Knee Orthopaedic Fixator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440703 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Knee Orthopaedic Fixator Market Size

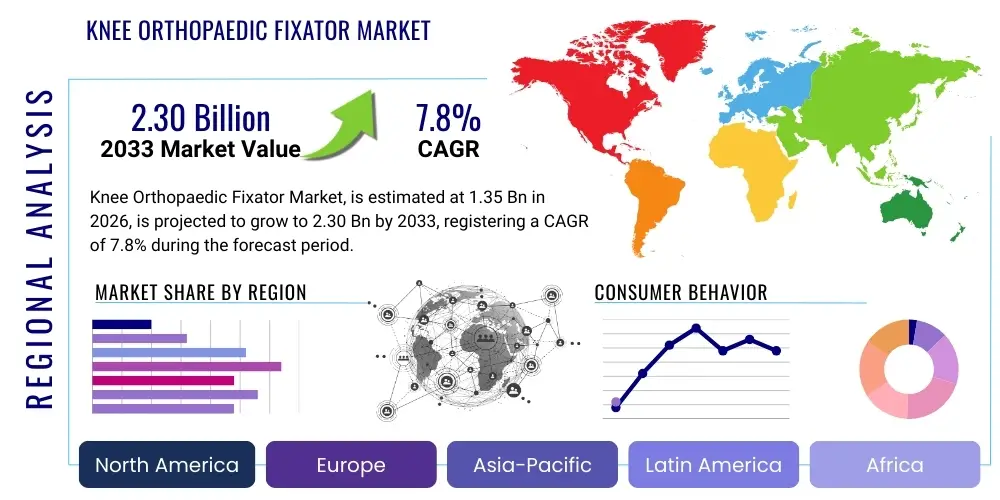

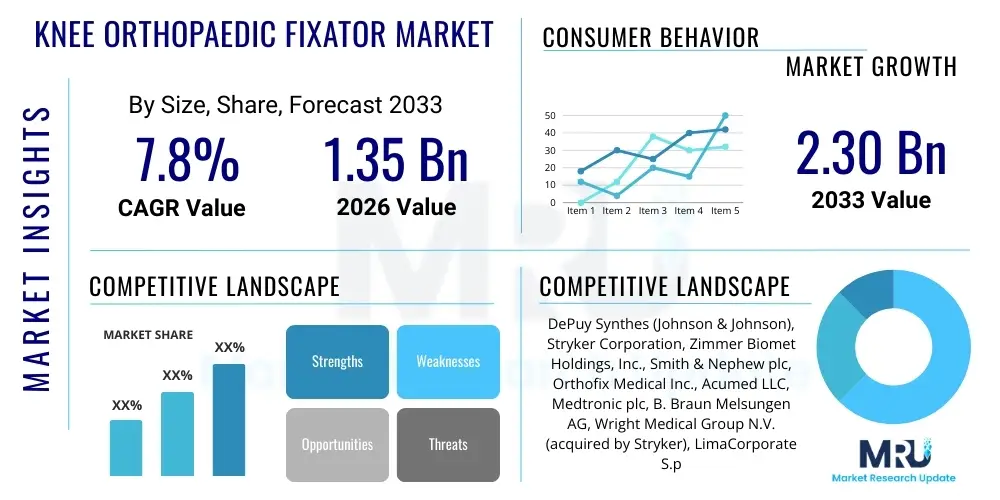

The Knee Orthopaedic Fixator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.30 Billion by the end of the forecast period in 2033.

Knee Orthopaedic Fixator Market introduction

The Knee Orthopaedic Fixator Market encompasses a range of medical devices designed to provide stability and support to the knee joint following trauma, fracture, surgical correction, or severe degenerative conditions. These fixators facilitate healing, enable early mobilization, and help in the precise alignment of bone fragments or joint structures. The market includes both external and internal fixation devices, tailored to various clinical needs and patient anatomies, playing a crucial role in modern orthopedic surgery and trauma management. Their primary objective is to restore function and mobility to the knee, a complex and weight-bearing joint, through secure immobilization during the recovery phase.

Product descriptions typically involve components such as pins, wires, clamps, rods, and frames for external fixators, or plates, screws, and intramedullary nails for internal applications. Major applications span a broad spectrum including complex intra-articular fractures, peri-articular fractures, correction of angular deformities, joint arthrodesis, and limb lengthening procedures, particularly around the knee region. The benefits extend beyond simple stabilization, offering advantages such as reduced surgical invasiveness for some external fixation techniques, enhanced patient comfort during recovery, and improved functional outcomes. These devices are indispensable in treating high-energy trauma, congenital deformities, and other conditions where conventional casting may be insufficient or impractical.

Driving factors for this market's growth are multifaceted and robust. A significant driver is the increasing global incidence of road accidents, sports-related injuries, and falls, which frequently lead to complex knee fractures and soft tissue damage requiring advanced fixation solutions. Furthermore, the burgeoning aging population worldwide is contributing to a higher prevalence of osteoporosis and degenerative joint diseases, increasing the susceptibility to fragility fractures around the knee. Technological advancements in fixator design, materials, and surgical techniques, including the development of biocompatible alloys and minimally invasive approaches, are also propelling market expansion. The growing adoption of knee orthopedic fixators in emerging economies, driven by improving healthcare infrastructure and rising disposable incomes, further solidifies the market's upward trajectory.

Knee Orthopaedic Fixator Market Executive Summary

The Knee Orthopaedic Fixator Market is experiencing robust growth, primarily fueled by an aging global demographic more prone to fragility fractures and a rising incidence of high-energy trauma such as road traffic accidents and sports injuries. Business trends indicate a strong emphasis on product innovation, with manufacturers focusing on developing lighter, stronger, and more biocompatible materials, alongside modular and patient-specific designs to improve surgical outcomes and reduce recovery times. There is a discernible shift towards advanced fixation systems that offer greater versatility and ease of use for surgeons, addressing complex knee pathologies more effectively. Strategic collaborations between device manufacturers and healthcare providers are also shaping the market, aiming to optimize patient care pathways and expand market reach. Furthermore, the increasing demand for minimally invasive surgical techniques is driving the development of fixators that can be implanted with less tissue disruption, offering quicker rehabilitation and reduced postoperative pain.

Regional trends reveal that North America and Europe currently dominate the market due to well-established healthcare infrastructures, high adoption rates of advanced medical technologies, and significant healthcare expenditure. However, the Asia Pacific region is poised for the fastest growth, driven by a large patient pool, increasing awareness regarding advanced orthopedic treatments, improvements in healthcare access, and a rise in medical tourism. Latin America and the Middle East & Africa also present lucrative opportunities, albeit with slower growth, as their healthcare systems continue to develop and become more accessible to the broader population. Urbanization and changing lifestyles in these regions are also contributing to a higher incidence of trauma, thereby stimulating demand for orthopedic fixators.

Segmentation trends highlight the continued dominance of external fixators, especially in trauma management, due to their versatility and ability to provide immediate stability. However, the internal fixator segment, particularly plates and screws, is rapidly expanding due to advancements in materials and design that allow for improved anatomical reconstruction and earlier weight-bearing. Application-wise, trauma and fracture management remain the largest segment, but deformity correction and arthrodesis procedures are showing steady growth, reflecting evolving surgical practices and an increasing demand for limb reconstruction. End-user trends indicate that hospitals continue to be the primary consumers, but ambulatory surgical centers are gaining traction due to their cost-effectiveness and increasing capacity to handle complex orthopedic procedures, offering patients more convenient options for treatment and follow-up care.

AI Impact Analysis on Knee Orthopaedic Fixator Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the precision, planning, and postoperative care associated with knee orthopedic fixators. Key themes revolve around AI's potential to enhance diagnostic accuracy for complex knee fractures through advanced image analysis, thereby informing optimal fixator placement and configuration. There's also significant interest in AI's role in surgical planning, where algorithms can simulate various fixation strategies to predict biomechanical outcomes, potentially reducing surgical time and improving patient-specific results. Concerns often include the integration challenges with existing healthcare systems, data privacy, and the validation of AI models to ensure clinical reliability. Expectations are high for AI to personalize treatment pathways, predict potential complications, and optimize rehabilitation protocols, ultimately leading to improved patient recovery and functional longevity of the fixator.

- AI-powered image analysis for enhanced diagnostic accuracy and 3D reconstruction of complex knee fractures, leading to more precise surgical planning and fixator selection.

- Predictive analytics for optimal fixator placement and alignment, using machine learning to analyze patient-specific anatomy and biomechanical data to prevent complications.

- Robotic assistance integrated with AI for guiding surgeons during fixator application, ensuring millimeter-level precision and reduced human error.

- Development of smart fixators with embedded sensors that collect real-time data on healing progress, weight-bearing, and potential issues, transmitting information to clinicians.

- AI algorithms for personalized rehabilitation protocols, adapting exercise plans based on patient progress and biometric feedback to accelerate recovery.

- Optimized inventory management and supply chain logistics for fixator components, leveraging AI to forecast demand and reduce waste.

- AI-driven training and simulation platforms for orthopedic surgeons to practice complex fixator procedures in a virtual environment, enhancing skill development.

- Automated quality control and inspection of manufactured fixators, ensuring consistency and adherence to stringent quality standards through computer vision.

- Predictive maintenance for surgical instruments and fixation devices, utilizing AI to anticipate equipment failures and ensure operational readiness.

- Enhanced post-operative monitoring through AI-driven wearables and remote sensing, allowing for early detection of infections or hardware complications.

- AI for patient stratification and risk assessment, identifying individuals who would benefit most from specific fixator types or surgical approaches.

- Drug discovery and material science advancements for fixators, with AI accelerating the identification of novel biocompatible materials and anti-infective coatings.

- Telemedicine integration for remote consultation and follow-up care, supported by AI tools for data interpretation and patient engagement regarding fixator management.

DRO & Impact Forces Of Knee Orthopaedic Fixator Market

The Knee Orthopaedic Fixator Market is shaped by a dynamic interplay of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its growth trajectory. Key drivers include the escalating global incidence of road accidents, sports injuries, and falls, which are major contributors to complex knee trauma requiring immediate and effective stabilization. The steadily increasing aging population worldwide, particularly susceptible to osteoporosis and fragility fractures, further amplifies the demand for reliable fixation solutions. Moreover, continuous technological advancements in fixator design, biomaterials, and minimally invasive surgical techniques are making these devices more effective, safer, and accessible, thereby fostering greater adoption among orthopedic surgeons. The growing awareness and demand for advanced healthcare facilities and sophisticated medical interventions, particularly in developing economies, also serve as significant market accelerators. Lastly, supportive reimbursement policies in developed countries encourage the utilization of advanced orthopedic fixators, driving market penetration.

Conversely, several restraints impede the market's full potential. The high cost associated with advanced orthopedic fixators and the surgical procedures for their implantation can be a significant barrier for patients, especially in regions with limited insurance coverage or lower per capita healthcare spending. Stringent regulatory approval processes for new devices, demanding extensive clinical trials and data, often delay market entry and increase development costs for manufacturers. There are also inherent risks of complications associated with orthopedic fixators, such as pin tract infections, malunion, nonunion, nerve damage, and vascular injury, which can deter both patients and surgeons. Furthermore, a lack of skilled orthopedic surgeons and adequate healthcare infrastructure in underserved regions limits the widespread adoption of these specialized devices, particularly in rural or economically challenged areas. The evolving landscape of healthcare policies and shifting reimbursement models can also introduce uncertainty for manufacturers and providers.

Despite these challenges, substantial opportunities exist for market expansion and innovation. Emerging markets across Asia Pacific, Latin America, and the Middle East & Africa present untapped growth potential due to improving healthcare infrastructure, rising healthcare expenditure, and increasing medical tourism. The development of personalized medicine and patient-specific fixator designs, facilitated by advanced imaging and 3D printing technologies, offers a pathway to superior outcomes and greater market differentiation. Advances in biomaterials, including resorbable fixators and those with enhanced anti-infective properties, promise to address existing limitations and improve patient safety. Moreover, the integration of smart technologies, such as sensors in fixators for real-time monitoring of healing progress, presents a significant innovation opportunity, enabling more proactive and data-driven patient management. The increasing focus on value-based care models also encourages the adoption of solutions that demonstrate superior long-term patient outcomes, favoring advanced fixator technologies.

Segmentation Analysis

The Knee Orthopaedic Fixator Market is comprehensively segmented across various dimensions, including product type, application, material, and end-user, to provide a granular understanding of its structure and dynamics. This segmentation allows for targeted market strategies, identifying key growth areas and niche opportunities within the broader orthopedic landscape. Each segment reflects specific clinical needs, technological advancements, and patient demographics, influencing market trends and competitive landscapes. Understanding these distinct market segments is crucial for stakeholders to develop tailored products, optimize distribution channels, and refine marketing approaches, ensuring that the diverse demands of orthopedic surgery are met effectively. The continuous evolution of surgical techniques and patient expectations further necessitates a detailed examination of these segments to predict future market shifts.

- Product Type

- External Fixators

- Monolateral Fixators

- Circular Fixators (e.g., Ilizarov, Taylor Spatial Frame)

- Hybrid Fixators

- Other External Fixators

- Internal Fixators

- Plates & Screws (e.g., Locking Plates, Non-locking Plates, Periarticular Plates)

- Intramedullary Nails

- Wires & Pins

- Other Internal Fixators

- External Fixators

- Application

- Trauma & Fracture Management (e.g., Tibial Plateau Fractures, Distal Femur Fractures)

- Deformity Correction (e.g., Genu Varum, Genu Valgum Correction)

- Arthrodesis (Joint Fusion)

- Osteotomy (Bone Cutting)

- Limb Lengthening & Reconstruction

- Other Applications

- Material

- Stainless Steel

- Titanium & Titanium Alloys

- PEEK (Polyether Ether Ketone)

- Bioabsorbable Materials (e.g., PLA, PGA)

- Carbon Fiber Composites

- Other Advanced Materials

- End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Orthopedic Clinics

- Trauma Centers

- Specialty Surgical Hospitals

Value Chain Analysis For Knee Orthopaedic Fixator Market

The value chain for the Knee Orthopaedic Fixator Market is a complex ecosystem spanning from raw material sourcing to post-sale services, intricately linking various stakeholders and processes. Upstream analysis begins with the procurement of specialized raw materials, primarily medical-grade stainless steel, titanium alloys, PEEK, and bioabsorbable polymers, from highly specialized suppliers. These materials are then processed into components such as rods, pins, plates, screws, and clamps by sub-component manufacturers who adhere to stringent quality and biocompatibility standards. Research and development activities, including biomaterial science and mechanical engineering, are critical at this stage to innovate new designs and improve material properties, ensuring the foundational quality and performance of the final product. This initial phase sets the stage for the manufacturing process, where precision engineering and regulatory compliance are paramount.

Midstream activities involve the design, manufacturing, assembly, and quality control of the knee orthopedic fixator devices. This stage is dominated by specialized medical device companies that invest heavily in advanced manufacturing technologies, such as CAD/CAM, 3D printing, and automated assembly lines, to produce a diverse range of fixators tailored to various anatomical requirements and surgical techniques. Rigorous testing and validation processes, including mechanical stress tests and biocompatibility assessments, are conducted to ensure product safety and efficacy, aligning with global regulatory requirements like FDA and CE mark certifications. Packaging and sterilization are also critical steps, ensuring that products reach healthcare providers in sterile, ready-to-use conditions. Innovation in modular design and patient-specific solutions is a key competitive differentiator in this phase, driven by continuous interaction with orthopedic surgeons and clinical feedback.

Downstream analysis focuses on distribution channels and end-user engagement. Distribution can be direct, with large manufacturers having their own sales forces engaging directly with hospitals, trauma centers, and orthopedic clinics. This allows for closer customer relationships, better technical support, and direct feedback loops. Indirect distribution involves working with third-party distributors, wholesalers, and medical supply companies, particularly beneficial for reaching broader geographical areas, including emerging markets, and smaller healthcare facilities. These distributors play a crucial role in logistics, inventory management, and regional market penetration. End-users, primarily orthopedic surgeons and hospitals, are pivotal in the value chain, as their preferences, clinical outcomes, and purchasing decisions directly influence market demand. Post-sale services, including surgeon training, technical support, and device maintenance, are also vital, ensuring optimal device utilization and patient satisfaction. These services help build brand loyalty and reinforce the product's value proposition in a highly competitive market.

Knee Orthopaedic Fixator Market Potential Customers

The primary potential customers for knee orthopedic fixators are multifaceted, encompassing various medical professionals and healthcare institutions that specialize in musculoskeletal care and trauma management. Foremost among these are orthopedic surgeons, who are the direct prescribers and users of these devices. Within this group, a wide array of specialists including trauma surgeons, joint reconstruction specialists, pediatric orthopedic surgeons, and limb lengthening and deformity correction specialists represent distinct and significant customer segments. Their decisions are heavily influenced by factors such as product efficacy, ease of use, patient outcomes, and alignment with specific surgical techniques and philosophies. Continued medical education, product demonstrations, and clinical evidence play a crucial role in shaping their adoption patterns for new fixator technologies.

Beyond individual surgeons, institutional buyers form a substantial segment of the market. Hospitals, particularly those with large emergency departments, trauma centers, and dedicated orthopedic departments, are major purchasers of knee orthopedic fixators. These institutions prioritize factors like product reliability, cost-effectiveness, bulk purchasing agreements, and comprehensive support services from manufacturers. Ambulatory Surgical Centers (ASCs), which are increasingly performing a wider range of orthopedic procedures, also represent a growing customer base, often seeking efficient and cost-effective solutions for their patient populations. Specialty orthopedic clinics, which focus on specific conditions like sports injuries or pediatric deformities, also acquire these devices for their specialized treatment offerings, often valuing highly customized or innovative solutions.

In addition to traditional healthcare providers, other emerging customer segments include military hospitals and disaster relief organizations, which frequently deal with high-volume, complex trauma cases requiring robust and versatile fixation solutions. Academic and research institutions, while not direct end-users in the same volume, represent influential customers due to their role in evaluating new technologies, conducting clinical trials, and training future generations of orthopedic surgeons, thereby impacting future adoption trends. The increasing trend of medical tourism, where patients travel to receive specialized orthopedic care, further expands the potential customer base to include healthcare facilities catering to international patients, often seeking the most advanced and proven fixation technologies available globally. This diverse customer landscape necessitates a nuanced and targeted approach from manufacturers to effectively reach and serve each segment's unique needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.30 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Orthofix Medical Inc., Acumed LLC, Medtronic plc, B. Braun Melsungen AG, Wright Medical Group N.V. (acquired by Stryker), LimaCorporate S.p.A., ConMed Corporation, Össur hf., DJO Global (Colfax Corporation), Integra LifeSciences Holdings Corporation, A.R. Medicom Inc., Globus Medical Inc., Arthrex, Inc., Advanced Orthopaedic Solutions, Bioventus LLC, OsteoMed L.P. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Knee Orthopaedic Fixator Market Key Technology Landscape

The Knee Orthopaedic Fixator Market is characterized by a rapidly evolving technology landscape, driven by the continuous pursuit of improved patient outcomes, reduced complications, and enhanced surgical efficiency. One of the foundational technological advancements includes Computer-Aided Design and Manufacturing (CAD/CAM) coupled with 3D printing. These technologies enable the creation of highly precise, patient-specific fixator components and even entire fixator systems, tailored to individual anatomical variations and fracture patterns. This personalization reduces the need for intraoperative adjustments, improves fit, and potentially minimizes surgical time, leading to better functional recovery. The ability to prototype and produce complex geometries rapidly also accelerates product development cycles for manufacturers, bringing innovative solutions to market faster.

Another significant area of innovation lies in advanced biomaterials. While stainless steel and titanium alloys remain standard, there is a growing trend towards materials with superior properties such as enhanced biocompatibility, reduced artifact in imaging, and improved mechanical strength-to-weight ratios. Polyether Ether Ketone (PEEK) is gaining traction for its radiolucency and mechanical properties similar to bone, making it an excellent choice for certain fixator components. Furthermore, the development of bioabsorbable materials like polylactic acid (PLA) and polyglycolic acid (PGA) for temporary fixation devices offers the advantage of degradation within the body over time, eliminating the need for a second surgery for removal and reducing long-term complications. Research into anti-infective coatings and drug-eluting implants is also crucial, aiming to mitigate the risk of infection, a common and severe complication associated with external fixators.

Beyond materials and design, the integration of smart technologies and surgical navigation systems is revolutionizing the application of knee orthopedic fixators. Robotic-assisted surgery and image-guided navigation systems provide surgeons with real-time feedback and unparalleled precision during fixator placement, particularly for complex intra-articular fractures and deformity corrections. These systems leverage advanced imaging (e.g., fluoroscopy, CT scans) and sophisticated software algorithms to guide pin insertion, bone fragment reduction, and overall fixator assembly, thereby minimizing malalignment and potential nerve or vascular damage. Furthermore, the emergence of smart implants with embedded sensors capable of monitoring parameters such as strain, temperature, and even early signs of infection represents a futuristic frontier. These intelligent fixators could provide valuable data on healing progress and alert clinicians to potential issues, allowing for proactive intervention and truly personalized post-operative care, thereby shifting the paradigm from reactive to predictive patient management.

Regional Highlights

- North America: This region is a dominant force in the Knee Orthopaedic Fixator Market, primarily driven by a high prevalence of orthopedic injuries, well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and significant healthcare spending. The presence of major market players, robust research and development activities, and favorable reimbursement policies further contribute to its leading position. The United States, in particular, exhibits high demand due to a large aging population and an active lifestyle that contributes to sports-related injuries and trauma.

- Europe: Europe represents another significant market, characterized by an aging population susceptible to degenerative knee conditions and fractures, alongside a sophisticated healthcare system. Countries like Germany, France, and the UK are key contributors, driven by strong R&D, high public and private healthcare expenditure, and increasing awareness of advanced orthopedic treatments. Regulatory frameworks are stringent, fostering high-quality product development, while technological advancements continue to drive market expansion.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for knee orthopedic fixators. This growth is attributable to a massive and rapidly aging population, increasing disposable incomes, improving healthcare infrastructure, and a rising incidence of road traffic accidents and sports injuries. Countries such as China, India, and Japan are pivotal, demonstrating growing demand fueled by medical tourism, government initiatives to improve healthcare access, and expanding healthcare coverage.

- Latin America: This region presents a market with significant potential, characterized by developing healthcare systems, increasing awareness of advanced medical treatments, and a growing burden of orthopedic trauma, particularly from road accidents. Countries like Brazil, Mexico, and Argentina are leading the adoption of modern orthopedic fixators as their economies grow and healthcare access expands, albeit at a slower pace than more developed regions.

- Middle East and Africa (MEA): The MEA market for knee orthopedic fixators is emerging, driven by improving healthcare expenditure, increasing investment in medical infrastructure, and a rising incidence of trauma. While currently smaller, countries in the Gulf Cooperation Council (GCC) are showing rapid growth due to medical tourism initiatives and high per capita healthcare spending. South Africa also represents a key market due to its advanced healthcare facilities compared to other African nations, though access remains a challenge in many parts of the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Knee Orthopaedic Fixator Market.- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Orthofix Medical Inc.

- Acumed LLC

- Medtronic plc

- B. Braun Melsungen AG

- Wright Medical Group N.V.

- LimaCorporate S.p.A.

- ConMed Corporation

- Össur hf.

- DJO Global (Colfax Corporation)

- Integra LifeSciences Holdings Corporation

- A.R. Medicom Inc.

- Globus Medical Inc.

- Arthrex, Inc.

- Advanced Orthopaedic Solutions

- Bioventus LLC

- OsteoMed L.P.

Frequently Asked Questions

Analyze common user questions about the Knee Orthopaedic Fixator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of knee orthopedic fixators available in the market?

The market primarily offers two main types: external fixators, which consist of pins or wires inserted through the bone and connected to an external frame, commonly used for complex fractures and deformity correction; and internal fixators, which include plates, screws, and intramedullary nails implanted entirely within the body to stabilize bone fragments, often preferred for definitive fracture management and joint reconstruction. Each type has specific indications based on fracture type, patient condition, and surgical goals.

What are the key driving factors for the growth of the Knee Orthopaedic Fixator Market?

The market's growth is predominantly driven by the increasing incidence of orthopedic trauma resulting from road accidents and sports injuries, a globally aging population more prone to fragility fractures, and continuous technological advancements in fixator design, materials, and surgical techniques. Additionally, rising awareness of advanced orthopedic treatments and improving healthcare infrastructure in emerging economies are significant accelerators. These factors collectively increase the demand for effective knee stabilization solutions.

What are the common risks and complications associated with knee orthopedic fixators?

While highly effective, knee orthopedic fixators carry potential risks including pin tract infections, which are the most common complication with external fixators. Other risks include nerve or vascular injury during insertion, delayed union or nonunion of the bone, malalignment if not properly applied, skin irritation, and the potential for discomfort or restricted mobility during the healing phase. Comprehensive surgical planning and diligent postoperative care are crucial to minimize these complications.

How is technological innovation impacting the Knee Orthopaedic Fixator Market?

Technological innovation is profoundly impacting the market through the development of patient-specific fixators via 3D printing and CAD/CAM, enabling superior anatomical fit and reduced surgical time. Advanced biomaterials like PEEK and bioabsorbables are improving biocompatibility and eliminating the need for removal surgeries. Furthermore, the integration of AI, robotic assistance, and smart implants with sensors is enhancing surgical precision, providing real-time healing monitoring, and personalizing rehabilitation protocols, leading to significantly improved patient outcomes.

Which geographical regions are expected to show significant growth in the Knee Orthopaedic Fixator Market?

While North America and Europe currently dominate due to established healthcare systems and high adoption rates, the Asia Pacific region is projected to exhibit the fastest growth. This surge is fueled by a large and aging population, increasing healthcare expenditure, rising medical tourism, and improving access to advanced medical treatments in countries like China and India. Latin America and parts of the Middle East and Africa are also expected to demonstrate steady growth as healthcare infrastructure continues to develop.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager