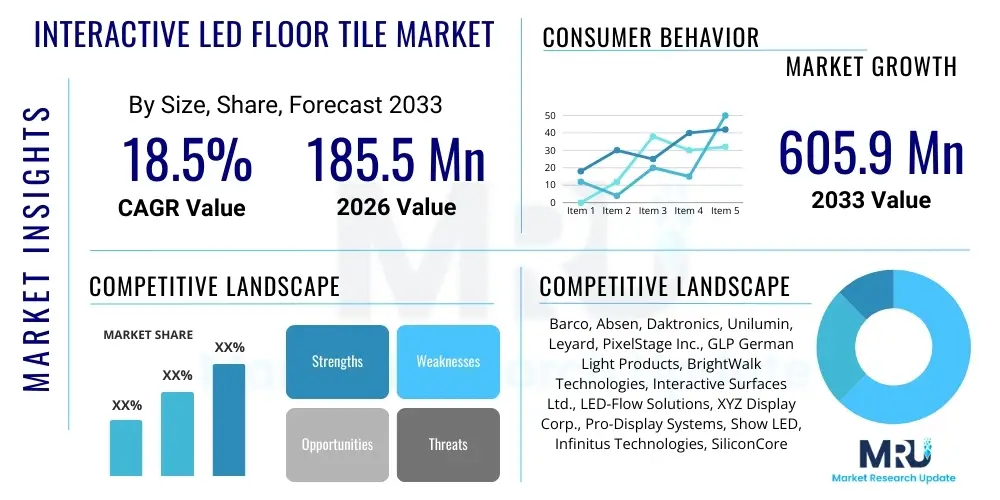

The Interactive LED Floor Tile Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $185.5 million in 2026 and is projected to reach $605.9 million by the end of the forecast period in 2033.

Interactive LED Floor Tile Market introduction

The Interactive LED Floor Tile Market encompasses specialized digital flooring systems that combine robust structural design with integrated light-emitting diodes (LEDs) and interactive sensors. These sophisticated systems allow for the display of dynamic graphics, videos, and personalized content, responding in real-time to pedestrian movement, pressure, and gestures. The core technology leverages pressure sensors or proximity sensors embedded beneath or within the LED array, transforming traditional flooring surfaces into immersive digital canvases. This technology finds primary applications across high-traffic commercial environments, entertainment venues, and public installations where enhanced visitor engagement and dynamic communication are paramount. Key sectors utilizing these solutions include large-scale experiential marketing campaigns, theatrical stages, retail showrooms, museums, and nightclubs, capitalizing on the visual novelty and functionality these tiles provide.

Product differentiation in this market centers around pixel pitch (the density of LEDs), load-bearing capacity, resistance to ingress (IP rating), modularity, and the sophistication of the accompanying software control systems. Modern interactive LED floor tiles are designed for both permanent installations, requiring high durability and seamless integration, and rental applications, necessitating quick setup and breakdown capabilities. The major benefits driving adoption include significantly increased brand recall through immersive experiences, enhanced spatial aesthetics, and versatility in content delivery, making static floors obsolete in digitally forward environments. Furthermore, these systems offer capabilities beyond mere display, such as directional guidance, real-time footfall tracking, and gamification, thereby offering substantial operational and marketing value to end-users.

Driving factors propelling market expansion are primarily the rapid global proliferation of experiential marketing strategies, where physical spaces are transformed into engaging digital narratives. Consumers increasingly demand personalized and memorable interactions, pushing retail, entertainment, and corporate sectors to adopt advanced display technologies. Technological advancements in LED efficiency, sensor reliability, and processing power have lowered the barrier to entry while simultaneously improving product performance, enhancing brightness, and reducing power consumption. Additionally, the growing focus on creating 'smart' public spaces and incorporating advanced human-computer interaction methods in architectural design further fuels the demand for durable, high-resolution interactive LED flooring solutions globally.

Interactive LED Floor Tile Market Executive Summary

The Interactive LED Floor Tile Market is characterized by robust growth, underpinned by a fundamental shift toward digital engagement and experiential venue design. Business trends indicate a strong move toward highly durable, high-resolution tiles (P3 and P4 pixel pitches) capable of supporting heavy loads and diverse environmental conditions, particularly for permanent installations in retail flagship stores and corporate lobbies. Key vendors are prioritizing modular design and integrated software platforms that simplify content management and enable real-time data analytics derived from user interaction. Mergers, acquisitions, and strategic partnerships between hardware manufacturers and specialized content creation agencies are becoming common, aiming to offer turnkey solutions that include both installation and dynamic content services, thereby addressing the complex integration challenges faced by end-users.

Regionally, North America and Europe currently dominate the market, attributed to high disposable income, early adoption of advanced retail technologies, and a thriving live events and entertainment industry demanding cutting-edge stage effects. However, the Asia Pacific region (APAC) is projected to exhibit the highest CAGR during the forecast period, driven by massive investments in public infrastructure development, the rapid expansion of theme parks and entertainment complexes in countries like China and India, and increasing penetration of large-format digital signage in rapidly modernizing urban centers. Latin America and the Middle East and Africa (MEA) are emerging markets, primarily focusing on luxury retail and major global expos, providing niche but significant growth avenues for specialized interactive tile providers.

Segment trends reveal that the Rental segment, primarily servicing exhibitions, concerts, and temporary events, remains critical, demanding flexibility and rapid deployment capabilities. Concurrently, the Permanent Installation segment is growing significantly in value due to the necessity for continuous, reliable operation in high-end commercial spaces, favoring suppliers offering extensive warranties and maintenance contracts. By application, the Entertainment & Events sector holds the largest market share, leveraging the tiles for dynamic stage backdrops and audience engagement features. However, the Retail sector is poised for substantial growth as businesses seek innovative methods to differentiate physical shopping experiences, utilizing the tiles for product promotion, wayfinding, and augmented reality integration within the store environment.

AI Impact Analysis on Interactive LED Floor Tile Market

User inquiries regarding AI's influence on the Interactive LED Floor Tile Market frequently revolve around personalization capabilities, predictive maintenance, and autonomous content generation. Users are keen to understand how AI can move the technology beyond simple reactive display into truly intelligent, responsive environments. Key themes highlight expectations for AI-driven analytics that optimize floor traffic flow, concerns about data privacy given the granular tracking capabilities, and demands for systems that can automatically adjust visual content based on real-time demographic recognition or behavioral patterns detected by embedded sensors. This user interest underscores a market expectation that future interactive flooring solutions will integrate cognitive capabilities to enhance functional utility beyond basic visual appeal, transforming them into valuable operational intelligence tools.

The integration of Artificial Intelligence transforms interactive LED floor tiles from simple reactive displays into intelligent surfaces capable of dynamic personalization and actionable data collection. AI algorithms process vast amounts of sensor data—including pressure mapping, footfall heatmaps, and movement trajectories—in real-time, allowing the system to identify complex patterns of user behavior that are invisible to traditional monitoring systems. For instance, AI can detect bottlenecks in retail environments and dynamically display directional signage on the floor tiles to redirect traffic, optimizing customer flow and improving spatial efficiency. This capability is pivotal in large venues, museums, and transportation hubs where managing large crowds safely and efficiently is a core operational requirement.

Furthermore, AI significantly enhances content management and delivery. Instead of pre-programmed loops, AI-powered systems can autonomously generate or select visual content that is maximally relevant to the detected audience, time of day, or prevailing environmental conditions (e.g., weather or external events). Machine learning models can predict maintenance needs by analyzing subtle shifts in LED performance or sensor response patterns, enabling predictive maintenance schedules that drastically reduce downtime and operational costs. The analytical layer provided by AI converts the floor tiles into powerful instruments for gathering business intelligence on consumer preferences, interaction duration, and engagement effectiveness, providing retailers and event organizers with unprecedented insights into physical space utilization.

- Enhanced Real-Time Personalization: AI enables dynamic content adjustment based on demographic profiles or specific user interactions.

- Predictive Maintenance: Machine learning algorithms analyze performance data to forecast component failures, reducing downtime.

- Optimized Traffic Flow: AI processes footfall data to dynamically adjust directional signage and manage crowd density.

- Behavioral Analytics: Deep learning models extract complex, actionable insights from sensor data regarding user engagement patterns.

- Autonomous Content Curation: AI systems can select or generate content that maximizes engagement based on environmental and temporal context.

- Improved Energy Efficiency: Algorithms optimize brightness and power usage based on ambient light levels and real-time usage patterns.

DRO & Impact Forces Of Interactive LED Floor Tile Market

The Interactive LED Floor Tile Market is influenced by a dynamic interplay of propelling drivers, market inhibitors, and strategic opportunities that collectively shape its growth trajectory and competitive landscape. The primary driving force is the global shift toward experiential retail and marketing, where generating high visitor engagement is prioritized over static displays. This push is strongly supported by advancements in sensor technology and LED pixel pitch reduction, leading to higher resolution and more robust floor products. Concurrently, substantial restraints impede faster market penetration, most notably the extremely high initial capital investment required for high-quality, durable, and certified interactive flooring systems, coupled with the complexity associated with installation, content creation, and maintenance, often necessitating specialized technical expertise.

Key opportunities within this market center around the integration of interactive floor tiles into broader 'smart building' and 'smart city' initiatives, transforming public spaces and architectural elements into connected data nodes. Developing highly modular, easy-to-install systems suitable for rapid deployment in temporary events represents a significant avenue for growth, particularly in the rental market segment. Furthermore, the convergence of interactive flooring with augmented reality (AR) technologies offers potential for creating profoundly immersive experiences, where physical interaction on the floor triggers synchronized virtual content viewed through handheld devices or specialized eyewear, thereby broadening application scope beyond traditional signage into gaming and virtual training simulations.

The overall impact forces are strongly positive, indicating that the drivers significantly outweigh the restraints over the long-term forecast period. While high costs remain a formidable short-term barrier, continuous innovation in manufacturing processes and standardization protocols are expected to gradually lower the total cost of ownership (TCO). The necessity for venues to constantly refresh their aesthetic appeal and functional utility in a highly competitive entertainment and retail landscape ensures persistent demand. The market is increasingly competitive, forcing vendors to innovate not just on hardware specifications (load capacity, waterproofing) but also on software platforms (user interface, analytics, content integration), making technological superiority a critical competitive impact force.

Segmentation Analysis

The Interactive LED Floor Tile Market is highly diversified, segmented primarily by installation type, pixel pitch, application, and geography, reflecting the varied requirements of different end-user industries. Understanding these segmentations is critical for market players to tailor product offerings and marketing strategies effectively. The installation type—Permanent versus Rental—dictates product specifications, particularly concerning durability, ease of maintenance, and modularity. Pixel pitch segmentation is crucial as it directly relates to the display resolution and required viewing distance; P3 and P4 (finer pitch) are increasingly preferred for close-range retail and corporate environments, while P5 and P6 (wider pitch) suffice for large stages and outdoor events. Application segmentation defines the usage context, ranging from high-impact entertainment to functional retail marketing tools.

The fastest-growing segment by application is the Retail and Commercial space, driven by the intense competition among physical stores to attract foot traffic and offer memorable in-store experiences. These environments demand high robustness and sophisticated content integration capabilities, often linking the floor display to inventory management systems or loyalty programs. Conversely, the Entertainment & Events segment, while mature, continues to dominate in terms of volume and peak usage demand, requiring rugged products capable of frequent setup and teardown, resistant to physical shock, and offering high brightness for stage lighting conditions. The educational and institutional segment, though smaller, presents a steady growth opportunity, particularly for interactive learning environments and museum exhibits seeking engaging educational installations.

Geographically, market growth patterns show clear differentiation in technological adoption rates and regulatory environments. The high demand for premium, custom installations in regions like North America and Western Europe contrasts with the emerging mass-market potential for standardized, cost-effective solutions in rapidly urbanizing regions of Asia Pacific. Manufacturers must therefore ensure their product portfolio includes offerings optimized for both high-end specification requirements and cost-sensitive, large-volume project demands. This market structure emphasizes the need for flexible manufacturing and robust global distribution networks to capitalize on both mature and emerging market opportunities effectively.

- By Installation Type:

- Permanent Installation

- Rental/Temporary Installation

- By Pixel Pitch:

- P3 and Below (High Resolution)

- P4 - P6 (Medium Resolution)

- P6 and Above (Standard Resolution)

- By Application:

- Entertainment and Events (Concerts, Stages, Nightclubs)

- Retail and Commercial Spaces (Flagship Stores, Shopping Malls)

- Corporate and Public Spaces (Lobbies, Museums, Airports)

- Education and Institutional (Museums, Interactive Learning Centers)

- By Component:

- Hardware (Tiles, Controllers, Sensors)

- Software and Services (Content Management Systems, Installation Services, Maintenance)

Value Chain Analysis For Interactive LED Floor Tile Market

The value chain for the Interactive LED Floor Tile Market begins with raw material sourcing and upstream component manufacturing, primarily involving the production of high-brightness LEDs, specialized tempered glass or polycarbonate surfaces for durability, and advanced sensor technologies (capacitive, resistive, or pressure-sensitive arrays). Upstream analysis reveals that supply chain vulnerabilities exist in the semiconductor and LED chip segments, which are often concentrated in specific geographical areas, necessitating robust inventory management and strategic supplier relationships for tile manufacturers. The subsequent stage involves the highly technical process of module assembly, integrating the LED matrices, control boards, protective housing, and sensor layers into the final tile product, requiring specialized clean room facilities and precision engineering to ensure high IP ratings and load-bearing strength.

Downstream analysis focuses heavily on solution integration, distribution, and end-user engagement. Distribution channels are typically specialized, relying on high-value B2B relationships. Direct sales models are often preferred for large, custom permanent installations where manufacturers engage directly with architects, system integrators, and venue owners to manage complex specification requirements and installation logistics. Indirect distribution, leveraging value-added resellers (VARs) and rental companies, is vital for reaching smaller commercial projects and fulfilling the high volume demands of the temporary events market. These downstream partners provide crucial services, including content creation, technical installation, on-site maintenance, and post-sales support, bridging the technical gap between complex hardware and the end-user's application needs.

The profitability across the value chain shifts depending on the stage. Component suppliers operate on high-volume, moderate margins, while the module manufacturing stage requires significant capital expenditure but yields higher margins for specialized, certified products. The greatest value capture often occurs at the integration and services level, particularly for sophisticated software and content creation services, which command premium pricing. Efficiency in the value chain is increasingly determined by the seamless integration of hardware production with software platforms, moving toward providing integrated ecosystems rather than fragmented components. This push necessitates stronger collaboration between hardware firms and software developers, ensuring plug-and-play functionality and robust analytic capabilities for the final buyer.

Interactive LED Floor Tile Market Potential Customers

Potential customers for Interactive LED Floor Tiles are diverse but primarily concentrated within sectors aiming to maximize public engagement, visual impact, and environmental interactivity. End-users fall broadly into three main categories: commercial entertainment venues, public and institutional spaces, and high-end retail brands. Commercial entertainment—including concert promoters, theater companies, theme park operators, and nightlife establishments—are key buyers, leveraging the tiles for immersive stage designs, dynamic dance floors, and queue-line entertainment. These customers prioritize high refresh rates, vibrant color reproduction, and extreme durability against continuous foot traffic and environmental stress, often opting for rental models for short-term events and permanent installations for fixed venues.

The retail and corporate sector constitutes another major customer base. Retailers, particularly luxury brands and large department stores, utilize interactive floors as central marketing tools—displaying dynamic product information, generating unique in-store experiences, and creating memorable brand activations. Corporate clients implement these tiles in lobbies, innovation centers, and exhibition booths to project a technologically advanced image, facilitate dynamic wayfinding, and engage visiting stakeholders. These installations demand high aesthetic quality, seamless integration with architectural design, and reliable, long-term operational guarantees, favoring permanent installation solutions with comprehensive service contracts.

Public sector and institutional buyers, such as museums, airports, art galleries, and municipal authorities involved in smart city planning, are increasingly adopting interactive flooring for functional and educational purposes. In these environments, the tiles serve for interactive educational exhibits, emergency wayfinding systems, and general public information display systems. Their purchasing criteria often emphasize longevity, compliance with safety regulations (slip resistance, fire rating), and energy efficiency. Identifying these distinct customer needs—ranging from the high-impact temporary demand of entertainment to the long-term reliability required by infrastructure projects—is crucial for manufacturers to tailor specific product lines, such as ultra-robust, high-load tiles for public transport versus high-pixel density screens for luxury retail displays.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 million |

| Market Forecast in 2033 | $605.9 million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Barco, Absen, Daktronics, Unilumin, Leyard, PixelStage Inc., GLP German Light Products, BrightWalk Technologies, Interactive Surfaces Ltd., LED-Flow Solutions, XYZ Display Corp., Pro-Display Systems, Show LED, Infinitus Technologies, SiliconCore Technology, Lopu Co. Ltd., VUE Audiovisual, Novastar, Coolux, Shenzhen LightS Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Interactive LED Floor Tile Market Key Technology Landscape

The Interactive LED Floor Tile market is defined by a confluence of hardware and software innovations aimed at improving durability, visual performance, and interaction capabilities. Core technological advancements center on developing ultra-robust, high-load-bearing surface materials, primarily thick tempered glass or specialized composite plastics, engineered to withstand significant static and dynamic pressure while maintaining optical clarity. The critical component is the integrated sensing technology, which increasingly moves beyond simple pressure sensors to incorporate advanced multi-touch and proximity sensing, sometimes leveraging infrared or camera-based tracking systems embedded within the tile structure to detect more nuanced gestures and movement patterns. This improved sensor fidelity allows for richer, more complex interactive content creation and greater data harvesting potential.

In terms of display technology, the industry is witnessing a steady trend toward smaller pixel pitch (P3 and P4), enabling floor screens to display high-definition video content suitable for close viewing distances common in retail environments. Furthermore, LED performance improvements focus on achieving higher brightness levels (essential for visibility in well-lit public spaces and outdoor installations) and enhanced color uniformity over the product's lifespan. Significant innovation is also directed toward modular connector systems that ensure rapid, seamless assembly and breakdown for rental applications, alongside specialized waterproofing and thermal management systems that address the challenges of heat dissipation inherent in high-density LED arrays encapsulated beneath protective layers.

The software landscape is equally critical, moving toward centralized, cloud-based Content Management Systems (CMS) that allow for remote deployment, scheduling, and real-time monitoring of content across multiple installations. The integration of Application Programming Interfaces (APIs) and Software Development Kits (SDKs) is enabling third-party developers to create bespoke interactive experiences, linking the floor display capabilities to external systems like corporate databases, social media feeds, or gaming engines. The most advanced technological differentiator lies in the integration of edge computing capabilities within the tile controllers themselves, allowing for immediate processing of sensor data for instantaneous, low-latency interaction responses, which is crucial for dynamic applications like interactive gaming and responsive physical navigation systems.

Regional Highlights

The Interactive LED Floor Tile Market exhibits distinct developmental maturity and growth dynamics across global regions, heavily influenced by local economic factors, technological adoption rates, and cultural emphasis on experiential design.

- North America: This region maintains a leading position, characterized by high spending on premium interactive solutions in the entertainment, corporate, and high-end retail sectors. The presence of major global event organizers, advanced architectural firms, and early technology adopters drives the demand for high-specification, custom-engineered permanent installations. The focus here is on integration with existing smart infrastructure and leveraging data analytics derived from interactive floor usage, supporting strong growth in both hardware sales and high-margin service contracts.

- Europe: Europe represents a mature market with significant demand, particularly from countries like Germany, the UK, and France. Demand is driven by historic venues requiring innovative, yet discreet, digital integration, as well as a robust calendar of international trade shows and music festivals necessitating high-quality rental equipment. Sustainability and energy efficiency are key purchasing criteria in this region, pushing manufacturers toward developing more energy-efficient and recyclable tile components.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. This explosive growth is fueled by massive urbanization projects, government investment in smart city infrastructure (especially in China, Japan, and South Korea), and the rapid expansion of entertainment complexes, theme parks, and mega-malls. While price sensitivity exists, the sheer volume of new construction projects ensures high market potential. Manufacturers focus on scalable, high-volume production models to cater to the region’s diverse requirements.

- Latin America (LATAM): LATAM is an emerging market experiencing steady growth, concentrated primarily in major urban centers and high-tourist areas (Brazil and Mexico). Adoption is often linked to large international events, sports arenas, and luxury brand retail expansions. Market penetration is slower compared to North America due to investment constraints, but the inherent desire for innovative marketing displays drives niche demand for impactful temporary and permanent installations.

- Middle East and Africa (MEA): Growth in the MEA region is sporadic but significant, largely tied to major infrastructural developments, high-profile global events (e.g., World Expos, major sports tournaments), and luxury retail developments in the Gulf Cooperation Council (GCC) countries. These projects often demand the highest specifications in terms of brightness, durability, and customization, supporting a premium pricing structure for key market players providing cutting-edge technology and installation expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Interactive LED Floor Tile Market, characterizing their strategic initiatives, product portfolios, and regional presence. These companies are instrumental in defining technological standards and driving market adoption through continuous innovation in display quality, sensing technology, and system integration.- Barco

- Absen

- Daktronics

- Unilumin

- Leyard

- PixelStage Inc.

- GLP German Light Products

- BrightWalk Technologies

- Interactive Surfaces Ltd.

- LED-Flow Solutions

- XYZ Display Corp.

- Pro-Display Systems

- Show LED

- Infinitus Technologies

- SiliconCore Technology

- Lopu Co. Ltd.

- VUE Audiovisual

- Novastar

- Coolux

- Shenzhen LightS Technology

Frequently Asked Questions

Analyze common user questions about the Interactive LED Floor Tile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan and required maintenance for interactive LED floor tiles?

The operational lifespan of interactive LED floor tiles generally ranges from 50,000 to 100,000 hours, comparable to standard commercial LED displays. Maintenance typically involves routine surface cleaning, calibration checks, and periodic replacement of individual LED modules or sensor components, which is crucial for maintaining interaction responsiveness and visual uniformity. Modern modular designs facilitate faster, less invasive repairs.

Are interactive LED floor tiles safe to walk on, and what is their load-bearing capacity?

Yes, interactive LED floor tiles are specifically engineered for high-traffic environments and feature tempered glass or robust polycarbonate surfaces that are highly slip-resistant and durable. Premium tiles are typically rated to withstand static loads exceeding 1,000 kg/sqm, ensuring safety and integrity even under heavy pedestrian traffic, vehicles, or stage equipment, meeting stringent international safety standards.

How do interactive LED floor systems integrate with existing venue infrastructure?

Interactive LED floor systems typically interface via specialized control units and Content Management Systems (CMS) using standard digital video inputs (like HDMI or DisplayPort) and network protocols (Ethernet, Wi-Fi). Advanced systems often provide open APIs and SDKs, enabling seamless integration with building automation systems, security cameras, lighting rigs, and third-party sensory inputs for synchronized, large-scale multimedia experiences.

What are the primary factors contributing to the high cost of interactive LED flooring?

The high cost stems primarily from the specialized, integrated components required: ultra-durable, load-bearing protective surfaces; high-density, high-brightness LEDs; complex embedded sensor arrays for real-time interaction; and advanced thermal management systems necessary to dissipate heat beneath the protective layers. Custom software development and highly specialized installation expertise further contribute to the initial investment.

Which applications yield the highest return on investment (ROI) for interactive floor tiles?

Applications in experiential retail and high-profile marketing events tend to yield the highest ROI by significantly boosting customer engagement, increasing dwell time, generating positive social media exposure, and providing granular, actionable data on consumer behavior and floor traffic patterns. This operational and marketing intelligence justifies the initial capital expenditure through demonstrable increases in brand recall and sales performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager