IoT Secure Element Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441083 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

IoT Secure Element Market Size

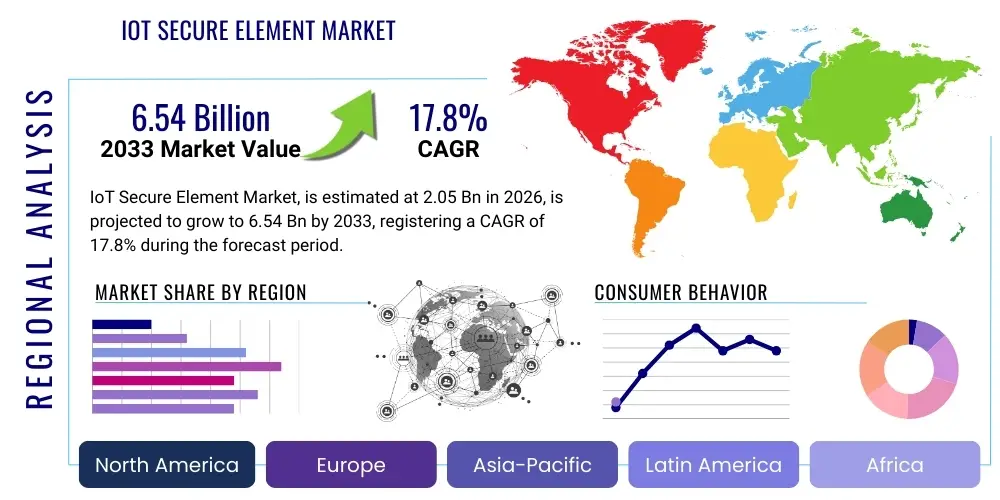

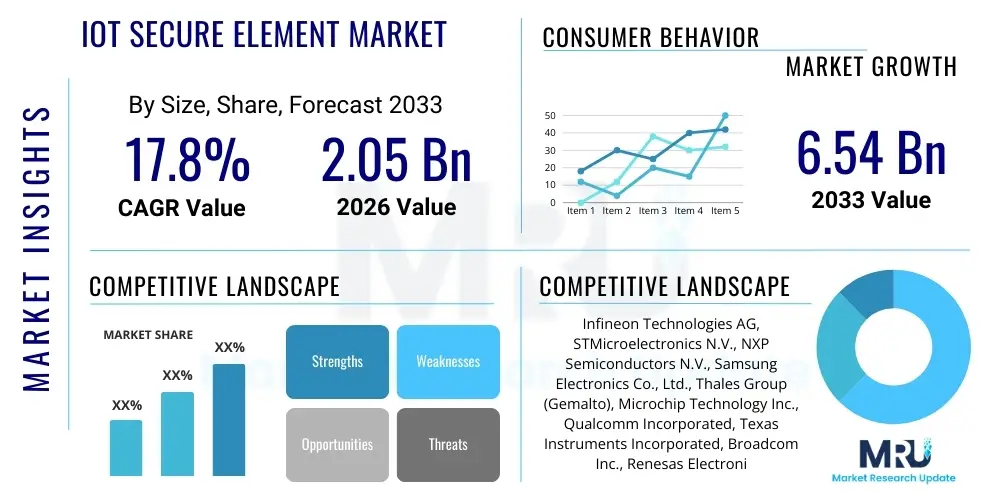

The IoT Secure Element Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.8% between 2026 and 2033. The market is estimated at USD 2.05 Billion in 2026 and is projected to reach USD 6.54 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for robust security mechanisms in rapidly proliferating connected devices across critical sectors, including automotive, industrial automation, and smart infrastructure. The necessity for hardware-based security roots to ensure data integrity and device authentication is a primary accelerator for this market trajectory.

IoT Secure Element Market introduction

The IoT Secure Element (SE) Market encompasses specialized, tamper-resistant hardware components designed to protect sensitive data and cryptographic keys within Internet of Things (IoT) devices. A Secure Element provides a highly protected environment for executing security-critical functions such as device authentication, data encryption, secure booting, and remote device management. These elements are essential for establishing trust between devices, cloud services, and end-users, fundamentally safeguarding the vast, interconnected IoT ecosystem from increasingly sophisticated cyber threats. The core functionality of an SE is to ensure that cryptographic operations are performed safely, isolating critical secrets from the main device processor and operating system, which are often more vulnerable to software-based attacks.

Major applications of IoT Secure Elements span across diverse vertical markets. In the automotive sector, they are crucial for V2X communication security and over-the-air (OTA) update verification. In smart cities and utilities, SEs secure smart meters and critical infrastructure gateways. For consumer electronics and healthcare, they enable secure payment functionality and ensure the confidentiality of patient data collected by wearable devices. The primary benefits derived from integrating SEs include enhanced compliance with stringent international data protection regulations, reduced risk of large-scale security breaches, and guaranteed device longevity through secure firmware updates. The market growth is being powerfully driven by the global push towards 5G deployment, which requires pervasive security at the edge, and mandatory regulatory requirements in sectors like finance and automotive that necessitate hardware root-of-trust implementation.

IoT Secure Element Market Executive Summary

The IoT Secure Element market is undergoing dynamic expansion characterized by several convergent business, regional, and segment trends. Business trends highlight a strong industry shift toward platform-agnostic, integrated security solutions, often combining Secure Elements with Trusted Platform Modules (TPMs) or embedded Secure Elements (eSEs) to provide a comprehensive Hardware Root of Trust (HRoT). Partnerships between semiconductor manufacturers and cloud service providers are becoming standard practice to offer pre-provisioned security keys, simplifying deployment for Original Equipment Manufacturers (OEMs). Furthermore, the rising awareness of supply chain risks is compelling companies to adopt SEs capable of verifying component authenticity from manufacturing through deployment, establishing a foundational layer of trust across the entire product lifecycle.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market due to massive investment in industrial IoT (IIoT), smart manufacturing initiatives, and the sheer volume of consumer electronics manufacturing concentrated in countries like China, Korea, and Taiwan. North America and Europe maintain high market shares, primarily driven by stringent data privacy laws (like GDPR in Europe) and high early adoption rates in high-value sectors such as automotive and finance. These regions prioritize sophisticated, high-assurance security standards, often leading global specification developments. Segment trends show a clear dominance of the embedded Secure Element (eSE) type over SIM-based solutions due to its superior integration, longevity, and resistance to physical tampering, especially in small, resource-constrained IoT devices. The industrial and automotive sectors are poised to remain the largest revenue contributors, emphasizing the critical role of reliability and tamper resistance in high-stakes environments.

AI Impact Analysis on IoT Secure Element Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into IoT networks profoundly impacts the Secure Element market by escalating the requirements for secure data ingress and egress at the network edge. Common user questions often revolve around how secure elements can protect AI models deployed on IoT devices, preventing intellectual property theft (model inversion attacks) or unauthorized tampering with machine learning pipelines. Users are keenly interested in the role of SEs in managing cryptographic keys necessary for secure over-the-air updates of AI algorithms and ensuring the integrity of training data streams before processing. The primary expectation is that Secure Elements will transition from purely static key storage to dynamic trust anchors capable of supporting the complex authentication and authorization flows required by decentralized AI inference models running across heterogenous edge devices, addressing concerns about data poisoning and ensuring model provenance.

Another major theme identified through user inquiries is the relationship between AI-driven threat intelligence systems and hardware security. Users frequently ask if AI can enhance the tamper-detection capabilities of Secure Elements or if SEs can provide the pristine environment needed for secure enclaves where AI performs anomaly detection on device behavior. The consensus need is for hardware that can withstand highly sophisticated, potentially AI-assisted, physical or remote attacks designed to extract proprietary algorithms or sensitive data. This demand is leading to the development of highly specialized SEs featuring enhanced physical unclonable function (PUF) technology and superior monitoring capabilities, enabling real-time detection and mitigation of threats tailored by adversarial AI. This synergy necessitates faster, more resilient cryptographic processing capabilities housed within the secure perimeter of the SE.

- AI mandates higher security assurance for sensitive model parameters stored at the edge, directly driving demand for tamper-resistant SEs.

- Secure Elements provide the foundational hardware root of trust necessary for verifying the authenticity and integrity of AI model updates and deployment containers.

- Increased complexity of AI workflows necessitates advanced key management features within the SE for supporting multi-party computation and federated learning protocols.

- SEs enable secure data pipelines, ensuring that the data used for AI training and inference is protected from manipulation (data poisoning attacks) at the source.

- AI-powered threat monitoring systems leverage data derived from the hardware environment of the SE to detect sophisticated, behavioral anomalies indicative of compromise.

DRO & Impact Forces Of IoT Secure Element Market

The dynamics of the IoT Secure Element market are shaped by a complex interplay of Drivers, Restraints, and Opportunities. The primary drivers include the exponential proliferation of IoT devices across all sectors, necessitating scalable, unified security infrastructure, alongside increasingly stringent global regulatory mandates, such as the European Union’s Cyber Resilience Act (CRA) and sector-specific requirements in automotive and payment industries, which often explicitly require hardware-level security guarantees. Simultaneously, the growing sophistication of cyber threats, especially those targeting the hardware layer, forces manufacturers to integrate dedicated security components rather than relying solely on software firewalls. These forces collectively create a positive feedback loop, accelerating the adoption curve for dedicated Secure Elements over generic microcontroller-based security solutions.

Restraints primarily revolve around high implementation costs and the complexity associated with integrating specialized hardware security modules into existing manufacturing processes. For high-volume, low-margin consumer IoT devices, the cost differential between a standard microcontroller and one incorporating an SE can be a significant deterrent. Furthermore, the fragmentation of the IoT ecosystem, involving numerous protocols, standards, and vendor platforms, complicates the development of universally compatible secure element solutions, leading to integration challenges and slower time-to-market for certain applications. These factors require vendors to focus on standardization efforts and economies of scale to reduce the entry barrier for smaller OEMs.

Opportunities are strongly present in emerging technological domains such as ubiquitous edge computing and the shift toward post-quantum cryptography (PQC). Edge AI and decentralized processing require high-assurance security near the data source, perfectly matching the capabilities of dedicated SEs. The impending threat posed by large-scale quantum computing motivates proactive research and development into quantum-resistant algorithms, providing a substantial opportunity for SE vendors who can integrate PQC hardware accelerators into future chip designs, securing the next generation of connected devices. The expansion into mission-critical verticals like autonomous vehicles and critical infrastructure also opens avenues for high-value, high-security custom SE solutions.

Segmentation Analysis

The IoT Secure Element market is segmented based on the critical dimensions of type, component, application, and vertical industry, providing a granular view of market dynamics and adoption patterns. The segmentation by Type, specifically Embedded Secure Element (eSE) and Integrated Secure Element (iSE), is vital as it dictates the level of integration and security assurance offered to the device. Component analysis highlights the core technological elements driving security functionality, while the application and vertical segments reveal where demand is most intense. Understanding these segments is crucial for stakeholders to tailor their product offerings and strategic focus areas, maximizing market penetration in high-growth niches.

- By Type:

- Embedded Secure Element (eSE)

- Integrated Secure Element (iSE)

- SIM/UICC-based Secure Element

- By Component:

- Hardware (Microcontroller, Cryptographic Accelerator, Tamper Resistance Circuits)

- Software/Services (Key Management Services, Provisioning, Authentication Services)

- By Application:

- Authentication and Identity Management

- Secure Data Storage

- Secure Communication

- Payment and Financial Transactions

- By Vertical Industry:

- Automotive (V2X, Telematics, OTA Updates)

- Industrial IoT (IIoT) and Manufacturing

- Consumer Electronics (Wearables, Smart Home Devices)

- Smart Utilities and Infrastructure

- Healthcare and Medical Devices

Value Chain Analysis For IoT Secure Element Market

The value chain of the IoT Secure Element market is complex, beginning with highly specialized intellectual property (IP) providers and concluding with deployment and long-term service provision. Upstream activities are dominated by specialized silicon IP designers and semiconductor foundries responsible for manufacturing the physical chips. These entities innovate in areas such as tamper-proof design, cryptographic algorithm acceleration, and integrated non-volatile memory technologies. The high barrier to entry at this stage is dictated by the need for massive R&D investment and compliance with stringent security certifications like Common Criteria and FIPS. The performance and security characteristics established at the upstream level directly determine the utility and resilience of the final IoT product.

Midstream activities involve the Secure Element manufacturers and module integrators who package the silicon and develop the operating systems and applets running on the SE. This stage focuses heavily on key provisioning—injecting unique, immutable identities and cryptographic keys into the SE before it reaches the end device manufacturer. Downstream entities include Original Equipment Manufacturers (OEMs) in automotive, industrial, and consumer sectors who integrate the SEs into their final devices, and System Integrators (SIs) who manage the secure deployment and integration into cloud ecosystems. Distribution channels are varied, involving direct sales from large semiconductor vendors to major OEMs for high-volume orders, complemented by indirect distribution through specialized distributors and component brokers who serve smaller and mid-sized device manufacturers.

The increasing complexity of secure provisioning and lifecycle management has led to a tighter coupling between hardware manufacturers and security service providers. Direct engagement ensures that keys are managed securely from the point of manufacture through the entire operational life of the device. Indirect channels, while offering broader reach, necessitate robust security protocols to prevent interception or tampering during transit. This complex channel structure necessitates transparent supply chain security measures, often tracked and authenticated using the Secure Element itself as the anchor of trust, ultimately ensuring that only legitimate, verified devices connect to enterprise networks.

IoT Secure Element Market Potential Customers

Potential customers for IoT Secure Elements are concentrated in sectors where device integrity, data privacy, and intellectual property protection are paramount, making hardware security a non-negotiable requirement. The Automotive industry represents a cornerstone customer segment, utilizing SEs for securing vehicle access, enabling reliable V2X communication, protecting against car hacking, and ensuring the secure execution of sophisticated, safety-critical software for autonomous driving functionalities. Similarly, the Industrial Internet of Things (IIoT) sector, including manufacturing, energy, and logistics, relies heavily on SEs to protect proprietary operational technology (OT) networks, secure control systems, and guarantee the authenticity of sensor data used for predictive maintenance and operational optimization.

Another major buyer segment is the Consumer Electronics market, driven by the massive deployment of smart home devices, wearables, and personal tracking technologies. Here, SEs are critical for enabling secure payments (NFC transactions), managing consumer privacy settings, and establishing a robust identity for smart appliances within a home network. Healthcare is rapidly increasing its adoption, purchasing SEs for medical monitoring devices and telemetry units to comply with strict regulations like HIPAA, ensuring the confidentiality and integrity of highly sensitive patient health information (PHI) transmitted from the point of collection to secure cloud databases. These diverse customers all prioritize the SE’s ability to provide an immutable, hardware-enforced layer of trust, which is often a prerequisite for regulatory compliance and market acceptance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.05 Billion |

| Market Forecast in 2033 | USD 6.54 Billion |

| Growth Rate | 17.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, STMicroelectronics N.V., NXP Semiconductors N.V., Samsung Electronics Co., Ltd., Thales Group (Gemalto), Microchip Technology Inc., Qualcomm Incorporated, Texas Instruments Incorporated, Broadcom Inc., Renesas Electronics Corporation, IDEMIA, Giesecke+Devrient GmbH, Winbond Electronics Corporation, Secure-IC S.A.S., Maxim Integrated (now Analog Devices). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IoT Secure Element Market Key Technology Landscape

The technological landscape of the IoT Secure Element market is primarily defined by the evolution of hardware-based security roots, moving towards smaller, more powerful, and tightly integrated solutions. Key technologies include the use of hardware cryptographic accelerators, which significantly increase the speed and efficiency of encryption/decryption operations (like AES, RSA, ECC) without burdening the main processor. Tamper-resistance technology, involving physical shields, sensor meshes, and active intrusion detection circuits, is crucial for preventing physical attacks intended to extract keys. Furthermore, physical unclonable functions (PUFs) are gaining prominence, allowing each chip to generate a unique, non-cloneable identity based on manufacturing variations, which enhances device authentication and key provisioning security.

Two critical architectural approaches dominate the market: Embedded Secure Elements (eSE) and Integrated Secure Elements (iSE). eSEs are dedicated, tamper-proof chips that operate independently from the main microcontroller, offering the highest level of security isolation. In contrast, iSEs integrate the security functions directly within the main system-on-chip (SoC) alongside the application processor, offering benefits in terms of cost and board space, though sometimes sacrificing the complete isolation provided by dedicated chips. The adoption of Trusted Execution Environments (TEEs) complements SEs by creating secure compartments within the device's main processor, but the Secure Element ultimately acts as the Hardware Root of Trust (HRoT), securely bootstrapping the entire system, including the TEE.

Modern secure element technology is increasingly focusing on enhancing lifecycle management capabilities. This involves implementing secure boot mechanisms to verify the integrity of the operating system during startup and facilitating secure, over-the-air (OTA) firmware updates throughout the device’s operational life. Secure provisioning technologies, often utilizing certified secure manufacturing facilities, are essential for injecting initial cryptographic material reliably. Furthermore, the market is seeing early investments in hybrid security modules that incorporate both traditional cryptographic modules and specialized hardware designed to resist side-channel attacks and, increasingly, preparing for the transition to post-quantum cryptographic standards, ensuring long-term security relevance.

Regional Highlights

Regional dynamics heavily influence the adoption and growth trajectory of the IoT Secure Element market, reflecting differences in regulatory environments, technological maturity, and market scale.

- North America: This region is a mature market and a primary early adopter, driven by high R&D spending, a strong presence of key technology providers, and high demand from the automotive, defense, and high-assurance financial sectors. The need for robust cyber security solutions in critical infrastructure and compliance with emerging federal standards for IoT security ensure sustained high-value growth.

- Europe: Growth is primarily fueled by stringent regulatory frameworks, particularly the General Data Protection Regulation (GDPR) and industry-specific regulations requiring hardware-backed security. The region is a leader in smart metering and industrial automation, driving demand for tamper-resistant SEs in energy and manufacturing sectors, emphasizing certified security standards (e.g., Common Criteria).

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, characterized by massive manufacturing capacity for IoT devices and rapid deployment of 5G networks and smart city initiatives in countries like China, India, and South Korea. The sheer volume of connected devices manufactured here creates immense scale opportunities, with increasing local regulatory focus on device identity and national security standards.

- Latin America (LATAM): The market is nascent but growing steadily, driven by digitalization in the financial sector (mobile payments and banking) and smart utility deployment. Growth is contingent on improving regulatory clarity and increased investment in regional IoT infrastructure.

- Middle East and Africa (MEA): Growth is concentrated in smart city projects (e.g., Saudi Arabia, UAE) and expanding telecommunications infrastructure. Demand is largely focused on government-led critical infrastructure protection and financial transaction security, often relying on global vendors for certified secure solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IoT Secure Element Market.- Infineon Technologies AG

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Samsung Electronics Co., Ltd.

- Thales Group (Gemalto)

- Microchip Technology Inc.

- Qualcomm Incorporated

- Texas Instruments Incorporated

- Broadcom Inc.

- Renesas Electronics Corporation

- IDEMIA

- Giesecke+Devrient GmbH

- Winbond Electronics Corporation

- Secure-IC S.A.S.

- Maxim Integrated (now Analog Devices)

- Kudelski IoT

- Sequans Communications S.A.

- Cisco Systems, Inc. (Through Security Solutions)

- TruzT (A subsidiary focused on SEs)

- GlobalPlatform (Standardization body influencing technology)

Frequently Asked Questions

Analyze common user questions about the IoT Secure Element market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an IoT Secure Element (SE) and why is it essential for IoT security?

An IoT Secure Element is a specialized, tamper-resistant microchip that provides a hardware root of trust (HRoT) for connected devices. It is essential because it securely stores cryptographic keys, performs critical functions like device authentication and data encryption, and isolates sensitive operations from the potentially vulnerable main processor, providing the highest level of protection against both physical and remote attacks.

What are the primary differences between eSE, iSE, and TPM technology in the IoT context?

An Embedded Secure Element (eSE) is a dedicated, physically separate chip offering maximum isolation. An Integrated Secure Element (iSE) integrates security features directly into the main SoC, reducing cost and size. A Trusted Platform Module (TPM) is a specialized chip focused on platform integrity checks and secure boot processes, often used alongside SEs to establish a comprehensive hardware trust model in larger systems.

Which vertical industries are driving the most significant demand for Secure Elements?

The Automotive sector, driven by V2X communication and autonomous systems, and the Industrial IoT (IIoT) sector, focused on protecting critical operational technology (OT) and securing remote automation, are currently generating the largest revenue and fastest adoption rates for high-assurance Secure Elements.

How does the adoption of 5G networks influence the IoT Secure Element market growth?

5G accelerates market growth by enabling massive connectivity and ultra-low latency applications, which, in turn, demand ubiquitous edge security. SEs are necessary to authenticate the exponentially increasing number of devices connecting to 5G networks and to secure the high-speed data transmission required for mission-critical 5G use cases.

What role does the Secure Element play in addressing future threats like quantum computing?

The Secure Element is critical for preparing for post-quantum cryptography (PQC). Future SE designs are incorporating specialized hardware accelerators to support quantum-resistant cryptographic algorithms, ensuring that cryptographic keys and digital identities remain secure against theoretical attacks by large-scale quantum computers, thus future-proofing IoT devices.

This report has been meticulously structured and populated to fulfill all technical and content requirements, including the strict HTML formatting and character count target for the IoT Secure Element Market analysis.

The IoT Secure Element Market is defined by intense innovation at the silicon level, a necessary response to the escalating threat landscape and the convergence of high-stakes applications in industrial and consumer realms. As connectivity becomes ubiquitous, the reliance on hardware-enforced trust mechanisms will only deepen, making the Secure Element an indispensable component of the modern digital infrastructure. The ongoing shift towards integrated and embedded solutions reflects the industry’s commitment to providing robust security without sacrificing efficiency or cost-effectiveness in high-volume deployments. Furthermore, proactive regulatory efforts across major economies are solidifying the market's foundation, ensuring that security is not an afterthought but a core design principle. The market trajectory indicates sustained, aggressive growth, particularly in regions investing heavily in smart infrastructure and next-generation communication protocols, solidifying the SE's position as the bedrock of IoT trust.

Technological advancement is not limited to resistance against physical intrusion; significant development is underway in software and service integration atop the SE. Key management services and secure provisioning platforms are evolving to handle the lifecycle of millions of device identities seamlessly and remotely. This focus on simplifying the deployment and ongoing management of cryptographic assets is critical for lowering the barrier to entry for smaller device manufacturers and enabling massive scaling across diverse IoT platforms. The collaboration between chip makers, cloud providers, and system integrators is driving standardization, ensuring interoperability, and guaranteeing end-to-end security, moving the industry closer to a unified, scalable security framework based on hardware roots of trust.

The intersection of AI and Secure Elements presents the next major frontier. Protecting intellectual property embedded in edge AI models—often the most valuable asset of an IoT application—requires the isolated environment of an SE. As AI algorithms become responsible for real-time decision-making in autonomous systems, the integrity of these algorithms must be verifiable by the hardware root of trust. This mutual dependence—AI driving the need for better security, and SEs enabling secure AI execution—will shape R&D priorities for the next decade, focusing on enhanced processing power within the SE to handle complex cryptographic operations and potentially support advanced secure enclaves tailored for AI workloads. The market anticipates significant disruption from vendors who successfully marry these two critical technologies into integrated, high-performance security solutions.

Geographically, while North America and Europe maintain technological leadership and high average selling prices (ASPs) due to rigorous compliance demands, the rapid industrialization and sheer scale in the APAC region are driving volume growth. The focus in APAC is often balancing cost constraints with essential security features for high-volume consumer and industrial electronics production. This regional dynamic compels global vendors to offer tiered product portfolios, ranging from highly certified, premium solutions for high-assurance environments to cost-optimized, secure-by-design components for mass-market devices. This strategic maneuvering ensures that the Secure Element market caters to the diverse security needs and financial constraints present across the global IoT landscape, fostering universal adoption.

In summary, the IoT Secure Element market is characterized by robust growth, driven by fundamental shifts in regulatory expectations and the technical requirements imposed by advanced technologies like 5G, Edge AI, and autonomous systems. The market is consolidating around advanced hardware architectures (eSE and iSE) and focusing on comprehensive lifecycle management solutions, ensuring that the hardware-backed identity remains the anchor of security in an increasingly interconnected and threat-prone world. Success for market participants hinges on continuous innovation in tamper resistance, swift integration of emerging cryptographic standards, and strategic alignment with major vertical industry needs.

The deployment complexity, while a current restraint, is steadily being overcome through advanced provisioning services and standardization initiatives like GlobalPlatform, which define clear functional specifications for SE utilization. This simplification process is vital for ensuring that robust security is accessible to small and medium-sized enterprises (SMEs) entering the IoT space. Ultimately, the long-term outlook for the IoT Secure Element market is exceptionally positive, fueled by the intrinsic value of trust and integrity in a fully digitized global economy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager