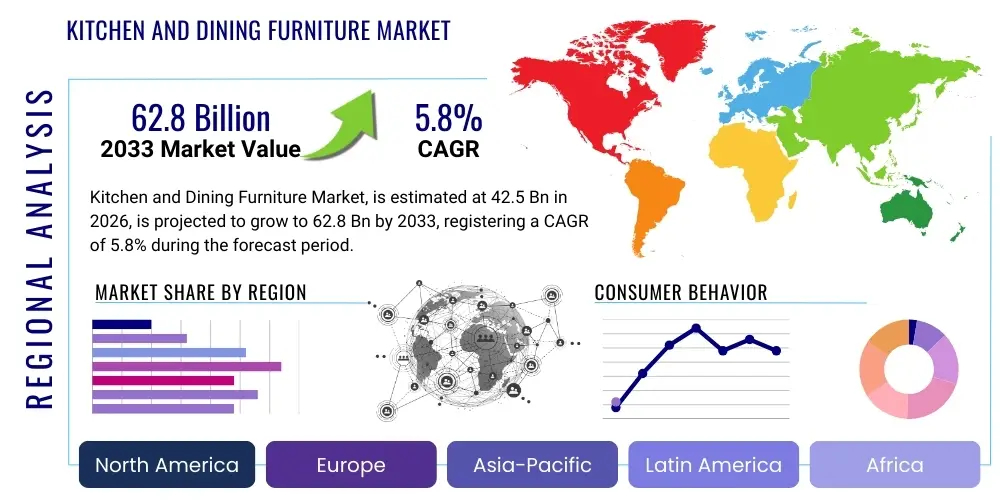

Kitchen and Dining Furniture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443095 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Kitchen and Dining Furniture Market Size

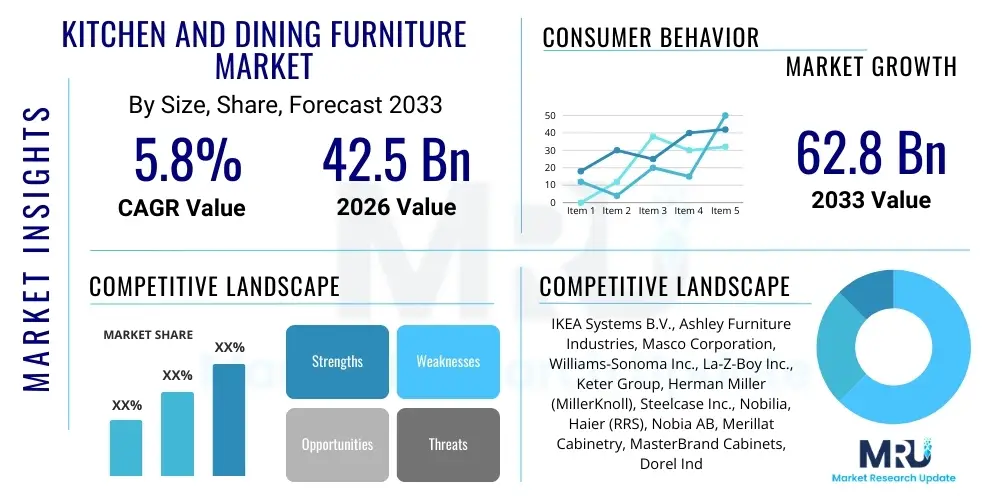

The Kitchen and Dining Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $42.5 Billion in 2026 and is projected to reach $62.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by rising global urbanization rates, increasing disposable income in emerging economies, and a pervasive trend toward home renovation and aesthetic upgrades, positioning the kitchen and dining area as central social hubs within the modern dwelling.

The valuation reflects a sustained demand across both residential and commercial sectors. Residential growth is characterized by a shift towards multi-functional, space-saving, and aesthetically integrated furniture solutions, particularly in urban environments where apartment sizes are often limited. Furthermore, the commercial sector, including hotels, restaurants, and corporate dining facilities, contributes significantly to market volume, prioritizing durability, customizable designs, and high-capacity seating arrangements to enhance guest experience and operational efficiency.

Market expansion is also fueled by innovations in material science, leading to the adoption of sustainable and eco-friendly products, which increasingly influence consumer purchasing decisions, particularly in developed regions like North America and Europe. The confluence of technological integration, such as smart features embedded in dining tables and cabinets, and sophisticated supply chain logistics supporting e-commerce growth, is enabling manufacturers to effectively meet diverse global consumer needs and sustain robust market growth trajectory throughout the forecast period.

Kitchen and Dining Furniture Market introduction

The Kitchen and Dining Furniture Market encompasses a wide range of furnishings designed specifically for food preparation, storage, and consumption areas within residential homes and commercial establishments. Key products include dining tables, chairs, bar stools, kitchen cabinets, islands, buffets, hutches, and specialized storage units. These products are essential components of interior design, blending functional utility with aesthetic appeal, often reflecting evolving architectural and lifestyle trends such as open-plan living and multi-functional spaces.

Major applications of kitchen and dining furniture span residential, hospitality, corporate, and institutional settings. In the residential sector, demand is primarily driven by new housing starts, remodeling projects, and consumer preferences for high-quality, durable materials such as solid wood, engineered wood, metal, glass, and composites. The commercial segment relies on these furnishings to establish ambiance and facilitate customer traffic flow, prioritizing resilience against heavy usage and compliance with specific safety and hygiene standards.

The primary benefits delivered by these products include enhanced functionality, optimized space utilization, and improved ergonomic design, contributing significantly to the overall quality of life and property value. Key driving factors stimulating this market include rapid global population growth, which necessitates increased housing development; technological advancements in manufacturing processes, allowing for greater customization at scale; and the expanding presence of online retail channels, which simplifies the purchasing process and offers a broader array of design options to consumers worldwide.

Kitchen and Dining Furniture Market Executive Summary

The Kitchen and Dining Furniture Market is characterized by vigorous competition and significant shifts driven by evolving consumer behaviors and technological integration. Business trends are dominated by the rise of direct-to-consumer (D2C) models and e-commerce platforms, drastically reducing lead times and expanding market reach globally. Manufacturers are intensely focused on sustainability, utilizing recycled materials and low-VOC finishes to appeal to environmentally conscious buyers. Customization and modularity represent key differentiation strategies, allowing consumers to design spaces that perfectly match specific dimensions and aesthetic visions, thereby maximizing usable space and increasing average transaction value across all price points.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, propelled by burgeoning middle-class populations, massive residential construction activity, particularly in China and India, and increasing discretionary spending on home furnishings. North America and Europe maintain maturity but drive innovation, especially in smart furniture technology and premium, ergonomic designs. These developed regions demonstrate a high replacement cycle demand, focused less on quantity and more on quality and technological sophistication, frequently adopting materials like reclaimed wood and advanced engineered surfaces.

Segment trends highlight the dominance of the residential sector, although the hospitality segment shows rapid recovery and strong growth post-pandemic, focusing on durable, easy-to-clean dining solutions. Segmentation by material reveals a steady preference for wood-based products, though the metal and plastic segments are gaining traction due to cost-effectiveness and versatility in contemporary designs. The market is consolidating, with larger players acquiring niche manufacturers to integrate specialized design expertise and expand geographic footprints, ensuring consistent growth across the 2026-2033 forecast period.

AI Impact Analysis on Kitchen and Dining Furniture Market

User inquiries regarding Artificial Intelligence (AI) in the Kitchen and Dining Furniture market primarily revolve around three core themes: personalized design experience, optimization of the supply chain, and the integration of AI-enabled smart features within the furniture itself. Consumers are highly interested in how AI can generate hyper-realistic 3D visualizations of proposed kitchen layouts instantly, using machine learning algorithms to recommend optimal configurations based on user lifestyle, floor plan dimensions, and aesthetic preferences. A major concern is the potential loss of traditional design roles versus the expectation of drastically faster and more accurate design consultations. Furthermore, businesses are keenly focused on how predictive analytics can manage inventory, forecast demand seasonality, and optimize logistics routes, thereby reducing waste and lowering operational costs in a supply chain frequently hampered by global volatility.

The integration of AI is transforming the conceptualization and production phases of kitchen and dining furniture, moving towards mass customization supported by automated design tools. These AI systems can analyze millions of design data points to identify emerging trends and instantaneously adapt factory floor operations via robotic systems and advanced CNC machines. This shift facilitates the creation of bespoke pieces at near mass-production costs, addressing the critical consumer demand for unique, personalized home environments. The application of AI extends beyond aesthetics and into functional utility, particularly in smart kitchens, where embedded sensors and connectivity allow cabinets or islands to manage inventory, assist with cooking processes, or monitor energy consumption.

In retail and marketing, AI tools enhance customer engagement by providing virtual try-on experiences and highly personalized advertising campaigns, drastically improving conversion rates. Chatbots and virtual assistants powered by natural language processing (NLP) handle initial customer queries, offering immediate support regarding product specifications, material durability, and warranty details, thus freeing human staff for complex problem-solving. Overall, the market anticipates AI will result in a more efficient, customer-centric, and highly digitized ecosystem, from raw material sourcing to final home delivery and post-sales support.

- Enhanced personalized furniture design through generative AI algorithms.

- Optimized supply chain and logistics via predictive demand forecasting and inventory management.

- Integration of smart features (e.g., self-regulating storage, interactive displays) into kitchen islands and cabinets.

- Automated quality control and defect detection during the manufacturing process using computer vision.

- Improved customer experience through AI-powered virtual showrooms and highly responsive chatbots.

- Reduced material waste and increased production efficiency through robotic fabrication processes.

DRO & Impact Forces Of Kitchen and Dining Furniture Market

The Kitchen and Dining Furniture Market is propelled by robust drivers, constrained by specific economic factors, and presents substantial future growth opportunities, all governed by interconnected impact forces. Key drivers include accelerating rates of residential construction globally, particularly in densely populated urban centers, and a significant increase in consumer expenditure allocated towards home aesthetics and comfort, often spurred by social media influence and aspirational home décor trends. Conversely, the market faces significant restraints, notably the volatile pricing of raw materials such as lumber, steel, and plastics, coupled with increasingly complex international trade tariffs and high global freight costs, which inflate end-product prices and narrow profit margins for manufacturers. These cost pressures necessitate constant innovation in material substitution and manufacturing optimization to maintain affordability.

Significant opportunities exist in the burgeoning trend of modular and multi-functional furniture, specifically designed for small-space living, addressing the unique challenges of apartment dwellers in major metropolitan areas. Furthermore, the push towards sustainability offers a competitive advantage, as consumers are increasingly willing to pay a premium for certified eco-friendly or ethically sourced products, driving investment in recycled and rapidly renewable materials. The expansion of high-end, luxury segment offerings, including bespoke, artisanal furniture pieces, also presents a lucrative pathway, targeting affluent consumers focused on long-term investment in durable, high-design items that serve as focal points in residential settings.

The core impact forces shaping the market include technological advancements, where investment in CNC machinery and advanced design software drastically shortens the product lifecycle and allows for rapid prototyping and market deployment. Secondly, demographic shifts, such as aging populations requiring accessible and ergonomic designs, and younger generations demanding high-tech, connected furniture, compel manufacturers to diversify their product lines continually. Finally, the growing dominance of e-commerce as a primary sales channel exerts strong pressure on traditional brick-and-mortar retailers to integrate digital showrooms and robust logistics networks, profoundly reshaping the competitive landscape and consumer purchasing journey.

Segmentation Analysis

The Kitchen and Dining Furniture Market is extensively segmented based on key parameters including product type, material, distribution channel, and end-use application, enabling a granular understanding of consumer behavior and market dynamics across different regions. Product type segmentation distinguishes between structural elements like kitchen cabinets and functional pieces such as dining sets and chairs, each possessing unique material requirements and price points. The material segment highlights the enduring preference for traditional wood products alongside the growing adoption of durable and modern alternatives like metal, glass, and engineered wood, catering to varied durability and aesthetic demands.

Segmentation by end-use application clearly differentiates between the vast residential sector, driven by renovation cycles and new housing, and the commercial sector, which includes high-volume purchasers like hotels, restaurants, and institutional entities that prioritize durability and specific aesthetic themes. Furthermore, the distribution channel segmentation is critical, illustrating the dramatic shift from traditional offline retail (specialty stores, department stores) towards online platforms and e-commerce portals, which offer convenience, competitive pricing, and extensive virtual customization tools, profoundly influencing market access and supply chain strategies for major industry participants.

Analyzing these segments provides strategic insights for stakeholders, allowing them to tailor product development and marketing efforts. For instance, focusing on the high-margin residential customization segment requires investment in advanced design technology, while targeting the commercial hospitality segment mandates adherence to robust safety standards and bulk manufacturing capacity. The intricate interplay between these segmented markets defines the overall competitive intensity and future growth vectors of the global kitchen and dining furniture industry.

- By Product Type:

- Dining Tables (Fixed, Extendable)

- Dining Chairs and Seating (Side Chairs, Arm Chairs, Benches, Stools)

- Kitchen Cabinets and Storage (Wall Cabinets, Base Cabinets, Tall Cabinets)

- Kitchen Islands and Trolleys (Fixed Islands, Mobile Carts)

- Bar and Counter Stools

- Buffets and Hutches

- By Material:

- Wood (Solid Wood, Plywood, Particleboard, MDF)

- Metal (Stainless Steel, Iron, Aluminum)

- Plastic and Composites

- Glass and Marble

- Rattan and Wicker

- By Distribution Channel:

- Offline (Specialty Furniture Stores, Hypermarkets/Supermarkets, Departmental Stores)

- Online (E-commerce Portals, Company Websites)

- By End-Use Application:

- Residential (Apartments, Houses, Villas)

- Commercial (Hotels, Restaurants & Cafes, Corporate Offices, Educational Institutions)

Value Chain Analysis For Kitchen and Dining Furniture Market

The value chain for the Kitchen and Dining Furniture Market commences with the upstream analysis, involving the sourcing and processing of raw materials. This phase is highly sensitive to global commodity prices, particularly for lumber (hardwood, softwood), metals (steel, aluminum), and various petroleum-derived plastics and finishes. Efficient procurement strategies, often involving long-term contracts and diversification of suppliers across different geographies, are critical for mitigating price volatility. Specialized suppliers manage the processing of these raw goods into standardized components such as engineered wood panels (MDF, particleboard) and metal frames, emphasizing quality control and adherence to environmental standards before they reach the manufacturing stage.

The manufacturing process is the core segment of the value chain, where components are designed, cut, assembled, and finished. This stage is increasingly characterized by high technological investment, utilizing CNC machines, robotic assembly lines, and advanced surface finishing techniques to ensure precision, scalability, and mass customization capabilities. Midstream activities involve stringent quality assurance testing, packaging for transport, and inventory management. The efficiency of the manufacturing process directly impacts profitability, demanding lean production methods and minimizing waste, especially as demand for personalized, short-run furniture designs increases.

Downstream analysis focuses on distribution and sales, encompassing both direct and indirect channels. The indirect channel relies heavily on large retail chains, specialty furniture stores, and interior design firms that act as intermediaries, providing showroom experiences and design consultation. The direct channel, consisting of manufacturer-owned stores and rapidly expanding e-commerce platforms, is gaining prominence, offering higher margins and direct control over the customer experience. Effective logistics, including last-mile delivery and specialized installation services, are crucial determinants of success in the downstream sector, requiring optimized warehousing and transportation networks to handle bulky, often fragile products.

Kitchen and Dining Furniture Market Potential Customers

The potential customers for the Kitchen and Dining Furniture Market are segmented into two broad categories: B2C (Business-to-Consumer) and B2B (Business-to-Business), each driven by distinct purchasing motivations, volume requirements, and product needs. The B2C segment, representing the largest volume of demand, primarily consists of homeowners undertaking new construction or renovation projects, as well as renters seeking affordable, modular solutions. These buyers are highly sensitive to design trends, material quality, and brand reputation, often utilizing online visualizers and prioritizing functionality that aligns with specific family needs and lifestyle dynamics, such as large dining capacity for entertaining or space-saving kitchen trolleys.

Within the B2B segment, major buyers include residential property developers and construction companies who purchase furniture in bulk for new housing developments, requiring durable, cost-effective standard solutions that can be installed quickly and consistently across multiple units. The hospitality sector, encompassing hotels, restaurants, and cafes, represents another vital customer base, demanding commercial-grade furniture that combines high aesthetic appeal with exceptional durability and ease of cleaning, often procuring bespoke designs to fit unique brand identities and high-traffic environments. These commercial purchasers prioritize warranties, material resilience, and timely bulk delivery schedules over singular design complexity.

Furthermore, interior designers and architectural firms act as influential intermediaries, purchasing on behalf of both residential and commercial clients, often seeking highly specialized, premium, and customizable products. Institutional buyers, such as schools, hospitals, and corporate dining facilities, focus predominantly on ergonomic, heavy-duty, and safety-compliant furniture that can withstand intense institutional use over extended periods. Catering to this diverse customer landscape requires manufacturers to maintain flexible production capabilities and develop differentiated product portfolios tailored to varying quality, volume, and customization specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $42.5 Billion |

| Market Forecast in 2033 | $62.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IKEA Systems B.V., Ashley Furniture Industries, Masco Corporation, Williams-Sonoma Inc., La-Z-Boy Inc., Keter Group, Herman Miller (MillerKnoll), Steelcase Inc., Nobilia, Haier (RRS), Nobia AB, Merillat Cabinetry, MasterBrand Cabinets, Dorel Industries Inc., Pulaski Furniture, Ethan Allen Global Inc., Hooker Furniture Corporation, Century Furniture, Natuzzi S.p.A., Roche Bobois. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kitchen and Dining Furniture Market Key Technology Landscape

The technological landscape of the Kitchen and Dining Furniture Market is evolving rapidly, driven by the necessity for enhanced manufacturing efficiency, greater product customization, and the seamless integration of smart features. At the core of modern production is advanced Computer Numerical Control (CNC) machining, which enables manufacturers to execute highly complex, precise cutting and routing operations with minimal human intervention. This technology is essential for reducing material waste, improving assembly fit, and facilitating mass customization by allowing rapid switching between different product designs without significant retooling. Furthermore, robotic assembly systems are being increasingly deployed to handle repetitive, high-precision tasks, leading to faster production cycles and consistent product quality, especially for large-scale cabinet production.

Another significant technological advancement is the use of 3D printing, or additive manufacturing, which, while not yet ubiquitous for large structural pieces, is crucial for prototyping new designs and producing complex, specialized hardware, joints, and decorative components quickly and cost-effectively. This is particularly relevant in the luxury and custom furniture segments where unique fittings are demanded. Digital visualization tools, powered by augmented reality (AR) and virtual reality (VR), are transforming the consumer purchasing experience by allowing customers to virtually place furniture items within their own living spaces before purchase, reducing returns and increasing customer confidence in their design choices, thereby bolstering e-commerce growth.

The emergence of the smart kitchen concept mandates the integration of IoT (Internet of Things) technology into dining furniture and cabinetry. This includes charging stations seamlessly built into dining surfaces, smart kitchen islands equipped with integrated scales, induction charging, and connectivity to home automation systems. The technology landscape also heavily features new material science breakthroughs, such as high-pressure laminates (HPL) with antimicrobial properties, durable engineered stone surfaces, and lightweight, high-strength metal alloys, all contributing to more functional, hygienic, and aesthetically versatile products that meet the stringent demands of modern residential and commercial environments.

Regional Highlights

- North America: This region is characterized by a high degree of maturity, strong purchasing power, and a substantial focus on high-end, customized, and smart furniture solutions. The United States and Canada dominate the market, driven by persistent demand for residential remodeling and the proliferation of open-concept kitchen designs that necessitate aesthetically matching dining furniture. Consumers here demonstrate a significant willingness to invest in durable, sustainable products, driving manufacturers towards locally sourced materials and eco-friendly certification. The region is a leader in adopting specialized e-commerce platforms and virtual design tools, streamlining the consumer journey for both residential consumers and commercial builders.

- Europe: The European market maintains a robust demand, led primarily by Germany, the UK, and France, often prioritizing ergonomic functionality, timeless design, and adherence to strict environmental regulations (such as REACH). The strong focus on compact living, particularly in Western European urban centers, fuels demand for modular, space-saving furniture, including extendable tables and highly integrated storage systems within kitchen cabinetry. Manufacturers are heavily invested in automating production to manage high labor costs while sustaining high quality standards. Replacement cycles in Europe tend to be longer than in other regions, emphasizing longevity and enduring aesthetic appeal.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth, largely due to rapid urbanization, increasing disposable income, and massive government investment in housing infrastructure, particularly in countries like China, India, and Southeast Asia. The region is seeing a massive shift from traditional, custom-built kitchens toward standardized, modular kitchen systems. Price sensitivity remains a factor in emerging APAC markets, driving demand for cost-effective engineered wood and composite materials. However, a rapidly expanding luxury consumer base in major metropolitan areas is simultaneously fueling demand for imported, high-end European and North American designs, creating a highly stratified market.

- Latin America (LATAM): The LATAM region presents moderate growth, often influenced by economic volatility, but shows localized spikes driven by tourism development and growing residential construction in major economic hubs like Brazil and Mexico. Consumer preferences generally lean towards robust, durable materials that offer good value, with local manufacturers dominating the lower and mid-price segments. Design trends are often a mix of European influences and vibrant, regional aesthetics, emphasizing natural wood finishes and compact design solutions suited for diverse housing sizes.

- Middle East & Africa (MEA): The MEA market, specifically the GCC nations (Saudi Arabia, UAE), exhibits high demand for luxury and imported furniture, driven by wealth concentration and significant construction projects in hospitality and high-end residential towers. This region is characterized by large interior spaces, leading to demand for expansive dining sets and elaborate, often ornate, kitchen fixtures. In contrast, the African continent represents an emerging market where affordability and basic functionality are the primary purchase criteria, though rapid development in specific urban centers is beginning to stimulate demand for modern, imported furniture lines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kitchen and Dining Furniture Market.- IKEA Systems B.V.

- Ashley Furniture Industries

- Masco Corporation

- Williams-Sonoma Inc.

- La-Z-Boy Inc.

- Keter Group

- Herman Miller (MillerKnoll)

- Steelcase Inc.

- Nobilia

- Haier (RRS)

- Nobia AB

- Merillat Cabinetry

- MasterBrand Cabinets

- Dorel Industries Inc.

- Pulaski Furniture

- Ethan Allen Global Inc.

- Hooker Furniture Corporation

- Century Furniture

- Natuzzi S.p.A.

- Roche Bobois

Frequently Asked Questions

Analyze common user questions about the Kitchen and Dining Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Kitchen and Dining Furniture Market?

The primary factor driving market growth is accelerated urbanization and corresponding increase in residential construction and remodeling activities globally. Additionally, rising disposable incomes allow consumers to invest more in high-quality, aesthetically pleasing kitchen and dining setups, often prioritizing customized and modular solutions.

How is sustainability impacting material choices in dining furniture?

Sustainability is profoundly impacting material choices, leading to increased consumer demand for furniture made from reclaimed or certified wood, recycled plastics, and low-VOC (Volatile Organic Compound) finishes. Manufacturers are responding by adopting ethical sourcing policies and promoting eco-friendly certifications to gain a competitive advantage and meet regulatory standards.

Which distribution channel is experiencing the fastest growth for kitchen cabinets and dining sets?

The online distribution channel, encompassing specialized e-commerce platforms and company direct-to-consumer websites, is experiencing the fastest growth. This channel offers extensive product catalogs, competitive pricing, virtual design tools (AR/VR), and simplified logistics, catering effectively to modern, digitally inclined consumers.

What role does technology play in modern kitchen furniture design?

Technology plays a crucial role by enabling mass customization through CNC machining and 3D printing. Furthermore, it integrates smart features (IoT connectivity, charging ports, automated storage) into kitchen islands and cabinets, enhancing both functionality and the aesthetic appeal of the modern smart home environment.

Which region holds the largest market share for Kitchen and Dining Furniture?

The Asia Pacific (APAC) region is projected to hold the largest market share due to its massive population base, rapid infrastructural development, and the significant expansion of the middle class in countries like China and India, generating vast demand for new home furnishings and kitchen systems.

Are modular kitchen systems replacing traditional custom-built kitchens?

Modular kitchen systems are increasingly replacing traditional custom-built kitchens, particularly in high-density urban areas and commercial developments. Modular systems offer superior efficiency, standardized quality, quicker installation times, and greater flexibility for reconfiguring layouts, aligning well with modern construction speeds and space constraints.

What are the key materials used in high-end dining tables?

Key materials in high-end dining tables include solid hardwoods (e.g., oak, walnut, teak), natural stone (marble, granite), tempered glass, and premium metal alloys like brushed stainless steel. These materials are chosen for their durability, aesthetic richness, and ability to command a premium price point.

How does the hospitality sector influence kitchen and dining furniture trends?

The hospitality sector drives trends towards high durability, easy maintenance, and commercial-grade aesthetics. Hotels and restaurants frequently demand customized, resilient seating arrangements and tables that can withstand heavy use while reflecting high-design concepts that appeal to modern clientele, often leading to rapid adoption of new materials and ergonomic designs.

What is the impact of global trade tariffs on the furniture market?

Global trade tariffs and geopolitical instability increase the overall cost of imported raw materials and finished goods, acting as a restraint on market growth. This volatility compels manufacturers to localize supply chains or diversify sourcing strategies to mitigate cost fluctuations and maintain stable pricing for consumers.

How do manufacturers ensure product quality in mass-produced kitchen cabinets?

Manufacturers ensure product quality through rigorous quality assurance programs, utilizing advanced computer vision systems for automated defect detection, standardized material inputs (e.g., consistent engineered wood specifications), and comprehensive stress testing protocols applied to hardware, joints, and finishes to guarantee long-term performance and durability.

What differentiates residential furniture from commercial-grade furniture?

Commercial-grade furniture is designed for superior durability, meeting stringent fire safety codes, and withstanding intense, high-frequency usage. Residential furniture typically prioritizes aesthetic customization, comfort, and domestic styling, often with lighter construction compared to its commercial counterpart, which emphasizes structural resilience.

What kind of customization options are most popular in kitchen furniture?

Most popular customization options include specific cabinet dimensions (height, depth), bespoke internal storage solutions (pull-out pantries, specialized drawers), hardware finishes (knobs, handles), and unique countertop materials. These options allow consumers to tailor the kitchen layout precisely to their functional and aesthetic preferences.

Is the demand for metal and glass furniture increasing?

Yes, the demand for metal (especially stainless steel) and glass furniture is increasing, driven by contemporary and industrial design trends. Metal offers exceptional durability and a sleek look, while glass provides a modern, light aesthetic, often utilized in kitchen islands and smaller dining tables to create a sense of spaciousness.

How long is the typical replacement cycle for dining room sets in developed markets?

In developed markets such as North America and Western Europe, the typical replacement cycle for high-quality dining room sets ranges from 8 to 15 years, although remodeling cycles or shifts in aesthetic preferences can trigger earlier replacement, particularly among affluent consumers seeking the latest design trends and technological features.

What are the key challenges in the supply chain for kitchen furniture?

Key supply chain challenges include managing the high logistical costs associated with transporting bulky items, ensuring consistent access to high-quality timber and raw materials amidst climate and geopolitical disruptions, and coordinating timely delivery and installation services, which are critical components of the final customer experience.

How is AI specifically used in consumer interaction within this market?

AI is utilized to power virtual design assistants and recommendation engines that analyze customer data and preferences to generate optimal kitchen layouts or suggest complementary dining pieces. Furthermore, AI-driven chatbots provide 24/7 customer service, handling preliminary inquiries regarding product specifications and availability, streamlining the initial sales funnel.

Are luxury consumers seeking different materials than the mainstream market?

Luxury consumers prioritize exclusivity and superior quality, typically seeking exotic solid woods, custom metalwork, genuine marble, and bespoke finishes. Unlike the mainstream market which often uses engineered wood and laminates, the luxury segment emphasizes natural materials, artisanal craftsmanship, and unique, often limited-edition, design collaborations.

What impact did the shift to remote work have on kitchen furniture demand?

The shift to remote work dramatically increased demand for both remodeling and new furniture, as consumers spent more time at home. Kitchens and dining areas often became multi-functional spaces (e.g., temporary offices or classrooms), driving demand for adaptable furniture like extendable tables and islands with integrated charging capabilities and comfortable, ergonomic seating.

What is the fastest growing product segment in the Kitchen Furniture category?

The fastest-growing product segment within Kitchen Furniture is advanced storage solutions, including specialized cabinets and customized pantry systems. This growth is driven by consumer desire to maximize organizational efficiency and declutter living spaces, particularly in smaller urban residences where vertical storage is paramount.

How important are social media and influencers in driving furniture purchases?

Social media and interior design influencers are highly important, serving as primary sources of aesthetic inspiration and trend recognition. Platforms like Instagram and Pinterest drive aspiration for specific looks and design aesthetics, significantly influencing purchasing decisions and accelerating the adoption rate of new furniture styles.

What are the future opportunities for customization in dining chairs?

Future opportunities for dining chair customization involve ergonomic optimization tailored to individual body measurements, personalized material combinations (e.g., mixed fabrics and metals), and smart integration, such as pressure-sensitive seating that monitors posture or integrated, invisible heating elements for enhanced comfort.

How is the rental housing market affecting furniture demand?

The growing rental housing market, especially among younger demographics, fuels demand for affordable, ready-to-assemble (RTA), and modular furniture. Renters often prioritize portability and temporary installation solutions, leading to increased sales of versatile, compact dining sets and lightweight kitchen storage units that are easy to move.

What are the key differences in consumer preferences between North America and APAC?

North American consumers prioritize large-scale, high-quality, and technologically integrated furniture, focusing on comfort and space. APAC consumers, especially in emerging markets, often prioritize value, space-saving design, and affordability, leading to high volume sales of modular and engineered wood products.

What kind of warranties do commercial furniture buyers typically seek?

Commercial furniture buyers typically seek extended warranties, often ranging from 5 to 10 years, covering structural integrity and finish durability under heavy commercial usage conditions. Robust warranties are essential for minimizing long-term operational costs related to replacement and repair in high-traffic settings like restaurants and hotels.

How does the economic outlook affect consumer spending on non-essential furniture?

A positive economic outlook correlates directly with higher consumer spending on non-essential, high-cost furniture items like bespoke kitchen cabinetry and premium dining sets. Conversely, economic downturns cause consumers to defer replacement purchases, opting instead for essential repairs or cheaper, temporary solutions, impacting the luxury segment disproportionately.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager