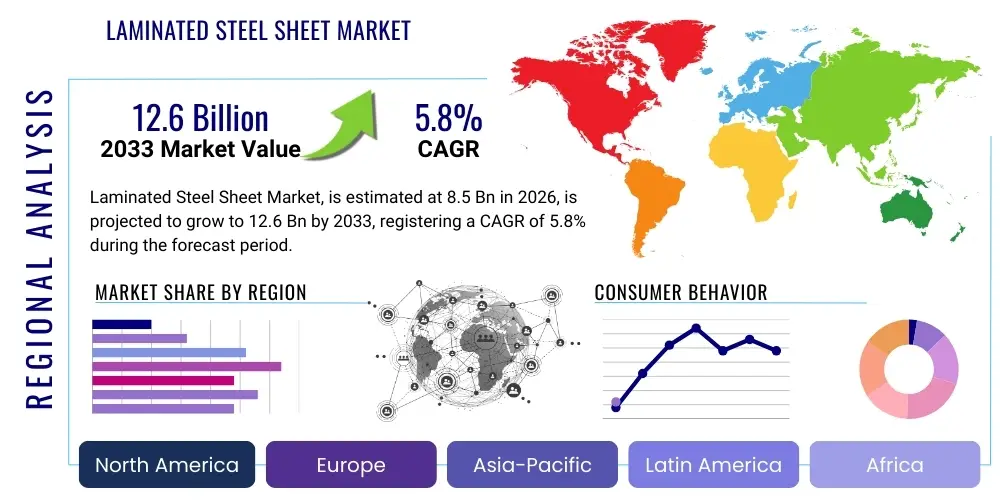

Laminated Steel Sheet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442875 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Laminated Steel Sheet Market Size

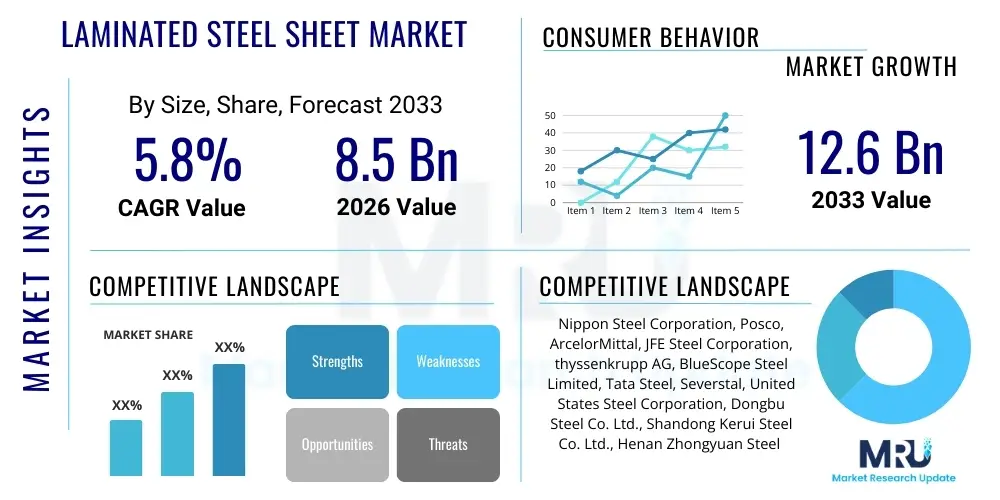

The Laminated Steel Sheet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Laminated Steel Sheet Market introduction

The Laminated Steel Sheet Market encompasses the production and distribution of steel substrates coated or bonded with polymeric films, which are utilized primarily to enhance aesthetic appeal, corrosion resistance, and specific functional properties such as insulation or sound dampening. These composite materials, often referred to as pre-coated or pre-finished metals, are critical inputs across diverse industrial sectors. The technology involves specialized coil coating lines that ensure robust adhesion between the metal and the laminated film, resulting in a durable and high-performance material ready for deep drawing, stamping, and other forming processes without damaging the surface finish. This integration of steel strength and polymer functionality drives its widespread adoption.

Product descriptions typically emphasize the multi-layered structure, where the steel core provides mechanical integrity while the laminated polymer film—often PVC, PET, or specialized polyolefins—offers protection against environmental factors, chemicals, and abrasion. Major applications span high-demand sectors, including automotive interiors and exteriors, construction panels (especially roofing and cladding), home appliances, and various electronics casings. The material’s ability to offer customization in terms of color, texture, and pattern directly at the manufacturing stage simplifies subsequent production processes for end-users, reducing costs associated with post-painting and finishing operations.

The primary benefits of laminated steel sheets include superior durability, enhanced aesthetics, and cost-effectiveness over the product lifecycle compared to traditional painted steel. Key driving factors propelling market growth are the stringent regulatory standards demanding lighter, more energy-efficient materials in transportation and construction, coupled with the increasing consumer demand for premium, durable finishes in white goods and electronics. Furthermore, the growth of urbanization and infrastructure development, particularly in emerging economies, necessitates high-performance, long-lasting building materials, which laminated steel sheets readily provide, solidifying their strategic importance in modern manufacturing.

Laminated Steel Sheet Market Executive Summary

The Laminated Steel Sheet Market is characterized by robust expansion driven by structural shifts in manufacturing preferences toward lightweight, sustainable, and aesthetically versatile materials. Current business trends indicate a strong emphasis on developing bio-based or recyclable lamination films (green lamination) to meet increasingly strict environmental, social, and governance (ESG) criteria, particularly in Europe and North America. Key players are investing heavily in advanced coil coating technologies, such as plasma pretreatment and UV curing systems, to improve adhesion strength and accelerate production throughput, thereby catering efficiently to high-volume industries like automotive and construction. Strategic mergers and acquisitions are also prevalent, aimed at consolidating supply chain control and expanding geographical footprint into high-growth regions like Southeast Asia, securing access to crucial raw material inputs and established distribution networks.

Regionally, Asia Pacific maintains its dominance in market share, fueled by massive infrastructure projects, burgeoning automotive production bases, and the rapid expansion of the consumer electronics manufacturing sector in countries such as China, India, and South Korea. North America and Europe, while growing at a slower pace, exhibit higher consumption of premium and specialized laminated sheets, driven by strict quality requirements in residential construction and a strong focus on interior design aesthetics within the appliance industry. Regulatory frameworks concerning material safety and fire resistance in developed markets significantly influence the material composition and technical specifications of laminated products demanded in these regions, pushing innovation toward advanced flame-retardant films and low-VOC (Volatile Organic Compound) adhesives.

In terms of segmentation trends, the PVC film segment historically held a significant share due to its flexibility and cost-effectiveness, though PET and specialized composite films are gaining rapid traction owing to their superior performance characteristics and better environmental profile, particularly in demanding applications requiring high heat resistance or superior scratch resistance. The construction segment remains the largest end-user, but the automotive segment is poised for the fastest growth, primarily due to the increasing adoption of lightweight laminated panels for interior components, contributing to overall vehicle weight reduction and improved fuel efficiency or electric vehicle battery range. Furthermore, customized patterns and antimicrobial laminates are emerging niches, responding directly to public health concerns and aesthetic personalization trends.

AI Impact Analysis on Laminated Steel Sheet Market

Common user questions regarding AI's impact on the Laminated Steel Sheet Market center primarily on how advanced data analytics and machine learning (ML) can optimize production efficiency, ensure consistent quality control, and predict future material demands. Users frequently inquire about the integration of AI-powered vision systems for defect detection during the lamination process and the feasibility of using predictive maintenance algorithms to minimize downtime in high-cost coil coating lines. Furthermore, there is significant interest in how AI can optimize complex supply chain logistics, including raw material procurement and inventory management, given the volatility of steel and polymer prices. The overarching theme is the expectation that AI will transition the industry from traditional reactive quality checks to proactive, highly optimized manufacturing environments.

The immediate influence of Artificial Intelligence is noticeable in enhancing operational excellence across the manufacturing lifecycle. AI algorithms are now employed to dynamically adjust process parameters—such as curing temperature, adhesive thickness, and line speed—in real-time to compensate for slight variations in raw material inputs, ensuring homogenous quality and reducing material waste, which is crucial for maximizing profitability in high-volume production. This precision tuning, inaccessible through manual control or traditional automation, significantly elevates the consistency of the finished laminated steel sheets, meeting the stringent specifications required by aerospace and high-end automotive clients.

Looking forward, the strategic integration of AI is expected to revolutionize product development and demand forecasting. By analyzing vast datasets encompassing customer feedback, material performance metrics, and global economic indicators, AI models can accurately predict shifts in demand for specific laminated sheet types (e.g., matte finish vs. high gloss) and geographical regions. This predictive capability allows manufacturers to optimize their product mix and inventory levels, reducing obsolescence risk. Furthermore, generative AI tools are beginning to assist in designing novel polymer film compositions that offer superior performance characteristics, such as enhanced UV stability or self-cleaning properties, accelerating the innovation cycle significantly.

- AI-driven real-time quality control using machine vision for defect identification.

- Predictive maintenance schedules for high-capital coil coating machinery, minimizing unscheduled downtime.

- Optimized resource allocation and waste reduction via ML algorithms adjusting production parameters.

- Enhanced supply chain visibility and price fluctuation forecasting for steel and polymer inputs.

- Accelerated material innovation through generative AI modeling of novel polymer laminate compositions.

- Improved demand forecasting accuracy across diverse application sectors (automotive, construction, appliance).

DRO & Impact Forces Of Laminated Steel Sheet Market

The Laminated Steel Sheet Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing global demand for aesthetically appealing and durable materials in residential and commercial construction, coupled with the mandatory requirement for lightweight components in electric vehicles (EVs) to extend battery range. Furthermore, ongoing innovation in polymer science allows for the creation of laminates with specialized properties, such as antimicrobial surfaces or enhanced fire ratings, widening the addressable market. These drivers collectively necessitate higher production volumes of high-specification laminated steel.

However, the market faces significant restraints, notably the high initial capital expenditure required for establishing and upgrading specialized coil coating and lamination lines. The volatility in the prices of key raw materials, specifically steel substrate (due to global trade tariffs and supply chain disruptions) and petroleum-derived polymers, creates financial instability for manufacturers and complicates long-term contract pricing. Additionally, the challenge of recycling composite materials (steel and polymer film) compared to monolithic steel poses an environmental barrier, placing pressure on manufacturers to develop easily separable or bio-degradable laminate solutions, which often come at a premium price.

Opportunities for growth are abundant, particularly in emerging markets where infrastructure spending is surging, creating vast demand for durable roofing and cladding materials. The development of functional laminates, such as those incorporating photovoltaic cells or smart coatings for temperature regulation, represents a key technological frontier. Furthermore, the shift towards modular construction methods favors laminated steel sheets due to their high degree of pre-finish and ease of installation, offering manufacturers a pathway to penetrate new market segments effectively. These market dynamics result in strong impact forces, pushing market participants toward technological specialization and robust supply chain management to maintain competitive advantage and meet evolving regulatory and consumer demands for sustainable products.

Segmentation Analysis

The Laminated Steel Sheet Market segmentation provides a critical understanding of the varying product specifications, application areas, and end-user needs that drive consumption across the globe. The market is primarily categorized based on the type of Lamination Film used, the application sector, and the specific steel substrate employed. This granular categorization helps manufacturers tailor their product offerings, optimize production batches, and focus marketing efforts on high-potential niches. The diversity in lamination films reflects varying performance requirements, ranging from cost-effective PVC used in general applications to highly technical fluoropolymer films needed for extreme outdoor durability or specific chemical resistance.

Analyzing segmentation by Application reveals the dominance of the Construction industry, which utilizes laminated steel for exterior cladding, insulation panels, and interior decorative finishes, valuing the material's longevity and low maintenance profile. However, the rapidly expanding Automotive segment, driven by the shift towards electric vehicles and the resultant need for lighter and acoustically dampening interior components, is projected to exhibit the fastest growth over the forecast period. The Appliance segment, focusing heavily on aesthetic appeal, demands consistent quality in texture and color, fueling the adoption of specialty PET and decorative films for refrigerators, washing machines, and ovens.

Geographical segmentation highlights regional manufacturing and consumption patterns; for instance, Asia Pacific leads in overall volume due to industrial scale, while Europe and North America prioritize advanced functional laminates for energy efficiency and compliance with strict building codes. Understanding these segments is paramount for strategic planning, allowing companies to invest appropriately in capacity expansion or research and development aimed at meeting highly specialized, segment-specific requirements, such as anti-fingerprint coatings for consumer electronics or highly UV-resistant films for solar infrastructure.

- By Lamination Film Type:

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Fluoropolymer (PVDF, PVF)

- Others (Acrylics, Specialty Composites)

- By Steel Substrate:

- Cold Rolled Steel (CRS)

- Galvanized Steel (GI)

- Electro-Galvanized Steel (EG)

- Stainless Steel

- By Application:

- Construction and Infrastructure (Roofing, Cladding, Doors, Windows)

- Automotive (Interior Trim, Body Panels, Underbody Protection)

- Home Appliances (Refrigerators, Washing Machines, Microwaves, Ovens)

- Consumer Electronics (Casings, Computer Components)

- Furniture and Interior Design

- Others (Marine, Industrial Equipment)

- By End-Use Industry:

- OEMs (Original Equipment Manufacturers)

- Fabricators and Converters

- Contractors and Installers

Value Chain Analysis For Laminated Steel Sheet Market

The value chain for the Laminated Steel Sheet Market is highly specialized and sequential, beginning with upstream raw material suppliers and extending through highly specialized processing steps to the final end-users. Upstream analysis focuses on the procurement of primary steel substrates, such as cold-rolled and galvanized steel coils, typically sourced from major integrated steel mills. Concurrently, specialized chemical companies supply the polymeric films (PVC, PET, PP, etc.) and high-performance adhesives necessary for the lamination process. Price volatility and quality consistency in both steel and polymer inputs are critical concerns at this stage, dictating the eventual cost structure of the laminated product. Strong contractual relationships with reliable suppliers are essential for minimizing production interruptions and securing preferential pricing, particularly in a globally competitive commodity market.

The core value addition occurs during the manufacturing and processing phase, where coil coaters and laminators execute the complex bonding procedure. This involves rigorous pretreatment of the steel surface to ensure optimal adhesion, followed by the precise application of adhesive and the lamination of the film, often achieved through specialized roller press technology under controlled temperature and pressure conditions. Investment in high-tech machinery and proprietary lamination techniques represents a significant barrier to entry and is a key source of competitive differentiation. Manufacturers must adhere to rigorous quality control standards, including adhesion testing, corrosion resistance checks, and color consistency matching, to meet the performance specifications required by high-stakes end-users like the automotive industry.

The downstream analysis involves the distribution channels leading to the end-users. Distribution is often bifurcated: direct channels are utilized for large Original Equipment Manufacturers (OEMs) in the appliance and automotive sectors, involving dedicated logistics and specialized inventory management. Indirect channels, involving regional distributors, service centers, and specialized metal processors, cater to the fragmented construction and smaller fabrication markets. These intermediaries play a crucial role in inventory holding, custom cutting, slitting, and just-in-time delivery services. Optimization of this distribution network is crucial for reducing transportation costs and ensuring rapid response to customer demand, particularly given the size and weight of steel coils and the need for protective handling of the pre-finished surface.

Laminated Steel Sheet Market Potential Customers

Potential customers for Laminated Steel Sheets represent a broad spectrum of heavy industrial and consumer-facing manufacturers, defined primarily by their need for materials that combine structural strength with pre-finished aesthetic and functional qualities. The largest cohort of buyers are Original Equipment Manufacturers (OEMs) within the home appliance industry, including global leaders manufacturing refrigerators, freezers, and washing machines. These buyers demand materials that offer superior scratch resistance, a variety of finishes (such as high-gloss, matte, or textured), and often antimicrobial properties, allowing them to differentiate their products in competitive retail markets. Consistency in color matching across large volumes is a non-negotiable requirement for these major end-users.

A rapidly growing segment of potential customers is the automotive manufacturing sector, specifically manufacturers focusing on Electric Vehicles (EVs) and luxury interior systems. While traditional automotive applications focused on exterior panels, the contemporary demand is centered on interior trim, dash panels, and acoustic barriers where the material contributes to both sound dampening and visual appeal. The requirement here is focused on fire safety, low-VOC emissions, and the ability of the material to withstand complex forming processes without cracking or delaminating. Tier 1 suppliers to automotive giants are also primary customers, acting as intermediaries who process the laminated sheets into finished subcomponents.

Another crucial group comprises large-scale construction companies, roofing specialists, and façade system providers involved in commercial and institutional projects. These customers prioritize durability, weather resistance, and long-term warranties. They purchase laminated steel sheets for exterior cladding, industrial roofing, cleanroom partitions, and modular housing components. Given the long lifespan required for building materials, these buyers emphasize the UV resistance, corrosion protection offered by the lamination film, and compliance with national and regional building codes regarding fire resistance and structural integrity. Distributors who stock diverse inventories and provide customized cutting services also serve smaller architectural firms and individual contractors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Steel Corporation, Posco, ArcelorMittal, JFE Steel Corporation, thyssenkrupp AG, BlueScope Steel Limited, Tata Steel, Severstal, United States Steel Corporation, Dongbu Steel Co. Ltd., Shandong Kerui Steel Co. Ltd., Henan Zhongyuan Steel Co. Ltd., Bekaert Deslee, Novacel, and Coilplus Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laminated Steel Sheet Market Key Technology Landscape

The technological landscape of the Laminated Steel Sheet Market is dominated by advancements in continuous coil coating and lamination processes, focusing heavily on enhancing adhesion, durability, and production speed while minimizing environmental footprint. A core technology involves surface pretreatment systems, moving beyond traditional chemical baths to incorporate plasma surface activation or specialized primer applications. These advanced pretreatments are essential for creating an optimal bonding surface, significantly improving the peel strength and longevity of the laminate, especially in applications exposed to harsh environments like coastal areas or industrial zones. The efficiency of the chemical pretreatment stage directly correlates with the final product's corrosion resistance and is a primary area of ongoing research and development investment across leading manufacturers.

Crucial to the lamination process itself is the development of high-speed, precision lamination lines utilizing sophisticated roller technology and temperature control systems. Modern lines are equipped with highly accurate tension control mechanisms to prevent stretching or wrinkling of the polymer film during bonding. Furthermore, there is a distinct technological shift towards utilizing solvent-free or water-based adhesives, which comply with increasingly stringent environmental regulations regarding VOC emissions. This shift mandates the use of highly efficient curing technologies, such as UV or Electron Beam (EB) curing, which offer instantaneous setting of the adhesive layer, allowing for faster line speeds and reduced energy consumption compared to traditional thermal ovens.

Innovation is also highly concentrated in the lamination film composition itself, moving beyond commodity PVC toward specialty polymers like advanced PET and fluoropolymers (e.g., PVDF) which offer superior thermal stability, color retention, and resistance to chemical etching. Nanotechnology integration is emerging as a key differentiator, where manufacturers incorporate nano-scale additives into the polymer film to enhance properties such as scratch resistance, self-healing capabilities, or anti-microbial functionality, particularly targeting high-touch surfaces in healthcare and consumer goods. The continuous integration of IoT sensors and automated vision systems within the production line also represents a key technological advancement, enabling highly consistent quality control and proactive process optimization.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, primarily due to expansive construction activities, massive automotive production bases, and the dominance of consumer electronics manufacturing in East Asia. China and India are major contributors, driven by rapid urbanization and government investments in infrastructure. The focus in this region is balanced between high-volume, cost-effective standard laminated products and specialized, high-performance materials needed for metro systems and high-rise commercial buildings.

- North America: This region is characterized by high demand for specialized, high-specification laminated steel sheets, particularly those meeting stringent fire codes and aesthetic requirements in commercial construction. The automotive sector, particularly truck and SUV manufacturing, contributes significantly, valuing acoustic properties and durability for interior components. Investment in sustainable lamination solutions and recyclable materials is a key focus, driven by corporate sustainability goals and consumer preferences.

- Europe: Europe is a mature market focused intensely on regulatory compliance, sustainability, and high-quality finishes. Demand is strong for low-VOC, fire-retardant, and circular economy-compliant laminated steel products, particularly in Germany and the Nordic countries, where energy-efficient building standards are paramount. The appliance sector is a major consumer, prioritizing aesthetic versatility and scratch resistance for premium home goods.

- Latin America (LATAM): Growth in LATAM is driven by recovering construction sectors in Brazil and Mexico, coupled with increasing foreign investment in automotive manufacturing. The market emphasizes durable, corrosion-resistant laminates suitable for diverse and often challenging climate conditions. Price sensitivity is higher in this region, leading to a strong demand for cost-optimized lamination films.

- Middle East and Africa (MEA): This region is witnessing substantial growth fueled by large-scale infrastructure projects, especially in the GCC countries (Saudi Arabia, UAE). Demand is concentrated on high-UV resistant and heat-resistant laminated steel for exterior applications, crucial for mitigating the effects of intense desert climates. Long-term durability and resistance to sand abrasion are critical performance metrics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laminated Steel Sheet Market.- Nippon Steel Corporation

- Posco

- ArcelorMittal

- JFE Steel Corporation

- thyssenkrupp AG

- BlueScope Steel Limited

- Tata Steel

- Severstal

- United States Steel Corporation

- Dongbu Steel Co. Ltd.

- Shandong Kerui Steel Co. Ltd.

- Henan Zhongyuan Steel Co. Ltd.

- Bekaert Deslee

- Novacel

- Coilplus Inc.

- A.J. Oster Co.

- Yodogawa Steel Works, Ltd.

- Metal Coaters & Laminators (MCL)

- Marcegaglia Group

- Koehler Company

Frequently Asked Questions

Analyze common user questions about the Laminated Steel Sheet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using laminated steel sheets over traditional painted steel?

Laminated steel sheets offer superior durability, enhanced corrosion and scratch resistance, and greater aesthetic flexibility through pre-applied decorative films. They also provide better resistance to chipping during post-forming processes and can reduce volatile organic compound (VOC) emissions associated with in-house painting operations, simplifying manufacturing logistics and improving environmental compliance.

Which application segment drives the highest demand in the Laminated Steel Sheet Market?

The Construction and Infrastructure segment currently accounts for the largest share of laminated steel sheet consumption globally, driven by their extensive use in roofing, exterior cladding, interior partitions, and modular building systems, where longevity and resistance to environmental degradation are critical requirements for structural integrity.

How is the Laminated Steel Sheet Market addressing sustainability concerns regarding composite materials?

The market is shifting towards developing eco-friendly solutions, including the use of bio-based polymer films, recyclable PET laminates, and adhesives designed for easier separation of the polymer layer from the steel substrate at the end of the product lifecycle, aligning with circular economy principles and regulatory pressures.

What role do technological advancements play in improving laminated steel sheet quality?

Technological advancements, particularly in plasma surface pretreatment, UV/EB curing systems, and high-precision roller technology, ensure stronger adhesion, faster production speeds, and enhanced functionality, such as self-cleaning or anti-microbial properties, crucial for high-end automotive and appliance applications.

Which region presents the most significant growth opportunities for laminated steel sheet manufacturers?

Asia Pacific (APAC) offers the most substantial growth opportunities due to massive urbanization rates, continuous infrastructure development, and rapidly expanding manufacturing bases across China, India, and Southeast Asia, creating sustained, high-volume demand for durable pre-finished metal products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager