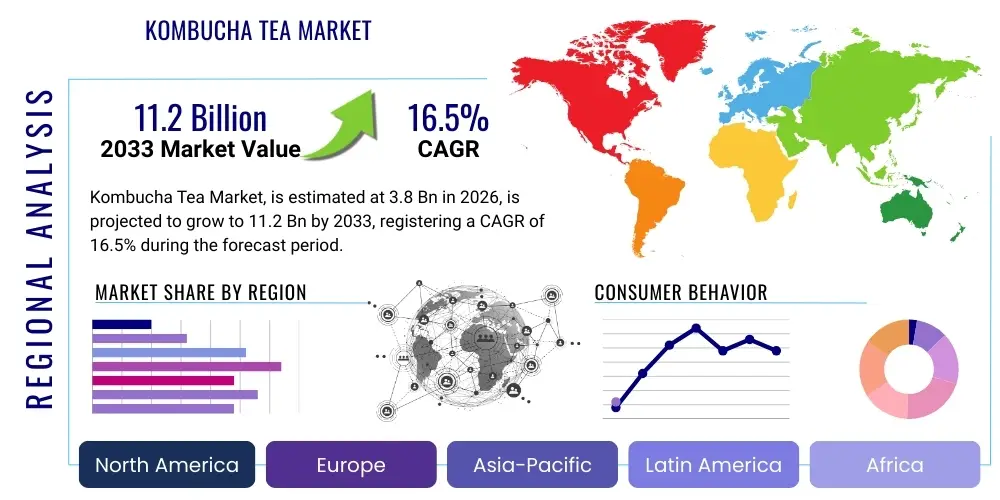

Kombucha Tea Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442496 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Kombucha Tea Market Size

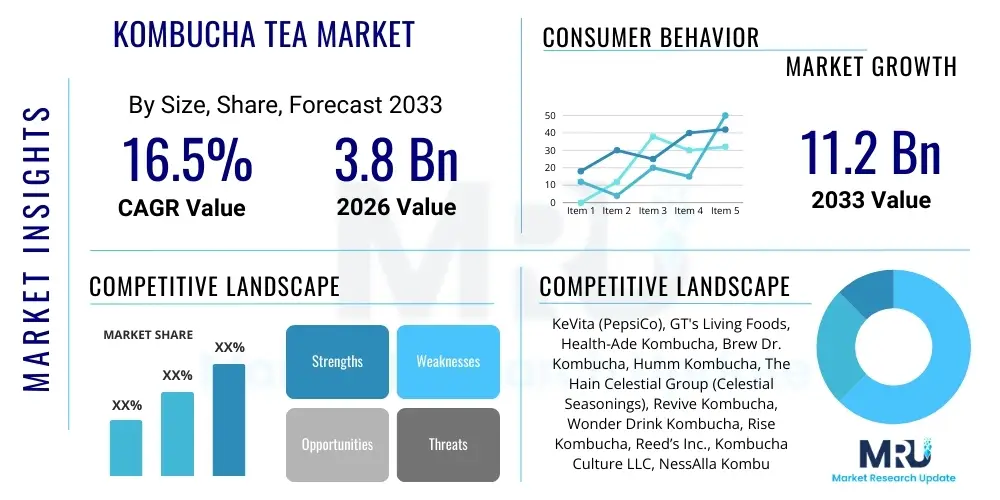

The Kombucha Tea Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Kombucha Tea Market introduction

The Kombucha Tea Market encompasses the production, distribution, and sale of fermented, lightly effervescent sweetened black or green tea drinks that are widely consumed for their purported health benefits, primarily associated with probiotics and organic acids. Kombucha is fundamentally a functional beverage, prepared through the fermentation of tea using a symbiotic culture of bacteria and yeast (SCOBY). This fermentation process is crucial, yielding acetic acid, various vitamins (B vitamins), enzymes, and trace amounts of alcohol, defining its distinct flavor profile which ranges from tart to slightly sweet. The beverage has successfully transitioned from a niche health food store item to a mainstream refreshment, driven by increasing consumer prioritization of gut health and natural, low-sugar alternatives to conventional sodas.

Major applications for kombucha extend beyond general refreshment, positioning the product prominently in the functional foods and beverage sector. Consumers utilize kombucha primarily as a digestive aid due to its probiotic content, a source of antioxidants, and an energy booster attributable to its natural caffeine levels and B vitamins. Furthermore, its versatility allows for continuous innovation in flavor profiles, incorporating fruits, herbs, and spices, which broadens its appeal across diverse demographic groups, including health-conscious millennials and older adults seeking preventative health solutions. The market is characterized by a strong emphasis on transparency in ingredients, organic certification, and sustainable production practices, aligning with modern consumer values.

The primary driving factor propelling the robust growth of the Kombucha Tea Market is the escalating global health and wellness trend. Specifically, the intensified focus on maintaining a healthy gut microbiome has significantly elevated the status of probiotic-rich foods and beverages. Coupled with this, the widespread consumer movement away from sugary drinks, artificial sweeteners, and preservatives has positioned kombucha as a clean-label, natural replacement. Regulatory environments in key markets are also becoming more accommodative of functional beverages, further facilitating market entry and expansion for both artisanal and large-scale producers, ensuring sustained market trajectory over the forecast period.

Kombucha Tea Market Executive Summary

The Kombucha Tea Market is undergoing rapid commercialization, transitioning from small-scale, localized production to globalized, industrial manufacturing processes while maintaining quality and perceived artisanal authenticity. Key business trends include aggressive mergers and acquisitions by major beverage conglomerates seeking to integrate health-focused brands, substantial investment in cold-chain logistics to manage the product’s shelf life requirements, and intensified focus on innovative packaging solutions, such as smaller, on-the-go formats and sustainable materials. Flavor diversification remains paramount, with manufacturers consistently launching exotic and functional ingredient blends (e.g., adaptogens, CBD infusions) to capture wider market segments and maintain consumer interest. The expansion into adjacent categories, such as hard kombucha (alcoholic versions) and kombucha concentrates, also represents a significant avenue for revenue generation and market penetration.

Regionally, North America, particularly the United States, currently dominates the market share due to its established health food culture, high disposable income, and early adoption of functional beverages. However, the Asia Pacific region, especially countries like China, India, and Australia, is poised to exhibit the highest growth rate (CAGR) driven by increasing Western influence on dietary habits, rising awareness of digestive health, and rapid urbanization leading to greater consumption of ready-to-drink (RTD) beverages. European growth is sustained by strong consumer demand in core markets like Germany and the UK, benefiting from robust organic food legislation. Regulatory challenges concerning residual alcohol content remain a regional hurdle, necessitating careful product formulation and labeling strategies across geographical boundaries.

Segment trends reveal that the bottled format (glass and PET) holds the majority market share due to its convenience and preservation properties. In terms of type, the flavored kombucha segment significantly outweighs the traditional unflavored segment, indicating consumer preference for enhanced palatability. Furthermore, the retail distribution channel, including supermarkets and hypermarkets, remains the dominant revenue generator, though online sales channels are experiencing accelerated growth, particularly post-2020, offering direct-to-consumer models and specialized subscriptions. The market structure continues to evolve, balancing the quality perception of premium small-batch producers against the scalability and mass distribution capabilities of global beverage giants.

AI Impact Analysis on Kombucha Tea Market

Common user questions regarding AI's impact on the Kombucha Tea Market center primarily on improving fermentation efficiency, ensuring consistent quality control, optimizing supply chain transparency, and accelerating new product development (NPD). Users frequently inquire about how Machine Learning (ML) can predict SCOBY health and fermentation endpoints to reduce batch variations, a historical challenge for brewers. Concerns also surface around ethical sourcing verification and consumer personalization through AI-driven preference analysis. The expectation is that AI will move kombucha brewing from an artisanal craft relying heavily on manual observation to a data-driven, scalable manufacturing process, enhancing both profitability and global reach while mitigating risks related to spoilage and product recalls.

- AI-driven fermentation optimization: Using sensors and machine learning to monitor temperature, pH, sugar levels, and gas production in real-time, predicting optimal harvest times and ensuring batch-to-batch consistency.

- Predictive quality control: Implementing AI vision systems for automated inspection of bottling lines, detecting contamination or inconsistencies in clarity and effervescence, minimizing human error.

- Supply chain risk management: Utilizing AI for demand forecasting based on regional health trends and seasonal consumption patterns, optimizing inventory levels of tea, sugar, and specialized flavor ingredients.

- Personalized flavor recommendation: Employing Natural Language Processing (NLP) on social media and e-commerce reviews to identify untapped flavor combinations and consumer willingness-to-pay for customized kombucha blends.

- Automation in packaging and logistics: Implementing robotics and advanced routing algorithms to manage the sensitive cold-chain distribution required for preserving live cultures, reducing spoilage during transit.

DRO & Impact Forces Of Kombucha Tea Market

The Kombucha Tea Market is heavily influenced by a confluence of powerful market dynamics encompassing robust drivers, structural restraints, and emerging opportunities that dictate its trajectory. The primary driver remains the pervasive consumer shift toward functional, low-sugar beverages and the validated linkage between gut health and overall immunity, making kombucha a preferred prophylactic drink. However, this growth is structurally restrained by the inherent complexity of maintaining quality due to the live nature of the product, requiring strict temperature control and cold-chain logistics, which increases operational costs substantially. Opportunities lie in the massive, untapped market potential in developing economies and the diversification into related product lines, such as powdered kombucha mixes or hard alcoholic versions, which circumvent some of the storage challenges and cater to different consumer needs.

Market drivers include the increasing prevalence of digestive disorders globally, stimulating demand for probiotic solutions, and the successful marketing campaigns that position kombucha as a sophisticated, healthy alternative to alcohol. Furthermore, governmental initiatives in developed nations promoting healthier lifestyles and taxing high-sugar soft drinks indirectly benefit the consumption of beverages like kombucha. The strong impact of these drivers ensures a sustained high CAGR. Key restraints, beyond logistics, include regulatory ambiguity regarding the definition and labeling of "non-alcoholic" kombucha due to varying residual alcohol levels (0.5% ABV threshold), which often complicates international trade and retail placement. Consumer confusion regarding sugar content in some large-batch commercial brands also occasionally dampens enthusiasm.

The impact forces within the market are predominantly positive, reflecting high supplier power due to the specialized nature of SCOBY production and moderate buyer power as consumers often exhibit brand loyalty within the health beverage segment. Competitive rivalry is intensifying due to the influx of large conventional beverage companies, forcing artisanal producers to invest heavily in differentiation through organic certification, unique ingredients, and superior branding. Technological advancements in non-thermal pasteurization (like high-pressure processing - HPP) offer a critical opportunity by potentially extending shelf life and easing distribution concerns, directly addressing a core restraint and allowing for explosive geographic expansion. This interplay of drivers and opportunities outweighs the current operational and regulatory restraints, pointing toward robust future expansion.

Segmentation Analysis

The Kombucha Tea Market is meticulously segmented based on key parameters including flavor type, ingredient source, product type, packaging format, distribution channel, and geographical region, enabling precise market sizing and strategic targeting. The segmentation analysis highlights the dominant role of flavored varieties, which are critical for mass-market appeal, and the increasing preference for organic and ethically sourced ingredients, reflecting a discerning consumer base willing to pay a premium for authenticity. Analyzing these segments is essential for manufacturers to tailor their supply chain management and marketing efforts, ensuring product alignment with specific consumer demographics and purchasing behaviors, particularly concerning the burgeoning influence of e-commerce platforms and specialized health food stores.

- By Type:

- Flavored

- Unflavored/Original

- By Ingredient Source:

- Organic

- Conventional

- By Distribution Channel:

- Supermarkets/Hypermarkets (Retail Sales)

- Convenience Stores

- Online Retail

- Specialty Food Stores/Health Stores

- Food Service (Cafes, Restaurants)

- By Packaging:

- Glass Bottles

- Cans

- Draft/Kegs (Food Service)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Kombucha Tea Market

The value chain of the Kombucha Tea Market begins with the sourcing of specialized raw materials, primarily high-quality organic black or green tea leaves, refined sugar, and purified water. Upstream activities are critical, involving securing reliable, often certified organic, suppliers for tea and sugar, and the highly specialized process of culturing and maintaining the SCOBY, which serves as the fundamental engine of the product. Due to the high demand for authenticity and specific health claims, managing the quality and origin of these inputs is non-negotiable. Furthermore, the early stages of the value chain involve robust Research & Development focused on optimizing SCOBY health, fermentation kinetics, and the introduction of new, safe flavorings such as cold-pressed juices and botanical extracts. This upstream complexity contributes significantly to the final product cost and differentiation.

Midstream activities involve the primary brewing process, including fermentation, flavoring, and bottling. This stage is capital-intensive, requiring specialized, often temperature-controlled, brewing vats and stringent hygiene protocols to prevent contamination and maintain the live culture viability. Quality control is paramount here, ensuring the final product meets regulatory standards for alcohol content and stability. The downstream segment focuses intensely on storage and distribution. Given that kombucha is a perishable, live product, distribution requires a seamless, reliable cold chain from the manufacturing facility to the point of sale. Direct distribution is often managed by specialized logistics partners capable of handling temperature-sensitive goods, or increasingly, through specialized e-commerce platforms that prioritize speed and temperature management to maintain probiotic efficacy.

Distribution channels are multifaceted, covering both direct and indirect routes. Indirect channels, primarily supermarkets, hypermarkets, and large convenience store chains, account for the bulk of volume sales, benefiting from high foot traffic and established infrastructure. Direct channels include specialized health food stores, farmer’s markets (especially for artisanal brands), and online Direct-to-Consumer (DTC) models. The DTC strategy is gaining momentum as it allows producers to control the brand experience, gather crucial consumer data, and ensure optimal product delivery conditions. The efficiency of the distribution system—whether direct or indirect—is the most critical determinant of market reach and overall profitability in the highly competitive final stages of the value chain.

Kombucha Tea Market Potential Customers

The core potential customer base for the Kombucha Tea Market is broad but fundamentally centered around the health-conscious consumer segments actively seeking functional and natural alternatives to sugary carbonated beverages. This segment includes millennials and Gen Z individuals who prioritize wellness, are highly engaged with dietary trends (such as ketogenic or paleo diets), and demonstrate a high willingness to pay a premium for products perceived as "clean label" or organically sourced. Additionally, potential customers include individuals suffering from minor digestive issues or those actively focusing on preventative healthcare, particularly the middle-aged demographic who are increasingly aware of the benefits of probiotics and gut microbiome health. The product positioning often appeals to fitness enthusiasts looking for natural energy and post-workout recovery drinks.

Beyond these primary segments, there is substantial growth potential among the casual refreshment consumer who is slowly substituting conventional soft drinks with healthier options, often attracted by the unique, complex flavor profiles of modern kombucha blends. Furthermore, the emerging market for hard kombucha targets younger adults seeking lower-calorie, gluten-free, and natural alcoholic beverages, broadening the customer base into the social drinking sphere. Geographically, potential customers are concentrated in urban and peri-urban areas with high concentrations of health food stores and specialized grocery outlets, though rapid retail expansion is bringing the product to mass market consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KeVita (PepsiCo), GT's Living Foods, Health-Ade Kombucha, Brew Dr. Kombucha, Humm Kombucha, The Hain Celestial Group (Celestial Seasonings), Revive Kombucha, Wonder Drink Kombucha, Rise Kombucha, Reed’s Inc., Kombucha Culture LLC, NessAlla Kombucha, Clearly Kombucha, Aqua ViTea Kombucha, Remedy Drinks, High Country Kombucha, LOVO Kombucha, LIVE Soda, Better Booch, Captain Kombucha |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kombucha Tea Market Key Technology Landscape

The technology landscape governing the Kombucha Tea Market is rapidly evolving, moving beyond traditional small-batch fermentation towards scalable, high-throughput manufacturing solutions that ensure both safety and consistency. One of the most critical technologies adopted is High-Pressure Processing (HPP), a non-thermal pasteurization method. HPP significantly extends the refrigerated shelf life of kombucha by inactivating pathogens and spoilage microorganisms without using heat, thus preserving the crucial probiotic and enzymatic activity that constitutes the product's primary health claim. While HPP is capital-intensive, its ability to mitigate distribution risks and open up export markets makes it an essential investment for large-scale players focused on global expansion and reduced product waste.

In addition to post-fermentation processing, technological advancements are deeply integrated into the core brewing operation itself. State-of-the-art breweries utilize advanced fermentation control systems, incorporating Internet of Things (IoT) sensors and sophisticated automation software. These systems monitor parameters such as specific gravity, dissolved oxygen levels, temperature gradients, and pH fluctuations continuously, allowing brewers to maintain ideal conditions for the SCOBY and achieve precise flavor profiles and consistent residual alcohol levels. This technological precision is vital for compliance in markets with strict non-alcoholic labeling requirements (generally less than 0.5% ABV). Furthermore, analytical chemistry tools, such as High-Performance Liquid Chromatography (HPLC), are standard for accurately measuring organic acid profiles and residual sugar content, ensuring quality documentation and transparency.

The future technology trajectory points toward integrating Artificial Intelligence and Machine Learning into process control, as detailed in the AI Impact section. This includes predictive maintenance of brewing equipment and the development of genetically optimized SCOBY cultures designed for specific flavor yields or enhanced stability. Packaging technology is also a significant area of focus, with a push towards lightweight, oxygen-barrier materials like specialized aluminum cans and recycled PET bottles, reducing shipping costs and environmental footprint while maintaining product integrity. Overall, the market's technological evolution is driven by the necessity to reconcile the artisanal perception of kombucha with the demands of industrial scale, focusing on preservation, precision, and efficiency.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Kombucha Tea Market, driven by varying consumer acceptance, regulatory frameworks, and distribution infrastructure sophistication. North America currently leads the global market, largely due to the high concentration of key players, advanced retail networks, and a deeply embedded culture of health and wellness, particularly among affluent urban consumers. The United States market is highly mature but continues to see significant investment in flavor innovation and the rapidly growing hard kombucha category. This maturity is supported by strong consumer education regarding probiotic benefits and a regulatory environment that, while complex regarding alcohol content, is generally favorable to functional beverages.

Europe represents the second-largest market, characterized by strong consumer preference for organic certification and locally sourced ingredients. Countries such as Germany, the United Kingdom, and France exhibit robust growth, propelled by stringent food quality standards and high consumer willingness to pay for premium, clean-label products. However, the European market structure is highly fragmented, with numerous regional players dominating local distribution, which creates barriers for non-EU entrants. Regulatory bodies in Europe maintain a keen focus on accurate labeling and potential sugar content, influencing product reformulation strategies across the continent. The consistent demand for low-sugar, natural products ensures a stable growth trajectory for European kombucha consumption.

The Asia Pacific (APAC) region is projected to register the fastest CAGR over the forecast period. This rapid acceleration is fueled by increasing urbanization, rising disposable incomes, and the growing influence of Western dietary habits that emphasize convenience and health. China and Japan are becoming significant hubs, though market penetration is relatively low compared to North America, indicating vast untapped potential. The traditionally strong Asian focus on fermented foods (e.g., kimchi, natto) predisposes the consumer base to accept kombucha. Challenges in APAC include complex, diverse regulatory landscapes across countries and the need for significant investment in cold-chain infrastructure to ensure product quality across long distances and variable climates. Latin America and the Middle East & Africa (MEA) remain nascent markets, poised for future expansion driven by increasing health awareness and entry by major international beverage brands.

- North America (U.S., Canada): Dominant market share; highly mature; strong focus on hard kombucha innovation; sophisticated cold-chain logistics; high consumer awareness of probiotic benefits.

- Europe (UK, Germany, France): Second largest market; driven by stringent organic and clean-label standards; decentralized distribution networks; emphasis on local sourcing.

- Asia Pacific (China, India, Australia): Highest projected CAGR; fueled by urbanization and rising disposable incomes; significant need for cold-chain infrastructure development; cultural openness to fermented products.

- Latin America (Brazil, Mexico): Emerging growth market; increasing health trends; focus shifting from conventional soft drinks to functional alternatives; challenging retail distribution outside major cities.

- Middle East & Africa (MEA): Nascent stage; growth driven primarily by expatriate populations and high-end urban retail centers; market highly sensitive to import costs and refrigeration capability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kombucha Tea Market.- GT's Living Foods

- KeVita (PepsiCo)

- Health-Ade Kombucha

- Brew Dr. Kombucha

- Humm Kombucha

- The Hain Celestial Group (Celestial Seasonings)

- Revive Kombucha

- Wonder Drink Kombucha

- Rise Kombucha

- Reed’s Inc.

- Kombucha Culture LLC

- NessAlla Kombucha

- Clearly Kombucha

- Aqua ViTea Kombucha

- Remedy Drinks

- High Country Kombucha

- LOVO Kombucha

- LIVE Soda

- Better Booch

- Captain Kombucha

- Kevita Inc.

- Townshend's Tea Company

- Buchi Kombucha

- Happy Kombucha

- Fermentaholics

- Kombucha Brooklyn

- Wild Tonic Jun Kombucha

- Mother Kombucha

- GoodBelly (NextFoods)

- Kite Hill Kombucha

Frequently Asked Questions

Analyze common user questions about the Kombucha Tea market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the expansion of the Kombucha Tea Market?

The market expansion is fundamentally driven by the global consumer shift towards functional beverages and the heightened awareness of the critical link between gut health, immunity, and overall wellness. Consumers are actively seeking natural, low-sugar alternatives to traditional soft drinks, positioning probiotic-rich kombucha as a premium health staple.

How does the residual alcohol content affect the commercial viability of kombucha?

Residual alcohol content, often resulting from the natural fermentation process, is a major regulatory challenge. Products must typically remain below 0.5% Alcohol By Volume (ABV) to be classified as non-alcoholic. Strict adherence to these limits through precise brewing and filtration technologies (like HPP) is essential for mass retail placement and legal compliance globally.

Which geographical region holds the largest market share for kombucha tea?

North America, particularly the United States, holds the largest market share due to early adoption, high consumer disposable income, a robust cold-chain distribution network, and aggressive marketing by both independent and large conglomerate-owned brands focusing on health and wellness.

What technological innovation is most critical for the future scalability of kombucha production?

High-Pressure Processing (HPP) is the most critical technology for scalability. HPP extends the product's refrigerated shelf life without compromising its live probiotic cultures, thereby easing logistical constraints, minimizing spoilage risks, and facilitating broader domestic and international distribution.

Are organic and conventional ingredient sources creating distinct market segments?

Yes, the market is significantly segmented by ingredient source. The Organic segment captures a premium price point and appeals to consumers prioritizing clean-label and sustainability, while the Conventional segment focuses on greater affordability and broader retail accessibility, serving different tiers of the consumer base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager