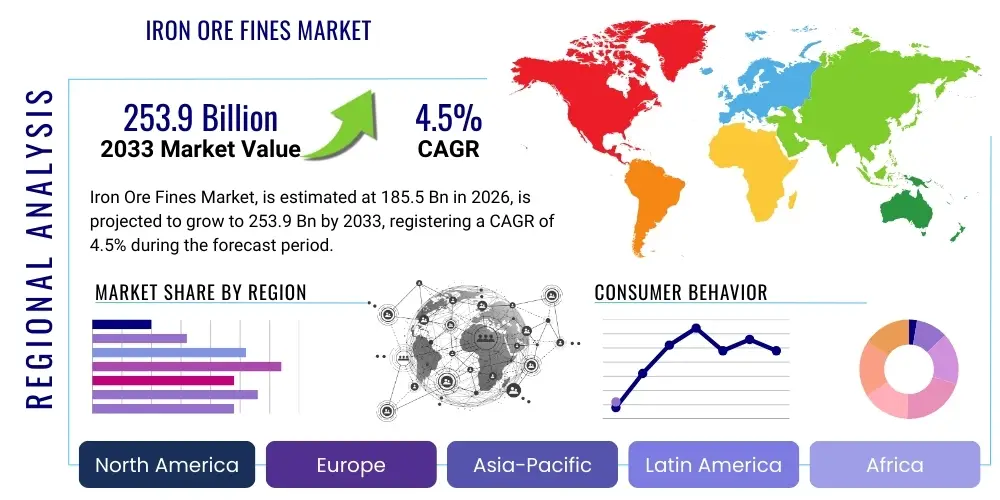

Iron Ore Fines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442280 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Iron Ore Fines Market Size

The Iron Ore Fines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $185.5 Billion in 2026 and is projected to reach $253.9 Billion by the end of the forecast period in 2033.

Iron Ore Fines Market introduction

The Iron Ore Fines Market encompasses the global trade and utilization of fine-grained iron ore particles, typically defined as having a size less than 6.3 mm or 10 mm, depending on regional standards. These fines constitute the vast majority of extracted iron ore, representing a critical intermediate commodity within the global steel supply chain. Their primary value proposition stems from their necessity as feedstock for agglomeration processes—namely sintering and pelletizing—which convert these fine particles into suitable blast furnace burdens. The high demand for steel, particularly in infrastructure, construction, and automotive sectors across developing economies, directly underpins the sustained growth and strategic importance of the iron ore fines segment. Market dynamics are heavily influenced by global steel production capacity, environmental regulations impacting sintering operations, and technological advancements aimed at improving fine utilization efficiency and reducing carbon footprints.

Iron ore fines are characterized by their relatively low cost compared to high-grade lumps or pellets, making them the primary economic choice for bulk steel production. Major applications revolve almost exclusively around preparing input material for primary iron production routes. Sintering involves blending iron ore fines with fluxes and coke breeze, followed by heating to produce a semi-fused product (sinter) suitable for blast furnaces (BF). Alternatively, fines are processed into pellets through balling and firing, offering superior permeability and metallurgical properties, particularly important for optimized BF or Direct Reduced Iron (DRI) production. The ability of fines to be efficiently processed into these agglomerated forms is crucial for minimizing waste and maximizing resource utilization in major steel-producing nations.

The core driving factors influencing this market include robust industrialization and urbanization trends in the Asia-Pacific region, especially China and India, which consume the lion's share of global steel. Furthermore, infrastructural initiatives globally require significant tonnages of steel, thereby driving consistent demand for its primary raw material. Benefits derived from utilizing iron ore fines include cost efficiency in mining operations (as fines are a natural byproduct), flexibility in blending different ore qualities, and enabling high-volume steel production when processed through advanced agglomeration facilities. However, environmental pressures, particularly related to the emissions from sintering, continually push market participants toward adopting cleaner technologies and optimizing pellet feed usage.

Iron Ore Fines Market Executive Summary

The Iron Ore Fines Market is exhibiting steady expansion, primarily driven by resilient demand from Asian steelmakers and strategic investments in agglomeration capacity globally. Key business trends include increased integration of advanced beneficiation techniques to improve fines quality and the growing preference for high-grade pellet feed fines to support lower-emission steelmaking routes like Electric Arc Furnaces (EAF) utilizing DRI. Market participants are focusing on optimizing logistics chains, often involving large-scale dedicated port infrastructure and bulk carriers, to maintain competitive pricing in the highly globalized seaborne trade. Mergers and acquisitions focused on securing high-quality reserves and transportation assets remain prevalent among tier-one mining corporations, aiming to stabilize supply amidst geopolitical fluctuations and environmental compliance pressures.

Regionally, Asia Pacific maintains undisputed dominance, largely attributed to the immense steel production capacities in China, Japan, and South Korea, which rely heavily on seaborne iron ore fines for sintering operations. Restructuring in the Chinese steel industry toward higher efficiency and reduced environmental impact is shifting demand towards premium fines suitable for pelletization. North America and Europe, while consuming less absolute volume than APAC, show strong interest in direct reduction grade fines (DR-grade) as these regions increasingly transition toward hydrogen-based DRI and greener steel production methodologies, emphasizing feedstock quality over sheer volume. The Middle East and Africa (MEA), notably driven by expansion in Saudi Arabia and the UAE, are emerging as significant demand centers, particularly for DR-grade pellets sourced from iron ore fines.

From a segmentation perspective, the market shows crucial differentiation based on grade and processing route suitability. High-grade fines (above 62% Fe content) command premium pricing due to their lower gangue content and efficiency in steelmaking, driving focus towards higher-yield mines. The Processing Technology segment emphasizes Sintering Feed Fines as the largest volume consumer, although Pellet Feed Fines are projected to exhibit faster growth due to the accelerating global transition towards cleaner steel production, which favors pellet utilization. Pricing dynamics remain acutely sensitive to global crude steel production rates and the inventory levels held by major Chinese ports, creating cyclical volatility that necessitates strategic inventory management by both miners and end-users.

AI Impact Analysis on Iron Ore Fines Market

User inquiries regarding AI's influence on the Iron Ore Fines market frequently center on operational efficiency, predictive quality management, and optimizing complex logistics. Common questions explore how Artificial Intelligence (AI) and Machine Learning (ML) can predict ore grade variability in real-time, optimize blasting patterns to yield finer, more consistent material, and minimize energy consumption during agglomeration. Users are particularly keen on understanding AI’s role in simulating sintering processes to reduce emissions and ensure consistent feedstock quality, thereby addressing environmental compliance concerns. The consensus expectation is that AI will primarily serve as an optimization tool, driving down operating costs and improving the metallurgical consistency of fines, which is paramount for high-efficiency steel production.

AI's primary impact is observed across the entire iron ore value chain, starting from exploration and resource modeling. Sophisticated ML algorithms are being deployed to analyze geological data, geophysical surveys, and drilling logs, leading to more accurate estimates of ore body characteristics, including the distribution of iron content and potential contaminants within the fines. This precision allows mining operators to optimize excavation strategies, ensuring consistent feedstock quality before it reaches the beneficiation plant. Furthermore, in the context of Iron Ore Fines specifically, AI models are critical for blending optimization, determining the precise proportions of different fine streams (sourced from various stockpiles or operational areas) required to meet stringent specifications for downstream sintering or pelletizing facilities, thus minimizing waste and maximizing the efficiency of the contained iron unit.

Downstream, AI integration significantly enhances the performance of processing plants. Within sintering facilities, predictive maintenance algorithms analyze sensor data from conveyers, mixing drums, and ignition furnaces to forecast equipment failure, dramatically reducing unplanned downtime. More critically, AI-driven control systems are being developed to regulate the precise parameters of the sintering process—such as temperature profiles, air flow, and moisture content—in real time. These systems utilize historical process data and real-time feedback loops to stabilize the quality of the resultant sinter, which is crucial for blast furnace stability. In the logistics and trade segment, AI is utilized for demand forecasting, optimizing shipping routes, and managing complex inventory across multiple global ports, providing miners and traders with competitive intelligence on supply chain bottlenecks and pricing volatility.

- AI-Enhanced Predictive Maintenance: Reducing downtime in grinding, screening, and agglomeration equipment.

- Real-Time Quality Control: Utilizing computer vision and sensor fusion to monitor and adjust fine particle size distribution and chemical composition during beneficiation.

- Blasting and Mining Optimization: ML models predicting optimal fragmentation for maximizing fines recovery and minimizing energy usage.

- Sintering Process Optimization: AI-driven control systems stabilizing thermal profiles and material permeability to enhance sinter quality and reduce emissions.

- Logistics and Trading Forecasting: Advanced algorithms predicting global steel demand, inventory levels, and optimizing bulk shipping schedules for iron ore fines.

- Resource Modeling Accuracy: Improving geological mapping and reserve estimation through automated analysis of complex exploration data.

DRO & Impact Forces Of Iron Ore Fines Market

The Iron Ore Fines Market is fundamentally shaped by a delicate balance of robust industrial demand, stringent environmental oversight, and inherent supply chain vulnerabilities. The primary driver remains the massive, continuous requirement for steel in emerging economies, particularly for essential infrastructure development and rapid urbanization, ensuring a baseline demand for iron units. Restraints largely center around the volatility of commodity pricing, which is highly sensitive to Chinese governmental policy regarding steel production cuts, and the significant capital expenditure required for developing and maintaining large-scale mining and beneficiation infrastructure. Opportunities are emerging from the global 'Green Steel' movement, promoting technologies like hydrogen-based direct reduction, which necessitate high-quality, pellet-grade fines, thus opening premium market segments. These forces interact to create a cyclical yet upward-trending market structure, heavily reliant on geopolitical stability and trade flow predictability.

The major drivers include rapid population growth and subsequent infrastructure spending in Southeast Asia and Africa, which necessitate large volumes of construction steel, consequently stimulating demand for iron ore fines as the primary raw material. Furthermore, advancements in beneficiation technology, allowing for the economical processing of lower-grade ores into saleable fines, are expanding the viable resource base and stabilizing supply. Conversely, the most significant restraints involve increasingly strict global carbon emission regulations targeting sintering operations, which are traditionally high emitters. This regulatory pressure forces steelmakers to invest heavily in abatement technologies or shift toward pelletization and DRI, potentially displacing some traditional sinter-feed fine consumption. Economic uncertainty, manifested through fluctuating foreign exchange rates and high inflation impacting operational costs for miners, also serves as a critical short-term restraint.

Opportunities are substantially centered around innovation and market diversification. The shift towards Direct Reduced Iron (DRI) production offers a premium market for high-purity iron ore fines suitable for pelletization, particularly in regions committed to decarbonization, such as Europe. Furthermore, the development of alternative agglomeration methods, such as cold bonding or briquetting of fines, offers potential solutions for small-to-mid-sized steel producers seeking to avoid the high capital costs and environmental impact of traditional sintering. The impact forces compelling the market include fierce competition among major global mining firms (oligopolistic structure), pervasive geopolitical risks affecting shipping routes and trade tariffs, and the relentless pressure from investors and regulators to implement sustainable mining and processing practices across the entire value chain, demanding transparency and efficiency improvements.

- Drivers: Robust global crude steel production; rapid urbanization and infrastructure investment; cost-effectiveness of fines compared to lumps; technological improvements in beneficiation processes.

- Restraints: Volatile commodity pricing linked to geopolitical events; strict environmental regulations targeting sintering emissions; high transportation costs for seaborne trade; dependence on the economic stability of key importing nations.

- Opportunity: Increasing adoption of Direct Reduced Iron (DRI) technology driving demand for premium pellet feed fines; development of innovative, low-emission agglomeration techniques (e.g., cold bonding); diversification of supply chains away from single-source dependence.

- Impact Forces: Supply chain rigidity due to concentrated ownership of major reserves; cyclical nature of the steel industry; pervasive influence of Chinese economic policies; growing pressure for Sustainable Development Goals (SDGs) compliance in mining.

Segmentation Analysis

The segmentation of the Iron Ore Fines market provides a granular understanding of demand patterns based on metallurgical characteristics, end-use processing requirements, and geographic consumption hubs. Primary market differentiation revolves around the quality of the fines, specifically iron (Fe) content and contaminants like alumina and silica, which dictate suitability for specific steelmaking processes. High-grade fines are essential for premium applications such as Direct Reduction, while lower-grade fines are typically routed through traditional sintering processes, often requiring more complex blending and flux additions to meet furnace specifications. Analyzing these segments is vital for miners to tailor their product offerings and for steel producers to manage their procurement strategies effectively, ensuring optimal material input for cost-efficient crude steel production.

The segmentation by Fe Content is critical for pricing and application suitability. Premium fines, generally exceeding 65% Fe, are increasingly sought after due to their efficiency advantages, as they reduce energy consumption and slag formation in the furnace. The volumetric majority still lies in the standard-grade fines (60-64% Fe), which are the workhorse of the global steel industry, predominantly consumed via sintering routes in high-volume production centers. Furthermore, the market is differentiated significantly by Processing Technology: Sinter Feed Fines dominate the current market volume due to the prevalence of Blast Furnace-Basic Oxygen Furnace (BF-BOF) steelmaking globally, while Pellet Feed Fines represent the high-growth segment, fueled by the push for cleaner steel production through DRI technology.

Geographic segmentation highlights the market's heavy concentration in the Asia Pacific region, driven by unparalleled crude steel production capacity. This region dictates global pricing and trade volumes for iron ore fines. However, regional specialization is evident: Europe and North America show a distinct preference for pellet feed and specialized high-purity fines suitable for non-BF routes, whereas Latin America and Oceania are dominant as major suppliers. Understanding these segmented demands allows stakeholders to forecast bottlenecks, manage inventory efficiently, and capitalize on evolving technological preferences across different industrial zones worldwide, mitigating risks associated with relying on homogeneous market assumptions.

- By Grade (Fe Content):

- High-Grade Fines (Fe > 65%)

- Medium-Grade Fines (Fe 60% – 65%)

- Low-Grade Fines (Fe < 60%)

- By Processing Technology:

- Sinter Feed Fines

- Pellet Feed Fines (including DR-Grade)

- Other Agglomeration Fines (e.g., Briquetting)

- By End-Use Industry:

- Steel Production (BF-BOF Route)

- Direct Reduced Iron (DRI) Production

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Iron Ore Fines Market

The value chain of the Iron Ore Fines market is characterized by capital-intensive upstream mining and beneficiation, followed by complex, highly specialized global logistics, culminating in downstream high-volume processing by the steel industry. Upstream activities involve exploration, drilling, blasting, and extraction of ore, followed by crushing and meticulous screening to produce the fine-sized material. Beneficiation processes, such as wet and dry magnetic separation, gravity separation, and flotation, are critical for removing impurities (gangue) like silica and alumina to meet required specifications for sintering or pelletizing. The efficiency of this upstream phase directly determines the ultimate cost and quality of the final product, influencing competitive advantage among global miners who strive to maximize yields from increasingly complex ore bodies.

The central link in the value chain is logistics and distribution. Iron ore fines are typically traded in massive volumes via seaborne markets, requiring specialized port infrastructure for handling and loading massive bulk carriers. Key distribution channels involve direct sales contracts between major miners (e.g., Vale, Rio Tinto) and large integrated steel mills, often complemented by robust spot markets managed by commodity traders. Indirect channels involve trading houses and brokers who facilitate smaller transactions and manage inventory in major transshipment hubs, such as Chinese ports, acting as crucial liquidity providers. The logistical costs, influenced by bunker fuel prices and shipping availability, represent a significant portion of the final delivered price, making supply chain resilience and efficiency paramount.

Downstream analysis focuses heavily on the end-user processing. Steel mills receive the iron ore fines and utilize them as feedstock for their agglomeration plants. The fines are processed into sinter or pellets, forming the essential burden material for Blast Furnaces (BFs) or feed for Direct Reduced Iron (DRI) plants. This downstream stage is dominated by the world’s largest integrated steel manufacturers who possess the required massive agglomeration facilities. The shift in end-user processing technology towards DRI/EAF routes is increasingly impacting the demand characteristics, prioritizing high-purity pellet feed fines, thereby driving investment upstream into beneficiation technologies capable of producing ultra-fine, low-impurity concentrates.

Iron Ore Fines Market Potential Customers

The primary consumers, or potential customers, of Iron Ore Fines are globally integrated steel manufacturers and metallurgical processing companies that operate large-scale ironmaking facilities. These entities require continuous, high-volume supply of iron units to feed their sintering, pelletizing, and eventually, their blast furnaces or direct reduction plants. These customers are highly sensitive to feedstock consistency, pricing volatility, and supply chain reliability, often engaging in long-term off-take agreements with major mining firms to secure steady supply of specific fine grades tailored to their specific process metallurgy and environmental compliance needs. Geographically, steelmakers located in proximity to deep-water ports, particularly across coastal Asia, constitute the largest customer base.

Beyond the major integrated steel mills, a secondary segment of customers includes independent pelletizers and briquetting specialists. These firms often procure lower or medium-grade fines from various sources and process them into higher-value agglomerated products (pellets or briquettes) for sale to smaller, non-integrated steel producers or specialized foundry operations. This segment is characterized by its flexibility and ability to handle complex blending, serving niche markets that may not be directly accessible to the largest miners. Furthermore, commodity trading houses and specialized brokers act as essential intermediaries, purchasing significant volumes of fines to manage strategic inventories, buffer price risk, and ensure liquidity in the global seaborne market, although their ultimate objective is to resell to the final end-users—the steel mills.

A growing category of potential customers includes emerging players in the 'Green Steel' sector, particularly those developing or operating hydrogen-based Direct Reduction (H-DRI) facilities. These entities represent a future premium segment, demanding extremely high-quality, ultra-low impurity iron ore fines suitable for specialized pellet production, often exceeding 67% Fe content. These customers are driven not just by cost efficiency but by carbon reduction mandates, positioning them as high-priority targets for miners specializing in premium beneficiation technologies. Their procurement decisions are heavily influenced by the guaranteed chemical consistency and physical integrity of the fines to ensure optimal reduction efficiency in their advanced process units.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion |

| Market Forecast in 2033 | $253.9 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vale S.A., Rio Tinto, BHP Group, Fortescue Metals Group (FMG), Anglo American plc, Cleveland-Cliffs Inc., Kumba Iron Ore (a subsidiary of Anglo American), Roy Hill Holdings Pty Ltd, Metalloinvest, LKAB (Luossavaara-Kiirunavaara Aktiebolag), ArcelorMittal S.A., NMDC Limited, Samarco Mineração S.A., Champion Iron Limited, EVRAZ plc, Capesize Iron Ore Pty Ltd, Cliffs Natural Resources, CITIC Pacific Mining, Minmetals Resources, Glencore plc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Iron Ore Fines Market Key Technology Landscape

The technology landscape governing the Iron Ore Fines market is focused heavily on improving beneficiation efficiency, reducing environmental footprint, and maximizing the recovery of high-purity fines from increasingly complex and lower-grade orebodies. Upstream technological advancements are dominated by sophisticated grinding and classification circuits, utilizing high-pressure grinding rolls (HPGRs) and advanced screening techniques to achieve optimal particle size distribution required for both sintering and pelletizing. Magnetic separation techniques, including ultra-fine magnetic separation and high-intensity wet magnetic separators, are crucial for lowering the silica and alumina content, particularly essential for producing premium DR-grade fines that command higher prices in the market. The integration of advanced process control (APC) systems utilizing sensor fusion and predictive modeling ensures precise control over these complex separation processes, guaranteeing consistent quality output regardless of variations in feed ore characteristics.

Midstream technological innovations are centered on enhancing agglomeration processes to meet stricter environmental standards. While traditional sintering remains dominant volumetrically, significant R&D efforts are directed toward reducing NOx and SOx emissions from sinter plants through improved heat recovery, recirculating gas technologies, and the implementation of advanced burner designs. For the high-growth pelletizing segment, technologies such as Grate-Kiln and Straight Grate systems are being optimized for energy efficiency. A critical development is the increased utilization of fluxed pellets and the adoption of technologies like dry magnetic separation to reduce water consumption in water-scarce mining regions. Furthermore, novel approaches to fines utilization, such as hot briquetting and cold bonding technologies, are gaining traction as environmentally friendlier alternatives that bypass the energy intensity of high-temperature agglomeration, although these methods currently serve niche markets and face challenges regarding mechanical strength and metallurgical performance consistency compared to traditional pellets.

Digital transformation, fueled by Industry 4.0 principles, is also reshaping the technological landscape. Comprehensive sensor networks, coupled with machine learning algorithms, are providing real-time operational visibility across mining, beneficiation, and logistics. This allows for proactive decision-making concerning stockpile management, blending strategies, and predictive maintenance schedules. Key emerging technologies also include the use of advanced robotics and autonomous vehicles in large-scale mine sites to improve safety and operational throughput, directly impacting the availability and consistency of raw iron ore fines supply. The pursuit of 'zero-waste' mining necessitates better tailings management technologies, including dewatering and dry stacking, which indirectly influence the overall economic viability and environmental compliance of fines production facilities globally, driving the need for continuous technological adaptation and capital investment.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global Iron Ore Fines market, driven overwhelmingly by China's dominant position as the world's largest steel producer. China, along with major consuming nations like Japan, India, and South Korea, accounts for the vast majority of seaborne iron ore fines imports, primarily utilizing them for sintering operations in their integrated steel mills. India is demonstrating particularly strong growth, fueled by massive domestic infrastructure commitments and corresponding expansions in crude steel capacity. The region is characterized by high trade volumes, intense competition, and a crucial dependency on seaborne supply from Australia and Brazil. Future regional demand growth will be increasingly moderated by Chinese government policies on capacity reduction and environmental clean-up, favoring high-quality, low-contaminant fines suitable for advanced agglomeration and lower-emission processes.

- Europe: The European market for Iron Ore Fines is defined by stringent environmental regulations and a decisive trajectory toward decarbonization, favoring the use of high-purity pellet feed fines over traditional sinter feed. Countries like Sweden and Germany are pioneering the shift towards hydrogen-based steel production (H-DRI), which demands premium DR-grade pellets, directly translating into high demand for specific, high-quality fines from producers like LKAB. While the overall volumetric consumption of fines is lower than in APAC, the European market represents a crucial growth area for specialized, premium products. Logistics are complex, relying on reliable shipping from suppliers in Brazil, North America, and potentially domestic sources like Sweden, emphasizing quality control and minimizing the supply chain carbon footprint.

- North America: North America, particularly the U.S. and Canada, exhibits a market characterized by high domestic pellet production capacity and strong reliance on the Electric Arc Furnace (EAF) route for steelmaking. Demand for iron ore fines is primarily concentrated on DR-grade and Blast Furnace-grade pellet feed, often sourced from highly integrated domestic producers like Cleveland-Cliffs. The region focuses heavily on vertically integrated supply chains, converting fine concentrates into pellets for use in both BF operations and the growing number of captive DRI facilities. Technological innovation focuses on optimizing pelletizing efficiency and utilizing high-quality reserves in the Great Lakes region and Canadian Shield, making the region a net exporter of certain high-grade iron ore pellets, built upon robust domestic fines production.

- Latin America: Latin America is fundamentally a major global supplier, dominating the seaborne trade of iron ore fines, particularly through Brazil (Vale S.A.). The region possesses some of the world's richest iron ore deposits, enabling high-volume, low-cost extraction. Fines exported from this region are crucial for meeting the bulk demand in APAC. Internal consumption in countries like Brazil and Mexico is significant, supporting their domestic integrated steel industries. Market dynamics are heavily influenced by mining safety regulations (following high-profile incidents), geopolitical stability, and the massive scale of infrastructure required to transport ore from remote mines to vast coastal port facilities. Brazil remains the single most important supply node impacting global iron ore fines pricing and supply security.

- Middle East and Africa (MEA): The MEA region is emerging as a significant market, especially for DR-grade fines. Countries like Saudi Arabia, UAE, and Egypt have invested heavily in Direct Reduced Iron (DRI) capacity, taking advantage of affordable natural gas to produce steel via the DRI-EAF route. This creates a strong, sustained demand for high-purity, pelletizable iron ore fines. Africa, meanwhile, contains vast untapped reserves of iron ore, positioning countries like South Africa (Kumba) and West African nations as critical future suppliers of fines, although challenges related to infrastructure development, political stability, and investment security remain key determinants of their market impact and operational scale.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Iron Ore Fines Market.- Vale S.A.

- Rio Tinto

- BHP Group

- Fortescue Metals Group (FMG)

- Anglo American plc

- Cleveland-Cliffs Inc.

- Kumba Iron Ore (a subsidiary of Anglo American)

- Roy Hill Holdings Pty Ltd

- Metalloinvest

- LKAB (Luossavaara-Kiirunavaara Aktiebolag)

- ArcelorMittal S.A.

- NMDC Limited

- Samarco Mineração S.A.

- Champion Iron Limited

- EVRAZ plc

- Capesize Iron Ore Pty Ltd

- Cliffs Natural Resources

- CITIC Pacific Mining

- Minmetals Resources

- Glencore plc

Frequently Asked Questions

Analyze common user questions about the Iron Ore Fines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Iron Ore Fines and Iron Ore Lumps?

Iron Ore Fines are small particles, typically below 6.3 mm, requiring agglomeration (sintering or pelletizing) before use in a blast furnace. Lumps are larger, typically 10-40 mm, and can be charged directly, although fines represent the majority of extracted iron ore.

How do environmental regulations impact the demand for Iron Ore Fines?

Stringent environmental regulations, particularly those targeting emissions from sintering, are decreasing the demand for traditional sinter feed fines and simultaneously boosting demand for high-purity fines suitable for pelletizing, which supports cleaner steel production routes like Direct Reduced Iron (DRI).

Which region dominates the global consumption of Iron Ore Fines?

The Asia Pacific (APAC) region, led by China, dominates the global consumption of iron ore fines due to its massive crude steel production capacity and reliance on the Blast Furnace-Basic Oxygen Furnace (BF-BOF) steelmaking process which utilizes large volumes of fines-derived sinter.

What is DR-Grade Iron Ore Fines, and why is it important?

DR-Grade Fines are ultra-high-purity iron ore fines (typically >67% Fe content and low contaminants) specifically used to produce pellets for Direct Reduced Iron (DRI) production. They are critical because the DRI process, often coupled with EAFs, is central to the steel industry's global decarbonization efforts.

What technological advancements are driving efficiency in the Fines market?

Key advancements include high-pressure grinding rolls (HPGRs) and advanced magnetic separation techniques for better beneficiation, coupled with AI-driven process control systems to optimize blending and agglomeration, ensuring consistent material quality and reducing operational costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager