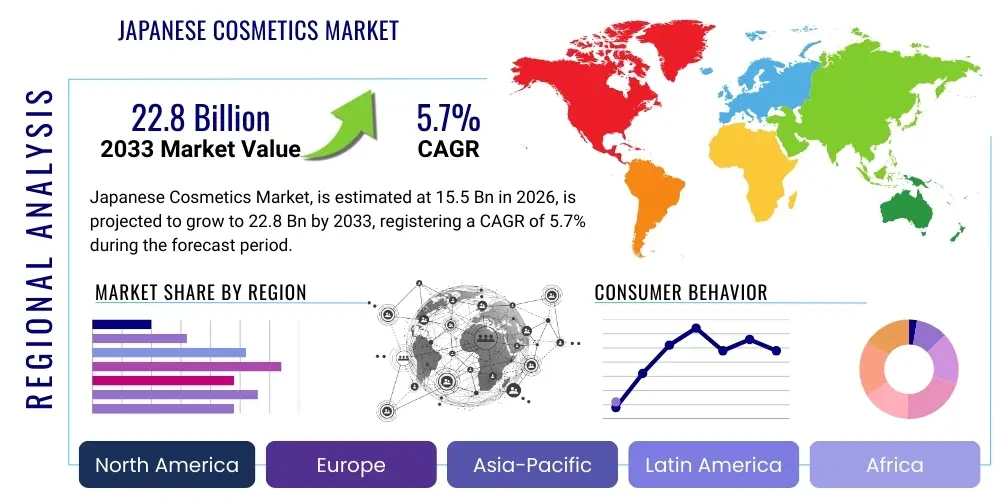

Japanese Cosmetics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442425 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Japanese Cosmetics Market Size

The Japanese Cosmetics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% between 2026 and 2033. This robust growth is primarily driven by Japan's strong culture of meticulous skincare, high disposable income, and continuous innovation in J-Beauty technology. The domestic market remains fiercely competitive, characterized by high consumer expectations for quality, efficacy, and natural ingredients. Furthermore, the increasing interest from global consumers in Japanese anti-aging and personalized beauty solutions fuels export growth, solidifying Japan's position as a global leader in sophisticated cosmetic formulation.

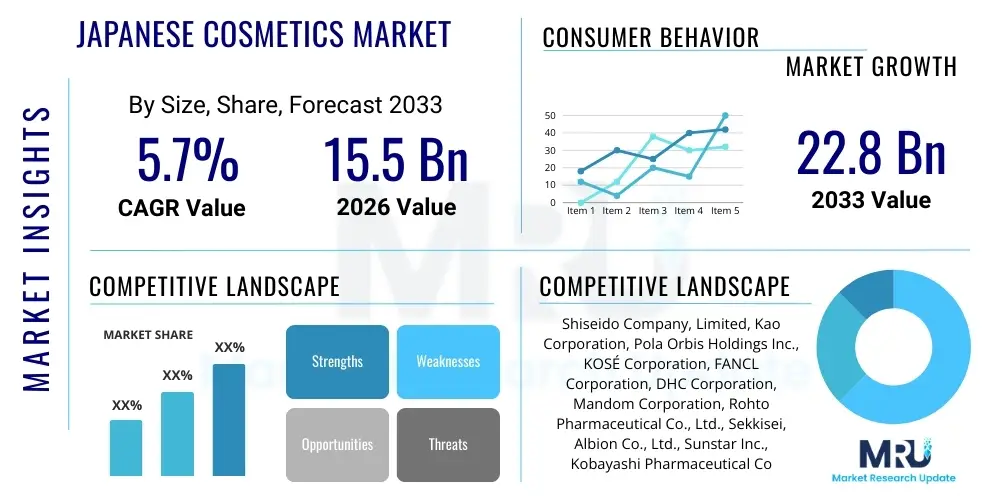

The market is estimated at $15.5 Billion in 2026 and is projected to reach $22.8 Billion by the end of the forecast period in 2033. This projection reflects the successful adaptation of Japanese companies to omnichannel retail strategies, leveraging both traditional department stores and burgeoning digital platforms. Although facing headwinds from a declining population, the market effectively counters this through premiumization strategies—focusing on high-value, niche products such as cosmeceuticals and advanced sun protection formulas. Investment in biotechnological research and sustainability practices is expected to be a major financial driver across the forecast period.

Japanese Cosmetics Market introduction

The Japanese Cosmetics Market encompasses a vast array of beauty and personal care products, deeply rooted in the concept of J-Beauty, which emphasizes preventive care, high-quality ingredients, and intricate, multi-step routines. Products range from foundational skincare items (cleansers, toners, serums, moisturizers, and high SPF sunscreens) and specialized anti-aging treatments to cutting-edge color cosmetics and unique hair care formulations. Unlike some Western markets, Japanese consumers prioritize efficacy, safety, and scientific validation over ephemeral trends, demanding transparency regarding ingredient sourcing and manufacturing processes.

Major applications of Japanese cosmetic products span daily consumer use, professional spa treatments, medical aesthetic contexts (cosmeceuticals), and specialized products targeting specific demographic concerns, such as senior care and hyper-pigmentation issues. Key benefits derived from Japanese cosmetics include advanced anti-aging capabilities utilizing proprietary fermented ingredients, superior hydration retention, and highly stable, effective UV filters. The meticulous regulatory environment ensures exceptional product safety, which further enhances consumer trust both domestically and internationally. This focus on long-term skin health distinguishes the Japanese market.

Driving factors for sustained growth include the rapid adoption of customized product lines powered by genomic and dermatological data, increased digital engagement facilitating personalized recommendations, and the strong global appeal of "Made in Japan" quality. Furthermore, the societal emphasis on maintaining a youthful appearance, especially among the rapidly aging population, sustains high demand for premium functional products. Exports, particularly to Asian countries captivated by Japanese aesthetics and quality, represent a crucial growth corridor, offsetting domestic demographic shifts through expansive cross-border e-commerce initiatives.

Japanese Cosmetics Market Executive Summary

The Japanese Cosmetics Market Executive Summary highlights resilience and innovation, driven by high consumer spending on premium skincare and sophisticated technological integration. Business trends show a strategic shift toward Direct-to-Consumer (DTC) models and enhanced omnichannel experiences, allowing brands to collect granular consumer data and tailor offerings dynamically. Large established players maintain dominance through brand loyalty and extensive distribution networks, while niche, independent brands specializing in sustainable or highly functional ingredients capture significant market share among younger, environmentally conscious consumers. Consolidation and strategic partnerships focusing on supply chain efficiency and R&D are defining features of the current competitive landscape.

Regionally, while the market is centered in metropolitan areas like Tokyo and Osaka, which serve as hubs for new product launches and flagship store operations, digital penetration has effectively democratized access across all prefectures. The export market, particularly within Asia Pacific (APAC), remains vital, with China, South Korea, and Southeast Asian nations showing persistent demand for high-quality Japanese makeup and specialized skincare. Regulatory harmonization efforts and Free Trade Agreements are streamlining export logistics, making international expansion more economically viable for small and mid-sized Japanese firms.

Segment trends underscore the supremacy of the Skincare category, specifically within the anti-aging and sun care sub-segments, which command the highest Average Selling Prices (ASPs). The fragrance segment is showing renewed vitality, moving away from traditional mass-market products towards artisanal, personalized scents. E-commerce is the fastest-growing sales channel, propelled by robust mobile infrastructure and immersive virtual try-on experiences. Conversely, the mass-market makeup segment faces pressure from international competitors, prompting domestic brands to differentiate through unique textures, natural formulations, and strong cultural storytelling tailored to the domestic aesthetic.

AI Impact Analysis on Japanese Cosmetics Market

User queries regarding AI's influence in the Japanese cosmetics sector frequently revolve around how AI enhances personalization, ensures product efficacy, and streamlines the complex Japanese retail experience. Key concerns focus on data privacy within high-tech diagnostic tools, the reliability of AI-driven skin analysis compared to human expertise, and the potential displacement of traditional beauty consultants. Expectations are high concerning the deployment of AI for hyper-personalized product recommendation engines, supply chain optimization (forecasting demand for intricate ingredient mixes), and accelerating R&D cycles through computational chemistry and ingredient interaction modeling.

AI is fundamentally transforming product development by enabling companies to simulate ingredient efficacy and predict shelf life, significantly reducing time-to-market for innovative formulas. Furthermore, AI-powered diagnostic tools, often integrated into mobile applications or retail kiosks, offer customers deep-level skin analysis—including pore visibility, hydration levels, and fine lines—leading directly to personalized product recommendations from the brand's expansive catalog. This technology supports the core J-Beauty principle of highly individualized care. Companies leverage Machine Learning (ML) to process consumer feedback from social media and e-commerce reviews, rapidly identifying micro-trends and consumer dissatisfactions, ensuring agile product modification and targeted marketing campaigns.

In retail and operations, AI optimizes inventory management for seasonal demands and limited-edition releases, critical for managing perishable natural ingredients often favored in Japanese formulations. Conversational AI chatbots are increasingly deployed on brand websites and messaging platforms to provide 24/7 customer service in multiple languages, improving the cross-border shopping experience. However, widespread adoption necessitates significant investment in data infrastructure compliant with stringent Japanese privacy laws, requiring robust cybersecurity measures to protect sensitive user biometric and skin health data collected via AI diagnostic platforms.

- AI-driven personalized skincare routines based on biometric and environmental data.

- Machine Learning (ML) optimization of complex supply chain logistics for J-Beauty ingredients.

- Computational chemistry accelerating the discovery of novel anti-aging compounds.

- Deployment of advanced skin diagnostic applications for in-store and at-home consultations.

- AI chatbots and virtual assistants enhancing customer engagement and personalized shopping advice.

- Automated quality control and ingredient purity verification processes during manufacturing.

DRO & Impact Forces Of Japanese Cosmetics Market

The dynamics of the Japanese Cosmetics Market are shaped by powerful Drivers (D), mitigating Restraints (R), attractive Opportunities (O), and resulting Impact Forces. Drivers include the global fascination with J-Beauty quality, Japan's high-tech manufacturing base, and the domestic market's persistent demand for advanced anti-aging and specialized skincare solutions fueled by the aging demographic. These factors collectively push companies toward continuous scientific innovation and premiumization, bolstering high margins even amidst global economic fluctuations. The stringent domestic regulatory framework, while initially a barrier, ultimately enhances the global trust in Japanese products, functioning as a powerful competitive advantage in export markets.

Restraints primarily revolve around demographic challenges, specifically a shrinking overall consumer base and intensified domestic competition leading to saturated product categories. High operational costs associated with maintaining ultra-high quality control standards and premium ingredient sourcing also restrict margins for non-premium segments. Furthermore, the complexities of navigating international cross-border e-commerce regulations, coupled with increasing environmental scrutiny regarding packaging waste, pose logistical and reputational challenges that require significant capital expenditure to address effectively. The reliance on traditional distribution channels, though diminishing, still adds friction to rapid product rollout compared to purely digital-first markets.

Opportunities are substantial, particularly in penetrating untapped niche markets such as men's grooming (driven by changing social norms), premium halal cosmetics tailored for export, and advanced personalized wellness products integrated with cosmetics (nutraceuticals). The further integration of AI, IoT, and genetic testing into personalized formulation platforms offers a significant competitive edge and a path to high-value product creation. Leveraging sustainability as a core marketing pillar, focusing on refillable packaging and circular economy practices, also presents a massive opportunity to resonate with modern global consumers. Impact Forces manifest as rapid product turnover, aggressive digital transformation mandates, and a sustained pressure on companies to invest heavily in patented, proprietary scientific assets to maintain differentiation.

Segmentation Analysis

The Japanese Cosmetics Market is intricately segmented based on product type, consumer gender, sales channel, and target application, reflecting the detailed and demanding nature of the consumer base. Skincare dominates the market share due to the cultural emphasis on maintaining flawless skin health, followed by hair care and color cosmetics. The market's structure is also highly stratified by price point, spanning from highly accessible drugstore brands to ultra-luxury prestige labels found exclusively in department stores and specialized boutiques. This segmentation allows manufacturers to precisely target distinct socio-economic and demographic groups with tailored marketing messages and distribution strategies.

Analysis by sales channel shows a decisive shift, with e-commerce experiencing the fastest expansion, though drug stores and specialized retail shops (like Matsumoto Kiyoshi and Don Quijote) remain critical points of mass-market access. Professional sales channels, serving salons and spas, specialize in higher-concentration products requiring expert application. Demographic segmentation highlights the significance of the mature consumer segment, driving demand for complex anti-aging and regenerative products, contrasting with the younger generation's focus on customizable and ethically sourced beauty items.

- By Product Type:

- Skincare (Moisturizers, Serums, Facial Cleansers, Sun Care, Toners)

- Makeup & Color Cosmetics (Lip Products, Eye Makeup, Face Makeup, Nail Care)

- Hair Care (Shampoos, Conditioners, Hair Treatments, Styling Products)

- Fragrances (Eau de Toilette, Perfumes, Colognes)

- Personal Care (Deodorants, Bath & Shower Products)

- By End User:

- Women

- Men (Men's Grooming and Skincare)

- By Distribution Channel:

- Offline (Department Stores, Specialty Stores, Drug Stores/Pharmacies, Supermarkets)

- Online (E-commerce Portals, Direct Company Websites, Social Commerce)

- By Price Range:

- Mass Market

- Premium/Prestige

- Luxury

Value Chain Analysis For Japanese Cosmetics Market

The Value Chain for the Japanese Cosmetics Market is characterized by highly sophisticated upstream activities, stringent manufacturing protocols, and complex, multi-tiered distribution channels. Upstream analysis focuses heavily on the sourcing of high-quality, often proprietary or fermented ingredients, coupled with extensive Research and Development (R&D) in biochemistry, material science, and delivery systems (e.g., encapsulation technology). Japanese raw material suppliers often collaborate closely with manufacturers to ensure ingredient purity and sustainability, leading to higher input costs but guaranteeing final product efficacy and safety, crucial elements of the J-Beauty brand promise.

Midstream processes involve meticulous manufacturing, often utilizing advanced robotics and clean-room environments to meet globally recognized quality standards (GMP). Packaging design is a critical midstream function, emphasizing aesthetic appeal, functional superiority (e.g., airless pumps for ingredient stability), and increasingly, environmental sustainability through minimalist or refillable designs. Direct distribution (DTC via e-commerce) bypasses some traditional intermediaries, offering brands higher control over the consumer experience and richer data collection. Indirect distribution relies on an extensive network of wholesalers, dedicated distributors, department store concessions, and large pharmacy chains, ensuring ubiquitous product availability across the nation.

Downstream activities are dominated by marketing and retail. Major emphasis is placed on highly informative marketing campaigns that stress scientific evidence and product benefits rather than celebrity endorsements alone. Retail presence is diversified: department stores cater to premium buyers seeking high-touch consultation, while drugstores provide convenience and affordability. The rapid growth of cross-border e-commerce represents the most dynamic downstream shift, requiring seamless logistics integration and localized digital marketing to capitalize on international demand for Japanese quality, maintaining the brand integrity from factory gate to the global consumer’s hand.

Japanese Cosmetics Market Potential Customers

The primary End-Users and Buyers of products in the Japanese Cosmetics Market are highly discerning consumers who prioritize scientific efficacy, ingredient quality, and detailed product ritual. The largest and most economically significant demographic comprises middle-aged to senior women (40+), who allocate substantial portions of their disposable income towards specialized anti-aging and functional skincare treatments designed to address deep wrinkles, elasticity loss, and pigmentation. This segment drives the high-value prestige sector and is exceptionally loyal to trusted domestic brands renowned for decades of research.

A second crucial customer group is the younger millennial and Gen Z population. While this segment may spend less on individual high-cost items, they are trend-sensitive, technologically fluent, and highly influenced by social media and global beauty trends, demanding ethically sourced, cruelty-free, and personalized products. They are the primary adopters of digital channels and are instrumental in the growth of niche, independent brands focusing on transparency and sustainable practices. Their purchasing decisions are often based on ingredient lists and brand mission rather than traditional advertising.

A rapidly emerging customer segment is the male consumer. Driven by heightened awareness of personal grooming and societal pressure in professional settings, Japanese men are increasingly investing in sophisticated skincare, specialized haircare (anti-hair loss), and subtle color cosmetics designed for masculine aesthetics. International consumers, particularly tourists and cross-border e-commerce shoppers in APAC, constitute a vital external customer base, driven by the perceived superior quality, safety, and meticulous formulation associated with Japanese manufacturing standards (the J-Beauty phenomenon).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $22.8 Billion |

| Growth Rate | 5.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shiseido Company, Limited, Kao Corporation, Pola Orbis Holdings Inc., KOSÉ Corporation, FANCL Corporation, DHC Corporation, Mandom Corporation, Rohto Pharmaceutical Co., Ltd., Sekkisei, Albion Co., Ltd., Sunstar Inc., Kobayashi Pharmaceutical Co., Ltd., IPSA, Atorrege AD+, Suzuran, Muji (Ryohin Keikaku Co., Ltd.), THREE, Addiction Beauty, Flowfushi, Isehan Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Japanese Cosmetics Market Key Technology Landscape

The technological landscape of the Japanese Cosmetics Market is dominated by advanced material science, proprietary ingredient fermentation processes, and increasingly sophisticated digital integration. A hallmark technology is micro-encapsulation, which ensures the stable delivery of highly volatile or sensitive active ingredients, such as retinoids and Vitamin C derivatives, deep into the epidermis with controlled release. Furthermore, continuous investment is poured into developing novel fermentation techniques that enhance the bioavailability and efficacy of traditional Japanese ingredients like rice extracts, sake kasu, and green tea derivatives, positioning Japanese companies at the forefront of bio-cosmetic innovation and efficacy.

In manufacturing, automation and precision engineering are standard, enabling the production of uniquely textured products (e.g., gel-to-oil formulations, melting textures) that define the sensory experience of J-Beauty. The digital front is characterized by the rapid adoption of AI and IoT sensors for personalized skin diagnosis. Technologies such as high-resolution cameras integrated with proprietary algorithms assess melanin distribution, sebum levels, and subtle textural changes, translating raw data into customized product routines in real-time. This technological convergence satisfies the consumer demand for individualized beauty solutions, moving beyond generalized demographic targeting.

Furthermore, Japanese companies are leading in sustainable technology, pioneering the use of plant-based packaging materials derived from biomass and employing advanced water purification systems to minimize environmental impact during production. Research into genomics and dermatological biomarkers allows for the creation of truly future-proof products that anticipate aging concerns before they become visually apparent. The integration of 5G technology is expected to further enhance the responsiveness and detail of augmented reality (AR) try-on features and remote expert consultations, blending physical product consumption with highly immersive digital service delivery, cementing the market’s reputation for technical excellence and consumer-centric innovation.

Regional Highlights

The Japanese Cosmetics Market's regional relevance extends far beyond its domestic consumption, positioning the country as the epicenter of advanced beauty research and export-driven growth, particularly throughout Asia. While the domestic market (Japan) remains the core consumer base, setting global standards for ingredient quality and product presentation, its influence is disproportionately large in terms of technological impact and trend origination.

The Asia Pacific (APAC) region is the most critical recipient of Japanese cosmetic exports. Driven by high brand affinity for Japanese quality, particularly in skincare and sun protection, APAC consumers, notably those in Greater China and South Korea, frequently adopt J-Beauty routines. Market penetration is significantly boosted by efficient cross-border e-commerce logistics and the effective utilization of Japanese key opinion leaders (KOLs) on global digital platforms, ensuring that regional growth remains paramount to the overall market trajectory.

- Japan (Domestic Market): Characterized by mature consumer demand, focus on premium anti-aging products, high digital adoption for personalized services, and stringent quality control standards that serve as a global benchmark.

- China: The largest and fastest-growing export destination, favoring high-end Japanese skincare, color cosmetics, and cosmeceuticals, often purchased via platforms like Tmall Global.

- South Korea: A highly competitive but influential market where Japanese brands often succeed by differentiating through clinical efficacy and sophisticated scientific formulation.

- North America and Europe: Growing importance due to niche market demand for specialist Japanese products (e.g., proprietary sunscreens, unique texture serums) appealing to informed beauty enthusiasts seeking high-performance alternatives to Western brands.

- Southeast Asia (ASEAN): Experiencing significant growth, driven by increasing disposable income and a strong preference for high-quality, whitening, and UV protection products imported from Japan.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Japanese Cosmetics Market.- Shiseido Company, Limited

- Kao Corporation

- Pola Orbis Holdings Inc.

- KOSÉ Corporation

- FANCL Corporation

- DHC Corporation

- Mandom Corporation

- Rohto Pharmaceutical Co., Ltd.

- Albion Co., Ltd.

- IPS Co., Ltd.

- FT Shiseido Co., Ltd.

- Daito Kasei Kogyo Co., Ltd. (Ingredient Supplier Focus)

- Nippon Shikizai, Inc.

- Isehan Co., Ltd.

- Mikimoto Cosmetics Co., Ltd.

- Naris Cosmetics Co., Ltd.

- Pigeon Corporation (Specialty in baby care/cosmetics)

- Suntory Wellness Ltd. (Nutricosmetics focus)

- Sana (Noevir Group)

- Utena Co., Ltd.

Frequently Asked Questions

What is driving the growth of the Japanese anti-aging skincare segment?

Growth is fueled primarily by Japan's rapidly aging population, high disposable income among senior consumers, and cultural demand for preventive beauty. Companies invest heavily in patented ingredients like collagen peptides, advanced ceramides, and fermented extracts to deliver superior efficacy and maintain consumer loyalty in this high-value segment.

How is J-Beauty defined, and how does it influence global cosmetic trends?

J-Beauty (Japanese Beauty) is defined by its focus on routine, scientific efficacy, high product purity, and minimalist design, emphasizing healthy skin structure over simply covering imperfections. It influences global trends by driving demand for sophisticated sun protection, multi-step routines, and high-tech cosmeceutical formulations globally.

Which distribution channel is experiencing the fastest expansion in the Japanese Cosmetics Market?

E-commerce, including dedicated brand websites and major online retail platforms, is the fastest expanding distribution channel. This growth is accelerated by mobile shopping penetration, personalized online consultation services, and successful cross-border sales targeting the Asia Pacific region.

What role does AI technology play in consumer interaction within the Japanese beauty industry?

AI is crucial for hyper-personalization, delivering advanced skin diagnostic results via apps or in-store devices. It enables personalized product recommendations based on individual skin data, optimizing customer experience and driving sales conversion through data-driven consultations.

What are the primary restraints affecting market expansion for domestic Japanese cosmetic manufacturers?

The primary restraints include high overhead costs associated with maintaining rigorous domestic quality standards, intense competition leading to market saturation in mass segments, and demographic challenges such as a declining and aging domestic population base, necessitating aggressive international expansion strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager