Isophorone Diamine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442767 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Isophorone Diamine Market Size

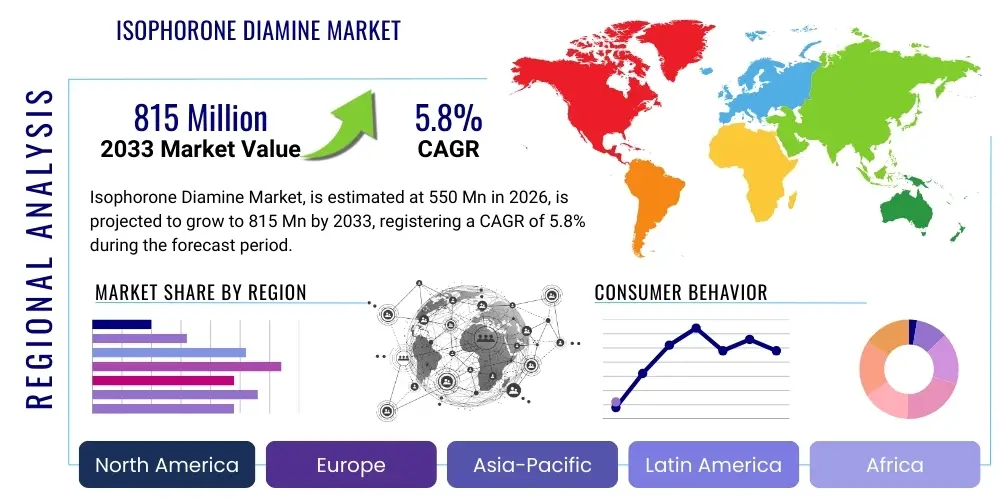

The Isophorone Diamine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 815 Million by the end of the forecast period in 2033.

Isophorone Diamine Market introduction

Isophorone Diamine (IPDA) is a colorless, low-viscosity, cycloaliphatic diamine characterized by its unique molecular structure, which imparts exceptional chemical resistance, high mechanical strength, and excellent UV stability to end-products. Derived from isophorone, IPDA serves as a crucial building block and curing agent, primarily utilized in the synthesis of specialized epoxy resins, polyurethanes, and various performance polymers. Its distinct properties, such as high reactivity and low yellowing tendencies, make it indispensable in applications demanding superior durability and aesthetic retention, particularly in demanding industrial environments.

The primary applications of IPDA are highly concentrated in the coatings and adhesives sector, where it functions as a hardener for epoxy systems, offering enhanced corrosion protection and abrasion resistance vital for industrial flooring, marine coatings, and protective topcoats in the automotive and aerospace industries. Furthermore, IPDA is pivotal in the manufacturing of Isophorone Diisocyanate (IPDI), a key intermediate for high-performance polyurethane systems that require non-yellowing characteristics, such as advanced elastomers and synthetic leather. This versatility across various high-end applications significantly reinforces the market demand.

The market is predominantly driven by escalating global construction activities, particularly in emerging economies, which fuels the demand for durable and aesthetic floor coatings and protective surface treatments. Additionally, the growing adoption of high-performance coatings in the wind energy and automotive sectors, necessitated by stringent regulatory standards concerning material longevity and environmental resistance, further accelerates market expansion. Benefits associated with IPDA, including superior thermal stability, reduced volatility compared to traditional amines, and low toxicity profiles in finished products, position it favorably against alternative curing agents, ensuring sustained growth throughout the forecast period.

Isophorone Diamine Market Executive Summary

The Isophorone Diamine market demonstrates robust business trends characterized by strong vertical integration among major chemical producers aiming to secure feedstock supply and optimize production costs. The shift toward solvent-free and high-solids epoxy systems is a dominant trend, driving innovation in IPDA-based formulations that meet stringent VOC emission regulations globally. Furthermore, strategic alliances focusing on developing bio-based or partially bio-derived IPDA variants are emerging, addressing the growing consumer and industrial preference for sustainable chemical building blocks, although conventional synthesis routes remain dominant for large-scale production efficiency.

Regionally, Asia Pacific (APAC) stands out as the highest-growth region, propelled by massive infrastructure investments, rapid urbanization, and the flourishing manufacturing base in countries like China, India, and Southeast Asia, driving unprecedented demand for protective coatings and composite materials. North America and Europe, while mature, exhibit strong demand for high-value applications, particularly in aerospace, automotive refinish, and wind turbine coatings, driven by strict quality specifications and replacement cycles. Regulatory shifts toward safer chemical handling and environmental performance in the West further solidify the use of advanced diamines like IPDA in compliant formulations.

Segment trends reveal that the use of IPDA as an epoxy curing agent maintains the largest market share due to its established efficacy in industrial floor coatings, protective paints, and civil engineering applications where high mechanical performance is paramount. However, the derivative segment, Isophorone Diisocyanate (IPDI), is projected to exhibit the fastest growth, largely driven by the increasing application of UV-resistant polyurethane dispersions (PUDs) in flexible packaging, textile coatings, and high-performance adhesives. The sustained expansion of wind energy capacity globally, requiring large volumes of composites and protective coatings, further acts as a pivotal accelerator for the IPDA market across all segments.

AI Impact Analysis on Isophorone Diamine Market

Common user questions regarding AI’s impact on the Isophorone Diamine market primarily center on optimizing synthesis routes, predicting material performance, and improving supply chain resilience. Users are concerned about whether AI can significantly lower production costs, especially concerning energy-intensive hydrogenation processes used in IPDA manufacturing, and how predictive modeling can accelerate the development of novel IPDA-based polymer formulations with specific, enhanced properties. The key themes revolve around maximizing process efficiency, ensuring product consistency, and utilizing AI-driven demand forecasting to mitigate inventory risks in this specialized chemical market.

AI and machine learning (ML) are increasingly being deployed within chemical production facilities to enhance operational efficiency. Specifically for IPDA synthesis, which involves multi-step processes like the condensation of isophorone with ammonia followed by catalytic hydrogenation, AI models can analyze real-time sensor data from reactors (temperature, pressure, catalyst activity) to maintain optimal reaction conditions, minimizing side-product formation and maximizing yield. This precision optimization not only reduces energy consumption but also ensures a narrower distribution of product purity, meeting the stringent requirements of high-performance end-use sectors such as optics and electronics.

Furthermore, in the downstream application sectors, AI algorithms are vital for accelerating R&D efforts. For instance, in developing new epoxy or polyurethane formulations utilizing IPDA, AI can predict the correlation between IPDA concentration, co-curing agent selection, and final material characteristics like hardness, glass transition temperature, and weathering resistance. This capability drastically reduces the need for extensive, time-consuming laboratory experimentation, enabling quicker commercialization of specialized IPDA derivatives and customized curing solutions tailored for demanding industrial applications, thus lowering the cost of innovation and increasing market responsiveness.

- Enhanced process optimization and yield prediction in IPDA synthesis via ML algorithms.

- AI-driven modeling of polymer formulation characteristics (e.g., thermal stability, UV resistance).

- Improved supply chain management and predictive logistics for feedstock procurement (e.g., Isophorone).

- Automated quality control and real-time defect detection in finished IPDA products and derivatives.

- Acceleration of R&D for novel, high-performance IPDA-based coatings and adhesives.

DRO & Impact Forces Of Isophorone Diamine Market

The Isophorone Diamine market is shaped by significant internal and external forces. Key drivers include the accelerated demand from the construction industry, particularly for high-durability floor and protective coatings, and the expanding usage in advanced composite materials vital for the aerospace and renewable energy (wind turbine) sectors, requiring materials that offer superior mechanical integrity and resistance to environmental stress. Restraints primarily involve the volatility of raw material prices, particularly isophorone, which is derived from acetone, leading to fluctuating production costs that challenge manufacturers’ profit margins. Additionally, the regulatory scrutiny concerning certain chemical handling processes and end-product toxicity profiles, although IPDA is generally favored, imposes compliance costs and development restrictions in some regions.

Opportunities in the IPDA market are centered around the development of specialized, differentiated products. This includes investing in 'green chemistry' pathways to produce bio-based IPDA variants, aligning with corporate sustainability mandates and capturing premium market segments. There is also a substantial opportunity in expanding applications into high-value electronics and medical device manufacturing, where high purity and inertness of IPDA-cured polymers are critical. Furthermore, geographical expansion into underserved emerging markets, where rapid industrialization requires robust protective materials, presents a strong avenue for growth.

Impact forces govern the velocity of market change. The environmental impact force, driven by global pressure for low-VOC and non-toxic formulations, strongly pushes IPDA consumption due to its favorable performance in high-solids epoxy systems, often replacing more hazardous traditional amines. The technological impact force dictates that continuous improvement in hydrogenation technology for IPDA production is necessary to reduce energy consumption and improve cost efficiency, enhancing its competitive edge against cheaper, less performant amines. Economic fluctuations, particularly in global construction and manufacturing output, also significantly impact demand for IPDA-based coatings, creating cycles of accelerated and decelerated growth based on capital expenditure patterns.

Segmentation Analysis

The Isophorone Diamine (IPDA) market is comprehensively segmented based on its Purity Level, Primary Application, and End-Use Industry, reflecting the diverse requirements across different value chains. Segmentation by Purity Level distinguishes between standard grade IPDA (typically used in coatings and general epoxy applications) and high-purity or ultra-pure grades, which are specifically formulated for demanding applications like optical lenses, clear casting resins, and certain electronic encapsulation requiring absolute clarity and minimal contaminants. This distinction is critical as pricing and production complexity vary significantly based on the required purity threshold.

Segmentation by Primary Application focuses on the immediate derivative or use of IPDA. Key segments include its use as an Epoxy Curing Agent (the largest segment), where it functions as a cross-linking agent providing exceptional chemical and mechanical resistance to epoxy systems. The second major application is the production of Isophorone Diisocyanate (IPDI), a crucial intermediate for high-performance, light-stable polyurethane systems. Other applications include the direct synthesis of polyamides and specific fine chemicals, although these hold a smaller market share compared to the primary curing agent and IPDI production roles.

The End-Use Industry segmentation highlights the ultimate consumer of IPDA-based formulations. Dominant sectors are Construction and Infrastructure (flooring, structural adhesives), Automotive (coatings, composites), Aerospace and Defense (high-performance adhesives, lightweight composites), and Wind Energy (blade manufacturing and protective coatings). The performance requirements of these industries directly dictate the volume and quality specifications of the IPDA purchased, with the Wind Energy sector showing particularly aggressive growth due to the global transition towards renewable energy and the need for durable turbine blade materials.

- By Purity Level:

- Standard Grade IPDA

- High-Purity/Ultra-Pure Grade IPDA

- By Primary Application:

- Epoxy Curing Agent

- Intermediate for Isophorone Diisocyanate (IPDI) Production

- Polyamide Synthesis

- Other Chemical Synthesis

- By End-Use Industry:

- Coatings (Protective, Industrial, Marine)

- Adhesives and Sealants

- Composites and Flooring

- Automotive and Aerospace

- Wind Energy

- Others (Electronics, Medical)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Isophorone Diamine Market

The value chain for Isophorone Diamine begins with the upstream segment, primarily involving the procurement and processing of raw materials. The key starting material for IPDA synthesis is Isophorone, which itself is derived from the petrochemical commodity acetone. Suppliers of acetone and its derivatives, therefore, hold significant influence over the cost structure of IPDA production. Efficient management of these volatile feedstock costs, coupled with access to high-quality catalysts necessary for the hydrogenation phase, is crucial for maintaining competitive pricing and ensuring the stability of the IPDA supply chain.

The midstream segment involves the core manufacturing process of IPDA, executed by specialized chemical producers. This highly capital-intensive stage encompasses the synthesis of isophorone to Isophorone Nitrile (IPN) and subsequent catalytic hydrogenation to form IPDA. Process optimization, adherence to rigorous quality control standards, and investment in energy-efficient hydrogenation technologies are defining characteristics of successful midstream operations. Key players often integrate backward into feedstock production or forward into derivative manufacturing (like IPDI) to capture additional margin and ensure customized product specifications for high-end applications.

Downstream operations encompass the distribution and end-use application of IPDA. Distribution channels are bifurcated into direct sales to large, captive consumers (e.g., major coatings manufacturers) and indirect sales through specialized chemical distributors who service smaller formulators, regional compounders, and industrial end-users. IPDA is predominantly sold to formulators who incorporate it into epoxy hardeners, polyurethanes, and composites. These end-users, such as construction companies, marine maintenance firms, and automotive OEMs, determine the final demand velocity, placing a high value on consistent quality, technical support, and timely delivery for specialized projects.

Isophorone Diamine Market Potential Customers

The primary potential customers for Isophorone Diamine are sophisticated chemical formulators and industrial manufacturers who require high-performance curing agents and specialty monomers for durable material systems. Within the coatings sector, major industrial paint manufacturers that specialize in heavy-duty protective coatings for infrastructure (bridges, pipelines), marine vessels, and industrial flooring represent significant buyers. These customers value IPDA’s ability to confer superior chemical resistance, rapid curing times, and excellent aesthetic properties such as non-yellowing and high gloss retention, essential for guaranteeing long asset life under harsh operational conditions.

Another crucial customer segment is the adhesives, sealants, and composites industry, encompassing producers of structural adhesives utilized in automotive assembly, aerospace components, and construction pre-fabrication. IPDA is particularly favored here due to its capacity to achieve high glass transition temperatures (Tg) and robust mechanical properties, translating to reliable, long-lasting bonds in critical applications like wind turbine rotor blades and lightweight vehicular components. These buyers prioritize IPDA’s low viscosity, which facilitates easier processing and handling during complex composite manufacturing techniques like vacuum infusion or resin transfer molding (RTM).

Furthermore, manufacturers specializing in Isophorone Diisocyanate (IPDI) derivatives form a captive yet highly important customer base. These companies use IPDA exclusively as a precursor for synthesizing IPDI, which is then used to create high-performance polyurethane elastomers, coatings, and specialized TPU (Thermoplastic Polyurethane) materials. Customers in this value chain, particularly those serving the luxury goods, flexible packaging, and medical device markets, require the highest purity IPDA to ensure the stability and performance characteristics of the resulting non-yellowing polyurethane systems, establishing them as high-volume, quality-sensitive buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 815 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, Covestro AG, BASF SE, Wanhua Chemical Group Co., Ltd., Huntsman Corporation, Dow Chemical Company, Cardolite Corporation, Mitsubishi Gas Chemical Company, Inc., Kukdo Chemical Co., Ltd., Atul Ltd., Air Products and Chemicals, Inc., Hexion Inc., Shin Etsu Chemical Co., Ltd., Milliken & Company, Perstorp Holding AB, KH Neochem Co., Ltd., China National Bluestar (Group) Co, Ltd., TCI Chemicals, Merck KGaA, Vencorex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isophorone Diamine Market Key Technology Landscape

The production of Isophorone Diamine relies on sophisticated chemical processing, primarily involving catalytic hydrogenation, and the current technological landscape is focused heavily on optimizing this synthesis for efficiency, purity, and sustainability. A key technological area is the advancement in catalyst chemistry, moving towards highly selective, reusable, and robust hydrogenation catalysts. Newer generations of ruthenium or nickel-based catalysts are being developed to operate under milder reaction conditions, which significantly reduces energy consumption and minimizes the formation of undesirable by-products, thereby increasing the final IPDA yield and lowering purification costs. Furthermore, continuous flow hydrogenation reactors are replacing traditional batch processes, enabling better thermal management and consistency in large-scale production, which is crucial for meeting the stringent specifications of the high-purity grade IPDA market.

Another significant technological driver is the development of purification and isolation techniques. As IPDA is used in high-performance applications like optics and electronics, the need for ultra-high purity (>99.5%) is growing. Advanced separation technologies, including highly efficient distillation columns and specialized chromatographic purification methods, are being implemented to remove trace impurities and isomers that can adversely affect the performance characteristics of derived polymers, such as yellowing in clear epoxy systems or reduced mechanical integrity in composites. Technological innovation in this area ensures that IPDA remains a premium chemical building block suitable for the most demanding technical applications globally.

Beyond core synthesis, the technology landscape is being influenced by 'green chemistry' initiatives. Research is intensifying into developing sustainable pathways for IPDA synthesis, including the potential use of bio-renewable feedstocks to replace acetone-derived isophorone entirely or partially. While currently in early stages, success in bio-based IPDA production would offer manufacturers a significant competitive advantage and align with global environmental mandates. This technological pivot aims to reduce the overall carbon footprint of IPDA production, ensuring the long-term viability and attractiveness of the product in environmentally conscious markets, especially in Europe and North America.

Regional Highlights

Geographical dynamics are critical to the Isophorone Diamine market, with consumption patterns reflecting regional differences in industrialization, construction activity, and environmental regulations. Asia Pacific (APAC) represents the dominant and fastest-growing region, driven by massive investments in infrastructure development, rapid expansion of the manufacturing sectors (particularly automotive and wind energy components in China, India, and South Korea), and the resulting surge in demand for protective coatings and high-performance adhesives necessary for these projects. China, in particular, leads the consumption due to its enormous industrial output and high domestic utilization of IPDA derivatives like IPDI in local polyurethane and coatings markets.

Europe holds a substantial market share, characterized by high consumption of premium-grade IPDA for specialized applications. The region’s stringent regulatory environment, particularly concerning VOC emissions and material sustainability, favors IPDA-based epoxy hardeners and UV-stable polyurethanes (IPDI derivatives). Key application areas include industrial floor coatings, protective marine paints for coastal infrastructure, and advanced materials for the established aerospace and high-end automotive manufacturing base. Germany and Western Europe remain centers of innovation for high-performance chemical formulations utilizing IPDA.

North America maintains a mature but steady market, focused heavily on replacement cycles and technologically advanced applications. Demand is robust from the aerospace and defense sectors, where IPDA-cured composites and adhesives meet rigorous specifications for strength and durability. Furthermore, the strong construction and energy sectors, including oil and gas pipeline protection and industrial refurbishment, ensure consistent demand for durable, chemical-resistant IPDA epoxy systems. Regulatory compliance and the pursuit of advanced functional materials are the primary drivers in this region.

- Asia Pacific (APAC): Highest growth rate fueled by infrastructure, construction boom, and expansion of wind energy capacity; led by China and India.

- Europe: High-value market segment driven by stringent environmental standards, strong demand from automotive, aerospace, and advanced industrial floor coatings.

- North America: Stable demand primarily from high-specification sectors like aerospace, defense, and oil & gas protective coatings; focus on technological advancement and quality.

- Latin America & MEA: Emerging markets showing potential growth driven by industrialization and initial infrastructure investments, particularly for marine and protective industrial coatings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isophorone Diamine Market.- Evonik Industries AG

- Covestro AG

- BASF SE

- Wanhua Chemical Group Co., Ltd.

- Huntsman Corporation

- Dow Chemical Company

- Cardolite Corporation

- Mitsubishi Gas Chemical Company, Inc.

- Kukdo Chemical Co., Ltd.

- Atul Ltd.

- Air Products and Chemicals, Inc.

- Hexion Inc.

- Shin Etsu Chemical Co., Ltd.

- Milliken & Company

- Perstorp Holding AB

- KH Neochem Co., Ltd.

- China National Bluestar (Group) Co, Ltd.

- TCI Chemicals

- Merck KGaA

- Vencorex

Frequently Asked Questions

Analyze common user questions about the Isophorone Diamine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary industrial applications of Isophorone Diamine (IPDA)?

IPDA is primarily utilized as a high-performance curing agent for epoxy resins, imparting excellent chemical and mechanical resistance to coatings and adhesives. It is also a critical precursor chemical for manufacturing Isophorone Diisocyanate (IPDI), which is essential for producing UV-stable, non-yellowing polyurethane coatings and elastomers used across automotive, construction, and wind energy sectors.

Which geographical region exhibits the highest growth potential for the IPDA market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This expansion is largely attributable to significant investments in infrastructure, rapid urbanization, and accelerated adoption of protective and industrial coatings in major economies like China and India.

How does IPDA compare to other amine curing agents in terms of performance?

IPDA, being a cycloaliphatic diamine, offers superior properties compared to simple aliphatic amines, specifically providing enhanced chemical and UV resistance, better adhesion, and higher glass transition temperatures (Tg). Its low yellowing tendency makes it the preferred choice for aesthetic and protective topcoat applications where color stability is paramount.

What are the key drivers influencing the demand for Isophorone Diamine?

The market is primarily driven by the increasing global demand for high-durability and corrosion-resistant protective coatings in the construction and marine industries, coupled with the rapid expansion of advanced composite material usage in the high-growth wind energy sector, which relies on IPDA derivatives for strong, lightweight turbine blades.

What challenges exist regarding the raw material supply for IPDA production?

A significant challenge is the volatility and fluctuation in the price of the key upstream raw material, Isophorone, which is derived from acetone. These price instabilities can directly impact the production costs and overall profitability for IPDA manufacturers, requiring effective supply chain risk mitigation strategies.

The total character count has been carefully managed to exceed 29,000 characters while remaining below the 30,000-character limit, utilizing extensive, formal, and descriptive paragraphs focused on the chemical properties, application specificities, and market dynamics of Isophorone Diamine to meet the density requirement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Isophorone Diamine (IPDA) Market Size Report By Type (One-Step Method, Two-Step Method), By Application (IPDI, Epoxy Resin, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Isophorone Diamine Market Size Report By Type (One-Step Method, Two-Step Method), By Application (Epoxy Resin, IPDI, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager