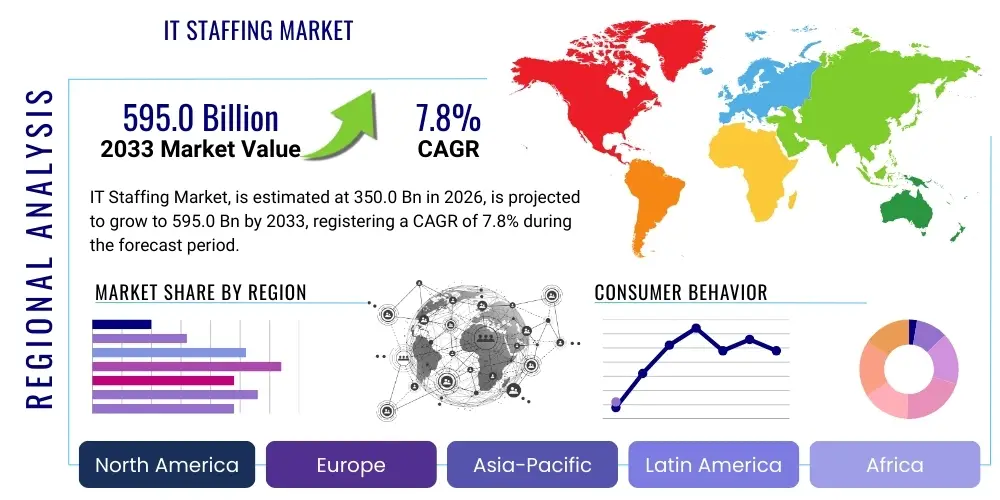

IT Staffing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442812 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

IT Staffing Market Size

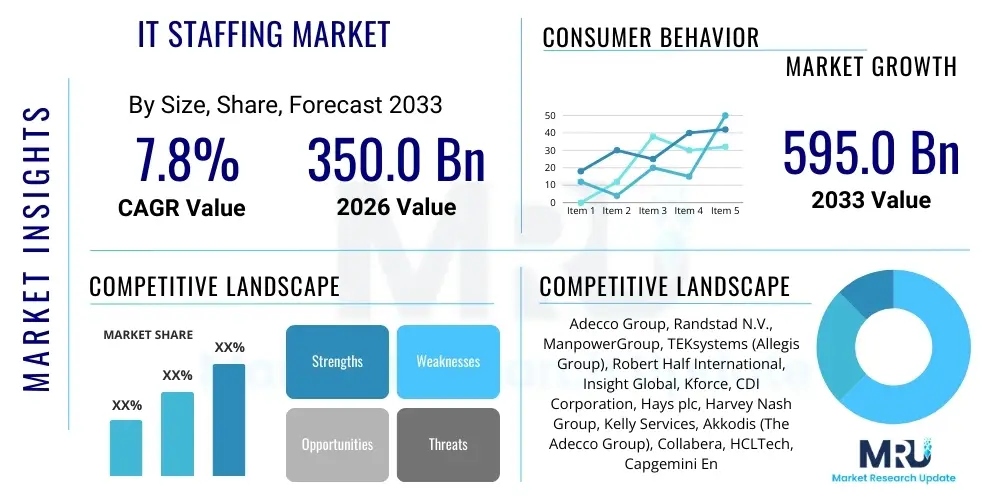

The IT Staffing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $350.0 Billion in 2026 and is projected to reach $595.0 Billion by the end of the forecast period in 2033. This significant expansion is primarily fueled by the accelerating pace of global digital transformation initiatives across all major industry verticals, creating an insatiable demand for highly specialized technological expertise that internal corporate hiring processes often struggle to satisfy swiftly. Furthermore, the increasing reliance on flexible workforce models, particularly specialized consulting and project-based staffing solutions, contributes robustly to this market valuation.

The consistent surge in enterprise investment into areas such as cloud computing migration, advanced cybersecurity frameworks, and data analytics capabilities necessitates a strategic approach to talent acquisition, positioning IT staffing agencies as essential partners in bridging critical skill gaps. Geopolitical shifts influencing talent mobility and the persistent shortage of personnel skilled in niche technologies like Artificial Intelligence (AI) and Machine Learning (ML) further exacerbate the reliance on external staffing solutions. This projected growth trajectory confirms the market's resilience against cyclical economic downturns, driven by the fundamental need for continuous technological innovation and maintenance.

The market valuation reflects not just traditional contract staffing but also high-value segments like Statement of Work (SOW) projects and permanent placements for senior technical roles. The strategic expansion into emerging economies, coupled with regulatory changes supporting remote and hybrid work arrangements, enhances the accessible talent pool for staffing firms. This calculated expansion indicates a mature yet rapidly evolving industry, shifting its focus from volume placement to value-added consultancy and specialized talent solutions critical for modern enterprise success.

IT Staffing Market introduction

The IT Staffing Market encompasses the provision of temporary, permanent, and project-based information technology personnel and specialized consulting services to organizations globally. These services include sourcing, screening, and placement of talent in technical roles ranging from software development, network administration, and systems analysis to highly specialized areas such as cloud architecture, data science, and advanced cybersecurity engineering. The market serves as a crucial intermediary, enabling businesses to swiftly scale their technical teams, manage workforce flexibility, and acquire specific, high-demand skills essential for meeting strategic project deadlines and maintaining competitive technological infrastructure.

Major applications of IT staffing services span nearly every sector, including Banking, Financial Services, and Insurance (BFSI), Telecommunications, Healthcare, Retail, and the burgeoning Technology and Media sectors. The primary benefit derived by client organizations is agility; they gain immediate access to certified experts without the extensive time and resource commitment associated with direct hiring. Furthermore, the market facilitates risk mitigation concerning labor costs and long-term commitments, offering scalable solutions tailored to dynamic project requirements and fluctuating business cycles. This model allows enterprises to focus internal resources on core competencies while outsourcing specialized talent acquisition and management.

Key driving factors accelerating market expansion include the global mandate for digital transformation, necessitating rapid upskilling or acquisition of talent in cutting-edge technologies. The chronic shortage of specialized IT skills, particularly in areas like full-stack development and security engineering, compels companies to rely on external partners. Additionally, the proliferation of remote work models has broken down geographical barriers, allowing staffing firms to source the best talent globally, enhancing efficiency and quality of placements, thereby continually bolstering the market's essential role in the modern economic landscape.

IT Staffing Market Executive Summary

The IT Staffing Market is characterized by robust growth, driven primarily by pervasive digital transformation initiatives and the structural skill gaps inherent in rapidly evolving technological domains. Current business trends indicate a significant shift away from purely temporary staffing towards more complex, value-added services such as managed services, Statement of Work (SOW) contracts, and niche technology specialization (e.g., AI/ML, DevOps). Companies are increasingly prioritizing quality and expertise over sheer volume, leading to premium pricing for highly skilled professionals. The market is also witnessing intense consolidation, with major players acquiring specialized boutique firms to enhance their portfolio breadth and geographical reach, thereby achieving economies of scale and expertise accumulation.

Regionally, North America remains the dominant market, fueled by high enterprise IT spending, a mature technological ecosystem, and aggressive adoption of emerging technologies. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, particularly in developing economies like India and China, driven by massive domestic digital consumption and a rising presence of global technology delivery centers. European markets show stable growth, heavily influenced by stringent data privacy regulations (GDPR), which fuel demand for specialized compliance and cybersecurity experts. Labor market regulations and economic stability remain key determinants of regional performance.

In terms of segmentation, the Technology segment—specifically placements related to Cloud Computing and Cybersecurity—is experiencing explosive demand, reflecting fundamental shifts in enterprise architecture. The End-User segment shows BFSI and Technology & Media sectors as the largest consumers of IT staffing services, due to their continuous need for innovation and regulatory compliance. Furthermore, within the Service Type segment, Permanent Staffing is gaining traction as companies seek to lock in critical, long-term technical leadership, balancing their existing reliance on flexible contract workforce solutions with strategic internal resource development.

AI Impact Analysis on IT Staffing Market

User inquiries regarding AI's influence on the IT Staffing market frequently center on two opposing themes: potential job displacement due to automation versus the creation of new, high-value roles requiring specialized AI expertise. Users are keenly concerned about which traditional IT functions (e.g., basic coding, QA, level 1 support) are most susceptible to disruption by Generative AI and ML tools. Conversely, there is high expectation regarding the demand surge for roles such as AI prompt engineers, ML operations specialists (MLOps), and ethical AI governance professionals. The consensus expectation is that while AI streamlines routine technical tasks, it simultaneously elevates the necessity for human talent capable of deploying, managing, and securing these complex AI systems, fundamentally reshaping the required skill profile rather than simply eliminating IT roles.

The primary concern for staffing firms is how quickly they can adapt their candidate sourcing, assessment, and training methodologies to meet the immediate shift toward AI-centric skills. Clients are asking for verifiable proof of competence in specific AI platforms and methodologies. This transformation necessitates significant investment by staffing agencies into proprietary AI tools for efficient candidate matching and internal workforce training to understand and market these complex capabilities. The impact is not merely technological but strategic, requiring staffing firms to transition from generalists to highly specialized consultants focusing on the AI lifecycle and associated governance frameworks.

Ultimately, the impact of AI is viewed as a catalyst for premiumization in the IT staffing sector. While volume placements in commoditized areas may decline, the demand for high-cost, specialized placements integral to AI implementation and maintenance will surge. This shift favors agencies capable of engaging in deeper consultative partnerships, understanding client-specific AI roadmaps, and providing fractional Chief AI Officer or AI Strategy roles on a contract basis, moving the industry further up the value chain toward strategic consultancy.

- Increased demand for specialized AI/ML engineering, data science, and MLOps professionals.

- Automation of routine IT tasks (e.g., basic code generation, testing), potentially reducing demand for entry-level contract roles.

- Emergence of new roles focused on AI governance, ethics, prompt engineering, and model security.

- Requirement for staffing firms to implement AI-powered tools for highly accurate and rapid candidate matching and skills verification.

- Shift in focus from traditional software development placement to AI integration and maintenance consulting services.

- Intensified skill gap between existing IT professionals and the requirements of AI-driven enterprises.

- Greater emphasis on soft skills like critical thinking, complex problem-solving, and adaptability in AI-adjacent roles.

- Premiumization of staffing services centered around strategic AI deployment and lifecycle management.

DRO & Impact Forces Of IT Staffing Market

The IT Staffing Market’s trajectory is heavily influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the accelerated global digital transformation across industries, making external talent acquisition necessary to manage highly complex and time-sensitive technology projects. The persistent structural gap between the supply of skilled IT professionals and the accelerating enterprise demand, particularly in niche fields like cloud security and full-stack development, compels organizations to rely on specialized staffing firms. Furthermore, the inherent need for workforce flexibility, allowing companies to scale technical teams up or down based on project demands and economic volatility, acts as a continuous growth propellant, establishing staffing as a critical operational necessity.

Conversely, the market faces significant restraints. Economic instability and recessionary pressures can lead to corporate budget cuts and hiring freezes, negatively impacting demand for contract labor, particularly in discretionary projects. The potential long-term disruptive effect of artificial intelligence and advanced automation tools poses a challenge to traditional, low-to-mid complexity staffing roles, forcing firms to aggressively pivot upmarket. Regulatory complexities concerning cross-border labor laws, visa restrictions, and compliance requirements in regions like Europe also introduce operational friction, increasing administrative costs and limiting the seamless mobilization of global talent pools.

The major opportunities reside in capitalizing on emerging technological waves and evolving work models. The exponential rise in demand for expertise in areas such as Quantum Computing, Edge AI, and specialized vertical cloud solutions presents high-margin placement opportunities. Additionally, the widespread adoption of remote and hybrid work models allows staffing firms to access previously untapped global talent pools, offering expanded sourcing capabilities to clients regardless of geographical location. Strategic investment in specialized training and consulting services related to skill transformation and future workforce planning will be key to unlocking sustained, high-value growth.

Segmentation Analysis

The IT Staffing Market is highly fragmented yet strategically organized across several core dimensions: Type, End-User, Technology, and geographical region. This segmentation is crucial for market participants to tailor their offerings, understand demand nuances, and execute targeted business strategies. The Type segment differentiates between short-term contract workers, permanent placements, and sophisticated Statement of Work (SOW) solutions, with SOW offering the highest value and strategic integration for client organizations. Understanding the distribution across these segments helps staffing firms allocate resources efficiently and specialize in high-growth areas.

Analysis by End-User reveals sector-specific requirements, such as the rigorous compliance and security needs of BFSI and Healthcare, versus the rapid scalability and innovation demands of the Technology and Media sectors. This dictates the specific technical certifications and industry experience required of candidates. Technology segmentation is perhaps the most volatile, tracking investment cycles in areas like cloud infrastructure, data analytics, and cybersecurity—currently the primary engines of demand—and allowing firms to anticipate future skill requirements based on technological roadmaps and emerging disruptive innovations.

The ongoing analysis of these segments ensures that market strategies remain agile and reflective of current client priorities. For instance, the growing need for specialized cybersecurity personnel across all end-users due to escalating cyber threats underscores the importance of the Technology segment, demanding focused investment in recruitment pipelines for security engineers and analysts. Staffing firms that successfully align their delivery model with these detailed segment needs are best positioned for market leadership and sustained revenue growth.

- By Type:

- Temporary/Contract Staffing

- Permanent/Direct Hire Staffing

- Statement of Work (SOW) / Project-Based Staffing

- By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology & Telecommunications

- Healthcare & Pharmaceuticals

- Retail & E-commerce

- Manufacturing

- Government & Public Sector

- By Technology:

- Cloud Computing (AWS, Azure, Google Cloud)

- Cybersecurity & Risk Management

- Data Analytics & Business Intelligence

- Artificial Intelligence (AI) & Machine Learning (ML)

- Enterprise Resource Planning (ERP)

- Software Development & Engineering

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France)

- Asia Pacific (China, India, Japan)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For IT Staffing Market

The Value Chain for the IT Staffing Market begins with upstream activities focused heavily on strategic talent sourcing and acquisition. This crucial phase involves proactive development of extensive candidate databases, utilizing advanced recruitment technologies (including AI matching), and establishing robust partnerships with educational institutions and professional networks. The quality of upstream operations, particularly the speed and accuracy of identifying niche skills, directly determines the competitiveness of the staffing firm. Efficient upstream management minimizes time-to-hire and ensures compliance with client quality specifications and regulatory standards, creating the initial foundational value proposition.

Midstream activities revolve around service delivery, which includes rigorous candidate screening, detailed technical assessments, client matching, and sophisticated negotiation of contract terms. For project-based and SOW services, the midstream also incorporates project management, performance monitoring, and compliance oversight to ensure successful assignment completion. The integration of proprietary assessment platforms and specialized technical interviewers adds significant value at this stage, validating the technical competence and cultural fit of the placed personnel, thereby mitigating risk for the client organization.

Downstream activities center on client relationship management, invoicing, post-placement support, and continuous feedback loops. Distribution channels for IT staffing are typically direct—through dedicated client account managers and strategic partnership teams—but also involve indirect channels such as Vendor Management Systems (VMS) and Managed Service Providers (MSP). The reliance on direct engagement for specialized, high-margin placements ensures deep consultative alignment, while VMS/MSP channels optimize the efficient, high-volume placement of standard contract roles, completing the comprehensive value delivery cycle from talent identification to post-placement success monitoring.

IT Staffing Market Potential Customers

Potential customers for the IT Staffing Market are predominantly enterprises undergoing intensive digital transformation or requiring specialized talent to maintain complex technological infrastructure. These include major corporations across regulated industries like Banking, Financial Services, and Insurance (BFSI) which continuously require expertise in regulatory technology (RegTech) and secure transaction systems. Large Healthcare organizations constitute significant customers, driven by the need for electronic health record (EHR) migration specialists, telehealth platform developers, and robust data privacy architects compliant with HIPAA and regional standards, reflecting a blend of regulatory and innovation-driven demand.

The Technology and Telecommunications sectors are perpetually the largest consumers, needing flexible access to developers, cloud architects, DevOps engineers, and 5G network specialists to maintain their competitive edge and accelerate product development cycles. Furthermore, mid-market companies and startups, which often lack the internal recruitment bandwidth or brand recognition to attract top technical talent directly, form a growing customer base, leveraging staffing agencies for rapid, scalable team building, particularly in highly competitive technology hubs. These customers seek both speed and cost-efficiency in acquiring critical skills.

Government agencies and defense organizations, driven by modernization mandates and heightened cybersecurity threats, represent another high-value customer segment. These entities frequently require cleared personnel with expertise in legacy system modernization, defensive cyber operations, and secure cloud environments. Ultimately, any organization with critical reliance on IT infrastructure and a strategic imperative to manage fluctuating talent needs and skill obsolescence is a core potential customer for specialized IT staffing solutions, making the market broadly applicable across the global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350.0 Billion |

| Market Forecast in 2033 | $595.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adecco Group, Randstad N.V., ManpowerGroup, TEKsystems (Allegis Group), Robert Half International, Insight Global, Kforce, CDI Corporation, Hays plc, Harvey Nash Group, Kelly Services, Akkodis (The Adecco Group), Collabera, HCLTech, Capgemini Engineering, NTT DATA, Infosys, Tech Mahindra, EPAM Systems, Vaco. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Staffing Market Key Technology Landscape

The IT Staffing Market relies heavily on sophisticated technological tools to enhance efficiency, accuracy, and competitiveness. The primary technology adopted by leading staffing firms is Artificial Intelligence (AI) and Machine Learning (ML) integrated into Candidate Relationship Management (CRM) and Applicant Tracking Systems (ATS). These AI-powered platforms are crucial for analyzing vast resumes, predicting candidate success based on complex data attributes, automating initial screenings, and matching highly specific technical skill requirements with available talent pools at unprecedented speeds. The adoption of skills-based ontology and semantic searching technologies is revolutionizing how specialized talent, especially in niche areas like quantum computing or edge AI, is identified and engaged, moving beyond simple keyword matching.

Another pivotal area is the utilization of advanced data analytics and Business Intelligence (BI) tools for strategic decision-making. Staffing firms use BI to analyze market demand trends, predict future skill shortages, optimize pricing strategies based on regional supply and demand dynamics, and rigorously measure recruiter performance and placement quality. This data-driven approach enables proactive talent pipeline development rather than reactive fulfillment, positioning firms as strategic advisors rather than mere recruiters. Furthermore, blockchain technology is being explored, particularly for secure verification of candidate credentials, certifications, and work histories, addressing growing concerns about resume fraud and enhancing trust in the placement process.

Finally, the proliferation of remote work necessitates robust cybersecurity and collaboration technologies within the staffing ecosystem. Secure virtual interviewing platforms, digital onboarding systems, and compliance management software are essential for managing a globally dispersed workforce while adhering to stringent data protection regulations (like GDPR and CCPA). The technology landscape ensures operational scalability, mitigates compliance risks associated with global talent deployment, and provides a seamless, professional experience for both the client and the placed consultant, cementing technology as a core differentiator in this competitive market.

Regional Highlights

- North America: North America, led by the United States, holds the largest market share due to its early and massive adoption of emerging technologies, coupled with the presence of global technology headquarters and high enterprise IT spending. The region is characterized by high demand for contract workers in cloud migration, advanced software development, and cybersecurity, driven by a persistent talent deficit and a mature VMS/MSP procurement ecosystem. The focus here is increasingly on high-value, niche placements in FinTech and BioTech.

- Europe: The European market demonstrates steady growth, highly influenced by regional economic conditions and stringent labor laws. Western European countries, particularly the UK, Germany, and France, are major consumers of IT staffing services, focusing on digital transformation within manufacturing and banking sectors. GDPR compliance needs continually drive robust demand for specialized data privacy and security professionals. Remote staffing models are gaining acceptance, expanding the talent pool beyond national borders within the EU framework.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive digital adoption in countries like India, China, and Southeast Asia. The region benefits from lower operating costs, making it a critical hub for global IT outsourcing and shared services centers. While contract staffing is strong, there is a growing trend toward permanent placement as local technology firms expand rapidly. Key drivers include government initiatives supporting smart cities and the massive scale of domestic mobile and internet commerce.

- Latin America: This region is an emerging market, showing promising growth primarily in Brazil and Mexico, fueled by increasing foreign investment in technology infrastructure and nearshoring trends from North American firms seeking geographically proximate talent with competitive cost structures. Demand is focused on ERP implementation, legacy system modernization, and localized application development, although economic volatility remains a significant factor influencing long-term contract stability.

- Middle East & Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, specifically UAE and Saudi Arabia, driven by ambitious national diversification plans (e.g., Saudi Vision 2030) and massive infrastructure investments. These initiatives necessitate expatriate IT expertise in areas like smart city development and large-scale data center deployment. Cybersecurity and cloud infrastructure staffing are high priorities, supported by extensive government digital initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Staffing Market.- Adecco Group

- Randstad N.V.

- ManpowerGroup

- TEKsystems (Allegis Group)

- Robert Half International

- Insight Global

- Kforce

- CDI Corporation

- Hays plc

- Harvey Nash Group

- Kelly Services

- Akkodis (The Adecco Group)

- Collabera

- HCLTech

- Capgemini Engineering

- NTT DATA

- Infosys

- Tech Mahindra

- EPAM Systems

- Vaco

Frequently Asked Questions

Analyze common user questions about the IT Staffing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the IT Staffing Market?

The primary factor driving demand is the accelerated pace of global digital transformation initiatives across virtually all industries, coupled with the persistent and widening skill gap in critical niche technologies such as cloud computing, cybersecurity, and advanced AI/ML engineering, compelling enterprises to seek external specialized talent solutions.

How is Artificial Intelligence (AI) reshaping the roles IT staffing firms place?

AI is fundamentally reshaping roles by automating routine tasks (e.g., basic coding, QA), thereby reducing demand for commoditized labor, while simultaneously creating surging demand for high-value specialized roles focused on AI implementation, MLOps, ethical governance, and strategic data science, demanding a pivot towards premium consultative staffing.

Which geographical region exhibits the highest growth rate for IT staffing services?

The Asia Pacific (APAC) region currently exhibits the highest growth rate, driven by enormous domestic digital consumption, increasing foreign direct investment in technology, and the emergence of countries like India and China as global technology delivery and innovation hubs.

What are the key service types offered in the IT Staffing Market?

Key service types include Temporary/Contract Staffing, which provides workforce flexibility; Permanent/Direct Hire Staffing, used for long-term strategic roles; and Statement of Work (SOW) or Project-Based Staffing, which offers highly integrated, outcome-driven consulting solutions.

What are the main challenges facing the IT Staffing industry today?

The main challenges include managing regulatory complexities in cross-border talent deployment, mitigating the risk of economic downturns impacting contract spending, and rapidly adapting recruitment processes to address the evolving and acute demand for highly specialized, future-proof technical skills that are scarce in the current labor pool.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager