Laboratory and Handheld Raman Instruments Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442721 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Laboratory and Handheld Raman Instruments Market Size

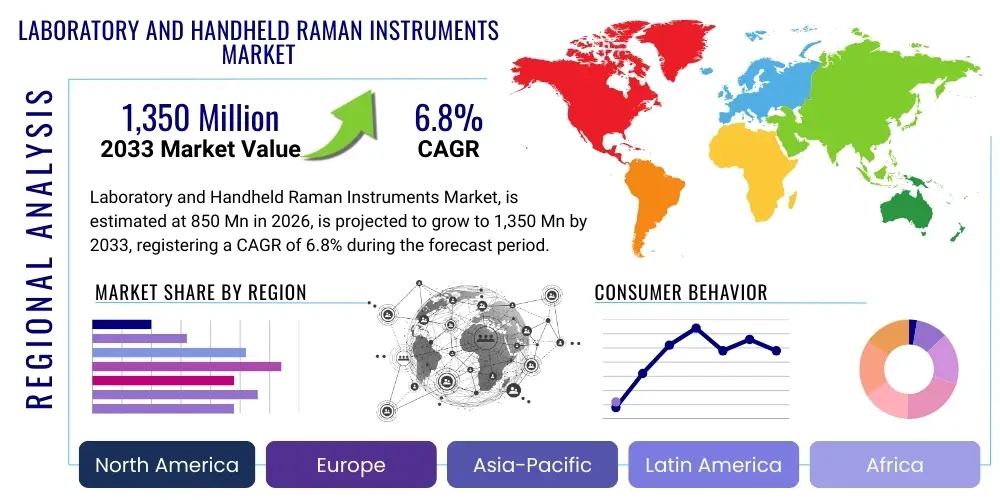

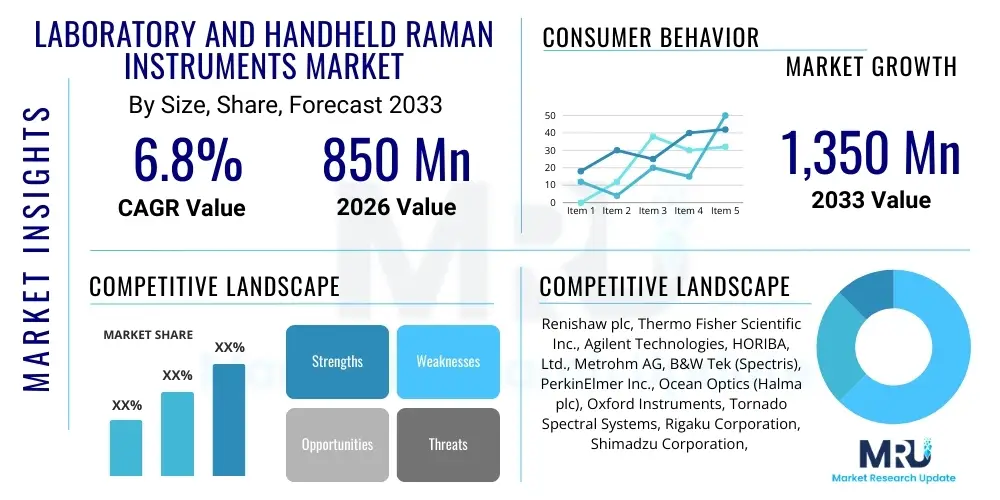

The Laboratory and Handheld Raman Instruments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Laboratory and Handheld Raman Instruments Market introduction

The Laboratory and Handheld Raman Instruments Market encompasses devices utilizing Raman spectroscopy, a powerful analytical technique based on inelastic light scattering, to provide chemical and structural information about materials. These instruments are categorized into sophisticated laboratory-based systems offering high resolution and sensitivity, and compact, portable handheld devices designed for rapid, on-site material verification and quality control. The technique operates by illuminating a sample with a laser, and analyzing the resulting shift in wavelength (Raman shift) of the scattered light, which serves as a unique spectroscopic fingerprint for the molecule or material being analyzed.

Major applications of these instruments span diverse fields, including pharmaceutical quality control, materials science research, forensic analysis, chemical threat identification, and geological exploration. In the pharmaceutical industry, Raman instruments are indispensable for polymorph screening, raw material verification, and process analytical technology (PAT) initiatives, ensuring regulatory compliance and accelerating development cycles. Handheld units, in particular, have revolutionized field operations by enabling non-destructive testing and identification of unknown substances directly at the point of need, such as customs checkpoints or disaster relief zones.

The core benefits driving market adoption include the instruments' ability to analyze samples in various states (solid, liquid, gas), requiring minimal or no sample preparation, and offering high specificity combined with rapid analysis times. Furthermore, continuous technological advancements, such as surface-enhanced Raman scattering (SERS) and spatially offset Raman spectroscopy (SORS), are expanding the detection limits and applicability, particularly in complex matrices. These innovations, coupled with the increasing global emphasis on safety, quality assurance, and faster diagnostic capabilities across industries, are major factors propelling the demand for both advanced laboratory and portable Raman solutions.

Laboratory and Handheld Raman Instruments Market Executive Summary

The Laboratory and Handheld Raman Instruments Market is exhibiting robust growth, fueled primarily by the stringent regulatory environments in the pharmaceutical and food safety sectors and the expanding need for rapid material identification outside traditional laboratory settings. Business trends indicate a strong move toward miniaturization, automation, and integration of artificial intelligence for enhanced spectral interpretation and reduced operator dependency. Key market players are focusing on developing high-throughput screening solutions and specialized probes to address challenging sample types, such as those analyzed through opaque packaging or in hazardous environments. Strategic mergers, acquisitions, and partnerships aimed at expanding geographical footprint and diversifying application portfolios remain critical competitive strategies.

Regionally, North America and Europe currently dominate the market due to established research infrastructures, high R&D spending, and early adoption of advanced analytical technologies in regulated industries. However, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This rapid expansion in APAC is attributable to increasing governmental investments in scientific research, the burgeoning pharmaceutical and biotechnology industries in countries like China and India, and the rising demand for forensic and quality control instruments driven by enhanced manufacturing activities and stricter environmental regulations. Market penetration in Latin America and the Middle East and Africa (MEA) is accelerating, particularly for handheld devices used in security and mining applications.

In terms of segmentation, the Handheld Raman Instruments segment is poised for faster growth compared to traditional laboratory systems, driven by its versatility and cost-effectiveness in field applications. Within application segments, pharmaceutical and life sciences remain the largest consumers, utilizing Raman spectroscopy heavily in raw material identification and formulation analysis. Technology trends highlight the increasing integration of hybrid techniques, combining Raman with other methods (e.g., FTIR) to offer comprehensive analytical solutions. The overarching theme across all segments is the increasing demand for user-friendly, high-precision instruments that can deliver actionable data quickly.

AI Impact Analysis on Laboratory and Handheld Raman Instruments Market

User queries regarding the impact of Artificial Intelligence (AI) on the Raman instruments market frequently center on themes such as automated spectral interpretation, the reduction of false positives, improving signal-to-noise ratios (SNR), and the feasibility of integrating deep learning models into resource-constrained handheld devices. Users are particularly interested in how AI can handle complex mixture analysis—a traditional challenge for standard Raman methods—and how it can standardize data analysis across different instrument models and environmental conditions. Concerns often revolve around the validation of AI models in highly regulated environments (e.g., pharma manufacturing) and the initial cost associated with implementing these advanced computational platforms. Expectations are high regarding AI's potential to transform routine quality control processes from being labor-intensive to fully autonomous.

AI's adoption is rapidly transforming the utility and efficacy of both laboratory and handheld Raman systems. Machine learning algorithms, particularly deep neural networks, are deployed to create highly robust spectral libraries capable of identifying thousands of complex compounds, including subtle molecular variations like polymorphs or isomers, which are often missed by traditional peak-matching methods. This algorithmic refinement drastically reduces the time required for unknown substance identification, transitioning hours of expert analysis into real-time results. For handheld devices, AI enables sophisticated background subtraction and noise filtering, making the identification of trace contaminants or low-concentration ingredients significantly more reliable even under challenging ambient light conditions.

Furthermore, AI-driven data processing facilitates the integration of Raman instruments into larger Process Analytical Technology (PAT) frameworks. By continuously monitoring spectroscopic data streams, predictive maintenance alerts and real-time process adjustments can be executed, optimizing manufacturing efficiency and preventing batch failures. The ability of AI to model complex chemical reactions based on subtle spectral shifts allows researchers to gain deeper kinetic insights, accelerating drug discovery and materials optimization. This shift towards smart, self-optimizing instruments positions AI as a critical differentiator in the competitive landscape, pushing the market toward instruments that are inherently smarter and more adaptable.

- Enhanced Spectral Interpretation: Deep learning models automate the identification of complex mixtures and subtle molecular differences.

- Real-time Quality Control: AI algorithms enable immediate pass/fail decisions in manufacturing and field applications.

- Improved Data Handling: Machine learning optimizes baseline correction and noise reduction, improving data quality from handheld units.

- Automated Diagnostics: AI facilitates rapid troubleshooting and calibration verification, reducing instrument downtime.

- Predictive Modeling: Used for process monitoring (PAT) to forecast reaction endpoints and optimize yields in pharmaceutical synthesis.

- Creation of Robust Libraries: Advanced pattern recognition expands the scope and reliability of chemical libraries for identification.

DRO & Impact Forces Of Laboratory and Handheld Raman Instruments Market

The market dynamics are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and resulting Impact Forces. The primary driver is the global emphasis on quality control, particularly in regulated industries like pharmaceuticals and food safety, requiring high-precision, non-destructive analysis. Opportunities lie significantly in expanding the adoption of portable Raman spectroscopy into emerging applications such as defense, security, and environmental monitoring, leveraging ongoing miniaturization and enhanced battery life. Conversely, the market faces restraints related to the high initial capital expenditure for laboratory-grade systems and the inherent technical limitations of Raman spectroscopy, such as fluorescence interference, which can sometimes mask the weaker Raman signal, necessitating specialized suppression techniques or alternative methodologies.

Key impact forces shape competitive strategies and technological development. The rapid pace of technological innovation, particularly in integrating SERS and SORS for ultra-trace detection, serves as a significant accelerating force, driving product differentiation and higher value proposition. Regulatory compliance acts as a powerful enabling force, mandating the use of validated analytical techniques for material verification. However, the lingering knowledge gap regarding advanced spectroscopic techniques among end-users in developing regions acts as a dampening force, slowing down widespread adoption. Successful market navigation requires vendors to strategically address fluorescence challenges through sophisticated hardware or AI-driven spectral processing while simultaneously making instruments more intuitive for non-specialist users.

The demand for rapid return on investment (ROI) in manufacturing settings strongly influences the adoption trajectory of handheld instruments, positioning them favorably due to their ability to speed up throughput and reduce dependency on central labs. Opportunities in niche applications, such as counterfeit detection in luxury goods or analysis of cultural heritage artifacts, are opening new revenue streams outside traditional life science markets. Managing the competitive pressure from alternative spectroscopic technologies (e.g., Near-Infrared or Mid-Infrared) requires continuous innovation in sensitivity, spectral resolution, and cost-efficiency to maintain Raman spectroscopy's competitive edge in key analytical domains.

Segmentation Analysis

The Laboratory and Handheld Raman Instruments Market is comprehensively segmented based on its modality, offering, application, and end-user. Modality segmentation differentiates between highly specialized, high-resolution laboratory-based spectrometers, which are essential for research and detailed analysis, and the compact, rugged handheld and portable instruments designed for rapid identification and on-site deployment. The offering segment further dissects the market into instruments (hardware) and associated services, including maintenance, calibration, and critical software for advanced data analysis and library management, reflecting the recurring revenue streams for vendors.

Application segmentation reveals the areas of highest demand, led by the pharmaceutical and life sciences sector for quality control, API identification, and PAT. Material science and chemistry follow closely, utilizing Raman for characterizing polymers, semiconductors, and nanomaterials. The public safety and security segment, driven by governmental mandates for narcotics, explosives, and hazardous material identification, constitutes a rapidly expanding niche. End-user segmentation captures the primary purchasing entities, including academic institutions and research laboratories focused on discovery, pharmaceutical and biotechnology companies focused on regulation and manufacturing, and industrial organizations requiring routine QA/QC.

- By Modality:

- Laboratory-Based Raman Spectrometers

- Handheld & Portable Raman Spectrometers

- By Offering:

- Instruments (Hardware)

- Software & Services (Maintenance, Training, Calibration)

- By Application:

- Pharmaceutical & Life Sciences (Drug Discovery, QA/QC, Polymorph Screening)

- Material Science & Chemistry (Polymer Analysis, Nanomaterials Characterization)

- Semiconductor & Electronics

- Public Safety, Security, & Forensics (Explosives and Narcotics Detection)

- Environmental & Geological Analysis

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Industrial Manufacturing (Chemical, Petrochemical)

- Governmental Agencies (Defense, Forensics, Customs)

Value Chain Analysis For Laboratory and Handheld Raman Instruments Market

The value chain for the Raman instruments market begins with upstream activities focused on the sourcing and manufacturing of highly specialized components, which include high-quality laser sources (often diode or solid-state lasers), highly sensitive detectors (like CCD or InGaAs), and precision optics (filters, gratings). The performance and reliability of the final instrument are heavily dependent on the quality control applied during this component manufacturing phase. Key upstream suppliers often specialize in high-precision photonics and optoelectronics, forming a critical, though highly specialized, sub-segment of the overall analytical instrument market. Integration and assembly of these components represent the core value-added step, where proprietary spectral processing software and ergonomic design for handheld units are finalized.

The distribution channel plays a crucial role in delivering the complex instruments to diverse end-users. Direct sales channels are frequently employed for large, high-value laboratory systems, especially to major pharmaceutical companies and government research laboratories, allowing vendors to provide specialized technical support, demonstrations, and customized installation. This direct approach ensures detailed understanding of specific customer application needs. In contrast, handheld instruments, which often require broader market penetration and simpler operational training, frequently utilize indirect channels through regional distributors and specialized scientific equipment dealers. These distributors offer localized sales support, rapid delivery, and basic maintenance services, especially important in geographically dispersed or emerging markets.

Downstream activities center on post-sale services, training, and application support, which generate significant recurring revenue and enhance customer retention. Customers require extensive training on spectral interpretation, method development, and regulatory compliance associated with using Raman data for validation purposes. Given the technical complexity of sophisticated Raman techniques (like SERS or confocal microscopy), strong application support is essential. Ultimately, the efficiency of the value chain is measured by the instrument's ability to consistently deliver accurate, actionable data in the final end-user application, whether that is rapid identification on a loading dock or detailed molecular mapping in a research lab, demonstrating the crucial link between high-quality upstream componentry and robust downstream servicing.

Laboratory and Handheld Raman Instruments Market Potential Customers

Potential customers for Laboratory and Handheld Raman Instruments span highly regulated industries and intensive research environments where non-destructive, rapid chemical analysis is paramount. The primary customers are pharmaceutical and biotechnology companies, which rely on Raman spectroscopy throughout the drug lifecycle—from early-stage API characterization and excipient verification to real-time monitoring of manufacturing processes (PAT). Their strict regulatory requirements, particularly those enforced by bodies like the FDA and EMA, mandate reliable spectroscopic tools, making them the largest and most valuable end-user segment for high-end laboratory systems and integrated PAT solutions.

Another significant customer segment is government and public safety organizations, including forensic laboratories, border patrol agencies, military units, and fire departments. These entities primarily purchase rugged, handheld Raman instruments for on-site identification of illegal substances, explosives, chemical warfare agents, and unknown hazardous materials. The need for speed and unambiguous identification in potentially dangerous environments drives this demand, often resulting in large-scale government contracts for durable portable devices. These customers prioritize robustness, ease of use, and reliability in harsh operational conditions over the ultra-high resolution required by research labs.

Furthermore, academic institutions and industrial material manufacturers constitute substantial customer bases. University and national research laboratories utilize cutting-edge laboratory Raman systems for fundamental research in materials science, physics, and chemistry, focusing on new material discovery (e.g., 2D materials, battery components). Industrial customers, encompassing chemical, petrochemical, and polymer manufacturers, employ Raman instruments for quality assurance of incoming raw materials and finished product inspection, seeking process efficiency and consistency. The diversified needs across these segments—from high-sensitivity research to rapid field deployment—ensure broad customer appeal for the various product offerings in the Raman spectroscopy market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Renishaw plc, Thermo Fisher Scientific Inc., Agilent Technologies, HORIBA, Ltd., Metrohm AG, B&W Tek (Spectris), PerkinElmer Inc., Ocean Optics (Halma plc), Oxford Instruments, Tornado Spectral Systems, Rigaku Corporation, Shimadzu Corporation, WITec GmbH, Kaiser Optical Systems (Endress+Hauser), S&I Photonics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory and Handheld Raman Instruments Market Key Technology Landscape

The technological landscape of the Raman instruments market is characterized by ongoing innovation aimed at overcoming the primary analytical challenge—fluorescence interference—while improving portability, sensitivity, and speed. A pivotal technology is Surface-Enhanced Raman Spectroscopy (SERS), which utilizes nanostructured metallic substrates to significantly amplify the Raman signal of trace analytes, dramatically lowering the limit of detection, particularly crucial for environmental sensing and forensic trace analysis. Another key advancement is Spatially Offset Raman Spectroscopy (SORS), which enables subsurface analysis and material identification through opaque or scattering containers, highly valuable for pharmaceutical authentication and quality control without opening primary packaging, thereby maintaining product sterility and integrity. These advanced techniques are essential in differentiating leading vendors from standard instrument providers.

Miniaturization and integration are transforming the handheld segment. Modern handheld devices incorporate smaller, more efficient laser sources and improved optical designs, allowing for powerful analytical capabilities in highly ergonomic and field-ready packages. Furthermore, the shift from older CCD technology to high-performance, compact complementary metal-oxide-semiconductor (CMOS) detectors has enhanced spectral acquisition speed and sensitivity in portable units. Advanced filter technologies, such as Volume Holographic Gratings (VHG), are also increasingly employed to improve stray light rejection and spectral resolution, ensuring that portable devices can deliver near-laboratory quality data in diverse field conditions. The combination of these hardware refinements is making high-end Raman spectroscopy accessible outside the confines of centralized laboratories.

The integration of advanced software, particularly algorithms rooted in chemometrics and artificial intelligence, represents the computational backbone of the modern Raman instrument. These software solutions handle complex tasks like multi-component mixture analysis, automated baseline removal, and regulatory compliance features, such as 21 CFR Part 11 readiness. Furthermore, developments in low-wavenumber Raman spectroscopy are expanding the utility of these instruments by allowing the analysis of lattice vibrations and crystalline structure, which is vital for polymorph identification in drug development. The future technological trajectory emphasizes hyper-spectral imaging capabilities, coupling Raman analysis with microscopic techniques to provide detailed chemical mapping of heterogeneous samples, accelerating both pathological diagnostics and advanced materials research.

Regional Highlights

North America maintains its leadership position in the Laboratory and Handheld Raman Instruments Market, driven by high expenditure on pharmaceutical R&D, the presence of major analytical instrument manufacturers, and strict regulatory frameworks governing food and drug safety (FDA). The region benefits from robust government funding for scientific research and a highly skilled technical workforce capable of utilizing complex spectroscopic instrumentation. The early and widespread adoption of Process Analytical Technology (PAT) initiatives within the U.S. pharmaceutical manufacturing sector further solidifies North America's dominance, creating consistent high demand for integrated, laboratory-grade Raman systems.

Europe is the second-largest market, exhibiting steady growth, particularly in Germany, France, and the UK. This growth is sustained by strong academic research programs, significant investment in material science and chemistry, and increasing governmental focus on security and forensic science, leading to high uptake of handheld units by law enforcement agencies. European regulations concerning product quality and environmental standards are rigorous, necessitating the continuous application of high-precision analytical tools like Raman spectroscopy for compliance and verification across multiple industrial sectors, including chemicals and automotive manufacturing.

Asia Pacific (APAC) is projected to experience the fastest CAGR during the forecast period. This accelerated growth is primarily attributed to the rapid expansion of the generic drug manufacturing industry in China and India, increased investment in biomedical research, and improving healthcare infrastructure. Furthermore, growing concerns over counterfeit products, food adulteration, and industrial material quality compel manufacturers and regulators in APAC countries to invest in cost-effective, high-throughput analysis tools, making handheld Raman devices particularly attractive for inspection purposes at ports and manufacturing facilities. Market penetration is increasing as local vendors emerge and global players expand their distribution networks throughout the region.

- North America (USA, Canada): Market leader due to large pharmaceutical R&D base, stringent FDA regulations, and advanced academic research institutions. Focus on high-throughput lab systems and integrated PAT solutions.

- Europe (Germany, UK, France): Strong demand driven by chemical and material science industries, robust academic research funding, and increasing adoption of portable devices for public security applications.

- Asia Pacific (China, India, Japan): Fastest-growing region due to expanding generic pharmaceutical manufacturing, rising government investment in science and technology, and urgent need for quality control against counterfeit goods.

- Latin America (Brazil, Mexico): Emerging market driven by growth in mining/petrochemical sectors and initial governmental investments in forensic capabilities. Price sensitivity favors handheld and mid-range instruments.

- Middle East & Africa (MEA): Growth centered around oil & gas processing (petrochemical analysis), mining operations, and increasing counter-terrorism/security needs, driving demand for robust field-portable devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory and Handheld Raman Instruments Market.- Renishaw plc

- Thermo Fisher Scientific Inc.

- Agilent Technologies

- HORIBA, Ltd.

- Metrohm AG

- B&W Tek (Spectris)

- PerkinElmer Inc.

- Ocean Optics (Halma plc)

- Oxford Instruments

- Tornado Spectral Systems

- Rigaku Corporation

- Shimadzu Corporation

- WITec GmbH

- Kaiser Optical Systems (Endress+Hauser)

- S&I Photonics

- SciAps, Inc.

- Bruker Corporation

- Foss Analytical A/S

- Anacom Solutions

- Avantes BV

Frequently Asked Questions

Analyze common user questions about the Laboratory and Handheld Raman Instruments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between laboratory and handheld Raman instruments?

Laboratory instruments offer superior spectral resolution, higher sensitivity, and greater customization (e.g., confocal microscopy, multiple laser options), making them ideal for complex research and method development. Handheld instruments prioritize speed, portability, ruggedness, and ease of use for rapid, on-site material identification and pass/fail quality checks in the field or manufacturing environment.

How does fluorescence interference affect Raman spectroscopy, and how is it mitigated?

Fluorescence, the emission of light by a sample excited by the laser, is typically much stronger than the Raman signal and can overwhelm it, making analysis impossible. Mitigation strategies include using near-infrared (NIR) excitation lasers (785 nm or 1064 nm) to move the excitation energy outside the fluorescence range, sample preparation techniques, or employing sophisticated software algorithms and time-resolved methods to subtract the fluorescence background.

Which application segment drives the highest demand for Raman instruments?

The Pharmaceutical and Life Sciences segment drives the highest demand. Raman spectroscopy is crucial for identifying raw materials, verifying Active Pharmaceutical Ingredients (APIs), performing polymorph screening, and implementing real-time Process Analytical Technology (PAT) to ensure quality and regulatory compliance throughout the drug manufacturing process.

What is the role of Artificial Intelligence (AI) in modern Raman instruments?

AI, specifically machine learning and deep learning, is utilized to automate and enhance data analysis. AI improves baseline correction, handles spectral deconvolution for complex mixtures, reduces false positives, and enables faster, more accurate identification of substances by building highly robust, self-learning spectral libraries, greatly improving the usability of both lab and field instruments.

Which geographic region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth. This is due to rapidly industrializing economies, significant growth in local pharmaceutical and biotechnology sectors (especially in China and India), increasing regulatory pressure for quality control, and substantial government investment in scientific research infrastructure.

The Laboratory and Handheld Raman Instruments Market is undergoing a rapid evolution characterized by the confluence of advanced photonics, algorithmic intelligence, and the global imperative for rapid material characterization. The persistent challenge of fluorescence is increasingly being addressed through technical innovations such as longer excitation wavelengths and advanced filtering systems, making the technology viable for a broader range of real-world samples. The transition of Raman spectroscopy from a purely academic tool to a critical industrial and security asset is fundamentally reshaping the competitive landscape. Vendors are focusing heavily on developing robust, validated solutions that integrate seamlessly into existing regulatory and operational frameworks, particularly within the highly scrutinized pharmaceutical manufacturing environment. This emphasis on integration and validation, coupled with the increasing computational power available even in handheld devices, ensures that Raman instruments remain a cornerstone of modern analytical chemistry. Furthermore, the societal push for enhanced border security, rapid identification of chemical threats, and sustainable environmental monitoring provides significant, enduring tailwinds for market expansion, ensuring steady growth across all modality segments over the forecast period. The strategic application of advanced materials science in sensor development, particularly for SERS substrates, continues to unlock new frontiers in ultra-trace detection capabilities, promising continued high-value applications in niche but critical areas.

To maintain growth momentum, key market participants are heavily investing in application-specific product development, moving beyond general-purpose instruments to highly optimized tools tailored for specific regulatory requirements, such as those governing in-situ measurement in bioreactors or hazardous material screening in defense logistics. This specialization enhances the instrument's utility and increases the perceived ROI for end-users, especially in capital-intensive sectors. Furthermore, comprehensive service agreements and training packages are becoming standard offerings, reflecting the market’s recognition that complex instrumentation requires strong technical support to ensure optimal operation and data integrity. The global market is thus segmenting not just by instrument type, but also by the quality and comprehensiveness of the accompanying service and software ecosystem.

The competitive dynamics are highly sensitive to technological breakthroughs. Companies that successfully implement user-friendly interfaces combined with powerful, AI-driven data processing capabilities are likely to capture significant market share in the high-volume handheld sector. Meanwhile, innovation in laser technology, particularly the pursuit of smaller, more stable, and higher-power lasers, remains crucial for laboratory systems seeking to achieve deeper sample penetration and faster acquisition times. Regional growth disparities highlight the need for tailored market entry strategies; North America and Europe demand feature-rich, integrated solutions compliant with strict validation protocols, whereas APAC and MEA markets show greater sensitivity to overall cost and prioritize the robustness and portability of field units for large-scale quality inspection programs. This duality of market need necessitates a balanced product portfolio from global leaders, addressing both the high-end research requirements and the high-volume field application demands.

The sustained growth of the Laboratory and Handheld Raman Instruments Market is inextricably linked to global trends in digitalization and regulatory harmonization. The ongoing digitalization of industrial processes facilitates the integration of Raman data into larger data management systems (LIMS, MES), enhancing traceability and decision-making capabilities. Regulatory bodies worldwide are increasingly accepting spectroscopic methods as validated alternatives to traditional wet chemistry techniques, which reduces friction for adoption, particularly in emerging markets where setting up sophisticated wet labs might be cost-prohibitive. Consequently, the future growth trajectory is likely to see Raman spectroscopy transition from an advanced analytical option to a mandated component of modern industrial and scientific infrastructure.

Further detailed analysis of the market reveals that component suppliers are consolidating their technological offerings, leading to standardized, high-performance modular components that accelerate innovation cycles for instrument manufacturers. For example, advancements in specialized volume phase holographic (VPH) gratings and highly sensitive low-noise scientific complementary metal-oxide-semiconductor (sCMOS) sensors are providing instrument designers with better tools to enhance signal collection efficiency and maintain small form factors. This modularity ensures that instrument updates can be deployed more rapidly, keeping pace with the evolving demands of end-users. Additionally, there is a growing trend toward multi-modal instruments, combining Raman spectroscopy with techniques like Atomic Force Microscopy (AFM) or Electron Microscopy (EM), allowing researchers to simultaneously obtain chemical and topographical information at the nanoscale, thereby catering to the highly specialized demands of advanced materials research and nanotechnology applications.

In the context of competitive positioning, intellectual property protection surrounding proprietary SERS substrates and patented SORS configurations provides a significant barrier to entry for new market players. Companies investing heavily in developing unique, high-performance substrates for enhanced sensitivity gain a distinct advantage in applications such as ultra-trace contaminant detection and biological marker analysis. Furthermore, the development of robust, pre-calibrated spectral libraries tailored to specific end-user segments (e.g., narcotics libraries for law enforcement, or excipient libraries for pharma QA/QC) reduces the learning curve for new users, thereby increasing the market appeal of the instruments. The ability to offer these comprehensive, application-ready solutions, rather than just the hardware, is a crucial determinant of market success and long-term customer loyalty in the analytical instruments sector.

The geopolitical landscape also impacts the market, particularly concerning supply chain resilience for critical optical components and the export controls placed on high-powered lasers and specialized detection equipment used in defense-related applications. Manufacturers are increasingly diversifying their sourcing and manufacturing footprints to mitigate risks associated with geopolitical instability and trade tariffs. This focus on supply chain robustness is essential for ensuring continuous production and delivery, particularly for high-volume handheld units often sourced globally. Simultaneously, the market is witnessing the rise of niche players offering highly specialized, compact systems (often OEM components) focused on integration into larger automated platforms or drones for remote sensing applications, reflecting the ongoing expansion of Raman spectroscopy beyond the benchtop and field application into autonomous surveillance and process monitoring systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager