Interior Wood Doors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443426 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Interior Wood Doors Market Size

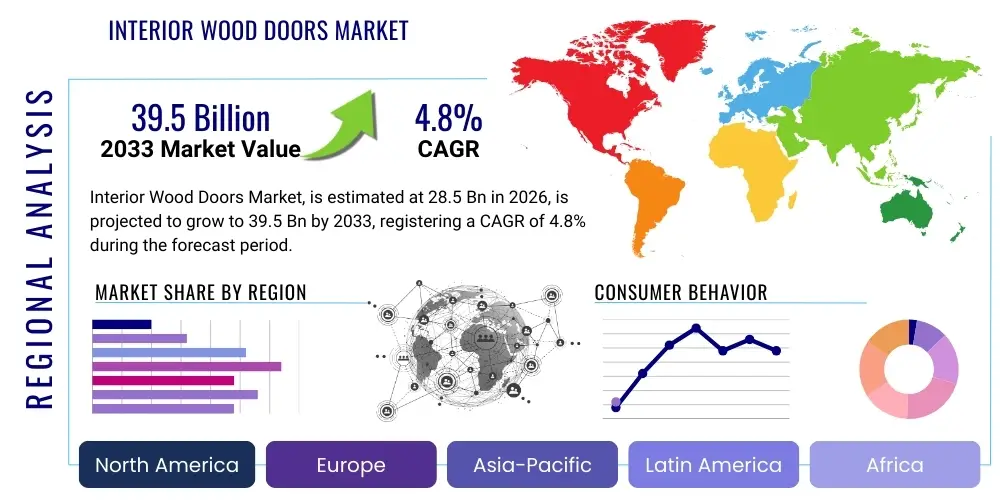

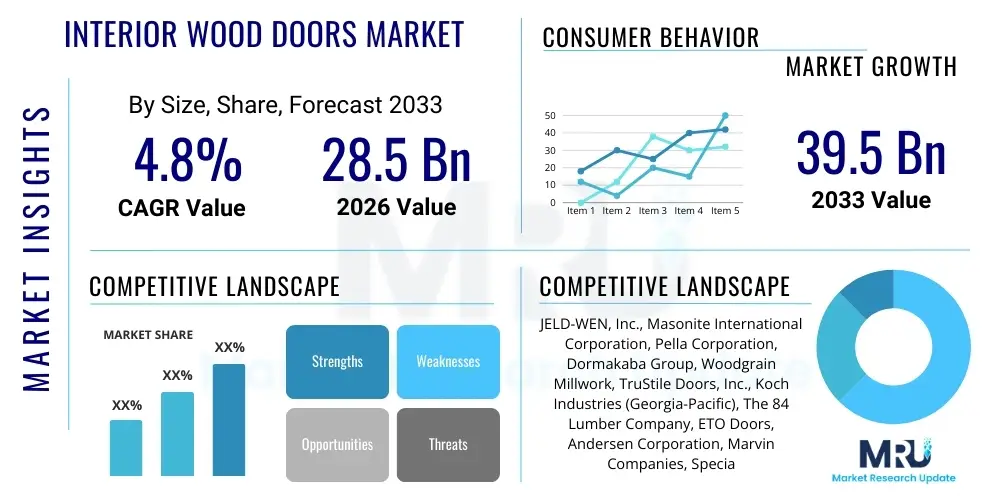

The Interior Wood Doors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 39.5 Billion by the end of the forecast period in 2033.

Interior Wood Doors Market introduction

The Interior Wood Doors Market encompasses the manufacturing, distribution, and sale of internal door systems primarily constructed from wood or sophisticated wood composite materials designed for deployment within residential, commercial, and institutional structures. These products serve multifaceted roles that extend beyond simple access, critically influencing interior aesthetics, acoustic isolation, and fire compartmentalization within buildings. The expansive product portfolio ranges from luxurious, custom-made solid hardwood stile and rail doors, favored for high-end properties due to their inherent structural stability and timeless visual appeal, to highly engineered, volume-produced hollow core and molded composite doors, which offer an optimal balance of cost-efficiency, weight management, and resistance to environmental stress, particularly warping and shrinking.

Global market growth is intrinsically linked to the macroeconomic performance of the construction and real estate sectors worldwide, with significant cyclical dependencies on interest rates, consumer confidence, and governmental infrastructure spending. A primary driver of sustained demand originates from the burgeoning residential renovation and repair (R&R) segment across North America and Europe, where aging housing stock necessitates replacement and aesthetic upgrades. Furthermore, the rapid pace of urbanization and the subsequent surge in multi-family and high-density housing developments across Asia Pacific provide a massive installed base for standardized, high-performance interior door solutions. Manufacturers are continually investing in research and development to enhance door performance, particularly focusing on improving sound transmission class (STC) ratings to meet the rising demand for quiet interior environments in dense urban settings and high-traffic commercial buildings like hotels and corporate centers. This technical sophistication distinguishes modern wood doors from earlier iterations.

The core benefits of selecting interior wood doors include their inherent aesthetic flexibility, allowing for paint-grade or stain-grade finishes that match any architectural style, from classical to ultra-modern minimalism. Wood also possesses natural thermal insulating properties, contributing marginally to overall building energy efficiency. Critical driving factors underpinning future market expansion include the increasing consumer preference for sustainable and natural building materials, leading to higher adoption rates of FSC-certified timber and rapidly renewable wood composites. Concurrently, technological advancements in door manufacturing, such as precision routing, automated finishing, and the development of superior bonding agents, have dramatically improved the product lifespan and structural integrity. This combination of aesthetic appeal, performance enhancement, and environmental compliance firmly positions wood doors as the dominant choice for interior applications globally, despite competition from non-wood substitutes like tempered glass and metal alloys.

Interior Wood Doors Market Executive Summary

The global Interior Wood Doors Market is navigating a phase of intense technological refinement and geographical diversification. Leading business trends emphasize consolidation, with major players pursuing strategic mergers and acquisitions to capture specialized manufacturing capabilities, particularly in the production of fire-rated and acoustic door systems, and to expand penetration into fast-growing regions. A significant operational shift involves the digitalization of the customer experience, ranging from AI-powered design tools for custom specification to the deployment of integrated logistics platforms that ensure timely, site-specific delivery. Competition is intensifying in the mid-range segment, prompting manufacturers of engineered doors to focus on optimizing material efficiency and adopting lean manufacturing techniques to maintain competitive pricing while mitigating the impact of volatile raw material costs, specifically in timber and adhesive markets.

Regionally, the dynamics are highly differentiated. North America and Europe, though slower in new construction volume growth, command higher Average Selling Prices (ASP) due to a strong emphasis on premium customization, demanding compliance with strict energy efficiency and fire safety codes, and a robust replacement market driven by consumer desire for higher-end architectural features. Conversely, Asia Pacific not only leads in new construction volume but is also rapidly adopting localized production capabilities for complex engineered doors, moving away from simple hollow core models towards superior solid core and veneer products suitable for high-rise residential and commercial development. Emerging regions, including the Middle East and Latin America, are characterized by large-scale, high-specification project demand, often requiring specialized, climate-resistant door products that can withstand extreme temperature variations and humidity levels without warping or cracking, highlighting a niche for specialized material science expertise.

In terms of segmentation, the most pronounced trend is the market’s reliance on the composite wood segment, driven by its structural consistency, environmental stability, and economic viability for mass production. Solid core construction, regardless of the outer skin material (veneer, laminate, or paint-grade HDF), is gaining traction across residential and commercial sectors due to heightened regulatory focus on acoustic separation and passive fire protection. The commercial end-user segment, while smaller in volume than residential, accounts for disproportionately higher revenue due to the complexity and required certification levels of its products. Distribution is increasingly polarized, with specialized distributors offering value-added services like pre-hanging, hardware fitting, and job-site logistics support for contractors, contrasting with the high-volume, standardized product flow through major retail home centers catering to the DIY and smaller builder markets, necessitating highly robust and diverse supply chain infrastructures.

AI Impact Analysis on Interior Wood Doors Market

The introduction of Artificial Intelligence (AI) and Machine Learning (ML) methodologies is fundamentally restructuring traditional wood door manufacturing and specification processes, transforming what was once a craft-intensive industry into a highly precise, data-driven operation. Core industry inquiries center around AI’s capacity to achieve unprecedented levels of material optimization, particularly in the initial timber cutting and veneer matching stages, where historical manual processing often resulted in significant material waste due to natural wood variations. Users are seeking robust solutions for minimizing input material variances and maximizing yield from expensive hardwoods, translating directly into enhanced profitability and stronger sustainability credentials. Furthermore, the role of AI in predictive quality assessment is a major focus, specifically its ability to analyze complex finish textures and dimensional metrics in real-time on the production line, maintaining exacting standards necessary for export and high-specification projects.

AI’s influence extends critically into the highly complex logistics and supply chain management aspects of the industry. Given the global nature of raw material sourcing—with timber often originating from diverse geographical locations—AI systems are deployed to model geopolitical risks, trade tariff impacts, and fluctuating environmental factors, providing superior price forecasting for core commodities like specific timber species and petroleum-based adhesives. This proactive risk modeling allows major manufacturers to secure long-term contracts and optimize inventory levels to buffer against rapid cost inflation. Moreover, AI-powered demand forecasting integrates real-time housing start data, building permit issuances, and seasonal sales cycles to provide highly accurate production schedules, thus reducing warehouse storage costs and improving responsiveness to sudden market shifts, a significant competitive advantage in a sector defined by long lead times.

In the realm of customer interaction and product design, AI is pioneering customized solutions at scale. Generative Design tools enable architects and homeowners to input specific constraints—such as room dimensions, desired acoustic rating, preferred aesthetic style, and budget limits—and receive optimized, technically viable door designs almost instantaneously. This dramatically cuts down the time required for design iterations, a notorious bottleneck in custom projects. Furthermore, digital sales platforms utilize ML algorithms to analyze customer interaction data, providing highly personalized recommendations for hardware, finishes, and door types, significantly enhancing conversion rates both online and through professional distributor networks. This transformation ensures that customization, historically a premium service, becomes economically feasible across a broader range of product tiers, broadening market access and consumer choice.

- AI-driven optimization of raw material yield during timber cutting and veneer slicing, minimizing waste percentages.

- Predictive maintenance schedules implemented for high-precision CNC routers, laminators, and press lines, significantly increasing overall equipment effectiveness (OEE).

- Generative Design algorithms accelerating bespoke door design, seamlessly integrating complex functional constraints such as fire resistance and sound transmission class (STC) ratings.

- Enhanced quality control systems utilizing high-speed computer vision and machine learning models to detect subtle defects in finishes, veneer grain matching, and dimensional tolerances with superhuman accuracy.

- Optimized dynamic inventory management and complex global logistics forecasting, mitigating the risk associated with volatile wood and composite pricing.

- Personalized digital showroom experiences using AI to recommend suitable door styles and custom hardware configurations based on project inputs and buyer psychological profiling.

- Automated compliance checking systems ensuring manufactured doors meet various global building codes (e.g., ADA, NFPA, EN standards) before physical production begins.

- Robot integration guided by AI in hazardous and repetitive tasks such as heavy lifting, sanding, and automated paint application, improving worker safety and product finish consistency.

DRO & Impact Forces Of Interior Wood Doors Market

The core drivers fueling the growth of the Interior Wood Doors Market include the accelerating rate of global urbanization, particularly in high-growth zones of Asia and Africa, which necessitates massive residential construction programs. This foundational demand is compounded by global regulatory trends emphasizing enhanced safety and comfort, specifically the widespread adoption of stricter fire codes (requiring certified mineral-core and intumescent-sealed doors) and higher mandated acoustic performance standards, crucial for multi-family dwellings, hospitals, and educational facilities. These regulatory mandates compel manufacturers to innovate and produce higher-specification, higher-margin engineered door products, replacing lower-performing commodity items. Furthermore, the robust consumer trend towards aesthetic upgrades and sustainability certifications (e.g., using low-VOC finishes and responsibly sourced materials) continuously drives demand in the premium replacement and renovation market segment, sustaining pricing power even during construction downturns.

Significant restraints challenge sustained market expansion, most prominently the pervasive instability in the global raw material supply chain. Fluctuations in the availability and pricing of quality lumber, plywood, and specialized core materials are heavily influenced by climate events, geopolitical trade restrictions, and surging global demand from competing industries. This volatility compresses manufacturer margins and complicates fixed-price contract negotiations. Secondly, the persistent threat of substitution from alternative materials, such as lightweight aluminum frames, PVC, and specialized engineered plastics, remains a restraint, particularly in applications where cost-effectiveness and resistance to extreme moisture exposure outweigh traditional wood aesthetics. Finally, the skilled labor shortage in installation and finishing trades poses a logistical constraint, slowing down project completion and occasionally resulting in improper installation that compromises the functional integrity of performance-rated wood doors.

Opportunities for strategic growth are concentrated in the rapid technological adoption of smart home integration and the development of sustainable, circular economy solutions. The rising proliferation of smart access control systems (biometric scanning, keyless entry) creates a demand for wood door solutions that can seamlessly integrate these complex electronic components without compromising structural integrity or aesthetic appeal. Simultaneously, manufacturers have a significant opportunity to develop advanced wood composite materials using recycled content or rapidly renewable materials, aligning with corporate sustainability goals and securing preferential supplier status with green building projects. Targeting underserved regional markets in the Middle East and Latin America with specialized, climate-resilient engineered products, coupled with building localized distribution and servicing networks, represents a substantial long-term strategic avenue for differentiated market penetration and high-margin revenue generation.

Segmentation Analysis

The Interior Wood Doors Market is highly fragmented and analyzed through several critical dimensions, including material type, door functionality, end-user application, and construction method. Understanding these segments is crucial for manufacturers tailoring their product portfolios and for investors assessing market risk and growth potential. The shift toward engineered and composite materials is fundamentally altering the market share distribution, prioritizing stability and cost over traditional aesthetics in certain high-volume applications. Residential construction remains the largest segment volume-wise, but commercial and institutional projects dictate the pace of technological innovation due to stringent regulatory compliance demands for fire safety and accessibility.

Segmentation by material (e.g., solid wood, composite wood, veneer) reflects the price sensitivity and performance requirements of the end-user. Solid wood doors command a premium for high-end residential and heritage renovation projects, valued for their natural beauty and longevity. However, composite wood doors, leveraging materials like HDF and particleboard cores with high-quality skins, dominate the mass market due to superior resistance to warping and lower production costs. Functionality segmentation highlights the increasing demand for specialized products, including acoustic doors essential for recording studios and hotel rooms, and fire-rated doors mandated for egress pathways in public buildings, demonstrating higher margin potential.

The market structure is also segmented by sales channels, primarily differentiating between direct sales to large construction enterprises (project-based sales) and indirect sales through retail distributors, home improvement stores, and specialized dealers. The growth of specialized contractors focused on interior finishing has elevated the role of dealers who can offer customization services and complex installation support. This intricate segmentation requires manufacturers to maintain flexible production lines capable of switching between high-volume standard products and low-volume, high-specification custom orders rapidly, adapting to diverse global market demands and localized building standards.

- By Material:

- Solid Wood Doors (Hardwood, Softwood)

- Engineered/Composite Wood Doors (Hollow Core, Solid Core)

- Molded Wood Doors (MDF, HDF Skins)

- Veneer Doors (Natural Veneer, Engineered Veneer)

- Laminate Doors

- By Door Type/Functionality:

- Panel Doors (Flush, Stile and Rail)

- Bifold/Multifold Doors

- Sliding Doors (Pocket Doors, Barn Doors)

- French Doors/Glass Insert Doors

- Security Doors

- By End-User:

- Residential (Single-family, Multi-family, R&R)

- Commercial (Office Space, Retail, Hospitality)

- Institutional (Healthcare, Education, Government)

- By Distribution Channel:

- Direct Sales (B2B Project Sales)

- Indirect Sales (Retail, Wholesale, E-commerce)

- By Core Type:

- Solid Core (Particleboard, Wood Fiber)

- Hollow Core

- Mineral Core (Fire Rated)

- Acoustical Core

Value Chain Analysis For Interior Wood Doors Market

The upstream segment of the Interior Wood Doors Value Chain is dominated by complex sourcing and primary processing activities. This segment includes responsible harvesting and timber management, followed by sawmilling, veneer cutting, and drying processes. Securing certified, high-grade lumber and veneer is a critical cost driver, particularly as environmental regulations necessitate stricter traceability and sustainable practices, leading to higher scrutiny on global suppliers. Key inputs, including advanced resins, adhesives (critical for engineered core stability), and specialized hardware (hinges, locks, closures), also define the quality and cost structure early in the chain. Manufacturers capable of partial backward integration, such as operating their own veneer preparation facilities, gain a competitive edge by controlling quality, reducing transportation costs, and buffering against volatile raw material price increases, enabling them to offer superior stability and consistency in their finished products compared to relying purely on external commodity suppliers.

The manufacturing and midstream segment centers on efficient, precision fabrication. This involves the transformation of raw materials into finished door units, encompassing core material construction (e.g., solid core lamination, mineral core insertion), cutting, edging, assembling the stile and rail components, and applying sophisticated finishes. High-capital investment in automated technology, such as specialized door pre-hanging equipment and robotic finishing lines, is essential here to meet the stringent dimensional tolerances and finish quality required by modern commercial specifications. Value addition in this stage includes offering specialized certifications (fire rating, acoustic testing) and customization services like pre-machining for specific hardware sets (mortise locks, automatic door closers). Process efficiency, driven by lean manufacturing methodologies and real-time sensor data, dictates the speed of throughput and the final per-unit production cost, making process engineering a core competitive battleground among global producers.

The downstream distribution and sales segment is characterized by diversified channels tailored to different customer types. Direct sales are primarily handled via specialized commercial sales teams targeting large general contractors, architects, and institutional developers, where the sales cycle is long but volumes are high and specifications are complex. Indirect channels rely on established networks of wholesale distributors, independent door and window dealers, and high-volume home improvement retailers. Distributors often manage crucial inventory buffers and provide vital pre-installation services, such as final sizing, frame assembly, and local delivery. Installation and post-sales support form the final critical component, as proper fitting is essential for the door's functional performance, especially fire-rated systems. Consequently, strong partnerships with certified installation contractors are crucial for maintaining brand reputation and ensuring compliance with manufacturer warranties and building safety standards.

Interior Wood Doors Market Potential Customers

The residential construction sector represents the foundational demand segment, encompassing both new single-family and multi-family housing projects, as well as the robust renovation and repair (R&R) market. Residential builders, whether large-scale national constructors or small custom home builders, are high-volume purchasers of interior wood doors. Decisions in this segment are typically balanced between aesthetic requirements (e.g., panel styles, trim profiles) and budget constraints, often favoring cost-effective, durable engineered wood doors like molded composite or veneered solid core options. Homeowners, particularly those engaged in high-end remodels, constitute a specialized sub-segment prioritizing customized, high-quality solid wood or exotic veneer doors, focusing heavily on brand reputation, finish consistency, and the integration of specialized hardware, viewing the door as a critical architectural design element rather than just a functional barrier.

The commercial end-user category is characterized by demanding performance criteria and high purchasing power. This segment includes developers and facility managers for hospitality (hotels, resorts), corporate offices, retail complexes, and mixed-use commercial developments. Purchases are governed by stringent regulatory compliance, requiring doors with certified fire ratings, superior acoustic insulation (essential for guest privacy and office productivity), and high resistance to wear and tear due to high traffic volumes. These professional buyers require detailed technical documentation, comprehensive warranty packages, and customized logistics planning for large project rollouts, favoring manufacturers who can provide integrated door-frame-hardware packages and maintain precise delivery schedules aligned with complex construction timelines. The specification process is heavily influenced by architectural and engineering consultants who mandate adherence to specific technical performance standards.

The institutional sector—including public and private hospitals, educational facilities (schools and universities), and government buildings—represents the most stringent customer base. These entities require doors that meet the highest levels of durability, security, and specialized compliance standards, such as accessibility requirements (ADA) and severe-use fire protection protocols. Purchasing decisions in this sector often emphasize longevity, low maintenance requirements, and standardized componentry for easy replacement and repair over decades of use. Furthermore, many institutional buyers prioritize manufacturers with strong track records in sustainability and ethical sourcing, aligning procurement decisions with broader public policy goals. This segment requires a highly specialized sales force capable of navigating complex public bidding processes and addressing highly technical performance inquiries related to safety and building codes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 39.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JELD-WEN, Inc., Masonite International Corporation, Pella Corporation, Dormakaba Group, Woodgrain Millwork, TruStile Doors, Inc., Koch Industries (Georgia-Pacific), The 84 Lumber Company, ETO Doors, Andersen Corporation, Marvin Companies, Specialty Building Products, Inc., Lynden Door, Inc., Premdor Inc., Madero Doors and Hardware, Lemieux Doors, VT Industries, Inc., Allegion plc, Heritage Millwork Inc., Coastal Industries, Milgard Windows & Doors, Simpson Door Company, Steves & Sons, Inc., Setra Group AB, Huttig Building Products, Sun Mountain Custom Doors. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Interior Wood Doors Market Key Technology Landscape

The Interior Wood Doors Market is heavily reliant on cutting-edge woodworking and material science technologies to deliver products that meet modern performance and aesthetic demands. One of the paramount technological innovations is the advancement in adhesive and bonding chemistry, crucial for the structural integrity of engineered wood products. New, formaldehyde-free, high-strength polyurethane and emulsion polymer isocyanate (EPI) adhesives provide superior water resistance and structural stability for solid core laminations and veneer application, ensuring doors resist warping and delamination even in high-humidity environments. This shift directly addresses the environmental concerns associated with older adhesive technologies and allows manufacturers to meet stringent air quality standards globally, positioning them competitively in green building projects requiring low-emitting materials.

Further process optimization is being achieved through the comprehensive deployment of multi-axis CNC routing and robotic automation. These highly precise machines allow for the rapid, error-free fabrication of complex door designs, including specialized grooves for sound seals, precise mortises for complex hardware, and elaborate panel profiles characteristic of stile and rail construction. Automation is not only accelerating production cycles but also enabling mass customization, where individual design variations can be executed efficiently without retooling major lines, greatly reducing the high cost and long lead times traditionally associated with bespoke architectural doors. Furthermore, integrated optical scanning and measurement systems operate in conjunction with CNC machines, dynamically adjusting cutting paths based on minor imperfections or variations in the natural wood grain, maximizing material yield and ensuring consistent final dimensions across large product batches.

The technology landscape also includes significant innovation in surface finishing and preservation. Electrostatic and robotic spraying systems utilize advanced, two-component polyurethane or acrylic coatings, which offer exceptional scratch resistance, UV stability, and chemical resistance, extending the door’s functional lifespan, particularly important for high-traffic commercial installations. The movement towards specialized acoustical and fire-retardant core technologies, often involving lightweight mineral compositions or proprietary wood treatments, is a key area of differentiation. These technologies are constantly being refined to reduce overall door weight while increasing their passive safety performance, reflecting the market’s responsiveness to evolving building safety codes and the demand for lightweight, high-performance building envelope components that facilitate easier installation and maintenance within large, complex building projects.

Regional Highlights

- Asia Pacific (APAC): The APAC market dominates in sheer volume potential, driven by an urbanization rate that mandates millions of new residential units annually, particularly in Tier 1 and Tier 2 cities across China, India, and Indonesia. The demand is segmented, with a vast requirement for cost-effective, durable hollow core and standardized HDF doors for high-rise apartments, juxtaposed against a rapidly expanding ultra-luxury segment demanding imported, custom European or North American style solid wood doors and exotic veneers. Local manufacturers are heavily investing in modernizing their production facilities, adopting technology transfers from Western partners to improve dimensional consistency and achieve international performance certifications, specifically for fire safety, to compete for high-value commercial contracts, signaling a shift from commodity production to engineered performance.

- North America: Defined by market maturity and consumer focus on quality, the North American market exhibits strong resilience driven by the high volume of home renovation and remodeling projects, often valued significantly higher than new construction sales. The market’s technological trajectory is heavily influenced by the push for smart home integration, requiring doors compatible with advanced security and automation systems. Manufacturers here focus on providing comprehensive product lines, including doors pre-finished with specific hardware and pre-hung frames to simplify installation for contractors. Furthermore, the region places a high premium on domestically sourced, certified wood products, and innovative composite materials designed to exceed strict regional energy efficiency codes and endure seasonal temperature extremes without structural failure.

- Europe: The European Interior Wood Doors Market is a leader in environmental compliance and advanced technical specification. The market is highly regulated, favoring products with full traceability and low environmental impact, adhering strictly to standards set by the EU Timber Regulation (EUTR) and various national energy performance directives. Demand concentrates on sophisticated, concealed-frame doors (flush aesthetics) and high-performance technical doors (acoustic, security, and fire-rated). Germany, the UK, and the Nordic countries lead in the adoption of prefabricated, highly industrialized door systems that simplify on-site labor and ensure minimal tolerance levels, essential for high-quality, long-lasting commercial and public sector buildings undergoing extensive refurbishment.

- Latin America: This region presents fragmented but potentially explosive growth opportunities, largely dependent on macroeconomic stability in key economies like Brazil, Mexico, and Chile. The primary market driver is the construction of middle-income housing, favoring locally sourced softwoods and cost-optimized engineered solutions. The commercial and hospitality sectors in major metropolitan areas, however, exhibit demand for international standards and premium materials, often necessitating imports or specialized local manufacturing joint ventures. Investment challenges include fluctuating local currency values impacting the cost of imported machinery and adhesives, necessitating strong localized procurement strategies and efficient internal logistical networks to manage geographically diverse project sites efficiently across diverse climatic zones.

- Middle East and Africa (MEA): The MEA market is characterized by high demand for architectural statement doors in hospitality, luxury residential, and large-scale government developments, often centered in the GCC states. The extreme climatic conditions—intense heat and high humidity—mandate specialized product engineering, requiring superior sealants, highly stable engineered cores (to prevent warping), and heat-resistant finishes, often driving up production complexity and cost. Africa presents a dual market: high-end imported doors for elite properties and mass demand for basic, durable low-cost solutions for rapidly constructed urban housing. Key opportunities involve developing manufacturing capabilities that specialize in climate-specific, high-performance composite wood doors tailored to regional construction standards and aesthetic preferences for large, impactful entryway designs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Interior Wood Doors Market.- JELD-WEN, Inc.

- Masonite International Corporation

- Pella Corporation

- Dormakaba Group

- Woodgrain Millwork

- TruStile Doors, Inc.

- Koch Industries (Georgia-Pacific)

- The 84 Lumber Company

- ETO Doors

- Andersen Corporation

- Marvin Companies

- Specialty Building Products, Inc.

- Lynden Door, Inc.

- Premdor Inc.

- Madero Doors and Hardware

- Lemieux Doors

- VT Industries, Inc.

- Allegion plc

- Heritage Millwork Inc.

- Coastal Industries

- Milgard Windows & Doors

- Simpson Door Company

- Steves & Sons, Inc.

- Setra Group AB

- Huttig Building Products

- Sun Mountain Custom Doors

Frequently Asked Questions

Analyze common user questions about the Interior Wood Doors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between solid core and hollow core wood doors, and when should each be used?

Solid core doors utilize a dense, often engineered wood or particleboard filling, providing superior noise reduction, thermal insulation, and fire resistance, making them mandatory for high-traffic, institutional, and multi-family residential applications. Hollow core doors, constructed with an internal cardboard structure, are significantly lighter and more economical, suitable primarily for low-traffic, budget-sensitive residential interiors where high acoustic or safety performance is not a primary concern, offering ease of installation due to their minimal weight.

How is sustainability impacting the selection and manufacturing of interior wood doors?

Sustainability is a core purchasing driver, emphasizing the demand for doors manufactured from FSC-certified or PEFC-certified timber, ensuring responsible forest management. Manufacturers are rapidly adopting low-VOC (Volatile Organic Compound) finishes and adhesives to comply with stringent environmental standards like LEED and WELL Building certifications. This focus ensures products are environmentally sound, reducing off-gassing and supporting circular economy objectives through the use of recycled wood composites in the core construction.

Which geographical region exhibits the fastest growth potential in the interior wood doors market, and what drives this acceleration?

The Asia Pacific (APAC) region is projected to experience the fastest growth, primarily driven by massive, sustained urbanization, resulting in unprecedented levels of new residential and commercial construction in economies like China, India, and Southeast Asia. This growth is accelerating due to governmental infrastructure spending and a rapidly expanding middle class demanding better quality, durable interior fittings that align with modern safety and aesthetic standards, shifting demand towards high-volume engineered core solutions.

What are the key technological advancements influencing interior wood door production, particularly in efficiency and quality?

Key technological advancements include sophisticated multi-axis CNC routing for mass customization and high precision; integration of IoT sensors for real-time monitoring of manufacturing conditions (humidity, temperature) critical for wood stability; and the implementation of AI-driven computer vision systems for automated, non-destructive quality control of surface finishes and dimensional accuracy, ensuring highly consistent and compliant products at rapid production speeds.

How do fire ratings affect the choice of interior wood doors in commercial settings, and what certifications are essential?

Fire ratings (e.g., 20, 45, 90 minutes) are legal requirements in commercial, healthcare, and educational facilities, necessitating specialized door assemblies utilizing mineral cores and intumescent seals designed to restrict the spread of fire and smoke for a specified time. Essential certifications include compliance with NFPA (National Fire Protection Association) standards in North America or EN standards (European Norms) in Europe, verified by third-party testing organizations like UL (Underwriters Laboratories) or Warnock Hersey, making compliance the highest priority in material specification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager