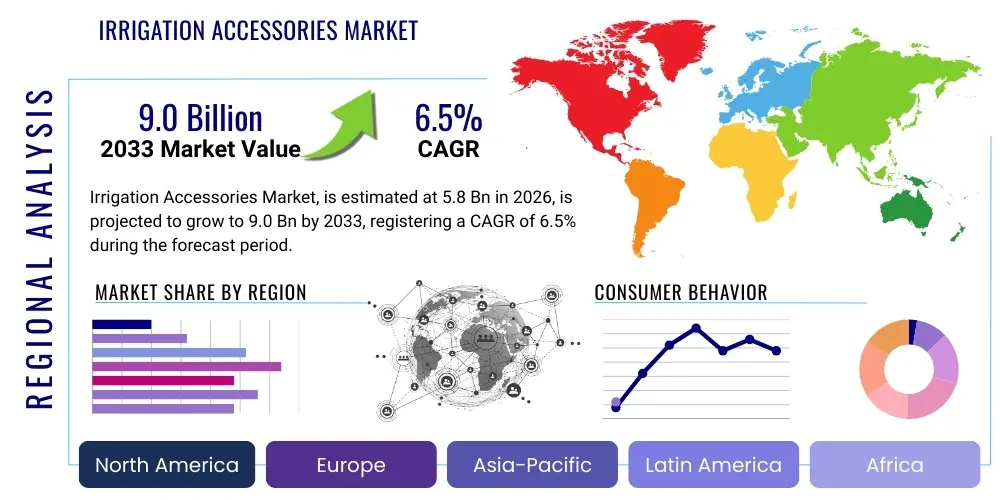

Irrigation Accessories Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442474 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Irrigation Accessories Market Size

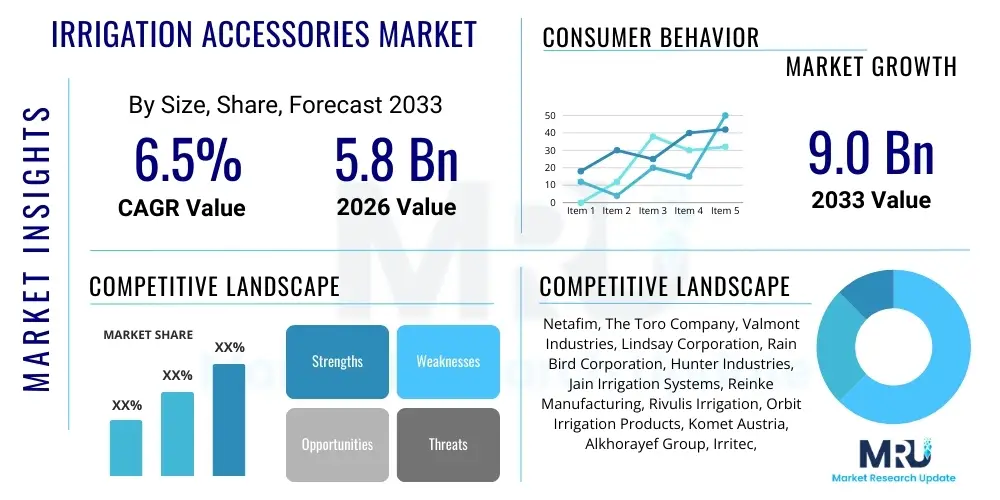

The Irrigation Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by increasing global concerns over water scarcity, coupled with governmental initiatives promoting efficient water usage in agriculture. The adoption of smart farming techniques, which heavily rely on advanced control valves, sensors, and specialized micro-irrigation components, significantly contributes to this upward trajectory, positioning the market as a vital component of sustainable agriculture.

Irrigation Accessories Market introduction

The Irrigation Accessories Market encompasses a vast array of components essential for the effective functioning and optimization of both conventional and advanced irrigation systems, ranging from large-scale agricultural operations to residential landscaping. Key product descriptions include sophisticated control valves, precision emitters, filters, fittings, connectors, hoses, risers, and specialized sensors and controllers. These accessories are fundamentally designed to ensure the uniform distribution of water and nutrients, manage system pressure, and prevent physical damage or clogging, thereby maximizing water use efficiency (WUE) and crop yield. The primary applications span across various sectors, notably large-scale commercial farming (field crops, fruits, vegetables), greenhouse operations, sports turf management, and residential gardens.

The core benefits derived from utilizing high-quality irrigation accessories include substantial water conservation, reduced energy consumption associated with pumping, optimized fertilizer utilization (fertigation), and minimized labor requirements due to automated controls. Enhanced operational longevity and system reliability are also significant advantages, as accessories like pressure regulators and filters protect the main infrastructure from fluctuations and contaminants. Driving factors for market acceleration are multi-faceted, involving rapid global population growth necessitating higher food production, diminishing freshwater resources placing pressure on traditional irrigation methods, and supportive government subsidies promoting the switch from flood irrigation to high-efficiency micro-irrigation systems, particularly in regions prone to drought. Furthermore, technological integration, especially the incorporation of IoT and sensor technology into control accessories, is revolutionizing system management, making precise, localized watering practices economically viable for more producers.

Irrigation Accessories Market Executive Summary

The Irrigation Accessories Market is currently characterized by robust expansion driven by global imperatives for water efficiency and agricultural productivity enhancement. Business trends indicate a strong shift toward digitalization and modular system design, allowing for easier integration of advanced components such as wireless controllers, smart pressure sensors, and specialized filtration units suitable for recycled water. Major manufacturers are focusing intensely on R&D to develop durable, low-maintenance materials (e.g., specialized plastics resistant to UV degradation and chemical corrosion) and connectivity standards that facilitate seamless integration into existing farm management platforms. Strategic mergers and acquisitions are common as large industry players seek to consolidate supply chains and acquire niche expertise in smart water management technology and proprietary flow control mechanisms. The market trajectory is intrinsically linked to global commodity price stability and the continuity of governmental support programs for agricultural modernization.

Regional trends highlight that Asia Pacific (APAC) currently dominates the market share, fueled by massive agricultural sectors in countries like India and China, coupled with significant governmental investments in infrastructure upgrades to combat monsoon variability and groundwater depletion. However, North America and Europe demonstrate the highest adoption rates of premium, high-tech accessories (e.g., sophisticated telemetry units, variable rate irrigation components) due to high labor costs and stringent environmental regulations demanding hyper-efficient water practices. Segment trends show a pronounced preference for drip and micro-irrigation accessories over traditional sprinkler components, reflecting the heightened focus on root-zone precision delivery. Within product types, smart controllers and specialized filtration systems are experiencing accelerated growth, driven by the need to manage complex water sources and achieve granular control over irrigation scheduling. The agricultural segment remains the undisputed leader in application, though residential and commercial landscaping is rapidly adopting smart accessories to meet local water restrictions and achieve aesthetic landscaping goals efficiently.

AI Impact Analysis on Irrigation Accessories Market

User queries regarding the impact of Artificial Intelligence (AI) on the Irrigation Accessories Market predominantly revolve around how AI enhances precision, reduces human intervention, and influences the demand for specific component types. Common questions analyze AI's role in predictive maintenance (identifying failing valves or clogged emitters before system failure), optimizing irrigation schedules based on hyper-local weather models and soil moisture data, and facilitating integration across diverse hardware platforms. Users are keen to understand if AI will necessitate a complete overhaul of existing accessory infrastructure or if it primarily drives the development of smarter controllers and sensors. Key themes synthesized from user concerns focus on data privacy (who owns the irrigation data?), interoperability standards (can AI platforms communicate effectively with legacy valves and pumps?), and the cost-effectiveness of deploying AI-enabled systems, particularly for small and medium-sized farms. Expectations center on AI driving the market towards true autonomous irrigation, where accessories function as interconnected nodes managed by complex optimization algorithms, leading to unmatched water and resource efficiency.

AI's influence is fundamentally shifting the value proposition of irrigation accessories from simple mechanical components to sophisticated data-collection and execution tools. For instance, traditional manual controllers are being replaced by AI-driven smart hubs that analyze inputs from soil sensors, weather forecasts, and historical crop data to determine the exact volume and timing of water required, activating specific zones via smart valves and flow meters. This shift increases the demand for highly accurate, low-power sensing accessories and networked control components (e.g., solenoid valves with digital feedback capabilities). Furthermore, AI algorithms are being applied to image processing captured by drones or satellites to monitor plant health stress, triggering targeted irrigation adjustments through variable-rate accessories, moving beyond fixed scheduling and uniform application. This technological evolution mandates higher quality and precision in accessory manufacturing to ensure reliability within highly sensitive digital environments, indirectly boosting the market for premium, certified components. The long-term impact points towards accessories becoming modular, communicative, and self-diagnostic, drastically improving system reliability and reducing the need for manual checks.

- AI-driven controllers optimize water delivery, reducing waste by 20-35%.

- Predictive maintenance algorithms use sensor data to flag potential failure points in valves and filters, minimizing downtime.

- Increased demand for communication-enabled accessories (smart valves, IoT flow meters) supporting telemetry.

- AI facilitates variable rate irrigation (VRI), requiring specialized VRI nozzles and zonal control accessories.

- Enhanced integration of external data (weather, satellite imagery) requiring standardized accessory interfaces.

- Development of self-learning irrigation models based on real-time accessory performance data feedback.

DRO & Impact Forces Of Irrigation Accessories Market

The Irrigation Accessories Market dynamic is defined by a powerful convergence of growth drivers (D), persistent restraints (R), significant opportunities (O), and structural impact forces. The primary drivers include escalating global water scarcity, governmental mandates promoting efficient water usage in agriculture, the accelerating adoption of micro-irrigation systems, and the integration of IoT/smart technologies into farm management practices. These factors collectively push farmers and consumers towards accessories that offer higher precision, greater durability, and enhanced automation. Restraints, however, temper this growth, prominently including the high initial capital investment required for modern, complex irrigation systems (especially smart components), a lack of technical expertise among smallholder farmers for managing advanced accessories, and the fragmented nature of the market, which can sometimes lead to incompatibility issues between different manufacturers' components. Furthermore, the volatility of raw material prices (plastics and metals) significantly impacts manufacturing costs and, consequently, final product pricing, acting as a periodic restraint on market penetration in price-sensitive developing economies.

Opportunities in the market center around the expansion of precision agriculture into developing regions, the burgeoning legal cannabis and specialized greenhouse industries demanding high-level irrigation control, and the retrofit market where older, inefficient systems are systematically upgraded with modern, water-saving accessories. Developing accessories optimized for non-conventional water sources, such as treated wastewater or brackish water, presents a substantial technological and commercial opportunity, necessitating advanced filtration and corrosion-resistant materials. The structural impact forces shaping the competitive landscape are dominated by technological innovation pressure, where leading firms must continuously update their product lines with smart features (e.g., wireless connectivity, integrated diagnostic tools) to maintain market relevance. Regulatory pressure, stemming from environmental protection agencies globally, forces adherence to strict water conservation standards, making high-efficiency accessories a regulatory compliance necessity rather than just an optional upgrade. Socioeconomic forces, such as the increasing commercialization of agriculture and the demand for higher yield per drop of water, sustain the underlying demand, ensuring continued investment across the value chain, from raw materials to distribution and aftermarket service components. The synergy between drivers and opportunities generally outweighs the restraints, promising a robust long-term growth trajectory characterized by innovation and consolidation.

Segmentation Analysis

The Irrigation Accessories Market is highly segmented, providing comprehensive solutions tailored to various applications, scales, and budgetary requirements. Segmentation is crucial for market participants to identify niche high-growth areas and customize product development based on specific end-user needs, whether it involves highly specialized emitters for hydroponics or robust, high-volume valves for large field crops. The primary axes of segmentation include the type of product (defining function, such as flow control or filtration), the application area (agricultural versus non-agricultural needs), the material used in manufacturing (impacting durability and cost), and the specific end-user category (determining scale and automation requirements). Analysis across these segments reveals differing growth rates; for instance, smart controllers and connectivity accessories exhibit significantly faster growth compared to traditional mechanical fittings, reflecting the industry's digital transformation. Geographic segmentation further differentiates demand, with mature markets prioritizing high-tech, data-driven solutions and emerging markets focusing on affordable, scalable micro-irrigation components.

Detailed examination of the product segment shows micro-irrigation accessories, including specialized drippers, micro-sprinklers, and sophisticated filtration units designed to handle impurities, dominating the volume market due to their superior water efficiency attributes. Meanwhile, the technology-driven segment of control accessories—specifically solenoid valves, pressure regulators, and centralized control systems—leads in terms of revenue growth, driven by their critical role in automated and precise water management systems. Within the application segmentation, the agricultural segment remains the cornerstone of the market, but non-agricultural uses, particularly commercial landscaping and municipal infrastructure projects focused on water conservation in urban areas, are expanding rapidly, demanding aesthetic and concealed accessory installations. Material segmentation indicates a steady shift towards high-grade engineered plastics (e.g., specialized polyethylene and PVC) offering excellent durability and resistance to chemicals and UV radiation, gradually displacing traditional metal components in non-high-pressure applications due to cost and ease of installation advantages. Understanding these nuanced segments is vital for supply chain planning and targeting effective marketing campaigns within this complex global market.

- Product Type: Drip Irrigation Accessories (Emitters, Driplines, Filters), Sprinkler Irrigation Accessories (Nozzles, Hoses, Risers, Couplings), Micro-Irrigation Accessories, Control Accessories (Controllers, Timers, Sensors, Flow Meters), Valves (Solenoid, Manual, Check), Pressure Regulators.

- Application: Agricultural (Field Crops, Row Crops, Orchards, Vineyards, Greenhouses, Nurseries), Non-Agricultural (Residential Lawns and Gardens, Commercial Landscaping, Golf Courses/Sports Fields, Municipal Parks, Industrial Dust Suppression).

- Material: Plastic (Polyethylene, PVC, Polypropylene), Metal (Aluminum, Brass, Steel, Cast Iron), Composite Materials.

- End-User: Large Commercial Farms, Small and Medium Enterprises (SMEs) in Agriculture, Residential Consumers, Landscaping Professionals/Contractors, Government Agencies/Municipalities.

Value Chain Analysis For Irrigation Accessories Market

The value chain for the Irrigation Accessories Market is characterized by several distinct stages, commencing with raw material suppliers and culminating in installation and aftermarket services, reflecting a relatively complex journey from production to end-user application. The upstream analysis focuses heavily on the procurement of critical materials, predominantly high-density polyethylene (HDPE), PVC, specialized engineering plastics, and various metals (steel, brass, aluminum) required for manufacturing valves, filters, and piping components. Pricing volatility and sustainability credentials in the material sourcing stage significantly impact the overall cost structure and environmental footprint of the final accessories. Manufacturers then transform these materials using processes like injection molding, extrusion, and precision machining, often requiring specialized tooling and adherence to strict quality standards (e.g., pressure rating, UV resistance). Key upstream risks include dependence on petrochemical derivative pricing and ensuring consistent quality of specialized plastics necessary for durable outdoor performance.

The downstream analysis primarily concerns the distribution channel and installation phases, which are critical for market penetration and customer satisfaction. The market utilizes a mixed distribution model: direct sales channels are typically employed for large-scale agricultural projects or major municipal contracts, where technical consultation and customized system design are required. In contrast, indirect channels, involving wholesalers, specialized irrigation distributors, agricultural cooperatives, and retail hardware stores, dominate the distribution of standardized and smaller accessories destined for residential and SME agricultural users. The effectiveness of the indirect channel hinges on the technical training provided to dealers, enabling them to correctly advise customers on system compatibility and installation best practices. Direct channels often incorporate robust aftermarket services, including maintenance, system monitoring, and the supply of replacement components, which form a significant, recurring revenue stream for major manufacturers. The growing complexity of smart accessories necessitates that distributors and installers possess expertise in both hydraulic engineering and digital connectivity protocols, driving the need for continuous professional development within the distribution network.

Irrigation Accessories Market Potential Customers

The potential customer base for the Irrigation Accessories Market is highly diversified, spanning from large, globally operating corporate farms to individual residential gardeners, but generally segmentable by scale and purpose. Large-scale commercial agriculture constitutes the largest and most valuable segment, particularly farms dedicated to high-value specialty crops (e.g., nuts, fruits, wine grapes) and staple crops utilizing pivot irrigation systems, where investment in advanced, durable accessories directly correlates with maximized yield and resource conservation mandates. These institutional buyers prioritize accessories that offer superior longevity, high-pressure handling capabilities, and seamless integration with complex centralized control systems, often negotiating customized supply agreements directly with manufacturers or specialized engineering firms. Furthermore, government agencies managing public lands, urban parks, and golf course complexes represent significant potential buyers, driven by environmental mandates to reduce municipal water consumption while maintaining high aesthetic standards, often preferring advanced flow meters, smart controllers, and highly efficient subsurface drip systems.

Another rapidly expanding segment involves professional landscaping contractors and property developers who require efficient, reliable, and often aesthetically inconspicuous irrigation solutions for residential and commercial property development. This customer group places a premium on ease of installation, durability, and compliance with local watering restrictions, driving demand for smart timers, hidden valves, and high-efficiency nozzles. Small and medium-sized farms (SMEs) represent a vast, global customer pool, particularly in emerging economies where they are transitioning from traditional, inefficient irrigation methods to micro-irrigation. These buyers are highly price-sensitive but prioritize accessories that are rugged, easy to maintain, and offer measurable short-term improvements in crop health and water conservation. The key to unlocking demand in this segment lies in developing cost-effective, modular accessory packages supported by accessible technical guidance and financing options. The growth of specialized, controlled environment agriculture (CEA), such as vertical farms and greenhouses, also creates a high-value niche market for hyper-precision accessories, including specialized dosing pumps, nutrient injection fittings, and highly accurate pressure regulation equipment, reflecting the need for unparalleled environmental control.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Netafim, The Toro Company, Valmont Industries, Lindsay Corporation, Rain Bird Corporation, Hunter Industries, Jain Irrigation Systems, Reinke Manufacturing, Rivulis Irrigation, Orbit Irrigation Products, Komet Austria, Alkhorayef Group, Irritec, Dramm Corporation, Nelson Irrigation Corporation, Metrohm, Senninger Irrigation, Weathermatic, Wyatt Water, Bauer GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Irrigation Accessories Market Key Technology Landscape

The technological landscape of the Irrigation Accessories Market is rapidly evolving, moving decisively beyond traditional mechanical components toward integrated, smart solutions enabled by the Internet of Things (IoT) and advanced sensor technology. A pivotal technological trend involves the proliferation of smart controllers and centralized management platforms, which utilize cloud computing and proprietary algorithms to manage irrigation schedules based on real-time environmental data, rather than pre-set timers. These smart accessories necessitate enhanced communication protocols, often leveraging LoRaWAN, cellular networks, or proprietary mesh systems, enabling valves, flow meters, and soil moisture sensors to communicate seamlessly with the central hub. This connectivity allows for highly granular control, such as automatically adjusting the flow rate or pressure via smart regulators in specific irrigation zones based on immediate weather changes or measured soil saturation levels. The adoption of battery-powered, wireless components is crucial for overcoming infrastructure limitations in remote agricultural settings, demanding accessories designed for ultra-low power consumption and exceptional durability in harsh outdoor environments.

Another major technological focus is placed on water quality management accessories, driven by the increasing use of recycled and non-conventional water sources. This demands continuous innovation in filtration technology, including self-cleaning screen filters and disc filters equipped with automated backwash systems, capable of handling high loads of organic and inorganic matter without manual intervention or excessive water loss. Furthermore, specialized accessories are being developed for fertigation and chemigation systems, such as precise dosing pumps, specialized injectors, and corrosion-resistant fittings, ensuring the accurate and safe mixing of nutrients or crop protection chemicals directly into the irrigation water stream. Materials science innovation is also critical; manufacturers are continuously developing new polymer compounds that resist UV degradation, chemical etching, and stress cracking, thereby extending the lifespan and reliability of vulnerable components like driplines and exposed connectors. These technological advancements collectively reduce labor requirements, improve resource efficiency, and enhance the overall resilience and longevity of modern irrigation infrastructure, making precision agriculture more accessible and reliable.

Regional Highlights

Geographic analysis reveals diverse market characteristics and growth drivers across major global regions, reflecting variations in agricultural practices, climate challenges, and technological adoption rates.

- Asia Pacific (APAC): APAC is the largest market due to its immense agricultural land base and high dependence on agriculture for livelihood, particularly in populous countries like China and India. Growth is primarily driven by massive government subsidies aimed at water conservation, promoting the switch from flood irrigation to micro-irrigation systems. Demand is focused on high-volume, cost-effective accessories, particularly driplines, basic filters, and simple solenoid valves. Increasing penetration of affordable smart controllers in newly industrialized areas is accelerating growth in the mid-to-high end segment.

- North America: Characterized by high technological maturity, large commercial farm sizes, and significant labor costs. This region leads the market in the adoption of premium, intelligent accessories, including sophisticated remote monitoring systems, VRI (Variable Rate Irrigation) nozzles for center pivots, and advanced IoT controllers. Water stress in the Western US and stringent regulations governing water usage strongly influence purchasing decisions, favoring high-efficiency components and data-driven systems that offer rapid ROI through resource savings.

- Europe: The market is defined by strong environmental regulations and a focus on sustainable farming (EU Green Deal). Demand is high for efficient, durable accessories that support advanced fertigation, precision nutrient application, and rainwater harvesting systems. Western European nations (e.g., Netherlands, Spain) are leaders in greenhouse and high-tech horticulture, driving niche demand for highly specialized, often customized, accessories for protected cultivation environments.

- Latin America (LATAM): Growth is robust, particularly in Brazil, Argentina, and Chile, driven by the expansion of export-oriented commercial agriculture (soybeans, fruits, wine). While price sensitivity remains, increasing investment in modernization for high-value crops is boosting the demand for semi-automated systems, durable plastic accessories, and efficient pumping station components.

- Middle East and Africa (MEA): This region exhibits the highest necessity for water-efficient technologies due to extreme aridity. Government initiatives in GCC countries prioritize massive projects utilizing highly treated wastewater for agriculture, driving demand for specialized, corrosion-resistant accessories, advanced desalination-compatible fittings, and highly reliable subsurface drip systems to minimize evaporation losses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Irrigation Accessories Market.- Netafim (Orbia)

- The Toro Company

- Valmont Industries, Inc.

- Lindsay Corporation

- Rain Bird Corporation

- Hunter Industries

- Jain Irrigation Systems Ltd.

- Reinke Manufacturing, Co., Inc.

- Rivulis Irrigation

- Orbit Irrigation Products

- Komet Austria GmbH

- Alkhorayef Group

- Irritec S.p.A.

- Dramm Corporation

- Nelson Irrigation Corporation

- Metrohm AG

- Senninger Irrigation (Hunter Industries)

- Weathermatic

- Wyatt Water

- Bauer GmbH

Frequently Asked Questions

Analyze common user questions about the Irrigation Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional to smart irrigation accessories?

The primary drivers are acute water scarcity, increasing global population requiring higher food production, and the necessity to reduce operational costs. Smart accessories, including IoT-enabled controllers and sensors, offer superior water usage efficiency and enable remote, data-driven management, leading to improved crop yield and significant resource savings compared to manual or time-based systems.

How significant is the role of government subsidies in the adoption of efficient irrigation accessories?

Government subsidies are critically significant, especially in high-growth agricultural regions like APAC. Subsidies lower the high initial capital investment required for switching to micro-irrigation systems, making advanced accessories accessible to small and medium-sized farmers and accelerating the mandatory adoption of water-saving technologies.

Which product segment is expected to show the fastest growth rate in the forecast period?

The Control Accessories segment, which includes smart controllers, flow meters, and specialized digital valves, is projected to exhibit the fastest growth. This is due to the rising integration of AI and machine learning in agricultural practices, increasing the demand for highly accurate, networked components capable of executing complex, variable-rate irrigation schedules.

What are the main material trends observed in the manufacturing of irrigation accessories?

There is a strong trend toward high-performance engineered plastics such as UV-stabilized polyethylene and PVC. These materials offer enhanced durability, superior chemical resistance (especially crucial for fertigation systems), lightweight installation advantages, and often a lower cost profile compared to traditional metal components in low-to-medium pressure applications.

What is the key difference in accessory demand between agricultural and residential applications?

Agricultural demand focuses on durability, high throughput, and industrial-grade connectivity for large systems. Residential demand, conversely, prioritizes aesthetic concealment, ease of installation, and highly user-friendly, low-power smart controllers that comply with local aesthetic guidelines and seasonal watering restrictions enforced by municipalities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager