Laser Automation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442341 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Laser Automation Market Size

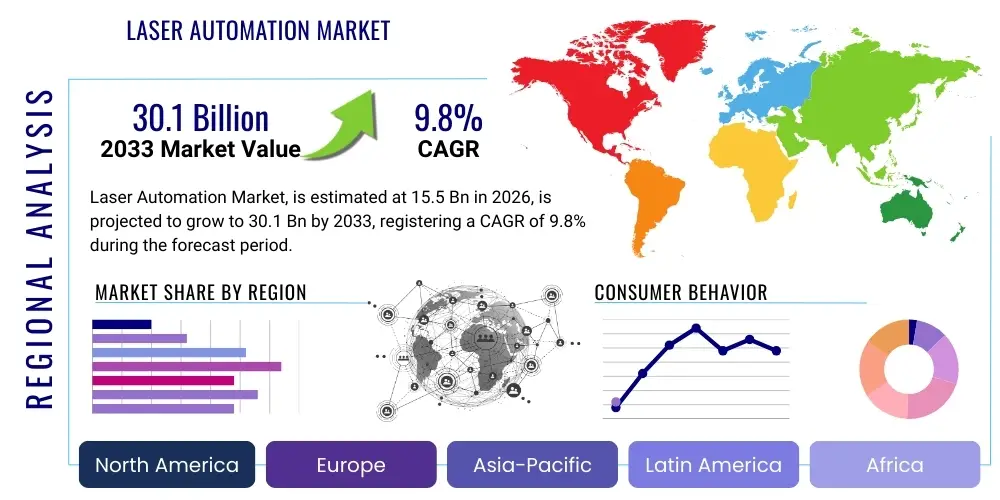

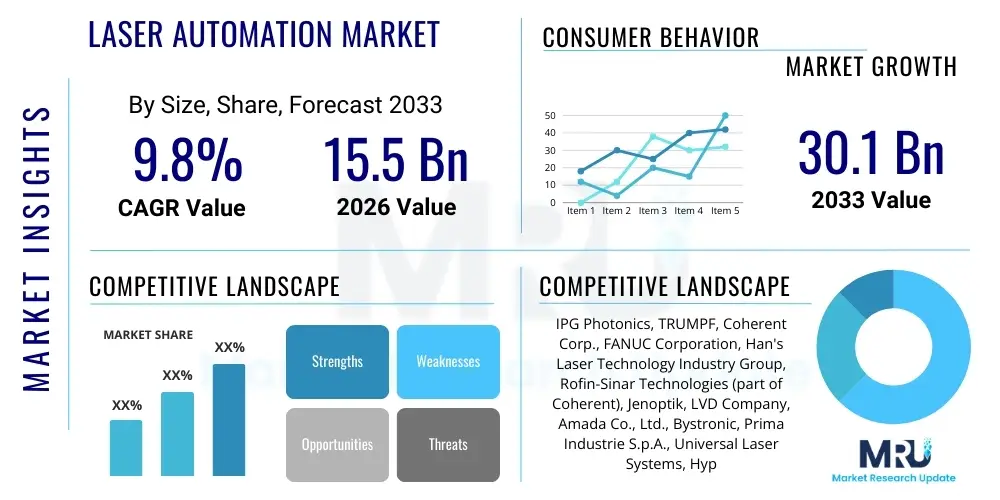

The Laser Automation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 30.1 Billion by the end of the forecast period in 2033.

Laser Automation Market introduction

The Laser Automation Market encompasses advanced industrial systems that integrate high-precision laser technology—including fiber lasers, CO2 lasers, excimer lasers, and diode lasers—with sophisticated robotic and computerized numerical control (CNC) platforms to execute manufacturing processes such as cutting, welding, marking, cladding, and surface treatment. These automated solutions are fundamentally altering traditional manufacturing paradigms by delivering unparalleled precision, speed, and repeatability across diverse materials, ranging from thin films in electronics to high-strength alloys in aerospace. The core product offering includes fully integrated automated cells, laser processing heads, specialized beam delivery systems, smart sensors for real-time monitoring, and accompanying control software optimized for complex industrial environments. The fundamental shift towards mass customization and miniaturization necessitates the precision afforded by laser automation, driving its adoption across global production lines.

Major applications for laser automation span mission-critical sectors where quality assurance and production efficiency are paramount. The automotive industry utilizes these systems extensively for lightweighting efforts, particularly in the welding of dissimilar materials and the fine-tuning of electrical vehicle (EV) battery components. In the electronics sector, laser automation is essential for micro-processing tasks like semiconductor wafer dicing, circuit board marking, and display panel cutting, demanding sub-micron accuracy. Furthermore, the medical device industry relies on automated laser systems for intricate tasks such as stent cutting, surgical instrument fabrication, and sterile marking, where biological compatibility and structural integrity are non-negotiable requirements. These automated processes drastically reduce material waste, minimize rework, and elevate overall throughput compared to conventional mechanical or chemical processing methods, resulting in significant operational cost savings.

The principal benefits driving market expansion include enhanced quality control through non-contact processing, vastly improved throughput rates achievable via continuous operation cycles, and the capability to process complex geometries and difficult materials that are challenging for traditional machining tools. Automation also addresses the persistent issue of labor scarcity in highly specialized welding and cutting domains, simultaneously ensuring worker safety by moving personnel away from high-energy processing zones. Crucial driving factors involve the global push toward Industry 4.0 standards, which mandates high connectivity and data utilization in manufacturing, the escalating demand for electric vehicles necessitating high-volume battery welding solutions, and increasing capital investments in advanced manufacturing infrastructure across developing economies aiming to secure a competitive edge in high-value goods production.

Laser Automation Market Executive Summary

The Laser Automation Market is experiencing robust expansion driven by the confluence of technological maturity, global industrial restructuring, and strategic shifts towards resilient, localized supply chains. Current business trends indicate a strong move toward integrated, modular, and flexible laser processing solutions that can be rapidly reconfigured to meet shifting production demands, a necessity accelerated by post-pandemic supply chain volatilities. Key stakeholders are focusing on incorporating advanced monitoring capabilities, utilizing machine vision and thermal sensing to ensure process stability and predictive maintenance, thereby maximizing system uptime. Corporate mergers and acquisitions are shaping the competitive landscape, as established industrial automation giants seek to acquire specialized laser technology firms to create comprehensive, full-stack manufacturing solutions. Furthermore, leasing and pay-per-use models for high-capital laser automation equipment are gaining traction, lowering the barrier to entry for Small and Medium-sized Enterprises (SMEs) and accelerating market penetration in regions with limited initial capital expenditure budgets.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of growth, largely attributable to massive investments in electronics manufacturing, automotive production—especially EV component fabrication—and government initiatives promoting advanced manufacturing modernization in nations like China, South Korea, and Japan. North America and Europe maintain significant market share, characterized by high adoption rates of premium, highly specialized automation systems, particularly in aerospace, defense, and high-end medical device manufacturing. These mature markets prioritize ultra-high precision and the integration of sophisticated software platforms that comply with strict regulatory standards (e.g., FDA requirements in medical applications, FAA regulations in aerospace). Emerging regional trends show increasing laser automation adoption in Latin America and the Middle East, fueled by diversification efforts away from resource-based economies and development of new high-tech industrial parks, though these regions primarily focus on applications like heavy machinery and construction materials processing initially.

Analysis of segmentation trends reveals that fiber lasers continue to dominate the market share due to their superior efficiency, low maintenance requirements, and scalability across a vast range of applications from fine cutting to deep penetration welding. However, ultrashort pulse (USP) lasers are exhibiting the highest growth trajectory, particularly within the electronics and medical sectors, owing to their ability to perform cold ablation, minimizing heat-affected zones (HAZ) and enabling flawless micro-structuring. The application segmentation highlights automotive and electronics as the largest consumption areas, while the medical device segment presents the fastest CAGR, driven by the increasing complexity and miniaturization of implanted devices. The component segment is seeing rapid growth in sophisticated beam delivery optics and advanced control software, reflecting the need for optimized process management and system integration within broader factory automation ecosystems.

AI Impact Analysis on Laser Automation Market

Common user inquiries regarding AI’s influence on the Laser Automation Market often revolve around critical performance metrics such as processing speed optimization, predictive failure rates, and the feasibility of achieving 'zero-defect' manufacturing. Users frequently question how machine learning algorithms can manage the complexity of real-time parameter adjustments in high-speed welding processes, especially when material properties or environmental factors fluctuate. Another significant theme is the integration challenge: how seamlessly AI vision systems can be incorporated into existing laser automation cells for quality inspection and defect classification, and what the necessary data infrastructure requirements are. Expectations center on AI transforming laser automation from programmed execution to intelligent, adaptive manufacturing, potentially unlocking new processing capabilities previously unattainable due to human operational limitations. Concerns often touch upon data security, the necessity of specialized AI talent for system maintenance, and the total cost of ownership associated with implementing cognitive laser systems.

The impact of Artificial Intelligence (AI) on the Laser Automation Market is profoundly transformative, moving systems beyond mere programmed sequences into realms of genuine cognitive manufacturing. AI algorithms, particularly those governing machine vision and deep learning, are enabling laser automation systems to perform real-time, closed-loop feedback adjustments faster and more accurately than human operators or traditional PID controllers. This capability is critical in high-speed applications like remote laser welding, where variances in gap width or material fit-up must be instantaneously compensated for by altering laser power, focus position, or scanning speed, ensuring consistent weld quality across entire production batches. Predictive maintenance, another critical AI application, uses sensor data collected over time—such as vibrational analysis, temperature fluctuations, and beam power degradation—to accurately forecast component failure, drastically reducing unscheduled downtime and optimizing maintenance scheduling to align with planned operational breaks.

Furthermore, AI-driven process optimization is simplifying the complex task of recipe development for new materials and processes. Instead of relying on lengthy, expensive, trial-and-error physical experiments, simulation-based training utilizing reinforcement learning is identifying optimal laser parameters (pulse energy, duration, frequency, focus spot size) much faster. This not only accelerates time-to-market for new products but also democratizes highly specialized laser processing knowledge, allowing less experienced engineers to achieve expert-level results. The net effect is an unprecedented improvement in throughput, energy efficiency, and material utilization, solidifying AI as a central pillar in the next generation of highly autonomous laser manufacturing environments, directly addressing the industry’s pursuit of extreme precision and operational resilience.

- AI-driven real-time parameter optimization enhances weld quality and consistency by compensating for material and environmental variability.

- Predictive maintenance using machine learning minimizes unscheduled downtime and extends the operational life of critical laser system components.

- Integrated AI machine vision systems enable rapid, non-destructive, and highly accurate quality inspection and defect classification post-processing.

- Accelerated process development through simulation and reinforcement learning reduces time-to-market for new materials and applications.

- Cognitive automation allows laser systems to adapt to changing production schedules and prioritize energy efficiency based on operational load.

DRO & Impact Forces Of Laser Automation Market

The dynamics of the Laser Automation Market are intricately governed by a set of mutually reinforcing drivers, restraints, opportunities, and consequential impact forces that dictate the pace and direction of technological adoption globally. The primary drivers revolve around the relentless industrial pursuit of higher precision and faster throughput, particularly within demanding sectors like electric vehicle battery production, where scalable, repeatable, high-quality welding is paramount. Simultaneously, the persistent trend of miniaturization in electronics and medical devices necessitates non-contact, minimal-damage processing capabilities, inherently favoring laser-based systems over mechanical methods. These drivers are amplified by government incentives and regulatory pressures across advanced economies that promote the adoption of clean, energy-efficient manufacturing processes, positioning laser technology as an environmentally superior alternative to traditional thermal or chemical treatments, thereby justifying substantial capital expenditure.

Conversely, significant restraints challenge market growth and widespread proliferation. The initial capital investment required for high-power fiber or ultrashort pulse laser systems and their integration into robotic cells remains prohibitively high for many smaller enterprises, especially in emerging markets, leading to cautious adoption strategies. Furthermore, the operational complexity and dependence on highly specialized, trained technical personnel for maintenance, programming, and process optimization act as a major bottleneck. The market also faces technical challenges related to the processing of highly reflective materials, such as copper and aluminum—critical in EV manufacturing—where traditional lasers suffer from poor absorption efficiency, although advancements like blue and green lasers are beginning to mitigate this constraint. Moreover, fluctuating global supply chains for critical optical components and high-power diodes can sometimes delay the deployment of new automation projects.

Despite the restraints, substantial opportunities are emerging that promise long-term market expansion. The largest immediate opportunity lies in the rapid scale-up of gigafactories globally for EV battery production, requiring thousands of automated laser welding and cutting systems. The burgeoning area of Additive Manufacturing (AM), or 3D printing, presents a parallel opportunity, as laser automation is the core technology powering processes like Selective Laser Sintering (SLS) and Selective Laser Melting (SLM), offering specialized integration for complex part fabrication. Geographically, untapped potential exists in Southeast Asia and parts of Latin America, where industrial modernization efforts are starting to mature, creating demand for cost-effective and scalable automation solutions. The cumulative impact forces translate into a heightened competitive environment focused on system modularity, software intelligence (AI integration), and total cost of ownership (TCO) reduction, pressuring manufacturers to innovate rapidly to maintain market relevance and secure large-scale, multi-year contracts from major automotive and electronics conglomerates.

Segmentation Analysis

The Laser Automation Market is comprehensively segmented based on technology type, application area, end-use industry, and core components, providing a granular view of market dynamics and adoption trends across various industrial ecosystems. The technological segmentation differentiates between the major laser sources, reflecting diverse energy characteristics and suitability for specific material processing needs, with fiber lasers capturing the largest revenue share due to their versatility and efficiency. Application segmentation highlights the specific manufacturing tasks automated by these systems, revealing cutting and welding as the dominant processes, though laser marking remains a fundamental requirement across almost all consumer and industrial goods for traceability. Understanding these segments is crucial for stakeholders to tailor their product offerings and R&D investments toward high-growth niches, especially within the rapidly expanding medical and aerospace sectors which demand specialized, highly regulated automation systems.

- By Technology Type:

- Fiber Laser Automation

- CO2 Laser Automation

- Diode Laser Automation

- Excimer Laser Automation

- Ultrashort Pulse (USP) Laser Automation (e.g., Picosecond and Femtosecond Lasers)

- Others (e.g., Solid-State Lasers)

- By Application:

- Laser Cutting Automation

- Laser Welding Automation

- Laser Marking and Engraving Automation

- Laser Drilling and Ablation Automation

- Laser Surface Treatment (Cladding, Hardening)

- Others (e.g., Laser Additive Manufacturing)

- By Component:

- Hardware (Robots, CNC Systems, Motion Controllers, Laser Heads, Optics)

- Software (Process Control Software, Simulation Software, AI/ML Modules)

- Services (Integration, Maintenance, Training)

- By End-Use Industry:

- Automotive and Transportation

- Electronics and Semiconductor

- Aerospace and Defense

- Medical Devices and Healthcare

- Heavy Machinery and Industrial Equipment

- Jewelry and Decorative

- Others (e.g., Textile, Consumer Goods)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Laser Automation Market

The Value Chain for the Laser Automation Market is complex and involves several distinct stages, commencing with the fabrication of fundamental photonics components and culminating in the delivery of fully integrated, operational manufacturing systems to end-users. Upstream activities are dominated by highly specialized manufacturers of laser sources (e.g., high-power diodes, gain media, and resonators) and precision optical elements (lenses, mirrors, beam expanders). These suppliers hold significant leverage due to the proprietary nature and high technical requirements of their products, demanding constant R&D investment to improve beam quality, power stability, and efficiency. The integration stage follows, where system integrators and automation companies source these core laser components and combine them with robotic arms, advanced motion platforms, complex safety enclosures, and proprietary control software to create a marketable automated laser cell. Success in this midstream segment hinges on systems engineering expertise and the ability to efficiently interface disparate hardware and software components.

Downstream analysis focuses on the distribution, installation, and post-sale servicing phases. Distribution channels vary significantly; complex, high-capital systems are typically sold through direct sales teams due to the necessity of custom integration and detailed technical consultation with the end-user. Conversely, standardized marking or low-power engraving systems may utilize indirect channels such as regional distributors and value-added resellers (VARs), who provide localized support and smaller-scale integration services. The effectiveness of the downstream value chain is increasingly measured by the quality of after-sales support, including remote diagnostics, rapid spare parts availability, and advanced training programs, as system uptime is a critical metric for industrial users. The shift towards connected systems (IoT/Industry 4.0) is making remote monitoring a standard expectation.

The distinction between direct and indirect distribution is critical in shaping market coverage and profitability. Direct channels facilitate deep engagement and customization, allowing integrators to capture higher margins on complex projects (e.g., aerospace welding cells). However, direct sales require significant investment in regional service infrastructure and skilled field engineers. Indirect channels, through specialized distributors, offer broader geographic reach and reduced overhead for market entry, particularly in regions where cultural or regulatory nuances make direct operation challenging. The efficiency of the overall value chain is strongly influenced by strategic partnerships between laser source manufacturers and robotic/automation firms, aiming to create pre-validated, seamless integration packages that reduce time-to-deployment and mitigate integration risks for end-user manufacturers.

Laser Automation Market Potential Customers

Potential customers for the Laser Automation Market are concentrated in sectors that require high-volume, high-precision, and repeatable material processing where human intervention is either impractical, inconsistent, or unsafe. The primary and most capital-intensive segment consists of Tier 1 and Original Equipment Manufacturers (OEMs) in the automotive industry, particularly those heavily invested in the transition to Electric Vehicles (EVs). These manufacturers are buyers of sophisticated automated systems for battery module welding, thermal management component assembly, and lightweight body-in-white structures. Their purchasing decisions are driven by scalability, cycle time, and stringent quality documentation requirements (traceability), demanding high power and high throughput fiber laser welding solutions integrated with six-axis robots and advanced vision systems to ensure structural integrity and crash safety standards are met consistently across millions of units annually.

The second major group includes semiconductor and electronics manufacturing facilities, encompassing microchip fabricators, display panel producers (OLED/LCD), and printed circuit board (PCB) manufacturers. These customers require ultra-high precision systems, often utilizing ultrashort pulse lasers for micro-drilling, surface texturing, and delicate cutting operations where minimizing heat-affected zones (HAZ) is crucial to device functionality. Their buying motivation stems from the need for processes capable of handling fragile, high-value components at micro-scale dimensions, pushing demand for sophisticated motion control platforms and advanced cleanroom compatibility. This segment typically invests heavily in R&D partnerships with laser system vendors to customize tools for next-generation material processing challenges.

A rapidly growing customer base is found within the medical device and aerospace industries, characterized by low volume but extremely high regulatory oversight and value per part. Medical device manufacturers purchase specialized laser automation systems for cutting bio-compatible materials, fabricating precision implants (stents, pacemakers), and performing deep, aseptic marking for traceability. Aerospace and defense contractors require complex, large-format systems for welding high-temperature superalloys, cladding turbine blades for repair, and ensuring structural integrity of critical components under extreme stress. These customers prioritize reliability, extensive qualification documentation, and systems capable of producing meticulous quality reports, often necessitating customized software packages that comply with internal quality management systems and governmental body standards (e.g., ISO, NADCAP, FAA).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 30.1 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IPG Photonics, TRUMPF, Coherent Corp., FANUC Corporation, Han's Laser Technology Industry Group, Rofin-Sinar Technologies (part of Coherent), Jenoptik, LVD Company, Amada Co., Ltd., Bystronic, Prima Industrie S.p.A., Universal Laser Systems, Hypertherm, Mitsubishi Electric Corporation, Lincoln Electric, Mazak Optonics Corporation, Photonics Industries International, Laserline GmbH, 600 Group, Precitec GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Automation Market Key Technology Landscape

The technological landscape of the Laser Automation Market is defined by continuous innovation across three primary axes: the laser source itself, the beam delivery and shaping mechanisms, and the intelligence integrated into the automation platform. Fiber lasers, particularly high-power single-mode and multi-mode variants, continue to dominate due to their superior wall-plug efficiency, robust solid-state construction, and maintenance-free operation, making them the default choice for high-volume automotive cutting and welding applications. Recent developments focus on high-brightness fiber lasers that allow for smaller spot sizes and increased working distances, enabling remote laser processing where the laser head does not need to be proximal to the workpiece. Concurrently, the rise of ultrashort pulse (USP) lasers (picosecond and femtosecond) has revolutionized micro-processing. These sources enable "cold ablation," minimizing thermal damage and expanding the feasible range of materials processed, critically important for flexible electronics manufacturing and high-precision medical device fabrication where thermal stress must be avoided.

Advancements in beam delivery and manipulation are also pivotal. Highly sophisticated scanner systems, including galvanometer-based scanners and polygon mirrors, enable speeds necessary for efficient marking and surface treatment, while remote laser welding heads equipped with dynamic focusing optics allow for rapid beam repositioning and real-time beam wobbling, which is essential for stabilizing welding pools and mitigating defects when processing reflective or dissimilar metals. The integration of advanced optical components, such as custom collimators and adaptive optics, is crucial for maintaining optimal beam quality across complex automation paths, ensuring that the laser energy is delivered precisely and consistently to the focal point regardless of the robotic arm's trajectory or environmental interference. This continuous enhancement in precision beam management is a key factor enabling the use of laser automation in tasks demanding micron-level accuracy.

Finally, the convergence of laser technology with advanced automation platforms, driven by Industry 4.0 principles, represents a significant technological leap. This includes the widespread adoption of collaborative robots (cobots) integrated with smaller, safer laser sources, facilitating flexible deployment alongside human workers in mixed-production environments. Furthermore, proprietary and open-source control software is becoming increasingly powerful, incorporating simulation tools for process planning (digital twins), sophisticated sensor fusion (e.g., combining thermal cameras, coaxial vision, and acoustic monitoring), and embedded AI modules for real-time quality control and self-correction. This holistic technological advancement ensures that current laser automation systems are not merely faster machines, but intelligent, adaptive manufacturing assets capable of learning and optimizing processes autonomously, thus providing substantial competitive advantages to adopters.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for laser automation, primarily driven by massive government investment in developing smart factory infrastructure, particularly in China and South Korea. China’s "Made in China 2025" strategy heavily prioritizes industrial automation, leading to immense demand for automated laser cutting and welding systems used in consumer electronics, semiconductor packaging, and the rapidly expanding domestic electric vehicle supply chain. Japan maintains leadership in high-end, ultra-precision automation, focusing on quality and reliability for aerospace and high-tech component manufacturing. The region's competitive landscape also features strong domestic players offering cost-effective solutions, intensifying pricing pressure while boosting accessibility.

- North America: North America is characterized by high demand for specialized, high-value laser automation solutions, particularly within the aerospace and defense (A&D) and medical device sectors. Adoption here is driven less by sheer volume and more by the need for regulatory compliance, traceability, and the processing of complex, expensive materials like titanium alloys and specialized polymers. Significant investments in automotive retooling for EV production, especially battery enclosures and power electronics welding, are stimulating rapid growth. The region benefits from strong R&D capabilities and early adoption of AI and machine learning for predictive maintenance and advanced process control.

- Europe: Europe, led by Germany’s robust machine tool industry, is a hub for innovation in laser automation technology, focusing heavily on integration, energy efficiency, and compliance with strict industrial safety standards. The automotive sector utilizes laser systems extensively for complex body assembly and powertrain components, aligning with stringent European Union emission regulations that necessitate lightweighting efforts. Scandinavia and Central European nations show increasing adoption in heavy machinery, shipbuilding, and precision tool manufacturing, prioritizing flexible manufacturing systems that support diverse batch sizes and product variability.

- Latin America (LATAM): The LATAM market is nascent but exhibits substantial growth potential, driven primarily by investments in automotive assembly, general industrial fabrication, and oil & gas infrastructure in countries like Brazil and Mexico. The primary demand centers around standardized fiber laser cutting and welding systems for medium to heavy gauge metals. Market penetration is currently hindered by slower industrial digitalization rates and reliance on imported, capital-intensive equipment, making the total cost of ownership (TCO) a critical purchasing factor, favoring durable and easily maintainable systems.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in strategic diversification initiatives, particularly in Saudi Arabia and the UAE, focusing on developing domestic defense capabilities and advanced industrial parks (Vision 2030). Laser automation systems are being deployed in defense manufacturing, oil and gas infrastructure component repair (cladding), and solar energy production equipment fabrication. South Africa is the primary industrial base in Africa, utilizing laser automation for mining equipment repair and automotive manufacturing, though overall regional growth remains contingent on stabilization of commodity markets and sustained foreign direct investment in non-extractive sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Automation Market.- IPG Photonics

- TRUMPF

- Coherent Corp.

- FANUC Corporation

- Han's Laser Technology Industry Group

- Jenoptik

- LVD Company

- Amada Co., Ltd.

- Bystronic

- Prima Industrie S.p.A.

- Universal Laser Systems

- Hypertherm

- Mitsubishi Electric Corporation

- Lincoln Electric

- Mazak Optonics Corporation

- Photonics Industries International

- Laserline GmbH

- 600 Group

- Precitec GmbH & Co. KG

- Electrolux Professional (Indirect involvement through heavy duty kitchen equipment fabrication)

Frequently Asked Questions

What is Laser Automation and how is it used in manufacturing?

Laser Automation refers to integrated systems combining high-power industrial lasers (fiber, CO2, USP) with advanced robotics and CNC platforms to perform complex, non-contact material processing tasks such as cutting, welding, marking, and drilling with high precision and speed. It is used extensively across automotive, electronics, medical, and aerospace industries to improve quality, throughput, and structural integrity of components, notably accelerating processes like EV battery welding and semiconductor micro-fabrication.

Which laser technology dominates the Laser Automation Market share?

Fiber laser technology currently dominates the market share due to its superior energy efficiency, low maintenance requirements, high output power, and versatility across a wide spectrum of industrial applications, from thick metal cutting to high-speed welding. However, ultrashort pulse (USP) lasers are showing the fastest growth rate, specifically in high-precision and micro-processing segments where minimal heat input is required for delicate materials.

How does the integration of AI influence the future of Laser Automation?

AI integration is transitioning laser automation from predefined programming to cognitive, adaptive manufacturing. AI enables real-time process monitoring, automated parameter adjustment to compensate for material variations, and robust predictive maintenance. This results in unprecedented quality consistency, minimized downtime, and faster optimization cycles for new manufacturing recipes, driving towards 'zero-defect' production goals essential for Industry 4.0 adoption.

What are the primary restraints affecting the growth of the Laser Automation Market?

The most significant restraints include the exceptionally high initial capital investment required for purchasing and integrating advanced laser automation cells, particularly high-power fiber and USP systems. Additionally, the market growth is constrained by the dependency on a limited pool of highly specialized technical expertise required for complex system programming, maintenance, and sophisticated process optimization.

Which end-use industries represent the highest growth opportunity for laser automation adoption?

The electric vehicle (EV) battery manufacturing sector represents the highest volume opportunity, requiring scalable, high-speed automated laser welding systems for module and pack assembly. The medical device industry, driven by the miniaturization and complexity of implants (e.g., stents), offers the highest CAGR, demanding highly precise ultrashort pulse laser systems for sterile and damage-free processing of bio-compatible materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager