Kitchen Backsplash Wall Tile Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443363 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Kitchen Backsplash Wall Tile Market Size

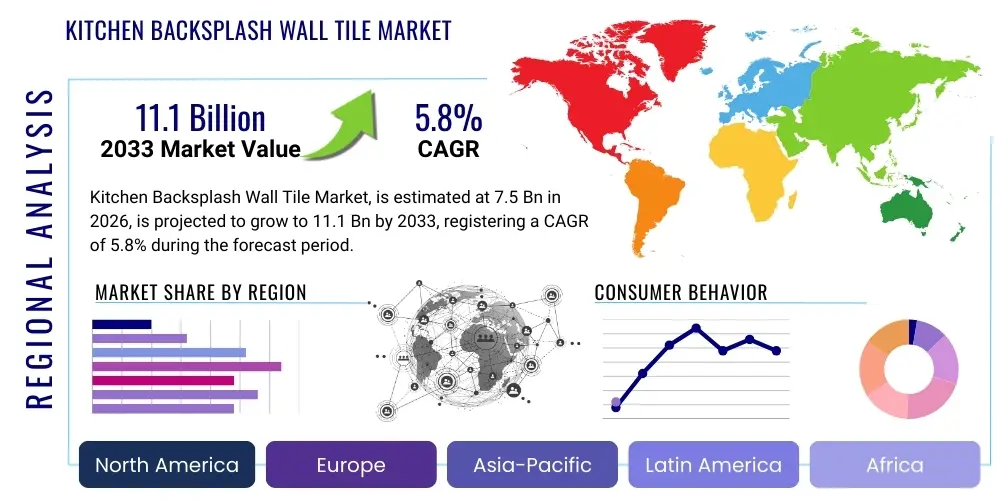

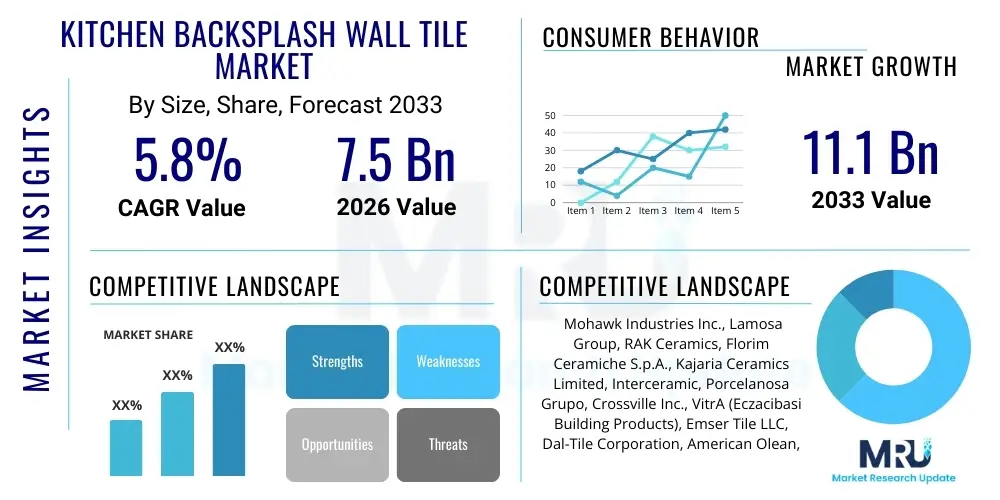

The Kitchen Backsplash Wall Tile Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 7.5 billion in 2026 and is projected to reach USD 11.1 billion by the end of the forecast period in 2033.

Kitchen Backsplash Wall Tile Market introduction

The Kitchen Backsplash Wall Tile Market encompasses the supply, distribution, and installation of various materials used to protect kitchen walls from splashes, heat, and moisture, while simultaneously serving a critical aesthetic function in interior design. These specialized tiles, which include ceramic, porcelain, glass, natural stone, metal, and composite materials, are experiencing robust demand driven by global urbanization, increasing disposable incomes, and a widespread trend toward kitchen renovation and personalization. The functional necessity of a backsplash, combined with its role as a design centerpiece, ensures sustained market relevance. Furthermore, advancements in digital printing technology and sustainable material science are introducing highly realistic textures and eco-friendly options, expanding consumer choice and driving replacement cycles in developed economies. The increasing popularity of open-plan living spaces elevates the visibility of the kitchen, thus amplifying the investment consumers make in high-quality, visually appealing backsplash solutions. Manufacturers are continually innovating to offer larger format tiles, complex mosaic designs, and easy-to-install peel-and-stick alternatives, catering to both professional contractors and the growing do-it-yourself (DIY) segment. The market growth is intricately linked to macroeconomic indicators such as consumer confidence and interest rates, which directly impact the housing sector's vitality globally, making stability in these areas crucial for sustained market performance and investment across the value chain, from raw material procurement to final installation.

Product description highlights the distinct types of tiles available, moving beyond traditional small ceramic squares to encompass sophisticated interlocking mosaics, textured 3D tiles, and large-format porcelain slabs designed to mimic natural marble or concrete finishes without the associated maintenance burden. These products must exhibit high durability, resistance to grease and staining, and easy cleaning properties, making material composition a key purchasing determinant. Major applications primarily involve residential kitchens, spanning new construction projects in rapidly developing urban centers and extensive remodeling activities in mature housing markets. Beyond standard residential use, professional applications include commercial kitchens in hospitality sectors such as restaurants, cafes, and hotels, where hygienic, durable, and fire-resistant surfaces are mandatory. The market is defined by cyclical consumer preferences, shifting from minimalist, monochromatic designs towards bold colors, intricate patterns (such as geometric and arabesque), and mixed material installations that incorporate wood or metal accents for a contemporary, bespoke look. This aesthetic evolution requires continuous investment in research and development by manufacturers to remain competitive and aligned with the dynamic demands of interior architecture and design professionals who exert significant influence over material specification in high-value projects.

The primary benefits driving market expansion include enhanced hygiene and ease of maintenance, significant protection for underlying drywall structures against moisture damage, and considerable contribution to overall property value through modernized aesthetics. Driving factors include favorable government policies supporting housing development, coupled with demographic shifts such as the rise of smaller households and apartment living, which often prioritize highly functional, optimized kitchen spaces. Furthermore, the pervasive influence of social media platforms and home improvement shows accelerates trend adoption, prompting homeowners to frequently update their kitchens to align with current design standards. Economic recovery in key regions, coupled with competitive pricing strategies among Asian manufacturers, continues to broaden accessibility across diverse consumer income brackets, underpinning the strong projected Compound Annual Growth Rate over the forecast period. The convergence of improved installation technology, greater material diversity, and the kitchen’s elevated status as the central hub of modern living ensures sustained structural demand, outweighing short-term economic headwinds that might periodically affect renovation spending, making the long-term outlook highly favorable for specialized tile manufacturers and distributors.

Kitchen Backsplash Wall Tile Market Executive Summary

The global Kitchen Backsplash Wall Tile Market is poised for substantial expansion, driven primarily by robust residential construction activity across Asia Pacific and technological advancements fostering product innovation in North America and Europe. Key business trends indicate a definitive shift towards premiumization, with consumers increasingly selecting high-end materials like genuine stone and large-format porcelain slabs, prioritizing long-term durability and aesthetic congruence over initial cost savings. Digital transformation is impacting manufacturing, allowing for customization and shorter production cycles, enabling companies to quickly respond to shifting design aesthetics such as the demand for muted, matte finishes or complex, digitally printed photographic designs. Furthermore, strategic mergers and acquisitions among regional tile manufacturers and global distributors are consolidating the market landscape, enhancing supply chain efficiencies, and allowing key players to achieve greater economies of scale. Sustainability is emerging as a critical competitive differentiator, compelling manufacturers to invest in recycled content tiles, low-VOC adhesives, and energy-efficient production methods to appeal to environmentally conscious millennials and Gen Z homebuyers. The integration of smart, antimicrobial coatings, though nascent, represents a future growth avenue addressing consumer concerns regarding cleanliness and health in high-contact kitchen environments, thereby driving new waves of product development and marketing focus, particularly important in post-pandemic consumer behavior focused on internal home hygiene.

Regionally, the Asia Pacific (APAC) region maintains market dominance and is projected to exhibit the highest growth rate, fueled by rapid urbanization, massive infrastructure spending, and escalating disposable incomes in countries like China, India, and Southeast Asian nations, leading to unprecedented levels of new housing construction. North America and Europe represent mature, high-value markets characterized by intense renovation cycles, where the emphasis is less on new builds and more on premium, replacement, and refurbishment activities, sustaining demand for specialty products like glass mosaics and artisanal ceramic tiles. Regulatory standards regarding indoor air quality and fire safety, particularly stringent in developed markets, influence material selection, favoring non-combustible and low-emission products. Conversely, emerging markets in Latin America and the Middle East and Africa (MEA) are seeing fluctuating demand tied closely to commodity price cycles and macroeconomic stability; however, increasing penetration of Western design philosophies via global retail chains is steadily stimulating the modernization of traditional kitchen designs, promising incremental growth in the latter half of the forecast period. The differential regional growth rates necessitate localized marketing and distribution strategies, acknowledging the variance in purchasing power, design preferences, and prevailing installation methods across these diverse geographies, ensuring market entry tactics are appropriately adapted.

Segmentation trends reveal that ceramic and porcelain tiles continue to hold the largest market share due to their advantageous balance of cost-effectiveness, versatility, and durability, making them the default choice across economic spectrums. However, the glass tile segment is demonstrating the fastest growth trajectory, capitalizing on its reflective qualities, wide array of color options, and suitability for creating contemporary, light-enhancing backsplashes, particularly favored in smaller urban kitchens. The residential sector remains the largest end-user, but the commercial segment, propelled by expansion in the fast-casual dining and boutique hotel industries, is demonstrating robust, albeit slower, expansion, demanding high-performance, easy-to-sanitize surfaces. Furthermore, distribution through specialized retail stores and online channels is capturing market share from traditional builder supply centers, reflecting consumer preference for direct access to diverse, curated selections and personalized digital design tools. The market structure, while still somewhat fragmented at the regional level, is showing signs of consolidation among material suppliers who can offer integrated solutions from manufacturing to installation support. The shift towards online visualization tools and direct-to-consumer models is compelling traditional wholesalers to digitize their operations and enhance logistical efficiency to maintain relevance in a rapidly modernizing retail environment.

AI Impact Analysis on Kitchen Backsplash Wall Tile Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Kitchen Backsplash Wall Tile Market frequently revolve around design personalization, supply chain efficiency, and manufacturing optimization. Consumers and industry professionals are intensely interested in how AI tools, specifically generative design algorithms and machine learning-powered visualization software, can simplify the complex decision-making process inherent in selecting a backsplash that complements existing kitchen aesthetics (cabinetry, countertops, flooring). Key concerns often focus on the accessibility and cost of these AI-driven design services, questioning whether they will democratize custom design or become exclusive to high-end renovation projects. Furthermore, manufacturing stakeholders inquire about AI's role in predictive maintenance for ceramic kilns, optimizing glaze formulas for material yield, and enhancing quality control systems through computer vision, ultimately aiming for reduced waste and improved product consistency. The consensus expectation is that AI will streamline the entire value chain, from initial conceptualization and virtual prototyping to efficient, demand-driven production planning, thereby compressing lead times and offering hyper-personalized product offerings that were previously economically infeasible. The core thematic drivers are efficiency, customization, and predictive analytics shaping future market structure, emphasizing the transition from mass production to flexible manufacturing paradigms.

In the design phase, AI-powered applications utilize photorealistic rendering capabilities, allowing users to upload images of their kitchen and instantly preview thousands of backsplash options across various materials and patterns. Machine learning algorithms analyze current interior design trends, historical purchasing data, and user preferences (e.g., color palate, lighting conditions) to generate highly relevant, aesthetically pleasing recommendations, drastically reducing the paradox of choice. This shift towards algorithmic design guidance minimizes design errors and increases customer satisfaction by ensuring visual harmony, which is particularly crucial for complex installations like patterned mosaics or mixed-material assemblies. For manufacturers, AI is being deployed in optimizing logistics, predicting shifts in material costs (like clay or specific pigments), and automating warehouse inventory management based on real-time sales velocity and seasonal demand forecasting, resulting in leaner operations and lower carrying costs. This predictive capability allows companies to allocate production capacity effectively, especially for custom or niche tile types that require specialized manufacturing runs, thereby enhancing responsiveness to market fluctuations and mitigating risks associated with overproduction or stockouts, leading to a more resilient and demand-responsive supply chain ecosystem across the globe.

The impact extends significantly into manufacturing quality assurance. AI-driven computer vision systems, integrated into the production line, are capable of inspecting every single tile for minute defects—color irregularities, warping, chip fractures, or size variations—at speeds and accuracies impossible for human inspectors. This rigorous, automated quality control guarantees uniform batch quality, a critical factor for professional installers who demand perfect consistency for seamless installations over large surfaces. Beyond quality, AI models optimize the firing process in kilns, calculating the precise temperature curves and duration required for specific tile compositions to achieve maximum strength and minimal energy consumption, addressing both operational efficiency and sustainability goals. These technological integrations position companies adopting AI early for a competitive advantage by offering higher-quality, more consistent products delivered through a highly optimized, responsive supply chain, fundamentally redefining operational best practices within the Kitchen Backsplash Wall Tile Market and setting new benchmarks for mass customization and production reliability. Furthermore, natural language processing (NLP) applications are increasingly used in customer service to analyze feedback on product defects or installation challenges, feeding crucial data back into the AI manufacturing optimization loop, enabling continuous, data-driven product improvement cycles.

- AI-driven personalized design recommendations based on existing kitchen aesthetics.

- Generative design tools allowing instant virtual prototyping and visualization for consumers.

- Optimized manufacturing processes using machine learning for kiln firing efficiency and energy savings.

- Computer vision systems for automated, high-speed quality control and defect detection.

- Predictive supply chain analytics for managing raw material costs and demand forecasting.

- Enhanced inventory management through real-time sales data integration and algorithmic stocking.

DRO & Impact Forces Of Kitchen Backsplash Wall Tile Market

The Kitchen Backsplash Wall Tile Market dynamics are fundamentally shaped by a confluence of driving forces, inherent restraints, and compelling opportunities that dictate its trajectory over the forecast period. Key drivers include sustained global growth in the housing sector, particularly the high volume of new residential constructions and large-scale urban development projects in emerging economies, which inherently demand tile solutions for wet areas like kitchens. Furthermore, the robust consumer culture surrounding home renovation and interior design, amplified by digital media, fuels replacement demand in mature markets, where homeowners treat the backsplash as a relatively affordable, high-impact aesthetic upgrade. Technological advancements in printing and material science (e.g., large-format tiles, lightweight substrates, and self-adhesive options) enhance the product's aesthetic appeal and ease of installation, thereby broadening the consumer base to include the DIY segment and accelerating adoption rates. The rising focus on kitchen hygiene and the demand for easy-to-clean, non-porous surfaces further cement the necessity of tile solutions over traditional painted walls, contributing significantly to market volume growth and reinforcing the functional superiority of tile materials.

However, the market faces significant restraints that temper its potential expansion. Economic volatility and fluctuations in the housing market, driven by rising interest rates and inflation, directly impact consumer spending on non-essential home improvements and new construction starts, creating periods of subdued demand. The intense competition from alternative backsplash materials, such as solid slab quartz, stainless steel panels, or specialized paint coatings, limits tile market penetration, particularly in high-end or industrial designs. Furthermore, the inherent complexity and time required for professional tile installation, coupled with a persistent shortage of skilled labor in many developed economies, can deter consumers who seek faster, less disruptive renovation processes. Tariffs on imported raw materials (e.g., clay, specialized glazes) and finished goods, influenced by geopolitical tensions, increase production costs, which must be absorbed or passed on to the consumer, potentially slowing adoption rates and narrowing profit margins across the value chain, particularly impacting smaller and medium-sized enterprises. The heavy, bulky nature of ceramic and stone tiles also contributes substantially to logistical costs and carbon footprint, presenting a challenge in an era of increasing environmental scrutiny and demanding streamlined delivery systems.

Despite these challenges, substantial opportunities exist, primarily through strategic material innovation and expansion into underserved consumer segments. The increasing adoption of sustainable and eco-friendly tiling options, utilizing recycled glass or locally sourced, low-impact clay, presents a significant growth avenue, aligning with global green building initiatives and consumer consciousness. Penetration into the rapidly expanding ready-to-assemble (RTA) and modular kitchen market offers manufacturers a scalable channel for pre-packaged, standardized backsplash kits designed for simplified installation. Geographically, untapped potential remains in smaller, secondary urban centers across high-growth regions where renovation activity is just beginning to accelerate. Impact forces, which are the culmination of these drivers and restraints, suggest that while demand remains fundamentally strong due to construction necessity, profitability will increasingly rely on operational efficiencies, effective branding focused on sustainability and design, and successful management of supply chain risks. The ability of market players to rapidly introduce high-quality, installation-friendly products that cater to evolving aesthetic trends, coupled with aggressive utilization of digital visualization technologies for enhanced consumer engagement, will be the decisive factor determining market leadership and sustained profitable growth throughout the forecast period.

Segmentation Analysis

The Kitchen Backsplash Wall Tile Market is meticulously segmented across dimensions including material type, application, end-user, and distribution channel, providing a granular view of market dynamics and consumer behavior. The material segmentation is critical, defining product attributes such as cost, durability, and aesthetic finish, which directly influence purchasing decisions, with porcelain and ceramic dominating volume due to their versatility and affordability. Application segmentation separates residential and commercial usage, acknowledging the differing requirements for hygiene, fire rating, and visual impact, where commercial demands higher performance standards. End-users are primarily categorized into New Construction and Renovation/Replacement, reflecting the cyclical nature of demand in the housing market, with renovation being a more stable, premium-focused driver in mature economies. Analyzing these segments helps stakeholders tailor product development, pricing strategies, and marketing campaigns to maximize market penetration across distinct consumer groups and industry verticals, ensuring that product offerings meet specific functional and aesthetic needs.

- Material Type:

- Ceramic Tiles

- Porcelain Tiles

- Natural Stone Tiles (Marble, Slate, Travertine, Granite)

- Glass Tiles

- Metal Tiles (Stainless Steel, Copper)

- Others (Wood Look, Composite, Peel-and-Stick Vinyl)

- Application:

- Residential Kitchens

- Commercial Kitchens (Hotels, Restaurants, Institutions)

- End-User Type:

- New Construction

- Renovation and Replacement

- Distribution Channel:

- Offline Retail (Specialty Stores, Home Centers, Builder Supply)

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites)

Value Chain Analysis For Kitchen Backsplash Wall Tile Market

The value chain for the Kitchen Backsplash Wall Tile Market begins with raw material extraction and processing, primarily involving mining and refining minerals such as clay, silica, feldspar, and specialized pigments, which constitute the upstream activities. This initial stage is highly capital-intensive and susceptible to global commodity price fluctuations and environmental regulations pertaining to mining and quarrying operations. Efficiency in raw material sourcing directly impacts the final product cost and consistency, requiring strong supplier relationships, particularly for natural stone and specialized, high-purity clays used in porcelain production. Following extraction, the manufacturing phase involves complex processes including mixture preparation, shaping (pressing or extrusion), drying, glazing, and high-temperature firing in kilns. Innovation at this stage focuses heavily on optimizing firing cycles for reduced energy consumption and employing advanced digital printing techniques to achieve intricate, realistic surface patterns, thus maximizing manufacturing efficiency and reducing operational expenses. Strategic manufacturers often integrate vertically backward into raw material processing to stabilize input costs and ensure supply reliability, enhancing control over quality standards from the foundational stage of production, which is crucial for maintaining market competitive advantage through cost leadership and consistent product quality across large production batches.

The midstream section of the value chain is dominated by distribution and logistics. Finished tiles are packaged, stored, and then transported through a multi-tiered distribution channel. Direct distribution involves manufacturers selling directly to large-scale construction companies or specific commercial clients, providing better margin control but requiring significant internal logistics capabilities. Indirect distribution, which represents the majority of the market volume, relies heavily on a network of importers, regional distributors, wholesalers, and specialized tile retailers or home improvement centers. These intermediaries play a crucial role in inventory management, localized marketing, and providing financing options, acting as the necessary link between large-volume manufacturers and disparate end-users, including individual consumers and smaller contractors. The efficiency of this distribution network is paramount, as tiles are heavy, brittle, and subject to high transportation costs and breakage risk; therefore, optimal logistical planning, robust packaging technologies, and sophisticated warehousing systems are essential components for maintaining product integrity and maximizing gross profit margins. The increasing need for speed-to-market is putting pressure on distributors to streamline their fulfillment operations and adopt digital tracking solutions.

Downstream activities center on installation, encompassing general contractors, specialized tile installers, and the growing DIY consumer segment. Installation services are highly localized, skill-dependent, and contribute significantly to the final installed cost of the product. The quality of installation directly impacts the longevity and aesthetic success of the backsplash, creating a strong market preference for highly trained, certified professional installers. The distribution channel is evolving rapidly with the rise of e-commerce, which bypasses some traditional intermediaries, allowing niche and custom tile manufacturers to reach a global audience directly. While large home centers (indirect channel) offer convenience and volume discounts, specialty stores and online platforms excel in offering curated, high-design selections and personalized consultation services, including design visualization tools. The increasing complexity of modern tile installations, especially involving intricate patterns or oversized slabs, emphasizes the continued importance of skilled labor, despite the increasing availability of beginner-friendly installation systems like self-leveling spacers and peel-and-stick options targeting the do-it-yourself segment of the market. Marketing efforts must increasingly focus on providing comprehensive installation support, whether through partnerships with professional networks or robust online tutorials for the self-installer.

Kitchen Backsplash Wall Tile Market Potential Customers

The primary customer base for the Kitchen Backsplash Wall Tile Market is diverse, segmented across institutional, commercial, and vast residential sectors, each possessing distinct purchasing drivers and material requirements. In the residential segment, potential customers are broadly categorized into two groups: homeowners engaging in renovation or remodeling projects (the replacement market) and property developers or builders involved in new construction projects. Renovation customers, often driven by aesthetic improvements and a desire to update outdated kitchens, typically prioritize design, material prestige (e.g., natural stone or artisanal ceramics), and ease of maintenance, viewing the backsplash as a focal point of their home investment. Builders in the new construction sector, conversely, are highly sensitive to cost-efficiency, project timelines, and bulk supply reliability, often selecting durable, mass-produced ceramic or porcelain tiles that offer standardization and favorable pricing for large-volume purchases. The increasing popularity of high-design rental properties and custom luxury homes further differentiates demand, requiring manufacturers to maintain broad product portfolios spanning entry-level functionality to high-end bespoke finishes tailored to specific architectural blueprints and stringent material performance criteria, necessitating sophisticated inventory management and production flexibility to address these divergent demands.

The commercial sector represents another critical cluster of potential customers, including the hospitality industry (hotels, resorts, restaurants), healthcare facilities, and educational institutions, all requiring materials that meet stringent regulatory standards for hygiene and fire resistance. Restaurants and commercial kitchens demand robust, impervious, and easy-to-clean surfaces that can withstand frequent exposure to high heat, grease, and aggressive cleaning agents, making durable porcelain or stainless steel tiles the preferred choices. Hotels and upscale resorts prioritize sophisticated aesthetics and branding, frequently utilizing bespoke designs, glass mosaics, and large-format tiles to create unique, high-impact kitchen and food service areas that align with their luxury positioning. While volume is generally lower than in residential new construction, commercial projects often involve high-value transactions and specific, recurring design requirements, making them strategically important targets for manufacturers specializing in high-performance materials and complex installation specifications. This customer segment is highly procurement-driven, relying on detailed specifications provided by architects and interior designers, underscoring the importance of building strong B2B relationships and ensuring compliance with industry certifications and long-term warranties that guarantee material longevity under intense usage conditions typical of commercial environments.

A rapidly emerging customer segment includes professional interior designers and architects who function as key influencers and specifiers, making purchasing decisions on behalf of end-clients in both residential and commercial projects. Their expertise in material performance, current trends, and compatibility with other finishes positions them as gatekeepers for premium and specialty tile products. Manufacturers must invest heavily in architect and design (A&D) outreach programs, providing detailed product specifications, samples, and Continuing Education Units (CEUs) to ensure their products are included in initial project blueprints. Furthermore, the burgeoning DIY market, particularly influenced by online tutorials and affordable tools, represents consumers seeking user-friendly, lightweight, and installation-simplified products, such as peel-and-stick vinyl or lightweight metal tiles. Catering to the DIY customer requires specialized packaging, clear instructions, and retail placement in accessible home improvement stores, acknowledging their purchasing criteria revolve around installation feasibility and perceived value, rather than professional contractor preference or complex material performance standards. Effective marketing to this group relies heavily on digital content and step-by-step guidance that demystifies the installation process, encouraging greater participation in home improvement projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mohawk Industries Inc., Lamosa Group, RAK Ceramics, Florim Ceramiche S.p.A., Kajaria Ceramics Limited, Interceramic, Porcelanosa Grupo, Crossville Inc., VitrA (Eczacibasi Building Products), Emser Tile LLC, Dal-Tile Corporation, American Olean, Arizona Tile, FAP Ceramiche, Villeroy & Boch AG, Atlas Concorde S.p.A., Marazzi Group (Sassuolo, Italy), Schluter-Systems, Jeffrey Court Inc., Fireclay Tile |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kitchen Backsplash Wall Tile Market Key Technology Landscape

The technological landscape of the Kitchen Backsplash Wall Tile Market is rapidly evolving, driven primarily by digital manufacturing advancements, which are significantly impacting product aesthetics, installation efficiency, and material performance. High-definition digital inkjet printing technology stands as the most transformative innovation, allowing manufacturers to replicate the intricate, random patterns of natural stone, wood, or concrete onto ceramic and porcelain surfaces with unparalleled realism and detail. This technology enables virtually limitless design possibilities, offering customization and large-scale visual variation, reducing the aesthetic drawbacks previously associated with mass-produced tiles. Furthermore, this digital approach minimizes waste by reducing the need for specialized molds and allows for quick design changeovers, enabling manufacturers to rapidly respond to volatile fashion trends. Beyond aesthetics, the development of specialized glazes and surface treatments, including high-resistance, anti-graffiti, and antimicrobial coatings, enhances the functional utility of tiles, making them suitable for hygiene-critical environments and reducing long-term maintenance needs in busy kitchen settings, thereby extending the product lifecycle and justifying a higher initial investment.

Innovation is also highly concentrated on simplifying and accelerating the installation process, targeting the growing DIY market and mitigating the high costs associated with skilled labor. This includes the development of lightweight substrates and mounting systems, such as advanced polymer-backed tiles and interlocking mechanisms, which allow for easier handling and non-traditional installation over existing surfaces without extensive demolition. Self-adhesive or "peel-and-stick" backsplash tile technology, which utilizes highly durable, heat-resistant adhesives applied to vinyl, metal, or thin-cut natural stone composites, significantly lowers the barrier to entry for novice installers, expanding the replacement market potential. Additionally, manufacturers are increasingly adopting sophisticated Computer-Aided Design (CAD) and manufacturing (CAM) systems to ensure precise dimensional calibration of large-format tiles, minimizing warpage and ensuring seamless joint alignments, which is critical for high-quality, professional installations that utilize minimal grout lines to achieve a modern, monolithic appearance. The synergy between digital design and precision manufacturing ensures that product specifications are consistently met, regardless of batch size or complexity, supporting global supply chains.

In terms of sustainability and material science, advancements in recycled content utilization, particularly recycled glass, are becoming a key technological differentiator, positioning companies favorably in markets with strong green building codes. Porcelain manufacturing, specifically, benefits from advancements in large-scale pressing technology (e.g., Continua+ systems) that allow for the economical production of extremely large, thin porcelain slabs (up to 5x10 feet), which are increasingly used as monolithic backsplashes to reduce grout lines, offering superior hygiene and a high-end look that mimics luxury stone slabs. These technical porcelain slabs require specialized cutting and handling equipment, representing a technological advancement not just in manufacturing but also in the installation tool ecosystem. The integration of 3D printing for creating custom, complex surface textures and molds, although currently niche, holds future potential for bespoke, high-value backsplash installations, demonstrating a continuous trajectory towards manufacturing flexibility and hyper-customization powered by advanced digital fabrication techniques. Further research into low-energy firing processes and water recycling during production minimizes environmental impact, meeting the evolving stringent environmental performance expectations of both regulatory bodies and end consumers across developed markets.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, driven by unprecedented residential building booms and rapid urbanization in China, India, and Southeast Asian nations. High population density and rising disposable incomes ensure massive demand for cost-effective ceramic and high-performance porcelain tiles in new apartment complexes. Market growth is sustained by large-scale government housing initiatives and the rapid migration of populations to metropolitan areas requiring standardized, durable, and easily sourced building materials, positioning APAC as the volume leader.

- North America: Characterized by high value and strong demand in the renovation segment. Consumers prioritize design aesthetics, specialty materials (glass, metal, high-end stone), and easy installation systems. Strict building codes and preference for larger, open-plan kitchens sustain demand for premium, custom-designed backsplashes. The market is highly influenced by fluctuating lumber and labor costs, pushing consumers towards durable, long-term interior surface investments.

- Europe: A mature market focused on quality, sustainability, and traditional design excellence, particularly in Italy and Spain, which are global manufacturing hubs for high-end ceramic and porcelain tiles. Demand is steady, primarily driven by replacement and refurbishment activities, with a strong emphasis on eco-labeling and energy-efficient production. Design preferences lean towards sophisticated, minimalist aesthetics and large-format tiles with minimal grout lines for a seamless look.

- Latin America (LATAM): Growth is sporadic but accelerating, tied closely to economic stability. Brazil and Mexico are key markets, showing increasing adoption of modern, functional backsplash tiles, moving away from simple painted surfaces as housing standards improve and global design trends penetrate the market. Infrastructure investments and the expansion of organized retail are slowly professionalizing the regional distribution channels.

- Middle East and Africa (MEA): Growth is linked to infrastructure investment and hospitality expansion (e.g., UAE, Saudi Arabia). High preference for luxurious, large-format polished tiles, including marble and marble-look porcelain, reflecting regional architectural aesthetics and emphasis on opulence. Government diversification projects away from oil dependence are fueling massive construction projects demanding premium interior finishes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kitchen Backsplash Wall Tile Market.- Mohawk Industries Inc.

- Lamosa Group

- RAK Ceramics

- Florim Ceramiche S.p.A.

- Kajaria Ceramics Limited

- Interceramic

- Porcelanosa Grupo

- Crossville Inc.

- VitrA (Eczacibasi Building Products)

- Emser Tile LLC

- Dal-Tile Corporation

- American Olean

- Arizona Tile

- FAP Ceramiche

- Villeroy & Boch AG

- Atlas Concorde S.p.A.

- Marazzi Group (Sassuolo, Italy)

- Schluter-Systems

- Jeffrey Court Inc.

- Fireclay Tile

Frequently Asked Questions

Analyze common user questions about the Kitchen Backsplash Wall Tile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Kitchen Backsplash Wall Tile Market?

The Kitchen Backsplash Wall Tile Market is projected to experience a robust CAGR of 5.8% between 2026 and 2033, driven by increasing residential renovation cycles and high-volume new construction in the Asia Pacific region. This growth reflects sustained consumer investment in kitchen aesthetics and functionality.

Which tile material currently holds the largest share in the backsplash market?

Ceramic and porcelain tiles collectively hold the largest market share due to their superior cost-to-performance ratio, exceptional durability, low porosity, and versatility in replicating high-end natural looks through advanced digital printing technologies. They are the standard for both residential and commercial applications.

How is the adoption of sustainable materials influencing the backsplash tile industry?

Sustainability is a significant growth opportunity, with increasing demand for eco-friendly options such as recycled glass tiles and ceramics made using low-impact production methods. Manufacturers are focusing on reducing embodied energy and utilizing locally sourced materials to appeal to environmentally conscious builders and consumers.

What is the primary factor driving the high growth of the Asia Pacific (APAC) Kitchen Backsplash Wall Tile Market?

The primary driver in APAC is rapid, large-scale urbanization and massive investment in residential infrastructure, leading to millions of new housing units requiring affordable, durable backsplash solutions. Rising middle-class incomes also contribute to increased spending on interior aesthetics.

What technological advancements are simplifying backsplash tile installation for the DIY segment?

Key technological advancements include the proliferation of lightweight, self-adhesive (peel-and-stick) tile formats and interlocking systems. These innovations significantly reduce the skill level and time required for installation, lowering overall project costs and expanding accessibility for non-professional homeowners.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager