Laboratory Automation Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443624 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Laboratory Automation Systems Market Size

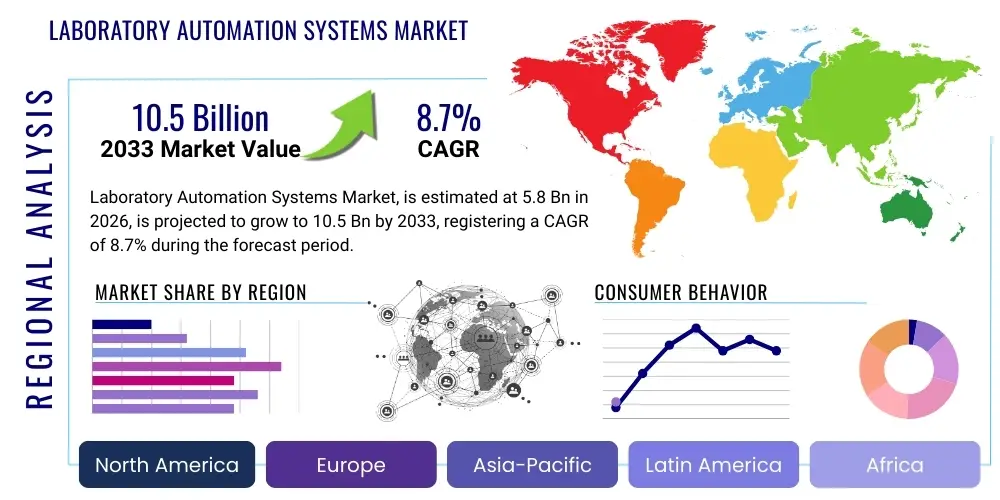

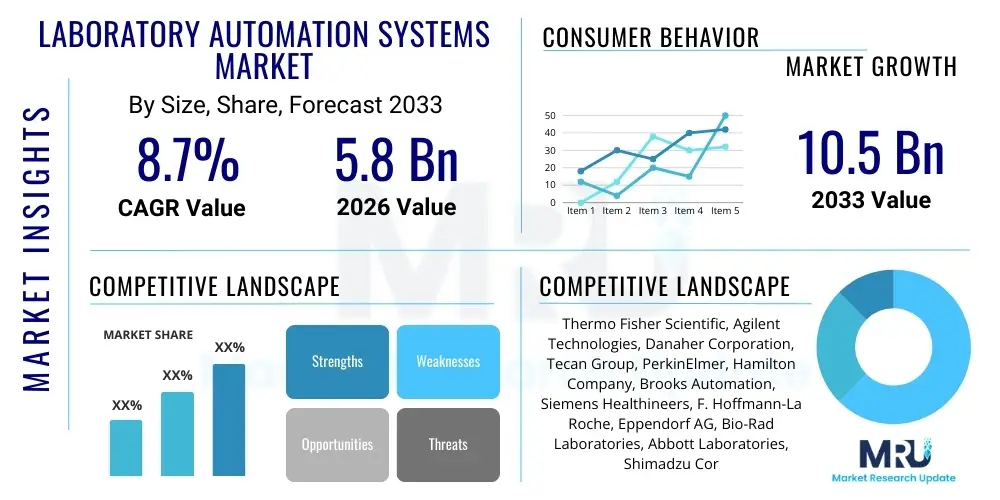

The Laboratory Automation Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033.

Laboratory Automation Systems Market introduction

Laboratory Automation Systems encompass a variety of technologies and devices, including robotic systems, automated liquid handlers, and integrated software platforms, designed to streamline, optimize, and standardize laboratory processes. These systems reduce manual labor, minimize human error, and accelerate high-throughput screening, particularly in complex research environments like drug discovery and clinical diagnostics. The primary product categories include automated workstations, robotic arms, and sophisticated data management software that connects various instruments into a seamless workflow, ensuring repeatable and reliable results across diverse scientific applications.

Major applications of laboratory automation span across pharmaceutical and biotechnology research, clinical diagnostics, genomics, and proteomics. In drug discovery, automation is crucial for compound screening and optimization, allowing thousands of samples to be processed rapidly and efficiently. For clinical laboratories, automation enhances sample handling, testing accuracy, and turnaround time, which is vital for patient care and epidemiological studies. The core benefit of adopting these systems lies in improving operational efficiency, increasing sample throughput, and enabling scientists to focus on data analysis rather than repetitive manual tasks, thereby accelerating the pace of scientific breakthroughs.

Driving factors for market expansion include the surging demand for high-throughput screening methods, driven by the escalating complexity of biological research and the need for rapid drug development, especially in response to global health crises. Furthermore, the growing focus on precision medicine, which requires extensive molecular profiling and personalized diagnostic testing, necessitates highly accurate and scalable automated solutions. Increased funding for life sciences research, coupled with technological advancements in robotics, artificial intelligence integration, and miniaturization of laboratory processes, further fuel the adoption of integrated laboratory automation platforms globally.

Laboratory Automation Systems Market Executive Summary

The global Laboratory Automation Systems Market is characterized by robust growth, driven primarily by the biopharmaceutical sector's investment in accelerating drug discovery pipelines and the clinical sector’s pursuit of standardized, high-volume diagnostic testing. Key business trends indicate a strong shift towards fully integrated, modular automation solutions rather than standalone instruments, facilitated by open-architecture software platforms that enable seamless communication between devices from different vendors. Strategic partnerships focusing on vertical integration—combining hardware manufacturing with sophisticated bioinformatics tools—are defining competitive strategies, aimed at offering end-to-end solutions from sample preparation to data interpretation.

Regionally, North America maintains market dominance due to significant R&D expenditures, the presence of major pharmaceutical and biotech hubs, and supportive regulatory frameworks promoting advanced diagnostic technologies. However, the Asia Pacific region is poised for the fastest growth, propelled by rapidly developing healthcare infrastructure, increasing outsourcing of clinical trials, and growing government initiatives to boost domestic life science research capabilities, particularly in China and India. Europe also represents a mature market, driven by stringent quality standards and established academic research institutions continually seeking efficiency gains through automation.

Segment trends reveal that Automated Liquid Handling Systems remain the largest component due to their foundational role in nearly all high-throughput workflows. Application-wise, drug discovery continues to be the dominant segment, reflecting continuous investment in small molecule and biologics development. End-user adoption is increasingly concentrated among large pharmaceutical and biotechnology companies that possess the capital required for high-initial-cost automation infrastructure, though smaller contract research organizations (CROs) are also rapidly adopting flexible, modular systems to enhance service offerings and scalability in competitive outsourcing markets.

AI Impact Analysis on Laboratory Automation Systems Market

Users frequently inquire about AI's role in optimizing experimental design, enhancing data quality, and improving the decision-making process within automated laboratories. Common concerns center on the necessary infrastructure upgrades, the integration challenges between existing legacy automation hardware and new AI algorithms, and the reliability of AI-driven experimental predictions versus traditional heuristic methods. Expectations are high regarding AI's ability to minimize reagent waste, predict system failures before they occur (predictive maintenance), and generate novel scientific hypotheses from vast, complex data sets. The consensus emphasizes that AI is transforming automation from simply performing repetitive tasks to intelligently guiding the entire workflow, maximizing efficiency and accelerating scientific outcomes.

- AI-driven experimental design optimization, reducing necessary physical experiments and time-to-result.

- Enhanced predictive maintenance for automation hardware, minimizing downtime and increasing operational longevity.

- Advanced image analysis and pattern recognition for automated screening, improving accuracy in microscopy and cell culture analysis.

- Integration of machine learning algorithms for complex data interpretation, transforming raw automation data into actionable scientific insights.

- Smarter liquid handling protocols, dynamically adjusting pipetting parameters based on real-time feedback and sample viscosity.

- Development of self-optimizing laboratory workflows that automatically adjust parameters based on performance metrics.

DRO & Impact Forces Of Laboratory Automation Systems Market

The Laboratory Automation Systems Market is primarily driven by the imperative to increase sample throughput and reduce manual error, coupled with substantial investments in drug discovery research, particularly concerning personalized medicine and biologics development. Restraints include the high initial capital expenditure required for sophisticated integrated systems and the significant barriers associated with integrating diverse instruments and training technical personnel to manage complex automated workflows. Opportunities abound in the burgeoning adoption of modular, flexible automation solutions tailored for smaller laboratories and Contract Research Organizations (CROs), as well as the increasing integration of AI and machine learning to optimize experimental protocols. The collective impact forces highlight a strong positive momentum, with technological innovation in miniaturization and robotics continuously mitigating cost restraints and driving wider acceptance across diverse scientific disciplines.

Segmentation Analysis

The Laboratory Automation Systems Market is intricately segmented based on product type, application, and end-user, reflecting the diverse needs across the life science and clinical sectors. Product segmentation details the specific instruments that comprise automation systems, ranging from sophisticated liquid handlers to integrated robotic arms and microplate systems, each serving distinct functional roles in the automated laboratory. Application segmentation highlights the areas where automation provides the most value, predominantly in drug discovery and clinical diagnostics where high-throughput processing is mandatory. End-user classification differentiates market consumption patterns based on organizational structure and budgetary capacity, focusing on the distinct purchasing behaviors of pharmaceutical giants versus academic institutions or diagnostic centers, providing a granular view of market dynamics and adoption rates across the healthcare ecosystem.

- By Product:

- Automated Liquid Handling Systems

- Microplate Readers

- Robotic Systems (Robotic Arms, Track-Based Systems)

- Automated Storage and Retrieval Systems (ASRS)

- Automated Plate Handlers

- Software & Informatics (LIMS, Scheduling Software)

- By Application:

- Drug Discovery

- Clinical Diagnostics

- Genomics and Proteomics

- Data Analytics and High-Throughput Screening

- Microbiology

- By End User:

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Hospitals and Diagnostic Laboratories

- Contract Research Organizations (CROs)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Laboratory Automation Systems Market

The value chain for the Laboratory Automation Systems market begins with upstream activities involving the sourcing and manufacturing of high-precision components, including specialized robotics, sensors, microfluidic chips, and sophisticated electronics. Key suppliers in this stage include specialized component manufacturers and software developers who provide the foundational technology platforms. Ensuring component quality and standardization is critical here, as the reliability of the final automation system depends heavily on the precision of these core elements. The subsequent midstream stage involves system integrators and original equipment manufacturers (OEMs) who assemble, program, and test the complex automation workflows, often customizing solutions based on specific end-user requirements, such as integrating liquid handlers with analytical instruments.

Downstream activities focus on distribution, installation, post-sales support, and maintenance, which are crucial given the complexity and high cost of these systems. Distribution channels are typically a mix of direct sales forces employed by major manufacturers (for large, complex installations in major pharma companies) and specialized third-party distributors or value-added resellers (VARs) who provide localized support and regional expertise. Direct channels ensure tight control over specialized technical sales and integration services, while indirect channels provide wider geographical reach, especially in emerging markets where local partnerships are essential for market penetration and timely technical service.

The service component—maintenance, software updates, and application support—is a critical revenue stream and differentiation factor in the downstream market. Since automation systems require constant calibration and specialized troubleshooting, the quality of post-installation support directly impacts customer satisfaction and system uptime. The continuous feedback loop between end-users and manufacturers regarding performance, reliability, and desired functional enhancements drives ongoing R&D, thereby optimizing the entire value chain towards greater efficiency and responsiveness to evolving laboratory needs.

Laboratory Automation Systems Market Potential Customers

The primary consumers and buyers of Laboratory Automation Systems are entities requiring high-volume sample processing, unparalleled precision, and standardized workflows in scientific or clinical settings. Pharmaceutical and biotechnology companies are major customers, utilizing automation extensively in drug discovery processes, including target validation, compound screening, and toxicology testing, necessitating large, fully integrated systems capable of operating 24/7. These organizations seek systems that can significantly reduce the time required to move from basic research to preclinical trials, directly impacting their competitive advantage and return on investment in R&D.

Academic and governmental research institutions represent another crucial customer segment, particularly those involved in large-scale genomics, proteomics, and infectious disease research. While often operating with tighter budgets than commercial entities, they prioritize flexibility and modularity to accommodate diverse and evolving research protocols. Their purchasing decisions are often influenced by grant funding cycles and the ability of the automation system to support collaborative, multidisciplinary projects. Furthermore, the rise of specialized core facilities within universities provides a centralized hub for high-end automation equipment utilized by multiple research groups.

Diagnostic laboratories and hospitals are rapidly increasing their adoption, driven by the need to manage massive patient sample loads, comply with strict regulatory standards (e.g., CLIA, ISO), and reduce the risk of human error in clinical testing. Automation here focuses on sample identification, sorting, pre-analytical processing, and connection to LIMS (Laboratory Information Management Systems) to ensure swift and accurate reporting of patient results. The growing trend towards personalized diagnostics, requiring intricate molecular testing, further solidifies diagnostic labs as significant end-users seeking robust and compliant automation solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Agilent Technologies, Danaher Corporation, Tecan Group, PerkinElmer, Hamilton Company, Brooks Automation, Siemens Healthineers, F. Hoffmann-La Roche, Eppendorf AG, Bio-Rad Laboratories, Abbott Laboratories, Shimadzu Corporation, Aurora Biomed, Accelerating Technologies Inc., SOTAX AG, Becton, Dickinson and Company, Synchron Lab Automation, Cerner Corporation, QIAGEN N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory Automation Systems Market Key Technology Landscape

The contemporary technology landscape of the Laboratory Automation Systems Market is defined by the convergence of precision engineering, advanced robotics, and sophisticated informatics. Core technologies include high-precision automated liquid handling (e.g., contactless dispensing systems and microfluidics-based pipetting), which ensures minimal sample loss and high accuracy even at nanoliter volumes, crucial for cost-effective research. Robotic arms (e.g., articulated and cartesian robots) are becoming more collaborative (cobots) and flexible, allowing them to safely operate alongside human technicians and adapt quickly to changing experimental layouts. Furthermore, track-based conveyor systems are standard in high-throughput labs, physically linking disparate instruments into an integrated workflow, providing rapid and reliable sample movement.

Software and data integration technologies are arguably the most critical components of modern automation. Laboratory Information Management Systems (LIMS) and specialized scheduling software coordinate the complex sequence of automated tasks and manage the vast quantities of generated data. The move toward cloud-based LIMS allows for remote access, real-time monitoring, and centralized data storage, facilitating global collaboration. Furthermore, machine vision systems (using cameras and specialized algorithms) are increasingly employed for quality control, verifying sample integrity, monitoring plate positions, and ensuring adherence to protocol, thereby enhancing the reliability of the entire automated process.

Future technological trends emphasize miniaturization and system intelligence. Microplate readers are advancing to incorporate complex detection methods (e.g., high-content screening capabilities), providing richer data from smaller sample volumes. The introduction of integrated sensors and IoT (Internet of Things) functionality allows automation platforms to constantly monitor their own performance and environmental conditions, feeding data back into AI systems for predictive maintenance. This shift ensures higher uptime and better experimental fidelity, transforming automation systems from simple mechanical tools into intelligent, self-regulating research partners capable of handling increasingly complex biological assays.

Regional Highlights

- North America: Dominates the global market, largely due to exceptionally high R&D spending by pharmaceutical and biotechnology giants in the US and Canada. The region benefits from robust government funding for life sciences research, early adoption of cutting-edge technologies like high-content screening and advanced genomics, and the presence of numerous top-tier academic research institutions. Market maturity is high, focusing on replacing older systems with fully integrated, scalable platforms.

- Europe: Represents a significant market share, driven by stringent regulatory frameworks (which necessitate standardized automation), strong academic research in countries like Germany, the UK, and Switzerland, and a thriving contract research organization (CRO) sector. The European market focuses heavily on quality control, clinical diagnostics automation, and maintaining robust standards in drug manufacturing and testing.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR during the forecast period. Growth is fueled by massive investments in healthcare infrastructure expansion, rising prevalence of chronic diseases necessitating complex diagnostic testing, and increasing outsourcing of research activities (clinical trials and preclinical testing) to countries like China, India, and South Korea, where cost-effective labor combined with new automation capabilities creates a compelling value proposition.

- Latin America (LATAM): Growth is steady, primarily concentrated in clinical diagnostics and public health initiatives in major economies such as Brazil and Mexico. The market is moderately constrained by capital investment limitations but is actively seeking modular, cost-efficient automation solutions to improve throughput in established diagnostic centers.

- Middle East & Africa (MEA): Currently the smallest market but shows potential, especially in the GCC countries (Gulf Cooperation Council) which are heavily investing in specialized medical city projects and building world-class biomedical research centers. Adoption is focused on high-end diagnostics and specialized genomics facilities, often procured through large government contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory Automation Systems Market.- Thermo Fisher Scientific

- Agilent Technologies

- Danaher Corporation

- Tecan Group

- PerkinElmer

- Hamilton Company

- Brooks Automation

- Siemens Healthineers

- F. Hoffmann-La Roche

- Eppendorf AG

- Bio-Rad Laboratories

- Abbott Laboratories

- Shimadzu Corporation

- Aurora Biomed

- Accelerating Technologies Inc.

- SOTAX AG

- Becton, Dickinson and Company

- Synchron Lab Automation

- Cerner Corporation

- QIAGEN N.V.

Frequently Asked Questions

Analyze common user questions about the Laboratory Automation Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Laboratory Automation Systems market?

The primary drivers include the urgent need for high-throughput screening (HTS) in drug discovery, the rising demand for standardized, accurate clinical diagnostics, and increasing global investments in genomics and personalized medicine research which mandate precise, large-scale processing capabilities.

Which product segment holds the largest share in the Laboratory Automation Systems market?

Automated Liquid Handling Systems typically hold the largest market share due to their fundamental role in nearly all automated laboratory workflows, including sample preparation, reagent dispensing, and assay setup across diverse applications like PCR, ELISA, and cell culture.

What is the main challenge faced by organizations adopting new laboratory automation?

The most significant challenge is the substantial upfront capital investment required for purchasing, integrating, and maintaining complex robotic and software infrastructure, coupled with the necessity for specialized technical training and the difficulty of integrating new systems with existing legacy lab equipment.

How is AI transforming the future of laboratory automation?

AI is moving automation beyond simple task execution by enabling predictive maintenance, optimizing complex experimental protocols, improving data analysis through machine learning, and facilitating robotic systems to dynamically adapt to varying experimental conditions, thereby accelerating discovery cycles.

Which geographical region is expected to show the fastest growth rate for laboratory automation?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by improving healthcare infrastructure, substantial government support for life science research, and the increasing trend of outsourcing clinical trials and drug manufacturing to countries within the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager