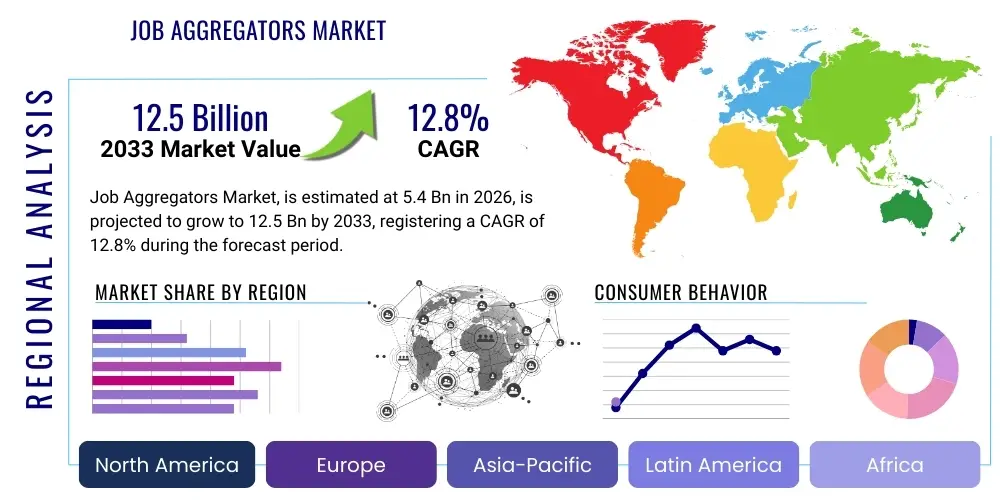

Job Aggregators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442469 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Job Aggregators Market Size

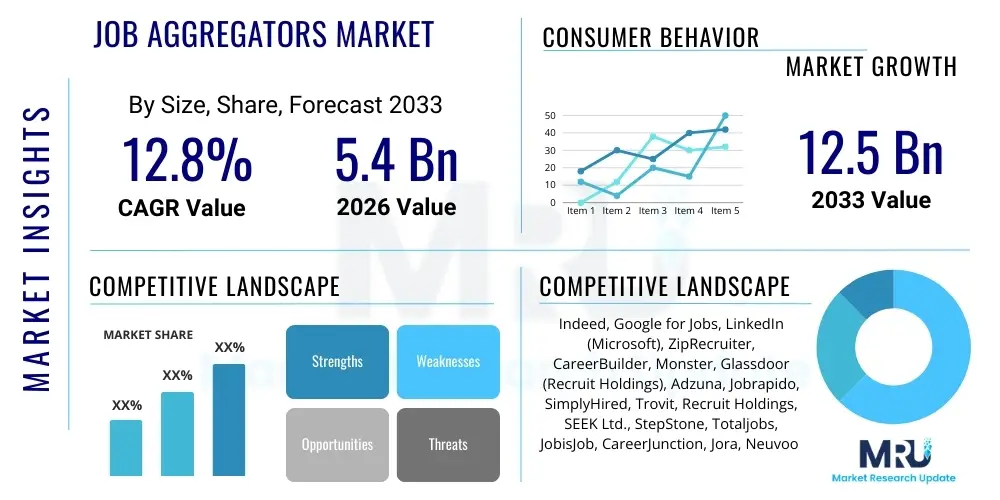

The Job Aggregators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $5.4 Billion in 2026 and is projected to reach $12.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing digitalization of recruitment processes globally, coupled with the persistent demand from both job seekers and employers for consolidated, efficient, and comprehensive job listing platforms. The fragmentation of traditional job boards and corporate career pages has cemented the role of aggregators as essential navigational tools in the modern employment landscape, driving consistent revenue growth through optimized advertising models.

Job Aggregators Market introduction

The Job Aggregators Market encompasses platforms that collect, index, and organize job postings from diverse sources—including company career sites, traditional job boards, and staffing agency websites—into a single, searchable interface. These platforms function primarily as powerful search engines designed specifically for employment opportunities, significantly enhancing the efficiency of the job search process by providing comprehensive access to millions of listings without requiring job seekers to visit numerous individual sites. The core product offering revolves around data centralization, advanced filtering capabilities, and localized job relevance, making the recruitment funnel significantly smoother for both candidates and hiring managers.

Major applications of job aggregators span across virtually every industry vertical, including technology, healthcare, manufacturing, finance, and retail. For job seekers, aggregators serve as the primary entry point for discovering new roles, utilizing sophisticated algorithms to match candidate profiles with suitable vacancies based on criteria such as location, salary, experience level, and required skills. For employers, aggregators act as vital distribution channels, ensuring their job listings achieve maximum visibility and reach a wider pool of qualified passive and active candidates, often at a lower cost-per-application compared to proprietary job board postings.

The market's robust growth trajectory is propelled by several interlocking driving factors. Key among these are the accelerating shift towards remote and hybrid work models, which necessitates broader geographical search capabilities facilitated by aggregators; the rapid adoption of mobile technology for job searching; and the continuous innovation in search algorithms, which leverage machine learning to provide highly personalized job recommendations, thereby increasing user engagement and platform utility. Furthermore, the inherent benefit of cost-effectiveness for small and medium-sized enterprises (SMEs) utilizing performance-based advertising models on aggregator sites drives continuous market penetration.

Job Aggregators Market Executive Summary

The Job Aggregators Market is characterized by intense competition and rapid technological integration, defining current business trends. Major players are moving beyond simple data aggregation to offer holistic recruitment solutions, including resume databases, applicant tracking system (ATS) integrations, and specialized talent analytics. A dominant business trend is the transition from purely pay-per-click (PPC) models to more diversified revenue streams encompassing subscription services for recruiters (SaaS recruitment tools) and premium visibility features for listings. Strategic acquisitions and vertical integration—where aggregators acquire niche job boards or HR technology firms—are common maneuvers aimed at capturing specialized talent pools and expanding service offerings, securing deeper market entrenchment against traditional human resources platforms.

Regionally, North America and Europe remain the dominant markets, attributed to high digital literacy, mature online recruitment ecosystems, and substantial corporate spending on talent acquisition. However, the Asia Pacific (APAC) region, particularly emerging economies like India and Southeast Asia, is demonstrating the fastest growth rate. This accelerated expansion in APAC is fueled by massive youth populations entering the workforce, increased internet penetration, and the rapid professionalization of local job markets. Regional trends indicate that platforms offering multilingual support and hyper-localized job relevance are securing competitive advantages in these emerging high-growth areas, while stringent labor regulations in Europe necessitate aggregators offer robust data privacy and compliance features.

Segment trends underscore the rising prominence of the Pay-Per-Click (PPC) model, favored by employers due to its measurable return on investment (ROI) compared to flat-fee models. From an industry vertical perspective, the IT & Telecom segment remains the largest consumer of aggregation services, reflecting the global tech talent shortage and high frequency of hiring cycles. Furthermore, the shift towards cloud-based deployment models is nearly universal, offering superior scalability, faster data indexing capabilities, and seamless integration with existing enterprise HR software. Future growth is strongly anticipated within specialized niche aggregation focusing on high-demand, high-skill roles, where general aggregation sometimes falls short in depth of specific industry knowledge and vetting requirements.

AI Impact Analysis on Job Aggregators Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on Job Aggregators reveals central themes revolving around personalization, data integrity, and job displacement anxieties. Users frequently ask how AI is improving the accuracy of job recommendations, whether generative AI will automate job description writing, and if machine learning is creating "filter bubbles" that limit discovery. There are significant concerns among recruiters regarding the veracity of aggregated data and how AI tools combat fraudulent or outdated listings. Job seekers, conversely, are keenly interested in AI-driven tools that analyze their resumes and suggest skills gaps or optimize their applications for specific roles indexed by the aggregators. The collective user expectation is for AI to transform these platforms from mere search engines into intelligent career advisors and precision-matching services.

The integration of AI is fundamentally restructuring the competitive landscape by shifting the basis of competition from volume of listings to quality of match. Aggregators are leveraging large language models (LLMs) and advanced machine learning algorithms to process unstructured data from job descriptions and candidate profiles, identifying nuanced semantic matches far beyond keyword reliance. This enhanced capacity for precision targeting allows aggregators to command higher advertising premiums and improve overall user satisfaction by reducing application volume while increasing hiring conversion rates. AI is also critical in optimizing the pricing strategy for sponsored listings, utilizing real-time market data to ensure cost-efficiency for advertisers based on anticipated click-through rates and application quality.

AI's influence extends deeply into operational efficiency, particularly in data cleaning and maintenance. Aggregators face the constant challenge of managing millions of redundant, expired, or fraudulent postings. AI-powered classification and anomaly detection systems are vital for instantly identifying and suppressing low-quality content, ensuring the platform’s utility and trustworthiness are maintained. Furthermore, AI Chatbots and conversational interfaces are increasingly being deployed to handle initial candidate queries and guide recruiters through complex platform features, significantly improving the scalability of customer support and reducing administrative overhead.

- AI-driven personalized recommendation engines significantly improve match quality between candidates and job requirements.

- Natural Language Processing (NLP) enhances the indexing process, extracting detailed skill requirements and location data accurately.

- Machine Learning (ML) algorithms optimize bidding strategies for sponsored job listings, maximizing recruiter ROI.

- Generative AI assists in automating the creation of high-quality, SEO-optimized job descriptions from brief inputs.

- AI systems are deployed for real-time fraud detection and filtering of spam or expired job postings, ensuring data hygiene.

- Predictive analytics forecast job market trends and demand for specific skills, providing strategic insights to employers.

DRO & Impact Forces Of Job Aggregators Market

The Job Aggregators Market is propelled by powerful digital drivers (D), yet constrained by significant structural and regulatory challenges (R), simultaneously presenting substantial opportunities (O) for expansion and diversification. Key drivers include the exponential growth in global online recruitment spending, the persistent convenience demanded by digitally native job seekers, and the necessity for employers to access passive candidates across fragmented digital environments. Restraints primarily involve challenges in maintaining data quality, addressing ethical concerns regarding algorithmic bias in filtering, and high reliance on third-party data sources which can lead to volatility. Opportunities are concentrated in expanding into niche high-skill verticals, developing proprietary candidate assessment tools, and offering advanced talent intelligence platforms to enterprise clients.

The core drivers are deeply rooted in demographic and technological shifts. The global workforce is increasingly mobile and tech-savvy, viewing aggregators as the mandatory first step in any career transition. For employers, the pressure to hire quickly and cost-effectively, particularly in competitive sectors like technology and specialized manufacturing, necessitates the broad reach and performance-based advertising models offered by aggregators. This fundamental demand drives consistent investment into platform scaling and indexing sophistication, ensuring the market expands parallel to the global digitalization of HR functions.

However, market growth faces headwinds, notably the inherent difficulty in differentiating genuine, active listings from duplicated or expired ones, which negatively impacts user trust. Furthermore, the market's high dependency on search engine optimization (SEO) and platform traffic acquisition makes aggregators vulnerable to policy changes by dominant search engines (e.g., Google for Jobs modifications). The impact forces driving the market include competitive intensity among the top-tier aggregators, the increasing bargaining power of large enterprise clients demanding customized features, and the ever-present threat of substitutes emerging from social professional networks or vertically integrated HR software solutions.

Segmentation Analysis

The Job Aggregators Market is extensively segmented based on Model, Industry Vertical, Deployment Type, and End-User, reflecting the diverse ways organizations monetize job discovery and how different sectors utilize these platforms. Analyzing these segments provides a clear framework for understanding market dynamics, competitive advantages, and future growth pockets. The Model segmentation—specifically comparing Subscription, PPC, and Featured Listings—reveals the prevailing shift towards performance-based advertising (PPC), which offers advertisers greater control over expenditure and measurability, solidifying its dominant position. Conversely, the deployment analysis confirms the near-total migration to Cloud-Based solutions, driven by scalability requirements necessary for handling billions of indexed job postings globally and ensuring seamless integration with modern HR stacks.

The industry vertical analysis underscores the critical role of aggregators in talent-intensive sectors. While IT & Telecom historically generate the highest ad spending, specialized verticals like Healthcare and Pharmaceuticals are witnessing rapid acceleration, fueled by persistent global shortages for clinical and technical staff. This surge is creating micro-markets where niche aggregators focusing solely on medical or biotech roles can compete effectively against generalist platforms by offering deeper domain expertise and targeted advertising channels. Understanding these vertical nuances is essential for market participants seeking strategic entry points or diversification opportunities outside the saturated generalist market space.

End-user segmentation differentiates between the needs of individual Job Seekers, corporate Recruiters/Employers, and Staffing Agencies. Job seekers demand simplicity, mobile optimization, and highly relevant results, whereas recruiters require sophisticated campaign management tools, detailed analytics on candidate funnel performance, and robust integration with their Applicant Tracking Systems. The staffing agency segment often utilizes aggregators as a high-volume lead generation tool, prioritizing expansive reach and bulk posting capabilities, sometimes leading to unique pricing structures tailored for agency needs rather than direct employer costs.

- By Model:

- Subscription

- Pay-Per-Click (PPC)

- Featured Listings

- Others (Flat-fee per post, programmatic)

- By Industry Vertical:

- IT & Telecom

- Healthcare and Pharmaceutical

- BFSI (Banking, Financial Services, and Insurance)

- Retail and E-commerce

- Manufacturing and Industrial

- Others (Education, Government, Hospitality)

- By Deployment:

- Cloud-Based

- On-Premise (Nearly phased out)

- By End-User:

- Job Seekers (Primary consumers of indexed data)

- Recruiters/Employers (Primary paying customers)

- Staffing Agencies

Value Chain Analysis For Job Aggregators Market

The value chain for the Job Aggregators Market begins with the upstream process of content sourcing and aggregation. This phase involves utilizing sophisticated web crawlers (spiders) and application programming interfaces (APIs) to systematically pull job data from thousands of external sources, including company websites, niche job boards, and governmental employment portals. Key activities in the upstream phase are data governance, ensuring legal compliance (e.g., GDPR, CCPA), and rapid content indexing. Efficiency in this stage dictates the breadth and timeliness of job listings offered by the aggregator, which forms the core competitive advantage.

The midstream phase focuses on data processing, enrichment, and platform maintenance. Once data is ingested, it must be cleaned, deduplicated, standardized (e.g., normalizing salary ranges and job titles), and enhanced using AI/ML algorithms to improve search relevance. This phase includes the development and optimization of the core search engine functionality and user interface (UI/UX). The profitability of the aggregator is highly dependent on the efficacy of its matching algorithms, which determine the conversion rates for sponsored listings and overall user engagement. Technological infrastructure maintenance, particularly server capacity and cybersecurity, is paramount in this stage.

The downstream activities involve monetization, distribution channels, and end-user support. Monetization primarily occurs through direct advertising sales (PPC, sponsorships) to recruiters and staffing agencies. The distribution channel is predominantly direct-to-consumer via the web platform and mobile applications (Direct). Indirect distribution occurs through partnerships with affiliate websites or integrations into third-party HR technology ecosystems. Effective downstream execution requires robust sales teams, performance analytics tools for advertisers, and localized customer support to handle complex billing and campaign management inquiries, ensuring long-term client retention.

Job Aggregators Market Potential Customers

The primary customer base for Job Aggregators is bifurcated into two essential groups: the end-users who consume the data (Job Seekers) and the paying customers who leverage the platform’s reach for talent acquisition (Employers/Recruiters and Staffing Agencies). Job seekers constitute the critical mass required for market relevance; while they typically do not pay directly for basic access, their volume and engagement metrics dictate the advertising value the aggregator can command. The aggregators’ ability to continuously attract high-quality, active job seekers is the foundational requirement for sustaining the business model.

The paying clientele, comprised of corporate HR departments and specialized recruitment firms, represents the core revenue source. Large enterprises are high-value customers, requiring programmatic advertising options, seamless integration with their existing Applicant Tracking Systems (ATS), and sophisticated geo-targeting capabilities to fill vacancies across multiple locations. Their purchasing decisions are driven by Cost-Per-Hire (CPH) efficiency and the quality of applicant flow. Potential customers in this segment increasingly demand access to passive candidates and data intelligence regarding salary benchmarks and competitive hiring landscapes.

Staffing Agencies and third-party recruiters form another substantial customer segment. These organizations rely on aggregators for high-volume lead generation to satisfy client contracts. They seek flexible contract terms, bulk posting discounts, and tools that allow them to filter and organize candidates efficiently before passing them into their own proprietary databases. Penetrating smaller businesses (SMEs) is also a key focus area, as aggregators offer an accessible, low-barrier-to-entry alternative to expensive traditional media recruitment or bespoke agency services, often tailored through automated self-service advertising portals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.4 Billion |

| Market Forecast in 2033 | $12.5 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Indeed, Google for Jobs, LinkedIn (Microsoft), ZipRecruiter, CareerBuilder, Monster, Glassdoor (Recruit Holdings), Adzuna, Jobrapido, SimplyHired, Trovit, Recruit Holdings, SEEK Ltd., StepStone, Totaljobs, JobisJob, CareerJunction, Jora, Neuvoo (Talent.com), Jobs2Careers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Job Aggregators Market Key Technology Landscape

The technological infrastructure supporting the Job Aggregators Market is highly specialized, centered on massive data processing, retrieval, and analysis. Key technologies include advanced web crawling frameworks designed to manage vast volumes of data intake from heterogeneous sources while adhering to strict ethical scraping policies. High-performance, scalable NoSQL databases and distributed computing systems are essential for storing and rapidly querying the billions of indexed documents, facilitating near real-time updates and search functionality. The market is increasingly characterized by investments in proprietary search engine technology that optimizes relevance ranking beyond simple keyword matching, utilizing vector embeddings and deep learning models to understand context.

Artificial Intelligence and Machine Learning (AI/ML) form the most critical technological layer, driving core features such as personalized job recommendations, automated deduplication of listings, and predictive analytics for recruiters. Specifically, Natural Language Processing (NLP) is vital for standardizing messy, unstructured job description data and extracting key entities like specific tools, certifications, and soft skills. This enriched data enables hyper-targeted advertising and ensures that algorithmic filtering reduces biases associated with traditional keyword matching. Furthermore, the adoption of robust cloud architecture (e.g., AWS, GCP) is universal, providing the elasticity required to handle peak search volumes and fluctuating data ingestion rates without performance degradation.

Mobile technology optimization is another foundational element, given that a majority of job search traffic originates from smartphones. Aggregators utilize Progressive Web Apps (PWAs) and highly optimized native mobile applications to ensure low latency, superior user experience, and integration with device-specific features like GPS for location-based searching and push notifications for instant job alerts. Finally, the growing demand for integration capabilities mandates the use of extensive, well-documented APIs, enabling seamless data exchange with thousands of third-party Applicant Tracking Systems (ATS) and Human Resource Information Systems (HRIS), consolidating the aggregator's position as a central component of the recruitment technology ecosystem.

Regional Highlights

The dynamics of the Job Aggregators Market vary significantly across major geographical regions, influenced by digital infrastructure maturity, local labor market regulations, and cultural hiring practices. North America, encompassing the United States and Canada, represents the most mature and largest market segment. The region is characterized by exceptionally high corporate investment in talent technology, leading to rapid adoption of advanced features like programmatic advertising and AI-driven screening tools. Competition is fierce, dominated by global giants, and growth is driven primarily by innovation in monetization models and the continuous capture of highly specialized talent pools.

Europe stands as the second-largest market, exhibiting high levels of sophistication, particularly in Western European nations like the UK, Germany, and France. However, this market is significantly fragmented by linguistic diversity and stringent regulatory frameworks, notably the General Data Protection Regulation (GDPR). Aggregators operating here must ensure meticulous data compliance and often need to tailor platforms to multiple national languages and labor laws, creating barriers to entry but rewarding those who achieve localized expertise. Northern Europe shows high penetration of cloud-based recruitment solutions, emphasizing remote and flexible work opportunities.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is underpinned by fast-growing economies, burgeoning middle classes, and massive urbanization trends driving demand for formal employment structures. Countries such as India, China, and Indonesia are seeing explosive growth in mobile-first job searching. The challenge in APAC lies in navigating the vast linguistic landscape, fragmented digital payment ecosystems, and varying levels of internet penetration, pushing aggregators to focus on strategic partnerships and localized content relevance.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets for job aggregation, driven by rising internet connectivity and structural shifts away from traditional recruitment methods. In LATAM, economic volatility can affect recruitment spending, but strong growth in sectors like IT and professional services is driving adoption. In MEA, particularly the Gulf Cooperation Council (GCC) states, large infrastructure and technology projects necessitate international talent acquisition, making global aggregators crucial tools. However, local aggregators capable of serving hyper-local cultural and regulatory requirements often hold significant influence in these nascent markets.

- North America: Market leader in terms of revenue, driven by high technology adoption and strong focus on programmatic job advertising and integration with enterprise HR systems.

- Europe: Characterized by regulatory complexity (GDPR compliance) and fragmented language markets; mature uptake of specialized, localized aggregators alongside major global platforms.

- Asia Pacific (APAC): Highest expected growth rate due to large youth populations, increasing mobile usage, and rapid urbanization; focus on hyper-localized content and multilingual support.

- Latin America (LATAM): Growth centered in major economies (Brazil, Mexico), driven by professional services sectors and increasing mobile internet penetration among job seekers.

- Middle East and Africa (MEA): Emerging market growth supported by large government investment in infrastructure and technology, necessitating tools for international talent sourcing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Job Aggregators Market.- Indeed

- Google for Jobs

- LinkedIn (Microsoft)

- ZipRecruiter

- CareerBuilder

- Monster

- Glassdoor (Recruit Holdings)

- Adzuna

- Jobrapido

- SimplyHired

- Trovit

- Recruit Holdings

- SEEK Ltd.

- StepStone

- Totaljobs

- JobisJob

- CareerJunction

- Jora

- Neuvoo (Talent.com)

- Jobs2Careers

Frequently Asked Questions

Analyze common user questions about the Job Aggregators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary revenue model for leading Job Aggregators?

The dominant revenue model is Pay-Per-Click (PPC) advertising, where employers or recruiters pay for candidate clicks on their job listings. This is often supplemented by subscription services for premium recruiter tools, featured listing placements, and access to resume databases for talent sourcing.

How do Job Aggregators ensure the accuracy and relevance of their indexed listings?

Aggregators utilize advanced proprietary AI and machine learning algorithms to continuously scan, deduplicate, and classify millions of listings. They employ automated systems for real-time removal of expired or fraudulent postings and leverage Natural Language Processing (NLP) to standardize disparate job titles and descriptions, improving search relevance for users.

Is the Job Aggregators Market facing competitive pressure from social media platforms?

Yes, significant pressure arises from professional networking sites like LinkedIn and general platforms integrating job features (e.g., Facebook Jobs). Aggregators mitigate this by focusing on broad reach, superior search engine performance, and specializing in high-volume, performance-based advertising models that social platforms do not yet fully replicate.

What technological advancements are most crucial for future market growth?

The most crucial advancements involve deeper AI integration, particularly in utilizing Large Language Models (LLMs) for hyper-personalized candidate matching and automated application optimization. Additionally, improved seamless integration capabilities via APIs with Applicant Tracking Systems (ATS) are vital for enterprise adoption and operational efficiency.

Which geographical region exhibits the fastest growth potential for job aggregation services?

The Asia Pacific (APAC) region, driven by countries such as India and Southeast Asian nations, is projected to show the highest CAGR. This growth is fueled by massive youth populations entering the formal workforce, rapid mobile adoption, and increased internet penetration across previously underserved areas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager