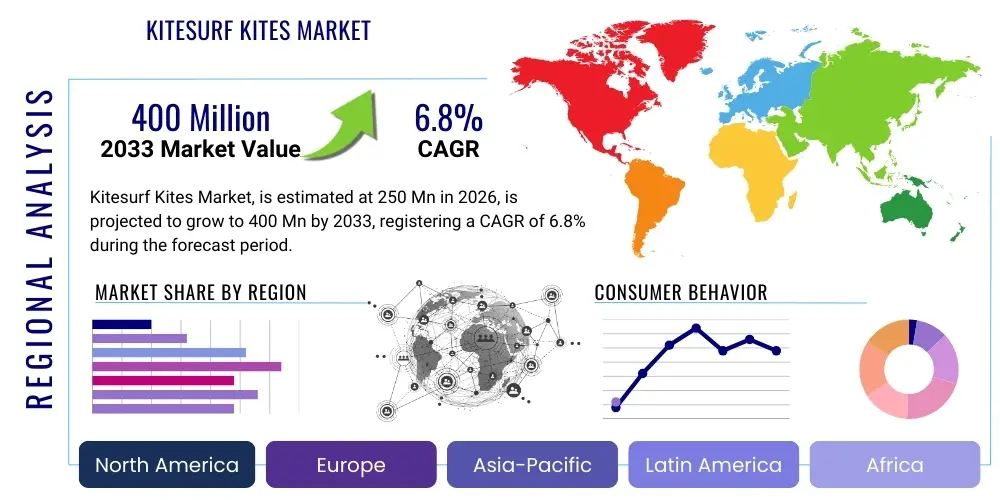

Kitesurf Kites Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443399 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Kitesurf Kites Market Size

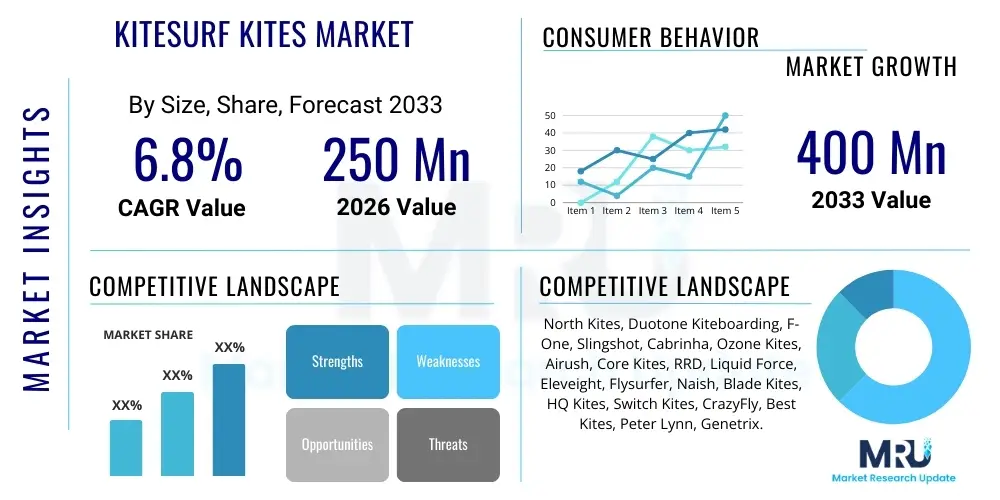

The Kitesurf Kites Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $250 Million USD in 2026 and is projected to reach $400 Million USD by the end of the forecast period in 2033.

Kitesurf Kites Market introduction

The Kitesurf Kites Market encompasses the global trade and manufacturing of high-performance inflatable wings designed to harness wind power, enabling the rider to glide across water, sand, or snow. These specialized textiles and structural components, often constructed from durable ripstop nylon or polyester canopy materials and rigid inflatable bladders (leading edge and struts), are essential components of the kitesurfing, kiteboarding, or snowkiting disciplines. Market growth is fundamentally driven by the increasing global participation in extreme water sports, the rise of specialized kitesurfing tourism, and continuous technological advancements in kite design that enhance safety, performance, and accessibility for novice users.

Products within this market range from beginner-friendly delta kites, which offer stability and easy relaunch, to advanced C-kites and hybrid models tailored for freestyle tricks and high-speed racing. Major applications include recreational kitesurfing in coastal areas, competitive sports events (such as the Olympic inclusion of Formula Kite), and specialized activities like hydrofoiling. The core benefits derived from modern kitesurf kites include superior lift-to-drag ratios, improved depower mechanisms for enhanced safety in high winds, and lightweight construction allowing for compact storage and transportation, catering directly to the needs of the adventurous consumer demographic.

Key driving factors supporting sustained market expansion involve the decreasing cost of manufacturing lightweight, durable materials, extensive marketing efforts by major sports equipment brands, and the proliferation of kitesurfing schools and rental centers worldwide. Additionally, evolving standards in kite safety, including single-line flagging systems and quick-release mechanisms, reduce the perceived barriers to entry for new participants, fueling broader adoption across diverse geographical locations, particularly in areas with consistent strong winds and suitable shorelines, thereby stabilizing demand throughout the forecast period.

Kitesurf Kites Market Executive Summary

The Kitesurf Kites Market is poised for substantial expansion, characterized by robust business trends focusing on material innovation and smart design integration. Manufacturers are increasingly prioritizing eco-friendly materials and sustainable production methods to appeal to environmentally conscious consumers, simultaneously investing in research and development to optimize aerodynamic efficiency and material durability. Key business trends include the shift toward specialized hydrofoil kites (which are smaller and more efficient) and the integration of digital tracking technologies within kites and control bars, enhancing user experience and performance data analysis. Strategic mergers, acquisitions, and partnerships between equipment producers and kitesurfing event organizers are also prevalent, aimed at strengthening brand visibility and expanding distribution networks globally.

Regional trends indicate significant market dominance by Europe and North America, owing to established coastal sports cultures, high disposable incomes, and sophisticated infrastructure supporting leisure activities. However, the Asia Pacific region, particularly countries like Vietnam, Thailand, and Australia, is rapidly emerging as a high-growth area due to increasing tourism, rising middle-class interest in extreme sports, and favorable wind conditions. Latin America, specifically Brazil, continues to be a crucial market for professional athletes and training facilities. Segment trends highlight the dominance of the inflatable kite segment (LEI) due to its versatility and safety features, although the foil kite segment is experiencing the fastest growth, driven by the popularity of hydrofoiling racing which demands different aerodynamic characteristics.

The market faces challenges related to seasonality and dependency on specific weather conditions, necessitating diversification into adjacent products like snowkiting gear. The overall competitive landscape is highly fragmented, featuring a mix of global industry giants and niche, high-performance boutique manufacturers. Success in this environment relies on rapid product cycle innovation, effective supply chain management capable of dealing with specialized material procurement, and targeted digital marketing campaigns leveraging high-quality extreme sports content to engage the core consumer base. Overall, the market remains healthy, fueled by persistent consumer demand for high-adrenaline, outdoor recreational experiences, ensuring stable value progression through 2033.

AI Impact Analysis on Kitesurf Kites Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Kitesurf Kites Market reveals key themes centered around optimization, training, and personalized equipment. Users frequently inquire about how AI can refine kite aerodynamics, predict optimal weather windows for riding, and personalize kite and board recommendations based on skill level, weight, and local wind conditions. There is considerable expectation regarding AI-driven design software that minimizes material waste and simulates performance under varied stress conditions before physical prototyping. Additionally, consumers express interest in AI integration within control systems and harnesses to provide real-time feedback and enhanced safety warnings, moving beyond simple sensor data toward actionable, predictive insights for recreational and professional riders.

- AI-Enhanced Aerodynamic Design: Utilizing generative design algorithms to optimize kite profiles (e.g., aspect ratio, leading edge diameter) for specific performance characteristics (drift, speed, lift).

- Predictive Maintenance and Material Stress Analysis: AI models analyzing stress patterns from integrated sensors to predict potential failure points in canopy or bridle lines, improving product lifespan and safety.

- Personalized Equipment Recommendations: Leveraging machine learning to match riders' skill data, physical metrics, and preferred riding styles with optimal kite models and sizes.

- Optimized Manufacturing Processes: Implementing AI-driven robotics and vision systems for precision cutting and stitching of high-tolerance fabric components, reducing waste and ensuring consistency.

- Smart Training and Coaching Platforms: AI processing video and sensor data to provide instant, objective feedback on technique, identifying flaws in kite handling, stance, and jump execution.

- Real-Time Environmental Forecasting: Integrating localized AI weather models with GPS-enabled gear to provide hyper-accurate wind and turbulence alerts, enhancing rider safety.

DRO & Impact Forces Of Kitesurf Kites Market

The market dynamics are defined by a complex interplay of Drivers, Restraints, and Opportunities (DRO), amplified by critical Impact Forces originating from technological, economic, and socio-cultural factors. Key drivers, such as the increasing commercialization of kitesurfing tourism and the inclusion of kiteboarding in major international sporting events, significantly boost demand for high-quality, competition-grade equipment. Conversely, the market is restrained by its inherent dependence on specific climatic conditions and the relatively steep learning curve and initial cost associated with acquiring professional-grade gear, which limits mass adoption compared to more accessible water sports.

Opportunities for growth are primarily centered on product diversification, including developing highly specialized hydrofoil kites and expanding into emerging geographical markets where coastal development is accelerating. Furthermore, advancements in materials science, particularly in developing lighter, stronger, and more resilient fabrics and bladder materials, offer avenues for manufacturers to differentiate their offerings based on durability and enhanced performance features. The ability to effectively market these technological advantages to both novice and expert riders will determine successful market penetration.

Impact forces significantly shape the trajectory of the market. Technological forces mandate continuous innovation in safety systems (e.g., quick-release mechanisms, automatic relaunch features) and performance efficiency (e.g., reduced weight, optimized shape). Economic forces, including global disposable income trends and exchange rate fluctuations, affect both manufacturing costs and consumer purchasing power, particularly for high-value imported equipment. Social forces, driven by increasing awareness of outdoor and extreme sports through digital media and influencer culture, promote greater participation, while environmental forces exert pressure on manufacturers to adopt sustainable materials and reduce their carbon footprint, necessitating adjustments in supply chain and product design practices across the industry.

Segmentation Analysis

The Kitesurf Kites Market is comprehensively segmented based on various technical and commercial factors, including Kite Type, Application, and Distribution Channel. This structural breakdown is crucial for manufacturers to target specific consumer needs and allocate resources efficiently. The segmentation by Kite Type distinguishes between leading edge inflatable (LEI) kites, which are the industry standard for general use and safety, and foil kites, which are increasingly adopted for high-performance racing, hydrofoiling, and snowkiting due to their unparalleled upwind ability and efficiency. Application segmentation focuses on the end-use environment, ranging from recreational use by casual enthusiasts to professional use in competitive events and specialized instruction programs, each requiring distinct kite characteristics and durability specifications.

The segmentation by Distribution Channel differentiates between sales made through specialized sports retailers, which offer expert advice and fitting services, and the rapidly growing e-commerce channel, which provides greater convenience and price competitiveness. Understanding the nuances within these segments allows companies to tailor their product offerings, pricing strategies, and marketing communication. For instance, the recreational segment demands robust safety features and ease of use (often supplied via LEI kites), while the professional segment prioritizes advanced materials, minimal weight, and maximum power generation (often supplied by C-kites or highly refined foil kites), reflecting significant differences in consumer expectations and willingness to pay.

The trend within segmentation is toward specialization, driven by the fragmentation of kitesurfing disciplines. The rise of specialized hydrofoiling has accelerated demand for smaller, highly efficient high-aspect ratio kites that operate effectively in lighter wind conditions. Furthermore, the market is increasingly segmented geographically, recognizing distinct differences in prevailing wind strength and temperature, which influences material choices and bladder durability requirements, confirming that a one-size-fits-all approach is becoming obsolete in this specialized equipment sector.

- By Kite Type:

- Leading Edge Inflatable (LEI) Kites (Bow Kites, Delta Kites, Hybrid Kites, C-Kites)

- Foil Kites (Open Cell, Closed Cell)

- By Application:

- Recreational Kitesurfing

- Professional/Competitive Kitesurfing

- Kitesurfing Schools and Training Centers

- By Distribution Channel:

- Offline (Specialty Stores, Retail Chains)

- Online (E-commerce Platforms, Brand Websites)

- By Geography:

- North America (U.S., Canada)

- Europe (Germany, France, UK, Spain, Italy)

- Asia Pacific (Australia, Japan, China)

- Latin America (Brazil, Mexico)

- Middle East & Africa (South Africa, UAE)

Value Chain Analysis For Kitesurf Kites Market

The value chain for the Kitesurf Kites Market begins with crucial upstream activities dominated by specialized material suppliers. These suppliers provide high-performance technical textiles, primarily ripstop nylon for the canopy (often demanding specific UV resistance and low-stretch characteristics) and robust, airtight polymer films for the bladders and inflatable struts. Upstream analysis also includes the provision of specialized components such as high-strength Dyneema or Spectra lines, complex pulley systems, and quick-release mechanisms. Manufacturers must secure reliable supply contracts for these materials, as material quality directly correlates with product safety, lifespan, and aerodynamic performance, making procurement a high-value, highly sensitive activity within the chain.

The core manufacturing stage involves sophisticated cutting (often laser or CNC controlled) and precision stitching and assembly, where the flat materials are transformed into complex three-dimensional aerodynamic shapes. This stage is followed by quality control, rigorous testing (including load testing and inflation integrity checks), and specialized packaging suitable for sporting goods distribution. Downstream analysis focuses heavily on market accessibility and consumer engagement. Distribution channels are bifurcated between direct sales via brand websites, which allow for better margin control and direct customer feedback, and indirect sales through a network of specialized global distributors, regional agents, and local kitesurfing shops.

The distribution network relies heavily on logistics capable of handling international shipments of bulky, yet delicate, equipment. Specialized retailers and training centers play a critical role downstream by offering hands-on product education, fitting advice, and essential after-sales service and repair, crucial for maintaining customer loyalty in a high-investment sport. The value chain is constantly optimized for speed-to-market, particularly given the seasonal nature of demand, ensuring that the latest kite models are available at the beginning of peak wind seasons in key markets globally. The effectiveness of the direct and indirect channels is often determined by the brand's established reputation for quality and innovation within the dedicated kitesurfing community.

Kitesurf Kites Market Potential Customers

The primary potential customers in the Kitesurf Kites Market fall into distinct segments based on experience level, commitment, and purchasing power. The largest segment comprises Recreational Kitesurfers, who purchase equipment primarily for leisure during holidays or weekends. These buyers seek reliable, easy-to-use, and forgiving kites, often favoring high-depower delta or hybrid LEI designs that prioritize safety and quick relaunch capabilities. Their purchasing decisions are often influenced by local school recommendations, ease of travel, and mid-range pricing. This demographic requires accessible information on durability and warranty coverage, forming the volume backbone of the market.

A secondary, highly valuable customer segment is the Professional and Expert Rider community. These individuals require cutting-edge, high-performance C-kites or specialized race foil kites, prioritizing maximum lift, speed, and responsiveness, regardless of cost. They are early adopters of new technologies and materials, often replacing their gear annually to maintain peak competitive edge. Their purchasing behavior is strongly influenced by sponsorship deals, professional reviews, and brand reputation in competitive circuits. These customers are crucial for brand validation and driving high-margin sales of specialized, premium equipment within the value chain.

Finally, Kitesurfing Schools and Rental Operators constitute a significant institutional customer base. These entities require bulk purchases of durable, beginner-friendly equipment (often robust, high-visibility delta kites in smaller and mid-range sizes) designed to withstand extensive use, abuse, and salt degradation. Their purchasing criteria center on equipment longevity, low maintenance requirements, and the availability of bulk purchasing discounts and training packages. This segment provides a critical entry point for new riders and generates sustained demand for replacement and upgrade cycles, acting as influential gatekeepers to the broader recreational market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million USD |

| Market Forecast in 2033 | $400 Million USD |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | North Kites, Duotone Kiteboarding, F-One, Slingshot, Cabrinha, Ozone Kites, Airush, Core Kites, RRD, Liquid Force, Eleveight, Flysurfer, Naish, Blade Kites, HQ Kites, Switch Kites, CrazyFly, Best Kites, Peter Lynn, Genetrix. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kitesurf Kites Market Key Technology Landscape

The Kitesurf Kites Market relies on a sophisticated technological landscape encompassing advanced material science, complex computational fluid dynamics (CFD) modeling, and integrated safety innovations. A core technology is the evolution of canopy material, moving toward high-tenacity, low-stretch fabrics like Teijin D2 and specialized double ripstop nylon, which offer superior durability against UV exposure and tearing, critically maintaining the kite's designed aerodynamic shape even under extreme load. The structural integrity is further supported by innovations in bladder materials, utilizing durable polyurethane films that reduce air leakage and enhance pressure retention in the leading edge and struts, which are vital for the kite's structural rigidity and relaunch capability on the water.

Aerodynamic design technology is constantly being refined through extensive CFD simulations, allowing designers to precisely model airflow, pressure distribution, and turbulence across the kite's profile. This computational analysis facilitates the optimization of aspect ratios (high vs. low), sweep angles, and profile depth to achieve desired performance characteristics—such as enhanced "drift" for wave riding or maximum "pull" for freestyle maneuvers. Key advancements include the development of "three-strut" and "no-strut" kite designs, minimizing weight and drag while maximizing portability and low-wind performance, fundamentally altering the standard design paradigm prevalent in the previous decade and responding directly to demands from the growing hydrofoiling community for ultra-light equipment.

Furthermore, safety systems represent a major technological focus. Modern kites incorporate fifth-line safety systems and sophisticated single-front-line flagging systems that fully depower the kite instantly upon activation of the quick-release mechanism, significantly reducing rider danger in unexpected high winds or entanglement scenarios. Control bar technology has also advanced, featuring improved trimming systems (cleat systems or strap systems) and ergonomic bar diameters with specialized grips. Integration of embedded technologies, such as micro-sensors for tracking performance data (altitude, speed, g-force) and pairing with GPS devices, is becoming standard, feeding into the wider trend of connected sports equipment and providing quantifiable metrics for training and competition.

Regional Highlights

- Europe: Europe represents the largest and most mature market for kitesurf kites, driven by a long coastline (Spain, Portugal, France, UK), high levels of disposable income, and a strong culture of competitive and recreational water sports. Key markets such as Germany and France exhibit high purchasing power for premium, technologically advanced equipment. Southern Europe, especially the Mediterranean coast, benefits from extended summer seasons conducive to kitesurfing, maintaining consistent demand. Regional growth is bolstered by well-established supply chains and numerous high-profile European-based manufacturers who dominate global innovation.

- North America: North America is a significant market, primarily centered in coastal states like California, North Carolina (Cape Hatteras), and Florida, known for reliable wind conditions and extensive specialized retail presence. The region is characterized by consumer demand for high-durability and safety-focused equipment due to often challenging surf conditions. Market expansion is supported by substantial investment in dedicated training academies and organized competitive events, driving demand for both robust LEI kites and advanced foil kites for competitive hydrofoiling circuits.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, primarily fueled by increased tourism in Southeast Asian countries (Vietnam, Thailand, Philippines) and the rising affluence in coastal cities of Australia and China. Favorable wind conditions and relatively low operating costs for new kitesurfing centers make it an attractive location for international riders. Growth here is concentrated in the mid-range segment, though high-end demand exists in Australia and Japan. The primary challenge remains establishing robust regulatory frameworks for water safety and dealing with diverse regional wind patterns.

- Latin America (LATAM): LATAM, spearheaded by Brazil (especially areas like Cumbuco and Taíba, world-renowned kitesurfing havens), remains critical for high-performance training and product testing due to its consistent, strong wind conditions ("wind machine"). While overall consumer spending power may be lower than in Europe, the region sustains demand for specialized, high-use equipment from professional athletes and dedicated tourists, positioning it as a key market for extreme performance models and durable school equipment.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, notably in South Africa (Cape Town) and parts of the UAE and Egypt (Red Sea resorts). South Africa serves as a major global winter destination for kitesurfers, driving demand for diverse kite sizes suitable for varied conditions, from flat water cruising to massive wave riding. The market here is highly reliant on sports tourism, necessitating continuous investment in high-quality rental and instructional gear to cater to international visitors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kitesurf Kites Market.- Duotone Kiteboarding (Formerly North Kiteboarding before brand split)

- North Kites (New entity following brand split)

- F-One

- Slingshot Sports

- Cabrinha Kites (Owned by Pryde Group)

- Ozone Kites

- Airush Kiteboarding

- Core Kites

- RRD (Roberto Ricci Designs)

- Liquid Force (Focusing increasingly on wake/kite crossover)

- Eleveight Kites

- Flysurfer Kiteboarding (Specialist in foil kites)

- Naish International

- Blade Kites

- HQ Kites

- Switch Kites

- CrazyFly

- Best Kites

- Peter Lynn Kiteboarding

- Genetrix

Frequently Asked Questions

Analyze common user questions about the Kitesurf Kites market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Kitesurf Kites Market?

The Kitesurf Kites Market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by increased global participation in water sports and technological innovations in equipment design.

Which kite type dominates the current market segmentation?

Leading Edge Inflatable (LEI) Kites, including popular models like Bow and Delta kites, currently dominate the market due to their superior safety features, ease of relaunch, and high versatility suitable for beginner to intermediate riders and large-scale instructional centers.

How is AI impacting the manufacturing of kitesurf kites?

AI is primarily impacting manufacturing through Enhanced Aerodynamic Design, utilizing generative algorithms to optimize kite shapes for specific performance criteria, and through Predictive Maintenance models that analyze stress patterns to enhance product durability and rider safety.

Which geographical region exhibits the fastest market growth potential?

The Asia Pacific (APAC) region, driven by expanding tourism in countries such as Vietnam and Thailand, alongside rising disposable incomes in Australia and China, is forecasted to be the fastest-growing market segment during the forecast period.

What are the main restraints hindering mass adoption of kitesurf kites?

The main restraints include the relatively high initial investment cost required for a complete setup (kite, board, bar, harness), the steep learning curve associated with mastering the sport, and the geographical dependency on consistent, suitable wind and weather conditions.

The Kitesurf Kites Market, while niche, presents a dynamic landscape characterized by continuous innovation aimed at reducing the barrier to entry and enhancing high-performance capabilities. The persistent demand from recreational enthusiasts, coupled with the rigorous requirements of professional athletes, ensures that manufacturers maintain dual focus on safety and cutting-edge aerodynamics. The technological trajectory involves deeper integration of advanced materials, such as high-modulus fibers and advanced polymer coatings, extending beyond the canopy to critical areas like leading edges and struts, ensuring minimal weight gain while maximizing rigidity necessary for responsive handling and rapid depower capabilities. This necessitates significant research investment upstream, solidifying partnerships between equipment brands and specialized material science firms to maintain a competitive edge. Furthermore, the drive toward sustainability is not merely a marketing strategy but an operational imperative, compelling companies to explore bio-based polymers and fully recyclable fabrics, balancing high performance with ecological responsibility, a factor increasingly weighted by the core consumer demographic.

The segmentation based on Kite Type is becoming highly granular. Within the LEI category, the differentiation between 'freeride,' 'wave,' and 'freestyle' specific models highlights tailored design characteristics: wave kites emphasize quick pivoting and excellent drift capabilities, while freestyle kites demand explosive pop and slack line predictability. This specialization mandates rigorous internal testing procedures, often utilizing specialized wind tunnels or high-speed camera analysis, to validate performance metrics against competitor claims. Foil kites, while still a smaller segment by volume, command premium pricing and demand exceptional precision in assembly, given their multi-chamber structure and high aspect ratios that translate directly into efficiency needed for competitive hydrofoil racing. The market's stability is further secured by the replacement cycle, as kites are consumable goods subject to wear and tear from UV, salt exposure, and intense physical stresses, ensuring recurring demand for both replacement parts and new generation models.

Regional variations in product preference heavily influence distribution strategies. In Northern Europe and North America, where the season can be short, riders often invest in highly durable, all-condition kites and extensive size ranges to cover varied wind speeds, relying heavily on online research and reviews before purchasing from specialized retail centers offering professional setup advice. Conversely, markets in developing kitesurfing hubs in Southeast Asia rely more heavily on rental and instructional sales, prioritizing cost-effectiveness, visibility, and straightforward maintenance procedures. The overall market health is inextricably linked to global tourism patterns and infrastructure development in coastal areas, as accessibility to good kitesurfing locations directly correlates with the growth in the rider base and subsequent equipment demand. Strategic localization, including translating complex technical manuals and training materials, remains essential for effective penetration into non-English speaking markets, maximizing the global reach of major brands.

The competitive environment is characterized by intense intellectual property development surrounding safety systems and bridle design geometry. Brands continuously file patents for unique features such as optimized leading-edge sweep, adjustable bridle attachments, and proprietary inflation systems (e.g., single-point inflation) that simplify setup and breakdown. The marketing spend is increasingly directed toward digital platforms, leveraging high-quality extreme sports videography and professional athlete endorsements to connect with the target audience—a demographic highly engaged with visual content related to adrenaline and adventure sports. Successful brands differentiate themselves not only on technological superiority but also through robust community engagement, sponsoring local events, and maintaining high standards of customer support and swift repair services, which are critical retention factors given the complexity and cost of the product.

Analyzing the impact of macroeconomic trends, fluctuations in the price of raw materials, particularly high-grade polyester and TPU films, can introduce volatility into the manufacturing cost structure. Manufacturers often mitigate this risk through long-term supply agreements and strategic inventory management. The rise of new manufacturing locations outside traditional hubs, seeking lower labor and operational costs, introduces complexities in quality control and logistics, requiring sophisticated global supply chain oversight. Furthermore, the inclusion of kitesurfing in the Olympics has provided an invaluable, global marketing platform, raising the visibility of the sport and driving interest from a broader demographic previously unaware of the sport, creating a sustainable growth pathway for the premium segment focused on competitive excellence. This validation accelerates the demand for highly technical race-specific equipment, driving innovation in both kite and hydrofoil design simultaneously.

The consumer journey in the Kitesurf Kites Market is multi-staged and high-commitment. Initial awareness is often generated through social media or travel experiences, followed by engagement with kitesurfing schools for instruction. The transition from student to independent buyer marks the primary purchase opportunity. Buyers are highly informed, often dedicating significant time to comparing kite characteristics (e.g., low-end grunt, turning speed, depower range) across multiple brands. Trust in safety features and longevity heavily influences the final decision, particularly for beginner and intermediate riders. For advanced riders, the decision often revolves around minute performance gains relevant to specific disciplines, such as unhooked freestyle, big air, or speed trials, confirming the highly technical nature of the purchasing process within the market ecosystem.

Market expansion opportunities are also found in adjacent recreational activities, specifically through snowkiting and landboarding, which utilize similar kite technology but demand different structural reinforcements and material resilience against abrasive surfaces. Manufacturers developing cross-sport compatible equipment can tap into year-round demand, mitigating the inherent seasonality of water-based kitesurfing. Technology transfer from aerospace and yachting industries, particularly related to sail membrane development and load distribution engineering, continues to offer fertile ground for product improvement, potentially yielding ultra-lightweight, extremely durable kites that redefine the performance ceiling in both competitive and recreational categories. The ability of companies to rapidly integrate these external technological advancements into their core product lines will be a primary determinant of competitive success in the latter half of the forecast period.

The environmental forces impacting the market are leading to a demand for full life-cycle accountability. Consumers are increasingly scrutinizing the source and disposal of non-biodegradable synthetic materials used in kite construction. This pressure is driving manufacturers to partner with organizations specializing in recycling large technical textiles or to develop take-back schemes for damaged or end-of-life kites. Furthermore, the operational footprint of manufacturing, including energy consumption and solvent use, is under review, leading to investment in cleaner production technologies. Successfully addressing these sustainability demands provides a crucial avenue for market differentiation and aligning with the eco-conscious values often held by participants in outdoor water sports.

Geographically, while established markets ensure volume stability, emerging markets offer high percentage growth potential. Focused investment in infrastructure, such as dedicated kite beaches and resort partnerships in regions like the Middle East and parts of South America, is essential to unlock this potential. These regions often lack established local manufacturing capabilities, making them heavily reliant on imports, thus emphasizing the importance of efficient international logistics and tariff management for maintaining competitive pricing. The demographic shift towards younger, digitally native extreme sports participants also mandates that brand presence and promotional activities are highly visible across key social media and streaming platforms, where equipment reviews and performance showcases influence purchasing decisions globally.

In terms of distribution, the balance between brick-and-mortar specialty stores and e-commerce platforms continues to evolve. While online channels offer convenience and price transparency, the specialized nature of kitesurfing equipment—requiring specific sizing advice, demonstration, and fitting of complex components like control bars and harnesses—still heavily favors the expertise offered by physical retailers. Therefore, successful distribution models often integrate both approaches: online presence for brand building and inventory visibility, coupled with strong partnerships with local schools and retail outlets that provide essential hands-on service and knowledge transfer, bridging the gap between digital discovery and high-value physical purchase.

The Kitesurf Kites Market's long-term sustainability is strongly tied to its ability to continuously mitigate safety concerns, which often act as a barrier to entry. Innovations in self-launch and landing systems, automated wind sensing technology, and simplified rigging processes are crucial for reducing the reliance on specialized assistance and making the sport safer for solo riders. Continued regulatory oversight and industry self-regulation regarding product testing and certification (often through organizations like IKO or VDWS) provide credibility and reduce liability exposure, simultaneously assuring consumers of equipment reliability. These safety advances, combined with ongoing efforts to reduce overall equipment weight and bulk for easier travel, collectively enhance the market's appeal to a broader, global recreational audience, ensuring consistent demand growth over the seven-year forecast horizon.

The intense competition among key players drives rapid product cycles, typically 12 to 18 months, forcing manufacturers to constantly refresh their lineups with marginal, but technically significant, improvements. This dynamic necessitates robust supply chain agility to manage obsolescence risk and rapid material turnover. Strategic focus on proprietary technologies, such as patented bridle systems (e.g., pulley-less designs) or unique strut geometries (e.g., flared wingtips), allows brands to command price premiums and capture market share within highly discerning consumer groups. The market remains inherently innovation-driven, where perceived performance and brand legacy play equally vital roles in influencing high-value purchases.

Finally, the interplay of economic forces dictates pricing strategies. Premium brands often maintain high price points, justified by cutting-edge R&D and superior material quality, targeting the expert segment. Meanwhile, mid-range brands focus on offering excellent value, balancing performance with durability to attract the majority of recreational buyers. The used equipment market also plays a significant role, providing an accessible entry point for highly price-sensitive consumers, thereby indirectly influencing new sales by standardizing equipment values and supporting the overall health of the ecosystem by increasing the total number of participants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager