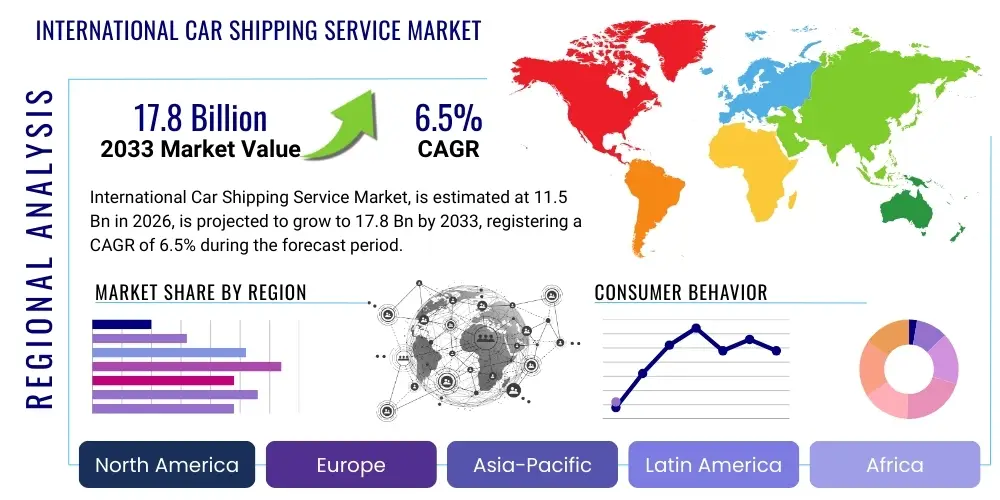

International Car Shipping Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441236 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

International Car Shipping Service Market Size

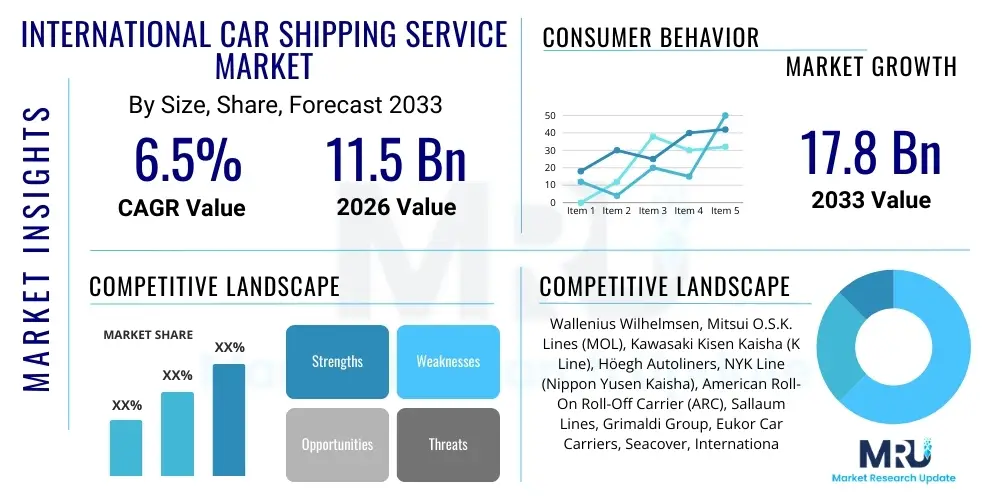

The International Car Shipping Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 17.8 Billion by the end of the forecast period in 2033.

International Car Shipping Service Market introduction

The International Car Shipping Service Market encompasses the specialized logistical planning, handling, and transportation of motor vehicles across international borders, utilizing sophisticated methods primarily involving ocean freight, supplemented by rail and road transport for multimodal solutions. This sector is fundamentally driven by the global structure of the automotive industry, which relies on moving finished products from centralized manufacturing hubs to diverse consumption markets worldwide. Services typically extend beyond mere physical transport to include critical ancillary functions such as meticulous pre-shipment inspections, detailed customs documentation management, marine insurance provision, and final destination handling, ensuring the secure and compliant transfer of high-value assets across complex logistical corridors.

The core product within this market revolves around providing secure, specialized transport capacity tailored to vehicles of all sizes and values, ranging from standard passenger sedans and commercial trucks to specialized heavy equipment and ultra-luxury automobiles. Major applications include enabling global inventory balancing for Original Equipment Manufacturers (OEMs) who manufacture in one region but sell globally, facilitating the robust international trade of used and classic vehicles, and supporting the relocation needs of expatriates and military personnel. The primary benefits derived from these services include mitigating the high risk of damage during long-distance transit, ensuring regulatory adherence in both exporting and importing jurisdictions, and providing scalable, cost-effective solutions that are crucial for maintaining the efficiency and profitability of the global automotive supply chain.

Market expansion is principally driven by several macroeconomic factors, including the increasing globalization of trade, which has fostered complex, interdependent supply chains necessitating reliable international vehicle movement. The surging purchasing power and expanding middle class populations in emerging economies, particularly across Asia Pacific and Latin America, are significantly boosting the demand for both new and quality used imported vehicles. Furthermore, advancements in digital technologies, such as online vehicle auction platforms and B2C sales channels, have simplified cross-border transactions, fueling the need for dependable, traceable, and highly structured international delivery services, thereby accelerating market velocity and demanding constant innovation in operational logistics and customer service models.

International Car Shipping Service Market Executive Summary

The International Car Shipping Service Market is currently navigating a pivotal phase characterized by strong business trends centered on digitalization and resilience. A defining trend is the increasing vertical integration among leading ocean carriers and freight forwarders, aiming to provide seamless door-to-door logistics solutions that incorporate inland transport and local customs clearance, moving away from purely port-to-port services. Furthermore, there is a pronounced shift towards greater supply chain visibility, driven by customer demand for real-time tracking and predictable transit schedules, compelling operators to invest heavily in advanced telematics and integrated planning software. The imperative for environmental sustainability is also reshaping carrier investment, with significant capital expenditure directed towards acquiring dual-fuel and LNG-powered Roll-on/Roll-off (RoRo) vessels to meet stringent global emission standards and satisfy the growing preference of OEMs for green logistics partners.

Regional market analysis reveals that Asia Pacific (APAC) maintains its critical status as the world’s foremost exporting region, underpinned by the automotive manufacturing dominance of Japan, South Korea, and China. This region dictates global pricing and capacity availability for RoRo services. Conversely, North America and Europe, while representing mature logistical environments, serve as high-value import destinations, especially for luxury and specialized vehicles, characterized by demand for premium containerized services and complex regulatory handling. The Middle East and Africa (MEA) region is experiencing rapid growth, fueled by strong consumer demand and its function as a major re-export hub, requiring diverse services that can manage varied port capabilities and specialized clearance procedures across the continent, often prioritizing cost-efficiency over speed.

Segmentation analysis highlights the enduring dominance of the Roll-on/Roll-off (RoRo) segment for bulk volume movements, favored by OEMs and large distributors due to its efficiency and cost structure for standard vehicles. However, the container shipping segment is rapidly expanding its market share, particularly due to the rising demand for shipping electric vehicles (EVs) and high-value classic cars that require specialized security, environmental isolation, and individual handling beyond the standard RoRo environment. The End-User landscape is dominated by the B2B segment (OEMs and dealerships), yet the increasing sophistication of B2C services, catering to individual relocators and the booming online used car trade, is driving segment growth and demanding higher levels of digital interaction and customer support from logistics providers.

AI Impact Analysis on International Car Shipping Service Market

User queries regarding the implementation of Artificial Intelligence (AI) in international car shipping services consistently emphasize three key areas: optimizing operational efficiency, ensuring compliance through automated checks, and significantly enhancing predictive risk management. Users frequently question how AI algorithms can effectively manage the notoriously volatile vessel scheduling by predicting port congestion and weather-related delays with greater accuracy than traditional methods. There is substantial interest in AI’s role in automating the complex and error-prone process of international customs declaration and tariff calculation, seeking guarantees of faster clearance times and reduced administrative costs. Furthermore, high-value cargo owners are exploring AI applications in enhanced security protocols, such as intelligent monitoring systems that detect anomalies indicative of tampering or theft during critical transit phases, thereby mitigating financial exposure and improving service reliability across the fragmented global logistics network.

- AI-driven predictive analytics utilize historical data and current trade flows to forecast cargo demand, enabling carriers to optimize the deployment of specialized RoRo vessels and ensure maximum capacity utilization on key routes.

- Dynamic route optimization models, leveraging AI, calculate the most efficient and low-risk paths by constantly evaluating real-time inputs such as severe weather, geopolitical conflicts, and changing port dwell times, ensuring prompt delivery.

- Machine Learning (ML) algorithms automate the complex classification and verification of vehicle import/export documentation, drastically accelerating customs clearance by reducing manual checks and ensuring compliance with disparate national regulations.

- Intelligent pricing engines, informed by ML, analyze market supply, demand elasticities, and operational costs to provide highly accurate, competitive, and dynamic rate quotations, improving profitability and transparency for shippers.

- AI-enhanced maintenance scheduling applies predictive models to vessel machinery and terminal equipment, minimizing the probability of unexpected breakdowns that could cause shipment delays and operational disruptions.

- Advanced security systems incorporating computer vision are used at terminals and on vessels to monitor vehicles, identifying and alerting staff to unauthorized access or movement, thus safeguarding high-value inventory.

- AI-powered chatbots and virtual logistics assistants provide sophisticated, instant customer support, handling tracking requests, providing regulatory guidance, and facilitating initial quotation and booking procedures efficiently.

DRO & Impact Forces Of International Car Shipping Service Market

The International Car Shipping Service Market operates within a complex matrix of internal drivers and external constraints, balanced by significant emerging opportunities, all subjected to overarching impact forces. The primary drivers sustaining growth include the fundamental commitment of major automotive manufacturers to globally diversified production networks, requiring continuous, large-scale vehicular transport, alongside the increasing accessibility of digital platforms that democratize the process of buying and selling vehicles across borders. Restraints prominently include the highly fragmented and often contradictory nature of international trade regulations and vehicle homologation standards, coupled with acute vulnerability to global economic fluctuations and periodic, severe capacity shortages in the specialized RoRo fleet. Opportunities are strongly linked to pioneering logistics solutions for Electric Vehicles (EVs), which require stringent safety protocols, and the adoption of digital freight marketplaces that enhance market transparency and connectivity. These elements are constantly mediated by powerful geopolitical and environmental impact forces that necessitate operational agility and significant capital expenditure.

Drivers: The sustained globalization of the automotive industry remains the paramount driver, as OEMs continue to leverage regional comparative advantages in manufacturing, necessitating vast intercontinental movement of both finished vehicles and knock-down kits. Concurrently, the growth in global wealth, particularly in Asia and the Middle East, translates directly into rising consumer demand for luxury, specialized, and vintage imported vehicles, fueling the high-margin segment of the shipping market. Furthermore, improvements in port infrastructure efficiency, especially in key developing countries, coupled with the increasing penetration of sophisticated tracking and logistics software (IoT integration), enhance the reliability and speed of services, making international shipping a more attractive option for dealers and individuals alike, thereby promoting market expansion.

Restraints: Significant limitations are imposed by the inherent vulnerability of the global shipping industry to external shocks, including volatile marine fuel prices, which necessitate complex and contentious surcharge mechanisms (BAFs). Furthermore, stringent and geographically varied import regulations concerning vehicle emissions, safety certifications, and age restrictions often require expensive vehicle modifications or prohibit import entirely, creating substantial logistical and compliance hurdles. Operational constraints, such as port labor disputes, customs bureaucracy delays, and the high capital intensity required to maintain and upgrade specialized RoRo and container fleets, also act as formidable restraints, limiting the pace of seamless market expansion and increasing operational risk exposure for carriers.

Opportunities: A critical area for future growth lies in servicing the rapidly expanding global fleet of Electric Vehicles (EVs). Shipping EVs requires specialized handling and adherence to strict safety guidelines related to lithium-ion battery fire risk, providing a high-value niche market for carriers investing in certified safety training and infrastructure. Digitalization presents another major opportunity, allowing companies to create sophisticated, customer-facing booking portals and integrated tracking systems, streamlining the complex transaction process for B2C clients. Additionally, the development of optimized intermodal transport solutions, combining ocean freight with efficient rail and road networks, especially in dense regions like Europe and North America, offers opportunities to reduce door-to-door transit times and improve overall service reliability.

Impact Forces: The International Car Shipping Service Market is profoundly affected by overarching external forces. Geopolitical instability, including trade wars, sanctions, and regional conflicts (e.g., disruptions to key maritime choke points), forces unpredictable rerouting, increases insurance premiums (War Risk Surcharges), and fundamentally alters trade flows. Simultaneously, increasingly strict Environmental, Social, and Governance (ESG) criteria are exerting massive pressure, compelling carriers to comply with IMO 2020 regulations and future decarbonization goals, requiring substantial investment in alternative fuels and clean technologies, which invariably translates into higher operating costs. Furthermore, sustained macroeconomic volatility, such as interest rate hikes or recessions in major economies, directly reduces consumer discretionary spending on vehicles, immediately dampening import volumes and impacting the profitability of key shipping lanes.

Segmentation Analysis

Segmentation analysis within the International Car Shipping Service Market is essential for understanding the diverse operational requirements and customer needs driving service differentiation. The market structure is highly dependent on the logistics method employed, the intrinsic value and type of the vehicle being transported, and the scale and nature of the customer utilizing the service. The choice between RoRo and containerized shipping defines the trade-off between volume efficiency and personalized security, which dictates carrier selection for major clients. Recognizing these distinctions allows service providers to tailor specialized product offerings, from dedicated high-security transport for ultra-luxury collectors to efficient, high-volume capacity contracting for major global OEMs. This layered segmentation ensures that logistical solutions are precisely matched to the specific demands of high-value cargo movement across continents.

- By Transport Type:

- Roll-on/Roll-off (RoRo) Shipping: Preferred method for high-volume, operational vehicles, utilizing specialized multi-deck vessels.

- Container Shipping: Provides superior protection for high-value, classic, or non-operational vehicles; includes Full Container Load (FCL) and Less than Container Load (LCL) options.

- Air Freight: Reserved for extremely high-value, time-critical, or racing vehicles due to premium cost.

- Multimodal Transport: Integration of ocean freight with coordinated rail and road networks for seamless inland delivery.

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks): Standard volume category, predominantly shipped via RoRo.

- High-Value & Luxury Vehicles: Requires specialized handling, often utilizing FCL or premium RoRo services with dedicated deck space.

- Classic & Vintage Cars: Demand climate-controlled or enclosed container shipping for preservation and security.

- Commercial Vehicles (Trucks, Buses, Trailers): Shipped on lower, heavy-duty decks of RoRo vessels or sometimes broken down for container transport.

- Heavy Machinery & Equipment (Agricultural and Construction vehicles): Requires specialized RoRo capacity due to size and weight restrictions.

- Electric Vehicles (EVs): Needs carriers with certified safety protocols for lithium-ion battery transport (a high-growth subsegment).

- By End-User:

- Original Equipment Manufacturers (OEMs): Largest volume shippers, demanding long-term contracts and highly optimized RoRo scheduling for new vehicle delivery.

- Automotive Dealerships & Distributors: Requires consistent, reliable service for inventory replenishment, utilizing both RoRo and LCL/FCL options.

- Individual Consumers/Private Owners (Relocation): Focuses on secure, insured, door-to-door services; often utilizes containerized LCL.

- Used Car Export/Import Businesses: Highly cost-sensitive segment, driving demand for efficient volume container consolidation and competitive RoRo rates.

- Government & Defense Agencies: Requires specialized, often secure and expedited movement of tactical and non-tactical fleets.

Value Chain Analysis For International Car Shipping Service Market

The value chain initiates with upstream activities characterized by massive capital investment and strategic asset management. This phase involves the procurement, operation, and maintenance of specialized RoRo vessels and the corresponding container fleet, requiring long-term financial commitments and adherence to strict international maritime safety standards. Upstream operations also include establishing and maintaining strategic agreements with global port terminals for priority berthing and efficient terminal handling services, which are critical inputs that directly influence the carrier's capacity and reliability. Securing long-term fuel supply contracts (bunker fuel) and complex risk insurance policies are also key upstream functions that define the market's operating cost structure and service predictability.

Midstream activities constitute the core service delivery and logistics coordination. This phase is dominated by the processes managed by freight forwarders and NVOCCs, who act as essential intermediaries, aggregating cargo volumes from fragmented sources to fill carrier capacity. Key midstream functions include detailed multimodal transport planning, managing complex customs documentation across various jurisdictions (Bills of Lading, export declarations, insurance certification), and the actual physical transit of the vehicle. Efficiency here is paramount, relying heavily on sophisticated Transport Management Systems (TMS) to optimize scheduling, track cargo in real-time, and manage potential deviations caused by unforeseen logistical disruptions or regulatory changes, thereby ensuring the security and integrity of the vehicle during the long intercontinental voyage.

Downstream activities focus on the delivery logistics and final mile fulfillment in the destination country. This stage involves customs clearance at the arrival port, payment of duties and taxes, terminal de-vanning (for containerized shipments), and inspection for transit damage. Critical downstream partnerships include local customs brokers and regional haulage companies (trucking and rail operators) responsible for moving the vehicle from the port to the dealership, distributor, or individual customer's doorstep. Distribution channels are bifurcated: Direct channels involve large OEMs utilizing dedicated carrier relationships for end-to-end control. Indirect channels involve the majority of individual and smaller dealership shipments, relying heavily on NVOCCs and specialized shipping agents who absorb the logistical complexity and provide localized customer support, effectively mitigating the complexity of international trade for the end-user.

International Car Shipping Service Market Potential Customers

The primary customer base for international car shipping services consists of high-volume, continuous shippers represented by global Original Equipment Manufacturers (OEMs). These massive entities require the most robust, reliable, and standardized Roll-on/Roll-off (RoRo) capacity to move millions of newly manufactured passenger vehicles, SUVs, and commercial units from production facilities in Asia (e.g., China, Japan, Korea) and Europe to major consumer markets globally. OEMs demand integrated, long-term contractual logistics solutions that guarantee capacity, ensure strict adherence to complex scheduling requirements, and provide deep integration with their own inventory management systems to maintain efficient global supply chains and minimize costly port dwell times.

The secondary, yet rapidly expanding, customer segment includes international automotive dealerships, distributors, and used car exporters. Dealerships require reliable services for inventory replenishment, often sourcing specific models or high-demand used vehicles from international auctions and markets (e.g., Japanese used car exports to Africa). This group often utilizes a flexible mix of RoRo and containerized shipping (FCL for large orders, LCL for single units), prioritizing both competitive pricing and consistent transit times. The proliferation of digital global used car marketplaces has amplified this demand, connecting buyers and sellers who rely on professional shipping agents to handle the complex export/import customs and logistics on their behalf, driving growth in the NVOCC and freight forwarding sectors.

Finally, the individual consumer and specialized collector segment represents a significant high-margin revenue stream. This includes military personnel, diplomats, expatriates, and high-net-worth individuals relocating personal or valuable classic vehicles across borders. These customers are primarily focused on security, comprehensive marine insurance, and white-glove, door-to-door handling, often opting for highly secure, enclosed container services over bulk RoRo. Specialized classic car shipping requires bespoke crating and climate control options, making this segment less price-sensitive and highly receptive to premium service providers who can demonstrate meticulous care and deep expertise in regulatory compliance for unique or antique vehicles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wallenius Wilhelmsen, Mitsui O.S.K. Lines (MOL), Kawasaki Kisen Kaisha (K Line), Höegh Autoliners, NYK Line (Nippon Yusen Kaisha), American Roll-On Roll-Off Carrier (ARC), Sallaum Lines, Grimaldi Group, Eukor Car Carriers, Seacover, International Vehicle Shipping, AutoShippers, CFR Rinkens, Schumacher Cargo Logistics, A-1 Auto Transport, Trans Global Logistics, Dependable Auto Shippers (DAS), Unicarriers, United Auto Transport, Intercontinental Car Transport |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

International Car Shipping Service Market Key Technology Landscape

The International Car Shipping Service Market is undergoing rapid technological transformation, primarily driven by the need for enhanced security, operational efficiency, and comprehensive supply chain visibility. The foundational layer of this technological evolution is the ubiquitous deployment of Internet of Things (IoT) devices and GPS tracking systems. These devices are strategically affixed to vehicles or containers, providing essential telemetry data—location, speed, temperature, and shock detection—in real-time throughout the entire transit process. This granular data is vital for high-value shipments, allowing carriers and customers to proactively address potential deviations or environmental concerns, significantly reducing the risks associated with damage and theft during extended storage at terminals or long maritime voyages, thereby enhancing overall service quality and reducing insurance claim incidence.

A second major technological area involves the advanced digitalization of complex administrative and operational processes. Major carriers and freight forwarders utilize sophisticated cloud-based Transport Management Systems (TMS) and integrated Enterprise Resource Planning (ERP) platforms tailored specifically for automotive logistics. These systems manage crucial functions such as complex scheduling of specialized RoRo vessels, optimization of port calls to minimize delays, and automated generation of necessary customs documentation, including electronic Bills of Lading (eBLs). Furthermore, the initial adoption of distributed ledger technology (blockchain) is being explored to create secure, immutable records of title transfers and customs declarations, aiming to streamline cross-border regulatory compliance and drastically accelerate the speed at which vehicles clear destination ports, resolving one of the industry’s most persistent bottlenecks.

Finally, Artificial Intelligence (AI) and data analytics are revolutionizing capacity planning and risk mitigation. AI algorithms are used for advanced demand forecasting, analyzing global trade indices, automotive sales trends, and economic indicators to accurately predict seasonal and regional shifts in vehicle shipping requirements, enabling optimized vessel allocation. At the terminal level, automation, including Automated Guided Vehicles (AGVs) and specialized robotic systems, is increasingly being incorporated into modernized RoRo port facilities to ensure rapid, damage-free loading and unloading procedures, minimizing vessel turnaround time. This convergence of advanced tracking, automated processes, and predictive intelligence is moving the industry toward a highly resilient, data-driven logistical model capable of handling the increasing volume and complexity of global automotive trade efficiently.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest share of the International Car Shipping Service Market, functioning as the primary global manufacturing and export hub. Countries like China, Japan, and South Korea leverage highly industrialized port systems and massive production scales, resulting in unparalleled volumes of RoRo traffic destined for North America, Europe, and emerging markets. The region's competitiveness is driven by advanced logistics technology adoption and a high concentration of the world’s largest car carriers. Sustained growth is forecast due to continuous regional economic expansion and substantial government investment into infrastructure supporting maritime trade routes, solidifying its position as the engine of global vehicle supply.

- North America (US and Canada): North America serves predominantly as a major net importer of vehicles, characterized by sophisticated consumer demand for both high-volume Asian imports and premium European luxury cars. The market requires specialized logistical expertise to navigate stringent federal regulations, including complex EPA and DOT compliance requirements, which differ significantly from other global standards. The region exhibits strong demand for high-security, customized containerized shipping solutions for collector and exotic vehicles, resulting in carriers prioritizing reliable scheduling and comprehensive insurance offerings to meet the high service expectations of the demanding local customer base.

- Europe: Europe represents a highly integrated yet strategically vital market, acting both as a source for high-value OEM exports (Germany, Italy) and a major destination for global imports. Key European ports are leaders in adopting green logistics technologies, influenced by strict EU mandates regarding emissions reductions and sustainable maritime practices. The market is defined by high volumes of intra-European RoRo movements, coupled with intense intercontinental traffic. Furthermore, the region’s robust classic and vintage car market necessitates premium, specialized container services, making the European segment highly diversified in its service requirements and technology adoption rates.

- Latin America (LATAM): LATAM is defined by rapid urbanization and rising disposable incomes, fueling increased demand for vehicle imports, particularly used vehicles from the US and Europe. While Mexico and Brazil host significant manufacturing and export capabilities, the region faces challenges related to inconsistent port infrastructure, complex and bureaucratic customs procedures, and higher security risks in certain operational areas. This necessitates carriers to engage in strong local partnerships and develop agile, cost-effective multimodal solutions, often relying on flexible LCL container consolidation to manage fragmented import volumes across diverse, challenging geographies.

- Middle East and Africa (MEA): The MEA region presents a market with immense untapped growth, driven by key trading hubs like the UAE and Saudi Arabia, which function as critical re-export gateways. Demand is strong for luxury imports in the Gulf and high-volume, affordable used vehicles across Africa. The logistical challenge lies in balancing the world-class port infrastructure of the Gulf with the often-underdeveloped and politically volatile ports across Sub-Saharan Africa. Carriers operating here must specialize in adapting services to highly diverse customs requirements and managing operational risk through localized security measures and expert knowledge of regional trade dynamics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the International Car Shipping Service Market.- Wallenius Wilhelmsen

- Mitsui O.S.K. Lines (MOL)

- Kawasaki Kisen Kaisha (K Line)

- Höegh Autoliners

- NYK Line (Nippon Yusen Kaisha)

- American Roll-On Roll-Off Carrier (ARC)

- Sallaum Lines

- Grimaldi Group

- Eukor Car Carriers

- Seacover

- International Vehicle Shipping

- AutoShippers

- CFR Rinkens

- Schumacher Cargo Logistics

- A-1 Auto Transport

- Trans Global Logistics

- Dependable Auto Shippers (DAS)

- United Auto Transport

- Intercontinental Car Transport

- Marine Transport Logistics

- Global Auto Logistics

- Autosport Logistics

- Kingston Container Services

Frequently Asked Questions

Analyze common user questions about the International Car Shipping Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between RoRo and Container shipping for international vehicle transport?

RoRo (Roll-on/Roll-off) shipping is the most cost-effective method for high-volume, operational vehicles, where cars are driven onto the ship and secured in specialized decks. Container shipping offers enhanced protection and security, ideal for high-value, non-operational, or classic cars, typically utilizing 20-foot or 40-foot containers for secure, individual movement.

How are global fuel costs and geopolitical risks impacting international car shipping rates?

Volatile global fuel (bunker) costs necessitate carriers to implement fluctuating Bunker Adjustment Factors (BAFs), directly increasing overall freight costs. Geopolitical risks, such as conflicts or sanctions, force major rerouting, escalating insurance premiums and operational costs, leading to rate volatility and unpredictable delays for shippers.

Which regions demonstrate the highest growth potential for vehicle export services?

Asia Pacific, particularly exporting hubs like China and South Korea, is projected to maintain dominance in export volume. However, the highest growth potential is observed in emerging markets across Latin America and Africa, driven by increasing demand for affordable imported used vehicles and expanding local manufacturing activities.

What key regulations must be considered when shipping an international vehicle?

Key regulations include destination-specific import duties and taxes, adherence to vehicle safety standards (e.g., DOT in the US, ECE in Europe), environmental compliance (emissions testing), and mandatory requirements for title clearance and export documentation. Proper customs brokerage is crucial to avoid substantial penalties and delays.

How is technology being utilized to improve transparency and tracking in car shipping logistics?

Leading carriers utilize advanced IoT sensors and GPS tracking integrated into Transport Management Systems (TMS) to provide real-time visibility into the vehicle's location and condition throughout the transit. This digitalization allows customers and dealerships to receive instant updates, significantly improving supply chain transparency and predictability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager