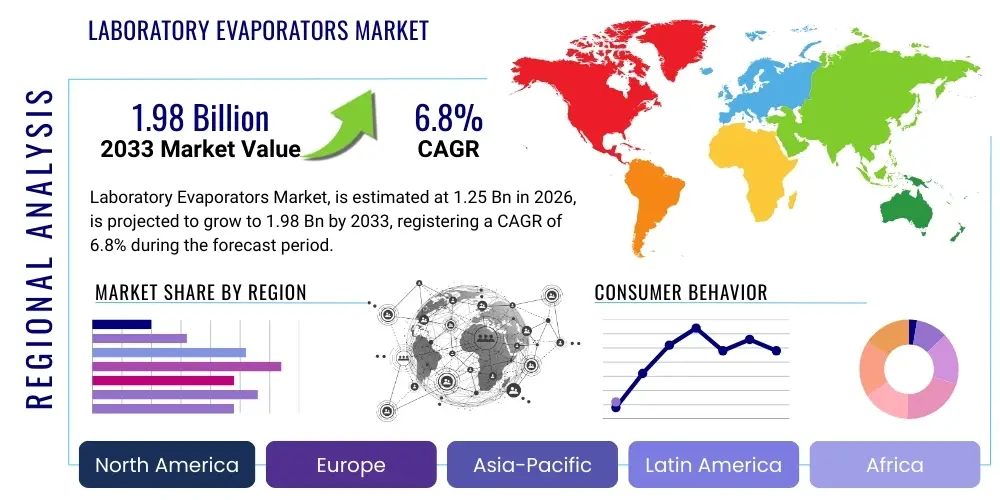

Laboratory Evaporators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442659 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Laboratory Evaporators Market Size

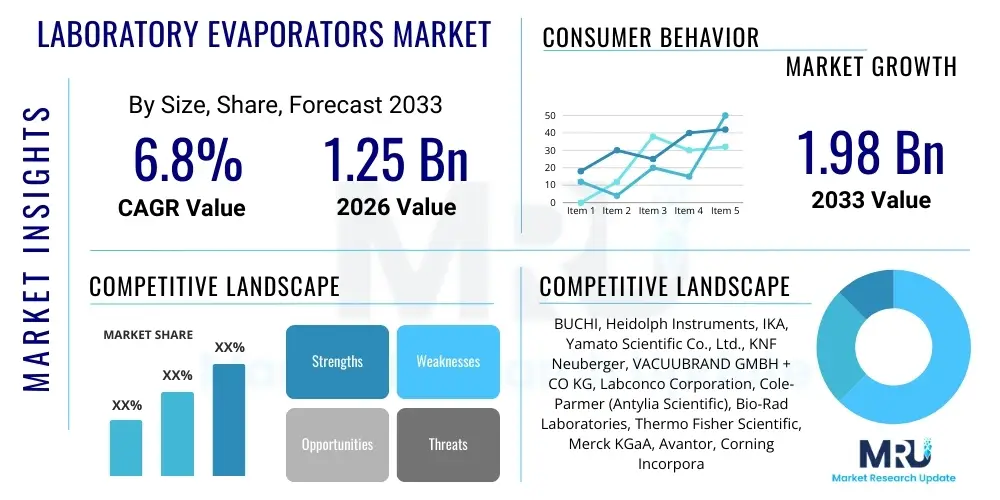

The Laboratory Evaporators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.98 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fueled by burgeoning research and development activities across the pharmaceutical, biotechnology, and chemical sectors, coupled with increasing governmental and private funding allocated for life sciences research globally. The necessity for efficient, high-throughput sample preparation techniques in analytical chemistry, quality control, and synthetic chemistry laboratories acts as a primary economic propellant for market expansion.

The valuation reflects robust demand for advanced evaporation technologies, particularly automated and robotic evaporation systems that enhance efficiency and safety in laboratories dealing with volatile solvents. Regulatory mandates requiring stringent quality control and impurity testing in drug development and environmental monitoring further solidify the market's foundation. Furthermore, the shift towards environmentally conscious laboratory practices, driving demand for efficient solvent recovery and reduced energy consumption, influences the adoption of newer, technologically superior evaporators, such as parallel evaporators and high-speed centrifugal systems.

Laboratory Evaporators Market introduction

The Laboratory Evaporators Market encompasses specialized scientific instruments designed for the efficient removal of solvents from samples, concentrating solutes for subsequent analysis, synthesis, or storage. These essential devices operate on principles such utilizing heat, vacuum, or centrifugal force to accelerate the evaporation process, thereby facilitating crucial steps in sample preparation across diverse scientific disciplines. Key product categories include rotary evaporators, which are fundamental in chemical synthesis and purification; centrifugal evaporators, valued for high-throughput capabilities in proteomics and genomics; and nitrogen blowdown evaporators, commonly utilized for environmental and clinical sample preparation, offering precision and minimizing sample loss.

Major applications of laboratory evaporators span drug discovery and development, where they are critical for compound synthesis, crystallization, and solvent removal; environmental analysis, necessary for concentrating contaminants from large volume samples; and food and beverage testing, ensuring quality and safety standards by preparing extracts for residual analysis. The primary benefits derived from using modern evaporators include enhanced sample integrity through precise temperature and vacuum control, improved laboratory efficiency via automation and parallel processing capabilities, and increased safety by handling volatile or hazardous solvents in closed systems. These instruments ensure reliable, reproducible results, which are paramount in regulatory environments like GMP and GLP settings.

Driving factors propelling market growth include escalating global investments in biopharmaceutical R&D, particularly in small molecule drug synthesis and personalized medicine initiatives, which require vast quantities of specialized sample processing. Technological advancements, such as the integration of smart sensors, robotic sample handling, and intuitive touchscreen interfaces, contribute significantly to user adoption by minimizing manual intervention and maximizing throughput. Moreover, the increasing demand for high-purity chemicals and compounds in emerging economies, combined with stricter regulatory scrutiny over chemical residuals, necessitates the use of high-precision evaporation equipment, thus sustaining robust market expansion throughout the forecast period.

Laboratory Evaporators Market Executive Summary

The Laboratory Evaporators Market is experiencing dynamic growth driven by innovation focused on automation, miniaturization, and enhanced solvent recovery systems. Key business trends indicate a strong move towards integrated evaporation workstations capable of managing complex workflows, linking sample preparation directly to analytical instrumentation such as HPLC or mass spectrometry. Manufacturers are increasingly prioritizing modular design and scalability, enabling laboratories to adapt their evaporation capabilities based on evolving research needs, which is particularly attractive to Contract Research Organizations (CROs) seeking flexible, high-throughput solutions. Furthermore, supply chain resilience and the strategic acquisition of niche technology providers by large market players are defining the competitive landscape, emphasizing the consolidation of expertise in specialized evaporation techniques.

Regionally, North America and Europe maintain dominance, primarily due to established pharmaceutical and biotechnology industries, robust funding mechanisms for academic research, and the early adoption of advanced laboratory infrastructure and automation technologies. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, propelled by massive government investment in domestic pharmaceutical manufacturing, rapid expansion of biotechnology hubs in countries like China and India, and improving regulatory standards necessitating modern analytical equipment. Emerging markets in Latin America and MEA are also showing promising growth, primarily driven by increasing healthcare expenditure and the establishment of local clinical and environmental testing laboratories seeking cost-effective and reliable evaporation solutions.

Segment trends reveal that the rotary evaporators segment continues to hold the largest market share owing to its versatility and widespread use in academic and traditional chemical laboratories. Nevertheless, the centrifugal evaporators segment is projected to grow at the fastest rate, driven by the escalating demand for high-speed, parallel processing required in high-throughput screening, genomics, and clinical diagnostics, especially within the context of drug safety testing. End-user analysis shows that the Pharmaceutical & Biotechnology Companies segment remains the primary revenue generator, while the Contract Research Organizations (CROs) segment is displaying accelerated demand for customizable, high-capacity evaporation units to meet diverse client requirements efficiently.

AI Impact Analysis on Laboratory Evaporators Market

Common user questions regarding AI’s impact on laboratory evaporators center on whether AI can optimize evaporation protocols, predict solvent recovery yields, and integrate evaporation control into broader laboratory automation platforms (LIMS/ELN). Users frequently express interest in AI's role in predictive maintenance, ensuring instrument uptime, and developing 'smart' evaporation cycles that minimize energy consumption and prevent sample degradation. There is also significant anticipation regarding how AI algorithms might process real-time sensor data (temperature, vacuum level, rotation speed) to dynamically adjust parameters, moving beyond static pre-set methods to truly adaptive, optimal evaporation. The overarching theme is the transition from manual, operator-dependent optimization to intelligent, autonomous process control within the sample preparation workflow.

The introduction of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is poised to transform the operational efficiency of laboratory evaporators, shifting their function from isolated instruments to integrated components of automated, smart laboratories. AI is being utilized to analyze historical evaporation runs, identifying optimal parameters for diverse solvent mixtures and sample volumes, which significantly reduces method development time and increases reproducibility across multiple users. This predictive capability minimizes the risk of 'bumping' (vigorous, uncontrolled boiling) or thermal degradation, critical concerns when handling thermally sensitive biological samples or valuable synthetic intermediates. Furthermore, AI-driven diagnostics enable preventative maintenance by flagging subtle deviations in motor performance, vacuum leaks, or heating bath consistency before they lead to instrument failure or experimental setbacks.

In high-throughput environments, the integration of AI allows evaporators to communicate seamlessly with robotic sample handlers and downstream analytical instruments. ML models can optimize the scheduling of evaporation cycles based on the solvent load and sample priority within a fully automated workflow. This level of optimization maximizes instrument utilization and shortens the overall turnaround time for large batches of samples, making complex procedures such as parallel synthesis work or comprehensive metabolomics profiling more efficient and resource-effective. The future trajectory suggests AI will enable self-optimizing evaporators that require minimal initial parameter setting, thereby democratizing complex analytical techniques and improving standardization across global research facilities.

- AI-Powered Protocol Optimization: Using ML algorithms to dynamically adjust vacuum, heat, and rotation speed for maximum efficiency and sample safety based on solvent properties and historical data.

- Predictive Maintenance: Analyzing sensor data to anticipate mechanical failures (e.g., pump wear, seal degradation) and scheduling preventative service, minimizing downtime.

- Automated Workflow Integration: Seamless communication with Laboratory Information Management Systems (LIMS) and robotic systems for fully autonomous sample handling and tracking.

- Enhanced Solvent Recovery: Employing smart algorithms to optimize condensation temperatures and coolant flow, maximizing solvent collection purity and volume, reducing environmental impact.

- Real-Time Sample Monitoring: Utilizing vision systems or advanced sensors interpreted by AI to detect signs of foaming or bumping instantly, triggering immediate corrective parameter adjustments.

- Data Logging and Compliance: Automated generation of audit trails and documentation detailing every parameter adjustment made during the evaporation cycle, crucial for GMP/GLP compliance.

DRO & Impact Forces Of Laboratory Evaporators Market

The Laboratory Evaporators Market dynamics are shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces. Primary drivers include the expansion of global pharmaceutical and biotechnology research budgets, particularly focused on drug discovery pipelines and synthetic chemistry, which require continuous solvent removal capabilities. The demand for automation in high-throughput sample processing environments, such as CROs and large screening laboratories, significantly propels the adoption of multi-sample and centrifugal evaporators. Conversely, major restraints involve the high initial capital investment required for advanced automated systems, especially challenging for smaller academic laboratories or laboratories in developing economies, and the continuous operational cost associated with energy consumption and consumables.

Opportunities for market growth are vast, centered around the development of eco-friendly evaporators that incorporate advanced solvent recovery features and utilize less hazardous refrigerants, aligning with sustainability goals. The rapid growth of applied sciences fields, such as proteomics, genomics, and personalized medicine, creates specific demand for evaporators capable of handling trace volumes of complex biological matrices with high precision. Furthermore, geographic expansion into emerging Asian markets, leveraging local manufacturing capabilities and developing region-specific, cost-effective models, presents a substantial avenue for revenue generation, provided market players can navigate varied regulatory landscapes and intellectual property protection issues effectively.

The pervasive Impact Forces influencing the market include strict regulatory guidelines from bodies like the FDA and EMA concerning product quality and impurity levels, which necessitate highly accurate and traceable sample preparation methods. Technological momentum pushes manufacturers toward producing instruments with higher levels of integration, remote monitoring, and safety features, responding directly to labor cost pressures and increased safety consciousness in chemical laboratories. Economic forces, particularly global inflation rates and fluctuating raw material costs (e.g., specialized glass and metal components), can influence manufacturing costs and final product pricing, potentially impacting procurement cycles, especially within budget-sensitive public research sectors. Therefore, strategic pricing and supply chain management remain critical for sustaining competitive advantage against these forces.

Segmentation Analysis

The Laboratory Evaporators Market is highly segmented based on the mechanism of evaporation (Type), the intended final application, and the organizational structure of the end-user. Understanding these segments is crucial for manufacturers to tailor product development and marketing strategies effectively, ensuring alignment with specific laboratory needs, whether focused on high-speed screening, fundamental chemical synthesis, or stringent environmental testing. The technological sophistication varies significantly across segments; for instance, rotary evaporators dominate academic and chemical synthesis sectors due to their robust simplicity and versatility, while centrifugal systems cater to high-end industrial and biotech applications demanding parallel sample processing and minimal cross-contamination risk.

Segmentation by application clearly delineates market priorities; drug discovery requires systems prioritizing rapid, safe handling of novel compounds, whereas environmental analysis necessitates high sample throughput and efficient concentration of trace analytes. The growth within the End-User segment is particularly indicative of the shifting research landscape, with Contract Research Organizations (CROs) becoming increasingly influential purchasers due to their need for flexible, multi-purpose evaporation equipment capable of adapting to diverse client projects. The convergence of these segment trends points toward a future market characterized by personalized instrument configurations and increased emphasis on automated, integrated workflow solutions, reducing manual labor and enhancing experimental reproducibility.

- By Type:

- Rotary Evaporators: Dominant in chemical synthesis; standard flask sizes (50mL to 50L).

- Centrifugal Evaporators: High-throughput; essential for parallel evaporation of microplates and multiple tubes (e.g., proteomics, genomics).

- Vacuum Evaporators: Used for heat-sensitive compounds; typically refers to general vacuum drying or concentration systems.

- Nitrogen Blowdown Evaporators: High precision, often used for trace analysis (e.g., environmental, clinical); uses inert gas flow.

- Parallel Evaporators: Intermediate throughput, often block-based heating; popular in medicinal chemistry for solvent switching.

- Others (e.g., Thin-Film Evaporators, Lyophilizers): Specialized applications requiring complex film control or freeze-drying integration.

- By Application:

- Drug Discovery & Development: Synthesis, purification, and formulation steps in pharmaceutical research.

- Chemical & Material Science: Organic synthesis, catalyst testing, and polymer research requiring solvent removal.

- Food & Beverage Testing: Preparation of extracts for contaminant and quality analysis (e.g., pesticide residues).

- Environmental Analysis: Concentrating pollutants from water, soil, and air samples prior to chromatography.

- Academia & Research Institutions: Fundamental research, teaching laboratories, and general chemical analysis.

- Clinical & Diagnostics: Sample preparation for metabolomics and toxicology screening.

- By End-User:

- Pharmaceutical & Biotechnology Companies: Major consumers due to extensive R&D pipelines and stringent QA/QC requirements.

- Contract Research Organizations (CROs): High demand for versatile, high-throughput systems serving multiple clients.

- Academic & Government Research Institutes: Purchase foundational and specialized evaporation equipment based on grant funding cycles.

- Testing Laboratories (Environmental, Food, Clinical): Focus on systems offering robust, verifiable concentration methods for regulated analyses.

Value Chain Analysis For Laboratory Evaporators Market

The value chain for the Laboratory Evaporators Market begins with upstream activities involving the sourcing of highly specialized components, primarily precision glass (e.g., borosilicate glassware for rotors, condensers, and receiving flasks), high-grade stainless steel for chassis and heating baths, and technologically advanced components such as vacuum pumps, rotary motors, and sensor technology. Suppliers of these core components, particularly manufacturers of high-performance vacuum pumps (crucial for evaporation efficiency), hold significant influence over the final product quality and cost structure. Key challenges in the upstream phase include managing volatility in raw material prices and maintaining stringent quality control standards for precision engineering components necessary for reliable vacuum and temperature regulation.

Moving through the value chain, the manufacturing and assembly phase is dominated by established global players who integrate these components, focusing on optimizing design for safety, efficiency, and user experience (e.g., advanced interfaces and automated controls). Distribution channels are critical and are characterized by a mix of direct sales forces for large institutional purchases and strategic partnerships with global scientific equipment distributors and dealers (indirect channel) such as Thermo Fisher Scientific, Avantor, and Merck KGaA. The indirect channel provides extensive market reach, warehousing, and localized technical support, which is indispensable for specialized laboratory equipment requiring expert installation and ongoing maintenance services, particularly in geographically dispersed markets.

Downstream activities center on the end-user laboratories—pharmaceutical, biotech, academic, and governmental—who utilize the equipment for mission-critical processes. Post-sales service, including calibration, preventative maintenance contracts, and rapid access to spare parts, constitutes a significant component of the value proposition and overall revenue stream for manufacturers. Direct channels are increasingly preferred for high-value, highly customized or integrated systems, allowing manufacturers greater control over the installation and post-sales experience. The effectiveness of the value chain is largely determined by the manufacturer's ability to minimize lifecycle costs for the end-user while continuously incorporating technological upgrades like solvent recovery systems and enhanced automation features to meet evolving regulatory and scientific demands.

Laboratory Evaporators Market Potential Customers

The primary potential customers and buyers of laboratory evaporators are organizations heavily engaged in analytical chemistry, synthetic processes, and quality assurance that require concentrated samples for subsequent analysis or synthesis. This demographic is spearheaded by Pharmaceutical and Biotechnology companies, which use evaporators continuously throughout their R&D pipelines—from early-stage synthesis and purification of novel drug candidates to final formulation testing and stability studies. Their purchasing criteria are centered on reliability, high throughput, compliance with GMP/GLP regulations, and compatibility with existing automation infrastructure, favoring advanced, often proprietary, models designed for parallel processing.

Another rapidly expanding segment of buyers includes Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs). CROs, operating under strict deadlines and managing diverse client projects, require highly flexible, multi-purpose evaporators that can handle a wide range of solvents and sample volumes efficiently. Their purchasing decisions are often weighted by factors such as instrument versatility, speed, and the ability to integrate seamlessly into complex robotic sample preparation workstations. As the outsourcing trend in drug development accelerates globally, the demand from this segment for robust and scalable evaporation solutions is expected to intensify significantly.

Furthermore, academic and governmental research institutions, alongside independent analytical and environmental testing laboratories, form a crucial customer base. Academic institutions, while often constrained by grant-based budgets, represent a foundational market for standard and mid-range rotary evaporators, which are essential teaching tools and workhorses for organic chemistry research. Environmental and food safety testing laboratories focus on high-sensitivity applications, driving demand for precise concentration technologies like nitrogen blowdown systems, ensuring accurate detection of trace contaminants, where precision and verifiable methods are paramount for regulatory adherence and public safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BUCHI, Heidolph Instruments, IKA, Yamato Scientific Co., Ltd., KNF Neuberger, VACUUBRAND GMBH + CO KG, Labconco Corporation, Cole-Parmer (Antylia Scientific), Bio-Rad Laboratories, Thermo Fisher Scientific, Merck KGaA, Avantor, Corning Incorporated, VWR International (Avantor), Genevac (SP Industries), Porvair Sciences, Radleys, Steris Corporation, Gilson, Inc., Eppendorf. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laboratory Evaporators Market Key Technology Landscape

The technology landscape of the laboratory evaporators market is characterized by continuous innovation focused on improving efficiency, reducing processing time, and enhancing sample integrity, particularly for sensitive biological and chemical materials. A crucial technological advancement is the sophisticated integration of vacuum control systems, moving beyond simple on/off switches to digital, stepwise, and programmed vacuum ramps. These controlled vacuum protocols are essential for minimizing foaming and bumping during solvent removal, especially when dealing with complex or high-boiling point mixtures. Furthermore, advanced heating technologies, including induction heating and precise water/oil bath temperature controllers, ensure uniform heat distribution and accurate temperature maintenance, critical for preventing thermal degradation of valuable samples.

Automation and high-throughput capabilities represent another cornerstone of the modern evaporator technology landscape. The proliferation of parallel evaporation systems, whether block-based or centrifugal, allows laboratories to process dozens or even hundreds of samples simultaneously, directly addressing the demand from high-throughput screening and medicinal chemistry applications. These automated systems often incorporate robotic arm compatibility, automated solvent draining, and intelligent endpoint detection, minimizing operator interaction and standardizing the evaporation process. This integration into fully automated workstations drastically improves laboratory productivity and provides robust data logging necessary for regulatory compliance and audit trails, reflecting a critical shift towards autonomous sample preparation.

Sustainability and safety features are increasingly mandated technologies shaping the market. Modern evaporators frequently incorporate high-efficiency solvent recovery systems (condensers) that maximize the recapture of expensive or hazardous solvents, reducing both operational costs and environmental waste. Innovations in chiller technology, moving towards low-GWP (Global Warming Potential) refrigerants, align with global environmental mandates. Safety features, such as automated shut-off mechanisms, non-sparking components, and reinforced glassware, are standard, ensuring operator protection when working with highly volatile or flammable solvents, thereby solidifying the market’s focus on responsible and safe laboratory operations.

Regional Highlights

The Laboratory Evaporators Market exhibits distinct regional dynamics heavily influenced by R&D expenditure, regulatory frameworks, and the concentration of pharmaceutical and biotechnology industries. North America, specifically the United States, commands the largest market share, driven by exceptionally high investments in biopharmaceutical R&D, a strong presence of major market players and leading academic research institutions, and the rapid adoption of advanced, automated evaporation technologies. The stringent regulatory environment in North America necessitates the use of high-precision, traceable laboratory equipment, further solidifying the region's market dominance and continuous demand for technology upgrades, including AI-integrated systems and parallel evaporators.

Europe represents the second-largest market, characterized by established pharmaceutical clusters in Germany, Switzerland, and the UK, coupled with robust public funding for scientific research through initiatives like Horizon Europe. European manufacturers are often leaders in precision engineering and sustainability, driving demand for energy-efficient evaporators featuring advanced solvent recycling mechanisms and compliance with strict European environmental standards. The stable growth in the European market is underpinned by strong emphasis on quality control in both chemical manufacturing and food safety testing sectors, demanding reliable and highly reproducible evaporation solutions for complex analytical workflows.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by massive government initiatives to boost domestic pharmaceutical and biotech manufacturing capacity in countries like China, India, and South Korea. Rapid economic development, coupled with increasing outsourcing activities to local CROs, necessitates significant investment in modern laboratory infrastructure, including high-throughput evaporators. As regulatory standards harmonize with global benchmarks and awareness regarding quality control processes increases, the adoption rate of advanced evaporation systems in APAC is expected to accelerate dramatically, moving beyond basic rotary evaporators towards specialized, automated centrifugal and parallel models to enhance productivity.

- North America: Market leader; driven by extensive pharmaceutical R&D, high regulatory compliance standards (FDA), and rapid adoption of high-end automation equipment.

- Europe: Strong stable market; emphasis on green chemistry, advanced manufacturing standards, and robust academic research funding; leading in solvent recovery technology.

- Asia Pacific (APAC): Highest projected CAGR; fueled by expanding domestic biopharma production, rising CRO sector, and increasing government investment in scientific infrastructure across China and India.

- Latin America: Emerging growth market; increasing healthcare spending and the establishment of local clinical testing laboratories driving demand for foundational and cost-effective evaporation solutions.

- Middle East and Africa (MEA): Growth focused on expanding petrochemical and environmental testing sectors; increasing need for reliable laboratory equipment in national R&D initiatives, particularly in energy and water security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laboratory Evaporators Market.- BUCHI

- Heidolph Instruments

- IKA

- Yamato Scientific Co., Ltd.

- KNF Neuberger

- VACUUBRAND GMBH + CO KG

- Labconco Corporation

- Cole-Parmer (Antylia Scientific)

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Merck KGaA

- Avantor

- Corning Incorporated

- VWR International (Avantor)

- Genevac (SP Industries)

- Porvair Sciences

- Radleys

- Steris Corporation

- Gilson, Inc.

- Eppendorf

Frequently Asked Questions

Analyze common user questions about the Laboratory Evaporators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Laboratory Evaporators Market?

The key growth drivers are the significant and sustained increases in global R&D spending within the pharmaceutical and biotechnology sectors, the accelerating trend toward high-throughput screening and automated sample preparation in analytical laboratories, and the necessity for precise, verifiable solvent removal to comply with strict GLP/GMP quality control standards. Furthermore, technological innovations like intelligent vacuum control and parallel evaporation systems are enhancing laboratory efficiency and driving replacement cycles.

How does the choice between rotary and centrifugal evaporators impact laboratory workflow?

Rotary evaporators are traditionally used for large-scale single-sample processing in chemical synthesis and purification, offering versatility and high solvent volume capacity. Centrifugal evaporators, conversely, are essential for high-throughput, parallel sample concentration (e.g., microplates or multiple tubes), minimizing sample cross-contamination and maximizing processing speed, making them indispensable for genomics, proteomics, and medicinal chemistry screening applications.

Which regional market holds the highest growth potential for laboratory evaporators?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This rapid expansion is primarily attributed to substantial government investments in establishing robust domestic pharmaceutical and biotechnology industries, the increasing number of Contract Research Organizations (CROs), and the ongoing efforts to upgrade laboratory infrastructure to meet international quality and safety standards.

What is the significance of solvent recovery systems in modern laboratory evaporators?

Solvent recovery systems are critical for both environmental sustainability and operational economics. They maximize the recapture of valuable or hazardous solvents, reducing laboratory waste and minimizing the purchasing cost of fresh solvents. Modern systems use advanced condenser technology and often low-GWP refrigerants, aligning laboratory operations with increasingly stringent environmental regulations and green chemistry principles.

Are automated laboratory evaporators integrating AI, and what benefits does this provide?

Yes, advanced automated evaporators are increasingly incorporating AI and Machine Learning (ML) capabilities. These integrations enable dynamic optimization of evaporation parameters (vacuum, temperature) based on solvent properties and real-time data, leading to enhanced reproducibility, minimized risk of sample loss (e.g., through bumping), faster method development, and predictive maintenance alerts that ensure maximum instrument uptime in high-throughput environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager