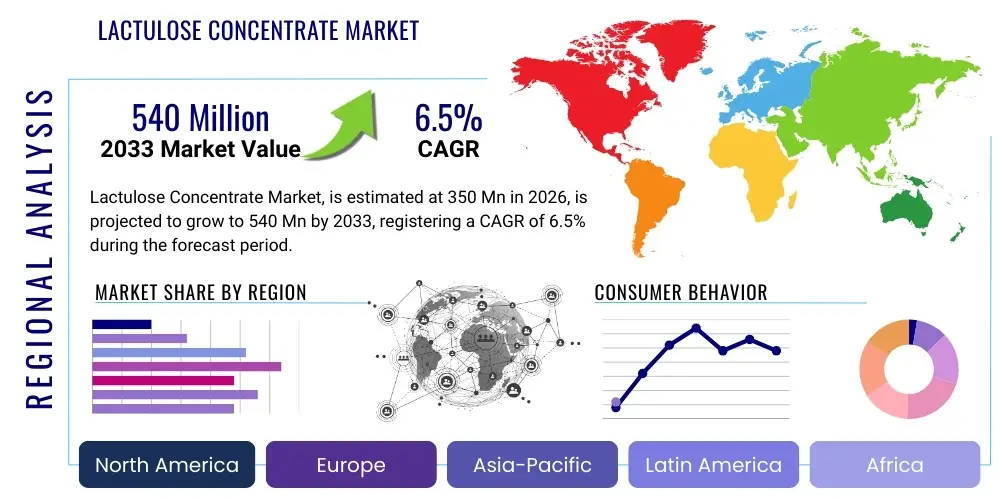

Lactulose Concentrate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441854 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Lactulose Concentrate Market Size

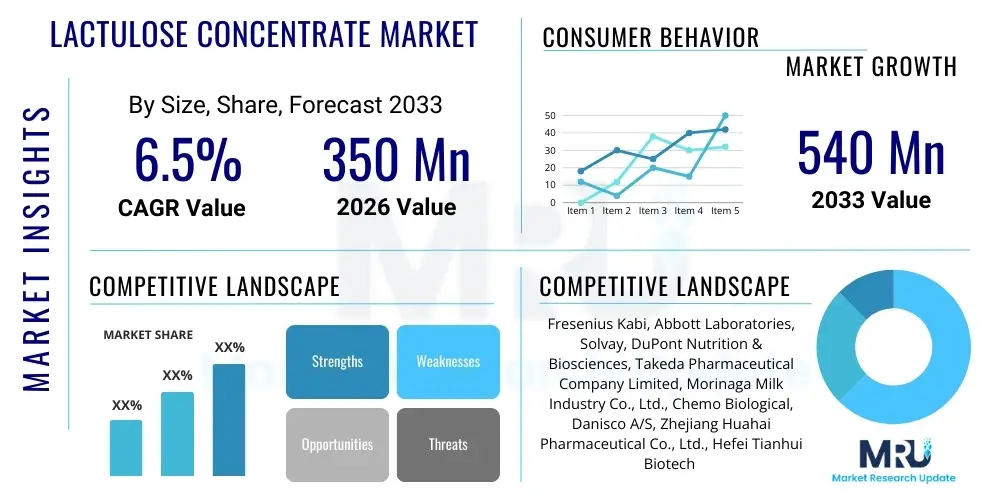

The Lactulose Concentrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 540 Million by the end of the forecast period in 2033.

Lactulose Concentrate Market introduction

Lactulose concentrate is a synthetic disaccharide widely utilized in the pharmaceutical and nutraceutical industries, primarily recognized for its osmotic laxative properties and its capacity as a prebiotic agent. This non-absorbable sugar is synthesized from lactose through isomerization and purification processes, resulting in a high-purity syrup or crystal form. Its principal therapeutic application lies in treating chronic constipation and hepatic encephalopathy (HE), capitalizing on its mechanism of drawing water into the colon and acidifying the intestinal environment. The increasing global prevalence of gastrointestinal (GI) disorders, driven by sedentary lifestyles and poor dietary habits, serves as a fundamental driving factor for sustained market expansion, particularly in established healthcare systems across North America and Western Europe.

Beyond its traditional role as a prescription medication, lactulose concentrate is gaining prominence in the functional food and dietary supplement sectors due to its potent prebiotic effects. It selectively promotes the growth of beneficial gut flora, such as Bifidobacteria and Lactobacilli, contributing significantly to overall gut health and immune system modulation. This shift towards preventative health and consumer awareness regarding the microbiome has opened lucrative avenues for market penetration outside of clinical settings. Furthermore, its use in specialized applications, such as animal nutrition and pharmaceutical excipients, diversifies the market landscape, mitigating risks associated with reliance solely on specific therapeutic indications.

The manufacturing process, which involves high-level purification techniques like chromatography and crystallization, is critical to ensuring product efficacy and safety, particularly regarding the removal of residual lactose and related impurities. Regulatory bodies worldwide, including the FDA and EMA, impose stringent quality standards, influencing the competitive structure of the market. Key benefits driving adoption include its non-systemic nature, generally favorable safety profile, and efficacy in treating severe conditions like HE. Major factors fueling market growth include the rising geriatric population, increased diagnosis rates of chronic liver diseases, and continuous innovation in purification technologies to achieve higher-purity concentrates necessary for modern pharmaceutical formulations.

Lactulose Concentrate Market Executive Summary

The Lactulose Concentrate Market is experiencing robust growth fueled by consistent demand from the pharmaceutical sector for treating chronic constipation and hepatic encephalopathy, coupled with accelerating uptake in the functional food and beverage industry for gut health formulations. Business trends highlight a focus on vertical integration among leading manufacturers to control raw material sourcing (lactose) and purification processes, aiming to secure high-purity output and comply with evolving pharmacopeial standards. Strategic mergers and acquisitions, particularly aimed at expanding production capacity in Asia Pacific and enhancing R&D capabilities for novel delivery systems, are defining the competitive landscape. Furthermore, the push towards standardized, high-concentration liquid formulations optimized for stability and shelf-life is a key operational priority for stakeholders.

Regionally, North America and Europe maintain dominance owing to high healthcare expenditure, established clinical guidelines promoting lactulose usage, and a large population segment suffering from GI tract motility issues. However, the Asia Pacific region is forecast to exhibit the highest growth rate, driven by rapidly expanding healthcare infrastructure, rising awareness about liver health, and the growing incorporation of prebiotics into consumer diets, especially in high-growth economies like China and India. Regulatory harmonization efforts across regions are streamlining market entry but simultaneously imposing higher standards for impurity profiles, necessitating substantial investment in advanced chromatography techniques for purification.

Segment trends reveal that the pharmaceutical application segment holds the largest market share due to the established therapeutic necessity of lactulose in clinical settings, particularly for serious liver conditions. Conversely, the nutraceutical segment, though smaller, is demonstrating faster growth, reflecting the broader consumer trend toward preventative and proactive health management through dietary intervention. In terms of product form, high-concentration liquid lactulose concentrate remains the preferred choice due to ease of formulation and cost-effectiveness in large-scale production, although crystallized or powdered forms are gaining traction for tablet and encapsulated supplement manufacturing requiring greater stability and dosage accuracy.

AI Impact Analysis on Lactulose Concentrate Market

Common user questions regarding AI's influence on the Lactulose Concentrate Market frequently center on its potential to revolutionize drug discovery protocols, optimize complex biomanufacturing processes, and enhance personalized therapeutic outcomes. Users are keen to understand how AI-driven predictive modeling can improve fermentation efficiency, predict yield fluctuations, and minimize impurities in high-volume lactulose synthesis, which is currently a costly and resource-intensive process relying heavily on chromatography. Key concerns also revolve around the use of machine learning algorithms in analyzing vast patient data sets to better tailor lactulose dosing for conditions like hepatic encephalopathy, where personalized treatment strategies are crucial for minimizing systemic side effects and improving neurological outcomes. The integration of AI in supply chain management for predicting demand based on seasonal disease patterns or demographic shifts is another thematic area of interest, promising reductions in waste and inventory holding costs.

In the domain of R&D, AI algorithms are being employed to scrutinize metabolite pathways related to lactulose's mechanism of action, particularly how it influences the gut microbiome composition in various disease states. This allows researchers to identify biomarkers that predict patient response, leading to more targeted clinical trials and potential development of synergistic formulations combining lactulose with other targeted prebiotics or probiotics. Furthermore, AI-powered image processing and diagnostic tools can assist clinicians in the earlier and more accurate diagnosis of liver dysfunction, which directly impacts the demand for lactulose as a frontline treatment for HE prophylaxis and management. Such diagnostic advancements inherently expand the treatable patient population and refine prescribing practices.

On the operational front, AI facilitates predictive maintenance schedules for sophisticated purification equipment, drastically reducing downtime and improving overall batch consistency and quality control—a vital consideration given the strict regulatory requirements for pharmaceutical-grade concentrates. By analyzing real-time sensor data from bioreactors and chromatographic columns, AI can autonomously adjust process parameters to maintain optimal synthesis conditions, leading to enhanced purity profiles and higher yield rates, ultimately lowering the cost of goods sold. This efficiency gain is critical for maintaining competitive pricing, especially when facing cost pressures from generic manufacturers or alternative therapeutic agents in the chronic constipation market.

- AI-driven optimization of chromatographic purification methods, enhancing purity levels and reducing production cycle times.

- Machine learning models predicting patient responsiveness and optimal dosing for hepatic encephalopathy treatment.

- Predictive analytics improving supply chain resilience and forecasting demand based on epidemiological data.

- Use of AI in drug repositioning studies to identify novel synergistic applications for lactulose in gut-brain axis disorders.

- Automated quality control systems minimizing batch variation and ensuring compliance with stringent pharmacopeial standards.

DRO & Impact Forces Of Lactulose Concentrate Market

The Lactulose Concentrate Market dynamics are primarily shaped by compelling drivers rooted in demographic shifts and increasing awareness of GI health. The exponential growth in the geriatric population worldwide significantly boosts the demand for lactulose, as elderly individuals are more susceptible to age-related constipation and chronic liver diseases, including cirrhosis leading to hepatic encephalopathy. Furthermore, the rising incidence of non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH) globally necessitates effective therapeutic agents like lactulose for managing potential complications. These epidemiological trends, coupled with greater consumer adoption of functional ingredients targeting gut microbiome health, act as powerful tailwinds supporting sustained market expansion. Regulatory approvals expanding the indications for lactulose, particularly in preventative care and pediatric gastroenterology, further solidify its market position.

However, the market faces notable restraints, largely pertaining to manufacturing complexities and competitive pressures. The high cost associated with obtaining pharmaceutical-grade purity, requiring advanced technologies such as ion exchange and sophisticated chromatography, poses a financial barrier, particularly for smaller market entrants. Price volatility of lactose, the primary raw material, can impact production costs and final product pricing. Additionally, the availability of effective generic osmotic laxatives (like polyethylene glycol) and emerging alternative treatments (e.g., novel probiotics, targeted dietary fibers) presents significant competition, forcing manufacturers to continuously prove the superior efficacy and safety profile of lactulose concentrate, especially in non-HE related applications. Regulatory hurdles for novel formulations in highly regulated markets also slow down product commercialization.

Opportunities for growth are concentrated in untapped geographical markets, particularly emerging economies where healthcare access is rapidly improving and lifestyle-related diseases are proliferating. Significant potential exists in developing innovative, patient-friendly delivery formats, such as highly stable, low-volume oral solutions or encapsulated micro-pellets, which can improve patient compliance and convenience, thereby increasing market share. The integration of lactulose concentrate into personalized nutrition strategies, guided by advancements in microbiome diagnostics, represents a long-term strategic opportunity. Overall, the market is characterized by strong impact forces stemming from regulatory standardization (Impact Force 1: High Purity Requirements), rapid scientific validation of gut health benefits (Impact Force 2: Prebiotic Validation), and increasing chronic disease burden (Impact Force 3: Global Epidemiological Shift), collectively ensuring upward trajectory despite manufacturing restraints.

Segmentation Analysis

The Lactulose Concentrate Market is primarily segmented based on Purity Level, Application, and Form, reflecting the diverse requirements of the pharmaceutical, nutraceutical, and food industries. Analysis by Purity Level is crucial as pharmaceutical-grade lactulose requires extremely low levels of residual sugars (e.g., galactose, lactose), driving the need for advanced separation techniques, which, in turn, influences pricing and manufacturing investment. Application segmentation reveals the fundamental dichotomy between high-value therapeutic uses (e.g., treating hepatic encephalopathy) and high-volume consumer health uses (e.g., prebiotic supplements). Understanding these segments allows manufacturers to tailor product specifications, packaging, and marketing strategies to meet specific end-user needs and regulatory requirements, such as Good Manufacturing Practices (GMP) essential for clinical applications.

The segmentation by Form—Liquid Concentrate versus Crystalline Powder—dictates ease of handling, transport costs, and suitability for final dosage forms. Liquid concentrate is predominant in large-scale clinical settings and over-the-counter syrup formulations due to its economic production and immediate dissolvability. Conversely, the crystalline or powdered form offers advantages in stability, extended shelf life, and integration into solid oral dosage forms like tablets or capsules, appealing strongly to the dietary supplement market and specific pharmaceutical formulations requiring dose consistency or complex blending with other excipients. These distinct requirements necessitate different operational capabilities and supply chain mechanisms for each form.

- By Purity Level:

- Pharmaceutical Grade (High Purity)

- Food Grade/Nutraceutical Grade (Standard Purity)

- By Application:

- Pharmaceutical (Hepatic Encephalopathy, Chronic Constipation)

- Nutraceutical (Prebiotic Supplements, Functional Foods)

- Animal Feed & Veterinary

- By Form:

- Liquid Concentrate (Syrup)

- Crystalline/Powder

Value Chain Analysis For Lactulose Concentrate Market

The value chain for the Lactulose Concentrate Market begins upstream with the sourcing of raw materials, primarily high-quality lactose derived from whey, a byproduct of the dairy industry. Stability of lactose supply and management of its price volatility are critical determinants of profitability. The manufacturing phase involves complex chemical processing—specifically, the isomerization of lactose to lactulose, followed by multi-stage purification. This purification, often utilizing proprietary ion-exchange and chromatographic separation techniques, is the most capital-intensive and technically challenging step, responsible for achieving the requisite high purity levels, especially for pharmaceutical applications. Suppliers with robust R&D capabilities focusing on yield enhancement and impurity removal hold significant competitive advantages in the upstream segment.

Midstream activities encompass formulation, packaging, and quality assurance. Lactulose concentrate is generally formulated into bulk syrup or crystallized into powder. Strict adherence to GMP and pharmacopeial standards (USP, EP, JP) is mandatory at this stage, requiring specialized cleanroom facilities and sophisticated analytical testing infrastructure. Distribution channels represent a critical downstream component, segmenting into distinct routes: direct sales to large pharmaceutical companies and contract manufacturing organizations (CMOs) for therapeutic applications, and indirect channels involving specialized ingredient distributors and agents serving the nutraceutical and functional food sectors. The specialized requirements of cold chain or ambient storage necessitate sophisticated logistics management throughout the global supply chain.

The downstream analysis focuses on end-users and the retail environment. For pharmaceutical products, distribution involves wholesale pharmacies, hospitals, and specialty clinics. For nutraceutical and dietary supplement applications, the product flows through health food stores, online e-commerce platforms, and mass retailers. Direct engagement with key opinion leaders (KOLs) and gastroenterologists is essential for promoting therapeutic use, while targeted digital marketing and consumer education campaigns drive demand in the nutraceutical space. The efficiency of the distribution network, particularly the ability to rapidly respond to localized regulatory changes and inventory demands across diverse regional markets, determines final market penetration and accessibility for both direct and indirect consumers.

Lactulose Concentrate Market Potential Customers

The primary customers for lactulose concentrate are segmented across various healthcare and consumer industries, reflecting its dual function as both a potent pharmaceutical drug and a versatile prebiotic ingredient. Pharmaceutical manufacturers represent the largest segment, requiring high-purity concentrate as the Active Pharmaceutical Ingredient (API) for prescription drugs treating conditions like chronic constipation and hepatic encephalopathy. These customers prioritize regulatory compliance, consistent batch quality, and secure long-term supply agreements. Contract Development and Manufacturing Organizations (CDMOs) also serve as significant bulk purchasers, utilizing the concentrate to produce finished dosage forms for multiple clients under strict quality protocols, thereby optimizing their supply chain efficiency and product formulation capabilities.

The burgeoning nutraceutical and dietary supplement industry forms the fastest-growing customer base. Companies focused on digestive health, immune support, and personalized nutrition purchase food-grade lactulose concentrate for incorporation into functional beverages, probiotic blends, powdered mixes, and specific dietary supplements. These customers emphasize solubility, flavor profile compatibility (especially masking sweetness), and proof of prebiotic efficacy, often requiring extensive technical support regarding formulation challenges. Retail chains and specialized ingredient distributors act as intermediaries, servicing smaller brands and bulk buyers who require reliable, large-volume sourcing of standardized concentrate for diverse applications ranging from sports nutrition to elderly care products.

Beyond human consumption, specialized sectors such as animal nutrition and fermentation media also constitute a segment of potential customers. The veterinary market utilizes lactulose in formulations designed for canine and feline chronic constipation and liver support. Additionally, specific biotechnological applications, requiring complex sugar substrates for fermentation processes in the production of biopharmaceuticals or industrial chemicals, occasionally utilize lactulose concentrate. This diversification of the end-user base ensures market stability, mitigating reliance on fluctuations in any single therapeutic area or consumer trend, reinforcing the product's fundamental versatility across bio-industrial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 540 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fresenius Kabi, Abbott Laboratories, Solvay, DuPont Nutrition & Biosciences, Takeda Pharmaceutical Company Limited, Morinaga Milk Industry Co., Ltd., Chemo Biological, Danisco A/S, Zhejiang Huahai Pharmaceutical Co., Ltd., Hefei Tianhui Biotech Co., Ltd., Symrise AG, CJ CheilJedang, Bio-chem Technology, Sanofi S.A., Shandong Kexing Biopharmaceuticals Co., Ltd., Merck KGaA, Dr. Falk Pharma GmbH, Vifor Pharma Management Ltd., Jiangsu Guotai International Group Guomao Co., Ltd., and G.M. Pharma International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lactulose Concentrate Market Key Technology Landscape

The technological landscape of the Lactulose Concentrate Market is fundamentally centered around optimizing two primary processes: the synthesis of lactulose from lactose and the subsequent high-purity separation required for pharmaceutical standards. Enzymatic synthesis, utilizing immobilized enzymes to catalyze the isomerization process, represents a key advancement. This method offers advantages over traditional chemical synthesis by providing higher reaction specificity, operating under milder conditions, and reducing unwanted byproducts, leading to higher yields and easier downstream purification. Continuous flow reactor technology is also gaining traction, enabling scalable, automated production with improved reaction control and consistency, which is crucial for meeting increasing global demand while maintaining strict quality parameters.

The most critical technological differentiator in the market remains purification technology. Chromatographic separation, particularly simulated moving bed (SMB) chromatography, is essential for removing residual sugars such as lactose, galactose, and epilactose to achieve pharmaceutical-grade purity (typically greater than 98% lactulose). Innovations in chromatography media—including highly selective resins and advanced membrane filtration systems—are paramount to improving throughput efficiency, reducing solvent usage, and lowering operational costs associated with purification, which often accounts for a significant portion of the total manufacturing expense. Companies that invest heavily in optimizing these separation steps gain a competitive edge in regulatory compliance and product quality differentiation.

Furthermore, formulation and stabilization technologies are increasingly important. For liquid concentrates, advancements focus on enhancing stability over a wide temperature range and preventing crystallization or degradation during long-term storage, often involving proprietary stabilizer blends and optimized pH controls. For crystalline forms, technologies related to spray drying, co-crystallization, and particle size reduction (micronization) are crucial for developing powder concentrates suitable for direct compression in tablet manufacturing or for high-solubility nutraceutical applications. These technological developments not only ensure product integrity and shelf life but also facilitate the development of novel delivery systems, such as slow-release capsules, which are being explored to enhance therapeutic efficacy and patient compliance, especially in managing persistent chronic conditions.

Regional Highlights

- North America: This region dominates the market share, driven by high prevalence rates of chronic constipation and liver cirrhosis, alongside sophisticated healthcare infrastructure and high patient awareness. Strong regulatory guidelines and established clinical practice standards mandate the use of high-purity lactulose for hepatic encephalopathy management. The U.S. and Canada benefit from advanced diagnostic capabilities leading to early disease detection, which increases the prescribed volume. Furthermore, the robust nutraceutical market in the U.S. significantly contributes to the demand for food-grade lactulose as a key prebiotic ingredient in functional foods and dietary supplements targeting gut health maintenance.

- Europe: The European market is characterized by a mature pharmaceutical industry and significant research activity in gastroenterology and hepatology, particularly in countries like Germany, France, and the UK. Favorable reimbursement policies for treating chronic liver failure and GI motility disorders support the stable demand for pharmaceutical-grade concentrate. Additionally, European Union regulations pertaining to functional food claims (EFSA) facilitate the clear marketing of lactulose’s prebiotic properties, driving consumption in the consumer health sector. Efforts towards regional quality standardization further bolster consumer confidence and product adoption.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market, primarily due to expanding healthcare access, significant economic development, and a rapidly aging population, especially in Japan, China, and India. Increased urbanization and subsequent lifestyle changes are escalating the incidence of chronic diseases, spurring demand for treatments like lactulose. Local manufacturing capabilities are growing rapidly, driven by favorable government policies aimed at self-sufficiency in pharmaceuticals. The enormous consumer base is also highly receptive to traditional and natural remedies, seamlessly integrating prebiotic supplements into dietary habits, thus propelling the nutraceutical segment’s trajectory.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities. In LATAM, improving public health infrastructure and rising awareness of chronic diseases are slowly increasing market penetration, though pricing sensitivity remains a factor. In MEA, particularly the Gulf Cooperation Council (GCC) countries, the demand is fueled by significant lifestyle disease prevalence (e.g., diabetes, obesity) which correlates with GI issues. Investment in healthcare infrastructure and rising medical tourism are key drivers. However, market growth relies heavily on imports and overcoming complex regulatory frameworks specific to individual nations within these diverse geographical areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lactulose Concentrate Market.- Fresenius Kabi

- Abbott Laboratories

- Solvay

- DuPont Nutrition & Biosciences

- Takeda Pharmaceutical Company Limited

- Morinaga Milk Industry Co., Ltd.

- Chemo Biological

- Danisco A/S

- Zhejiang Huahai Pharmaceutical Co., Ltd.

- Hefei Tianhui Biotech Co., Ltd.

- Symrise AG

- CJ CheilJedang

- Bio-chem Technology

- Sanofi S.A.

- Shandong Kexing Biopharmaceuticals Co., Ltd.

- Merck KGaA

- Dr. Falk Pharma GmbH

- Vifor Pharma Management Ltd.

- Jiangsu Guotai International Group Guomao Co., Ltd.

- G.M. Pharma International

Frequently Asked Questions

Analyze common user questions about the Lactulose Concentrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for pharmaceutical-grade lactulose concentrate?

The primary application driving the demand for high-purity, pharmaceutical-grade lactulose concentrate is the treatment and management of hepatic encephalopathy (HE), a severe complication of chronic liver disease where lactulose is utilized to reduce ammonia levels in the bloodstream and normalize cognitive function.

How does the manufacturing technology impact the cost of lactulose concentrate?

Manufacturing costs are significantly influenced by the purification stage, where advanced techniques like Simulated Moving Bed (SMB) chromatography are used to achieve low impurity levels required for pharmaceutical use. These high-tech separation processes require substantial capital investment and operational expenditure, directly impacting the final product price.

Which geographical region exhibits the fastest anticipated growth rate in the lactulose concentrate market?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by the rapid expansion of healthcare infrastructure, increasing prevalence of chronic lifestyle diseases, and growing consumer acceptance of prebiotic ingredients in functional food and dietary supplements.

What are the key differences between food-grade and pharmaceutical-grade lactulose concentrate?

The key difference lies in the purity level and regulatory compliance. Pharmaceutical-grade lactulose requires significantly higher purity (typically over 98%) with extremely low residual sugar content, mandatory GMP certification, and adherence to specific pharmacopeial standards (e.g., USP, EP) suitable for API use in prescription medications, whereas food-grade has slightly less stringent purity requirements suitable for nutraceutical applications.

How is the increasing focus on gut microbiome health influencing the market segmentation?

The rising awareness of gut microbiome health is rapidly expanding the nutraceutical application segment. This trend drives demand for food-grade lactulose concentrate as a highly effective prebiotic ingredient used in formulations aimed at selectively stimulating the growth of beneficial intestinal flora like Bifidobacteria and Lactobacilli for overall digestive wellness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager