Kitchen exhaust cleaning services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442188 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Kitchen exhaust cleaning services Market Size

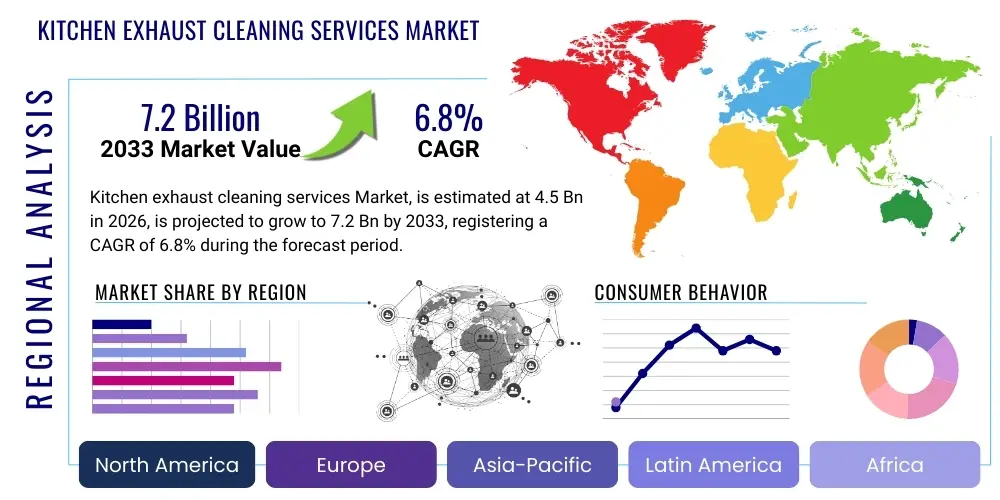

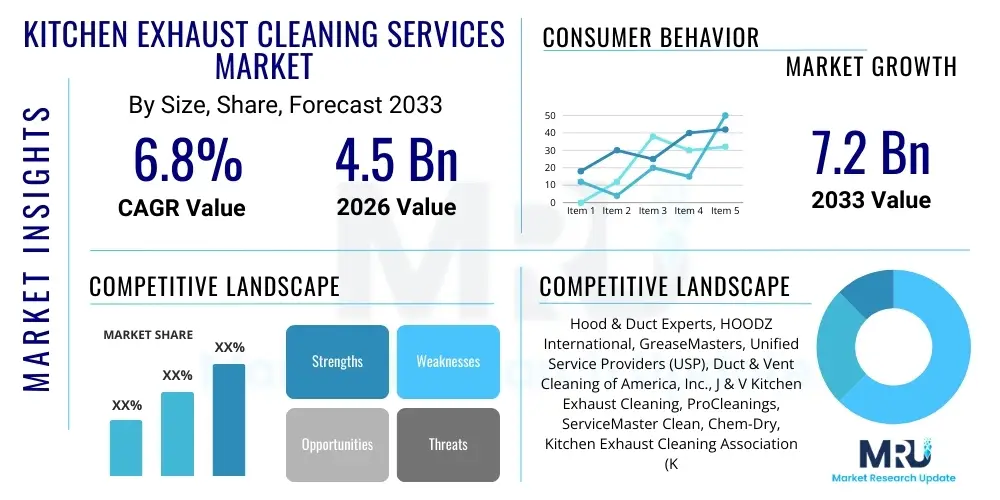

The Kitchen exhaust cleaning services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by increasingly stringent fire safety regulations mandated globally, particularly the enforcement of standards like NFPA 96 in North America and similar national safety codes across Europe and Asia Pacific. Commercial kitchens, spanning quick-service restaurants, fine dining establishments, hotels, and institutional cafeterias, are recognizing kitchen exhaust cleaning not merely as a maintenance chore but as a critical risk mitigation strategy essential for insurance compliance and operational continuity.

Market expansion is further bolstered by the rapid resurgence and expansion of the global foodservice industry following pandemic-related disruptions. As commercial cooking operations intensify, the accumulation of grease, oil, and flammable contaminants within ventilation systems accelerates, necessitating professional cleaning services at mandated frequencies. Furthermore, rising awareness among facility managers regarding the severe consequences of non-compliance—including hefty fines, insurance claim nullification, and catastrophic fire risks—is transitioning cleaning services from a discretionary expense to a non-negotiable operational necessity, cementing the market's robust long-term demand curve.

Kitchen exhaust cleaning services Market introduction

The Kitchen Exhaust Cleaning Services Market encompasses the professional maintenance and cleaning of commercial kitchen ventilation systems, specifically focusing on exhaust hoods, ducts, fans, and associated components. This specialized service is crucial for removing flammable grease, particulate matter, and residue that accumulates during cooking processes. The primary application spans the entire spectrum of the foodservice and hospitality industries, including standalone restaurants, hotel kitchens, institutional cooking facilities (hospitals, schools, government buildings), and corporate cafeterias. The core benefit derived from these services is enhanced fire prevention, as accumulated grease is a leading cause of commercial kitchen fires.

The industry standard, globally recognized through directives such as the NFPA 96 Standard for Ventilation Control and Fire Protection of Commercial Cooking Operations, dictates the required frequency and depth of cleaning. Driving factors for market adoption include mandatory regulatory compliance, stipulations from insurance providers requiring proof of cleaning certification, and the operational benefit of improved airflow and system efficiency, which reduces energy consumption and prolongs the lifespan of expensive ventilation equipment. Effective cleaning ensures the hygienic integrity of the kitchen environment and mitigates potential health risks associated with poor indoor air quality, contributing significantly to overall facility management performance.

Key services offered within this market segment include detailed inspection, scraping and degreasing of internal ductwork, cleaning of exhaust fan assemblies, filter replacement, and the issuance of post-service certification stickers demonstrating compliance. The technical complexity of navigating extensive ductwork and handling hazardous chemical cleaners necessitates specialized training and equipment, distinguishing professional services from standard janitorial functions. This specialization, combined with legal imperatives for fire safety, provides a resilient demand foundation for market participants, driving consistent contract renewals and expansion across various end-user segments.

Kitchen exhaust cleaning services Market Executive Summary

The Kitchen Exhaust Cleaning Services Market is currently characterized by significant business trends focusing on regulatory compliance enforcement and technological integration. Geographically, North America and Europe dominate the market due to established, mature regulatory frameworks (NFPA 96 in the U.S. and equivalent standards in Europe) that mandate rigorous cleaning schedules and documentation. Emerging markets in the Asia Pacific are experiencing accelerated growth, fueled by rapid urbanization, substantial investment in commercial infrastructure, and the subsequent modernization and formalization of fire safety standards within their expanding foodservice sectors. Competitive dynamics are segmented, featuring large national service providers alongside numerous localized, highly specialized firms.

Segment trends reveal that the deep cleaning segment, which involves comprehensive access and chemical application to all internal parts of the duct system, generates the highest revenue due to its complexity and necessity for regulatory certification. Furthermore, the institutional segment (hospitals, schools) shows promising stability and growth, often requiring customized, high-frequency contracts due to stricter internal health and safety protocols compared to independent restaurants. The market is also witnessing a strong trend toward consolidated service offerings, where cleaning providers integrate ancillary services such as fire suppression system inspection and filter management, offering holistic facility maintenance solutions to enhance customer value and recurring revenue streams.

Technological advancement is playing a pivotal role in optimizing service delivery, notably through the adoption of digital reporting systems and specialized robotic tools for difficult-to-access duct sections. These innovations improve cleaning consistency, enhance documentation accuracy, and increase operational efficiency, thereby addressing persistent industry challenges such as labor intensity and verification difficulties. The confluence of strict compliance requirements, the robust growth of the global foodservice sector, and incremental technological adoption provides a favorable environment for sustained market expansion throughout the forecast period, positioning the industry as essential for commercial safety infrastructure.

AI Impact Analysis on Kitchen exhaust cleaning services Market

Common user questions regarding AI’s impact on kitchen exhaust cleaning services center on how artificial intelligence can enhance compliance documentation, predict cleaning schedules, and potentially automate the highly physical cleaning process. Users frequently express concern about how AI can ensure standardized cleaning quality across different technicians and locations, asking if predictive modeling can move the industry beyond static, calendar-based schedules to dynamic, usage-based requirements. Furthermore, interest lies in how computer vision and machine learning can be employed during post-cleaning inspections to automatically verify grease removal thickness according to regulatory standards (NFPA 96 minimum requirement), reducing subjective human error and liability risks for facility owners and service providers alike. The core expectation is that AI will primarily drive optimization, predictive maintenance, and enhanced reporting integrity, rather than immediate, full automation of the physical cleaning labor.

The integration of AI systems, particularly machine learning algorithms trained on operational data, offers a transformative pathway for service providers. By analyzing variables such as cooking volume, type of cuisine (e.g., high-grease frying vs. low-grease baking), operating hours, and historical inspection data, AI can generate highly accurate predictive maintenance schedules. This capability allows service providers to offer value-added, dynamic cleaning contracts, ensuring compliance is maintained precisely when needed, optimizing resource deployment, and reducing unnecessary service interruptions for the client. This shift from reactive or calendar-based scheduling to proactive, condition-based servicing represents a significant technological leap in efficiency and compliance assurance, directly addressing liability concerns.

Furthermore, AI-powered image analysis tools and specialized sensor data interpretation are revolutionizing post-cleaning inspection and reporting. Drones or specialized cameras equipped with computer vision can navigate exhaust ducts, capturing high-resolution imagery. AI algorithms then process this data instantly to measure residual grease depth, identify structural defects, and generate detailed, immutable compliance reports. This automation minimizes disputes, enhances transparency, and provides irrefutable evidence for insurance and regulatory audits. While AI currently assists primarily in diagnostics, scheduling, and documentation, its impact on operational intelligence is profound, professionalizing the service delivery and increasing overall market credibility.

- Enhanced Predictive Scheduling: AI algorithms analyze cooking data and usage patterns to determine optimal, dynamic cleaning frequency, moving beyond static monthly or quarterly schedules.

- Automated Compliance Documentation: Machine learning verifies cleanliness standards (e.g., grease thickness measurement) via camera feeds, generating precise, non-refutable digital audit trails.

- Robotic Path Optimization: AI guides semi-autonomous robots or specialized cleaning tools within complex duct systems, ensuring thorough coverage in hard-to-reach areas.

- Labor Efficiency Improvement: AI-driven route and resource allocation reduces technician travel time and optimizes crew sizing for specific job scopes.

- Risk Scoring and Prioritization: Facilities can be scored based on fire risk using AI models, allowing service providers and regulators to prioritize inspections and deep cleaning efforts.

DRO & Impact Forces Of Kitchen exhaust cleaning services Market

The market is defined by strong regulatory Drivers and significant operational Restraints, balanced by clear Opportunities stemming from modernization and market expansion. The primary driving force remains stringent governmental and insurance mandates concerning fire safety in commercial cooking environments. The impact force of regulatory compliance is exceptionally high, as non-adherence leads directly to operational shutdown, insurance cancellation, or severe legal penalties, establishing a constant, non-cyclical demand base. This regulatory environment acts as a protective barrier for professional service providers against non-specialized competition.

However, the industry faces substantial Restraints, most notably the high labor intensity and corresponding shortage of skilled technicians trained in specialized degreasing techniques and confined space entry protocols. Furthermore, operational costs, particularly for specialized chemical disposal and high-powered cleaning equipment, can be prohibitive for smaller firms. Opportunity lies in technological innovation, specifically the deployment of IoT sensors within exhaust systems to monitor grease accumulation in real-time, allowing for optimized, data-driven service calls. Additionally, market penetration into historically underserved institutional sectors (e.g., large-scale corporate campuses, military bases) presents avenues for substantial, stable contract growth, mitigating volatility associated with the standard restaurant cycle.

The combined impact forces dictate that profitability relies heavily on efficiency and compliance expertise. While regulatory mandates ensure demand, the need to scale operations efficiently while maintaining high standards drives the adoption of technologies that reduce dependency on manual labor. Service providers capable of integrating advanced digital reporting and predictive maintenance models will capture greater market share by offering superior compliance assurance and cost-efficiency to large-scale, multi-location clients, effectively transforming market competition from a price-based model to a value-based, risk-mitigation partnership.

Segmentation Analysis

The Kitchen Exhaust Cleaning Services Market is comprehensively segmented based on service type, application, and geography, reflecting the diverse operational needs and regulatory landscapes across different end-user verticals. Segmentation by service type is critical as it defines the depth and scope of the cleaning intervention, ranging from standard hood degreasing to complex internal ductwork cleaning. This segmentation directly impacts pricing models and required specialized equipment. The application segmentation, conversely, highlights the dominant end-users, where commercial restaurants represent the largest consumer segment but institutional facilities offer the highest stability and contract volume due to continuous, year-round operation and stricter internal health codes.

Deep cleaning services are typically performed bi-annually or quarterly, depending on the volume and type of cooking, and involve complete access to the entire exhaust system, often requiring roof access for fan removal and specialized chemical application. Inspection services, frequently mandated monthly or more often, focus on visual checks and measurement of grease accumulation without full system cleaning, serving as a precursor to scheduling full deep cleans. The market's structural integrity is maintained by the mandatory nature of these different service requirements, ensuring a baseline demand across all segments. Service providers often tailor their packages to align with specific regional regulatory mandates, creating bespoke offerings for complex clients like casino resorts or cruise lines which operate extensive, high-volume kitchen infrastructure.

The growth dynamics within each segment are influenced by macroeconomic factors. For instance, the expansion of global hotel chains drives the market for high-standard, consistent service contracts, while the growth of fast-casual and quick-service restaurant (QSR) chains generates high-frequency, standardized service demands. Understanding these segments is vital for strategic market entry and resource allocation, allowing service providers to focus on either volume (QSRs) or margin (institutional and high-end hospitality), depending on their operational capabilities and geographic footprint. The shift toward specialized coatings and filter maintenance also begins to create new micro-segments focused on preventive maintenance rather than just reactive cleaning.

- By Service Type:

- Deep Cleaning (Hood, Duct, Fan)

- Inspection and Certification

- Filter Exchange and Maintenance

- Access Panel Installation and Maintenance

- By Application:

- Restaurants (QSR, Fine Dining, Casual Dining)

- Hotels and Hospitality

- Institutional Facilities (Hospitals, Schools, Universities)

- Industrial and Corporate Cafeterias

- Government and Military Facilities

- By Frequency:

- Monthly

- Quarterly

- Semi-Annually

- Annually (Low-Volume Operations)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Kitchen exhaust cleaning services Market

The value chain for the Kitchen Exhaust Cleaning Services Market commences with the Upstream suppliers who provide essential inputs, primarily specialized cleaning chemicals, solvents, degreasers, and safety equipment. This upstream segment is characterized by reliance on certified chemical manufacturers who must comply with stringent environmental and workplace safety regulations regarding hazardous materials. Also included upstream are manufacturers of specialized cleaning equipment, such as high-pressure washing systems, negative air machines, and proprietary mechanical scraping tools. Supplier negotiation power is moderate, as providers often seek specialized, high-performance, and environmentally conscious products, although generic commodity chemicals remain available for some applications.

The Midstream segment is occupied by the core service providers—the cleaning companies themselves—who organize, schedule, execute, and certify the cleaning operations. These firms invest heavily in labor training, specialized equipment, liability insurance, and acquiring necessary regulatory certifications (e.g., adherence to NFPA standards). The distribution channel in this market is predominantly direct, operating through business-to-business (B2B) contractual agreements with end-user facility managers or corporate purchasing departments. The efficacy of the midstream operation is highly dependent on logistics, scheduling optimization, and the efficiency of the field teams, as services must often be performed during off-peak hours (late nights or early mornings) to minimize client disruption.

The Downstream segment comprises the various End-Users who consume the service (restaurants, hotels, institutions). Their influence is high, as they dictate cleaning frequency based on operational volume and regulatory mandates, and their satisfaction drives long-term contract retention. Additionally, regulatory bodies and insurance companies act as significant indirect stakeholders in the value chain, as they validate and enforce the requirement for the service. The service provider's ultimate value proposition is risk mitigation and compliance documentation, making robust reporting systems and impeccable service records crucial competitive differentiators in securing and maintaining lucrative long-term contracts across the market.

Kitchen exhaust cleaning services Market Potential Customers

The primary End-Users and buyers in the Kitchen Exhaust Cleaning Services Market are operators of any commercial facility that involves cooking activities generating grease-laden vapors. This expansive customer base is dominated by the foodservice sector, encompassing everything from single-unit independent eateries to massive multinational quick-service restaurant chains. These customers are driven by the legal requirement to maintain fire safety standards and the necessity of preserving favorable insurance terms. High-volume cooking operations, such as those found in 24-hour diners or corporate headquarters cafeterias, are highly valuable clients due to the mandatory high frequency of cleaning needed to prevent excessive grease build-up, often requiring monthly contracts.

Beyond the standard restaurant vertical, significant potential customers exist within the institutional and hospitality sectors. Hotels and resorts, for instance, often operate multiple kitchens (banquet halls, internal restaurants, employee dining) under one corporate umbrella, requiring standardized, reliable service across complex infrastructure. Similarly, educational facilities (schools, universities) and healthcare facilities (hospitals) represent extremely stable customers; while their profit margins may be lower than commercial restaurants, their mandatory cleaning cycles and large campus footprints guarantee substantial contract volume and high retention rates, often prioritizing service reliability and strict adherence to internal health codes over minor cost reductions.

A growing segment of potential customers includes large-scale industrial food processing plants and specialized facilities like offshore platforms or military bases where unique safety and logistical challenges necessitate highly specialized cleaning crews and advanced scheduling protocols. These customers prioritize vendors with impeccable safety records and capacity for rigorous documentation. Targeting these diverse segments requires a multifaceted sales strategy, ranging from centralized account management for multi-location national chains to localized, relationship-driven sales for independent, small-to-medium enterprises (SMEs), ensuring market penetration across all operational scales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hood & Duct Experts, HOODZ International, GreaseMasters, Unified Service Providers (USP), Duct & Vent Cleaning of America, Inc., J & V Kitchen Exhaust Cleaning, ProCleanings, ServiceMaster Clean, Chem-Dry, Kitchen Exhaust Cleaning Association (KECA) members, National Hood Cleaning Service, Enviro-Clean Services, FilterShine, Power Wash Industries, Restaurant Technologies, Inc., Commercial Kitchen Cleaners, KEC, Hood Cleaners of America, Industrial Cleaning Solutions, Safe Kitchens. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kitchen exhaust cleaning services Market Key Technology Landscape

The technological landscape within the kitchen exhaust cleaning market is rapidly evolving, moving beyond traditional manual scraping and chemical application towards automation and enhanced verification methods. A central technology includes specialized, powerful negative air units coupled with high-efficiency particulate air (HEPA) filtration systems, which are essential for containing contaminated air and ensuring environmental compliance during the cleaning process. These specialized air handlers create negative pressure, preventing the spread of grease aerosols and hazardous residues into the kitchen area. Concurrently, the use of advanced, biodegradable, and non-caustic chemical degreasers represents a significant shift, addressing growing environmental and occupational safety concerns compared to older, harsh solvent-based cleaners.

Digitalization and data capture are equally critical technological trends. Service providers are increasingly utilizing robust mobile applications and cloud-based platforms for real-time reporting, photographic documentation, and compliance certification issuance. These platforms are often integrated with customer relationship management (CRM) systems and accounting software, streamlining the entire service lifecycle from scheduling to invoicing and regulatory audit preparation. This digital approach ensures immutability of records—a crucial factor for insurance claims and regulatory inspections—and significantly professionalizes the industry standard of verification.

Furthermore, the market is beginning to adopt sophisticated inspection technology, including small, agile duct-crawling robots and inspection drones equipped with high-definition thermal and standard cameras. These tools are used to thoroughly inspect the internal condition of ductwork before and after cleaning, especially in areas inaccessible to human technicians (e.g., long horizontal runs or vertical risers). The integration of remote video verification not only guarantees cleaning thoroughness but also reduces the physical risk and time associated with technician entry into confined spaces, thereby improving operational safety and efficiency across large-scale cleaning projects. Future advancements are expected in automated scraping mechanisms and specialized coating applications designed to slow down grease accumulation.

Regional Highlights

- North America: This region maintains market leadership, primarily driven by the universal adoption and strict enforcement of the NFPA 96 standard. The U.S. and Canada benefit from a mature foodservice market and sophisticated insurance industry mandates that demand certified cleaning, creating consistent, high-frequency demand. Technological adoption, especially in digital compliance reporting and scheduling software, is highest here.

- Europe: Characterized by fragmented, country-specific regulations (e.g., UK’s TR19), requiring localized expertise and certification. Market growth is stable, underpinned by strong regulatory bodies and high standards in the hotel and institutional sectors. Environmental regulations regarding chemical disposal and water usage are particularly stringent, driving demand for eco-friendly cleaning solutions.

- Asia Pacific (APAC): Exhibits the highest growth rate due to rapid expansion of organized foodservice and hospitality infrastructure, particularly in countries like China, India, and Southeast Asian nations. As local fire and building codes are formalized and enforced, the transition from informal internal cleaning to professional, certified services accelerates, offering vast opportunities for international service providers.

- Latin America (LATAM): Growth is concentrated in urban centers and major tourism hubs (e.g., Mexico City, São Paulo). The market is developing, with increased foreign investment driving adoption of international standards like NFPA 96, especially within multinational hotel and restaurant chains, gradually formalizing local market practices.

- Middle East and Africa (MEA): This region, particularly the GCC countries, shows robust demand linked to massive infrastructure projects, luxury hospitality development, and high-volume commercial catering services. Stringent fire safety requirements associated with large-scale oil and gas camps and major international airports propel the need for highly reliable, specialized cleaning services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kitchen exhaust cleaning services Market.- HOODZ International

- Duct & Vent Cleaning of America, Inc.

- GreaseMasters

- Unified Service Providers (USP)

- Hood & Duct Experts

- ServiceMaster Clean

- Chem-Dry

- J & V Kitchen Exhaust Cleaning

- ProCleanings

- Restaurant Technologies, Inc. (Focusing on oil and filter management integration)

- FilterShine (Specialized in filter exchange)

- National Hood Cleaning Service

- Enviro-Clean Services

- Power Wash Industries

- Commercial Kitchen Cleaners

- KEC (Kitchen Exhaust Cleaning)

- Hood Cleaners of America

- Industrial Cleaning Solutions

- Fire Protection Services (Diversified offerings)

- Accuvent Cleaning Systems

Frequently Asked Questions

Analyze common user questions about the Kitchen exhaust cleaning services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is NFPA 96, and how does it influence kitchen exhaust cleaning frequency?

NFPA 96 is the U.S. standard for Ventilation Control and Fire Protection of Commercial Cooking Operations. It mandates cleaning frequency based on cooking volume: systems in high-volume, 24-hour operations require monthly cleaning, moderate-volume kitchens require quarterly cleaning, and low-volume operations require semi-annual or annual cleaning to maintain fire safety compliance and insurance validity.

How is the cleanliness of a kitchen exhaust system officially verified and certified?

Verification is typically achieved through pre- and post-cleaning inspections, often involving specialized tools to measure residual grease depth, primarily focusing on ductwork accessibility and completeness of grease removal. Upon satisfactory completion, certified providers issue a formal Certificate of Performance or compliance sticker, which facility owners must retain for regulatory audits and insurance documentation.

What impact does non-compliance with cleaning standards have on commercial kitchens?

Non-compliance carries severe consequences, including heightened fire risk leading to property damage and loss of life; potential voiding of commercial property insurance policies in the event of a fire; imposition of substantial fines or operational shutdowns by local fire marshals; and compromised airflow efficiency and hygiene within the cooking environment.

Are robotic systems used for kitchen exhaust cleaning, or is it primarily a manual service?

While the actual deep cleaning (grease removal) remains predominantly a skilled manual service, robotic systems and inspection drones are increasingly used for pre-cleaning diagnostics and post-cleaning verification, especially in long or difficult-to-access duct sections. AI and robotics enhance quality control and documentation integrity, but do not fully replace human technicians.

What are the key differentiating factors when selecting a professional kitchen exhaust cleaning service provider?

Key factors include the provider's adherence to relevant national and local fire safety codes (e.g., NFPA 96 certification), comprehensive insurance coverage, the quality and detail of digital compliance reporting offered, demonstrated expertise in handling all system components (hood, duct, fan), and the capacity to service the location during required off-hours without disrupting operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager