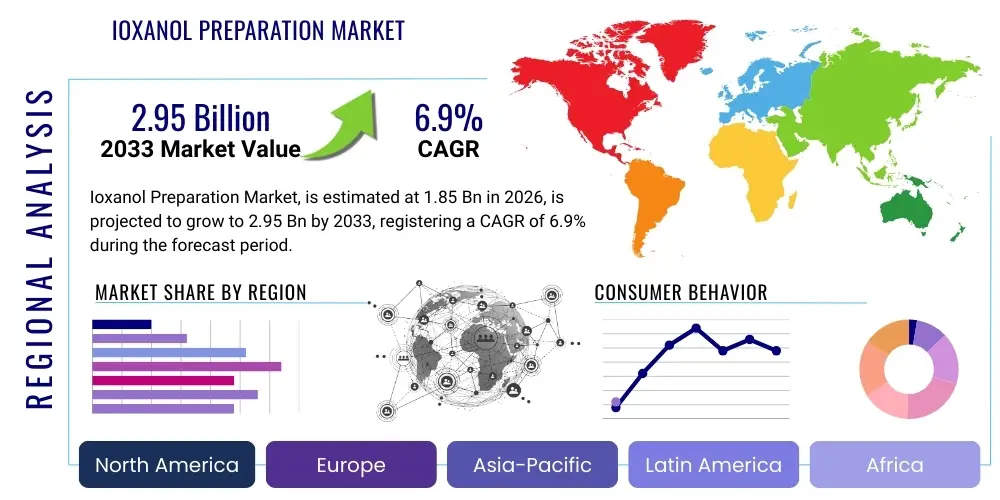

Ioxanol Preparation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443536 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Ioxanol Preparation Market Size

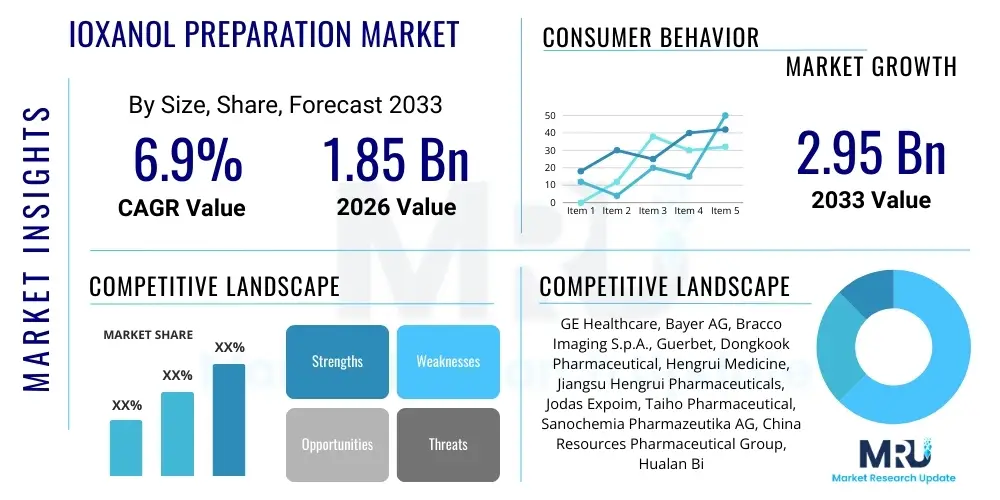

The Ioxanol Preparation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing global prevalence of chronic diseases, particularly cardiovascular disorders and cancer, which necessitate frequent and precise diagnostic imaging procedures. Ioxanol, a low-osmolar, non-ionic contrast agent, minimizes adverse effects compared to older ionic agents, driving its preferential adoption across established and emerging healthcare systems, especially for high-risk patients or procedures requiring larger contrast volumes.

Ioxanol Preparation Market introduction

The Ioxanol Preparation Market encompasses the production, distribution, and utilization of ioxanol, a critical iodinated contrast medium essential for enhancing visualization in various diagnostic imaging modalities. Ioxanol, chemically known as N,N'-bis(2,3-dihydroxypropyl)-5-[N-(2,3-dihydroxypropyl)acetamido]-2,4,6-triiodo-isophthalamide, is favored due to its non-ionic structure and low osmolality, which significantly improves patient tolerance and reduces the risk of adverse reactions such as contrast-induced nephropathy (CIN) and generalized hypersensitivity. This characteristic makes it a standard agent in modern radiological practices globally, particularly within complex interventional procedures and computed tomography (CT) scans. The pharmaceutical formulation of Ioxanol typically involves solutions for injection, meticulously prepared to ensure stability, sterility, and optimal concentration for effective imaging results.

Major applications for Ioxanol preparation span across angiography (coronary, peripheral, and cerebral), CT scanning (chest, abdomen, pelvis), urography, and certain myelography procedures. Its utility is deeply integrated into critical care diagnostics, emergency medicine, and routine outpatient screening for various conditions affecting vascular systems and solid organs. The clinical benefits derived from Ioxanol preparations include superior image contrast enhancement, leading to clearer differentiation between normal and pathological tissues, thereby facilitating accurate disease staging, treatment planning, and monitoring of therapeutic efficacy. The driving factors sustaining market momentum are multi-faceted, including rapid advancements in imaging technology that demand high-quality contrast agents, the expanding elderly population globally requiring more diagnostic interventions, and heightened healthcare expenditure in developing economies focused on upgrading radiological infrastructure.

The product versatility of Ioxanol allows its use in a broad spectrum of medical fields, ranging from oncology and cardiology to neurology and gastroenterology. The regulatory landscape, while stringent, continues to support the use of established contrast agents like Ioxanol due to their well-documented safety and efficacy profiles. Furthermore, the market benefits from continuous research and development efforts aimed at optimizing contrast delivery systems and minimizing contrast volume requirements, which ensures Ioxanol remains at the forefront of injectable contrast media choices despite competitive pressure from alternative non-iodinated agents or procedural substitutes. Ensuring widespread availability and cost-effectiveness remains crucial for market penetration, especially in regions facing infrastructural challenges.

Ioxanol Preparation Market Executive Summary

The Ioxanol Preparation Market is characterized by robust growth, propelled by strong underlying business trends such as increasing investment in radiology departments globally, enhanced standardization of imaging protocols requiring non-ionic contrast media, and vigorous competition driving efficiency in manufacturing and distribution. Business trends emphasize strategic alliances between pharmaceutical manufacturers and large hospital groups to secure long-term supply contracts, alongside intensified focus on generic versions of Ioxanol as patents expire, particularly impacting pricing dynamics in mature markets like North America and Western Europe. Companies are increasingly investing in sophisticated packaging and delivery mechanisms, such as pre-filled syringes, to enhance safety, reduce preparation time, and minimize medical waste, thus aligning with evolving clinical workflow demands and reducing the risk of contamination errors.

Regionally, the market exhibits divergent growth trajectories. North America and Europe currently represent the largest revenue generators due to high procedural volumes, established healthcare infrastructure, and high adoption rates of advanced imaging technologies. However, the Asia Pacific (APAC) region is poised for the fastest expansion, driven by astronomical increases in healthcare access, significant governmental investment in modernization of public health systems, and a burgeoning middle class demanding better diagnostic services. Key regional trends in APAC involve the establishment of large-scale diagnostic chains and the localization of manufacturing, which helps mitigate supply chain risks and reduces import dependency. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit starting from a lower base, largely supported by medical tourism and focused public health campaigns aimed at early disease detection, which increases the utilization of contrast-enhanced imaging.

Segment-wise, the market sees dominant revenue contribution from the Computed Tomography (CT) and Angiography application segments, owing to the high volume of cardiovascular and trauma-related diagnostics. In terms of concentration, the 350 mg I/mL concentration segment often commands higher value due to its usage in complex vascular imaging and procedures demanding high contrast visibility, while the 300 mg I/mL concentration remains the standard for general CT applications. End-user trends show hospitals maintaining the largest market share, but diagnostic centers and ambulatory surgical centers (ASCs) are exhibiting faster growth. This shift reflects the decentralization of diagnostic services, moving routine procedures away from acute care settings toward more cost-effective outpatient environments, a trend accelerated by evolving reimbursement policies globally.

AI Impact Analysis on Ioxanol Preparation Market

The impact of Artificial Intelligence (AI) on the Ioxanol Preparation Market is centered primarily on optimizing the diagnostic workflow, enhancing patient safety, and improving the efficiency of contrast medium usage. Common user questions often revolve around whether AI can predict adverse reactions to Ioxanol, if AI can optimize the injected dose based on real-time patient parameters, and how AI-powered image analysis might reduce the need for high contrast volumes. Analysis indicates that users are highly interested in AI’s capability to personalize contrast protocols, moving away from standardized dosing toward precision medicine approaches, thereby reducing the risk of Contrast-Induced Nephropathy (CIN) and associated healthcare costs. Furthermore, there is significant interest in AI's role in streamlining scheduling and inventory management within radiology departments, ensuring efficient stock levels of Ioxanol preparations and minimizing wastage due to expiration or ordering errors. The key themes highlight AI as a tool for safety enhancement, dosage precision, and workflow optimization, rather than a direct threat to the product itself, solidifying Ioxanol's continued relevance.

AI's influence extends deeply into the pre-procedural assessment phase. Machine learning algorithms are increasingly utilized to analyze electronic health records (EHRs), predicting patient risk factors for adverse reactions to iodinated contrast agents like Ioxanol, including renal impairment or severe allergic responses. This proactive identification allows clinicians to implement protective measures, such as hydration protocols or alternative imaging modalities, or select the safest appropriate Ioxanol preparation concentration. By flagging high-risk patients more reliably than traditional scoring systems, AI ensures that Ioxanol is administered judiciously and safely, bolstering clinician confidence in its use. The integration of AI tools for patient risk stratification is becoming a standard practice in major diagnostic centers, positioning Ioxanol preparations within a framework of enhanced clinical safety and personalized care delivery.

During the imaging procedure itself, AI algorithms are being developed and deployed to analyze physiological parameters and real-time imaging data to dynamically adjust contrast injection rates and volumes. This intelligent delivery system, often integrated with the power injector, ensures optimal enhancement while minimizing the total amount of Ioxanol required, leading to reduced overall contrast load per patient. Post-procedure, AI-powered image processing techniques, such as noise reduction and image reconstruction (e.g., using Deep Learning Reconstruction), are capable of generating high-quality diagnostic images even when lower contrast doses are used. This efficiency gain, driven by AI, indirectly impacts market demand by supporting lower per-procedure consumption rates, though this is balanced by the overall increase in the number of diagnostic procedures performed globally. Ultimately, AI transforms Ioxanol usage from a generalized protocol into a highly optimized, patient-centric process.

- AI enhances pre-procedural risk assessment for Contrast-Induced Nephropathy (CIN) and allergic reactions to Ioxanol.

- Machine learning algorithms optimize contrast dose injection protocols, reducing required Ioxanol volume per procedure.

- AI improves image quality and noise reduction, maintaining diagnostic value even with reduced contrast concentration.

- Predictive analytics aid in inventory management and supply chain efficiency for Ioxanol preparations in hospitals.

- AI-driven workflow automation streamlines patient scheduling for contrast-enhanced procedures, increasing throughput.

DRO & Impact Forces Of Ioxanol Preparation Market

The Ioxanol Preparation Market is significantly shaped by a powerful interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the impact forces influencing its trajectory. The primary driver is the escalating global burden of chronic non-communicable diseases, such as cardiovascular diseases, neurological disorders, and oncology-related conditions, all of which necessitate regular, high-resolution diagnostic imaging enhanced by contrast agents like Ioxanol. Coupled with this is the demographic shift towards an aging global population, inherently requiring more diagnostic procedures, thus sustaining high demand. Furthermore, the established safety profile of Ioxanol as a non-ionic, low-osmolar agent continues to drive its preference over older, higher-osmolar alternatives, cementing its clinical dominance and ensuring continuous adoption in critical imaging contexts globally. Advances in imaging technology, such as faster CT scanners and highly sophisticated angiography systems, demand contrast agents that can deliver high flow rates and optimal enhancement, a capability inherent in modern Ioxanol formulations.

Conversely, the market faces significant restraints, most prominently the risk of Contrast-Induced Nephropathy (CIN), a serious complication that, despite Ioxanol's relatively low risk profile compared to older agents, still requires cautionary measures, particularly in patients with pre-existing renal impairment. Stringent regulatory scrutiny and complex approval processes for new formulations or generic versions in major economic zones also act as a bottleneck, raising development costs and slowing market entry. Another critical restraint is the pricing pressure exerted by the increasing presence of generic Ioxanol manufacturers, particularly in competitive markets, leading to margin erosion for proprietary manufacturers. Furthermore, ongoing research into non-iodinated contrast alternatives, such as gadolinium-based agents (though with their own safety concerns) and emerging contrast-free imaging techniques (e.g., specific MRI sequences), poses a long-term substitutional threat, compelling continuous innovation in the iodinated contrast segment.

Opportunities for market expansion are predominantly centered on penetrating high-growth emerging economies, particularly across Asia Pacific and Latin America, where healthcare infrastructure investment is rapidly accelerating and access to advanced diagnostic imaging is expanding beyond metropolitan centers. Strategic opportunities also exist in the development of specialized, highly concentrated Ioxanol preparations tailored for specific, high-end interventional procedures, offering premium pricing potential. Furthermore, integrating Ioxanol administration with advanced digital health technologies, including AI-driven personalized dosing and safety monitoring platforms, offers manufacturers a competitive edge by enhancing clinical utility and minimizing adverse event liabilities. Strategic acquisitions and partnerships focused on streamlining supply chain logistics, ensuring rapid response to regional demand surges, and improving temperature stability during transit represent viable avenues for future market growth and increased global footprint.

Segmentation Analysis

The Ioxanol Preparation Market segmentation provides a granular view of market dynamics, revealing varying growth rates and competitive landscapes across different product types, concentrations, applications, and end-user categories. Analyzing these segments is crucial for stakeholders to identify high-potential areas for investment, tailor marketing strategies, and understand specific customer needs. The market is primarily stratified based on the iodine concentration of the preparation, which directly correlates with the specific diagnostic procedure and imaging clarity required. Application segmentation reflects the vast clinical scope of Ioxanol, highlighting the reliance of diverse medical specialties on this agent for accurate diagnosis and interventional guidance. End-user segmentation illustrates the consumption patterns across institutional settings, demonstrating the transition of some procedures from large hospital environments to specialized outpatient facilities, thereby influencing distribution requirements and bulk purchasing behaviors. This comprehensive segmentation framework allows for precise forecasting and targeted strategic planning within the dynamic global healthcare ecosystem.

- By Concentration (Type):

- Ioxanol 300 mg I/mL

- Ioxanol 350 mg I/mL

- Other Concentrations (e.g., lower concentrations for pediatric use or higher concentrations for specialized angiography)

- By Application:

- Computed Tomography (CT) Scanning

- Angiography (Coronary, Peripheral, Cerebral)

- Urography and Pyelography

- Magnetic Resonance Imaging (MRI) (Used in specific protocols, although less common than CT/Angiography)

- Interventional Radiology Procedures

- Other Diagnostic Procedures

- By End-User:

- Hospitals (Including large teaching and regional facilities)

- Diagnostic Centers and Clinics (Freestanding radiology centers)

- Ambulatory Surgical Centers (ASCs)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Ioxanol Preparation Market

The value chain for the Ioxanol Preparation Market begins with upstream activities focused on the synthesis of the active pharmaceutical ingredient (API), Ioxanol, requiring highly specialized chemical manufacturing processes involving complex iodination steps and purification to ensure medical- grade quality and stability. Key upstream factors include the stable supply of raw materials, primarily iodine and precursor chemical intermediates, which are subject to global commodity pricing fluctuations and geopolitical stability risks. Manufacturing involves stringent quality control protocols (GMP compliance) specific to injectable pharmaceuticals, focusing on sterility, pyrogenicity testing, and precise concentration verification. Efficiency in upstream synthesis directly impacts the final product cost and market competitiveness, with integration or long-term contracts with raw material suppliers being a common strategy to mitigate supply chain volatility and ensure quality consistency, a crucial element for injectable contrast media.

The downstream segment involves the extensive process of formulation, aseptic filling, packaging (often in glass vials or pre-filled plastic syringes), and rigorous quality assurance before distribution. Distribution channels are highly regulated and specialized, often relying on both direct and indirect models. Direct distribution is typically employed for major hospital networks and large governmental procurement bodies, allowing manufacturers to maintain tight control over inventory, temperature control (critical for pharmaceuticals), and volume pricing. This approach ensures rapid delivery and specialized technical support for contrast media handling equipment, such as power injectors. Conversely, indirect distribution utilizes third-party specialized pharmaceutical logistics companies and regional distributors, particularly important for reaching smaller clinics, remote diagnostic centers, and overseas markets where direct presence is economically unfeasible.

The choice between direct and indirect channels heavily influences market reach and profitability. While direct sales offer higher margins and closer customer relationships, indirect channels provide broader geographic coverage and reduced operational complexity, especially in fragmented markets like APAC. Potential customers, or end-users, are primarily hospitals and diagnostic centers, which purchase through bulk procurement tenders or established long-term contracts. The final consumption point requires specialized capital equipment (CT, angiography systems) and trained personnel (radiologists, radiographers) for administration, further cementing the role of technology and training as crucial downstream factors. Effective management of the cold chain logistics and regulatory compliance across different countries remains a major hurdle that defines competitive success in the downstream segment, highlighting the complexity inherent in distributing high-volume injectable medical products globally.

Ioxanol Preparation Market Potential Customers

Potential customers for Ioxanol preparation are predominantly institutions that operate high-volume diagnostic imaging and interventional radiology suites, where contrast enhancement is mandatory for accurate clinical decision-making. The primary end-users are large public and private hospitals, including teaching hospitals and integrated healthcare networks, which account for the majority share of the market volume due to their comprehensive service offerings, emergency care capabilities, and high patient throughput for complex procedures like coronary angiography and trauma CT scans. These large institutions often have established formulary committees and purchasing organizations (GPOs) that dictate procurement decisions, prioritizing product safety, reliability of supply, and competitive pricing based on large annual volume contracts, making them the cornerstone of market demand for manufacturers.

Beyond the hospital setting, a rapidly growing customer base includes dedicated Diagnostic Imaging Centers and specialized Radiology Clinics. These centers focus exclusively on non-invasive and minimally invasive diagnostic procedures, often offering faster scheduling and lower costs than traditional hospitals, thereby capturing a significant portion of the outpatient imaging market. For these centers, ease of use, product stability, and efficient packaging (such as pre-filled syringes) are key purchasing criteria, as they streamline workflow and reduce reliance on in-house pharmacy preparation. The accelerated growth of these outpatient facilities, particularly in urban and suburban areas, represents a crucial expansion opportunity for Ioxanol manufacturers looking to diversify their customer portfolio outside the traditional hospital framework.

Furthermore, Ambulatory Surgical Centers (ASCs) that perform interventional procedures, particularly vascular and pain management interventions requiring fluoroscopic guidance, are emerging as significant potential customers. Although their volume of contrast agent usage is generally lower per site compared to a major hospital, the cumulative demand from the growing number of ASCs contributes substantially to market growth, reflecting the trend toward specialized, decentralized procedural care. Military and governmental healthcare facilities, as well as veterinary practices requiring advanced imaging for animal patients, also constitute smaller but important customer segments, often purchasing Ioxanol through separate, specialized supply contracts or specific government tenders, necessitating tailored distribution and regulatory compliance strategies from suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | CAGR 6.9% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Healthcare, Bayer AG, Bracco Imaging S.p.A., Guerbet, Dongkook Pharmaceutical, Hengrui Medicine, Jiangsu Hengrui Pharmaceuticals, Jodas Expoim, Taiho Pharmaceutical, Sanochemia Pharmazeutika AG, China Resources Pharmaceutical Group, Hualan Biological Engineering, Double-Crane Pharmaceutical, Fuxin Dare Pharmaceutical Co., Ltd., Zydus Lifesciences, Teleflex Incorporated, Merck KGaA, Dr. Reddy's Laboratories, Omnivision Pharmaceutical, Trivitron Healthcare. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ioxanol Preparation Market Key Technology Landscape

The technological landscape surrounding the Ioxanol Preparation market is primarily defined by advancements in pharmaceutical manufacturing, sophisticated drug delivery systems, and the integration of contrast delivery with advanced imaging equipment. In pharmaceutical manufacturing, proprietary technologies focus on enhancing the purity and stability of the Ioxanol API, ensuring the lowest possible levels of free iodine and minimizing impurities that could trigger adverse reactions. Advanced sterilization techniques, particularly aseptic filling processes, are crucial to maintaining the injectable grade standard, with continuous monitoring and validation required to meet stringent global regulatory standards like those set by the FDA and EMA. Furthermore, research into micro-emulsion technologies and stabilized formulations aims to extend shelf life and potentially reduce viscosity, which is critical for rapid injection through automated power injectors, especially in high-flow angiography procedures.

A major technological focus is the development of optimized delivery mechanisms. Pre-filled syringes represent a substantial technological advancement, replacing traditional vials and reducing the need for bedside preparation. These syringes integrate seamlessly with high-pressure power injectors (e.g., dual-head injectors used for simultaneous contrast and saline flush), offering precise control over injection flow rate and volume, which is vital for achieving consistent and predictable vascular enhancement in dynamic procedures like cardiac CT. These delivery systems also incorporate safety features, such as air-bubble detection and anti-reflux mechanisms, thereby enhancing patient safety and optimizing clinical workflow efficiency. The technological competition here lies in the development of highly reliable, cost-effective, and user-friendly pre-filled systems compatible with leading power injector brands across the globe.

Furthermore, technology related to digital integration and patient monitoring plays a key role. Modern imaging suites use information technology (IT) solutions to track contrast usage per patient, manage inventory, and cross-reference injection protocols with patient renal function data, often utilizing AI and electronic medical records (EMR) systems. This digital infrastructure enables compliance with best practices for contrast administration, such as minimizing total iodine load. Advances in imaging hardware, specifically spectral CT and photon-counting CT, are also influencing contrast utilization by improving the signal-to-noise ratio and potentially allowing for diagnostic quality images with slightly lower doses of Ioxanol, driving technological innovation toward formulations that remain effective at lower concentrations while maintaining viscosity standards suitable for automated injection systems required for rapid volumetric scanning.

Regional Highlights

- North America: This region dominates the Ioxanol Preparation Market in terms of market value, driven by high adoption rates of advanced diagnostic technologies, well-established healthcare reimbursement systems, and a high volume of complex interventional cardiology and oncology procedures. The U.S. remains the largest consumer, benefiting from continuous investment in radiology infrastructure and the widespread use of proprietary and branded Ioxanol formulations. Stringent safety standards and high awareness of non-ionic contrast agents ensure sustained demand, although competition from generic versions is consistently increasing, impacting overall pricing.

- Europe: Europe represents a mature market characterized by universal healthcare coverage and high quality of radiological services, particularly in countries like Germany, France, and the UK. The market is supported by robust clinical guidelines advocating for low-osmolar contrast agents. Growth is steady, focused on optimizing procurement through large tenders and consolidating manufacturing footprints within the region to stabilize supply chains, especially post-Brexit. Eastern European countries present a faster growth rate due to ongoing modernization of public health facilities and increased accessibility to CT and angiography systems.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, fueled by rapid expansion of healthcare access, massive population bases (China and India), and significant government expenditure directed toward building diagnostic capabilities. Increasing incidence of chronic diseases and rising medical tourism further boost demand. The region is highly competitive, featuring both multinational corporations and strong domestic manufacturers vying for market share, often leading to competitive pricing strategies and a greater emphasis on manufacturing localization and generic drug penetration.

- Latin America: Growth in Latin America is moderate but consistent, largely driven by improving economic conditions, increased private sector investment in healthcare (particularly in Brazil and Mexico), and efforts to standardize clinical practice. Market dynamics are heavily influenced by currency fluctuations and regulatory variability across countries, necessitating tailored distribution strategies, with demand concentrated in major metropolitan areas equipped with advanced diagnostic equipment.

- Middle East & Africa (MEA): The MEA region exhibits promising opportunities, particularly within the GCC countries (Saudi Arabia, UAE), which boast world-class healthcare facilities serving a wealthy patient population and medical tourists. Demand is supported by high rates of cardiovascular disease and significant governmental spending on healthcare infrastructure. South Africa leads the African continent in terms of consumption, while the rest of Africa offers long-term growth potential as basic diagnostic infrastructure improves, contingent on addressing logistical challenges and affordability constraints for contrast agents like Ioxanol.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ioxanol Preparation Market.- GE Healthcare

- Bayer AG

- Bracco Imaging S.p.A.

- Guerbet

- Dongkook Pharmaceutical

- Hengrui Medicine

- Jiangsu Hengrui Pharmaceuticals

- Jodas Expoim

- Taiho Pharmaceutical

- Sanochemia Pharmazeutika AG

- China Resources Pharmaceutical Group

- Hualan Biological Engineering

- Double-Crane Pharmaceutical

- Fuxin Dare Pharmaceutical Co., Ltd.

- Zydus Lifesciences

- Teleflex Incorporated

- Merck KGaA

- Dr. Reddy's Laboratories

- Omnivision Pharmaceutical

- Trivitron Healthcare

Frequently Asked Questions

What is the projected CAGR for the Ioxanol Preparation Market between 2026 and 2033?

The Ioxanol Preparation Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.9% during the forecast period of 2026 to 2033, driven by increasing global diagnostic imaging procedure volumes and the favorable safety profile of low-osmolar contrast agents.

What are the primary applications driving the demand for Ioxanol preparations?

The primary applications driving demand for Ioxanol include Computed Tomography (CT) scanning and Angiography (both coronary and peripheral), which rely heavily on high-quality iodinated contrast media to enhance visualization of soft tissues and vascular structures for diagnosing prevalent chronic diseases.

How does the use of Ioxanol preparations differ by concentration (e.g., 300 mg I/mL vs. 350 mg I/mL)?

The 300 mg I/mL concentration is typically utilized for general CT scans and routine diagnostic procedures, offering adequate contrast enhancement. The 350 mg I/mL concentration, being higher, is generally preferred for complex vascular procedures, such as coronary angiography, where maximal vessel opacification and definition are required for accurate intervention and diagnosis.

Which geographical region is anticipated to experience the fastest market growth?

The Asia Pacific (APAC) region is anticipated to experience the fastest market growth, primarily due to accelerating modernization of healthcare infrastructure, substantial government investment in diagnostic services, and the rapidly increasing patient base requiring advanced imaging procedures in countries like China and India.

What is the main impact of AI on the Ioxanol preparation workflow?

AI's main impact is enhancing patient safety and optimizing consumption by leveraging machine learning to perform pre-procedural risk assessment for complications like CIN and implementing personalized, dose-optimized injection protocols, ensuring efficient and judicious use of the contrast agent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager