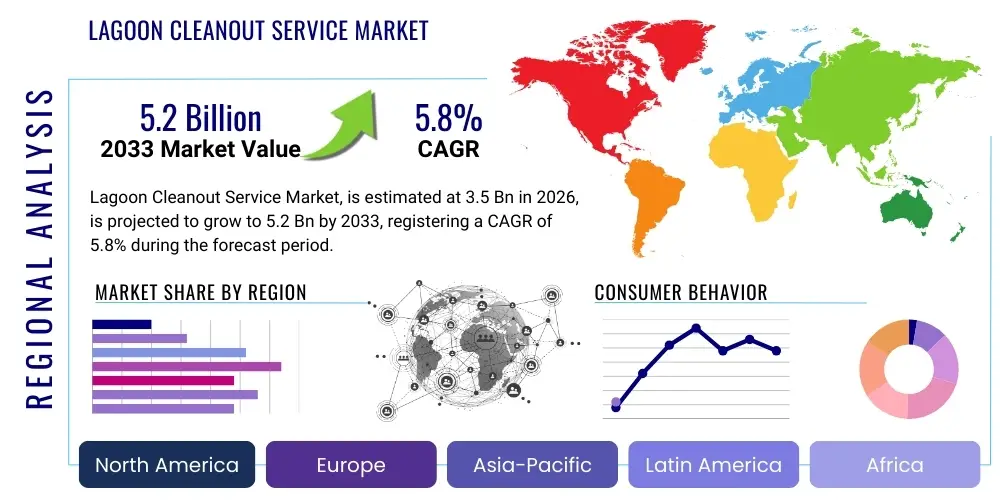

Lagoon Cleanout Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442970 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Lagoon Cleanout Service Market Size

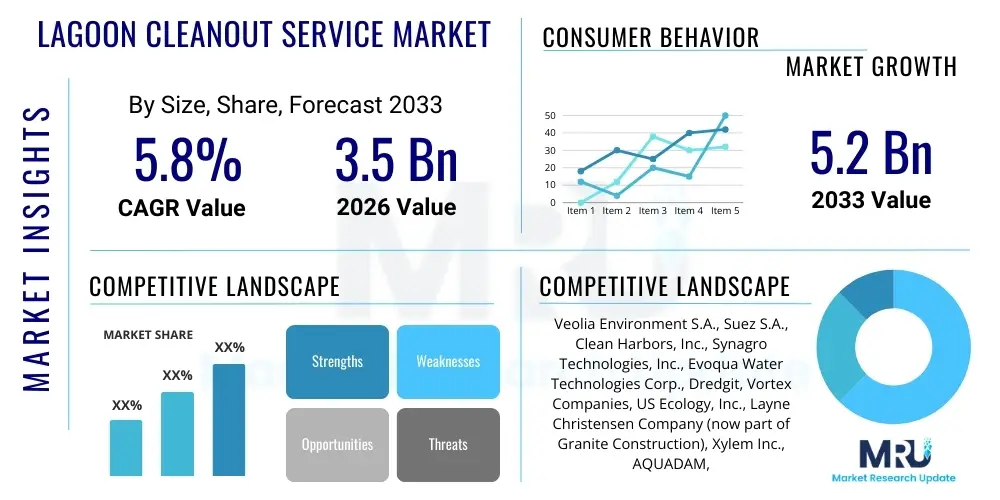

The Lagoon Cleanout Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Lagoon Cleanout Service Market introduction

The Lagoon Cleanout Service Market encompasses specialized environmental and engineering services dedicated to the periodic or scheduled removal and management of accumulated sludge, sediment, and contaminants from industrial, municipal, and agricultural wastewater lagoons and retention ponds. These services are crucial for maintaining the operational capacity, efficiency, and environmental compliance of these critical water treatment infrastructure assets. The primary service scope involves dredging, dewatering, transportation, and appropriate disposal or beneficial reuse of the removed biosolids and waste materials, often requiring advanced, specialized equipment and highly trained personnel to handle diverse waste streams ranging from municipal biosolids to complex industrial residues. Effective lagoon maintenance prevents the overflow of untreated water, mitigates odor issues, restores treatment volume, and ensures adherence to stringent national and international environmental discharge regulations, such as those governed by the Environmental Protection Agency (EPA) or regional environmental bodies across Europe and Asia Pacific.

The core product delivered by this market is the restoration of lagoon functionality and capacity through comprehensive sludge management. Major applications span municipal wastewater treatment plants struggling with aging infrastructure and increased population loads, industrial sectors like pulp and paper, food and beverage processing, and chemical manufacturing that generate significant process wastewater, and large-scale agricultural operations utilizing manure lagoons. The inherent benefits derived from utilizing professional lagoon cleanout services include substantial cost savings over complete lagoon reconstruction, extended operational life of existing assets, improved water quality treatment metrics, and drastically reduced risk of regulatory fines or environmental catastrophes stemming from lagoon failure or contamination overflow. Moreover, the optimized removal and treatment processes often enable resource recovery, turning waste sludge into usable byproducts such as fertilizer or biogas fuel, contributing significantly to circular economy initiatives within the water sector.

Key driving factors accelerating market expansion include the global increase in stringent environmental enforcement regarding nutrient loading (phosphorus and nitrogen) in receiving waters, mandatory infrastructure maintenance cycles dictated by permits, and the undeniable necessity of accommodating burgeoning urban and industrial wastewater volumes without immediate capital expenditure on new facilities. Technological advancements, particularly in automated dredging systems and polymer-based dewatering chemistries that significantly improve efficiency and reduce project timelines, further stimulate market growth. Furthermore, the rising public awareness and corporate focus on Environmental, Social, and Governance (ESG) standards prompt industrial facilities to proactively manage their wastewater footprint, bolstering the demand for reliable and effective lagoon cleanout solutions that minimize environmental impact and maximize operational sustainability.

Lagoon Cleanout Service Market Executive Summary

The Lagoon Cleanout Service Market is experiencing robust growth driven by escalating global regulatory pressure concerning wastewater discharge quality and the imperative for industrial and municipal entities to maintain aging treatment infrastructure. Current business trends indicate a strong shift towards highly specialized, integrated service models, where providers offer comprehensive solutions encompassing initial lagoon assessment, regulatory documentation, customized dredging techniques (hydraulic vs. mechanical), dewatering optimization using mobile units, and environmentally compliant final disposal or resource recovery strategies. The market is witnessing consolidation among smaller specialized firms and major environmental services conglomerates, aiming to offer national or even international scale and access to greater capital for advanced equipment acquisition. The demand is increasingly focused on sustainable outcomes, necessitating innovation in beneficial reuse options for biosolids and minimizing landfill dependence, which represents a crucial pivot point for service providers seeking long-term competitive advantages and alignment with global sustainability goals.

Regionally, North America and Europe currently dominate the market due to mature wastewater treatment infrastructure, well-established regulatory frameworks, and readily available technology, although the Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This rapid expansion in APAC is fueled primarily by massive investments in new centralized wastewater infrastructure in developing economies like China and India, coupled with the retroactive enforcement of environmental protection laws targeting industrial pollution. In Latin America and the Middle East & Africa (MEA), growth is patchy but significant, often tied to major industrial projects in mining, oil and gas, and urbanization initiatives requiring specialized remote site cleanout capabilities. The adoption rate of advanced technologies like geo-textile tube dewatering is highest in regions facing severe water scarcity or high transportation costs, making localized volume reduction essential for economical operation.

Segmentation trends highlight the municipal sector as the largest consumer of cleanout services by volume, primarily driven by routine maintenance and capacity restoration needs. However, the industrial segment, particularly food and beverage (F&B) and chemical processing, often commands higher contract values due to the complexity and hazard level of the sludge composition, necessitating specialized handling and disposal protocols. Within service types, advanced dewatering and beneficial reuse segments are growing faster than traditional land application or landfill disposal, reflecting the market’s responsiveness to sustainability mandates and increasing landfill gate fees. Furthermore, the adoption of subscription-based or long-term maintenance contracts, moving away from purely reactive emergency cleanouts, is becoming prevalent, providing more stable revenue streams for service providers and better operational predictability for end-users, symbolizing a shift towards predictive infrastructure management.

AI Impact Analysis on Lagoon Cleanout Service Market

Common user questions regarding AI's impact on the Lagoon Cleanout Service Market typically revolve around operational efficiency gains, predictive maintenance capabilities, and enhanced regulatory compliance monitoring. Users are frequently asking how Artificial Intelligence (AI) and Machine Learning (ML) can optimize dredging paths to maximize sludge removal efficiency while minimizing energy consumption, particularly in large, complex lagoons with uneven bottoms and varying sediment densities. Another major theme focuses on leveraging AI for sophisticated data analysis, specifically predicting when a lagoon will require its next cleanout based on real-time sensor data regarding influent flow rates, solids loading, and historical performance metrics, moving away from purely time-based or reactive scheduling. Furthermore, users are keen to understand how computer vision and deep learning can be deployed via drones or robotic surface vehicles to accurately map sludge volumes and identify potential structural integrity issues within the lagoon liner or berms, thereby reducing the need for costly, time-consuming manual surveys and significantly enhancing worker safety during operations.

The integration of AI and ML technologies is poised to fundamentally transform the operational aspects of lagoon cleanout services, moving them from labor-intensive, reactive processes toward data-driven, optimized, and predictive maintenance regimes. AI algorithms are increasingly being used to analyze complex environmental data streams, including satellite imagery and underwater sonar data, to create highly accurate three-dimensional models of sludge accumulation patterns within lagoons. This predictive modeling capacity allows service providers to determine the precise volume of material to be removed and calculate the optimal blend of dewatering chemicals required for efficient processing, significantly reducing chemical costs and improving throughput. The application of sophisticated process control systems, utilizing neural networks, further optimizes the dewatering phase, ensuring consistent dryness levels of the final material, which is critical for meeting stringent disposal or beneficial reuse criteria and maximizing transportation efficiency.

Beyond technical operational improvements, AI also holds profound implications for risk management and regulatory adherence within the cleanout market. By continuously monitoring and correlating environmental compliance parameters (e.g., effluent quality, nutrient levels) with cleanout schedules, AI systems can proactively alert facility managers to potential issues before they become compliance violations. This predictive compliance feature offers substantial value, especially for industrial clients operating under strict discharge permits. The ultimate impact of AI is expected to streamline the entire cleanout lifecycle, offering significant reductions in project duration, decreasing overall labor costs through automated or semi-automated processes, and enhancing the environmental outcomes by ensuring maximally efficient resource recovery from the removed sludge materials.

- AI-driven optimization of dredging paths and equipment movement for maximal sludge extraction efficiency.

- Predictive maintenance scheduling using ML models based on real-time inflow/outflow and solids loading data.

- Computer vision and drone-based inspection for high-resolution 3D mapping of sludge volumes and structural integrity assessment.

- Automated polymer dosing optimization in dewatering processes to minimize chemical consumption and maximize throughput.

- Enhanced regulatory compliance monitoring and proactive risk flagging through complex environmental data correlation.

- Development of autonomous or remote-controlled robotic cleanout systems, reducing human exposure to hazardous materials.

DRO & Impact Forces Of Lagoon Cleanout Service Market

The Lagoon Cleanout Service Market is shaped by a powerful interplay of Driving factors, Restraints, and Opportunities (DRO), which collectively constitute the primary Impact Forces determining its growth trajectory and structure. Key drivers include the mandatory nature of environmental compliance, where regulatory bodies globally enforce strict limits on effluent discharge, necessitating routine maintenance to prevent solids carryover and capacity loss in lagoons. Furthermore, the accelerating urbanization and industrialization, particularly in emerging economies, dramatically increase the volume of wastewater requiring treatment, thereby accelerating sludge accumulation rates and the demand for timely cleanout interventions. Restraining factors primarily involve the high capital expenditure associated with specialized dredging and mobile dewatering equipment, which creates substantial entry barriers for new service providers. Operational complexity, especially when dealing with hazardous industrial sludge that requires highly specialized permitting and disposal routes, also acts as a constraint, increasing project costs and timelines. The greatest opportunities lie in the adoption of sustainable resource recovery technologies, transforming sludge from a waste liability into valuable resources such as high-grade fertilizers, soil amendments, or bioenergy feedstock, capitalizing on the growing circular economy paradigm and creating new revenue streams for service providers.

The cumulative impact forces strongly favor market expansion, particularly in the mid-to-long term. The necessity of maintaining existing infrastructure, coupled with the prohibitive cost and time required to construct new lagoon systems, places immense pressure on municipal and industrial entities to maximize the lifespan and efficiency of their current assets through professional cleanout services. Economic factors play a critical role; as transportation and landfill disposal costs continue to rise globally, the economic incentive to utilize advanced on-site dewatering technologies that drastically reduce sludge volume (and thus disposal weight) becomes overwhelmingly strong. This drives investment in mobile dewatering fleets and specialized chemical expertise. Regulatory enforcement acts as a non-negotiable driver; failures in lagoon maintenance can lead to catastrophic environmental damage, massive fines, and reputational damage, making proactive cleanout a necessary operational expenditure rather than an optional capital project. This regulatory environment creates a stable, consistent demand base for service providers capable of guaranteeing compliance.

However, the market’s reliance on specialized technology and highly skilled labor introduces vulnerability to supply chain disruptions and escalating labor costs, which restrains profitability margins. Furthermore, public resistance or permitting challenges related to the land application or beneficial reuse of biosolids in certain geographies can severely limit the most cost-effective disposal opportunities, forcing reliance on more expensive options. To mitigate these restraints, successful market players are focusing on vertical integration, controlling the entire process from assessment to final disposal, and investing heavily in automation (as detailed in the AI analysis) to reduce labor dependency and improve operational predictability. The long-term opportunity for this market remains robust, anchored by the fundamental need for clean water and functional wastewater infrastructure globally, ensuring sustained growth through infrastructure resilience initiatives and mandatory environmental stewardship.

Segmentation Analysis

The Lagoon Cleanout Service Market is strategically segmented based on factors such as the type of service performed, the end-user generating the wastewater, and the specific technology employed for sludge removal and processing. This stratification allows service providers to tailor specialized contracts and pricing models to address the unique chemical composition, volume, and regulatory constraints inherent in different waste streams, ranging from non-hazardous municipal biosolids to corrosive or toxic industrial sludges. Understanding these segments is paramount for strategic market entry and resource allocation, as the operational complexities and necessary equipment differ vastly between, for example, maintaining a large agricultural manure lagoon and decommissioning an industrial chemical treatment pond. The predominant market share is currently held by the municipal sector, given the sheer volume and routine nature of required cleanout activities, but the industrial segment offers higher margin projects due to specialized risk management and complex material handling requirements.

Key service segmentation revolves around the physical processes involved: initial assessment and survey, physical removal (dredging or excavation), volume reduction (dewatering), and post-processing (disposal or beneficial reuse). While dredging represents the most visible and equipment-intensive service, the dewatering segment, particularly the use of geo-textile tubes and advanced centrifuges, is the fastest-growing area due to its direct impact on cost efficiency via significant volume reduction prior to transport. End-user segmentation is equally critical, dividing the market into reliable, consistent municipal demand versus the fluctuating, high-variability demand from various industrial sub-sectors (e.g., mining, food processing, oil and gas). Each industrial sub-sector requires specific certifications and safety protocols, influencing which service providers are qualified to bid on complex contracts. The technological segmentation drives competitive advantage, with advanced hydraulic dredging and remote-controlled systems gaining traction over traditional, less efficient mechanical excavation methods, particularly in deep or hazardous lagoons where minimizing human intervention is paramount for safety and efficiency.

The evolving regulatory environment consistently pushes demand towards sustainable disposal methodologies, creating a burgeoning sub-segment focused exclusively on biosolids conversion and resource recovery. This includes composting, pelletizing for fertilizer production, and anaerobic digestion for biogas generation. Service providers offering these comprehensive, end-to-end solutions that guarantee regulatory compliance and maximize resource utilization are positioned for premium growth. The complexity of managing these diverse segments requires service providers to maintain a broad portfolio of specialized equipment, extensive permitting knowledge, and deep expertise in chemical engineering and environmental science, allowing them to effectively service the entire spectrum of demand across municipal, industrial, and agricultural clients who are united by the fundamental requirement of maintaining functional wastewater treatment capabilities.

- By Service Type:

- Sludge Dredging and Pumping

- Mechanical Excavation

- Sludge Dewatering (Geotextile Tubes, Centrifuges, Filter Presses)

- Transportation and Logistics

- Disposal and Beneficial Reuse (Land Application, Incineration, Composting)

- By End-User:

- Municipal Wastewater Treatment Plants

- Industrial (Pulp & Paper, Food & Beverage, Chemical, Oil & Gas, Mining)

- Agricultural Operations (Manure Lagoons)

- Power Generation Facilities

- By Lagoon Type:

- Aerated Lagoons

- Facultative Lagoons

- Anaerobic Lagoons

- Sludge Storage Ponds

Value Chain Analysis For Lagoon Cleanout Service Market

The value chain for the Lagoon Cleanout Service Market begins with the upstream suppliers of critical equipment and materials, followed by the core service providers, and concludes with the downstream processes of logistics and final disposal/reuse. Upstream analysis focuses on manufacturers of specialized machinery, including high-capacity hydraulic and submersible pumps, automated dredging systems, and mobile dewatering units such as belt presses, filter presses, and custom-designed geotextile tube systems. Critical chemical suppliers providing flocculants, coagulants, and polymers essential for efficient sludge conditioning and dewatering constitute another vital upstream component. The bargaining power of these upstream suppliers can be significant, particularly for proprietary dewatering chemistries or highly specialized dredging robotics, which influences the operational costs and technological capabilities of the core service providers. Strong strategic partnerships between cleanout companies and equipment manufacturers are essential to ensure rapid deployment, maintenance, and technological upgrades, securing a competitive edge in a capital-intensive industry.

The core of the value chain is the service execution phase, performed by lagoon cleanout companies. These firms manage project planning, regulatory compliance documentation, on-site execution (dredging and dewatering), and quality control. Distribution channels in this market are predominantly direct: service providers negotiate contracts directly with end-users (municipalities, plant managers, industrial operators). Indirect channels exist primarily through engineering, procurement, and construction (EPC) firms or environmental consulting companies who subcontract the physical cleanout work as part of a larger infrastructure project or compliance mandate. The efficiency and profitability of the core service provider are directly tied to optimizing logistics, minimizing mobilization costs, and maximizing the efficacy of the dewatering process, which dramatically reduces the volume and weight of material that must be handled in the downstream phase.

Downstream analysis centers on the disposition of the dewatered sludge. This phase includes specialized transportation logistics (requiring specific permits and handling) and the final destination, which may be a permitted landfill, an agricultural site for land application, or a processing facility for beneficial reuse (e.g., composting, incineration, anaerobic digestion). The costs and regulatory complexities associated with the downstream phase are substantial and highly variable by region. Service providers who can offer integrated, cost-effective beneficial reuse options significantly enhance their value proposition and reduce the client's long-term environmental liability. Direct distribution relies on the service provider managing the entire process, whereas indirect distribution involves partnerships with licensed disposal facilities or specialized composting/fertilizer companies. The regulatory landscape heavily impacts this downstream segment, creating significant competitive barriers and favoring firms with extensive, multi-regional disposal network access and compliance expertise.

Lagoon Cleanout Service Market Potential Customers

Potential customers and end-users of Lagoon Cleanout Services represent a diverse ecosystem unified by the legal and operational necessity of managing large volumes of wastewater sludge and sediment accumulated in stabilization ponds or retention lagoons. The largest volume buyers are Municipal Wastewater Treatment Plants (WWTPs), which rely on these services for routine capacity restoration and to meet National Pollutant Discharge Elimination System (NPDES) permit requirements. As municipal populations expand and existing treatment infrastructure ages, the predictable and consistent demand from this sector forms the foundational revenue base for the entire market. Municipal clients prioritize reliability, adherence to strict safety standards, and documented compliance with biosolids management regulations, often engaging in long-term, multi-year maintenance contracts to ensure asset longevity and uninterrupted service delivery to the public.

The Industrial sector represents the second major customer base, characterized by higher project value, greater technical complexity, and more variable sludge composition, often requiring specialized hazard mitigation. Key industrial buyers include companies in the Food and Beverage (F&B) sector (e.g., dairies, breweries, slaughterhouses) whose lagoons accumulate high volumes of organic solids; the Pulp and Paper industry, which deals with fiber-laden, challenging-to-dewater sludges; and the Chemical and Petrochemical sectors, where cleanout often involves strict safety protocols for handling toxic or volatile residues. These industrial clients are driven by the need to maintain continuous production, minimize downtime associated with cleanout, and ensure corporate environmental responsibility, often demanding cutting-edge dewatering technologies to achieve minimal final waste volumes for disposal.

A rapidly expanding segment of potential customers is the large-scale Agricultural sector, particularly concentrated animal feeding operations (CAFOs) that utilize vast manure lagoons for waste storage and treatment. While historically managed in-house, increasing environmental scrutiny and state-level nutrient management regulations are pushing CAFOs towards professional cleanout services to manage nutrient loading and prevent ground or surface water contamination. Additionally, entities like Power Generation facilities (particularly those using coal ash or cooling ponds) and Mining operations that use tailings ponds or settling basins also require periodic, highly specialized cleanout and material handling services. These end-users typically seek partners who can demonstrate superior expertise in resource recovery, suchating the sludge back into soil amendments or energy sources, thus transforming an operational liability into a sustainable asset management practice.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Environment S.A., Suez S.A., Clean Harbors, Inc., Synagro Technologies, Inc., Evoqua Water Technologies Corp., Dredgit, Vortex Companies, US Ecology, Inc., Layne Christensen Company (now part of Granite Construction), Xylem Inc., AQUADAM, Inc., Pure Aqua, Inc., Waste Management, Inc., Tetra Tech, Inc., ARCADIS N.V., Brown and Caldwell, CDM Smith, Aquatech International, Dredging Supply Company (DSC), GZA GeoEnvironmental, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lagoon Cleanout Service Market Key Technology Landscape

The technological landscape of the Lagoon Cleanout Service Market is rapidly evolving, driven primarily by the need for greater efficiency, lower environmental impact, and enhanced worker safety. Traditional mechanical excavation, while still utilized for dry or shallow lagoons, is increasingly being superseded by sophisticated hydraulic dredging systems. Modern hydraulic dredges utilize remote operation capabilities, precise GPS tracking, and advanced cutter heads or pump mechanisms designed to handle high solid concentrations with minimal disturbance to the underlying liner structure, a critical concern in environmental liability management. Furthermore, specialized submersible pumps, often paired with proprietary mixing and agitation systems, ensure homogenous sludge slurries are efficiently conveyed from the lagoon to the dewatering processing area, optimizing the subsequent treatment stages. The integration of high-definition sonar and LiDAR scanning technologies provides service providers with accurate, real-time three-dimensional mapping of sludge profiles, enabling precise volumetric calculations and targeted removal operations, drastically improving overall project accuracy and reducing unnecessary water removal.

The most transformative technology in recent years is the advancement in mobile dewatering solutions, which is essential for reducing logistical costs. Geo-textile tube dewatering (sludge bagging) technology utilizes high-strength, porous synthetic fabrics combined with specific polymer conditioning agents to rapidly separate solids from liquids on-site. This method is highly favored for its simplicity, cost-effectiveness, and ability to achieve high solids concentration with minimal energy input, making the residual filtrate water safe for discharge or return to the treatment facility. Complementing this, high-performance mobile mechanical dewatering equipment, such as centrifuges and belt filter presses mounted on trailers, are employed when extremely low moisture content is required for beneficial reuse applications like composting or pelletizing. These mechanical units offer flexibility and high throughput, albeit with a greater energy consumption footprint, demanding continuous optimization of chemical conditioning protocols via automated injection systems to ensure peak operational performance and cost efficiency.

Additionally, the incorporation of digitalization and advanced monitoring solutions is defining the competitive edge. Telemetry and SCADA systems are now standard on most high-end cleanout equipment, allowing for remote monitoring and adjustment of flow rates, chemical dosing, and pump pressures, ensuring operational continuity and proactive troubleshooting. Furthermore, the burgeoning application of Unmanned Aerial Vehicles (UAVs) equipped with multispectral cameras and thermal sensors is becoming vital for pre-cleanout inspection and post-cleanout verification. These digital tools significantly reduce the duration and complexity of site surveys, mitigate safety risks associated with personnel entering hazardous environments, and provide irrefutable documentation for regulatory compliance purposes. The future trajectory of technology in this market points toward full automation and integration with AI-driven analytics, enabling fully optimized, prescriptive maintenance cycles that maximize resource recovery and minimize operational externalities.

Regional Highlights

- North America: The market here is mature and characterized by stringent federal and state environmental regulations, notably concerning biosolids management and nutrient reduction (TSS, TP, TN). The region, particularly the U.S., possesses extensive municipal and industrial wastewater infrastructure, much of which is aging and requires consistent, professional cleanout services to avoid costly reconstruction. High labor costs and advanced regulatory scrutiny drive the strong adoption of automated dredging and sophisticated mobile dewatering technologies. Key market demand originates from states with large agricultural industries (Midwest) and highly urbanized coastal regions needing strict compliance with water quality standards.

- Europe: Growth is steady, fueled by the European Union’s Water Framework Directive and increasingly circular economy mandates that strongly encourage beneficial reuse of sludge over landfilling. Germany, France, and the UK represent significant markets due to advanced treatment facilities and proactive maintenance regimes. The focus is heavily placed on sustainability, leading to strong demand for cleanout providers offering integrated solutions for thermal utilization or advanced composting/pelletizing of dewatered materials, minimizing the environmental footprint and maximizing resource value.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by rapid industrialization, massive infrastructure investment, and newly enforced environmental protection laws, particularly in China, India, and Southeast Asia. The sheer scale of wastewater generation coupled with the historical lack of maintenance in many industrial areas is creating immense, urgent demand for professional cleanout services. While price sensitivity remains a factor, the rapid adoption of modern technology, often through joint ventures with Western firms, is accelerating market maturity.

- Latin America (LATAM): Market activity is concentrated in countries with large mining, oil and gas, and food processing industries (e.g., Brazil, Mexico). Growth is often tied to specific large-scale industrial projects and export mandates that require adherence to international environmental standards. The municipal sector is often constrained by local government funding limitations, leading to more reactive or emergency-based cleanout projects rather than proactive maintenance contracts seen in developed regions.

- Middle East and Africa (MEA): Growth is primarily sector-specific, driven by major infrastructure development, desalination projects, and oil and gas operations. Water scarcity issues amplify the need for efficient wastewater management, including lagoon maintenance. The adoption of advanced, integrated cleanout solutions is critical in remote or highly sensitive environmental areas, often relying on international service providers due to the requirement for specialized equipment and operational expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lagoon Cleanout Service Market.- Veolia Environment S.A.

- Suez S.A.

- Clean Harbors, Inc.

- Synagro Technologies, Inc.

- Evoqua Water Technologies Corp.

- Dredgit

- Vortex Companies

- US Ecology, Inc.

- Layne Christensen Company (now part of Granite Construction)

- Xylem Inc.

- AQUADAM, Inc.

- Pure Aqua, Inc.

- Waste Management, Inc.

- Tetra Tech, Inc.

- ARCADIS N.V.

- Brown and Caldwell

- CDM Smith

- Aquatech International

- Dredging Supply Company (DSC)

- GZA GeoEnvironmental, Inc.

Frequently Asked Questions

Analyze common user questions about the Lagoon Cleanout Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for professional lagoon cleanout services?

The primary factor driving demand is the absolute necessity of maintaining regulatory compliance (e.g., EPA or EU directives) regarding wastewater discharge quality, coupled with the need to restore lost treatment capacity due to sludge accumulation in aging infrastructure.

How often should a typical municipal wastewater lagoon be cleaned out?

Cleanout frequency varies significantly but is generally required every 5 to 15 years, depending on the initial design, influent solids loading rate, and the percentage of remaining operational capacity. Advanced monitoring and predictive modeling are increasingly used to determine the optimal, data-driven schedule.

What are the key technological advancements transforming sludge dewatering efficiency?

Key advancements include high-performance, mobile geo-textile tube dewatering systems and optimized polymer chemistry, which significantly reduce the volume and weight of sludge on-site, drastically lowering final disposal and transportation costs.

Which end-user segment offers the highest potential for specialized, high-value cleanout projects?

The Industrial segment, particularly Chemical, Petrochemical, and Pulp & Paper, offers the highest potential for specialized, high-value projects due to the complexity, variable composition, and hazardous nature of the sludge, requiring specialized handling, permits, and advanced dewatering techniques.

What role does resource recovery play in the future of the lagoon cleanout market?

Resource recovery is becoming a central focus, moving sludge from a waste liability to a valuable asset through beneficial reuse processes such as creating high-quality fertilizer, soil amendments, or generating biogas via anaerobic digestion, aligning service providers with global sustainability goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager